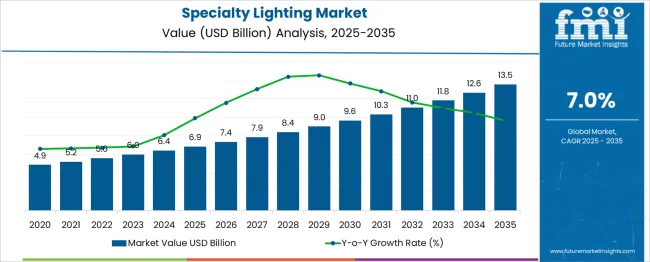

The Specialty Lighting Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Lighting Market Estimated Value in (2025 E) | USD 6.9 billion |

| Specialty Lighting Market Forecast Value in (2035 F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The specialty lighting market is growing steadily, driven by increasing demand for energy-efficient and high-performance lighting solutions across various industries. Advances in lighting technology have led to widespread adoption of LED light sources due to their longevity, energy savings, and superior illumination quality.

The integration of wired lighting systems has supported enhanced control, safety, and reliability in critical applications. The medical sector has emerged as a significant application area, requiring specialized lighting to meet strict hygiene, precision, and functionality standards.

Rising investments in healthcare infrastructure and technological upgrades are contributing to the growing use of specialty lighting in medical facilities. Furthermore, increasing awareness of lighting's impact on patient outcomes and staff productivity is encouraging the adoption of advanced lighting solutions. The market is expected to continue expanding as innovation in LED technology and wiring systems evolves. Growth will likely be driven by the LED light source segment, wired lighting technology, and the medical application segment.

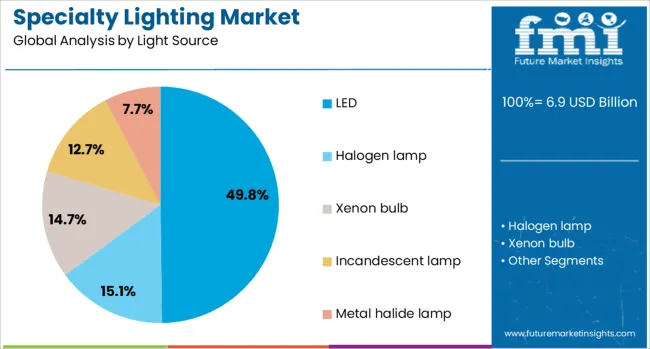

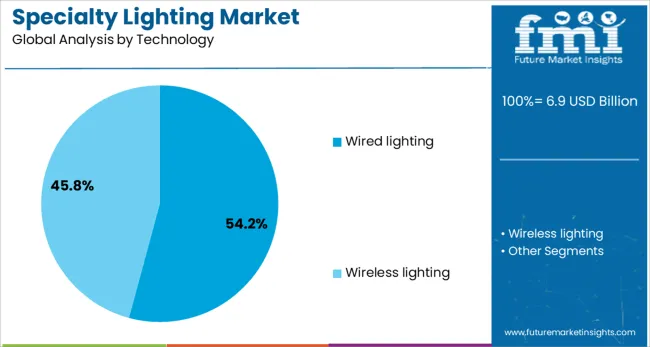

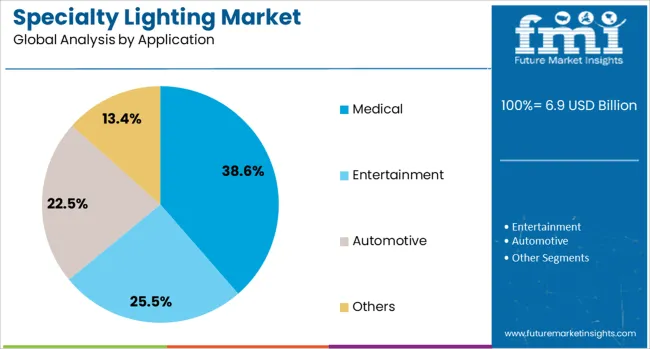

The specialty lighting market is segmented by light source, technology, application, and distribution channel and geographic regions. By light source of the specialty lighting market is divided into LED, Halogen lamp, Xenon bulb, Incandescent lamp, and Metal halide lamp. In terms of technology of the specialty lighting market is classified into Wired lighting and Wireless lighting. Based on application of the specialty lighting market is segmented into Medical, Entertainment, Automotive, and Others. By distribution channel of the specialty lighting market is segmented into Offline sales and Online sales. Regionally, the specialty lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED light source segment is expected to account for 49.8% of the specialty lighting market revenue in 2025, maintaining its leadership position. This dominance is driven by the superior energy efficiency, durability, and adaptability of LEDs compared to traditional lighting. LEDs provide better color rendering and flexibility in design, which is critical for specialized applications.

The segment benefits from continuous improvements in LED efficiency and cost reduction, making it accessible across diverse sectors. Its long operational life reduces maintenance needs, which is particularly valuable in environments requiring consistent, reliable lighting.

As industries increasingly prioritize sustainability and cost savings, the LED segment is set to remain the preferred light source.

The wired lighting technology segment is projected to hold 54.2% of the market revenue in 2025, leading the specialty lighting market by technology type. Wired systems offer robust and secure connections essential for environments where reliability and safety are paramount. This technology supports advanced control systems that allow precise adjustment of lighting intensity and distribution.

Wired lighting is often preferred in fixed installations where continuous operation and minimal downtime are required. The ability to integrate with building management and automation systems further strengthens the segment’s position.

Growth in commercial and healthcare infrastructure development has reinforced the adoption of wired lighting solutions. As the demand for intelligent lighting systems rises, wired lighting technology is expected to maintain its market dominance.

The medical application segment is projected to contribute 38.6% of the specialty lighting market revenue in 2025, securing its place as the largest application sector. The segment growth has been supported by the need for lighting solutions that meet stringent medical standards, including high color accuracy and minimal heat emission.

Medical facilities require specialized lighting for surgical rooms, examination areas, and patient care zones to ensure precision and safety. Increasing healthcare spending and expansion of medical infrastructure globally have driven demand in this segment.

Furthermore, the focus on improving patient comfort and staff efficiency has encouraged the integration of adaptive lighting technologies. The medical sector’s growing complexity and technological advancement ensure sustained demand for specialty lighting tailored to its unique requirements.

Specialty lighting solutions are being deployed to deliver focused illumination for architectural, entertainment, and industrial applications. In 2024, tunable color lighting systems gained popularity in retail and hospitality projects for creating dynamic visual environments and functional adaptability. In 2025, precision beam fixtures were integrated into manufacturing and inspection areas to improve operational accuracy and worker safety. Market opportunities are emerging in intelligent lighting systems that incorporate wireless controls and IoT-based energy monitoring. Providers delivering customizable fixtures with advanced beam control, adjustable color temperature, and compatibility with centralized control platforms are poised to lead in this evolving illumination category.

The requirement for customized lighting solutions in specialized environments has been identified as the primary driver behind growth in the specialty lighting market. In 2024, retail stores and galleries began installing fixtures with adjustable beam angles and spectral tuning to create immersive product displays and exhibit effects. In 2025, industrial inspection and quality control lines were equipped with high-CRI, narrow-beam luminaires to enhance defect detection in precision manufacturing. These trends suggest that when lighting solutions are aligned with use-case specificity rather than general illumination, they command higher investment. Manufacturers delivering adjustable, high-performance specialty fixtures are thus being positioned to lead in niche lighting applications.

In 2024, connected lighting systems began to be trialed in office and hotel installations to offer centralized control, occupancy-based dimming, and daylight harvesting integration. In 2025, such networked solutions were expanded to outdoor architectural installations with remote programmability and energy tracking features. These implementations show that specialty lighting can evolve from standalone fixtures into intelligent illumination networks. Suppliers providing lights with embedded sensors, wireless control interfaces, and software dashboards stand to capture growing demand from clients seeking both aesthetic effect and centralized management capabilities.

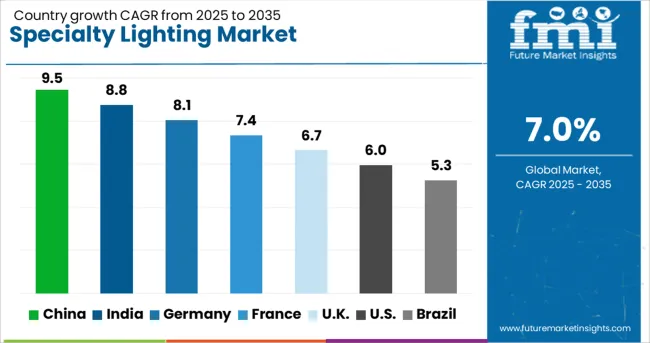

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global specialty lighting market is projected to grow at a CAGR of 7% from 2025 to 2035. China leads with 9.5%, followed by India at 8.8% and Germany at 8.1%. France posts 7.4%, while the United Kingdom records 6.7%. Growth is driven by rising adoption of advanced lighting systems in automotive, healthcare, entertainment, and horticultural sectors. China and India dominate due to large-scale manufacturing capabilities and smart city projects. Germany focuses on energy-efficient lighting for automotive and medical applications, while France and the UK prioritize premium lighting solutions for architectural and theatrical environments.

China is projected to grow at 9.5%, supported by strong industrial production and demand for advanced lighting in automotive and commercial spaces. LED-based specialty lighting dominates, particularly in stage, event, and retail applications. Domestic manufacturers are investing in IoT-integrated lighting systems for smart environments. Government energy efficiency mandates further accelerate LED penetration across industries.

India is forecast to grow at 8.8%, driven by increased adoption of lighting in retail, healthcare, and entertainment sectors. LED penetration accelerates due to affordability and energy-saving benefits. Local companies focus on cost-effective lighting solutions for horticulture and stage lighting applications. Rapid growth in events, exhibitions, and film production further stimulates demand.

Germany is expected to grow at 8.1%, driven by advancements in automotive lighting and healthcare illumination technologies. Adaptive headlights, surgical lights, and UV disinfection systems dominate the market. German manufacturers focus on research for high-efficiency optics and durable LED modules. Compliance with stringent EU energy regulations promotes innovation in sustainable specialty lighting solutions.

France is forecast to grow at 7.4%, supported by strong demand for architectural and theatrical lighting solutions. Manufacturers prioritize high-quality luminaires for museums, heritage buildings, and event venues. Smart dimming and color-control systems dominate premium lighting installations. Integration of wireless connectivity and mobile control platforms enhances flexibility in lighting design.

The UK is expected to grow at 6.7%, driven by rising adoption in horticultural, retail, and entertainment applications. LED-based plant growth lights dominate greenhouse farming initiatives. Theatrical and film production sectors adopt intelligent lighting with remote control features. Sustainability goals push demand for low-energy, high-lumen fixtures integrated with smart building systems.

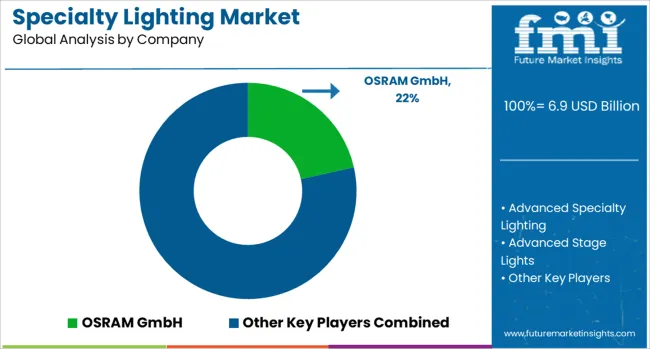

The specialty lighting market is moderately consolidated, led by OSRAM GmbH with a significant market share. The company holds a dominant position through its extensive portfolio of specialty lighting solutions, strong R&D capabilities, and global presence across healthcare, industrial, and entertainment sectors. Dominant player status is held exclusively by OSRAM GmbH.

Key players include Advanced Specialty Lighting, Advanced Stage Lights, Advanced UV, Brandon Medical, Color Imagination LED Lighting, CREE (IDEAL INDUSTRIES, INC.), Crystal IS, Getinge AB, Herbert Waldmann, Integra Lifesciences, Signify Holding, SMART Global Holdings (Cree LED), Steris PLC, Ushio, and Xylem, each offering innovative solutions such as UV-C disinfection lamps, surgical and medical-grade lights, horticultural lighting systems, and stage lighting technologies.

Emerging players remain limited due to high investment requirements, stringent performance standards, and established brand dominance in niche lighting segments. The growing need for sterilization lighting, advanced lighting in healthcare environments, and specialized illumination solutions for industrial and entertainment applications drives market demand.

In January 2024 at CES, OLEDWorks introduced a new automotive OLED lighting brand, featuring cutting-edge flexible light panels designed to enhance vehicle interiors and exteriors with superior energy efficiency, advanced styling options, and next-generation illumination technology.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Light Source | LED, Halogen lamp, Xenon bulb, Incandescent lamp, and Metal halide lamp |

| Technology | Wired lighting and Wireless lighting |

| Application | Medical, Entertainment, Automotive, and Others |

| Distribution Channel | Offline sales and Online sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OSRAM GmbH, Advanced Specialty Lighting, Advanced Stage Lights, Advanced UV, Brandon Medical, Color Imagination LED Lighting, CREE (IDEAL INDUSTRIES, INC.), Crystal IS, Getinge AB, Herbert Waldmann, Integra Lifesciences, Signify Holding, SMART Global Holdings (Cree LED), Steris PLC, USHIO, and XYLEM |

| Additional Attributes | Dollar sales by lighting type (architectural, industrial, accent, task), regional demand trends, competitive landscape, buyer preferences for high color rendering, glare control, and smart dimming features, integration with IoT-based building management systems and wireless control platforms, innovations in tunable white lighting, OLED panels, and next-generation energy-efficient LED technologies. |

The global specialty lighting market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the specialty lighting market is projected to reach USD 13.5 billion by 2035.

The specialty lighting market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in specialty lighting market are led, halogen lamp, xenon bulb, incandescent lamp and metal halide lamp.

In terms of technology, wired lighting segment to command 54.2% share in the specialty lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA