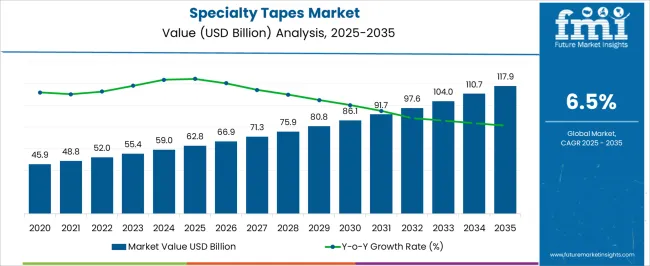

The specialty tapes market is estimated to be valued at USD 62.8 billion in 2025 and is projected to reach USD 117.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The specialty tapes market, valued at USD 62.8 billion in 2025 and projected to reach USD 117.9 billion by 2035 at a CAGR of 6.5%, illustrates a steady trajectory along the market maturity curve with distinct phases of adoption. Early adoption was driven by niche applications in automotive, electronics, and healthcare, where adhesive performance and material customization offered distinct advantages. The transition from USD 62.8 billion in 2025 to USD 80.8 billion in 2029 reflects the market’s shift from early growth to a more established adoption stage, supported by wider acceptance across industries.

Between 2030 and 2033, values rising from USD 86.1 billion to USD 104.0 billion indicate expansion into mainstream adoption, where specialty tapes become integral to high-volume manufacturing, medical usage, and packaging solutions. At this phase, competition intensifies and differentiation rests heavily on innovation in temperature resistance, biocompatibility, and electrical insulation. By 2035, with the market nearing USD 117.9 billion, the sector positions itself in the late growth phase, approaching maturity, though innovation-driven opportunities remain. The adoption lifecycle reveals movement from innovators and early adopters to early majority dominance, while late majority uptake strengthens as industries standardize specialty tapes in operational frameworks, ensuring continued but moderated long-term growth potential.

| Metric | Value |

|---|---|

| Specialty Tapes Market Estimated Value in (2025 E) | USD 62.8 billion |

| Specialty Tapes Market Forecast Value in (2035 F) | USD 117.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The specialty tapes market represents a defined segment within the global adhesives and industrial materials industry, playing a critical role in bonding, sealing, and insulation across diverse applications. Within the overall adhesives and sealants sector, it holds about 5.8%, supported by demand from packaging, construction, and automotive industries. In the electrical and electronics materials market, it secures 4.6%, reflecting usage in insulation, shielding, and thermal management.

Across the healthcare and medical consumables sector, specialty tapes account for 3.9%, with adoption in wound care, surgical drapes, and wearable devices. Within the consumer goods and packaging industry, the market represents 3.4%, driven by applications in labeling and product assembly. In the aerospace and defense materials segment, it contributes about 2.7%, where high-performance tapes are used in extreme environments for bonding and protection. Recent trends in this market have been defined by innovation in performance, sustainability, and application diversity. Growth has been influenced by advancements in high-temperature resistant tapes, double-sided adhesives, and pressure-sensitive tapes tailored for industrial automation.

Eco-friendly developments, such as solvent-free and recyclable adhesive formulations, are gaining wider acceptance. Key players are investing in UV-curable and flame-retardant tapes for high-demand sectors like electronics and aerospace. Strategic collaborations are being formed with healthcare companies to deliver skin-friendly, breathable tapes for wearables and medical use. Digital printing compatibility and customized tape solutions are also shaping the market, enabling greater adoption across consumer and industrial applications. These trends illustrate how material innovation, compliance needs, and diversified end-use demand are driving the market.

The specialty tapes market is experiencing strong growth driven by increasing demand across diverse industrial applications, including electronics, automotive, healthcare, and construction. Rising requirements for high-performance bonding, insulation, and surface protection solutions are supporting the adoption of advanced tape technologies.

Innovations in adhesive formulations, thermal resistance, and substrate compatibility are enabling specialty tapes to replace traditional fastening methods in precision manufacturing environments. Regulatory emphasis on lightweight materials and energy efficiency is further enhancing the use of specialty tapes in electrical and electronics assembly and component protection.

Expanding production in emerging economies combined with growth in e-commerce logistics is creating additional opportunities for value-added tape solutions. The future outlook remains positive as industries continue to prioritize efficiency, durability, and specialized material performance in their operational and manufacturing processes.

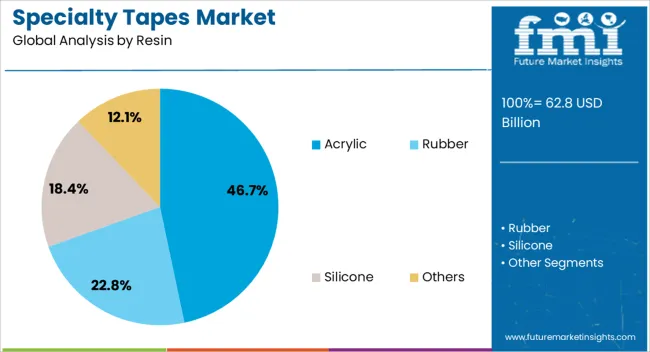

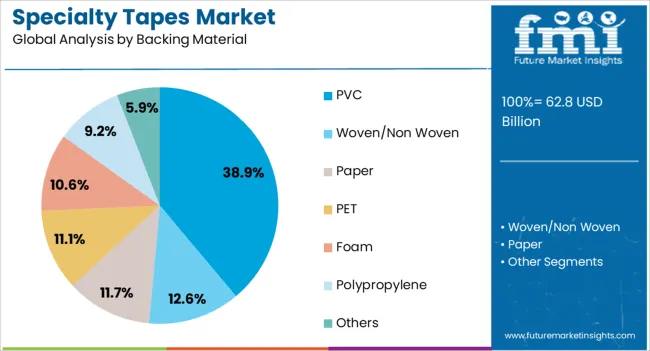

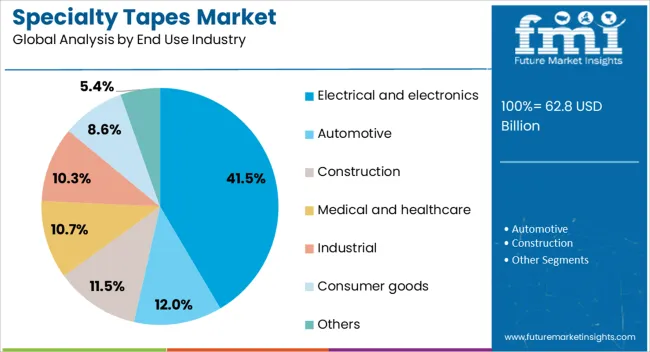

The specialty tapes market is segmented by resin, backing material, end use industry, and geographic regions. by resin, specialty tapes market is divided into acrylic, rubber, silicone, and others. In terms of backing material, specialty tapes market is classified into PVC, woven/non woven, paper, PET, foam, polypropylene, and others. Based on end use industry, specialty tapes market is segmented into electrical and electronics, automotive, construction, medical and healthcare, industrial, consumer goods, and others. Regionally, the specialty tapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic resin segment is projected to account for 46.7% of the total market revenue by 2025, making it the leading resin category. Growth in this segment is supported by the material’s excellent UV resistance, strong adhesion to multiple surfaces, and durability under varying temperature conditions.

Acrylic-based specialty tapes are widely used in industries that demand long-term bonding strength and weatherability.

Their performance reliability in both indoor and outdoor environments has positioned acrylic resin as the preferred choice for high-performance tape applications.

The PVC backing material segment is expected to represent 38.9% of the total market revenue by 2025, establishing itself as the dominant backing material type.

PVC offers exceptional flexibility, flame retardance, and insulation properties, making it highly suitable for applications in the electrical and electronics sector.

Its capacity to maintain integrity under mechanical stress and environmental exposure has strengthened its role in protective wrapping, insulation, and surface shielding applications.

The electrical and electronics end use industry segment is projected to hold 41.5% of the total market revenue by 2025, positioning it as the leading industry application.

This dominance is driven by the increasing demand for insulation, component protection, and secure assembly solutions in the rapidly growing electronics manufacturing sector.

Specialty tapes are being used extensively for circuit board assembly, cable management, and thermal management solutions, aligning with the miniaturization and performance demands of modern devices.

The market plays a crucial role across diverse industries, including healthcare, automotive, electronics, packaging, and construction. These tapes are engineered with specific adhesive properties and functional capabilities to meet demanding application requirements such as insulation, protection, sealing, and bonding. Their adoption has been driven by rising technological sophistication in medical devices, lightweight automotive manufacturing, and miniaturized electronics assembly. Industry players focus on advanced materials, pressure-sensitive adhesives, and eco-friendly solutions to meet evolving regulatory standards. While growth opportunities are significant, the market is shaped by raw material price volatility, stringent compliance norms, and the need for consistent performance under extreme conditions.

Healthcare has emerged as a dominant sector in driving specialty tape consumption, particularly with the rising use of medical-grade adhesives in wound care, surgical drapes, wearable devices, and diagnostic patches. Specialty tapes are designed to provide skin-friendly adhesion with breathability, ensuring comfort and safety in prolonged use. With increasing emphasis on home healthcare and telemedicine, demand for tapes in wearable monitoring devices has expanded. The sterilization compatibility and hypoallergenic properties have made medical tapes indispensable in hospitals and clinical settings. The ongoing innovation in bio-compatible adhesive technologies continues to support strong growth in this segment, reinforcing its role as a key market driver.

Automotive and aerospace industries increasingly rely on specialty tapes to replace mechanical fasteners and improve efficiency in lightweight structures. Applications include wire harnessing, vibration damping, paint masking, surface protection, and bonding of interior components. Heat-resistant and flame-retardant tapes are critical in aerospace cabin insulation and structural assemblies. In electric vehicles, specialty tapes are used for battery cell insulation, thermal management, and EMI shielding. These solutions support cost reduction by simplifying assembly processes while also meeting stringent safety and performance standards. The global push toward energy-efficient and lightweight mobility solutions have positioned specialty tapes as essential enablers in advanced transportation technologies.

Electronics and industrial applications represent another strong growth avenue for specialty tapes. Miniaturization trends in consumer devices, wearables, and smart appliances demand tapes with precise adhesion and insulation capabilities. Thermal management, shielding, and protection of sensitive components are achieved through advanced tape formulations. In industrial operations, tapes are used for bonding, masking, splicing, and surface protection, reducing downtime and ensuring efficiency. Manufacturers have been investing in high-performance tapes with resistance to solvents, UV, and extreme temperatures. The rise of cleanroom manufacturing in semiconductors and precision equipment has further reinforced the relevance of specialty tapes in mission-critical operations.

The market faces challenges related to the volatility of raw material prices, especially adhesives, resins, and polymers. Dependence on petrochemical feedstocks creates exposure to supply chain fluctuations and global energy price trends. Moreover, stringent regulatory frameworks concerning VOC emissions, recyclability, and safety compliance demand continuous innovation in adhesive formulations. Manufacturers are under pressure to balance cost efficiency with sustainability by introducing eco-friendly and recyclable tapes. Geopolitical disruptions and trade barriers also pose risks to material availability and pricing. Despite these hurdles, investments in green adhesive technologies and circular economy models are expected to shape future market opportunities.

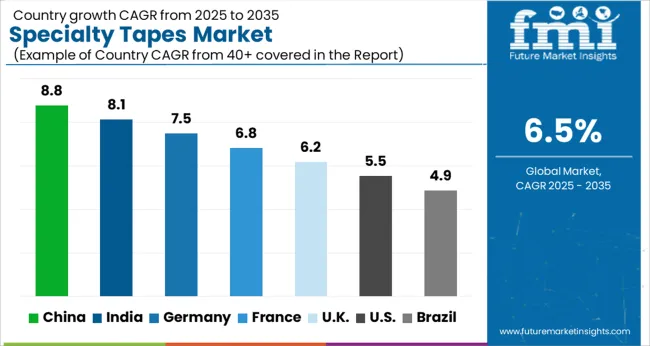

| Countries | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| U.K. | 6.2% |

| U.S. | 5.5% |

| Brazil | 4.9% |

The market is projected to grow at a CAGR of 6.5% between 2025 and 2035, supported by demand from automotive, healthcare, and electronics applications. India recorded 8.1%, showing strong progress through its expanding industrial and packaging sectors. Germany posted 7.5%, where advanced manufacturing and medical applications enhanced adoption. China reached 8.8%, supported by large-scale production capacity and technology-driven manufacturing growth. The United Kingdom stood at 6.2%, with usage rising across construction and consumer goods. The United States accounted for 5.5%, with innovation focused on high-performance adhesive solutions. These developments highlight how diverse regional strengths are shaping the future expansion of the Specialty Tapes market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 8.8%, driven by robust demand from automotive, electronics, and construction industries. The use of adhesive technologies in EV battery assembly, consumer electronics, and high rise construction has reinforced adoption. Local manufacturers focus on pressure sensitive, heat resistant, and double sided specialty tapes, while investments in R&D target improved bonding strength and durability. The export market is also gaining momentum, with Chinese suppliers offering competitively priced products to Southeast Asia and Europe. Government initiatives encouraging domestic production of advanced materials further strengthen the sector.

India is forecast to grow at a CAGR of 8.1%, supported by rising usage in packaging, healthcare, and automotive industries. Growth has been reinforced by demand for medical tapes in wound care and surgical applications, alongside increasing use of adhesive solutions in automotive interiors and lightweight components. Domestic producers are scaling operations to reduce reliance on imports, while partnerships with multinational companies bring advanced adhesive technologies into the Indian market. Construction and infrastructure projects further create opportunities for heat resistant and insulation tapes.

Germany is expected to expand at a CAGR of 7.5%, driven by its advanced automotive, industrial manufacturing, and healthcare sectors. Specialty tapes are being increasingly applied in EV production, thermal management, and advanced medical applications. Imports from Asian suppliers complement domestic production, with European firms focusing on innovation in recyclable and solvent free adhesive solutions. High demand is observed in aerospace and defense, where reliability and performance are prioritized. Strict European regulations also encourage the adoption of environmentally compliant adhesive technologies.

The United Kingdom is projected to grow at a CAGR of 6.2%, supported by demand from healthcare, packaging, and construction sectors. Specialty medical tapes, double sided tapes for packaging, and insulation tapes for energy projects are key growth areas. Imports dominate the market, though domestic players focus on niche applications and customized adhesive solutions. Regulatory pressure to reduce single use plastics is further boosting demand for paper based and recyclable adhesive tapes.

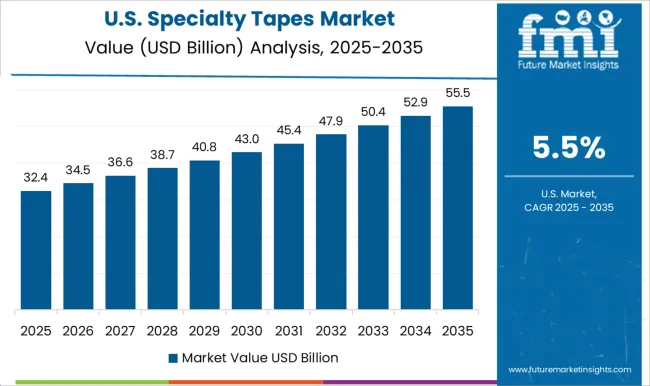

The United States is forecast to grow at a CAGR of 5.5%, driven by widespread adoption in aerospace, automotive, healthcare, and electronics industries. Specialty tapes are increasingly applied in EV batteries, aircraft interiors, and medical devices. Domestic manufacturers focus on high performance adhesive systems, while investments in ecofriendly and recyclable solutions are also gaining attention. Strong demand for advanced pressure sensitive and thermal management tapes positions the U S as a critical global market, with innovation playing a central role in growth.

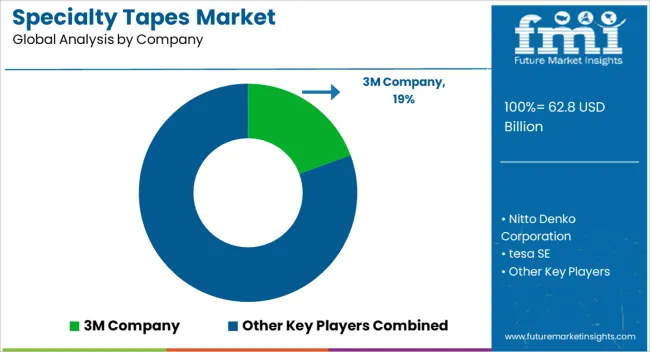

The market is shaped by a wide spectrum of global leaders, diversified adhesive manufacturers, and specialized regional firms that focus on high-performance bonding solutions. 3M Company dominates with an expansive portfolio of pressure-sensitive and performance tapes, leveraging its strong brand presence and innovation capabilities across industries such as automotive, healthcare, and construction. Nitto Denko Corporation maintains a strong footprint in Asia and globally, offering solutions tailored for electronics, automotive, and energy storage. tesa SE, backed by its expertise in adhesive technologies, provides tapes for industrial, consumer, and professional applications with strong distribution networks in Europe and beyond.

Avery Dennison Corporation and Lintec Corporation are significant players focusing on advanced adhesive formulations, sustainability in materials, and applications in packaging and labeling. Berry Global Inc. and Intertape Polymer Group, Inc. contribute with extensive manufacturing scale and cost-competitive offerings. Saint-Gobain Performance Plastics Corporation and Lohmann GmbH & Co. Kg bring specialized engineering expertise for aerospace, medical, and industrial environments. Henkel AG & Co. KGaA and HB Fuller Company integrate specialty tapes within broader adhesive solutions portfolios, benefiting from cross-industry synergies. Competition is increasingly driven by demand for lightweighting in automotive, miniaturization in electronics, and growth in medical adhesive tapes. Players differentiate through material innovation, sustainability initiatives, and customization for niche applications. Partnerships, acquisitions, and capacity expansions remain key strategies as the market evolves with greater emphasis on eco-friendly and high-strength adhesive technologies.

| Items | Values |

|---|---|

| Quantitative Units | USD 62.8 Billion |

| Resin | Acrylic, Rubber, Silicone, and Others |

| Backing Material | PVC, Woven/Non Woven, Paper, PET, Foam, Polypropylene, and Others |

| End Use Industry | Electrical and electronics, Automotive, Construction, Medical and healthcare, Industrial, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Nitto Denko Corporation, tesa SE, Lintec Corporation, Avery Dennison Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Berry Global Inc., Saint-Gobain Performance Plastics Corporation, Lohmann GMBH & Co. Kg, Nichiban Co. Ltd, Adchem Corporation, Shurtape Technologies LLC, HB Fuller Company, and Henkel AG & Co. KGaA |

| Additional Attributes | Dollar sales by tape type and end-use industry, demand dynamics across industrial, medical, and consumer segments, regional trends in adhesive and substrate adoption, innovation in adhesive chemistries and specialty backing materials, environmental impact of recyclability and disposal, and emerging use cases in flexible electronics, medical dressings, and protective films. |

The global specialty tapes market is estimated to be valued at USD 62.8 billion in 2025.

The market size for the specialty tapes market is projected to reach USD 117.9 billion by 2035.

The specialty tapes market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in specialty tapes market are acrylic, rubber, silicone and others.

In terms of backing material, pvc segment to command 38.9% share in the specialty tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA