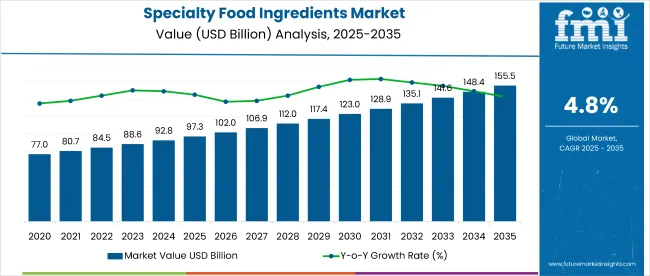

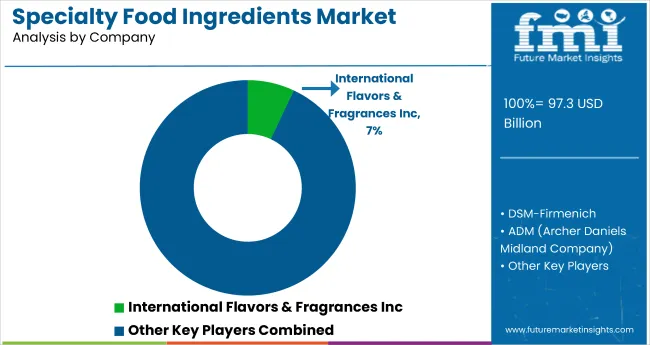

The global specialty food ingredients market is valued at USD 97.3 billion in 2025 and is slated to reach USD 155.5 billion by 2035, reflecting a CAGR of 4.8%. Growth is driven by rising demand for functional and fortified foods, increasing health consciousness among consumers, and advancements in clean-label ingredient formulations. In addition, the post-pandemic recovery and the shift towards convenient, nutrient-enriched products have positively impacted market expansion.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 97.3 billion |

| 2035 Market Size | USD 155.5 billion |

| CAGR (2025 to 2035) | 4.8% |

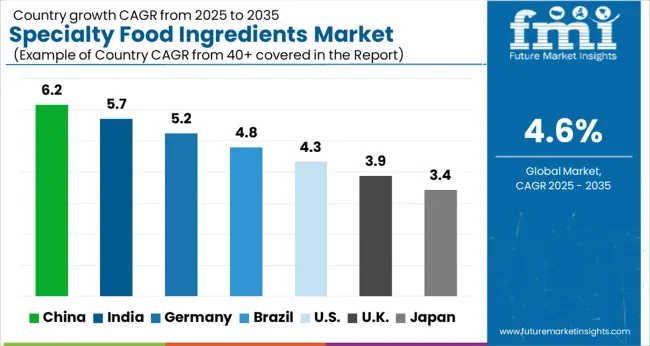

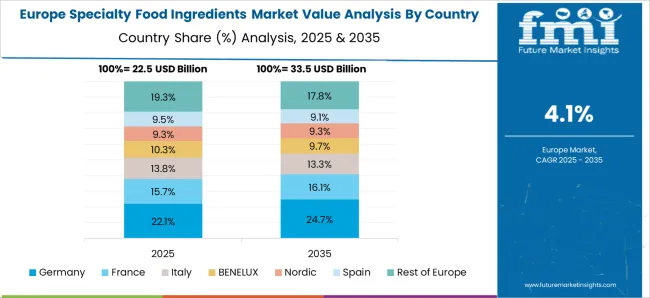

Germany is projected to lead with the highest CAGR of 13.4% from 2025 to 2035, driven primarily by rising obesity rates and an increased focus on health-centric food products. France is expected to follow with a steady growth rate of 6.0%, supported by growing demand for natural flavors and functional foods.

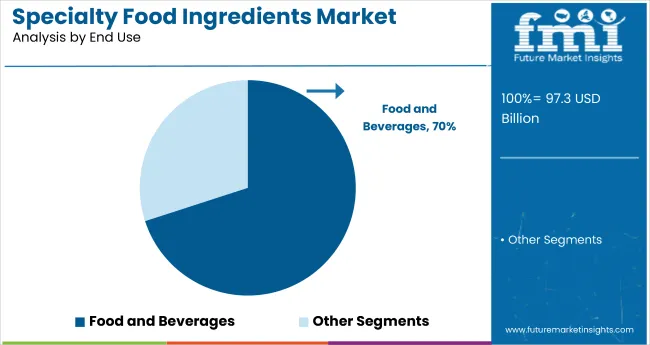

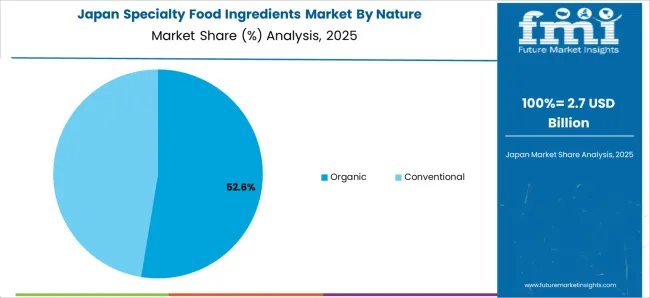

Japan ranks third with a moderate CAGR of 5.8%, fueled by its aging population and the increasing demand for nutraceutical and fortified food products. The top two segments in 2025 are conventional ingredients, leading the nature category with 65% market share, and food and beverages, leading with end-use segment with a 70% share due to broad application across key food categories.

Recent innovations in the specialty food ingredients market include advancements in precision fermentation, biofortification, and enzyme-based processing, enabling cleaner labels and improved nutritional profiles. Companies are leveraging recombinant technologies to produce functional compounds like beta-carotene and lycopene with enhanced efficiency.

Governments across Europe and North America have strengthened regulatory frameworks to support clean-label claims, allergen disclosures, and sustainability certifications. The European Food Safety Authority (EFSA) and the USA FDA have introduced guidelines favoring natural and organic ingredients, while APAC countries like China and India are streamlining approval processes to encourage foreign investments and technological integration in specialty food manufacturing.

The market holds 20-25% of the global food additives market, driven by demand for functional, clean-label, and health-oriented ingredients. Within the functional food and nutraceutical ingredients sectors, it accounts for nearly 30%, particularly due to its role in enhancing nutritional value.

In the processed food market, specialty ingredients contribute around 15-18%, supporting flavor, texture, and shelf-life extension. For the organic food and clean-label markets, the share ranges from 10-15%, as natural ingredients are prioritized. Overall, specialty food ingredients represent a growing portion of these parent markets, especially as health and wellness trends accelerate globally.

The specialty food ingredients market segments include nature, type, end use, distribution channel, and region. The nature segment includes organic and conventional. The type segment comprises antioxidants, colorants, emulsifiers, enzymes, flavors, minerals, preservatives, and vitamins.

The end-use segment includes food and beverages, personal care, and nutrition and health. The food and beverages sub-segment covers bakery, confectionery, beverages, dietary supplements, convenience foods, dairy & frozen foods, functional foods, and meat products.

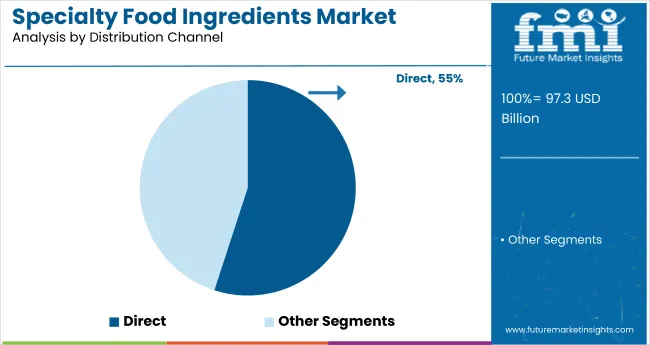

The personal care, nutrition, and health sub-segment includes nutraceutical ingredients and active pharmaceutical ingredients. The distribution channel segment includes direct and indirect channels, with indirect further categorized into hypermarkets, supermarkets, convenience stores, specialty retail stores, and online retailers. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The conventional segment currently dominates the specialty food ingredients market, accounting for approximately 65% of the total market share in 2025.

Enzymes emerge as the most lucrative segment in the specialty food ingredients market, projected to hold the largest share at 32.1% in 2025.

The food and beverages segment is projected to lead the specialty food ingredients market with a commanding 70% market share. This dominance is driven by the widespread application of specialty ingredients across a variety of food categories such as bakery, beverages, dairy, and convenience foods.

The direct distribution channel is considered the most lucrative in the specialty food ingredients market, projected to account for over 55% of the market share in 2025.

The market is growing steadily, driven by rising demand for clean-label and functional foods, increasing health-conscious consumer behavior, and advancements in enzyme, vitamin, and flavor technologies across the food, beverage, and nutraceutical industries.

Recent Trends in the Specialty Food Ingredients Market

Challenges in the Specialty Food Ingredients Market

Among the top five countries, Germany leads the specialty food ingredients market with the highest projected CAGR of 13.4% from 2025 to 2035, driven by rising obesity rates and a focus on health-centric products. Japan follows with a moderate CAGR of 5.8%, fueled by an aging population and growing demand for nutraceuticals.

The USA market is expected to grow at 5.2%, supported by clean-label and functional food trends. France and the UK show steady growth rates of 6.0% and 4.6%, respectively, reflecting increased demand for natural ingredients and convenience foods in these mature markets.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

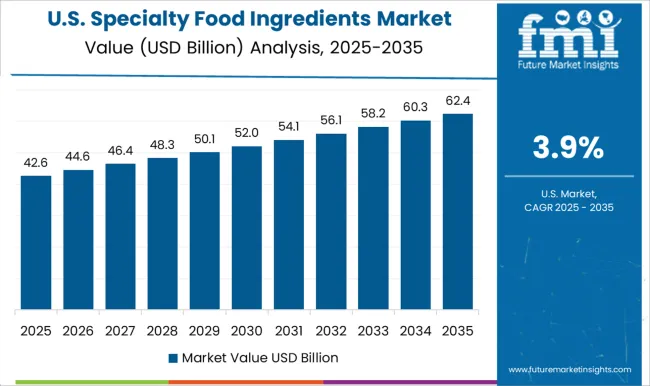

The USA specialty food ingredients are projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by increasing consumer demand for clean-label and functional foods.

The UK specialty food ingredients revenue is expected to grow at a CAGR of 4.6% during 2025 to 2035. Growing health consciousness and demand for convenience foods have led to increased usage of functional and natural ingredients.

The Germany specialty food ingredients revenue is forecasted to register the highest CAGR of 13.4% between 2025 and 2035, propelled by the growing obese population and increased focus on health-focused food products.

The specialty food ingredients demand in France is expected to grow at a CAGR of 6.0% from 2025 to 2035. The growth is supported by rising demand for natural flavors and colorants in the bakery and beverage sectors.

The Japan specialty food ingredients sales are projected to grow at a CAGR of 5.8% from 2025 to 2035. Rising consumer health awareness and an aging population drive demand for nutraceutical and fortified food products.

The market is moderately consolidated, with a handful of tier-one companies such as Evonik, Archer Daniels Midland Company, and Koninklijke DSM N.V. holding significant market shares. These leading players compete through strategic investments in innovation, extensive R&D, and global expansion initiatives.

Companies like Cargill Inc. and Ingredion Incorporated are emphasizing sustainability and transparency in their supply chains, investing in natural and organic ingredient lines. Pricing strategies are carefully balanced with innovation to retain competitive advantage while catering to cost-sensitive clients, especially in developing regions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 97.3 billion |

| Projected Market Size (2035) | USD 155.5 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in metric tons |

| By Nature | Organic, Conventional |

| By Type | Antioxidants, Colorants, Emulsifiers, Enzymes, Flavors, Minerals, Preservatives, Vitamins |

| By End Use | Food and Beverages (Bakery, Confectionery, Beverages, Dietary Supplements, Convenience Foods, Dairy & Frozen Foods, Functional Foods, Meat Products), Personal Care, Nutrition and Health (Nutraceutical Ingredients, Active Pharmaceutical Ingredients) |

| By Distribution Channel | Direct, Indirect (Hypermarkets, Supermarkets, Convenience Stores, Specialty Retail Stores, Online Retailers) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | Evonik, Archer Daniels Midland Company, PPG Industries, KF Specialty Ingredients, Koninklijke DSM N.V., Specialty Commodities Inc., Ingredion Incorporated, Prinova Group LLC, Naturex, Kerry Group Plc, E. I. Dupont De Nemours and Company, Cargill Inc., Frutarom, Woodland Foods Inc., Tate & Lyle Plc, AmTech Ingredients LLC, Roquette Frères S.A., Vidhi Limited, Sensient Technologies Corporation. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global specialty food ingredients market is estimated to be valued at USD 97.3 billion in 2025.

The market size for the specialty food ingredients market is projected to reach USD 152.0 billion by 2035.

The specialty food ingredients market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in specialty food ingredients market are organic and conventional.

In terms of type, vitamins segment to command 28.7% share in the specialty food ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Bulk Food Ingredients Market Growth – Industry Insights & Trends 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Textural Food Ingredients Market Analysis – Size, Share & Forecast 2023-2027

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA