The compostable plastic packaging material market is projected to grow from USD 2.1 billion in 2025 to USD 3.5 billion by 2035, registering a CAGR of 5.2% during the forecast period. Sales in 2024 reached USD 1.9 billion, reflecting steady growth driven by increasing demand for sustainable and eco-friendly packaging solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.1 Billion |

| Projected Market Size in 2035 | USD 3.5 Billion |

| CAGR (2025 to 2035) | 5.2% |

This growth is attributed to the rising environmental concerns, government regulations banning single-use plastics, and the surge in e-commerce and retail sectors seeking biodegradable alternatives. The market's expansion is further supported by innovations in compostable plastic packaging materials, enhancing their durability and appeal to both consumers and retailers.

In 2025, Cornwall Airport in Newquay started composting their used Vegware packaging in 2024. After understanding Cornwall Airport’s sustainability goals, Vegware’s Senior Waste Management Consultant, David Dyce advised on the composting solutions available. “For Cornwall Airport’s needs and requirements, one solution stood out - First Mile’s Return and Recycle scheme. Together with First Mile, we worked with Cornwall Airport to establish a post back service. With the system implemented across the whole site, used Vegware packaging could be collected and sent for in-vessel composting”.

The compostable plastic packaging material market is largely driven by sustainability, with producers concentrating on developing packaging from renewable and biodegradable materials. Innovations include the development of advanced compostable polymers, integration of smart features such as composability indicators, and ergonomic designs for enhanced user experience.

These advancements align with global sustainability goals and regulatory requirements, making compostable plastic packaging materials an attractive option for environmentally conscious consumers. Additionally, the development of modular and customizable packaging solutions has enhanced efficiency and convenience for users, further driving market growth.

Rapid expansion is expected in the compostable plastic packaging material market, fueled by rising demand for sustainable and environmentally friendly packaging options across the food and beverage, healthcare, and personal care sectors. Companies investing in innovative, biodegradable technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing consumer awareness and the shift towards circular economy practices. With continuous advancements in materials and manufacturing processes, the compostable plastic packaging material market is set to offer lucrative opportunities for stakeholders over the forecast period.

The market is segmented on the basis of material type, end-use industry, and region. By material type, the market encompasses polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, cellulose-based materials, polybutylene succinate (PBS), and other bio-based polymers. In terms of end-use industry, the market is categorized into food & beverage, personal care & cosmetics, healthcare & pharmaceuticals, homecare & toiletries, agriculture & horticulture, and industrial goods.

From a regional perspective, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

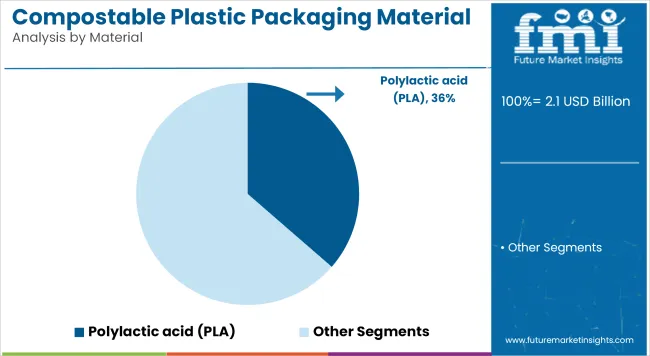

Polylactic acid (PLA) has been projected to account for 36.4% of the global compostable plastic packaging material market by 2025, owing to its bio-based origin, commercial composability, and suitability for direct food contact. Derived from renewable agricultural sources such as corn starch and sugarcane, PLA has been widely adopted for rigid and semi-rigid packaging formats in foodservice and consumer goods applications. Its compatibility with conventional thermoforming, extrusion, and injection molding processes has enabled streamlined integration into existing production lines.

Transparent PLA films and clamshell containers have been used in bakery, produce, and takeaway segments, offering clarity and stiffness comparable to PET. Heat resistance and barrier performance have been enhanced through copolymerization and blending with other bio resins.

Global CPG brands and packaging converters have deployed PLA in trays, cups, blister packs, and labels to meet zero-waste targets and comply with compostable packaging mandates. Composting certification by organizations such as TÜV Austria and BPI has supported end-user acceptance across regulated markets.

Market adoption has been further driven by expanding PLA resin capacities in the USA, China, and Europe, alongside improvements in feedstock supply chain sustainability. The alignment of PLA with plastic bans, EPR frameworks, and food packaging circularity initiatives has strengthened its position as the leading material in the compostable packaging domain.

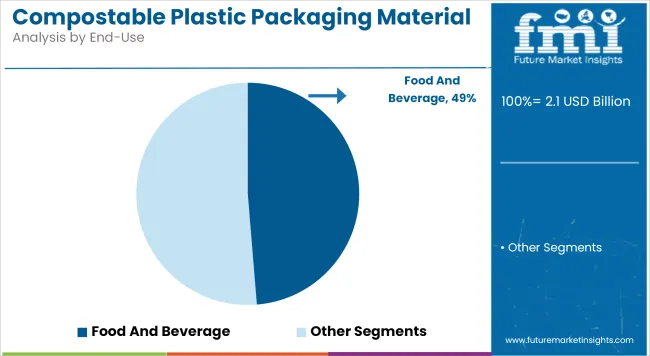

The food and beverage industry has been estimated to contribute 48.7% of the global compostable plastic packaging material market by 2025, supported by rapid demand for single-use, biodegradable alternatives to conventional plastic films and containers. Compostable pouches, cutlery, sachets, and thermoformed trays have been increasingly introduced across ready-to-eat meals, beverages, snacks, and produce segments.

Packaging functionality has been maintained through multilayer structures combining PLA, PBS, or starch blends, offering adequate moisture and oxygen barriers while ensuring industrial composability. Hot-fill compatibility, seal integrity, and grease resistance have also been improved to align with product shelf-life requirements.

Adoption has been accelerated by bans on non-recyclable plastics in food packaging, particularly across Europe and North America. Restaurant chains, organic brands, and specialty food retailers have integrated compostable solutions to align with clean-label and low-impact consumption trends.

Food safety compliance, printing compatibility, and certifications such as EN 13432 and ASTM D6400 have been central to packaging transitions in this sector. Supply chain collaborations between resin producers, converters, and retailers have enabled scalability, allowing compostable packaging materials to become embedded in high-volume food and beverage workflows.

Challenges

Cost and infrastructure limitations Compostable plastics often have higher production costs compared to conventional plastics. Additionally, limited composting infrastructure and inconsistent composting standards pose challenges for widespread adoption.

Opportunities

Material innovation and policy-driven growth Advancements in next-generation biopolymers, including PHA and PLA blends, are improving the performance and cost-efficiency of compostable plastics. Government policies banning petroleum-based plastics and promoting compostable packaging are creating new market opportunities. The development of at-home compostable materials is expanding the market reach to individual consumers.

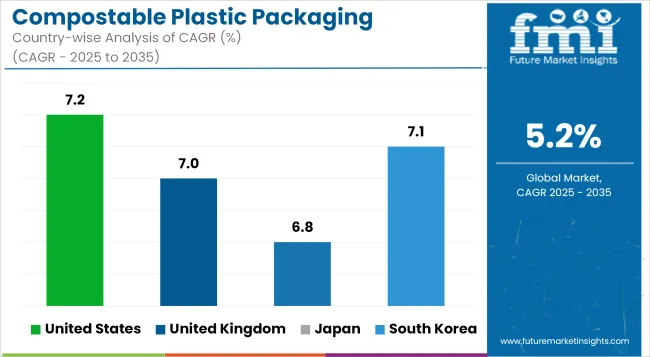

The compostable plastic packaging material market in the United States has emerged owing to the consumer requirement for sustainable and environmentally safe alternatives to conventional plastics. The transition toward biodegradable films, plant-based polymers, and compostable resins in food and beverage, as well as e-commerce packaging, is accelerated with stricter environmental regulations and corporate sustainability initiatives.

American manufacturers have been actively working to promote the development of innovative bio-based materials such as PLA and PHA with enhanced barrier properties and shelf-life. The development of high-performance compostable laminates and advanced coatings for water-resistance are making way for durable compostable packaging solutions.

An AI-based automation system in manufacturing processes is being adopted for better production efficiency and waste reduction. Research is being conducted on compostable packaging that has properties such as oxygen barrier functionalities, which would help in sustaining product freshness for longer. Further, biodegradable smart labels are being developed to enable the consumer to receive instant disposal and sustainability information.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK's market for compostable plastic packaging materials is rapidly witnessing a surge and a significant boom as a result of the government's strict policies to reduce plastic waste. The imposition of the UK Plastic Packaging Tax, combined with single-use plastic bans, has triggered many companies toward opting for compostable packaging for food service, retail, and personal care packaging.

Brands are now integrating home-compostable and industrially compostable films for their packaging to meet circular economy goals. UK manufacturers are now creating high-barrier compostable coatings to bolster moisture resistance and product protection, especially for food packaging applications.

Besides, AI-led quality control systems are influencing uniformity in the production of compostable materials. Research on compostable barrier films is improving the oxygen and moisture resistance for longer shelf life for products. The refillable packaging models have also encouraged brands to consider compostable alternatives for disposable elements.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

The market for compostable plastic packaging material here in Japan keeps gaining momentum with an emphasis on reflecting environmental responsibility and higher advanced packaging technology. The 2050 carbon neutrality commitment in a country has prompted the increased utilization of biodegradable plastic films, compostable pouches, and laminated fiber-based materials in a growing number.

Japanese manufacturers develop heat-resistant and high-strength compostable plastics fit for food wrapping and pharmaceutical applications. Also, the studies concerning nano-enhanced biopolymers are improving the mechanical properties and barrier properties of compostable packaging materials.

The integration of smart sensors into compostable films is gaining momentum as a way to monitor the packaging surroundings in real time. Companies are also investigating plant-based antimicrobial coatings for improved shelf life. Ultra-thin compostable laminates are helping in materials savings and at the same time increasing their strength.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

The compostable plastic packaging materials market in South Korea is growing rapidly because there are a lot of green initiatives pushed by governments and corporate sustainability pledges. Micro rise of eco-friendly consumers was affected by the demand for compostable films, biodegradable trays, and plant-based packaging solutions.

Manufacturers have come up with integrating smart composting indicators into their packaging materials to serve customers with proper disposal education. They have also come up with compostable multi-layer films, making it possible for sustainable packaging to perform better even in humid conditions like fresh produce and frozen foods.

Heat sealable compostable films have improved integrity packaging for different food applications. Researching antimicrobial biopolymers is considerable to prolong shelf life and improve food safety. AI-driven quality control systems are adopted to maintain uniformity in production compostable materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

The compostable plastic packaging material industry is expanding fast as companies are looking for environmentally friendly, biodegradable, and high-performance solutions to conventional plastics. Companies are launching plant-based resins, water-resistant biodegradable films, and compostable adhesives to enhance the material's strength and performance.

Ultra-thin compostable coatings with enhanced food preservation are being developed by companies while ensuring recyclability. Smart compostable labeling is also becoming popular, facilitating improved waste sorting and disposal. Demand for transparent compostable films is growing, enabling customers to glimpse products on packs without needing traditional plastics.

Alliances between innovative sustainable materials providers and pack firms are speeding industry uptake of compostable options.

The overall market size for the Compostable Plastic Packaging Material Market was USD 2.1 Billion in 2025.

The Compostable Plastic Packaging Material Market is expected to reach USD 3.5 Billion in 2035.

The Compostable Plastic Packaging Material Market will be driven by increasing regulatory pressures, consumer demand for eco-friendly packaging, and advancements in bio-based packaging technologies.

The top 5 countries driving the development of the Compostable Plastic Packaging Material Market are the USA, Germany, China, France, and Japan.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Compostable Pouch Market Insights – Growth & Forecast 2024-2034

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Compostable Packaging Companies

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Compostable Foodservice Packaging Providers

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Hinged Lid Compostable Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA