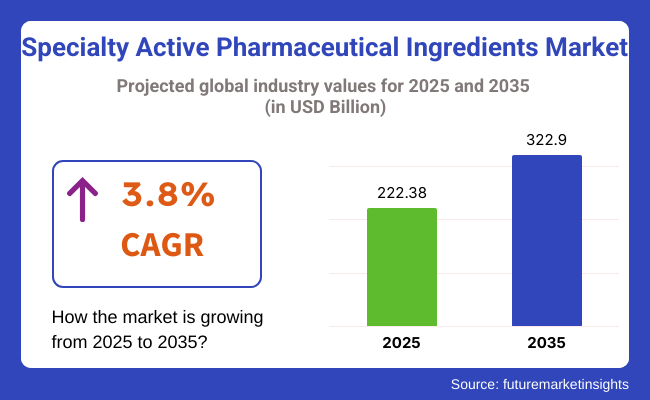

The global specialty active pharmaceutical ingredients market is estimated to be valued at USD 222.38 billion in 2025 and is projected to reach USD 322.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The specialty active pharmaceutical ingredients (APIs) market is expected to see sustained momentum through 2035, driven by precision therapeutics, complex formulation demand, and biologics pipeline expansion. High-potency APIs (HPAPIs), oncology-focused compounds, and custom synthetic peptides are witnessing increased outsourcing by mid-sized pharma and biotech innovators.

Regulatory incentives for orphan drugs and rare disease therapies in the USA and EU are boosting specialty API development. Furthermore, personalized medicine and targeted drug delivery platforms are reshaping demand patterns, pushing CDMOs to invest in cleanroom containment, continuous manufacturing, and advanced analytics.

Leading manufacturers are actively investing in product innovation and strategic collaborations to strengthen their market position. MediPharm Labs, a pharmaceutical company specialized in precision-based cannabinoids has begun their production of on novel cannabis metered dose inhalers for the EU and the United Kingdom as per the global pharmaceutical standards in 2025.

This innovative product delivers a precise dose of cannabis active pharmaceutical ingredients (API) with GMP-qualified components and excipients. “We’re excited to expand our international portfolio and partner with Blackpoint to bring our innovative cannabis metered dose inhaler to the EU and United Kingdom. This smoke- and vapor-free format supports our mission to advance global access to pharma-grade cannabinoid wellness products” stated by David Pidduck, CEO of MediPharm Labs.

Manufacturers in developed nations are prioritizing technological advancements and supply chain resilience. In contrast, manufacturers in emerging markets are expanding through strategic mergers and focusing on cost-effective production. In 2025, Eli Lilly and Company has announced.

The company plans to construct four new manufacturing sites across the country, aiming to bolster the domestic supply chain and reshore critical production capabilities. The expansion will focus on manufacturing active pharmaceutical ingredients (APIs) within the USA, reducing reliance on overseas production.

North America remains a dominant market for specialty APIs, driven by advanced healthcare infrastructure, robust R&D activities, and supportive regulatory frameworks. The USA, in particular, has witnessed increased adoption of specialty APIs following investments in domestic manufacturing capabilities. Europe is experiencing substantial growth in the specialty API market, propelled by stringent regulatory standards and a focus on high-quality manufacturing.

Countries like Germany, France, and the UK have implemented policies encouraging the development and use of specialty APIs, particularly in oncology and rare diseases. Collaborations between public health institutions and private entities are facilitating the deployment of advanced specialty APIs across hospitals and research centres. Increasing investments in personalized medicine and biotechnological advancements are propelling market expansion in these regions.

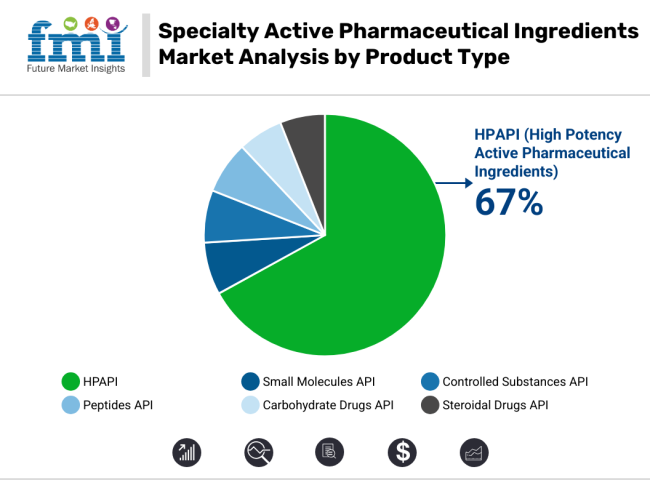

In 2025, the highly potent active pharmaceutical ingredients (HPAPIs) segment is projected to account for over 67% of total specialty API market revenue. This dominance has been driven by the increasing demand for targeted therapies in oncology, hormonal disorders, and autoimmune diseases. HPAPIs have been widely used in low-dosage, high-efficacy formulations, making them ideal for cytotoxic drugs and antibody-drug conjugates (ADCs).

Their high potency allows for precise treatment outcomes with minimal systemic exposure. Many Manufacturers are expanding their manufacturing capabilities to cater to increased global demands. Additionally, regulatory agencies such as the EMA and USFDA have provided clearer guidance on occupational exposure limits (OELs) and safety protocols, encouraging adoption among CDMOs and generics manufacturers

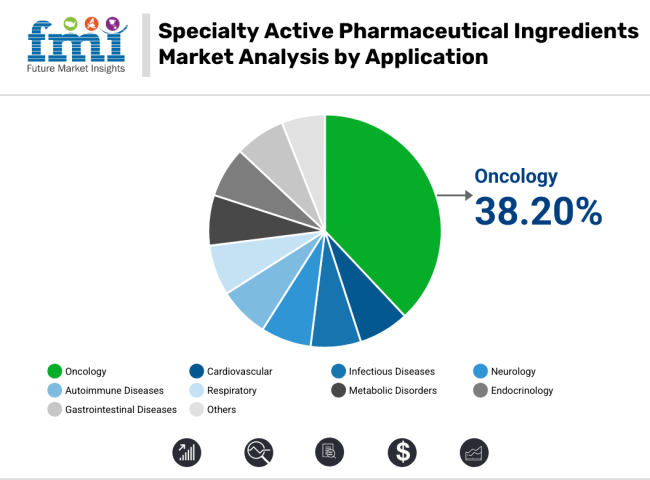

The cancer application segment is estimated to contribute over 38.20% of the total revenue in the specialty active pharmaceutical ingredients (APIs) market in 2025. This dominance in the revenue share is attributed to the escalating global cancer burden and the parallel increase in demand for targeted, potent and personalized oncology therapies.

According to GLOBOCAN 2024, cancer cases have continued to rise, particularly in aging populations across both developed and emerging regions, leading to increased demand for specialized APIs designed for chemotherapeutic and immuno-oncology drugs. Highly Potent APIs (HPAPIs), cytotoxics, and small molecule inhibitors have been preferred for their ability to achieve efficacy at lower dosages, reducing off-target effects in oncology applications.

The strong clinical pipeline of next-generation anticancer drugs, including antibody-drug conjugates and kinase inhibitors, has further stimulated demand. In addition, several regulatory fast-track designations granted by agencies like the FDA and EMA have accelerated oncology drug approvals, boosting demand for scalable, high-purity APIs.

The North American specialty API market is expanding due to high adoption of precision medicine, increasing prevalence of chronic and rare diseases, and strong presence of leading pharmaceutical manufacturers. The USA leads the region, supported by rising investments in high-potency API (HPAPI) production, growing demand for biologic drug formulations, and increasing FDA approvals for specialty APIs.

However, challenges such as high manufacturing costs, regulatory scrutiny on quality control, and patent expiration issues impact market growth. The increasing integration of AI-driven drug development, expansion of advanced API synthesis techniques, and rising collaborations between biopharmaceutical companies and CDMOs are expected to drive further market growth in North America.

Europe represents a significant market for specialty APIs, driven by increasing focus on innovative drug formulations, growing adoption of advanced pharmaceutical manufacturing technologies, and strong regulatory frameworks supporting specialty API development. Countries such as Germany, France, and the UK are key markets, benefiting from well-established R&D infrastructure, rising demand for novel biologic therapies, and increasing government initiatives to support specialty drug manufacturing.

However, challenges such as strict EMA regulatory processes, high costs of API purification technologies, and slow adoption of AI in specialty drug formulation may impact market expansion. The increasing focus on biosimilar APIs, expansion of high-potency API production facilities, and rising partnerships between pharmaceutical firms and contract manufacturers are shaping the European market landscape. Additionally, advancements in continuous manufacturing techniques are improving API production efficiency and cost-effectiveness.

The Asia-Pacific region is witnessing rapid growth in the specialty API market due to increasing pharmaceutical manufacturing capabilities, rising demand for cost-effective specialty drugs, and growing investments in biotech innovation. Countries such as China, Japan, and India are key markets, with expanding access to API production facilities, increasing government funding for specialty drug research, and rising demand for generic and biosimilar specialty APIs.

However, challenges such as regulatory inconsistencies, lack of advanced manufacturing infrastructure in certain regions, and quality control concerns may hinder market penetration. The increasing presence of global pharmaceutical manufacturers, expansion of AI-assisted drug synthesis techniques, and integration of green chemistry principles in API production are driving market expansion. Furthermore, advancements in CRISPR-based drug development and increasing research into novel bioengineered APIs are improving efficiency and patient outcomes in the region.

Challenges

The specialty API market faces challenges such as high production costs, complex regulatory approval pathways, and difficulties in scaling up manufacturing processes for high-potency and biologic APIs. The need for specialized containment facilities for cytotoxic APIs, challenges in ensuring supply chain security, and growing concerns over environmental sustainability in API production create barriers to market expansion.

Additionally, challenges in maintaining consistent API quality, high costs associated with compliance to GMP regulations, and resistance to transitioning from traditional API synthesis to green chemistry impact market growth.

Opportunities

The increasing adoption of AI-powered drug discovery, expansion of sustainable API production techniques, and rising investment in continuous manufacturing present significant growth opportunities in the market. The development of highly targeted specialty APIs for rare and orphan diseases, increasing focus on custom API synthesis, and expansion of CRISPR-based and RNA-targeted therapies are fueling market growth.

Additionally, increasing research into bioengineered and plant-based specialty APIs, expansion of contract manufacturing partnerships for specialty drug development, and growing collaborations between biotech firms and regulatory bodies for accelerated specialty API approvals are expected to create new avenues for industry expansion. The rise of digital twin technology in API optimization and increasing consumer preference for personalized medicine are further enhancing accessibility and long-term market potential.

Emerging Trends

Expansion of CRISPR and RNA-Based Specialty APIs

Emerging specialities are taking over the current API scenario, and with the emergence of CRISPR and RNA-based therapy, it is expected that gene editing at one hand will revolutionize treatments for a wide spectrum of genetic diseases, cancers, and orphan diseases, whereas the other will open treatment avenues, thanks to mRNA vaccines and RNAi drugs, which satisfy gene expression control for previously untreatable conditions.

The resultant explosion of innovation is also resulting in a demand for very specific APIs wherein advanced techniques have to be utilized in their synthesis, purification, and manufacture. Pharmaceutical companies and contract development and manufacturing organizations (CDMOs) have strategically started investing in sophisticated capabilities that lend considerable support to clinical advancement and thus improving the accuracy of treatment interventions and broadening indications in diseases.

Growth of Green Chemistry and Sustainable API Manufacturing

The specialty API market is witnessing a shift toward green chemistry and sustainable manufacturing, driven by regulatory pressures and environmental concerns. Companies are increasingly adopting eco-friendly processes, such as biocatalysis, solvent recycling, and flow chemistry, to reduce waste and energy consumption.

Continuous manufacturing is gaining traction as it enhances process efficiency, minimizes raw material usage, and ensures consistent product quality. The demand for sustainably produced APIs is further fueled by pharmaceutical companies seeking to lower their carbon footprint and comply with stringent global environmental regulations, fostering long-term market growth.

Between 2020 and 2024, the specialty active pharmaceutical ingredient market experienced significant growth, driven by the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders.

Advancements in biotechnology and a surge in demand for targeted therapies led to the development of complex APIs, including monoclonal antibodies and peptide-based drugs. However, challenges such as stringent regulatory requirements, high production costs, and supply chain disruptions, especially during the COVID-19 pandemic, posed constraints to market growth.

This growth is expected to be driven by technological advancements in API synthesis, increasing outsourcing of API production to specialized manufacturers, and a growing emphasis on personalized medicine. Additionally, the integration of artificial intelligence in drug development processes is expected to enhance the efficiency of API production, further driving market expansion.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of stringent guidelines ensuring the safety and efficacy of specialty APIs, leading to standardized protocols and usage regulations. |

| Technological Advancements | Introduction of advanced biotechnological methods for API synthesis, improving product purity and bioavailability, thereby enhancing therapeutic outcomes and expanding application possibilities in various medical fields. |

| Consumer Demand | Increased awareness and acceptance of specialty APIs in targeted therapies, leading to higher demand for advanced medications in chronic disease management and oncology treatments. |

| Market Growth Drivers | Rising prevalence of chronic diseases, advancements in biotechnology, and a shift towards targeted therapies, contributing to the increased adoption of specialty APIs across various therapeutic areas. |

| Sustainability | Initial efforts towards sustainable sourcing and production processes, including the utilization of green chemistry principles, aligning with the global emphasis on environmental responsibility and resource efficiency in pharmaceutical manufacturing. |

| Supply Chain Dynamics | Dependence on specialized suppliers for raw materials, with efforts to localize production to mitigate supply chain disruptions observed during global events, ensuring a steady supply of high-quality specialty APIs to meet the growing demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential adjustments of regulations to balance patient safety with technological innovation, alongside stricter quality assessments to ensure product effectiveness. |

| Technological Advancements | Development of next-generation APIs with improved functionality, user-friendly formulations, and integration with other bioactive compounds for personalized medicine, catering to the evolving healthcare needs and patient preferences. |

| Consumer Demand | Growing preference for personalized medicine solutions and innovative drug formulations, driven by improved therapeutic efficacy and a focus on individualized patient care, reflecting the evolving healthcare landscape and treatment paradigms. |

| Market Growth Drivers | Expansion of healthcare infrastructure, increasing health consciousness among populations, and continuous technological innovations enhancing drug development efficiency and therapeutic outcomes, thereby broadening the scope and reach of specialty APIs in the global market. |

| Sustainability | Adoption of comprehensive sustainable practices in API production, including the use of renewable resources, eco-friendly manufacturing processes, and waste reduction strategies, in line with global environmental standards and the pharmaceutical industry's commitment to sustainability. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities through technological advancements and strategic partnerships, leading to reduced dependency on imports, improved supply chain resilience, and the ability to swiftly respond to market changes and healthcare needs in various regions. |

Market Outlook

The United States specialty API market is witnessing strong expansion, fueled by the growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and autoimmune conditions. With pharmaceutical companies shifting focus toward biologics and targeted therapies, the demand for high-potency and complex APIs continues to rise. Advances in synthetic biology, peptide synthesis, and high-containment manufacturing are further enhancing production capabilities.

Additionally, regulatory support for novel drug development and an increasing number of FDA approvals for specialty drugs are boosting market growth. The expanding role of CDMOs in contract manufacturing and process optimization is also shaping the market’s competitive landscape.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.0% |

Market Outlook

India’s specialty API market is experiencing rapid growth, driven by its well-established pharmaceutical manufacturing ecosystem and cost-effective production capabilities. The country’s dominance in generic drug manufacturing is evolving, with companies increasingly focusing on high-value specialty APIs, including high-potency APIs (HPAPIs), peptides, and biologics.

Government initiatives such as the Production-Linked Incentive (PLI) scheme and investments in R&D are further strengthening India’s position in the global API supply chain. Additionally, growing partnerships with multinational pharmaceutical firms and an expanding contract manufacturing sector are enhancing export opportunities. With regulatory compliance improving and innovation in synthesis techniques, India is emerging as a key hub for specialty API production, serving both domestic and global markets.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.4% |

Market Outlook

China's specialty API market is growing at a significant pace, fueled by strong government support for pharmaceutical innovation and increased investments in biotechnology. The country is shifting from low-cost bulk API manufacturing to high-value specialty APIs, including biologics, peptides, and HPAPIs, to meet the rising demand for advanced therapies.

The expansion of domestic pharmaceutical companies, along with collaborations with global firms, is enhancing China's role in the specialty API supply chain. Additionally, the growing prevalence of chronic diseases and an aging population are driving the need for innovative and targeted treatments. Strengthening regulatory frameworks and improving quality standards are further positioning China as a key player in the global specialty API market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.9% |

Market Outlook

Germany’s specialty API market is expanding steadily, driven by its strong pharmaceutical industry, advanced manufacturing capabilities, and commitment to innovation. The country is known for its stringent quality standards, making it a preferred hub for specialty API production, particularly in high-potency APIs (HPAPIs), biologics, and peptide-based therapies.

A robust focus on research and development, supported by government initiatives and private sector investments, is fostering the development of next-generation drug substances. Additionally, Germany's role as a key exporter of pharmaceutical ingredients strengthens its global market position. With increasing demand for targeted therapies and sustainable manufacturing practices, the country continues to lead in specialty API advancements and regulatory compliance.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.0% |

Market Outlook

Japan’s specialty API market is expanding steadily, driven by its strong focus on biotechnology, precision medicine, and advanced healthcare solutions. The country’s aging population is increasing the demand for specialized treatments, particularly in areas such as oncology, neurodegenerative diseases, and cardiovascular disorders. Japan's pharmaceutical industry is highly research-driven, with continuous innovation in biologics, peptides, and high-potency APIs (HPAPIs).

Strict regulatory standards ensure high-quality manufacturing, making Japan a key player in the global specialty API landscape. Additionally, collaborations between pharmaceutical companies, research institutions, and biotechnology firms are fostering innovation. With a commitment to sustainability and advanced manufacturing technologies, Japan continues to strengthen its position in the specialty API market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The specialty active pharmaceutical ingredient (API) market is highly competitive, driven by increasing demand for high-potency APIs (HPAPIs), advancements in biologics manufacturing, and the growing adoption of targeted therapies. Companies are investing in advanced synthesis technologies, continuous manufacturing, and sustainable API production to maintain a competitive edge.

The market is shaped by well-established pharmaceutical manufacturers, contract development and manufacturing organizations (CDMOs), and emerging biotech firms, each contributing to the evolving landscape of specialty APIs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Inalco Pharmaceuticals | 22-26% |

| Sussex Research Laboratories Inc. | 18-22% |

| PolyPeptide Laboratories | 10-14% |

| Nitto Denko Avecia Inc. | 8-12% |

| Corden Pharma International GmbH | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Inalco Pharmaceuticals | Market leader offering HPAPI manufacturing, biologics production, and custom synthesis solutions. |

| Sussex Research Laboratories Inc. | Develops advanced specialty APIs with a focus on synthetic chemistry and biologic drug substances. |

| PolyPeptide Laboratories | Specializes in small molecule API development and continuous manufacturing technologies. |

| Nitto Denko Avecia Inc. | Provides high-quality HPAPIs and contract manufacturing services for pharmaceutical companies. |

| Corden Pharma International GmbH | Focuses on peptide APIs, lipid-based drug delivery, and high-containment API production. |

Key Company Insights

Inalco Pharmaceuticals (22-26%)

A leader in specialty APIs, Inalco excels in HPAPIs, biologics, and contract manufacturing, offering advanced synthesis and innovative drug substance development solutions.

Sussex Research Laboratories Inc. (18-22%)

Specializing in pharmaceutical R&D, Sussex Research pioneers complex API synthesis, carbohydrate-based APIs, and custom drug development services for global clients.

PolyPeptide Laboratories (10-14%)

A major innovator in peptide-based API production, PolyPeptide delivers advanced manufacturing, process optimization, and high-purity peptide synthesis for therapeutic applications.

Nitto Denko Avecia Inc. (8-12%)

A strong player in contract API development, Avecia specializes in oligonucleotide APIs, high-potency drug substances, and custom pharmaceutical manufacturing.

Corden Pharma International GmbH (5-9%)

A key provider of complex APIs, Corden Pharma focuses on peptides, lipids, and high-containment manufacturing solutions for specialized drug development.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of specialty API manufacturing, offering competitive pricing and cutting-edge innovations to meet diverse pharmaceutical and biopharmaceutical industry needs.

Small Molecules API (Controlled Substances API and HPAPI) Peptides API, Carbohydrate Drugs API and Steroidal Drugs API.

In-house and Outsourced.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global specialty active pharmaceutical ingredient industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global specialty active pharmaceutical ingredient industry stood at USD 214.2 billion in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 322.9 billion by 2035 end.

China is expected to show a CAGR of 5.9% in the assessment period.

The key players operating in the global specialty active pharmaceutical ingredient industry are Key Players Inalco Pharmaceuticals, Sussex Research Laboratories Inc., PolyPeptide Laboratories, Nitto Denko Avecia Inc., Corden Pharma International GmbH, Pepscan Holding NV, Provence Technologies Group, BCN Peptides S.A., Senn Chemicals AG., Lupin Ltd and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Consumption, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Consumption, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Consumption, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Consumption, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Consumption, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Consumption, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Consumption, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Consumption, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Consumption, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Consumption, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Consumption, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Consumption, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumption, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumption, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Consumption, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA