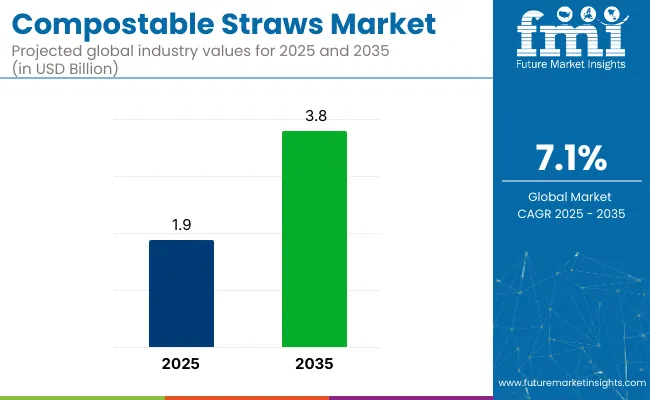

The global compostable straws market is projected to grow from USD 1.9 billion in 2025 to USD 3.8 billion by 2035, registering a CAGR of 7.1% during the forecast period. Sales in 2024 were recorded at USD 1.8 billion. This growth is primarily attributed to the rising implementation of plastic bans, growing environmental consciousness, and increasing adoption of eco-friendly alternatives in the foodservice and hospitality sectors.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.9 billion |

| Projected Value (2035F) | USD 3.8 billion |

| CAGR (2025 to 2035) | 7.1% |

Compostable straws, made from materials such as polylactic acid (PLA), paper, wheat, and bamboo, provide a biodegradable and non-toxic solution to plastic straws, breaking down naturally without harming the environment. Their expanding application in cafés, quick-service restaurants, and institutional catering has accelerated global market penetration.

In 2023, Sulapac Ltd., a Finland-based sustainable packaging innovator, secured €15 million in a funding round co-led by Lifeline Ventures and Chanel to scale up the production of its bio-based straws and packaging solutions. The investment was directed toward expanding manufacturing capabilities and developing new PLA-free compostable straw technologies to address micro plastic concerns.

We are excited that these international players recognize the potential of our innovation and support our mission to save the world from plastic waste. The renewed support from the leading luxury house Chanel also indicates that sustainability is a priority in the luxury market. As a truly sustainable alternative celebrating premium quality and design, Sulapac is the perfect fit for this segment.”- Suvi Haimi, CEO of Sulapac.

Recent innovations in the compostable straws market focus on durability and water resistance. Manufacturers are developing multi-layered coatings, using cellulose, agar, and edible-grade materials to improve functionality. These designs prevent premature sogginess while ensuring full composability.

The market is expected to witness significant growth in Asia-Pacific due to expanding foodservice sectors and strong government support for biodegradable materials. Manufacturers are expected to scale local production and invest in cost-efficient materials to meet volume demand and regulatory compliance.

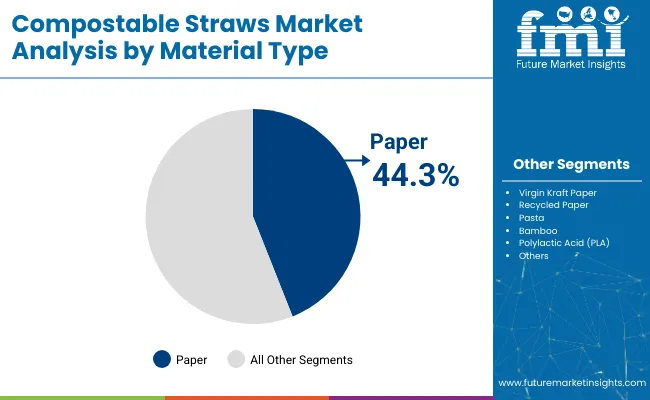

The market has been segmented based on material type, width/diameter, sales channel, end use, and product type. By material type, paper, virgin Kraft paper, recycled paper, pasta, bamboo, and polylactic acid (PLA) have been adopted to align with biodegradability goals, consumer safety, and regulatory compliance in sustainable foodservice packaging.

Width segmentation includes <7 mm, 7-10 mm, 10-15 mm, and >15 mm variants to accommodate various beverage types, from soft drinks to smoothies and bubble tea. Sales channels include manufacturers, distributors, brick & mortar stores, hypermarkets, supermarkets, convenience stores, specialty stores, discount stores, and e-retail, reflecting the expanding accessibility of eco-friendly straws across B2B and B2C landscapes.

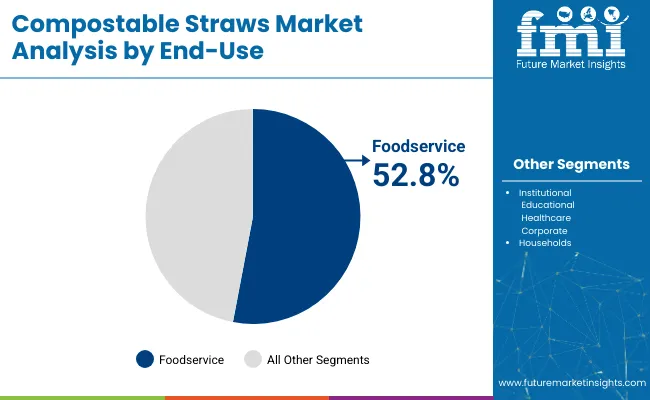

End use is segmented into foodservice (hotels & restaurants, bars & lounges, cafés & fast food chains, cinemas, airline & railway), institutional (educational, healthcare, corporate), and households to capture diversified consumption environments. Product types include straight and flexible straws, each available in printed and non-printed formats to cater to brand customization needs and visual appeal in different service settings.

The paper segment is expected to dominate the compostable straws market with a 44.3% share in 2025, driven by its eco-friendliness, wide availability, and compliance with global plastic-ban mandates. Paper straws decompose naturally within 30-60 days under industrial composting, making them a go-to alternative to single-use plastic straws in regulatory-sensitive regions such as North America and the EU.

Manufacturers prefer paper due to its ease of molding into various diameters, compatibility with food-safe inks, and ability to hold up in cold beverages for up to 2-3 hours. Innovations in multi-ply construction, moisture-resistant coatings, and enhanced bonding adhesives have significantly improved the structural integrity and user experience of paper-based straws, narrowing the performance gap between paper and synthetic options.

With global initiatives like the EU’s Single-Use Plastics Directive and India’s plastic straw ban, demand for paper-based compostable straws has surged across fast-food chains, cafés, bars, and event caterers. Additionally, the lower cost of raw materials and simpler production infrastructure relative to PLA or bamboo options gives paper an economic advantage, especially for high-volume foodservice applications. This segment is expected to remain dominant as both private-label and branded suppliers expand capacity and customization capabilities.

The foodservice segment is projected to account for the largest share of 52.8% in the compostable straws market in 2025, owing to rising sustainability commitments among restaurants, QSRs, hotels, and cafés. As consumers increasingly demand green packaging in their dining experiences, foodservice operators have adopted compostable straws to reinforce brand values and meet regulatory requirements.

This shift is particularly prominent in North America and Western Europe, where large fast-food chains (e.g., McDonald’s, Starbucks, Costa Coffee) have eliminated plastic straws in favor of compostable alternatives. Public sector institutions, catering services, and airline lounges are also rapidly adopting compostable straw formats in line with zero-waste and ESG compliance goals.

Beyond sustainability, the segment’s growth is reinforced by operational benefits including ease of bulk procurement, custom-print branding options, and compatibility with paper cups and lids. Compostable straws offer seamless integration into dine-in, takeaway, and delivery ecosystems without requiring equipment changes. With growing demand from bars, juice bars, and fast-casual outlets in urban centers, the foodservice segment is set to remain the key demand driver through 2035, supported by evolving dining norms and green certification requirements.

Challenge: Disposal Infrastructure and Cost Constraints

Maybe one of the largest challenges the compostable straws market faces is a lack of disposal infrastructure to facilitate appropriate biodegradation. Compostable straws are meant to degrade easier than plastic, yet they are most often reliant on industrial composting not accessible to much of the nation. Without a way to obtain it, compostable straws will also end up in landfills and forfeit the environmental advantage they provide.

Another flaw is that they are more expensive than standard plastic straws. The added expense makes them undesirable for small food establishments and dollar stores, where price sensitivity is issue number one. So the utilization of compostable straws is not being promoted on a broad scale, and most companies will not be able to switch over on an expense basis.

Opportunity: Improvements in Material Science and Consumer Demand

Advances in material technology are opening up new avenues of possibility for compostable straws to achieve performance as much as sustainability. New-generation coating technologies are enhancing the water resistance of paper straws in a manner that they can be made robust without sacrificing their biodegradable character.

Other newer options such as seaweed, rice, or tapioca-based edible straws are being found as well, providing new consumer experiences and minimizing waste. This is due to the increasing need for green restaurants, especially from green-conscious millennials and Gen Z.

Their willingness to utilize green alternatives is a gigantic business opportunity for companies that have embraced green practice. As the customers increasingly demand greener products, the companies can gain from the trend towards greener living.

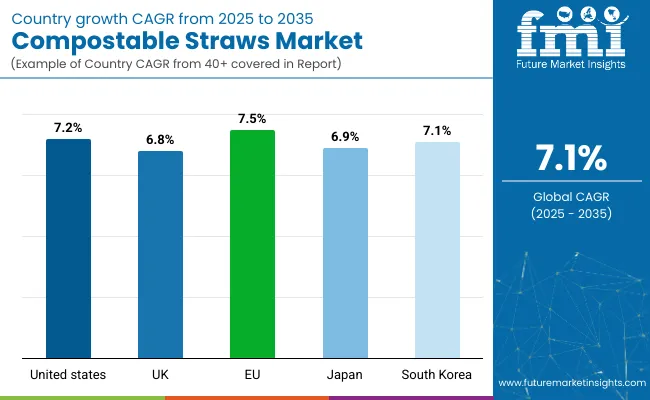

US demand for compostable straws grew due to growing environmental consciousness and government restrictions on single-use plastics in the majority of states, including California and New York. Demand has been driven by the foodservice industry, coffee shops, and fast food restaurants.

In coming years, more companies will utilize compostable straws produced from renewable resources such as plant polymers and straw fibers. Compostable straws will be made more durable by coming technology, as well as even more pleasant to use, and they will be food service favorite number one.

Increased Demand by Quick-Service Restaurants: Major chains like McDonald's and Starbucks have launched compostable straw programs, and mass-market expansion has been the result. The close to USD 150 billion USA food delivery market continues to drive demand for biodegradable straws with sustainable packaging increasing more mainstream.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

UK compostable straw market is seeing a fast expansion with the plastic straw prohibition in the 2020 Single-Use Plastics Directive. The environment, social movements, hospitality sector pressure drive the market.

The sector is also investing in completely compostable products such as wheat, bamboo, and PLA straws. The drinks sector and retailers are also adopting completely compostable products in an effort to acquire new customer base via sustainable adoption of straws.

Hospitality and Retail Growth: UK hospitality industry worth more than £100 billion is increasingly turning to compostable straws in its bid for sustainability. Waste management infrastructure growth continues to drive industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

European Union also has been the forerunner in prohibiting single-use plastics with strict control through EU Directive on Plastics. Plastic straws are banned in Germany, France, and Italy, and compostable straws are trending nowadays.

Compostable straws market is growing as consumers are in search of eco-friendly products and CSR. Additionally, R&D effort towards manufacturing technology has made the cost of bio-based straws lower, and now they become affordable to business.

Increased Investment in Sustainable Packaging: The European food and beverage packaging industry valued at approximately €350 billion still contains biodegradable and compostable material, thus further increasing demand for sustainable straws.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

The market of biodegradable straws in Japan is led by the Japanese government moving away from plastic waste and towards more environmentally friendly alternatives. The Japanese Ministry of the Environment initiated aggressive campaigns to cut plastic waste by 25% in 2030, and it has accelerated the use of biodegradable straws at a faster pace.

They enjoy a longer lifespan of a product and dependability, so very long-lasting products exist in the form of compostable straws which are manufactured using fresh raw materials such as rice, seaweed, and break-down plastic. Convenience stores, supermarkets, and beverage chains employed more and more of the compostable type.

Innovation Technologies of Biodegradable Straws: Nanotechnology-derived bioplastics mixed with very thin but extremely durable material in its bioform already dominating marketplaces Japan first before top rank for green straw manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The South Korean market is expanding for biodegradable straws due to strict waste management regulations and consumer demand for eco-friendly products. The government's Zero Waste campaign and banning plastic straws in coffee shops compelled companies to shift to biodegradable straws.

The region's local production is also turning to new material such as cornstarch, bamboo fibers, and bioplastics PLA-based biodegradable materials to manufacture straws sustainable and stronger. South Korea's goal of a carbon-neutral target by 2050 is catalyzing the market demand.

Green Packaging Solution Development: South Korea's green food and retail market with chain leaders such as Starbucks Korea and Paris Baguette adopted compostable straws with total passion, catalyzing growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

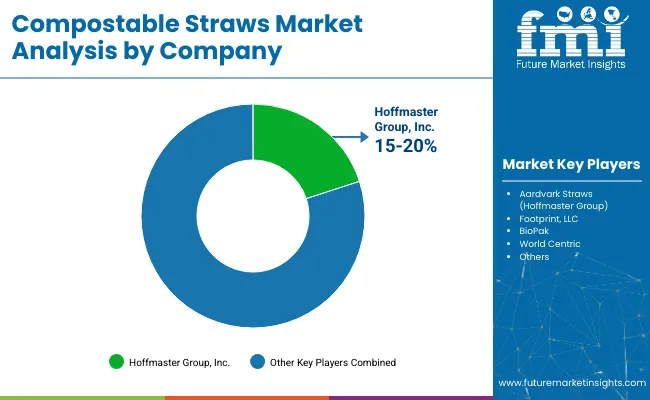

Compostable straw is a competitive industry with the dominance of powerful global players and a combination of regional producers specializing in sustainable packaging. There are some powerful players with large market shares, specializing in material innovation and sustainable product development.

The companies are leadership-generating in biodegradable alternatives to plastic, responding to global regulatory policy and changing consumer behavior. The market is controlled by a combination of seasoned industry players and new entrants to the market, all of whom have important parts to play in shaping industry trends through technological innovation and strategic partnerships.

The global compostable straws market size was estimated at USD 1.9 billion in 2025.

The compostable straws market is expected to reach approximately USD 3.8 billion by 2035.

The increasing environmental awareness, government regulations banning single-use plastics, and consumer demand for sustainable alternatives are expected to drive the demand for compostable straws during the forecast period.

The top 5 countries driving the development of the compostable straws market are the United States, Canada, Germany, France, and China.

On the basis of material type, paper-based compostable straws are expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Pouch Market Size and Share Forecast Outlook 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Plastic Packaging Material Market from 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Market Share Insights of Compostable Foodservice Packaging Providers

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Competitive Overview of Compostable Packaging Companies

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Hinged Lid Compostable Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA