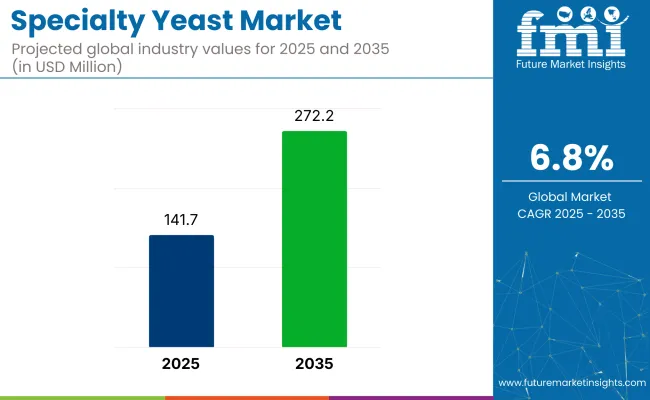

The global specialty yeast market is valued at USD 141.7 million in 2025 and is slated to reach USD 272.2 million by 2035, registering a CAGR of 6.8%. Growth will be driven by increasing demand for natural, clean-label ingredients in food, beverage, and cosmetics, along with the rising popularity of plant-based diets.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 141.7 million |

| Projected Value (2035) | USD 272.2 million |

| CAGR (2025 to 2035) | 6.8% |

The functional benefits of specialty yeasts, such as flavor enhancement and immune support, are expected to contribute to their broader application. Additionally, innovations in fermentation processes and strain development are enhancing product versatility and cost-efficiency, further propelling adoption.

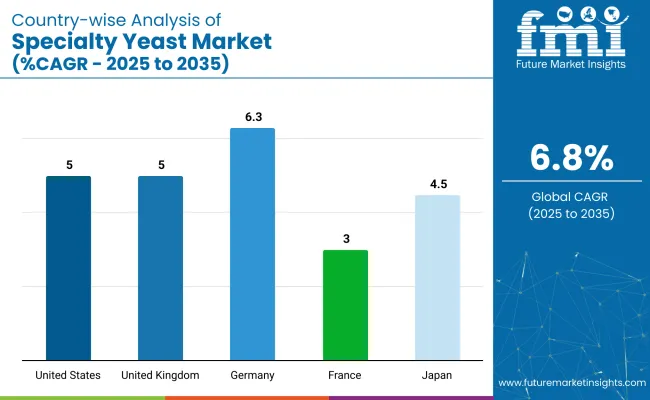

In 2025, North America is expected to remain the largest contributor to the specialty yeast market, with the USA growing at a CAGR of 5.0%, benefiting from strong demand in the food, beverage, and pharmaceutical sectors.

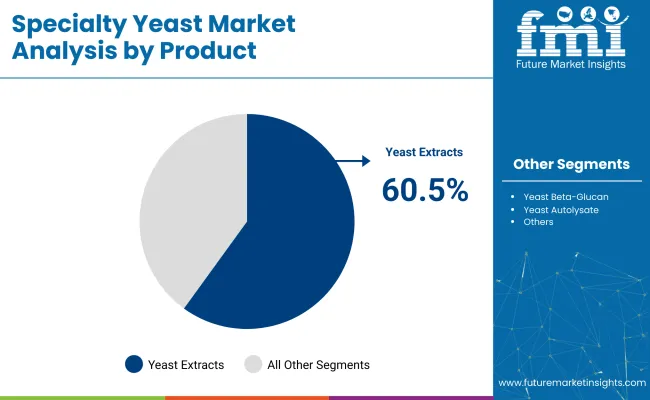

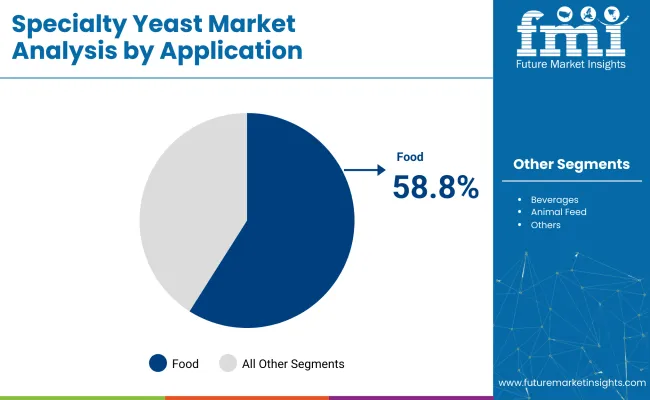

Meanwhile, Germany and the UK are expected to register growth with CAGRs of 6.3% and 5.0% respectively. Yeast extracts are likely to hold a prominent share in the product category, accounting for over 60.5% market share in 2025. On the application front, the food segment is forecast to account for 58.8% market share.

The specialty yeast market holds a relatively niche but growing share within its broader parent categories. It accounts for approximately 4-6% of the global functional food ingredients market, given its role in clean-label and nutritional formulations. Within the fermentation ingredients market, its share is estimated at 5-7%, driven by its applications in food, beverages, and biopharma.

In the natural flavor enhancers and clean-label additives categories, specialty yeast contributes about 6-8%, owing to its role as a natural alternative to MSG. Its share in the nutritional supplements segment remains lower, at around 2-3%, but is steadily increasing.

The global specialty yeast market is segmented based on product type, species, application, and region. Under product type, the market includes yeast extract, yeast beta-glucan, yeast autolysate, and others (including mineral-enriched yeasts and yeast-based flavor enhancers).

By species, the segmentation covers Saccharomyces cerevisiae, Kluyveromyces, Pichia pastoris, and others (such as Candida utilis and hybrid yeasts). By application, the market is divided into food, beverages, animal feed, and others (including cosmetics, pharmaceuticals, and agriculture). Regionally, the analysis spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Yeast extract is projected to maintain its dominance in the product category, capturing over 60.5% of the specialty yeast market in 2025. This is attributed to its wide functionality in food processing, including flavor enhancement, nutritional fortification, and its role as a natural alternative to MSG. The extract’s broad usage across soups, snacks, sauces, and health supplements continues to position it as a high-demand product, particularly among clean-label and vegan product manufacturers.

Saccharomyces cerevisiae is anticipated to retain a commanding position, accounting for approximately 70% of the market share in 2025. Its dominance stems from its versatility, high fermentation capacity, and suitability for various end-use applications, ranging from baking and brewing to enzyme and supplement production. Additionally, this species is favored in nutritional yeast production for its B-complex vitamin content, aligning with plant-based diet trends.

The food segment is expected to hold the largest share of the specialty yeast market, accounting for approximately 58.8% of the total market in 2025. Specialty yeasts, especially yeast extracts and autolysates, are increasingly utilized for their flavor-enhancing and nutritional properties in processed and functional foods. Rising demand for clean-label and plant-based diets is fueling their inclusion in savory snacks, soups, sauces, and dairy alternatives.

Recent Trends in the Specialty Yeast Market

Key Challenges in the Specialty Yeast Market

Among the listed countries, Germany exhibits the fastest growth at a CAGR of 6.3%, driven by its strong biotechnological infrastructure and demand for sustainable food solutions. The United States and the United Kingdom follow with steady growth at 5.0% each, supported by robust consumer demand and advanced food sectors.

Japan is projected to grow at 4.5%, benefiting from its innovation in precision fermentation. France, at 3.0% CAGR, reflects a mature but slower-growing market focused on exports and boutique applications.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The specialty yeast market in the USA is projected to grow at a CAGR of 5.0% from 2025 to 2035. The USA continues to lead global specialty yeast consumption, driven by its mature food, beverage, and pharmaceutical industries. The country’s robust biotechnology infrastructure, strong consumer preference for natural and clean-label ingredients, and ongoing R&D in yeast strain innovation are contributing significantly to market growth.

The specialty yeast demand in the UKis anticipated to grow at a CAGR of 5.0% from 2025 to 2035. Growth is largely driven by the nation’s well-developed food and beverage sector, with increasing adoption of natural ingredients and clean-label formulations. British consumers are leaning toward healthier dietary habits, which include yeast-based functional foods.

The revenue from specialty yeast in Germany is forecasted to grow at a CAGR of 6.3% from 2025 to 2035. As Europe’s industrial powerhouse, Germany leverages its advanced biotechnological expertise and food processing infrastructure to support widespread specialty yeast adoption.

The sales of specialty yeast in France are expected to register a CAGR of 3.0% in the specialty yeast market between 2025 and 2035. Though growth remains modest, France plays a crucial role in exporting premium yeast-based solutions across Europe and North Africa. Domestic demand is driven by innovation in gourmet food, bakery products, and natural cosmetics.

French manufacturers are investing in biotech applications and partnering in international food innovation programs. However, the market faces constraints due to the nation’s prioritization of renewable energy over oil-based chemical production, which limits local industrial-scale fermentation capacity.

The specialty yeast market in Japan is projected to grow at a CAGR of 4.5% from 2025 to 2035. The country’s food culture and high emphasis on quality and functionality have made it a fertile ground for specialty yeast applications.

Japanese firms are known for precision fermentation and supply high-value yeast extracts for seasoning, cosmetics, and functional foods. Innovations in probiotic and enzyme-rich yeasts are also being explored. The market is supported by a highly urbanized, health-conscious population and government initiatives promoting advanced food biotechnology.

The specialty yeast market is moderately consolidated, with several global players commanding strong shares through innovation, partnerships, and advanced fermentation capabilities.

Companies like Lallemand, DSM, Angel Yeast, Synergy Flavors, and Archer Daniels Midland dominate based on their deep R&D pipelines, international production footprints, and versatile product portfolios tailored for clean-label and functional applications. These firms actively serve segments such as food, beverage, animal feed, and personal care through bioactive and nutritional yeast derivatives.

Top players are increasingly focused on strain innovation, fermentation optimization, and sustainable sourcing. Strategic acquisitions and regional capacity expansions remain core to maintaining competitive positioning. For instance, Angel Yeast and DSM have emphasized local production hubs in Asia-Pacific and Europe to reduce logistic bottlenecks and serve niche dietary requirements.

Meanwhile, companies like Ohly and Chr. Hansen continues investing in biofunctional ingredient lines, tapping into consumer trends around immunity, veganism, and gut health. These strategies ensure resilience amid price sensitivity and rising regulatory demands for clean, traceable ingredients.

Recent Specialty Yeast Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 141.7 million |

| Projected Market Size (2035) | USD 272.2 million |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions /Volume in Kilotons |

| By Product Type | Yeast Extract, Yeast Beta- Glucan, Yeast Autolysate, Others (Mineral-Enriched Yeast, Flavor Enhancers) |

| By Species | Saccharomyces cerevisiae, Kluyveromyces, Pichia pastoris, Others (Candida utilis, Hybrid Yeasts) |

| By Application | Food, Beverages, Animal Feed, Others (Cosmetics, Pharmaceuticals, Agriculture) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, South Korea, Brazil, Australia |

| Key Players | Lallemand, Synergy Flavors, Koninklijke DSM N.V., Angel Yeast, Archer Daniels Midland, Ohly, AB Mauri Food Inc., Levex, Biorigin, DCL Yeast Ltd., ACH Foods, Kemin Industries Inc., Leiber GmBH, Chr. Hansen Holding A/S, Hansen Holding A/S |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per product type, the segment has been categorized into Yeast Extract, Yeast Beta-Glucan, Yeast Autolysate, and Others

This segment is further categorized into Saccharomyces C, Kluyveromyces Pichia Pastoris and Others

Different applications include Beverages, Food, Animal Feed, and Others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 141.7 million in 2025.

The market is forecasted to reach USD 272.2 million by 2035, reflecting a CAGR of 6.8%.

Yeast extracts are expected to lead the market with a 60.5% share in 2025.

The food segment is expected to account for a 58.8% market share by 2035.

Germany is anticipated to be the fastest-growing market with a CAGR of 6.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA