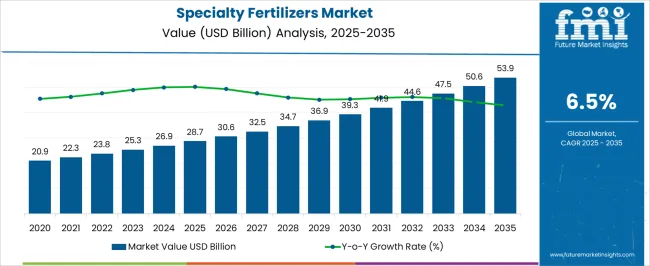

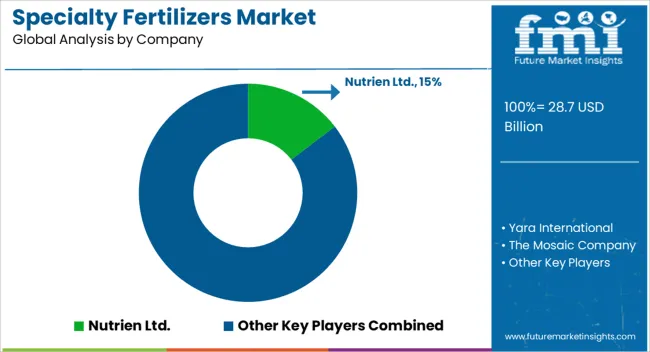

The specialty fertilizers market is estimated to be valued at USD 28.7 billion in 2025 and is projected to reach USD 53.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

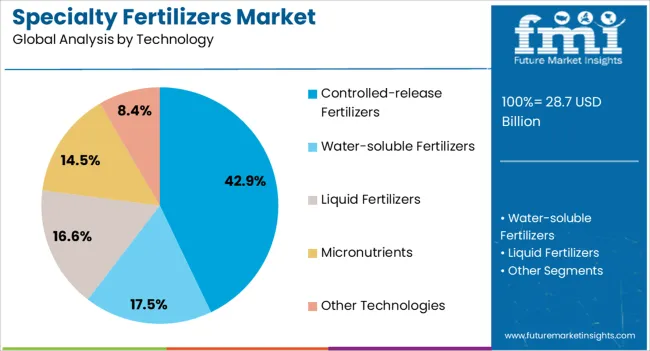

The specialty fertilizers market, estimated at USD 28.7 billion in 2025 and projected to reach USD 53.9 billion by 2035 at a CAGR of 6.5%, demonstrates a pronounced contribution of technology-driven segments to overall market expansion. Advanced nutrient delivery systems, including controlled-release fertilizers, water-soluble formulations, and micronutrient-enriched variants, form the core of technological contributions. Controlled-release fertilizers, designed to gradually release nutrients in synchrony with crop uptake, account for a substantial share due to efficiency gains, reduction in nutrient losses, and enhanced crop yields.

Water-soluble fertilizers, compatible with fertigation systems, have witnessed growing adoption owing to precision agriculture practices, enabling uniform nutrient distribution and improved resource utilization. Micronutrient-enriched formulations, tailored to address soil deficiencies and specific crop requirements, contribute to incremental growth, particularly in regions with intensive horticulture and specialty crop cultivation. The technology mix also includes nano-fertilizers and biostimulant-integrated products, which are gradually influencing market dynamics through enhanced nutrient bioavailability, reduced environmental impact, and improved soil health. These innovations are expected to expand their share as regulatory frameworks and agronomic guidelines increasingly favor environmentally efficient and high-performance inputs.

Over the forecast period, technological advancements are projected to drive differential growth across segments, with controlled-release and water-soluble fertilizers remaining dominant. The market’s progression from USD 28.7 billion to USD 53.9 billion underscores that technological contribution, especially innovations enhancing nutrient efficiency and crop productivity, will be central to competitive differentiation and sustained adoption across global specialty fertilizer markets.

| Metric | Value |

|---|---|

| Specialty Fertilizers Market Estimated Value in (2025 E) | USD 28.7 billion |

| Specialty Fertilizers Market Forecast Value in (2035 F) | USD 53.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The specialty fertilizers market represents a focused segment within the global agriculture and crop nutrition industry, emphasizing enhanced nutrient efficiency, targeted delivery, and improved crop performance. Within the broader fertilizers and plant nutrition sector, it accounts for about 5.5%, driven by demand from high-value crops, precision farming, and sustainable soil management practices. In the controlled-release and slow-release fertilizer segment, it holds nearly 4.8%, reflecting adoption in horticulture, orchards, and greenhouse applications.

Across the micronutrient and trace element market, the share is 4.2%, supporting tailored nutrient supplementation for optimal plant growth. Within the crop protection and productivity enhancement category, it represents 3.9%, highlighting integration with agronomic practices to maximize yield and quality. In the organic and biofertilizer sector, it secures 3.5%, emphasizing the combination of natural inputs with technology-driven nutrient solutions. Recent developments in this market have focused on precision formulation, environmentally friendly solutions, and crop-specific nutrient strategies. Innovations include polymer-coated fertilizers, nano-fertilizers, and foliar-applied nutrient systems to enhance efficiency and minimize leaching.

Key players are collaborating with agritech companies, research institutions, and farm cooperatives to improve soil health, nutrient uptake, and crop resilience. Adoption of digital agriculture tools, smart application devices, and real-time soil monitoring is gaining traction to optimize fertilization schedules and resource use. The development of multi-nutrient blends and customized formulations for specialty crops is being deployed to enhance market differentiation. These trends demonstrate how innovation, efficiency, and crop-focused solutions are shaping the market.

The specialty fertilizers market is experiencing robust growth driven by the need for precise nutrient delivery, enhanced crop productivity, and sustainable agricultural practices. Rising concerns over soil health degradation and the environmental impact of conventional fertilizers are encouraging adoption of advanced formulations that optimize nutrient uptake and minimize leaching losses.

Increased investment in precision farming technologies and supportive government initiatives for sustainable agriculture are further accelerating market penetration. Technological advancements in controlled nutrient release and water-soluble fertilizers are enabling efficient application across diverse cropping systems.

The market outlook remains positive as farmers increasingly prioritize yield optimization, cost efficiency, and environmental stewardship, positioning specialty fertilizers as a critical component of modern agricultural practices.

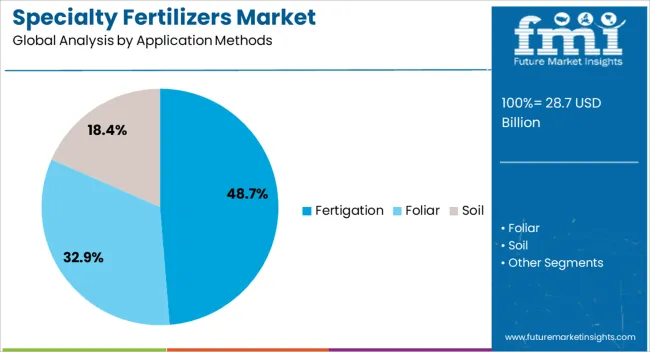

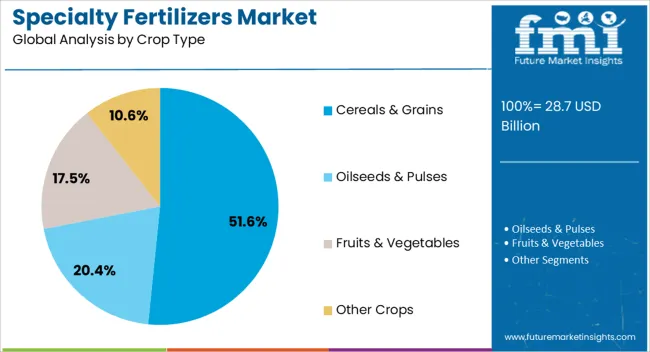

The specialty fertilizers market is segmented by application methods, technology, crop type, type, and geographic regions. By application methods, specialty fertilizers market is divided into fertigation, foliar, and soil. In terms of technology, specialty fertilizers market is classified into controlled-release fertilizers, water-soluble fertilizers, liquid fertilizers, micronutrients, and other technologies. Based on crop type, specialty fertilizers market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and other crops. By type, specialty fertilizers market is segmented into Urea ammonium nitrate (UAN), calcium ammonium nitrate (CAN), monoammonium phosphate (MAP), and others. Regionally, the specialty fertilizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fertigation segment is projected to hold 48.7% of total market revenue by 2025 within the application method category, making it the most dominant method. Growth is being driven by its ability to deliver nutrients directly through irrigation systems, ensuring uniform distribution and improved nutrient use efficiency.

This method reduces labor costs, minimizes nutrient losses, and supports precise application schedules tailored to crop growth stages.

Adoption is also supported by expanding use of micro-irrigation systems in both developed and emerging economies, where water scarcity and cost optimization are key considerations.

The controlled-release fertilizers segment is expected to account for 42.9% of the market revenue by 2025 in the technology category, positioning it as the leading technology type. Its dominance stems from the ability to supply nutrients gradually over time, reducing the frequency of application and improving nutrient availability throughout the crop cycle.

This technology significantly minimizes nutrient runoff and environmental impact, aligning with sustainability goals.

Farmers are increasingly adopting controlled-release fertilizers to enhance yields while maintaining soil fertility over multiple growing seasons.

The cereals and grains segment is anticipated to contribute 51.6% of total market revenue by 2025 within the crop type category, making it the largest segment. This is due to the high global demand for staple crops and the need to improve productivity per hectare.

Specialty fertilizers are widely used in cereals and grains cultivation to address nutrient deficiencies, improve crop quality, and enhance stress tolerance.

The segment benefits from rising global population trends, which drive demand for staple food production and necessitate efficient nutrient management practices.

The market has witnessed significant growth due to the increasing demand for high-efficiency, crop-specific nutrient solutions. These fertilizers provide targeted nutrient delivery, improving crop yield, soil health, and resource efficiency compared to conventional fertilizers. Growth has been supported by advancements in controlled-release formulations, micronutrient-enriched products, and bio-based fertilizers. Expansion of precision agriculture and adoption of modern farming techniques have further accelerated market development. Rising global food demand, increasing focus on sustainable production, and the need to reduce nutrient losses in agricultural practices have encouraged farmers and agribusinesses to incorporate specialty fertilizers for optimized crop performance and long-term soil productivity.

Precision agriculture has emerged as a key driver for the specialty fertilizers market, as farmers seek to apply nutrients efficiently while minimizing environmental impact. Technologies such as soil mapping, GPS-guided machinery, and variable-rate nutrient application have allowed tailored fertilization for individual plots. Specialty fertilizers, including slow-release, water-soluble, and foliar-applied nutrients, are increasingly integrated into these systems to optimize plant growth and reduce nutrient runoff. By enabling precise control over nutrient timing and quantity, farmers can enhance crop quality and yield, while simultaneously improving resource utilization. This synergy between precision farming technologies and specialty fertilizers has been critical in driving adoption globally.

Technological innovations in the formulation and delivery of specialty fertilizers have improved nutrient efficiency, solubility, and plant uptake. Coating technologies for controlled-release fertilizers have extended nutrient availability, reducing leaching and volatilization losses. Chelated micronutrients and bio-stimulants have been developed to enhance soil fertility, stimulate plant metabolism, and promote stress tolerance. Advances in polymer and nutrient encapsulation technologies have enabled consistent nutrient delivery in diverse environmental conditions. Analytical tools for soil and plant health monitoring allow formulation adjustments for specific crops and growth stages. These technological developments have improved productivity, cost-effectiveness, and environmental compliance, reinforcing the adoption of specialty fertilizers across multiple agricultural sectors.

Specialty fertilizers have found applications across cereals, fruits, vegetables, and high-value crops, supporting sustainable and optimized cultivation practices. The growing global population and increasing demand for higher-quality food products have encouraged the use of nutrient-rich formulations. High-value crops such as fruits, nuts, and horticultural produce require precise nutrient management to enhance yield, taste, and shelf-life, driving demand for specialty fertilizers. In addition, organic and bio-based fertilizers are increasingly being adopted to meet regulatory requirements and consumer preferences. Farmers and agribusinesses have incorporated specialty fertilizers as a part of integrated crop management strategies to achieve consistent performance, soil health maintenance, and higher profitability.

Despite growth potential, specialty fertilizers face challenges related to cost and availability. Formulation complexity, raw material sourcing, and advanced processing techniques often make these products more expensive than conventional fertilizers, limiting accessibility for small and medium-sized farmers. Supply chain disruptions, seasonal availability of raw materials, and regional production imbalances can further constrain market growth. The improper application techniques and lack of technical knowledge can reduce efficacy, discouraging adoption in certain regions. Addressing these cost and operational challenges through optimized formulations, scalable production, and farmer education is essential to ensure broader penetration and sustained market development across diverse agricultural landscapes.

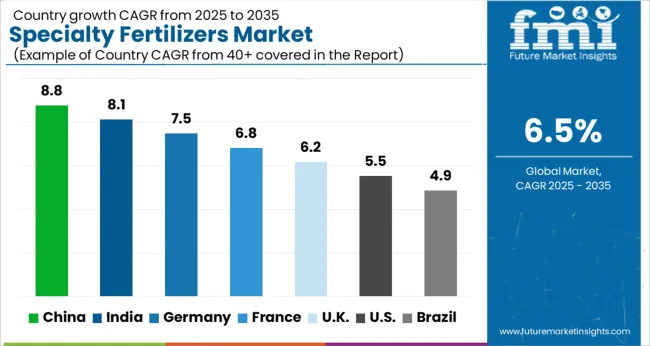

| Countries | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The market is projected to grow at a CAGR of 6.5% from 2025 to 2035, supported by rising adoption of precision agriculture and crop-specific nutrient solutions. Germany recorded 7.5%, reflecting the integration of advanced fertilizer formulations in high-value crops. China reached 8.8%, driven by large-scale cultivation and modernization of agricultural practices. India achieved 8.1%, where increasing use of tailored fertilizers for diverse crop requirements fueled market growth. The United Kingdom reached 6.2%, supported by research and innovation in sustainable fertilizer technologies. The United States posted 5.5%, where deployment in specialty crop production and horticulture maintained steady expansion. Together, these countries highlight a global network of production, adoption, and technological advancement in specialty fertilizers. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 8.8%, driven by increasing adoption of high efficiency fertilizers in commercial agriculture, horticulture, and cash crops. Adoption has been reinforced by precision farming practices, integrated nutrient management systems, and government initiatives promoting optimized fertilizer use. Domestic manufacturers focus on controlled release, water soluble, and micronutrient enriched formulations to enhance crop yields and reduce environmental impact. Exports of specialty fertilizers also contribute to market expansion, with significant demand from neighboring Asian countries.

India is projected to expand at a CAGR of 8.1%, supported by rising adoption in intensive farming, high value horticulture, and cash crop cultivation. Adoption has been reinforced by government programs promoting micro nutrient application and soil health management. Domestic producers supply cost effective water soluble and micronutrient enriched fertilizers, while imports from China and Europe meet demand for advanced formulations. Increasing awareness among commercial farmers about yield optimization further supports growth in both rural and peri urban agricultural regions.

Germany is expected to grow at a CAGR of 7.5%, driven by demand from high value crop cultivation, horticulture, and organic farming segments. Adoption has been reinforced by stringent EU regulations on nutrient application, environmental protection, and sustainable farming practices. Domestic manufacturers focus on technologically advanced controlled release fertilizers and specialty nutrient blends. Exports to other European nations supplement domestic supply, particularly in the high purity fertilizer segment.

The United Kingdom is projected to grow at a CAGR of 6.2%, supported by adoption in horticulture, high value crops, and organic farming applications. Imports dominate supply of premium and advanced formulations, while domestic producers focus on conventional specialty blends and micronutrient fertilizers. Growth is reinforced by government programs for nutrient management, soil health improvement, and yield optimization in commercial agriculture.

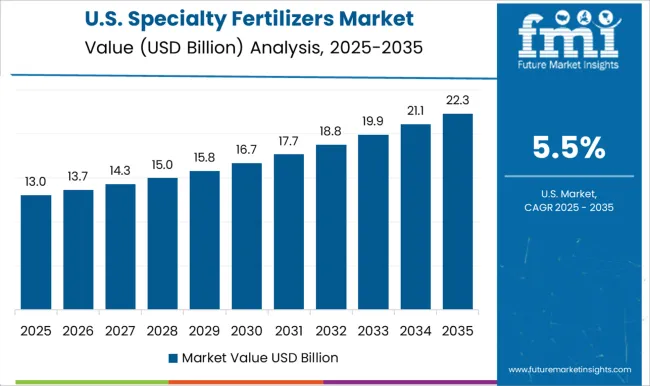

The United States is expected to grow at a CAGR of 5.5%, supported by adoption in high value crops, greenhouse cultivation, and precision agriculture. Domestic manufacturers focus on producing micronutrient enriched, slow release, and water soluble fertilizers to optimize yields while minimizing environmental impact. Exports play a secondary role, with demand primarily driven by large scale commercial farms, horticulture, and specialty crop producers. Technological innovation in nutrient formulations continues to enhance adoption and market growth.

The market is characterized by a diverse mix of global fertilizer manufacturers, chemical producers, and regionally strong agricultural solution providers. Nutrien Ltd. and Yara International dominate through extensive distribution networks, innovative nutrient formulations, and strong focus on precision agriculture technologies.

The Mosaic Company emphasizes high-quality phosphate- and potash-based fertilizers, targeting large-scale commercial farming operations. ICL Group, K+S Group, and EuroChem Group leverage technological advancements in controlled-release nutrients and micronutrients, enhancing crop performance while minimizing environmental impact. Haifa Chemicals and SQM specialize in potassium and specialty nutrient products, maintaining competitiveness through R&D-driven product differentiation.

Coromandel International Ltd., Sinochem Group, and CF Industries Holdings focus on regional markets with customized fertilizer solutions catering to local soil and crop requirements. Smaller players such as Tessenderlo Group, The Andersons, Inc., OCI Nitrogen, and Zuari Agro Chemicals Ltd. complement the market with niche products and value-added services, including integrated crop nutrition solutions and advisory support.

Competitive dynamics are increasingly influenced by product innovation, sustainability, nutrient efficiency, and the ability to support precision farming practices, with companies emphasizing tailored solutions for enhanced crop yield, resource optimization, and environmental stewardship.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.7 billion |

| Application Methods | Fertigation, Foliar, and Soil |

| Technology | Controlled-release Fertilizers, Water-soluble Fertilizers, Liquid Fertilizers, Micronutrients, and Other Technologies |

| Crop Type | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crops |

| Type | Urea Ammonium Nitrate (UAN), Calcium Ammonium Nitrate (CAN), Monoammonium Phosphate (MAP), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nutrien Ltd., Yara International, The Mosaic Company, ICL Group, K+S Group, EuroChem Group, Haifa Chemicals, Sociedad Química y Minera de Chile (SQM), Coromandel International Ltd., Sinochem Group, CF Industries Holdings, Tessenderlo Group, The Andersons, Inc., OCI Nitrogen, and Zuari Agro Chemicals Ltd. |

| Additional Attributes | Dollar sales by fertilizer type and application, demand dynamics across crop, horticulture, and turf management sectors, regional trends in precision agriculture and nutrient optimization adoption, innovation in controlled-release formulations, efficiency, and soil compatibility, environmental impact of nutrient runoff and production processes, and emerging use cases in sustainable farming, high-value crop cultivation, and soil health enhancement. |

The global specialty fertilizers market is estimated to be valued at USD 28.7 billion in 2025.

The market size for the specialty fertilizers market is projected to reach USD 53.9 billion by 2035.

The specialty fertilizers market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in specialty fertilizers market are fertigation, foliar and soil.

In terms of technology, controlled-release fertilizers segment to command 42.9% share in the specialty fertilizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA