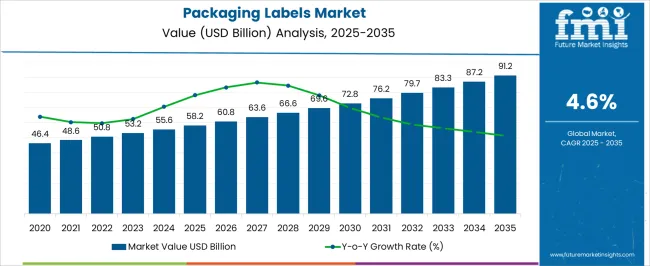

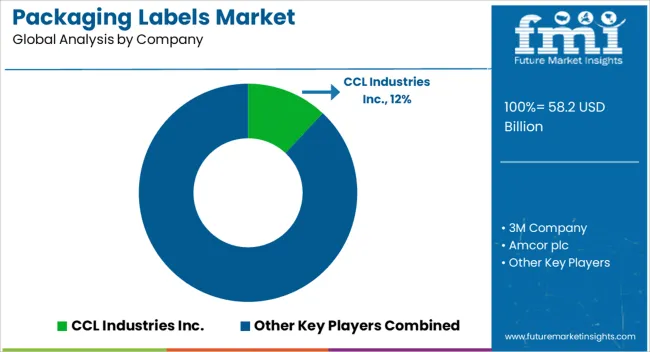

The packaging labels Market is estimated to be valued at USD 58.2 billion in 2025 and is projected to reach USD 91.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The market shows steady and consistent growth throughout the forecast period. Between 2025 and 2030, the market grows from USD 58.2 billion to USD 72.8 billion, contributing USD 14.6 billion in growth, with a CAGR of 5.1%. This early-phase growth is driven by the increasing demand for packaging labels across various industries, such as food and beverage, healthcare, and consumer goods.

Factors such as the growth of e-commerce, rising consumer demand for product information and branding, and innovations in label technology contribute to the market’s expansion. From 2030 to 2035, the market continues its upward trajectory, expanding from USD 72.8 billion to USD 91.2 billion, adding USD 18.4 billion in growth, with a slightly lower CAGR of 4.1%. This deceleration reflects the market’s maturity as the demand for packaging labels becomes more standardized, but growth remains strong due to ongoing product innovations, including eco-friendly materials, smart labels, and digital printing technologies. The overall market growth highlights a consistent and stable upward trend, with technological advancements continuing to drive incremental growth across multiple industries.

| Metric | Value |

|---|---|

| Packaging Labels Market Estimated Value in (2025 E) | USD 58.2 billion |

| Packaging Labels Market Forecast Value in (2035 F) | USD 91.2 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The packaging labels market is gaining strong momentum as manufacturers and brand owners focus on enhancing product appeal, traceability, and compliance with evolving global standards. Current market conditions are being shaped by increased demand for smart labeling, product authentication, and sustainability across both consumer and industrial sectors.

Industry developments have shown that digital transformation in packaging and the integration of QR codes, tamper-evident features, and serialization are accelerating the transition toward more intelligent labeling solutions. Reports from packaging associations and corporate sustainability disclosures have emphasized the rising importance of recyclable and adaptable label materials to meet regulatory and environmental mandates.

Looking ahead, innovations in print technology, increased automation in label application systems, and rising e-commerce penetration are expected to drive further growth As businesses seek to enhance shelf visibility and consumer interaction while ensuring operational efficiency, packaging labels are anticipated to play a strategic role in shaping brand identity, compliance, and customer engagement across multiple verticals.

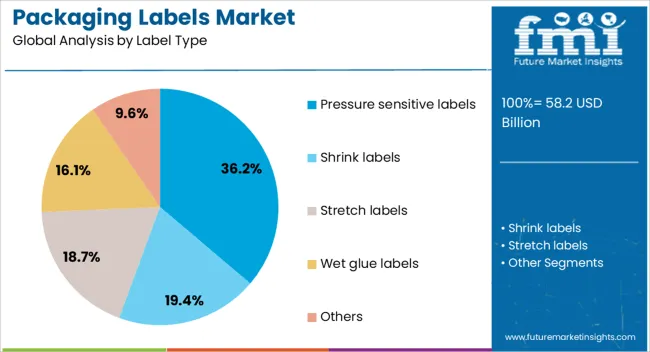

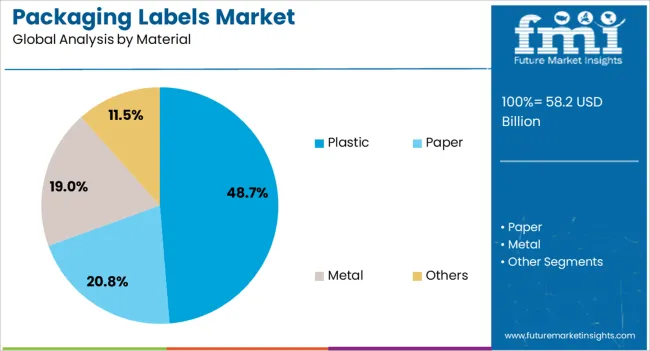

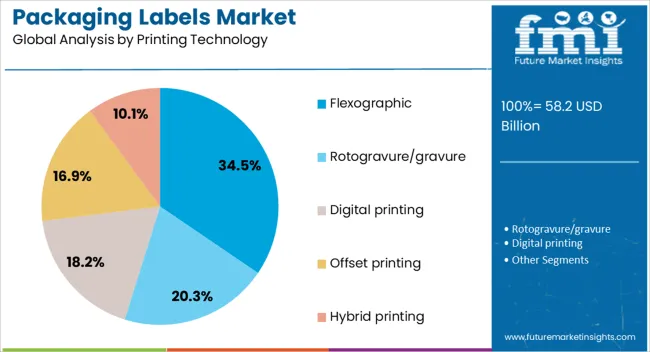

The packaging labels market is segmented by label type, material, printing technology, end use industry, and geographic regions. By label type, the market is divided into pressure sensitive labels, shrink labels, stretch labels, wet glue labels, and others. In terms of material, the market is classified into plastic, paper, metal, and others. Based on printing technology, the market is segmented into flexographic, rotogravure/gravure, digital printing, offset printing, and hybrid printing. By end use industry, the market is segmented into food & beverages, pharmaceutical, consumer goods, chemicals, automotive, industrial, and others. Regionally, the packaging labels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pressure sensitive labels segment is projected to hold 36.2% of the packaging labels market revenue share in 2025, making it the leading label type segment. Its dominance is being driven by versatility, ease of application, and suitability across a wide range of packaging materials and product types.

Industry sources have highlighted that pressure sensitive labels offer significant advantages in terms of design flexibility, print clarity, and compatibility with various adhesives, which make them highly adaptable to automated labeling lines. These labels have been widely adopted in food and beverage, pharmaceuticals, and personal care products due to their ability to maintain adhesion under varying temperature and moisture conditions.

The segment’s prominence is further supported by advancements in sustainable adhesives and linerless technologies, which have helped manufacturers reduce waste and improve production efficiency These benefits, combined with reduced application time and enhanced aesthetic appeal, have contributed to the strong positioning of pressure sensitive labels in the overall market.

The plastic material segment is anticipated to account for 48.7% of the market revenue share in 2025, securing its role as the dominant material category. This leadership position is being maintained due to the material’s lightweight nature, cost efficiency, and durability, which are critical for high-speed production environments and diverse packaging formats.

Industry-led sustainability initiatives have prompted innovations in recyclable and bio-based plastics, enabling compliance with environmental regulations while preserving performance. Reports from packaging manufacturers have emphasized that plastic labels provide excellent moisture resistance, clarity, and printability, which are essential for visually intensive product labeling.

The demand from sectors like beverages, cosmetics, and household chemicals has remained strong, where plastic labels ensure visual appeal and long-lasting adhesion The segment’s growth has been supported by ongoing investments in mono-material packaging systems and compatibility with emerging label removal and recycling technologies, positioning it as a preferred material choice across industries.

The flexographic printing technology segment is expected to represent 34.5% of the market revenue share in 2025, maintaining its lead among printing technologies. This growth is being attributed to its high-speed capability, cost-effectiveness for long print runs, and compatibility with various substrates including paper, film, and foil.

Industry updates and equipment manufacturer briefings have noted that flexographic presses are increasingly equipped with automation and digital integration features, allowing for faster changeovers and reduced downtime. The segment has gained preference in sectors such as food, beverages, and logistics where large volume labeling with consistent quality is critical.

Advancements in UV-flexo inks and sustainable plates have further enhanced print performance while addressing environmental concerns The ability to produce high-resolution graphics at scale, combined with lower per-unit costs and reliable throughput, has supported the continued expansion of flexographic printing as a dominant technology in the packaging labels market.

The packaging labels market is experiencing growth driven by the increasing demand for packaging solutions across various industries such as food and beverage, pharmaceuticals, and consumer goods. Labels provide critical information about product ingredients, nutritional facts, usage instructions, and brand identity, making them an essential part of packaging. The growing trend of customization, along with the rising focus on branding and product differentiation, is further fueling the demand for innovative label designs. Despite challenges such as raw material costs and environmental concerns, the market continues to expand with technological advancements in printing and labeling techniques.

The primary driver of the packaging labels market is the growing demand for packaging solutions that provide detailed consumer information and enhance brand identity. As consumer awareness regarding ingredients, nutrition, and product sourcing rises, companies are investing in clear, informative labels to meet regulatory requirements and consumer preferences. In industries like food and beverage, pharmaceuticals, and cosmetics, packaging labels play an important role in ensuring compliance with legal standards while offering essential product details. The increasing focus on branding and product differentiation is pushing companies to adopt creative and customized label designs that attract consumers and build brand recognition. As e-commerce continues to thrive, the need for strong product labeling that communicates trust and transparency is driving the demand for high-quality packaging labels.

A significant challenge in the packaging labels market is the rising raw material costs. The price of materials such as paper, film, and adhesives can fluctuate due to global supply chain disruptions and demand imbalances. These price increases can impact the overall cost of labeling solutions, making it difficult for manufacturers, particularly small and medium-sized businesses, to maintain profitability. Additionally, the environmental impact of packaging labels, particularly those made from non-recyclable materials or containing excessive plastic, is a growing concern. Governments and consumers are increasingly calling for more sustainable and eco-friendly labeling options. This shift toward sustainability may require manufacturers to invest in new materials and production processes, adding complexity and cost to operations, which can hinder market growth.

The packaging labels market presents significant opportunities driven by technological innovations and the growing demand for sustainable labeling solutions. Advancements in printing technologies, such as digital printing, enable more customized, cost-effective, and high-quality labels. These technologies allow brands to quickly adapt to market trends and consumer demands with smaller production runs and personalized designs. Moreover, the rise in consumer preference for environmentally friendly products is opening opportunities for the development of sustainable packaging labels made from recyclable, biodegradable, or plant-based materials. Brands that invest in eco-friendly labeling solutions can tap into the growing market for sustainable products. The use of smart labels integrated with technologies like QR codes, NFC, and RFID is becoming increasingly popular, enabling brands to enhance consumer engagement, improve traceability, and offer value-added features.

A key trend in the packaging labels market is the increasing adoption of smart labels. Smart labels, which incorporate technologies like QR codes, RFID, and NFC, are gaining traction as they provide consumers with real-time information and enhance the overall customer experience. These labels enable manufacturers to offer more interactive features, such as tracking, authentication, and personalized offers, driving brand loyalty and consumer trust.The trend toward product customization is becoming increasingly prominent, as brands aim to cater to consumer preferences for unique and personalized packaging. Digital printing technologies allow companies to create small, customized label runs efficiently, catering to niche markets and seasonal promotions. These trends reflect the growing desire for more interactive, transparent, and tailored packaging solutions, which are driving innovation in the packaging labels industry.

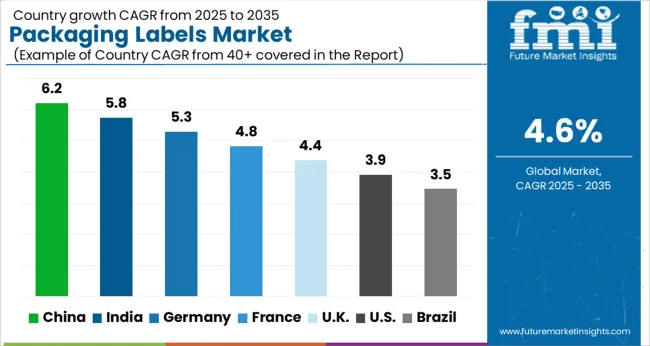

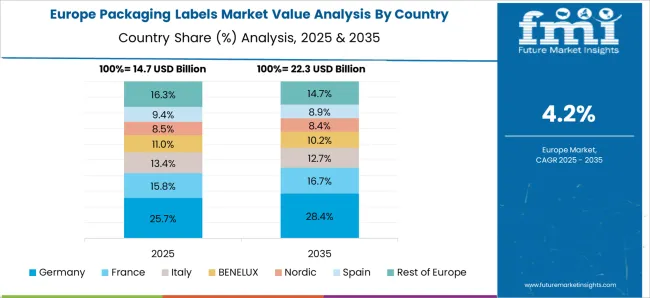

The packaging labels market is expected to grow at a global CAGR of 4.6% from 2025 to 2035. China leads the market with a growth rate of 6.2%, followed by India at 5.8%. Among OECD countries, Germany is expected to grow at 5.3%, while the UK shows 4.4% growth, and the USA stands at 3.9%. The growth is driven by the increasing demand for packaged goods in sectors such as food and beverage, pharmaceuticals, and personal care. Packaging labels are becoming more important as consumer preferences shift toward convenience, traceability, and sustainability. As a result, there is significant demand for advanced labeling solutions that provide better functionality, security, and brand differentiation. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to grow at a 6.2% CAGR through 2035, driven by the growing demand for packaged products across sectors such as food, beverages, and pharmaceuticals. With the increasing middle-class population and rising urbanization, there is greater consumption of packaged goods, which is boosting the demand for packaging labels. The expanding e-commerce sector in China is also contributing to the need for labels that ensure product authenticity and traceability. The adoption of sustainable and smart packaging solutions, such as QR codes and RFID labels, is further accelerating the market’s growth.

India is expected to grow at a 5.8% CAGR through 2035, driven by the booming retail and food & beverage sectors. The demand for packaging labels in India is increasing with the growing adoption of packaged food and beverages, driven by convenience and long shelf life. As the retail and e-commerce industries expand, there is a rising need for labels that ensure product authenticity, improve brand visibility, and meet regulatory requirements. India’s growing focus on sustainable packaging solutions is also pushing the demand for eco-friendly labels that align with environmental concerns.

Germany is projected to grow at a 5.3% CAGR through 2035, driven by the increasing demand for sustainable packaging solutions. Germany’s automotive, pharmaceutical, and consumer goods industries are driving the demand for high-quality, functional packaging labels. The focus on smart packaging and sustainability, combined with Germany’s well-established regulatory frameworks for labeling, is encouraging companies to invest in advanced labeling technologies. The market is also witnessing growth due to the increasing popularity of digital printing solutions that provide cost-effective and flexible labeling options for various industries.

The United Kingdom is projected to grow at a 4.4% CAGR through 2035, driven by the rising demand for consumer goods and packaged food & beverages. As one of the leading markets in Europe, the UK has a well-established packaging industry, and the demand for innovative and eco-friendly packaging labels is on the rise. The UK market is focusing on the integration of digital and RFID technology to improve tracking, inventory management, and consumer engagement. The increasing focus on sustainability in packaging is also contributing to the adoption of recyclable, compostable, and biodegradable labels.

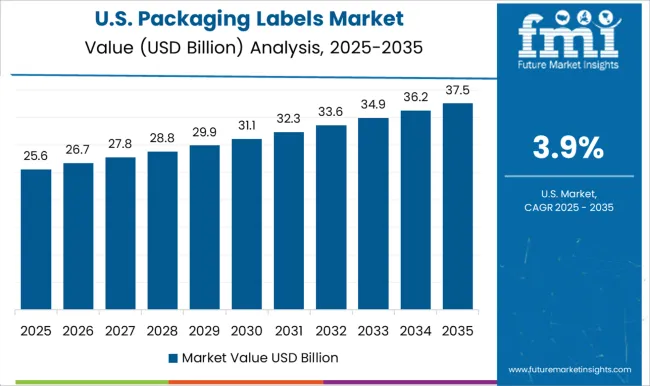

The United States is projected to grow at a 3.9% CAGR through 2035, with increasing demand for packaging labels across industries such as food & beverage, pharmaceuticals, and personal care. The USA market is focusing on enhancing label functionality through the integration of smart and connected packaging solutions. Furthermore, regulatory requirements for product labeling are driving the demand for accurate and compliant packaging labels. The market is also benefiting from the rise of e-commerce, where labels play an important role in brand recognition, product authenticity, and consumer engagement.

The packaging labels market is shaped by leading companies providing innovative labeling solutions that meet the growing demand for product identification, branding, and consumer engagement. CCL Industries Inc. is a market leader, offering a wide range of labels, including pressure-sensitive, shrink, and stretch films, catering to diverse industries such as food and beverage, cosmetics, and pharmaceuticals. 3M Company provides advanced labeling solutions known for their high durability, ease of application, and tamper-evident features, serving both industrial and consumer markets. Amcor plc specializes in packaging solutions, including labels designed for sustainability and enhanced product visibility. The company focuses on creating environmentally friendly and recyclable label products for a wide array of applications. Anchor Printing and Avery

Dennison Corporation focus on high-quality, customizable labeling solutions for retail, industrial, and commercial uses, offering materials that combine functionality with aesthetic appeal. Berry Global and Constantia Flexibles Group GmbH provide advanced labels with a strong emphasis on functionality, visual appeal, and durability, focusing on meeting market needs in packaging for the food, beverage, and personal care industries. Coveris Holding S.A. and Fort Dearborn Company offer innovative label solutions, catering to consumer goods industries with a focus on packaging design that enhances brand presence.

Fuji Seal International, Inc. and HERMA GmbH offer advanced self-adhesive labels, focusing on ease of use, high performance, and security features, making them highly sought after for packaging and product labeling applications. Honeywell International Inc. and Huhtamaki Group provide packaging solutions with integrated labeling technologies, catering to global markets, including industrial sectors and consumer packaging. ID Images, Klöckner Pentaplast Europe GmbH & Co KG, and KRIS FLEXIPACKS PVT. LTD. focus on delivering high-quality, customizable packaging labels with an emphasis on durability and protection, catering to the growing demand for e-commerce packaging and product security. Lintec Corporation and Mondi Plc provide premium labeling products that combine environmental responsibility with high-performance features for industrial and retail use.

Multi-Color Corporation and Neenah, Inc. offer innovative packaging labels with excellent print quality and versatility, serving industries like beverage, automotive, and consumer electronics. Resource Label Group, LLC, Sato Holdings Corporation, Taghleef Industries Inc., and UPM Raflatac provide high-performance, customizable labeling solutions with cutting-edge technologies that support businesses across multiple sectors, including retail and logistics. WestRock Company completes the competitive landscape with its comprehensive portfolio of labeling and packaging solutions, focusing on innovative designs and functionality for the food and beverage sector, where product differentiation and branding are crucial.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.2 Billion |

| Label Type | Pressure sensitive labels, Shrink labels, Stretch labels, Wet glue labels, and Others |

| Material | Plastic, Paper, Metal, and Others |

| Printing Technology | Flexographic, Rotogravure/gravure, Digital printing, Offset printing, and Hybrid printing |

| End use Industry | Food & beverages, Pharmaceutical, Consumer goods, Chemicals, Automotive, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CCL Industries Inc., 3M Company, Amcor plc, Anchor Printing, Avery Dennison Corporation, Berry Global, Constantia Flexibles Group GmbH, Coveris Holding S.A., Fort Dearborn Company, Fuji Seal International, Inc., HERMA GmbH, Honeywell International Inc., Huhtamaki Group, ID Images, Klöckner Pentaplast Europe GmbH & Co KG, KRIS FLEXIPACKS PVT. LTD., Lintec Corporation, Mondi Plc, Multi-Color Corporation, Neenah, Inc, Resource Label Group, LLC, Sato Holdings Corporation, Taghleef Industries Inc., UPM Raflatac, and WestRock Company |

| Additional Attributes | Dollar sales by product type (pressure-sensitive labels, shrink sleeves, wrap-around labels, and RFID tags) and end-use segments (food and beverage, cosmetics and personal care, pharmaceuticals, retail, logistics). Demand dynamics are influenced by the rising demand for sustainable packaging solutions, increasing e-commerce growth, and the need for smart labeling technologies for tracking and security. Regional trends show strong growth in North America and Europe due to increasing sustainability regulations and packaging innovations, while Asia-Pacific is expanding due to rapid industrialization and growing consumer markets. |

The global packaging labels market is estimated to be valued at USD 58.2 billion in 2025.

The market size for the packaging labels market is projected to reach USD 91.2 billion by 2035.

The packaging labels market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in packaging labels market are pressure sensitive labels, shrink labels, stretch labels, wet glue labels and others.

In terms of material, plastic segment to command 48.7% share in the packaging labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resealable Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Leading Specialty Labels Packaging Providers

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Services Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA