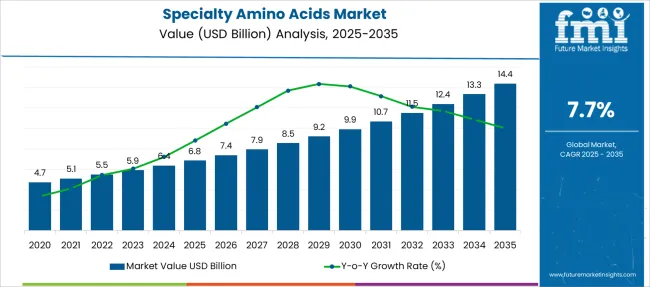

The Specialty Amino Acids Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Amino Acids Market Estimated Value in (2025 E) | USD 6.8 billion |

| Specialty Amino Acids Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The Specialty Amino Acids market is exhibiting consistent growth, fueled by rising demand across pharmaceutical, nutraceutical, and clinical nutrition applications. Increasing consumer focus on preventive healthcare and functional food consumption has driven the incorporation of bioavailable amino acids into therapeutic and dietary regimens. Technological advancements in precision fermentation and bioprocessing have enabled large-scale and cost-efficient production, contributing to the expanded availability of high-purity specialty amino acids.

Additionally, increasing clinical trials evaluating amino acids for chronic disease management, metabolic disorders, and neurological support have highlighted their therapeutic potential. Regulatory support for amino acid fortification and inclusion in pharmaceutical formulations has further validated their safety and efficacy.

With personalized medicine gaining prominence and demand for functional ingredients intensifying, the market is anticipated to accelerate in both developed and emerging regions. The convergence of scientific innovation and health-conscious consumer behavior continues to pave the way for broader adoption of specialty amino acids across healthcare, food technology, and life sciences sectors..

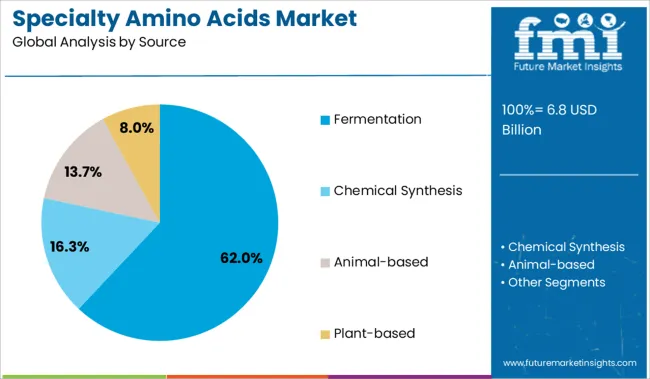

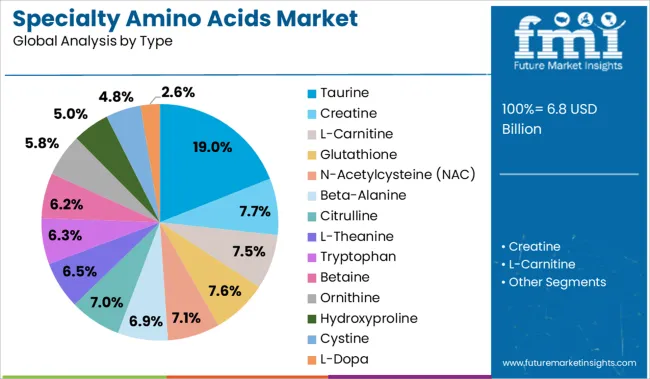

The market is segmented by Source, Type, Grade, and End-use and region. By Source, the market is divided into Fermentation, Chemical Synthesis, Animal-based, and Plant-based. In terms of Type, the market is classified into Taurine, Creatine, L-Carnitine, Glutathione, N-Acetylcysteine (NAC), Beta-Alanine, Citrulline, L-Theanine, Tryptophan, Betaine, Ornithine, Hydroxyproline, Cystine, L-Dopa, Selenocysteine, and Others.

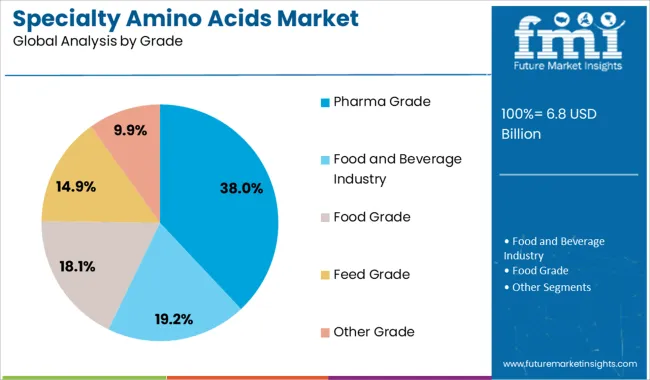

Based on Grade, the market is segmented into Pharma Grade, Food and Beverage Industry, Food Grade, Feed Grade, and Other Grade. By End-use, the market is divided into Pharmaceuticals, Dietary Supplements, Food & Beverages, Functional Beverages, Infant Formulation, Dairy, Convenience Foods, Meat Processing, Bakery, Confectionery, Others, Personal Care & Cosmetics, Animal Feed, Poultry, Swine, Cattle, Others, Clinical Nutrition, Pet Food, Vaccine Formulation, Agriculture, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fermentation source segment is projected to account for 62% of the Specialty Amino Acids market revenue share in 2025, positioning it as the dominant production method. This leadership has been driven by the method's ability to produce high-purity amino acids using sustainable and scalable processes. Fermentation-based synthesis has been widely preferred due to its bio-efficiency, lower environmental impact, and capacity to deliver amino acids that meet stringent pharmaceutical and nutraceutical standards.

The process has enabled manufacturers to avoid the use of synthetic chemicals, aligning with clean-label trends and regulatory expectations in both food and drug sectors. Continuous improvements in microbial strain engineering and fermentation technology have contributed to higher yields and reduced production costs, enhancing overall commercial viability.

Fermentation has also offered greater flexibility for tailoring specific amino acid profiles, which is critical in therapeutic and clinical applications. These advantages have collectively supported the growth and widespread adoption of fermentation as the leading source in the specialty amino acids market..

The taurine type segment is expected to hold 19% of the Specialty Amino Acids market revenue share in 2025, marking it as a key contributor among various amino acid types. Growth in this segment has been attributed to the expanding use of taurine in energy drinks, sports nutrition, and pharmaceutical applications. Taurine has been recognized for its roles in cardiovascular function, neurological development, and cellular protection, leading to its inclusion in formulations targeting both general wellness and clinical support.

The segment’s performance has also been influenced by its rising incorporation in infant formulas and ophthalmic preparations. Enhanced by ongoing research validating its safety and functional efficacy, taurine has continued to see increased regulatory approvals globally.

The reliability of its supply chain through fermentation and synthetic methods has further supported its commercial uptake. As consumer awareness regarding taurine's physiological benefits increases, demand has been sustained across multiple industries, reinforcing its leading position within the specialty amino acids type segment..

The pharma grade segment is projected to represent 38% of the Specialty Amino Acids market revenue share in 2025, making it the leading grade in the market. This dominance has been underpinned by the stringent quality requirements of pharmaceutical and clinical nutrition applications, where purity, safety, and efficacy are paramount. Pharma grade amino acids have been extensively used in injectable formulations, parenteral nutrition, and as excipients in various drug products.

Increasing demand for precision medicine and specialized treatment protocols has accelerated the need for high-quality amino acids that meet pharmacopeial standards. This grade has also benefited from robust regulatory validation and consistent performance across clinical settings. Additionally, the growing prevalence of chronic and metabolic diseases has created expanded opportunities for pharma grade formulations in both hospital and outpatient settings.

Manufacturers have continued to invest in GMP-compliant production infrastructure to meet rising demand, ensuring a steady supply of pharma grade amino acids. These factors have collectively reinforced the segment’s leading status in the global market..

The specialty amino acids market has been influenced by rising demand for targeted nutrition and advanced formulation in sports, geriatric, and cognitive wellness segments. From 2023 to 2025, amino acids such as BCAAs, glycine, and tryptophan were integrated into high-performance supplements and personalized health blends. This shift has enabled amino acid manufacturers to move beyond bulk protein supply into premium, function-specific categories, reinforcing their role in precision-driven product development.

Specialty amino acids have been increasingly utilized in animal feed formulations to optimize livestock growth performance. In 2023, lysine, methionine, and threonine were heavily incorporated into swine and poultry diets to enhance feed efficiency and reduce reliance on traditional protein sources. By 2024, arginine and glutamine were being integrated into aquaculture feeds following global livestock productivity campaigns. In 2025, taurine-enriched blends were rolled out in companion animal nutrition as premium pet food brands emphasized precision feeding. This use case has been underpinned by growing production targets in meat, dairy, and aquaculture sectors, where amino acids have been recognized as essential nutrition buffers and cost-saving additives.

Opportunities have been identified in high-value, precision nutrition segments where specialty amino acids are being deployed to support targeted health and performance outcomes. In 2023, branched-chain amino acids were introduced in sports supplement blends to support muscle endurance and recovery. In 2024, glycine-enriched formulas were incorporated into elderly nutrition products for improved metabolic support. By early 2025, specialty amino acids such as histidine and tryptophan were being explored in mental wellness supplements to support cognitive balance. These deployments have demonstrated that amino acids can serve as active functional ingredients beyond general protein enrichment. As consumer interest in precise nutrient formulations grows, amino acid manufacturers are positioned to expand into premium supplement and functional food segments.

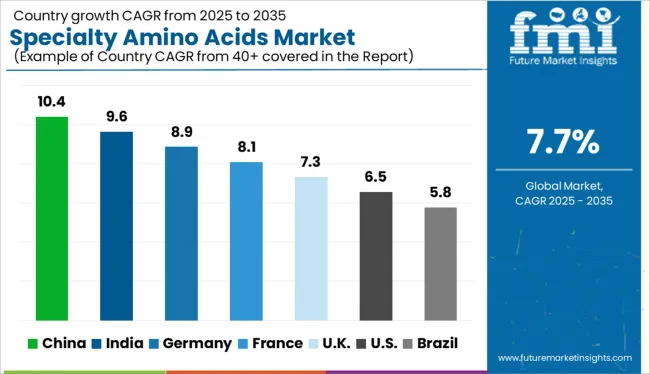

| Country | CAGR |

|---|---|

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| U.K. | 7.3% |

| U.S. | 6.5% |

| Brazil | 5.8% |

The specialty amino acids market is projected to expand globally at a CAGR of 8% from 2025 to 2035. Among 40 countries analyzed, China leads with 10.4%, followed by India at 9.6% and Germany at 8.9%. France aligns closely with the global average at 8.1%, while the United Kingdom records a slower 7.3%. Higher growth in China and India reflects aggressive expansion in nutritional, pharmaceutical, and sports supplement sectors. Germany benefits from pharmaceutical-grade purity and tight manufacturing standards. France continues to align with functional foods and nutraceuticals, while the UK reflects measured growth due to pricing pressures and conservative healthcare adoption.

China is projected to lead the global specialty amino acids market with a CAGR of 10.4%, driven by substantial demand from dietary supplements, parenteral nutrition, and functional beverages. Domestic companies have scaled up fermentation capacity for amino acids such as glutamine, citrulline, and arginine. Regulatory fast-tracking has enabled wider nutraceutical innovation pipelines. Local players collaborate with fitness tech firms to integrate amino acid use in performance-based nutrition.

India is forecast to grow its specialty amino acids market at a CAGR of 9.6%, with expanding demand across performance nutrition, pediatrics, and functional medical foods. Domestic supplement brands have introduced fast-absorbing amino acid formulations tailored for protein-deficient populations. Contract manufacturers are increasing L-glutamic acid and lysine production through microbial fermentation. Government nutrition initiatives and sports development programs boost amino acid awareness.

The specialty amino acids market in Germany is anticipated to grow at an 8.9% CAGR, anchored in pharmaceutical-grade applications and high regulatory compliance. Clinical nutrition players are formulating amino acid-based injectables and enteral feeds. L-ornithine, L-cysteine, and L-histidine are used in hospital-grade interventions. Local biotech firms focus on advanced purification for intravenous amino acid delivery systems, while plant-based fermentation solutions gain industrial momentum.

France is projected to grow its specialty amino acids market at 8.1% CAGR, supported by demand from functional nutrition and medical-grade dietary solutions. Amino acid-enriched infant formulas, geriatric supplements, and bariatric care items form the core of national product development. French nutraceutical companies blend arginine, taurine, and lysine into energy and recovery drinks. Product safety, EFSA approval, and traceability remain key drivers.

The United Kingdom specialty amino acids market is projected to grow at 7.3% CAGR, shaped by demand in clinical nutrition and limited by pricing pressure in OTC sports formulations. Consumer demand leans toward clean-label, vegan-sourced amino acids. However, NHS procurement policies and reimbursement constraints restrict wider deployment. Local firms are investing in flavor-masking technology and novel delivery formats to differentiate offerings in sports and general wellness categories.

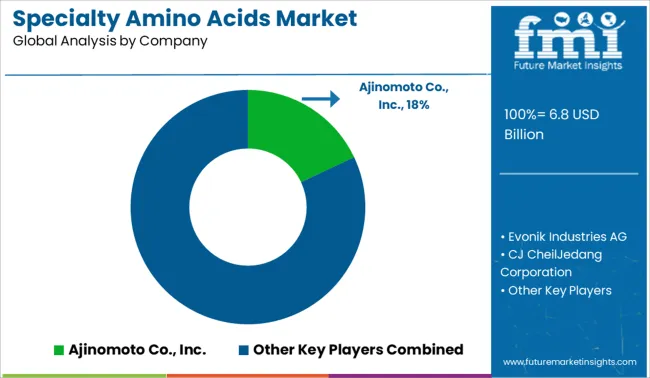

The specialty amino acids market is moderately consolidated, led by Ajinomoto Co., Inc. with an 18% market share. The company maintains its dominant position through large-scale fermentation capacity, proprietary biosynthesis technology, and deep penetration in nutraceutical and pharmaceutical segments. Tier 1 leadership is held solely by Ajinomoto Co., Inc. Tier 2 suppliers include Evonik Industries AG, CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., ADM, Fufeng Group, and Meihua Holdings Group Co.—each offering a wide portfolio of conditionally essential and functional amino acids supported by vertically integrated production. Tier 3 players such as Daesang Corporation and Prinova Group LLC focus on custom blends and formulation-ready inputs tailored for food, wellness, and clinical nutrition applications. Market demand is sustained by expanding use of amino acids in metabolic health, oncology support, and personalized supplementation.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Source | Fermentation, Chemical Synthesis, Animal-based, and Plant-based |

| Type | Taurine, Creatine, L-Carnitine, Glutathione, N-Acetylcysteine (NAC), Beta-Alanine, Citrulline, L-Theanine, Tryptophan, Betaine, Ornithine, Hydroxyproline, Cystine, L-Dopa, Selenocysteine, and Others |

| Grade | Pharma Grade, Food and Beverage Industry, Food Grade, Feed Grade, and Other Grade |

| End-use | Pharmaceuticals, Dietary Supplements, Food & Beverages, Functional Beverages, Infant Formulation, Dairy, Convenience Foods, Meat Processing, Bakery, Confectionery, Others, Personal Care & Cosmetics, Animal Feed, Poultry, Swine, Cattle, Others, Clinical Nutrition, Pet Food, Vaccine Formulation, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., ADM, Fufeng Group, Meihua Holdings Group Co., Daesang Corporation, Prinova Group LLC, and Others |

| Additional Attributes | Dollar sales by amino acid type (L‑lysine, L‑threonine, L‑tryptophan, L‑methionine), Dollar sales by application (human nutrition, animal feed, pharmaceuticals, cosmetics), Trends in high‑purity and fermentation‑derived production, Use of crystalline vs peptide‑based delivery forms, Growth in sports nutrition and gut‑health supplements, Regional adoption in North America, Europe, and APAC |

The global specialty amino acids market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the specialty amino acids market is projected to reach USD 14.4 billion by 2035.

The specialty amino acids market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in specialty amino acids market are fermentation, chemical synthesis, animal-based and plant-based.

In terms of type, taurine segment to command 19.0% share in the specialty amino acids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA