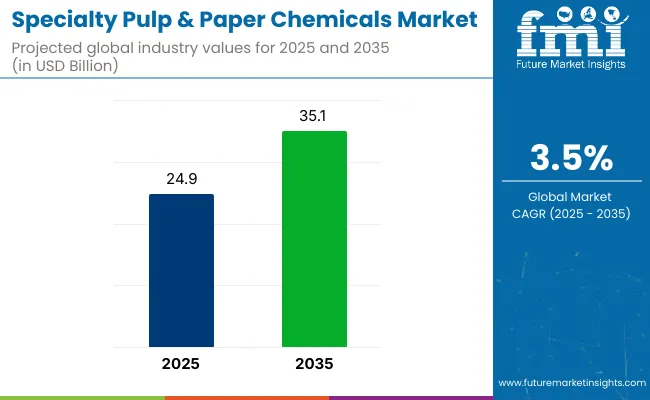

The specialty pulp & paper chemicals market is projected to grow from USD 24.9 billion in 2025 to USD 35.1 billion by 2035, registering a CAGR of 3.5% during the forecast period. Sales in 2024 reached USD 24.0 billion, Expansion is being supported by increased demand for specialty additives in high-grade paper, tissue products, and coated packaging.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 24.9 billion |

| Market Value (2035F) | USD 35.1 billion |

| CAGR (2025 to 2035) | 3.5% |

Growing usage in India’s recycled paper processing and sustainable packaging applications is expected to bolster consumption. Stringent regulatory focus on eco-safe chemicals and end-user preference for higher-performance paper grades are aiding adoption. Global players are also focusing on mill-specific chemical customization. The rise of digital packaging formats and sustainable labeling is anticipated to elevate demand for functional, printable surface treatments across emerging paper substrates.

In March 2025, Chemical leader SNF and Japan’s Mitsubishi Chemical Corporation have partnered in a pioneering project to produce N-vinylformamide (NVF), an advanced monomer essential for polymers used in the paper industry. This collaboration combines the expertise of both companies to drive innovation and sustainability in industrial manufacturing.

“This project exemplifies strategic synergy,” said Pascal Remy, CEO of SNF Group. “By combining Mitsubishi Chemical’s monomer expertise with our leadership in water-soluble polymers, we’ve created a groundbreaking facility that supports the circular economy through recycled paper production. Together, we’re advancing sustainability and innovation.”

Major emphasis is being placed on the integration of biodegradable and bio-based chemicals in pulp processing and surface enhancement. Regulatory standards in India and APAC have pushed for reductions in AOX emissions and improved effluent treatment capabilities in the paper industry.

As a response, suppliers are accelerating the introduction of plant-derived binders, wet strength resins, and retention aids. Digital transformation in chemical dosing and performance analytics is also contributing to operational efficiency. Market traction is further supported by customer partnerships aiming for recyclability and product lifecycle optimization.

Opportunities are anticipated to grow for high-retention, low-energy chemicals, particularly in premium packaging and hygiene paper grades. Asia-Pacific and Latin America are projected to witness elevated demand due to capacity upgrades and rising use of specialty tissue and packaging paper.

Collaborative R&D initiatives, especially those combining Nano cellulose and green chemistry, are expected to strengthen global competitiveness while enhancing product differentiation across specialty paper segments. Continued R&D investment is expected to generate high-performance yet low-impact chemical solutions.

The market is segmented based on chemical type, function, application segment, and region. By chemical type, the segmentation includes bleaching agents, binding agents, sizing agents, coating chemicals, process chemicals, functional additives, and deinking agents, each contributing to specific paper and pulp performance enhancements.

Functional segmentation encompasses strength enhancement, printability improvement, water resistance, optical brightening, pitch & stickies control, pH adjustment, and drainage & retention aid-tailored for process optimization and quality consistency.

Applications cover printing & writing paper, packaging & board, tissue & towel, newsprint, specialty papers (security, filter, label), and recycled paper processing. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

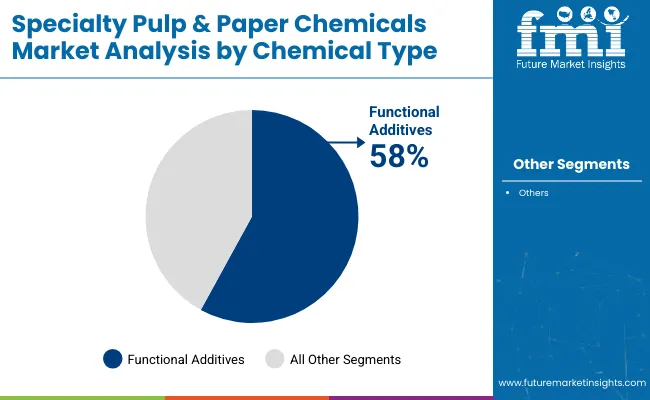

Functional additives are projected to account for 58.0% of the specialty pulp and paper chemicals market by 2025. These additives have been incorporated to improve paper strength, brightness, water resistance, and printability. Fillers, retention aids, and optical brightening agents have been integrated into production lines to enhance sheet characteristics.

Paper longevity and surface quality have been optimized using tailored chemical blends. Increased demand for high-performance printing and specialty-grade papers has accelerated the use of functional additives. Micro-fibrillated cellulose and nanomaterial-based additives have been adopted for lightweight yet strong paper products. Brightness enhancement has been achieved using fluorescent whitening agents across coated and uncoated substrates. Production speed and machine efficiency have been improved by using retention polymers and drainage aids.

Functional additives have also been applied to meet sustainability goals by reducing raw material inputs. Performance consistency has been ensured across recycled fiber sources through controlled additive dosing. Defoamers and enzyme blends have been used to streamline wet-end processing. Packaging manufacturers have relied on additives to achieve bulk control and improve rigidity.

Innovation has been driven by increasing demand for biodegradable and food-grade additives. Demand from packaging converters and premium paper manufacturers has sustained investment in new chemistries. Smart formulations have been tailored for digital printing compatibility and moisture barrier needs. Ongoing collaboration with chemical suppliers has facilitated customization and faster product development cycles.

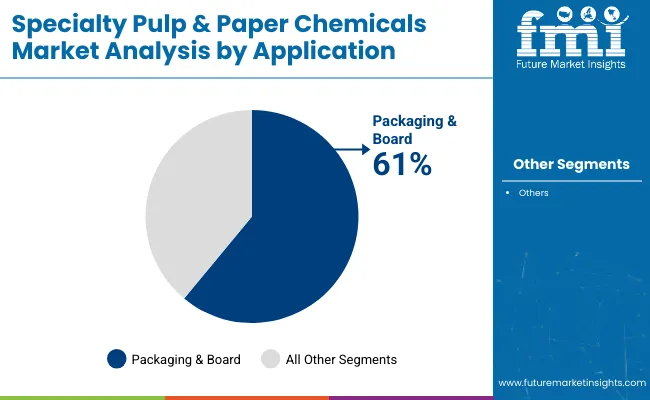

The packaging & board segment is expected to represent 61.0% of the market for specialty pulp and paper chemicals by 2025. Increased consumption of folding cartons, corrugated boxes, and liquid packaging boards has fueled chemical use in this category. Coating chemicals, sizing agents, and strength enhancers have been applied extensively to improve barrier properties and durability.

Light weighting initiatives have been supported through fiber optimization and chemical reinforcement. Sustainability mandates and food safety regulations have driven the adoption of functional and biodegradable additives in packaging boards. Water- and oil-resistant coatings have been deployed to replace polyethylene laminates in food-grade packaging. Custom stiffness and printability profiles have been developed using precision chemical formulations. Recycled fiber usage has been enhanced with deinking agents and strength-rescuing binders.

High-performance boards for e-commerce and logistics applications have required specialized chemical blends. Print-grade and multi-ply packaging formats have been optimized for aesthetics and mechanical strength. Anti-microbial coatings and odor-control additives have been used for fresh food and meat packaging. Producers have favored integrated chemical systems for barrier control, smoothness, and moisture resistance.

Board mills and packaging converters have collaborated with chemical suppliers for inline customization. Application-specific solutions have been designed for beverage cartons, detergent boxes, and frozen food trays. Rapid digital printing growth has prompted the use of additives that enable ink adhesion and color fidelity. As packaging volumes increase globally, the segment is expected to retain its dominant share.

Environmental Regulations and High Production Costs

Stringent environment regulations highlighting the need of lowering chemical waste and emissions are anticipated to hinder the specialty pulp and paper chemicals market growth. The need for investment into research and development to switch to sustainable and bio-based chemicals and the resultant lack of economies of scale can also lead to higher production costs. Market stability can also be impacted by fluctuations in raw material prices.

Growth in Sustainable and Bio-Based Chemicals

A big trend in the specialty pulp and paper chemicals market is the drive toward green ways and eco-friendly methods.Bio-based and enzymatic chemical innovations can achieve high-performance standards while also decreasing environmental impact for manufacturers. The ones that invest in green chemistry solutions and circular economy initiatives are poised to capture competitive advantage in this changing market landscape.

The specialty pulp and paper chemicals market in the USA is growing. This is because more people want green paper goods. Strict rules and new ways to make these chemicals help too. The EPA and FDA make sure these chemicals are safe and green.

Trends show that we are using more enzymes for green paper. Coating chemicals help print better and last longer. There is also more money going to water treatment chemicals which help make the process better and clean waste water. Bio-based chemicals are also liked more because they are better for the earth.

| Country | CAGR (2025 to 2035) |

|---|---|

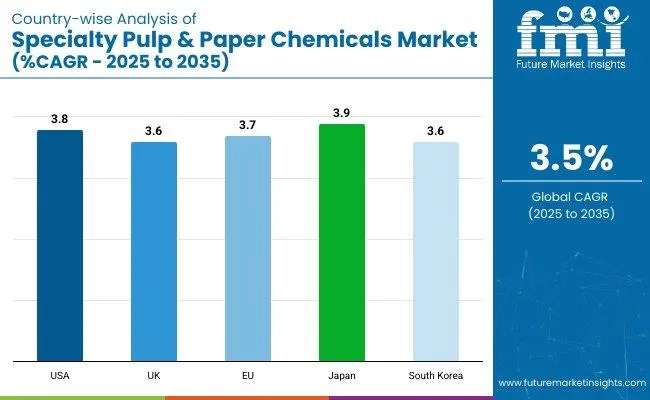

| USA | 3.8% |

The UK's market for specialty pulp and paper chemicals is seeing steady growth. This is because more people like recycled and biodegradable paper. The government is also pushing for more sustainable practices. New methods in fiber treatment and deinking are helping too. The UK Environment Agency (EA) and the British Paper and Board Industry Federation (BPIF) set rules to make sure the industry follows health and environmental standards.

There are some key trends in this market. People want more functional additives and chemicals that make paper stronger. There is also more use of sustainable coatings for food packaging. Nanotechnology in specialty chemicals is being used a lot for making high-performance paper. Efforts to reduce waste and support a circular economy are sparking new ideas in chemical formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The market for specialty pulp and paper chemicals in the EU is growing. Strict rules on the environment help this growth. There is a shift to green, bio-based chemicals. Demand for top-quality papers for packaging, printing, and labels is also rising. The European Chemicals Agency and the European Commission watch over the safety rules. They ensure safe use of these special chemicals in paper making.

Big players in this market are Germany, France, and Italy. Their paper tech is advanced. They invest more in green, bio-based chemicals. Need for special coatings and retention agents is high. Strong recycling plans and EU Green Deal rules push the use of these sustainable chemicals.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan's market for specialty pulp and paper chemicals is growing fast. This is because of more need for top-quality special papers, new ways to change fibers, and help from the government for recyclable and green paper. Two main players, the Ministry of Economy, Trade and Industry (METI) and the Japan Paper Association (JPA), make sure industry rules follow eco-friendly practices.

Key trends show more use of nanocellulose-based chemicals. There’s also more money going into biodegradable coatings for food wraps. Enzyme treatments are on the rise to better fiber quality and cut chemical waste. Japan’s push for top paper tech also helps specialty chemicals grow in areas like electronics and medical wraps.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's market for specialty pulp and paper chemicals is growing. There is more need for strong and water-resistant paper. People are making eco-friendly chemicals. The government backs green packaging. The Korean Ministry of Environment (MOE) and Korea Paper Association (KPA) push for safe chemical use in paper making.

The market trends show more use of bio binders and aids. Functional additives in special paper are getting popular. There is more money going into chemicals to treat wastewater. This helps the paper business be greener. Digital printing is getting bigger, so there is more need for good paper coatings and brighteners.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The specialty pulp and paper chemicals market is driven by high-performance paper products, eco-friendly chemical formulations, and advances in paper processing technologies. The transition toward sustainable packaging, improved durability of paper, and enhanced printability are driving the market.

Companies are developing bio-based chemicals, specialty coatings as well as optimizing processes to improve efficiency and lower environmental impact. The market consists of five top chemical manufacturers, pulp and paper processing companies, and sustainability-oriented suppliers.

The overall market size for the specialty pulp and paper chemicals market was USD 24.9 billion in 2025.

The specialty pulp and paper chemicals market is expected to reach USD 35.1 billion in 2035.

Increasing demand for high-performance paper products, advancements in eco-friendly and sustainable chemicals, rising adoption of specialty coatings and functional additives, and growing emphasis on biodegradable packaging solutions will drive market growth.

The USA, China, Germany, India, and Japan are key contributors.

The functional chemicals segment is expected to lead due to their wide-ranging applications in enhancing paper strength, printability, and water resistance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Specialty Active Pharmaceutical Ingredient Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA