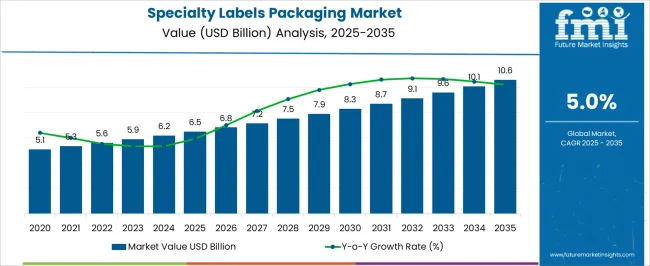

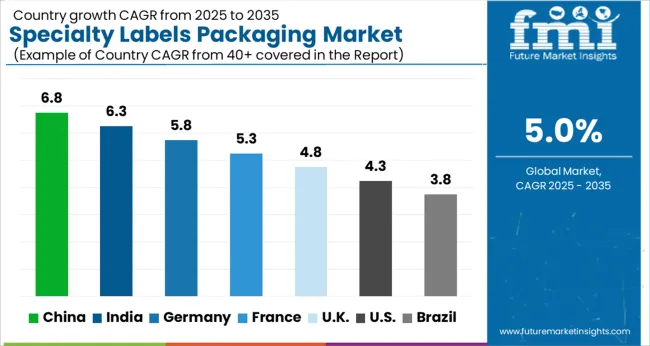

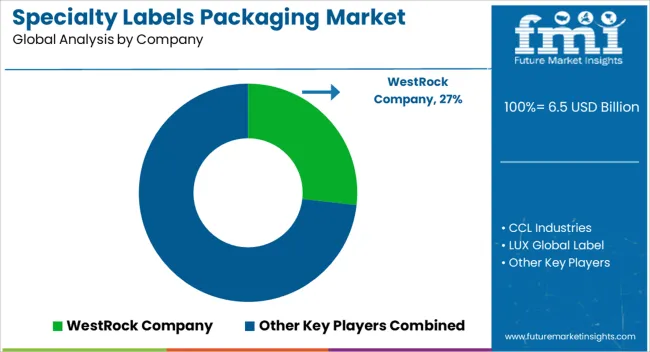

The Specialty Labels Packaging Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Labels Packaging Market Estimated Value in (2025 E) | USD 6.5 billion |

| Specialty Labels Packaging Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The specialty labels packaging market is experiencing consistent expansion due to rising demand for product authentication, regulatory compliance, and enhanced shelf appeal across consumer and industrial sectors. Brand owners are increasingly investing in customized label solutions to convey brand identity, ensure traceability, and deter counterfeiting.

This has led to increased adoption of high performance label materials, innovative print technologies, and specialized ink formulations. The shift toward clean labeling, sustainability goals, and smart packaging integration is further shaping the market’s direction.

Companies are actively upgrading their labeling infrastructure to accommodate variable data printing, security features, and regulatory updates. As consumer packaged goods, pharmaceuticals, and food and beverage segments continue to prioritize differentiation and compliance, the specialty labels packaging market is expected to benefit from evolving material science, printing automation, and ink chemistry innovations.

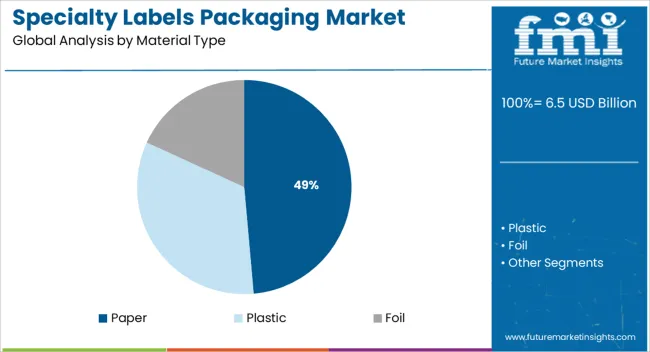

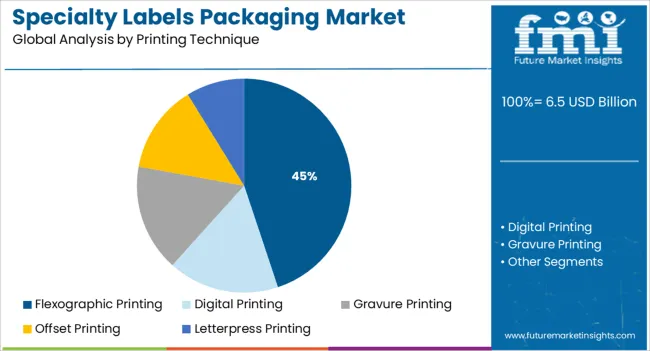

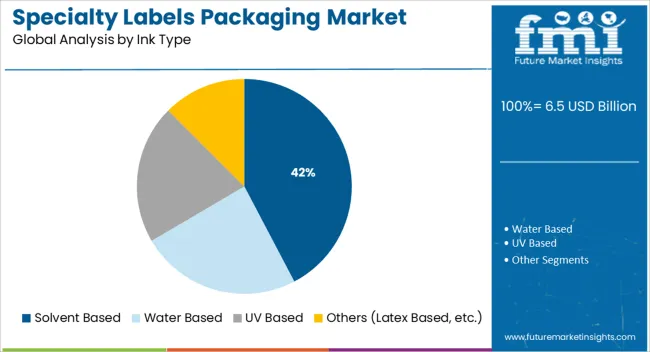

The market is segmented by Material Type, Printing Technique, Ink Type, and End Use and region. By Material Type, the market is divided into Paper, Plastic, and Foil. In terms of Printing Technique, the market is classified into Flexographic Printing, Digital Printing, Gravure Printing, Offset Printing, and Letterpress Printing. Based on Ink Type, the market is segmented into Solvent Based, Water Based, UV Based, and Others (Latex Based, etc.). By End Use, the market is divided into Food & Beverages, Pharmaceutical, Cosmetics & Personal Care, Homecare & Toiletries, Chemicals, Automobiles, and Other Consumer Durables. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper segment is anticipated to account for 48.60% of the total market revenue by 2025 within the material type category, making it the most widely used substrate. This dominance is supported by the growing consumer preference for sustainable packaging materials and the ease of recyclability associated with paper based labels.

Regulatory focus on reducing plastic content in packaging has further strengthened the appeal of paper substrates in labelling applications. Additionally, paper offers excellent printability and compatibility with a range of adhesives and coatings, which has expanded its utility in diverse product categories.

Its cost effectiveness and environmentally responsible profile have enabled brands to meet both aesthetic and compliance requirements, thereby positioning paper as the leading material type in the specialty labels segment.

Flexographic printing is expected to hold 44.90% of market revenue by 2025 within the printing technique category, making it the most adopted technology. This preference is attributed to its high speed production capability, adaptability to a wide variety of substrates, and suitability for both short and long print runs.

Flexographic systems offer precise color reproduction and are particularly effective for printing on flexible materials and textured surfaces, which are common in specialty labeling. The technology also supports water based and UV curable inks, offering flexibility in regulatory and environmental compliance.

With its strong cost to output ratio and rapid setup time, flexographic printing remains the preferred choice for label converters seeking scalability, efficiency, and print consistency across high volume operations.

Solvent based inks are projected to contribute 42.30% of total revenue by 2025 within the ink type category, emerging as the leading segment. This dominance is driven by the inks’ durability, fast drying characteristics, and superior adhesion on non porous and synthetic label materials.

These properties are particularly valuable in applications requiring resistance to moisture, abrasion, and extreme environmental conditions. Solvent based inks perform well on flexible films, metallic foils, and other specialty substrates commonly used in automotive, chemical, and industrial packaging labels.

Despite rising environmental concerns, continuous improvements in solvent recovery systems and low volatile organic compound formulations are enabling ongoing usage within regulated limits. This combination of performance reliability and technological adaptation continues to position solvent based inks as the ink of choice in demanding label applications.

The global specialty labels packaging market witnessed a CAGR of 4.4% during the historical period, with a market value of USD 6.2 Billion in 2024.

Specialty label packaging is a type of packaging that is designed for a specific type of product. This type of packaging is often used for delicate products or requiring special care.

Specialty labels can be made from various materials, such as paper, plastic, or foil, and printed using various methods, such as digital, flexographic, or offset. They can be used for various purposes, including product identification, branding, and marketing.

food service industry are predicted to drive the demand for specialty label packaging. The increased use of packed food creates a growth opportunity for the market. Overall, the global specialty label packaging market is projected to grow faster during the forecast period.

Labels are generally used to inform consumers about credentials, directions for use, warnings, etc. The increased demand for packed food is driving the market for specialty label packaging,, as labels play a significant role in every industry. The shelf life of labels has become a perilous concern for both manufacturers and consumers.

The specialty labels market is growing due to the increasing demand for high-quality and durable labels. Specialty labels are used for various applications, including boxes, pouches, pallets, and more.

They are also used for safety and security purposes. The above-mentioned factors propel the demand for specialty labels and drive the market, which is expected to grow over the upcoming decade.

Based on the material segment, the paper segment holds the significant portion of the global specialty label packaging market. The targeted segment is predicted to grow 1.6x the current market value from 2025 to 2035. Paper is widely used in specialty label packaging due to its low cost and easy availability.

Paper labels are used in various applications, such as food and beverage, healthcare, and consumer goods. This is due to the massive benefits attained from paper, such as its easy recyclable properties, ease of use, and good tear stability, prompting segments such as pressure-sensitive labels.

As per FMI analysis, the end-use industry that offers lucrative growth opportunities for the specialty labels packaging market is food and beverage. The food and beverage industry is the largest consumer of specialty label packaging.

Being an essential industry, there has been a massive spike in <consumer demand for packaged food products and beverages. The industry is growing rapidly due to changing consumer preferences and the need for convenient packaging. Thus, the food & beverage segment is projected to register a CAGR of 5.3% from 2025 to 2035 across the specialty labels packaging market.

The growing Indian paper industry is projected to drive the demand for specialty label packaging. It is predicted to boost the market at the rate of 5.7% CAGR during the forecasted period. There has been substantial growth in the packaging industry in India. The reason for this is the abundant availability of raw materials like paper, favorable regulations, and the business environment required by an industry to prosper.

According to the data provided by the Indian Paper Manufacturers Association (IPMA), approximately 71% of paper is made from recycled fiber, and the Indian paper industry is growing faster due to technology and innovation.

Paper is used in the packaging industry as the paper is most used material in the specialty labels packaging market, the growing paper industry is expected to increase the production of specialty labels packaging and is projected to drive the specialty labels packaging market across India.

FMI analysis states that the USA will account for around 83% of the North American specialty label packaging market by the end of 2025. Growing environmental concerns and consumer preference for packaged products drive sustainable label sales.

The USA's high paper recycling rate is driving the specialty label packaging market. The USA Environmental Protection Agency (EPA) reports that the recycling rate for paper and paperboard packaging products was 68.2% in 2020. This increase in the recycling rate is due to the growing demand for recycled paper and paperboard products.

The high paper recycling rate in the USA is driving the market for specialty label packaging because recycled paper and paperboard products are used to make these labels. Many companies use recycled paper for their labels because it is a sustainable and environmentally friendly option.

The key players in the specialty label packaging market are trying to increase their sales and revenues by expanding their capabilities to meet the growing demand.

The key players are trying to adopt a merger & acquisition strategy to expand their resources and are developing new products to meet customer needs. Also, the players are focusing on upgrading their facilities to cater to the demand. Some of the recent key developments by the leading players are as follows-

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Million Sq. M. | Revenue in USD Billion, Volume in Million Sq. M., and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material Type, Printing Technique, Ink Type, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | WestRock Company; CCL Industries; LUX Global Label; S. Anand Packaging Pvt. Ltd.; Sai Impression; All4Labels Global Packaging Group; LABEL TECH INC.; Consolidated Label Co.; Label Tech, Inc.; Specialty Inc.; AWT Labels & Packaging; Vistaprint; HERMA GmbH; Sticker Mule;Inkmonk; SheetLabels.com; StickerYou; Packhelp; Resource Label Group, LLC; Paramount Labels |

The global specialty labels packaging market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the specialty labels packaging market is projected to reach USD 10.6 billion by 2035.

The specialty labels packaging market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in specialty labels packaging market are paper, plastic and foil.

In terms of printing technique, flexographic printing segment to command 44.9% share in the specialty labels packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Leading Specialty Labels Packaging Providers

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA