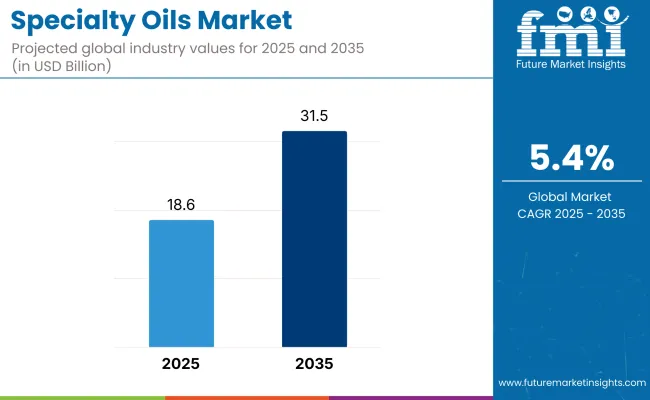

The specialty oils market is valued at USD 18.6 billion in 2025 and is expected to reach USD 31.5 billion by 2035, advancing at a 5.4% CAGR throughout the forecast period.

Within the specialty oils market, the United States remains the most lucrative country in 2025, supported by robust demand for clean-label bakery shortenings and nutraceutical MCT blends. Meanwhile, India is poised to be the fastest-growing national market from 2025 to 2035 as packaged snacks, functional beverages, and personal-care formulations surge across Tier-2 and Tier-3 cities.

Across industries, heightened focus on trans-fat elimination, oxidative stability, and label-friendly ingredient decks is reshaping the specialty oils market. Manufacturers prioritise low-3-MCPD palm fractions, high-oleic seed oils, and enzymatically interesterified blends that mimic dairy fat mouthfeel.

Supply-chain volatility and price swings in crude vegetable oils restrain adoption among cost-sensitive SMEs, spurring players to diversify feedstock (algae, shea, and rice-bran) and lock in long-term grower contracts. Key trends steering the specialty oils market include cold-press micro-lot launches, solvent-free fractionation, and blockchain-enabled traceability for RSPO-certified palm streams.

Looking ahead, the specialty oils market is set to shift toward precision-fermented and bio-engineered lipid systems. By 2030, scalable microbial oil platforms are expected to deliver custom fatty-acid profiles on demand, slashing land-use intensity by up to 85%.

AI-driven formulation engines will match lipid structures to targeted melting curves, enabling rapid prototyping for plant-based meat and medical-nutrition emulsions. Producers that embed Scope-3 carbon tracking, offer fully segregated sustainable supply chains, and provide “lipid-as-a-service” co-development models will capture outsized share through 2035.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 18.6 billion |

| Projected Value (2035F) | USD 31.5 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Keto-centric nutrition trends and demand for rapid-energy lipids propel coconut-derived medium-chain triglyceride (MCT) oils in the specialty oils market. Brands are rolling out solvent-free, deodorised MCT fractions with > 98% C8/C10 purity, finding traction in RTD coffees, sports gels, and brain-health supplements. Palm-kernel MCTs face reputational headwinds, reinforcing coconut’s appeal despite higher cost.

| Source Segment | CAGR (2025 to 2035) |

|---|---|

| Coconut & MCT Oils | 6.1% |

Emollient-rich specialty oils such as shea, rice-bran, and high-oleic sunflower are in high demand for natural skin-care, hair-serum, and baby-care lines. Brands value their non-comedogenic profiles and vitamin-E payloads, fuelling premiumisation. Food and beverage remain dominant by volume, yet cosmetics deliver superior margin upside and faster SKU rotation.

| End-use Segment | CAGR (2025 to 2035) |

|---|---|

| Cosmetics & Personal Care | 5.9% |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to industrial expansion | Steady growth driven by sustainability and innovation |

| Rising demand in automotive & manufacturing | Increased adoption of bio-based & high-performance oils |

| Development of synthetic & specialty blends | Focus on biodegradable & eco-friendly formulations |

| Stringent emissions & safety regulations | Stronger push for sustainable & low-carbon alternatives |

| Cost-effective & performance-based oils | Preference for sustainable, efficient, & clean oils |

| Automotive, power, pharmaceuticals | Expanding to renewable energy, food processing |

| R&D in synthetic oils & performance enhancers | Higher investments in green chemistry & bio-based solutions |

| Dominance of Asia-Pacific & North America | Growth in emerging economies & sustainable industries |

To accurately analyze and forecast data pertaining to specialty oils, Future Market Insights (FMI) of new approach has been implanted in which an extensive survey has been conducted with key stakeholders in the specialty oils landscape, including manufacturers, suppliers, distributors, and end-users in various sectors such as automotive and pharmaceuticals, as well as in power transmission.

Survey respondents indicated that growth in specialty oils, both in formulating and final application, is being fueled by a demand for higher performance lubrication, better energy efficiency, and sustainability. Due to an increase in regulatory pressure and consumer demand for eco-friendly alternatives, bio-based and biodegradable specialty oils emerge as the segment develops.

Interviewed experts across the study strongly highlighted innovations that are shaping the future of specialty oils. Investment in R&D has accelerated, especially in respect of synthetic and plant-based oils that provide improved viscosity, oxidation stability and more effective service life.

Additionally, the demand patterns are shifting with the transition toward electric vehicles and renewable energy sources to meet the changing needs of the industry, new formulations are needed.

The survey also highlighted regional differences in industry growth. North America and Europe are adopting sustainable specialty oils at an increasing rate owing to stricter environmental regulations, while the demand in Asia-Pacific is persistent, primarily driven by industrialization and automotive production.

Geopolitical uncertainties and volatile raw material prices were also identified by participants as challenges that could constrain industry expansion through the next decade. However, the FMI survey highlights how companies are adapting through strategic sourcing, supply chain diversification, and investment in sustainable alternatives, providing a comprehensive outlook on the future trajectory of the specialty oils market.

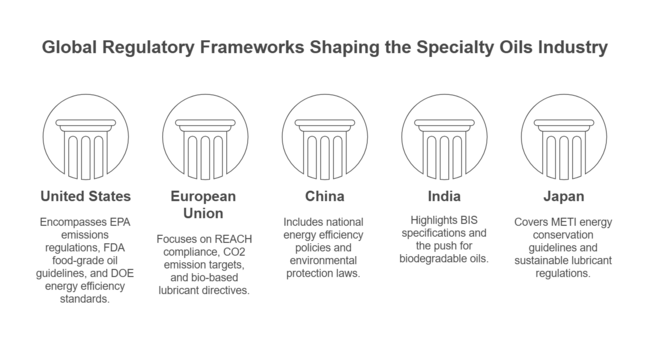

| Country/Region | Key Regulations |

|---|---|

| United States | EPA regulations on emissions and hazardous chemicals, FDA guidelines on food-grade oils, and DOE energy efficiency standards. |

| European Union | REACH compliance for chemical safety, stringent CO2 emission targets, and directives promoting bio-based lubricants. |

| China | National energy efficiency policies, environmental protection laws restricting toxic substances, and automotive fuel efficiency standards. |

| India | BIS (Bureau of Indian Standards) specifications for industrial and automotive lubricants, government push for biodegradable oils. |

| Japan | METI energy conservation guidelines, focus on sustainable industrial fluids, and automotive lubricant regulations. |

| Brazil | ANP (National Agency of Petroleum) standards for specialty oils, environmental protection rules for oil disposal. |

| Australia | Environmental Protection Act for safe chemical handling, guidelines on biodegradable industrial fluids. |

| Middle East | Oil and gas industry regulations on lubricant standards, government policies promoting sustainable energy. |

The demand for specialty oils industry is highly correlated with industry of chemicals and lubricants, as well as the sectors or vertical like automotive, power transmission, manufacturing, pharmaceuticals, personal care etc. It falls under the industrial oils and specialty chemicals category, meeting specialized demands for high-performing, customized lubrication and formulation solutions.

The growth of the specialty oils industry is interconnected with industrial growth, energy demand, regulatory frameworks, and technologies from a macroeconomic standpoint.

Global economies are gradually recovering from the pandemic, and the increasing industrialization, particularly in emerging nations such as China, India, and Southeast Asia, is significantly fueling the demand for specialty oils in power generation, machinery maintenance, and automotive lubrication sectors.

Furthermore, the current energy transition and sustainability trend are driving industries to transition to bio-based and eco-friendly specialty oils, in line with stringent emission laws in regions such as the EU and North America.

Additionally, changes in crude oil prices, trade policies, and geopolitical tensions affect raw material availability and pricing. However, the industry is expected to fuel growth due to increasing infrastructure investments, rising automotive production (especially EVs), and increasing demand for high-performance lubricants. Driven by innovation, regulatory support, and industrial modernization, the specialty oils industry is projected to grow at a steady CAGR of 3.3% through 2035.

Top players in the specialty oils market are engaging in cost-based competition to innovate, expand, and form strategic alliances. Few players are leveraging a cost leadership strategy to win bulk buyers in the automotive and industrial manufacturing domains by proposing competitively priced offerings.

Some are focusing more on differentiation with high investments in R&D, supporting the development of high-performance and bio-based specialty oils that meet evolving sustainability requirements. Mergers and acquisitions (M&A) are also a focus, with larger firms acquiring smaller, specialized players to broaden product offerings and fortify their segment presence.

Sector collaborations with OEMs, chemical manufacturers, and renewable energy companies are streamlining supply chain processes and product customization further optimizing supply chains and enabling greater product customization.

Top companies growing every day are aggressively expanding both production capacity and distribution networks around the world. Others are making multibillion-dollar bets on developing industries such as Asia-Pacific and Latin America, where industrialization and vehicle ownership are on an upward trajectory. Sustainability continues to be a central tenet of growth strategies, with firms increasingly focused on greener formulations and minimizing carbon footprints while adhering to more rigorous environmental regulations. Moreover, automation is making an impact, since businesses are adopting AI-powered predictive maintenance and smart manufacturing to maximize operations, directing them to keep their competitive edge in the changing landscape of specialty oils.

The specialty oils industry is concentrated, with the leading five players, AAK AB, Bunge Limited, Cargill Incorporated, Mewah International Inc., and Wilmar International, controlling over 58.8% of the industry share collectively.

These companies focus on innovation in products, partnerships, regional expansion, and sustainability initiatives as major strategies for sustaining their superiority. Innovations continue being researched on and invested in, with health and sustainability-focused products taking precedence.

For example, the acquisition of IOI Loders Croklaan by Bunge Limited complemented the specialty oils portfolio and diversified its product offering in the specialty oils segment and met the increasing consumer trends.

This process led to Adani Wilmar, now the largest refiner of consumer-packed edible oils in India, a joint venture between Wilmar International and Adani Group. Likewise, companies are widening their geographical footprint to leverage emerging industries for example, Synthite’s expansion spans India, China, Brazil, the USA, Vietnam, and Sri Lanka.

Firms are innovating palm oil alternatives and focusing on responsible sourcing to satisfy growing environmental concerns among consumers. Industry leaders are anticipated to invest in such growth to consolidate their position.

| Company Name | Industry Position & Offerings |

|---|---|

| Exxon Mobil Corporation | A global leader offering a diverse range of specialty oils for industrial applications. |

| Chevron Corporation | Provides high-quality specialty oils for automotive and industrial uses. |

| Royal Dutch Shell plc | Extensive portfolio serving automotive, manufacturing, and power generation sectors. |

| BP Plc. | Offers specialty oils under the Castrol brand, focusing on performance and sustainability. |

| Total Energies | Supplies specialty oils across automotive, aerospace, and energy industries. |

Driven by increasing sustainability concerns, companies are shifting to renewable raw materials, with bio-based and eco-friendly specialty oils expected to transform the industry. Stringent laws governing emissions and disposal of generation waste are expected to impel the production of biodegradable and low-carbon specialty oils, paving way for immense opportunities for manufacturers.

In addition, the growing EV industry will increase the need for advanced lubricants and thermal management fluids, making specialty oils integral to next-gen transportation solutions. The industry will also be driven by the cosmetics and personal care industries, as high-purity oils gain greater consumer preference for use in skincare and medicinal products.

To take advantage of these trends, businesses should prioritize innovation, sustainability, and strategic partnerships. Focusing efforts on R&D to develop high-performance, eco-friendly specialty oils will be key to the sector's compliance with regulations and their fulfillment of consumer expectations.

The rise of industrial and automotive activities in regions like Asia-Pacific and Latin America presents an opportunity to increase the production capacity in these high-growth locations, which will help improve industry penetration.

As for manufacturing processes, companies need to further expand on the digitalization and automation front. Building strategic partnerships with end-user industries, including automotive manufacturers and renewable energy companies, can facilitate the development of customized solutions that address industry-specific needs.

In addition to these innovative strategies, fortifying supply chain resilience will also take on new importance for ensuring a secure raw material supply that allows competitive edge in this changing landscape.

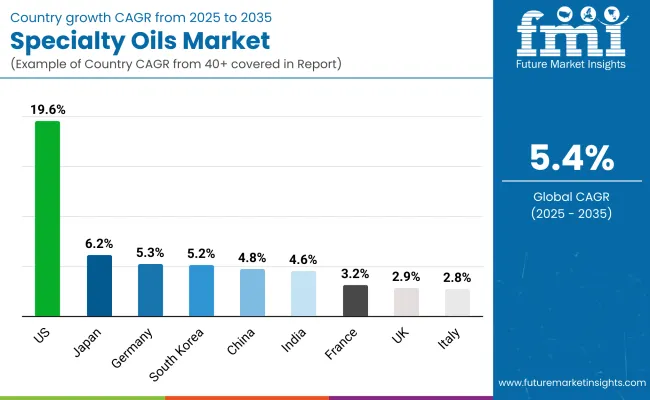

The United States is a key player in the specialty oils industry, accounting for 19.6% of the global industry share. The dominance is fueled by its robust industrial base, developed automotive sector, and increasing needs for sustainable lubricants.

The USA Environmental Protection Agency (EPA) has launched several sweeping, new environmental policies, putting pressure on manufacturers along the lines of bio-based and biodegradable specialty oils.

The growth of the renewables sector, coupled with the increasing production of electric vehicles (EVs) and advancements in battery infrastructure, is further driving demand for specialty oils.

In addition to that, the growing pharmaceutical and personal care industries are driving the consumption of high-purity white oils. Players in the industry will need to make strategic investments in R&D and manufacturing capabilities.

FMI opines that the United Kingdom specialty oils sales will grow at nearly 3.5% CAGR through 2025 to 2035.

Sustainability compliance and net-zero transition drive the UK specialty oils industry.

Government initiatives towards electric mobility and renewable energy are expected to create demand for specialty transformer oils.

The cosmetics and personal care industry is also driving the demand for high purity white oils and liquid paraffin. Due to increasing industrial and heavy engineering activities the industry for lubricants will also grow.

Growth in investments in eco-friendly formulations and collaboration with automotive and energy firms to create next-generation specialty oils are likely to be beneficial for industry players.

FMI opines that the United Kingdom specialty oils sales will grow at nearly 2.9% CAGR through 2025 to 2035.

The industry for specialty oils in France is defined by its emphasis on sustainability, strict environmental regulations, and industrial innovation. The government's pledge to cut carbon emissions is promoting the use of biodegradable specialty oils, especially in power generation and transmission.

There is a rise in demand for white oil and petroleum jelly in the cosmetics and pharmaceutical sectors. Moreover, the growth of the economy is expected to generate demand for advanced automotive and transformer oils within the country’s burgeoning electric vehicle sector. Key stakeholders: Companies investing in bio-based specialty oil production and supply chain optimization will hold a strong competitive share in the French industry.

FMI opines that the France specialty oils sales will grow at nearly 3.2% CAGR through 2025 to 2035.

Germany holds the 5.3% industry share of global specialty oils industry, buoyed by a robust manufacturing and automotive sector. The shift to electric mobility is raising demand for specialty lubricants in EV parts. Germany's transition to a renewable-integrated power grid is also driving demand for transformer oil.

The demand for high-purity specialty oils is fueled by the country’s top pharmaceutical and cosmetics industries.

Manufacturers are being driven to innovate and provide sustainable solutions due to increasingly rigid environmental standards. Players in the industry investing in R&D or expanding local production capacity stand to benefit from an advanced industrial landscape in Germany.

FMI opines that Germany specialty oils sales will grow at nearly 4% CAGR through 2025 to 2035.

Italy’s specialty oils industry is aided by its strong manufacturing, automotive and personal care industries. The country’s thrust towards energy efficiency and sustainability is also spurring the demand for transformer oils in power transmission networks.

White oils and petroleum jelly are being driven by the cosmetics industry, especially premium skincare and beauty products. Furthermore, the food and beverage sector in Italy is propelling the utilization of specialty oils for processing and packaging activities.

With high barriers to entry in the premium and eco-friendly formulations industries, companies focusing on sustainable solutions will gain a competitive edge as consumer and industrial demand shifts toward sustainability.

FMI opines that Italy specialty oils sales will grow at nearly 2.8% CAGR through 2025 to 2035.

Thanks to its advanced electronics, automotive, and power industries, the specialty oils industry in South Korea is continuously growing. South Korea’s efforts for energy security and transition to renewable power generations are driving demand for specialty transformer oils.

The growing cosmetics & personal care industry is also adding to the demand for good quality white oils. The increasing demand for high-performance lubricants is driven by South Korea’s automotive industry, particularly the rapid growth of its EV production and adoption. Businesses that invest in innovative, sustainable solutions will leverage South Korea’s high-tech industrial ecosystem and deepening regulatory focus on environmental responsibility.

FMI opines that Italy specialty oils sales will grow at nearly 5.2% CAGR through 2025 to 2035.

Japan holds 6.2% of the global specialty oils market, driven by technological advancements, the rapid expansion of its automotive sector, and the development of energy-efficient delivery systems. The automotive and manufacturing sectors of the country are fueling demand for high-performance industrial oils, including synthetic lubricants.

Stringent environmental regulations in Japan are driving the consumption for bio-based and low-emission specialty oils. White oils are increasingly being utilized in the cosmetics and pharmaceuticals industries owing to their innovation and quality standards.

With Japan's commitment to promote carbon neutral emissions and sustainable solutions, industry players who invest in R&D and optimization of eco-friendly manufacturing solutions will enjoy a competitive advantage.

FMI opines that Italy specialty oils sales will grow at nearly 2.5% CAGR through 2025-2

As the most industrialized, fastest growing automotive producer, and one of the largest energy sectors in the world, China remains the leading and highest growth specialty oils industry. The China specialty oil industry is expected to grow at a CAGR of 4.1% in the period of 2025 to 2035.

The country’s transition to electric vehicles drives demand for high-performance lubricants and transformer oils. The increasing consumption of white oil is also fueled by the rapid expansion of the cosmetics and pharmaceutical industries. Government policies in China underwrite and encourage green energy and environmental sustainability, affecting specialty oil formulations.

As industrialization progresses, the need for specialty oils in heavy machinery and manufacturing will increase. Firms developing production near sales industries, supply chains and sustainability will prosper in this competitive industry.

FMI opines that China specialty oils sales will grow at nearly 4.8% CAGR through 2025 to 2035.

India’s specialty oils industry is poised for robust growth between 2025 and 2035 and expected to grow at a CAGR of 4.6%, driven by the rapid expansion of industrial sectors, increasing demand for high-performance lubricants, and a strong push for sustainability. The country’s booming automotive industry, coupled with the transition toward electric vehicles (EVs), is expected to drive demand for advanced automotive and industrial oils.

The growing power sector, with significant investments in grid infrastructure and renewable energy, will further boost the consumption of transformer oils. Government regulations promoting environmentally friendly and biodegradable oils are expected to reshape the industry. Policies supporting green energy and reducing carbon emissions will encourage manufacturers to invest in bio-based specialty oils.

With India’s focus on industrial growth, sustainability, and technological advancements, companies that prioritize product innovation and eco-friendly solutions will have a competitive edge in this rapidly growing industry.

White Oil, Automotive Oil, Transformer Oil, Industrial Oil, Liquid Paraffin, Rubber Process Oil, Petroleum Jelly, Other Product Types

Automotive, Power Generation, Pharmaceutical, Personal Care & Cosmetics, Food & Beverages, Manufacturing, Heavy Engineering Equipment, Transmission & Distribution, Other End Users

North America, Latin America, Europe Industry, East Asia Industry, South Asia & Pacific Industry, Middle East & Africa (ME&A) Industry

The growing demand for high-performance lubricants in the automotive, manufacturing, and power generation industries is a key factor driving industry expansion. Additionally, the shift toward bio-based and eco-friendly oils, growing industrialization in emerging economies, and stringent environmental regulations are fueling demand.

Sustainability concerns are encouraging the adoption of biodegradable and bio-based specialty oils. Industries are transitioning to low-emission formulations to comply with stringent environmental regulations, particularly in regions like North America and the European Union.

Automotive, power generation, pharmaceuticals, cosmetics, and food processing industries are the largest consumers. Transformer oils are vital for electricity grids, while high-purity white oils are extensively used in personal care and medical applications.

The rise in electric vehicle adoption is driving increased demand for advanced lubricants, such as thermal management fluids and high-performance greases, which are essential for battery cooling and efficient component operation.

Government regulation affects the specialty oils industry in terms of emissions, waste management, and product sustainability. Renewable energy projects and electric vehicle uptake further influence demand for special oils applied in transformers and industrial use.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End-Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Mint Oils Market

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA