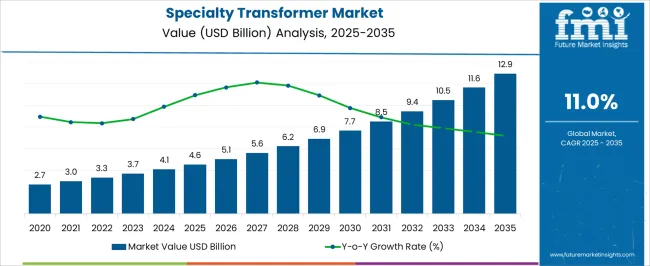

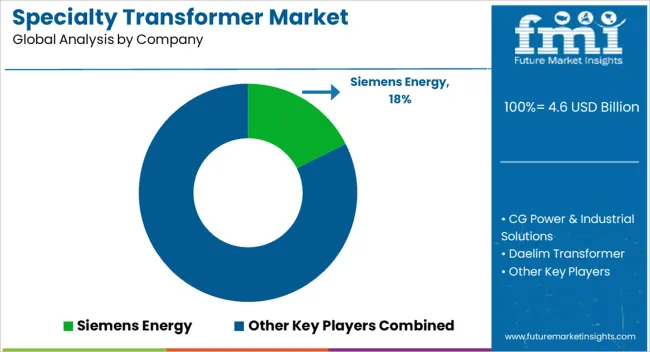

The specialty transformer market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

This growth translates into a substantial absolute dollar opportunity of USD 8.3 billion over the decade. The market is expected to steadily expand, with intermediate values of USD 5.1 billion in 2026, USD 6.2 billion in 2029, USD 7.7 billion in 2031, and USD 10.5 billion in 2034. The consistent year-on-year growth highlights the increasing demand and adoption of specialty transformers across industries, creating significant investment potential for manufacturers and stakeholders in this segment. From an absolute dollar perspective, the incremental opportunity grows each year, starting at USD 0.5 billion in 2026 and reaching USD 2.3 billion by 2035.

The cumulative market expansion across 2025–2035 provides a clear view of revenue potential, as the market nearly triples in size. Businesses entering or expanding in this segment can capitalize on the steady increase, capturing value at various stages, from USD 3.3 billion in 2027 to USD 9.4 billion in 2033. This trend underscores the importance of strategic planning to harness the multi-billion-dollar opportunity inherent in the specialty transformer market over the next decade.

| Metric | Value |

|---|---|

| Specialty Transformer Market Estimated Value in (2025 E) | USD 4.6 billion |

| Specialty Transformer Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

Continuing from the specialty transformer market projections, a breakpoint analysis highlights key stages where market growth accelerates or shifts significantly. Between 2025 and 2027, the market moves from USD 4.6 billion to USD 5.3 billion, marking the initial growth phase where early investments and adoption establish a foundation. The next significant breakpoint occurs around 2029–2031, as the market crosses USD 6.9 billion to USD 7.7 billion, reflecting a period of rapid expansion. These stages indicate critical decision points for manufacturers and investors to optimize production capacity, align supply chains, and capture incremental revenue during periods of accelerated market uptake.

Another notable breakpoint is observed between 2033 and 2035, when the market surges from USD 10.5 billion to USD 12.9 billion, representing the largest absolute dollar growth in a single two-year span. This phase signals maturity approaching peak demand, where strategic scaling and differentiation become crucial. Intermediate years, such as 2030–2032, serve as bridging periods, ensuring sustained momentum. By identifying these breakpoints, stakeholders can better allocate resources, prioritize market entry or expansion strategies, and maximize the absolute dollar opportunity within the specialty transformer market, capitalizing on both growth spurts and stable progression phases.

The specialty transformer market is experiencing steady expansion, driven by the growing demand for customized power solutions across industrial and utility sectors. Industry publications and electrical engineering reports have emphasized the increasing need for transformers designed for high-performance applications, including metal processing, renewable energy integration, and heavy-duty manufacturing.

Technological advancements in insulation materials, cooling systems, and core designs have enhanced efficiency, load-handling capacity, and operational safety of specialty transformers. Additionally, industrial modernization projects and capacity expansions in steel, mining, and petrochemical sectors are contributing to higher procurement of application-specific transformers.

Regulatory requirements for energy efficiency and safety compliance have further encouraged manufacturers to innovate in transformer design and production. Looking ahead, continued investments in industrial automation, infrastructure upgrades, and electrification initiatives are expected to sustain market growth, with electric arc furnace transformers playing a pivotal role in energy-intensive manufacturing operations.

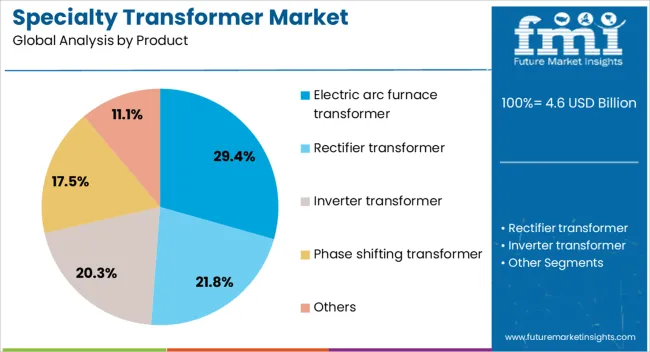

The specialty transformer market is segmented by product, and geographic regions. By product, specialty transformer market is divided into electric arc furnace transformer, rectifier transformer, inverter transformer, phase shifting transformer, and others. Regionally, the specialty transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric arc furnace transformer segment is projected to account for 29.4% of the specialty transformer market revenue in 2025, holding a leading position among product categories. This growth is supported by the rising demand for electric arc furnaces in steel production and metal recycling industries, where precise voltage regulation and high-current capacity are critical.

Technical reports from the metallurgical sector have noted that electric arc furnace transformers are engineered to withstand frequent short circuits, thermal stresses, and high load fluctuations inherent in steelmaking operations. Their robust construction and advanced cooling systems allow continuous operation under demanding conditions, enhancing productivity and reducing downtime.

Global steel production trends, especially in emerging economies, have driven the expansion of facilities equipped with electric arc furnaces, thereby increasing transformer demand. Furthermore, energy efficiency improvements and digital monitoring capabilities in modern electric arc furnace transformers have made them a preferred choice for operators seeking both performance and operational cost savings.

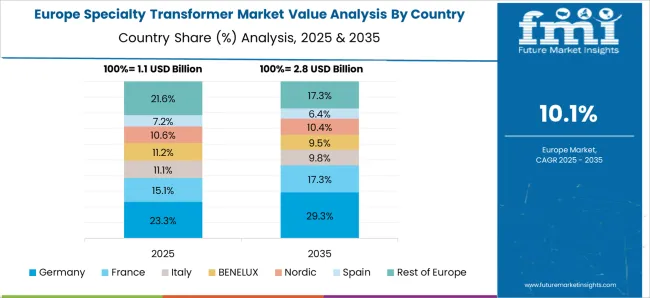

The specialty transformer market is witnessing steady growth as industries demand electrical equipment with tailored performance for unique operational conditions. These transformers, designed for high voltage, extreme temperatures, and specific load requirements, are critical for sectors such as manufacturing, energy distribution, and transportation. North America and Europe account for substantial adoption due to industrial modernization and grid infrastructure investments, while Asia Pacific demonstrates emerging potential through rapid industrialization. Manufacturers focus on precise engineering, reliability testing, and application-specific designs, even as raw material costs, regulatory requirements, and competitive pressures shape market development.

Maintaining dependable operation is a core concern for specialty transformer producers. Variations in core materials, winding techniques, and insulation systems can affect efficiency, heat dissipation, and operational lifespan. Strict quality control measures are essential to prevent failures that could lead to costly downtime or equipment damage. Suppliers serving high-demand industrial applications must demonstrate documented testing protocols, compliance with recognized electrical standards, and traceable manufacturing processes. Achieving consistent output under varying load and environmental conditions requires robust engineering and meticulous production oversight. Companies that ensure reliable performance gain preference among industrial buyers, whereas inconsistent delivery can erode market confidence. Focused investment in monitoring, testing, and precision fabrication remains a key differentiator in securing contracts across critical sectors.

The market is evolving with engineering methods that optimize transformer efficiency, compactness, and thermal management. Innovative winding configurations, advanced magnetic core designs, and improved insulation materials enhance energy transfer and reduce losses. Specialized transformers can handle non-standard voltages, frequency variations, or corrosive and high-temperature environments, expanding suitability across mining, petrochemical, and heavy machinery applications. Accurate simulation, modeling, and performance testing ensure units meet precise operational specifications. Manufacturers collaborating with industrial clients to tailor designs strengthen market positioning and increase product adoption. Improved component integration and reliability tracking allow operators to maximize uptime while minimizing maintenance needs, making these transformers highly valuable in sectors with stringent operational demands.

Specialty transformers are increasingly applied in sectors requiring customized electrical solutions. Heavy industry, renewable energy systems, and transportation electrification projects require units that handle unusual voltage, load, or environmental challenges. Growing deployment of smart grids and automated industrial facilities also creates demand for compact, high-performance transformers. Companies offering modular designs or retrofit capabilities can serve legacy infrastructure while meeting new operational standards. International industrial expansion, particularly in Asia Pacific, is driving procurement of transformers that meet local conditions and voltage regulations. Providers emphasizing engineering flexibility, precision customization, and proven durability gain credibility among engineers and facility managers. Expanding applications across both emerging and established industrial markets create pathways for sustained demand growth.

Adoption of specialty transformers is influenced by regulatory standards and supply chain stability. Compliance with electrical safety codes, fire protection regulations, and environmental directives is mandatory, varying across regions. Delays in certification or misalignment with local codes can restrict market access. Raw material availability, particularly high-grade copper, silicon steel, and insulating compounds, affects manufacturing schedules and pricing. Suppliers must manage procurement cycles and maintain inventory buffers to meet project timelines. Competitive pressures arise from both established global producers and regional manufacturers offering lower-cost alternatives. Businesses that combine regulatory readiness, quality documentation, and secure sourcing are better positioned to capture contracts in complex industrial projects, while others may face operational bottlenecks or lost opportunities.

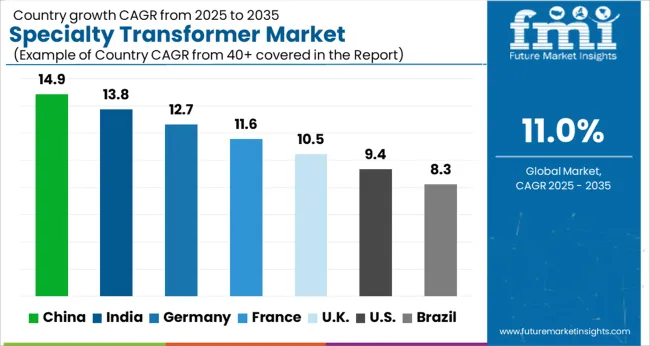

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

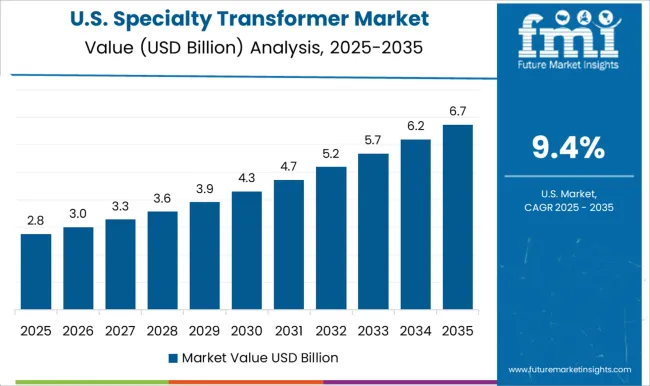

| USA | 9.4% |

| Brazil | 8.3% |

The global specialty transformer market was projected to grow at an 11.0% CAGR through 2035, driven by demand in power distribution, industrial equipment, and renewable energy integration. Among BRICS nations, China recorded 14.9% growth as large-scale manufacturing plants were commissioned and quality and safety standards were enforced, while India at 13.8% growth saw expansion of production facilities to meet rising regional consumption. In the OECD region, Germany at 12.7% maintained significant output under strict electrical equipment regulations, while the United Kingdom at 10.5% relied on moderate-scale manufacturing for industrial and utility applications. The USA, expanding at 9.4%, remained a mature market with steady demand from energy, industrial, and utility sectors, supported by adherence to federal and state-level electrical safety and product standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The specialty transformer market in China is growing at a CAGR of 14.9%, driven by demand from power generation, renewable energy, industrial manufacturing, and smart grid projects. Manufacturers supply dry-type, cast resin, and oil-immersed transformers for voltage regulation, industrial machinery, and renewable energy integration. Government initiatives promoting power infrastructure modernization, renewable energy adoption, and energy efficiency encourage market adoption. Pilot projects in power plants, manufacturing facilities, and renewable energy projects demonstrate benefits including improved energy transmission, operational reliability, and reduced downtime. Collaborations between transformer manufacturers, power companies, and research institutions enhance transformer design, efficiency, and safety standards. Rising industrialization, urbanization, and the shift towards renewable energy continue to drive the Chinese specialty transformer market.

The market in India is growing at a CAGR of 13.8%, supported by increasing industrialization, renewable energy installations, and grid modernization. Manufacturers provide dry-type, cast resin, and oil-immersed transformers for industrial equipment, power distribution, and renewable energy projects. Government initiatives promoting smart grids, energy efficiency, and renewable energy integration encourage adoption. Pilot deployments in industrial facilities and renewable energy projects demonstrate benefits including voltage stability, improved operational efficiency, and enhanced reliability. Collaborations between transformer manufacturers, utilities, and research institutions enhance transformer design, energy efficiency, and compliance with regulatory standards. Growth in industrial power demand, renewable energy adoption, and modernization of power infrastructure continue to drive India’s specialty transformer market.

The market in Germany is recording a CAGR of 12.7%, driven by demand from renewable energy, industrial manufacturing, and smart grid projects. Manufacturers supply dry-type, cast resin, and oil-immersed transformers for voltage regulation, industrial machinery, and energy distribution. Government and EU initiatives promoting energy efficiency, renewable energy integration, and industrial modernization encourage adoption. Pilot projects in renewable energy plants and industrial facilities demonstrate benefits including improved reliability, reduced energy losses, and better operational efficiency. Collaborations between transformer manufacturers, utilities, and research institutions enhance design, safety standards, and energy efficiency. Germany’s focus on sustainable energy and industrial innovation supports continued market growth.

The market in the United Kingdom is growing at a CAGR of 10.5%, supported by industrial expansion, renewable energy projects, and grid modernization initiatives. Manufacturers provide dry-type, oil-immersed, and cast resin transformers for industrial machinery, energy distribution, and renewable energy integration. Government initiatives promoting energy efficiency, smart grid development, and industrial modernization encourage adoption. Pilot deployments in industrial facilities and renewable energy plants demonstrate benefits including voltage stability, improved operational reliability, and reduced downtime. Collaborations between transformer manufacturers, utilities, and research institutions enhance transformer performance, design, and safety compliance. Growth in industrial demand and renewable energy adoption continues to drive the UK specialty transformer market.

The market in the United States is expanding at a CAGR of 9.4%, driven by demand from industrial manufacturing, renewable energy, and utility companies. Manufacturers supply dry-type, oil-immersed, and cast resin transformers for voltage regulation, industrial operations, and renewable energy integration. Federal initiatives promoting smart grids, energy efficiency, and renewable energy adoption encourage market growth. Pilot projects in industrial facilities and renewable energy plants demonstrate benefits including improved reliability, voltage stability, and operational efficiency. Collaborations between transformer manufacturers, utilities, and research institutions enhance transformer design, energy efficiency, and safety compliance. Rising industrialization, renewable energy adoption, and modernization of power infrastructure continue to support the USA specialty transformer market.

Siemens Energy, CG Power & Industrial Solutions, and Daelim Transformer supply specialty transformers for industrial, utility, and renewable energy applications, with brochures highlighting voltage ratings, insulation class, and cooling methods. Eaton, General Electric, and HD Hyundai Electric provide high-performance transformers for oil and gas, power distribution, and rail systems, with datasheets detailing winding configuration, impedance, and short-circuit withstand capability. Hitachi Energy, Prolec Energy, and Raychem RPG focus on compact and high-efficiency designs for medium- and high-voltage applications, with brochures emphasizing thermal management, dielectric strength, and reduced noise levels. Schneider Electric, SGB SMIT, and TRAIL (Transformers & Rectifiers India Ltd.) deliver transformers for industrial automation, offshore platforms, and specialty grids, with technical literature presenting tap changer design, load handling, and moisture-resistant insulation systems.

Virginia Transformers, WEG, and Wilson Power and Distribution Technologies supply modular and customizable transformers, with datasheets highlighting oil-immersed and dry-type options, thermal monitoring, and operational longevity. Other regional suppliers compete with cost-effective, tailored solutions, with brochures emphasizing simplified installation, maintenance ease, and compliance with IEC and local safety standards. Market strategies focus on efficiency, reliability, and application-specific customization. Leading suppliers such as Siemens Energy and Hitachi Energy emphasize high-efficiency designs, advanced thermal performance, and robust insulation systems to suit renewable and heavy-industrial applications.

CG Power & Industrial Solutions and Eaton differentiate through modular designs, tap changer flexibility, and specialized voltage regulation capabilities. Observed industry patterns indicate investment in low-loss cores, vacuum-pressure impregnation techniques, and integrated monitoring systems for predictive maintenance. Product roadmaps frequently include dry-type and cast-resin transformers for indoor use, oil-immersed high-voltage units, and transformers with advanced diagnostic sensors. Differentiation is achieved through verified electrical performance, thermal stability, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate voltage rating, power capacity, cooling method, impedance, insulation class, load handling, and noise level. Siemens, CG Power, and Daelim literature emphasizes thermal performance, winding configuration, and operational reliability. Eaton, GE, and HD Hyundai brochures highlight short-circuit withstand, tap changer design, and dielectric strength. Hitachi, Prolec, and Raychem RPG datasheets provide compact design specifications, thermal monitoring, and insulation stability.

Schneider, SGB SMIT, and TRAIL materials detail industrial applications, moisture resistance, and high-voltage compliance. Virginia Transformers, WEG, and Wilson Power datasheets present modularity, oil-immersed versus dry-type options, and expected operational lifetime. Tables, diagrams, and performance charts are consistently included to allow electrical engineers, procurement specialists, and project managers to evaluate transformer suitability efficiently. Market adoption is determined not only by electrical performance but also by the clarity and technical depth of brochures, making documentation essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Product | Electric arc furnace transformer, Rectifier transformer, Inverter transformer, Phase shifting transformer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, CG Power & Industrial Solutions, Daelim Transformer, Eaton, General Electric, HD Hyundai Electric, Hitachi Energy, Prolec Energy, Raychem RPG, Schneider Electric, SGB SMIT, TRAIL (Transformers & Rectifiers India Ltd.), Virginia Transformers, WEG, and Wilson Power and Distribution Technologies |

| Additional Attributes | Dollar sales vary by transformer type, including dry-type, oil-immersed, cast resin, and instrument transformers; by application, such as power distribution, industrial facilities, renewable energy integration, and railways; by end-use industry, spanning utilities, manufacturing, oil & gas, and transportation; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing electricity demand, grid modernization, and renewable energy adoption. |

The global specialty transformer market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the specialty transformer market is projected to reach USD 12.9 billion by 2035.

The specialty transformer market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in specialty transformer market are electric arc furnace transformer, rectifier transformer, inverter transformer, phase shifting transformer and others.

In terms of , segment to command 0.0% share in the specialty transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA