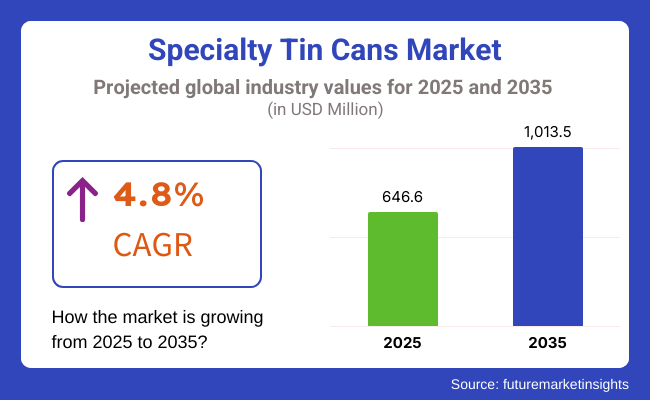

FMI’s new report estimates that specialty tin cans will reach a market size of USD 646.4 million by 2025, and project to reach a value of USD 1013.5 million by 2035. Sales are expected to witness an increase in CAGR of 4.8% over the forecasted period from 2025 to 2035. The revenue from specialty tin cans was worth USD 618.3 million in 2024.

Specialty tin cans are widely used in packaging premium food, confectionery, cosmetics, and gift items. This market is expected to have over 40.2% of the metal packaging sector by 2035. With their durability, recyclability, and aesthetic appeal, they become increasingly attractive to brands looking to provide premium packaging solutions. Also, stricter regulations on plastic packaging have further driven the demand for sustainable alternatives like tin cans.

Among material types, tinplate steel special cans are foreseen to dominate and take more than 65% of the market. They are preferred due to high strength, corrosion resistance, and long shelf life of packaged products. Meanwhile, there is a buzz about aluminum-based specialty cans as they are lightweight and recyclable.

The specialty tin cans market has the incremental opportunity of USD 367.1 million with growth to 1.6 times its current value by 2035.

The table below presents the expected CAGR for the global specialty tin cans market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.4% |

| H2 (2024 to 2034) | 5.0% |

| H1 (2025 to 2035) | 4.8% |

| H2 (2025 to 2035) | 5.6% |

In the first half (H1) of the decade from 2024 to 2034, the market is anticipated to grow at a CAGR of 4.4% with a slightly lower rate of growth of 5.0% during the second half (H2) of the same decade. Going further into this period from H1 2025 to H2 2035, the CAGR is supposed to decline marginally from 4.8% in H1 to 5.6% in H2. The first half witnessed a decline of 60 BPS, while in the second half the market saw an increase of 80 BPS.

Market Growth Fueled by Rising Demand for Premium and Sustainable Packaging

Besides sustainability, specialty tin cans are more customers barreling for various industries, from foodstuffs through cosmetics to luxury goods, as brands tend to enhance the presentation of products on the shelf. Their capacity to offer optimal product security, coupled with upscale looks, is what is boosting market growth.

Government Policies on the Reduction of Plastics Favor Market Growth

Regulations limiting the use of single-use plastics are impelling companies to switch over to other alternatives like metal packaging solutions in the form of tin cans, fully recyclable and in harmony with global sustainability goals.

High Production Costs and Complexity of Recycling are the Challenges

Though tin cans are sustainable, the high production costs and heavy energy consumption in manufacturing deter the widespread adoption of tin cans. The less-than-ideal recycling process of tin cans in certain regions does affect the overall rate of growth. However, long-term growth in the specialty tin cans market is anticipated owing to investments in innovative manufacturing techniques and better recycling infrastructure.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Coatings & Printing Technologies | To enhance durability, corrosion resistance, and aesthetic appeal for premium markets. |

| Automation & AI in Manufacturing | To improve efficiency, reduce waste, and meet high-volume demand. |

| Lightweight & Sustainable Materials | To reduce material costs while maintaining strength and recyclability. |

| Circular Economy & Recyclable Tin Cans | To meet consumer and regulatory expectations for closed-loop packaging. |

| Government Collaboration & Compliance | To ensure adherence to sustainability regulations and streamline market approvals. |

From 2020 to 2024, the global specialty tin cans market grew at a CAGR of 4.2%, increasing from USD 520.5 million in 2020 to USD 618.3 million in 2024. Wielding its key advantages of aesthetic appeal and product protection, tin cans saw a rise in demand in the premium food, beverage, and personal care industries during the review period.

Also, innovations in printing technology, the rise in demand for decorated and custom-designed packaging, and the increasing inclination of consumers toward sustainable and reusable metal packaging acted as growth factors for the market. However, volatility of raw material prices and high manufacturing costs stood to be major bottlenecks to profit margins.

| Market Aspect | 2019 to 2024 (Past Trends) |

|---|---|

| Market Growth | Steady growth (~3.5% CAGR) driven by premium product demand. |

| Sustainability Push | Initial focus on recyclable tin cans with minimal environmental impact. |

| Raw Materials | Predominantly tin-plated steel and aluminum. |

| Technology & Automation | Traditional printing and manufacturing methods. |

| Product Innovation | Basic customization options for branding and finishes. |

| Cost & Pricing | High production costs due to material price fluctuations. |

| Industry Adoption | Used primarily in luxury food, beverage, and personal care packaging. |

| Customization | Limited design flexibility and printing capabilities. |

| Regulatory Influence | Compliance with basic food safety and recycling regulations. |

| E-commerce Influence | Moderate impact; used in select premium packaging applications. |

| Circular Economy | Early-stage efforts towards improved recyclability. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Accelerated expansion (~4.6% CAGR) fueled by sustainability trends and innovation. |

| Sustainability Push | Full commitment to closed-loop recycling and lightweighting. |

| Raw Materials | Increased use of eco-friendly coatings and lightweight alloys. |

| Technology & Automation | AI-driven production, high-speed digital printing, and precision manufacturing. |

| Product Innovation | Smart tin cans with interactive packaging features and anti-counterfeit technology. |

| Cost & Pricing | Cost reductions through advanced manufacturing techniques and material optimization. |

| Industry Adoption | Expanded adoption in gourmet food, specialty teas, confectionery, and gift packaging. |

| Customization | Advanced personalization with intricate embossing, digital printing, and premium finishes. |

| Regulatory Influence | Stricter regulations promoting sustainable sourcing and higher recyclability rates. |

| E-commerce Influence | Higher demand due to the rise in luxury e-commerce packaging and direct-to-consumer brands. |

| Circular Economy | Widespread integration of reusable tin cans and closed-loop recycling systems. |

| Factor | 2019 to 2024 Priorities |

|---|---|

| Sustainability | Consumers preferred recyclable tin cans but were price sensitive. Manufacturers gradually transitioned to sustainable coatings. |

| Cost & Pricing | Consumers paid a premium for luxury tin cans. Manufacturers balanced cost and aesthetics. |

| Performance (Durability, Barrier Properties, Strength) | Consumers wanted sturdy packaging. Manufacturers ensured product integrity. |

| Aesthetics & Branding | Consumers preferred decorative, high-end packaging. Manufacturers focused on embossing and metallic finishes. |

| Product Availability & Convenience | Limited specialty tin can option due to high production costs. |

| Food Safety & Hygiene | Consumers had concerns about coatings. Manufacturers ensured compliance with safety regulations. |

| Reusability & Circular Economy | Some consumers are interested in reusability, but manufacturers focused on recyclability. |

| Factor | 2025 to 2035 Priorities |

|---|---|

| Sustainability | Consumers expect fully recyclable and reusable packaging. Manufacturers invest in lightweighting and closed-loop systems. |

| Cost & Pricing | Consumers accept price increases for sustainability. Manufacturers focus on cost-effective material sourcing and production. |

| Performance (Durability, Barrier Properties, Strength) | Consumers demand advanced coatings for extended shelf life. Manufacturers invest in corrosion-resistant materials. |

| Aesthetics & Branding | Consumers expect premium, interactive designs. Manufacturers enhance customization and printing technologies. |

| Product Availability & Convenience | Sustainable, customized tin packaging becomes widely available, with increased production capacity. |

| Food Safety & Hygiene | Consumers demand BPA-free, non-toxic coatings. Manufacturers invest in advanced food-safe coatings. |

| Reusability & Circular Economy | Strong demand for reusable, refillable tin cans. Manufacturers integrate reusable packaging into mainstream products. |

Tier 1 companies are Tier 1 because they lead the specialty tin cans market with a great part, commanding levels of production with diversified product lines. They are well known as master's within the field of manufacturing different specialty tin can styles and having a reputed powerful presence around the globe with a loyal customer base.

They usually invest in advanced technology, sustainable solutions, and maintain regulatory compliance to provide a product of high quality. Other examples include Crown Holdings, Inc., Ball Corporation, Ardagh Group S.A., Silgan Holdings Inc., and Toyo Seikan Group Holdings Ltd.

Tier 2 companies are slightly larger companies that are well established and have a reasonable degree of influence within the regional markets. While they might have reasonably competent technology and are responsive to the regulations, they are otherwise by no means of the stature of the more powerful players.

Their relative output volume should mean a greater ability to cater to specialized niche modes of application for client-specific solutions within the specialty tin can segment. Main examples are CCL Container, Independent Can Company, Allstate Can Corporation, Massilly Holding S.A.S., and Nampak Ltd.

Tier-3 companies are the small local companies servicing particular regional demands. These players are primarily focused on fulfilling their local market needs and are a part of an unorganized sector compared to the structured operations of tier 1 and tier 2.

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Asia Pacific (APAC) | Strong growth as sustainability concerns drive demand for recyclable metal packaging. Investments in advanced manufacturing processes rise. |

| Europe | The EU enforces stricter sustainability mandates. Innovations in lightweight and decorative tin cans gain traction. |

| Global | Industry-wide shift to sustainable and smart packaging. Government policies push for improved recyclability and circular economy initiatives. |

| Latin America | Growth accelerates as brands adopt sustainable metal packaging. Local manufacturing expansion supports the supply chain. |

| Middle East & Africa (MEA) | Governments push for sustainable packaging, increasing demand. Investments in local manufacturing of specialty tin cans rise. |

| North America | Rising sustainability concerns lead to increased use of recyclable and decorative tin packaging. Demand remains strong in premium and limited-edition product categories. |

| South Asia | Governments in India and Bangladesh implement stricter packaging laws. Growth in premium retail and e-commerce drives demand for specialty tin cans. |

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| India | 7.2% |

| Germany | 4.1% |

| China | 5.8% |

| Brazil | 3.9% |

| United Kingdom | 4.4% |

| Canada | 4.1% |

Specialty tin cans find increasing demand in the USA because of their durability, recyclability, and premium appeal. Key consumers are in the food, beverage, cosmetics, and luxury good industries that use specialty tin cans for branding and differentiation purposes. The market is being fueled by sustainability concerns and innovations in decorative tin packaging.

Germany is leading in the transition toward sustainable specialty tin cans, with strict regulations that hold manufacturers accountable for their products mostly in the sphere of recycling and environmental compliance. Increasing demand for durable, tamper-proof, and decorative metal packaging in food, beverage, and cosmetics industries is behind the demand. Advanced investment in packaging technology is consequent on the coloration of product appeal against a backdrop of reducing the adverse effects on the environment.

This section represents details of the different propulsion segments in the industry. In terms of material type, aluminum specialty cans are estimated to constitute a share of 64.2% by 2035. By end-use industry, beverages are projected to dominate the market in terms of share by occupying a share of 58.9% toward the end of 2035.

| Material Type | Market Share (2025) |

|---|---|

| Aluminum Specialty Cans | 64.2% |

Due to their lightweight, high recyclability, and excellent barrier properties, aluminum specialty cans have remained the most preferred choice above all. They can maintain carbonation whilst supplying enough protection against UV light, oxygen, and contaminants, making them very suitable for any carbonated drink, craft beverage, and aerosol product.

As sustainability takes center stage in the development of the industry, producers are developing ultra-light cans with recycled aluminum content to minimize material usage and yet maintain strength. Moreover, premiumization in beverages and cosmetics will continue to spur demand for custom-printed, embossed, and sleek aluminum specialty cans.

| End-Use Industry | Market Share (2025) |

|---|---|

| Beverages | 58.9% |

The beverage sector still remains the largest consumer of specialty cans, with increasing craft beer, functional drinks, energy drinks, and RTD (ready-to-drink) cocktails consuming them. Their portability, shelf life, and branding opportunities are increasingly attractive to premium and niche beverages.

Leading beverage brands are moving towards aluminum cans from their plastic bottle counterparts to comply with eco-conscious consumer choices as well as stringent packaging regulations, with increasing demand for personalized and limited-edition cans responsible for rising demand for highly customizable specialty can formats.

The key players in the specialty cans market are focusing on lightweight materials, modern printing technologies, and out-of-the-box designs. Investment is happening for the augment of recycling infrastructure, the implementation of smart packaging features, and development of resealable closures for better function and sustainability.

| Manufacturer | 2025 to 2035 (Future Priorities) |

|---|---|

| Ball Corporation | Investing in lightweight, ultra-thin, and resealable aluminum cans. |

| Crown Holdings Inc. | Developing smart cans with NFC-enabled tracking and authentication. |

| Ardagh Group | Scaling up 100% recycled aluminum can be produced. |

| Can-Pack S.A. | Innovating sleek and slim can formats for energy drinks and RTD cocktails. |

| Toyo Seikan Group | Advancing multi-layer coatings for improved corrosion resistance. |

| Silgan Holdings Inc. | Enhancing sustainable and resealable metal can designs. |

| CPMC Holdings Ltd. | Expanding high-volume specialty can manufacturing for global brands. |

| Berlin Packaging | Introducing eco-friendly coatings and finishes for specialty cans. |

| Envases Group | Scaling up refillable and reusable metal packaging solutions. |

| Nampak Ltd. | Investing in recyclable aluminum aerosol and beverage can innovations. |

| Massilly Group | Advancing hermetically sealed can technologies for extended shelf life. |

| ShengXing Group | Scaling up digitally printed aluminum cans for personalized branding. |

| Crown Aerosols & Promotional Packaging | Investing in biodegradable coatings for specialty metal packaging. |

| Ball Metalpack | Enhancing BPA-free and low-carbon footprint can be manufacturing. |

| Ardagh Metal Packaging | Innovating temperature-sensitive cans with color-changing designs. |

| Kingcan Holdings | Expanding eco-friendly aluminum cans with lightweight design improvements. |

| Grupo Zapata | Developing high-pressure specialty cans for technical applications. |

| Trivium Packaging | Scaling 100% infinitely recyclable specialty can solutions. |

| CANPACK Group | Advancing smart packaging with AR and QR-enabled interactive branding. |

Key Developments

| Company Strategy | Development |

|---|---|

| Product Launch | Silgan Holdings introduced a new range of lightweight tin cans for premium food and beverage packaging, designed to enhance shelf appeal and recyclability. |

| Partnership | Crown Holdings partnered with Nestlé to develop high-barrier tin cans for infant formula, improving product protection and sustainability. |

| Acquisition | Ardagh Group acquired Exal Corporation for USD 750 million, strengthening its presence in the specialty tin can market for food and personal care packaging. |

| Certification | Ball Corporation received Cradle-to-Cradle certification for its tin-plated steel packaging, reinforcing its commitment to sustainability. |

| Acquisition | Can-Pack S.A. acquired Massilly Group's specialty tin can division, expanding its offerings in decorative and luxury metal packaging. |

| Manufacturer | Vendor Insights |

|---|---|

| Silgan Holdings | Maintained leadership through innovation in lightweight tin cans for food and beverage applications. |

| Crown Holdings | Strengthened its presence in premium and high-barrier metal packaging solutions. |

| Ardagh Group | Expanded its specialty tin can business through acquisitions and sustainable packaging initiatives. |

| Ball Corporation | Increased focus on sustainability with recyclable and refillable tin can solutions. |

| Can-Pack S.A. | Grew its market share in decorative and specialty tin cans through strategic acquisitions. |

| Massilly Group | Maintained steady growth in food-grade tin packaging with an emphasis on safety and compliance. |

| Colep Packaging | Diversified into aerosol and specialty tin can production, boosting its market presence. |

| Envases Group | Strengthened its market share in premium and decorative tin cans for confectionery and cosmetics. |

| Tinplate Company of India | Expanded its production capacity to meet rising demand for specialty tin packaging. |

| P. Wilkinson Containers | Focused on high-end custom tin cans for luxury brands and gift packaging. |

| Allstate Can Corporation | Specialized in food-safe and decorative tin cans, maintaining a niche market presence. |

The market for specialty tin cans is expected to grow exponentially, driven by the demand for packaging that is sustainable, high-barrier, and aesthetically pleasing. The major planned actions include the following:

Sustainability initiatives: Units designed with full recyclability and a resulting lower carbon footprint that foster green practices.

Premiumization and customization: Highlighting decorative and high-end specialty tin packaging for luxury brands.

Advanced barrier technology: Extending product protection for food, beverage, and medicinal uses.

Compliance with regulatory mechanisms: Molded with innovative concepts and supporting extraction measures for safeguarding consumers and the environment.

Automation and efficiency: Investments in high-speed manufacturing technologies in line with customer demand.

Through these approaches, therefore, developments in the specialty tin cans market will be ensured, along determining their competitive edge.

The market is expected to grow with a CAGR rate of 4.6% from 2025 to 2035.

The global specialty tin cans market was valued at USD 618.3 million in 2024.

The market is estimated to grow by 2035 with a value of USD 1013.5 million.

Table 01: Global Market Volume (Million Units) Analysis, by Product Type, 2017 to 2032

Table 02: Global Market Value (US$ Million) Analysis, by Product Type, 2017 to 2032

Table 03: Global Market Volume (Million Units) Analysis, by Closure, 2017 to 2032

Table 04: Global Market Value (US$ Million) Analysis, by Closure, 2017 to 2032

Table 05: Global Market Volume (Million Units) Analysis, by Capacity, 2017 to 2032

Table 06: Global Market Value (US$ Million) Analysis, by Capacity, 2017 to 2032

Table 07: Global Market Volume (Million Units) Analysis, by End Use, 2017 to 2032

Table 08: Global Market Value (US$ Million) Analysis, by End Use, 2017 to 2032

Table 09: Global Market Volume (Million Units) Analysis, by Region, 2017 to 2032

Table 10: Global Market Value (US$ Million) Analysis, by Region, 2017 to 2032

Figure 01: Global Market Share Analysis, by Product Type, 2022(E) to 2032(F)

Figure 02: Global Market Attractiveness, by Product Type, 2022(E) to 2032(F)

Figure 03: Global Market Share Analysis, by Closure, 2022(E) to 2032(F)

Figure 04: Global Market Attractiveness, by Closure, 2022(E) to 2032(F)

Figure 05: Global Market Share Analysis, by Capacity, 2022(E) to 2032(F)

Figure 06: Global Market Attractiveness, by Capacity, 2022(E) to 2032(F)

Figure 07: Global Market Share Analysis, by End Use, 2022(E) to 2032(F)

Figure 08: Global Market Attractiveness, by End Use, 2022(E) to 2032(F)

Figure 09: Global Market Share Analysis, by Region, 2022(E) to 2032(F)

Figure 10: Global Market Attractiveness, by Region, 2022(E) to 2032(F)

Figure 11: North America Market Share Analysis by Product Type, 2022E to 2032F

Figure 12: North America Market Share Analysis by Closure 2022(E)

Figure 13: North America Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 14: North America Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 15: North America Market Value Share Analysis by Country, 2022E

Figure 16: Latin America Market Share Analysis by Product Type, 2022E to 2032F

Figure 17: Latin America Market Share Analysis by Closure 2022(E)

Figure 18: Latin America Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 19: Latin America Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 20: Latin America Market Value Share Analysis by Country, 2022E

Figure 21: Europe Market Share Analysis by Product Type, 2022E to 2032F

Figure 22: Europe Market Share Analysis by Closure 2022(E)

Figure 23: Europe Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 24: Europe Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 25: Europe Market Value Share Analysis by Country, 2022E

Figure 26: East Asia Market Share Analysis by Product Type, 2022E to 2032F

Figure 27: East Asia Market Share Analysis by Closure 2022(E)

Figure 28: East Asia Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 29: East Asia Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 30: East Asia Market Value Share Analysis by Country, 2022€

Figure 31: South Asia Market Share Analysis by Product Type, 2022E to 2032F

Figure 32: South Asia Market Share Analysis by Closure 2022(E)

Figure 33: South Asia Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 34: South Asia Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 35: South Asia Market Value Share Analysis by Country, 2022E

Figure 36: MEA Market Share Analysis by Product Type, 2022E to 2032F

Figure 37: MEA Market Share Analysis by Closure 2022(E)

Figure 38: MEA Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 39: MEA Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 40: MEA Market Value Share Analysis by Country, 2022€

Figure 41: Oceania Market Share Analysis by Product Type, 2022E to 2032F

Figure 42: Oceania Market Share Analysis by Closure 2022(E)

Figure 43: Oceania Market Incremental Opportunity Analysis (US$ Million), by Capacity, 2022E to 2032F

Figure 44: Oceania Market Attractiveness Analysis by End Use, 2022E to 2032F

Figure 45: Oceania Market Value Share Analysis by Country, 2022E

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Specialty Active Pharmaceutical Ingredient Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA