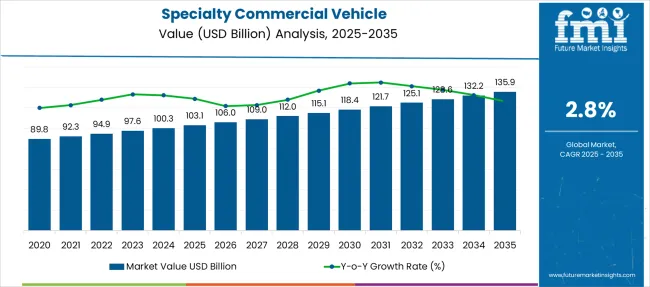

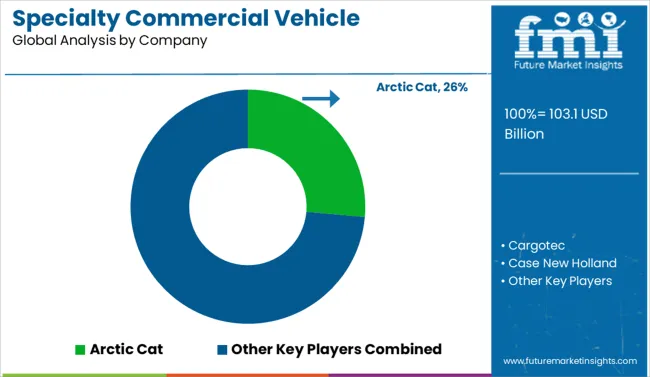

The Specialty Commercial Vehicle Market is estimated to be valued at USD 103.1 billion in 2025 and is projected to reach USD 135.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Commercial Vehicle Market Estimated Value in (2025E) | USD 103.1 billion |

| Specialty Commercial Vehicle Market Forecast Value in (2035F) | USD 135.9 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

Urban infrastructure development and rising healthcare investments are prompting municipalities and private operators to upgrade their fleets with advanced specialty vehicles that meet safety, hygiene, and operational standards.

Advancements in vehicle design, including modular interiors, integrated digital systems, and enhanced suspension technologies, are improving service efficiency and reducing lifecycle costs. Government incentives for vehicle modernization and emission reduction are further supporting market adoption.

With a focus on reliability, customization, and compliance, the market is expected to experience strong momentum as industries continue to prioritize task-specific mobility and efficient service delivery through specialized fleet assets.

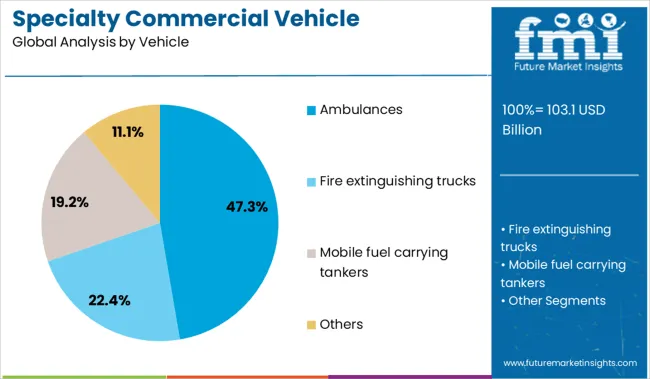

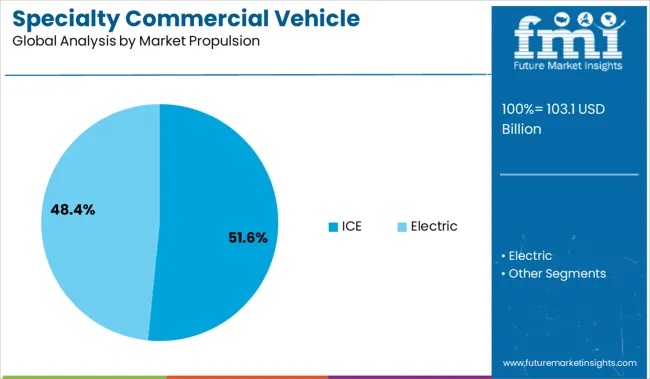

The market is segmented by Vehicle, Market Propulsion, Market Application, and region. By Vehicle, the market is divided into Ambulances, Fire extinguishing trucks, Mobile fuel carrying tankers, and Others. In terms of Market Propulsion, the market is classified into ICE, Electric, BEV, HEV, and PHEV.

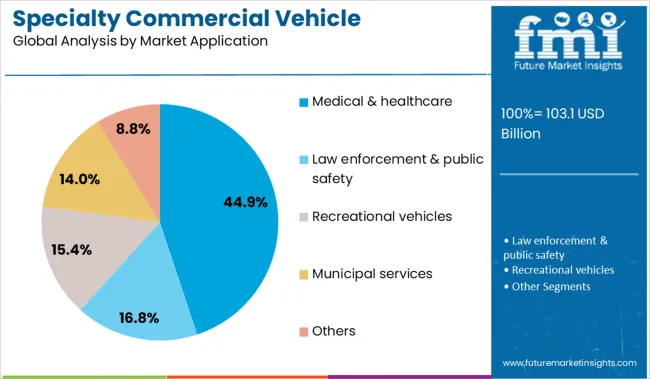

Based on Market Application, the market is segmented into Medical & healthcare, Law enforcement & public safety, Recreational vehicles, Municipal services, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ambulance segment is projected to contribute 47.30% of total revenue by 2025 within the vehicle category, positioning it as the most dominant. This is driven by growing public and private investment in emergency medical infrastructure, rising incidence of road accidents, and increased demand for mobile healthcare services.

Ambulances are being equipped with life-saving equipment, connectivity features, and hygiene-optimized designs to support prehospital care and critical patient transfers. Their use has expanded beyond urban centers to rural and remote areas, making them essential for equitable healthcare access.

As governments and private hospitals upgrade emergency response fleets, the ambulance category continues to lead the specialty commercial vehicle segment.

The internal combustion engine segment is expected to hold 51.60 percent of the total market revenue by 2025 under the propulsion category. Its dominance is supported by well-established fueling infrastructure, lower upfront costs, and high reliability for long-distance and continuous operation requirements.

ICE vehicles remain widely used in regions where electric charging networks are underdeveloped or impractical for emergency and utility operations. Their ability to operate under varied load conditions and terrain without compromising on performance makes them suitable for a wide range of applications.

Despite the growing interest in electrification, the ICE segment retains its leadership due to operational dependability and widespread availability.

The medical and healthcare segment is projected to contribute 44.90 percent of total market revenue by 2025 under the application category, making it the leading segment. This growth is driven by increasing investments in mobile medical services, pandemic preparedness, and healthcare outreach programs.

Specialty vehicles designed for medical use are being deployed for diagnostics, vaccination, emergency treatment, and health screening in both urban and rural settings. The segment benefits from rising awareness around health equity and the need for agile healthcare delivery systems.

As healthcare providers focus on extending services beyond hospital settings, specialty commercial vehicles tailored to medical applications are becoming critical enablers of efficient and responsive care delivery.

Sales are driven by healthcare outreach, last‑mile cold chain logistics, and security logistics. Refrigerated and utility vehicle types together account for 55-60% of unit output. Adoption is highest in North America and Europe, but markets in Asia and Latin America are growing at 7-8% annually. Vehicle customization and integration with telematics, power management, and modular equipment systems are now standard in new builds.

Investment in mobile service and refrigerated delivery fleets continues to fuel specialty vehicle purchases by public agencies, private logistics firms, and NGOs. In 2023 to 2024, refrigerated van registrations rose 14% in Europe and 18% in North America. Mobile healthcare units, including diagnostics, dental, and vaccination clinics, grew 9% globally, with pilot fleets deployed in rural Latin America and Southeast Asia. Utility providers used custom boom vans and inspection platforms to support grid modernization and fiber rollout, increasing specialty vehicle spend by 12-15%. Brands now offer pre-wired power and HVAC packs, modular box designs, and integrated telematics, reducing up-fit time by 25% and speeding deployment to customer sites.

Specialty vehicle builders face complexity and long delivery cycles due to regulatory certification, custom component sourcing, and operator training requirements. Up‑fit project budgets often exceed 18-22% of base vehicle cost, pushing total spend beyond USD 85,000 per unit. Approval for refrigeration equipment and emissions modification can extend delivery times by 6-8 weeks based on jurisdiction. Smaller fleets in emerging regions struggle to locate certified up-fitters and face 12-16 week lead times for HVAC, electrical and modular box suppliers. Maintenance knowledge gaps and a lack of regional service partners lead to higher downtime, audits show up to 22% reduction in fleet availability, and discourage fleet expansion where local support is weak.

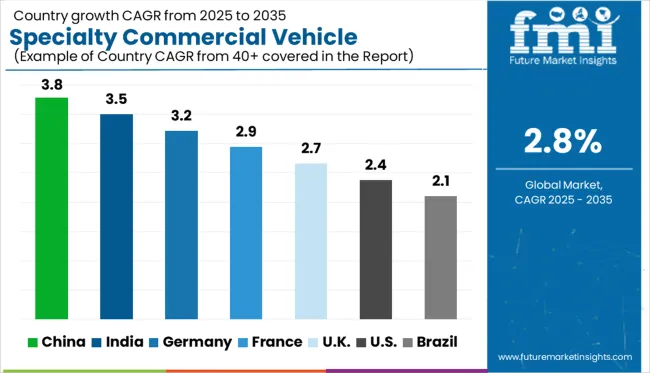

| Countries | CAGR |

|---|---|

| China | 3.8% |

| India | 3.5% |

| Germany | 3.2% |

| France | 2.9% |

| UK | 2.7% |

| USA | 2.4% |

| Brazil | 2.1% |

The global specialty commercial vehicle market is expected to grow at a CAGR of 6.8% from 2025 to 2035. However, key national markets show significantly lower growth. India (BRICS) leads among the listed countries with a CAGR of 3.5%, trailing the global average by 3.3 percentage points, reflecting demand in infrastructure and municipal services but limited by slower fleet modernization.

Germany (OECD) follows at 3.2% (-3.6 pp), driven by industrial applications but tempered by economic headwinds. France posts 2.9% (-3.9 pp), reflecting modest adoption across waste management and construction segments.

The UK records 2.7% (-4.1 pp), while the United States (OECD) trails at 2.4%, 4.4 pp below the global average, suggesting market maturity and lower fleet replacement rates in core applications. The report features insights from 40+ countries, with the top five shown below.

India shows a 3.5% growth rate in the specialty commercial vehicle market, lower than the global average of 6.8%. Market demand is centered on water tankers, mobile medical vans, and multi-axle tippers used in construction corridors. Delays in vehicle certification and fragmented procurement across states have slowed the segment.

New purchases are being driven by infrastructure grants under state-level programs. Fleet owners are using region-specific chassis adaptations to comply with road-grade limitations in hilly zones. Manufacturers are leaning on third-party body fabricators for cost efficiency.

Germany reports a 3.2% growth rate in the specialty commercial vehicle market, below the global average of 6.8%. Demand is focused on snow plows, mobile cranes, and waste vacuum trucks for public service fleets. Procurement is aligned with municipal budgets that follow multi-year replacement cycles. Body manufacturing is highly standardized under EU safety protocols, limiting rapid variation. Electric chassis pilots are being tested in airport and seaport vehicles with short operational ranges. Buyers are focusing on lifecycle performance rather than upfront pricing.

The United States records a 2.4% growth rate in the specialty commercial vehicle market, well below the global average of 6.8%. Fleet purchases are concentrated in telecom maintenance trucks, SWAT armored carriers, and asphalt pavers. Procurement is segmented between federal programs and county-level contracts, causing irregular order cycles. Build specifications vary significantly by application, reducing cross-market scalability. EV retrofits are advancing slowly due to payload and duty-cycle constraints. Buyers are responding to regulatory pressures for telematics integration, though rollout remains inconsistent.

France posts a 2.9% growth rate in the specialty commercial vehicle market, under the global average of 6.8%. Common use cases include livestock transporters, compact refuse collectors, and rail inspection trucks. Design preferences are shifting toward modular builds that can be retrofitted across multiple sectors. Low-volume production keeps price points elevated for domestic buyers. Industry participants note longer replacement intervals due to the durability of older fleet stock. Regulation changes tied to Euro 7 standards have paused new tender cycles in several departments.

The United Kingdom shows a 2.7% growth rate in the specialty commercial vehicle market, below the global benchmark of 6.8%. Street sweepers, armored carriers, and refrigerated delivery vans lead demand. Limited municipal funding has restrained fleet renewals across county councils. Chassis reconfiguration is common, especially in retrofitted food delivery vehicles. Buyers are delaying investment in hydrogen-powered variants due to infrastructure lag. Analysts tracking utility fleets observe high retention of older units past their service windows.

The specialty commercial vehicle market in 2025 is shaped by demand across emergency response, public transport, and purpose-built utility segments. Arctic Cat leads with a significant share, driven by its production of rugged vehicles used in off-road, rescue, and government operations. Demers Ambulances, Emergency One, and Rosenbauer International supply emergency and fire-response fleets with configurable, regulation-compliant platforms.

Case New Holland, Oshkosh Corporation, and REV focus on military-grade and construction-ready models. Farber Specialty Vehicles, Matthews Specialty Vehicles, and LDV manufacture mobile clinics, command centers, and outreach units. Mercedes-Benz, Volvo, and Hino Motors offer chassis integration for transit and municipal applications. High customization requirements, safety compliance, and fleet servicing demands act as entry barriers in this specialized sector.

In January 2025, Toyota and Daimler Truck merged their Japanese truck subsidiaries, Hino Motors and Mitsubishi Fuso, creating a new heavy-vehicle company valued at USD 6.4 billion. The move aimed to consolidate operations, streamline development, and respond to shifting global logistics and emissions standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 103.1 Billion |

| Vehicle | Ambulances, Fire extinguishing trucks, Mobile fuel carrying tankers, and Others |

| Market Propulsion | ICE, Electric, BEV, HEV, and PHEV |

| Market Application | Medical & healthcare, Law enforcement & public safety, Recreational vehicles, Municipal services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arctic Cat, Cargotec, Case New Holland, Demers Ambulances, Eicher, Emergency One, Farber Specialty Vehicles, Hino Motors, Isuzu, LDV, Matthews Specialty Vehicles, Mercedes-Benz, NFI, Oshkosh Corporation, Pierce, REV, Rosenbauer International, Specialty Vehicles, Traton, and Volvo |

| Additional Attributes | Dollar sales by vehicle type and end-use application, growing demand in construction, emergency response, and utility services, stable deployment in waste management and municipal fleets, advancements in electrification and chassis customization support operational flexibility and regulatory alignment |

The global specialty commercial vehicle market is estimated to be valued at USD 103.1 billion in 2025.

The market size for the specialty commercial vehicle market is projected to reach USD 135.9 billion by 2035.

The specialty commercial vehicle market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in specialty commercial vehicle market are ambulances, fire extinguishing trucks, mobile fuel carrying tankers and others.

In terms of market propulsion, ice segment to command 51.6% share in the specialty commercial vehicle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA