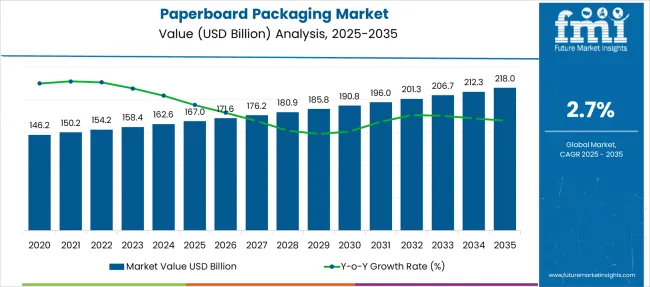

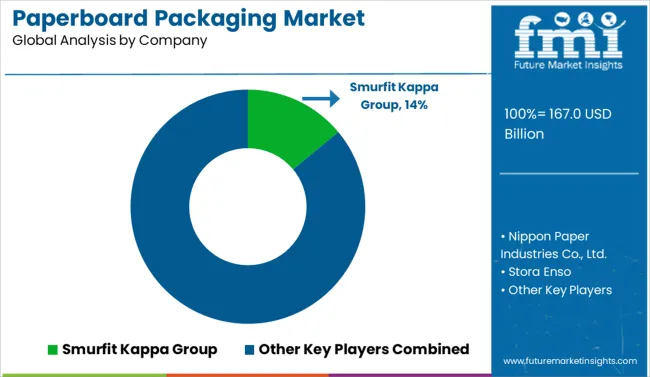

The Paperboard Packaging Market is estimated to be valued at USD 167.0 billion in 2025 and is projected to reach USD 218.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period. A rolling CAGR evaluation reveals a stable but gradually flattening growth pattern. Between 2025 and 2030, the market moves from USD 167.0 billion to 190.8 billion, translating into a five-year CAGR of approximately 2.6%, driven by consistent demand in food and beverage packaging and rising e-commerce shipments. The following interval (2026-2031) maintains similar momentum, as the market climbs to 196.0 billion, indicating growth without significant acceleration. In later years (2030-2035), the CAGR remains close to 2.7%, with absolute gains increasing modestly as values reach 218.0 billion by 2035, demonstrating a mature market with incremental opportunities rather than sharp surges.

The year-on-year growth curve in the chart below highlights an early decline post-2022, stabilizing between 2029 and 2033, before a marginal recovery in the last phase. This pattern suggests low volatility and high predictability, positioning the market as resilient but not aggressively expanding. For competitive advantage, manufacturers should prioritize lightweighting, premium board grades, and cost optimization, leveraging automation and regional supply chain networks to maintain margins in a low-growth environment.

With an estimated 15% share in the USD 1.1 trillion packaging sector, paperboard remains a primary choice for sustainable and versatile packaging formats. Within the paper and pulp industry, paperboard packaging absorbs around 10-12% of global capacity, underlining its reliance on upstream raw material trends. Its integration with food and beverage packaging is even more pronounced, where it commands an 18-20% share, driven by the widespread use of folding cartons for beverages, snacks, and frozen products. In consumer goods packaging, the material holds 12-14% share, particularly in cosmetics, personal care, and pharmaceuticals where visual branding is crucial. The strongest growth linkage lies with e-commerce packaging, where paperboard holds a leading 22-25% share, aligning with demand for lightweight, protective, and customizable solutions in online retail logistics.

| Metric | Value |

|---|---|

| Paperboard Packaging Market Estimated Value in (2025E) | USD 167.0 billion |

| Paperboard Packaging Market Forecast Value in (2035F) | USD 218.0 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

The paperboard packaging market is witnessing steady expansion, driven by surging demand for eco-friendly packaging solutions and heightened regulatory focus on reducing single-use plastics. Rapid urbanization, the rise in e-commerce shipments, and increased consumption of packaged goods have created favorable conditions for manufacturers prioritizing sustainable alternatives.

Recyclability, cost-efficiency, and printability are being viewed as major purchasing criteria among consumer goods and industrial sectors alike. Additionally, the shift toward circular economy practices and brand mandates for carbon reduction is further reinforcing the adoption of fiber-based packaging formats.

Advancements in coating technologies and barrier enhancements have expanded the application range of paperboard across both dry and moist product categories. Moving forward, continued innovation in lightweighting, digital print adaptability, and automation in converting processes is anticipated to unlock scalable growth opportunities across diverse industries.

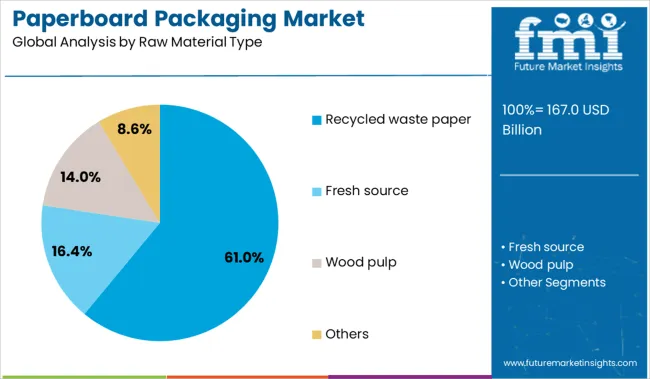

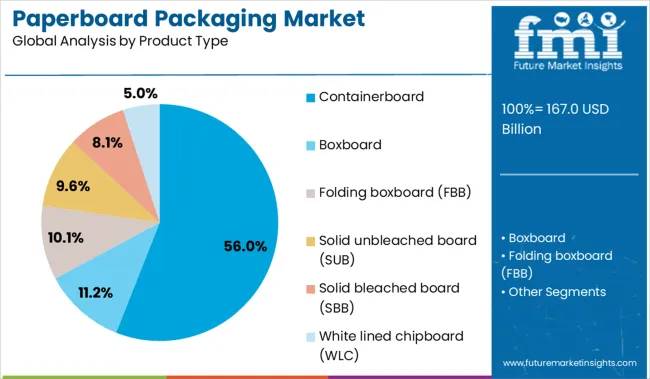

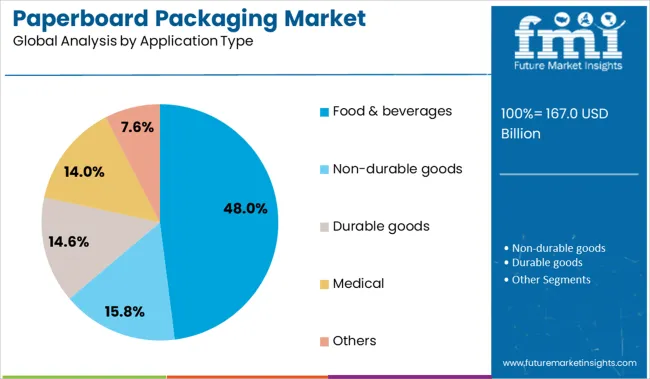

The paperboard packaging market is segmented by raw material type, product type, application type, and region. By raw material type, it includes recycled waste paper, fresh source, wood pulp, and others, catering to both sustainable and virgin material demand. In terms of product type, the segmentation covers containerboard, boxboard, folding boxboard (FBB), solid unbleached board (SUB), solid bleached board (SBB), and white lined chipboard (WLC), reflecting the diversity of packaging solutions. Based on application type, the market encompasses food and beverages, non-durable goods, durable goods, medical, and other end-use industries. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Recycled waste paper is projected to account for 61.0% of the raw material share in 2025, positioning it as the leading input in the paperboard packaging market. This leadership is being driven by increased emphasis on closed-loop recycling systems and global sustainability mandates.

The availability of post-consumer and post-industrial waste paper streams, coupled with lower energy and water requirements in recycled paper production, has made it a cost-effective and environmentally favorable option. Governments and corporate buyers are increasingly incentivizing the use of recycled materials to meet carbon footprint reduction targets and extended producer responsibility (EPR) compliance.

Additionally, advancements in fiber recovery technologies and deinking processes have improved the quality and strength characteristics of recycled paperboard, further broadening its applicability across high-volume packaging formats.

Containerboard is expected to command 56.0% of the product type market share in 2025, making it the dominant format within paperboard packaging. The exponential rise in e-commerce, logistics, and retail-ready packaging applications is supporting its widespread use.

Containerboard provides an optimal balance of rigidity, cushioning, and stackability, making it suitable for secondary and tertiary packaging in both consumer and industrial supply chains. The ability to manufacture containerboard in a variety of grades and fluting profiles has allowed it to meet diversified end-use requirements.

As demand intensifies for lightweight yet durable packaging that can withstand long-distance transportation and automated handling systems, containerboard remains a preferred choice across geographies. The product's compatibility with flexographic and digital printing also enables value-added branding opportunities.

The food and beverages industry is projected to contribute 48.0% of the paperboard packaging market revenue in 2025, making it the largest application segment. This growth is being attributed to the increasing demand for sustainable, food-grade packaging that aligns with both safety standards and environmental considerations.

Brands are moving away from plastic-based formats toward recyclable and biodegradable paperboard cartons, trays, and sleeves. The ability of paperboard to provide protection, shelf appeal, and compliance with direct food contact regulations has made it a preferred material across ready-to-eat meals, dairy products, bakery, and beverage packaging.

In addition, innovations in aqueous and biopolymer coatings have enhanced paperboard’s barrier properties, supporting its application in chilled and frozen food supply chains. The sector’s reliance on fast-moving consumer goods (FMCG) dynamics and high turnover rates further supports volume growth.

The paperboard packaging sector continues to gain momentum as regulatory mandates, brand positioning efforts, and material recyclability shape procurement strategies. Corrugated, folding carton, and tray-style paperboard formats have witnessed widespread use in consumer goods, driven by e-commerce growth and premiumization in food and personal care.

Suppliers that deliver high-strength board grades, advanced coatings, and short-run print customization have secured contracts across CPG, pharma, and specialty retail. Stakeholders are also prioritizing mono-material packaging formats that align with global recycling infrastructure and Extended Producer Responsibility (EPR) frameworks.

Mandatory packaging disclosures, including nutrition panels, allergen alerts, and digital identifiers such as QR codes, have necessitated structured print space, making paperboard cartons essential for compliance execution. Folding cartons allow modular layout flexibility, accommodating language localization and regulatory labeling without altering pack shape.

Simultaneously, premiumization strategies have elevated demand for embossed finishes, foil accents, and tactile enhancements that improve shelf presence. In e-commerce, lightweight paperboard mailers with engineered shock resistance are replacing plastic void fills and outer shells. Coated paperboard options now offer humidity tolerance and oil resistance, enabling wider food-contact use cases. Regulatory shifts toward recyclability and reduced composite materials have made paperboard a preferred substrate across SKUs, reinforcing its role as a compliance-enabling and brand-forward medium.

The evolution of functional coatings such as vapor barriers, anti-scuff finishes, and compostable linings is positioning paperboard for greater penetration into frozen, refrigerated, and liquid-contact categories. Use cases have expanded in insulated meal kits, ready-to-heat containers, and luxury cosmetic sets, where traditional plastic formats are being phased out. Print-to-pack solutions involving digital presses and modular die-cutting are enabling rapid prototyping and SKU agility for small-batch product lines. Collaboration between substrate manufacturers and specialty converters has yielded recyclable coated paperboard variants suitable for aseptic or semi-rigid applications. Subscription-based DTC brands are investing in compartmentalized and interactive packaging to enhance unboxing experiences, driving the need for precision-milled trays and smart-fold formats. These advancements are transforming paperboard packaging from a cost center to a value-adding touchpoint in brand strategy and supply chain design.

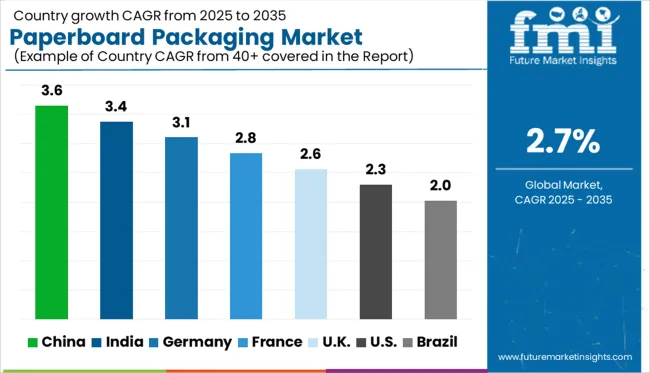

| Countries | CAGR |

|---|---|

| China | 3.6% |

| India | 3.4% |

| Germany | 3.1% |

| France | 2.8% |

| UK | 2.6% |

| USA | 2.3% |

| Brazil | 2.0% |

The global paperboard packaging market is projected to grow at a 2.7% CAGR between 2025 and 2035, supported by demand from foodservice, e-commerce, and premium retail channels. China leads at 3.6%, propelled by large-scale export packaging and folding carton uptake in the FMCG sector. India follows with 3.4%, benefiting from single-serve packs, growth in organized retail, and the rise of regional print-conversion hubs.

Germany, expanding at 3.1%, emphasizes laminated and specialty coated board for electronics and retail categories. France achieves 2.8%, with luxury-driven adoption in beauty and spirits packaging. The United Kingdom, at 2.6%, focuses on rigid boxes for gifting, cosmetics, and branded e-commerce kits. Collectively, these markets showcase the dual strategy of volume-led growth in Asia and premium-centric demand in OECD regions. These five nations were selected as strategic references from over 40 markets evaluated.

China is expected to grow at a 3.6% CAGR through 2035, anchored in high-volume consumer goods packaging, foodservice applications, and folding cartons for e-commerce shipments. Rapid integration of digital print lines and advanced converting equipment across Guangdong and Zhejiang strengthens domestic supply.

Local converters are introducing barrier-coated paperboard as a substitute for plastic trays in frozen food and ready-meal formats. Multicolor offset and flexographic solutions dominate carton production for FMCG and beverage labels. Bulk demand also arises from electronic packaging inserts and protective sleeves. Export-oriented manufacturers emphasize lightweight designs for shipping cost optimization, keeping China at the forefront of high-volume packaging innovations.

Demand for paperboard packaging in India is forecast to grow at a 3.4% CAGR, supported by demand from organized retail, quick-service restaurants, and regional printing networks. Folding cartons for pharmaceutical, personal care, and processed food brands represent the core growth segment. Domestic mills in Gujarat and Maharashtra are investing in multilayer board lines with PE coatings for moisture-sensitive products.

Corrugated board integration with high-strength liner grades supports e-commerce shipment packaging. Government-driven initiatives for reducing single-use plastics have accelerated board substitution in takeaway and home-delivery formats. India’s export-led segments in tea, spices, and confectionery also fuel the use of printed folding cartons in primary and secondary packaging.

Germany is projected to grow at a 3.1% CAGR, driven by premium folding cartons, coated boxboard, and high-strength corrugated formats. The market emphasizes rigid and laminated boards for electronics, medical devices, and luxury goods packaging. Folding cartons designed for compact pharmaceutical blister packs dominate demand in healthcare distribution.

Automated carton erecting and filling systems are being integrated across food and confectionery lines, reinforcing value-added board usage. Manufacturers are also incorporating water-based barrier coatings for dry snack packs and bakery cartons. Germany’s mature market aligns with sustainability certifications such as FSC and PEFC, impacting supply sourcing and customer procurement norms.

France is expected to grow at a 2.8% CAGR, shaped by aesthetic-driven packaging in cosmetics, luxury wines, and gourmet food segments. Rigid box formats dominate premium categories, while folding cartons remain prevalent in personal care and confectionery. French converters are leveraging advanced embossing, foil stamping, and soft-touch finishes for brand differentiation.

Investment in specialty board lines for perfume and spirits packaging reinforces value orientation. FMCG brands are gradually adopting mono-material boards for recyclability under EU packaging directives. France’s market maintains a strong linkage between packaging functionality and brand presentation, favoring short-run, high-quality print processes for boutique and artisanal labels.

The United Kingdom is forecast to grow at a 2.6% CAGR, slightly below the global average, anchored in retail-ready, gifting, and branded e-commerce packaging. Folding cartons and rigid paperboard boxes dominate premium gifting segments, including cosmetics and confectionery. Rising adoption of subscription box models supports higher-value board formats with advanced digital print customization.

Retail and grocery chains are shifting toward shelf-ready cartons for efficient merchandising. The UK market also shows increasing interest in FSC-certified boards for sustainable branding, driven by consumer preference for traceable sourcing. Despite reliance on imports for specialty coated grades, converters maintain strong domestic production for short-run, high-value packaging orders.

Smurfit Kappa Group leads the paperboard packaging market with its integrated corrugated, containerboard, and fiber-based solutions. International Paper Group maintains scale-driven dominance across North America and global FMCG segments, offering strength-optimized paperboard for e-commerce and retail packaging. Stora Enso and Mondi plc drive European innovation with lightweight, recyclable coatings and renewable fiber-based boards aligned with stringent sustainability mandates.

Nippon Paper Industries and Oji Holding Corporation strengthen Asian supply networks by focusing on virgin pulp and premium folding carton solutions for food and personal care sectors. Svenska Cellulosa Aktiebolaget (SCA) emphasizes FSC-certified boards suited for healthcare and consumer packaging, while SAPPI enhances high-barrier specialty paperboard capacity in African markets. ITC Limited leverages its domestic advantage in India with customizable and eco-conscious formats for foodservice and personal care packaging. Competitive advantage revolves around cost optimization, recyclability compliance, and digital printing integration for short-run customization.

In November 2024, Mondi opened FlexStudios, a 2,300 m² innovation hub in Steinfeld, Germany, designed for co-creating sustainable flexible packaging solutions with customers, offering pilot lines, testing labs, and interactive R&D spaces.

| Item | Value |

|---|---|

| Quantitative Units | USD 167.0 Billion |

| Raw Material Type | Recycled waste paper, Fresh source, Wood pulp, and Others |

| Product Type | Containerboard, Boxboard, Folding boxboard (FBB), Solid unbleached board (SUB), Solid bleached board (SBB), and White lined chipboard (WLC) |

| Application Type | Food & beverages, Non-durable goods, Durable goods, Medical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smurfit Kappa Group, Nippon Paper Industries Co., Ltd., Stora Enso, South African Pulp & Paper Industries, Mondi plc, ITC Limited, Oji Holding Corporation, International Paper Group, and Svenska Cellulosa Aktiebolaget |

| Additional Attributes | Dollar sales are segmented by package type including folding cartons, rigid boxes, trays, and sleeves, with folding cartons holding the largest share. Growth is fueled by lightweight, recyclable formats for food, pharma, and personal care sectors. OEMs and CDMOs deliver turnkey converting, structural customization, and private-label packaging services. Adoption accelerates in North America, Europe, and Asia-Pacific with e-commerce expansion and brand differentiation needs. |

The global paperboard packaging market is estimated to be valued at USD 167.0 billion in 2025.

The market size for the paperboard packaging market is projected to reach USD 218.0 billion by 2035.

The paperboard packaging market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in paperboard packaging market are recycled waste paper, fresh source, wood pulp and others.

In terms of product type, containerboard segment to command 56.0% share in the paperboard packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paperboard Mailer Market Growth - Demand & Forecast 2025 to 2035

Paperboard Tray Market Growth - Trends & Forecast 2025 to 2035

Paperboard Partition Market Demand & Protective Packaging Innovations 2024 to 2034

Paperboard Jar Market Analysis – Size, Demand & Forecast 2024-2034

Paperboard Jewellery Box Market Growth & Trends Forecast 2024-2034

Paperboard Clamshell Boxes Market

Paperboard Bowl Market

Paper Paperboard Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Push-up Paperboard Tube Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Push-up Paperboard Tube Market

Folding Paperboard Boxes Market

Poly Coated Paperboard Market

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Coated Recycled Paperboard Providers

Unbleached Kraft Paperboard Market Analysis by Product type, Coating type, and End Use through 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA