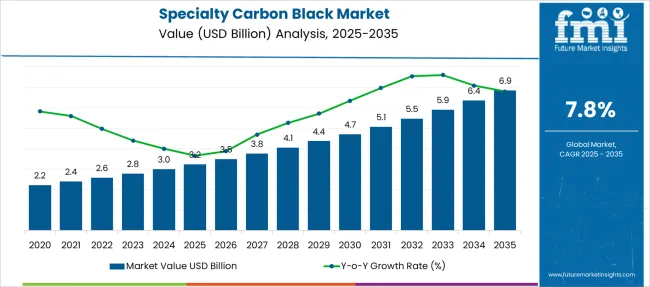

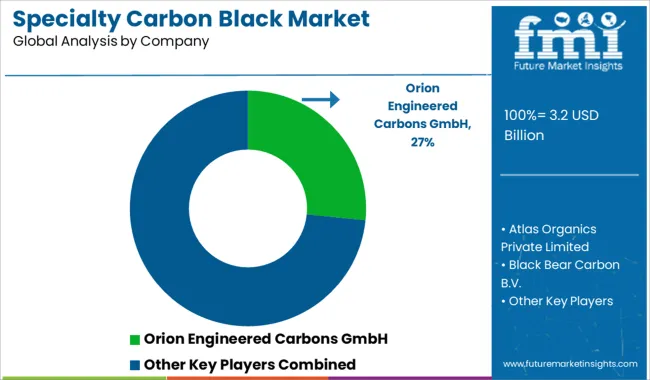

The Specialty Carbon Black Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Carbon Black Market Estimated Value in (2025 E) | USD 3.2 billion |

| Specialty Carbon Black Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The specialty carbon black market is witnessing steady growth due to its essential role in enhancing the performance of rubber and polymer products. Increasing demand for high-performance materials in automotive and industrial applications has accelerated the adoption of specialty carbon blacks.

Industry stakeholders have focused on improving material properties such as conductivity, durability, and tensile strength, which specialty carbon blacks help achieve. Advances in manufacturing processes have allowed for better customization of carbon black grades to meet specific end-use requirements.

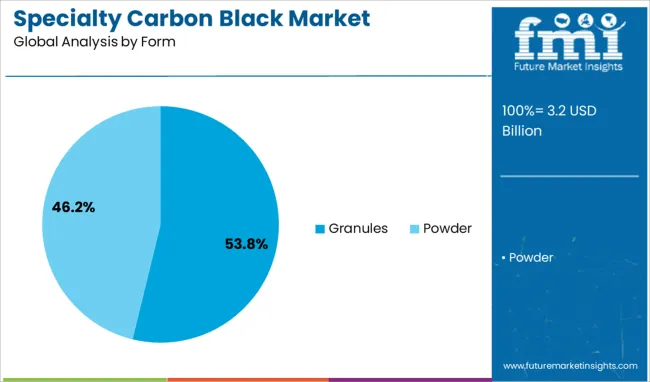

The growing emphasis on sustainability and recycling in rubber products has also influenced material choices. The market is expected to expand further as manufacturers seek to optimize product performance while complying with environmental regulations. Segmental growth is projected to be driven by the granule form due to ease of handling and processing, conductive carbon black as a preferred grade for enhanced electrical properties, and the rubber application segment reflecting its large industrial demand.

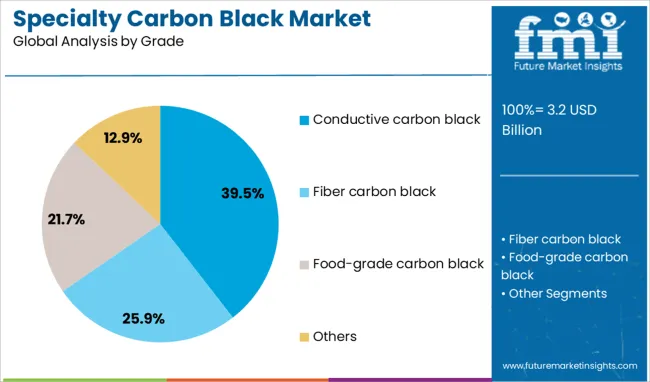

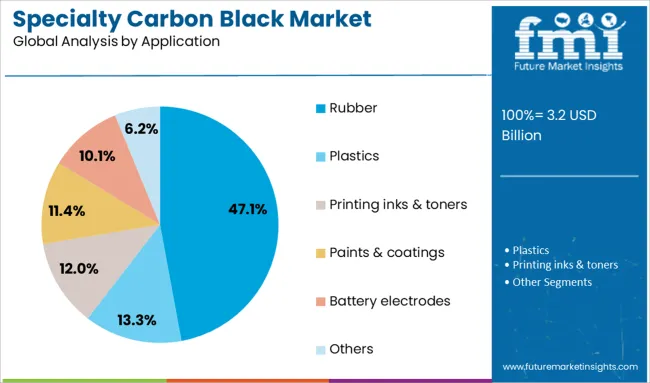

The specialty carbon black market is segmented by form, grade, application and geographic regions. The carbon black market is divided into Granules and Powder. In terms of grade, the specialty carbon black market is classified into Conductive carbon black, Fiber carbon black, Food-grade carbon black, and Others. Based on the application, the specialty carbon black market is segmented into Rubber, Plastics, Printing inks & toners, Paints & coatings, Battery electrodes, and Others. Regionally, the specialty carbon black industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The granules segment is expected to hold 53.8% of the specialty carbon black market revenue in 2025, maintaining its leading position. This form is preferred for its ease of transportation, storage, and integration into manufacturing processes. Granules reduce dust generation compared to powder forms, which improves worker safety and minimizes material loss.

Additionally, granules offer better flow characteristics and dispersion in rubber compounds, contributing to consistent product quality. The operational efficiencies and cost savings associated with granules have driven widespread industry adoption.

As manufacturers aim to streamline production and enhance material handling, the granules segment is anticipated to sustain its market dominance.

The conductive carbon black segment is projected to account for 39.5% of the market revenue in 2025, leading the grade categories. Its growth is attributed to its ability to impart electrical conductivity and static dissipation in rubber and plastic products. Conductive carbon blacks are widely used in tires, cables, and electronic components where controlled electrical properties are critical.

Increasing demand for electrically conductive materials in emerging applications such as flexible electronics and electric vehicles has further boosted this segment. The grade’s role in improving product performance and safety has cemented its importance.

With ongoing innovation and expanding application fields, conductive carbon black is expected to retain its leading market share.

The rubber segment is forecasted to hold 47.1% of the specialty carbon black market revenue in 2025, making it the dominant application segment. Specialty carbon black enhances rubber properties, including abrasion resistance, tensile strength, and durability, which are essential for automotive tires and industrial rubber products.

The growth of automotive production and infrastructure development has directly supported demand within this application. Additionally, the focus on developing fuel-efficient and high-performance tires has increased the use of specialty carbon blacks with tailored properties.

The demand for rubber products in diverse industries such as manufacturing, construction, and transportation continues to drive this segment. As manufacturers pursue improved product specifications and regulatory compliance, the rubber application segment is expected to sustain its market leadership.

The specialty carbon black market is experiencing strong growth, with revenue moving upward due to increasing usage in high-performance plastics, coatings, batteries, and inks. Demand is driven by the automotive and electronics industries seeking enhanced material properties. Opportunities are expanding with rising lithium-ion battery adoption in electric vehicles and growth in conductive packaging applications. Emerging trends include tailored carbon black grades and nanostructured materials for advanced performance. However, challenges such as volatile raw material prices and complex regulatory frameworks are creating barriers. The market outlook indicates sustained demand and a strong focus on customized, application-specific solutions.

Rising demand for specialty carbon black has been fueled by its critical role in conductive, UV-protective, and pigment applications. In 2024 and 2025, widespread use in electric vehicle batteries and high-grade polymer composites strengthened consumption across Asia-Pacific and North America. Automotive and electronics industries have been adopting specialty grades to achieve superior performance standards. Customized formulations for reinforced fibers and conductive polymers are being developed to meet specific requirements. The sector is being shaped by the need for precision-engineered materials, which is creating opportunities for producers to deliver solutions that meet performance-critical industrial applications.

Significant opportunities are emerging from the adoption of specialty carbon black in lithium-ion batteries and conductive plastics. In 2025, electric vehicle battery production increased reliance on high-purity carbon black grades optimized for energy storage performance. Consumer electronics and packaging sectors also contributed to higher demand for conductive solutions with excellent dispersion and stability. Manufacturers are engaging in partnerships with OEMs to co-develop customized carbon black grades suitable for advanced coatings and inks. These developments position suppliers with tailored product portfolios to benefit from long-term supply agreements and strong penetration in emerging applications.

The market has seen rapid movement toward specialized carbon black grades and nanostructured solutions. In 2025, application-specific grades designed for conductivity, UV resistance, and pigment stability became increasingly relevant across plastics and coatings industries. Granular forms are preferred for consistent processing and easier handling. Nanotechnology-driven developments are enhancing dispersion quality and electrical conductivity in batteries and electronics. Producers are closely collaborating with downstream users to deliver bespoke material solutions, resulting in significant shifts in product design and manufacturing approaches. These advancements indicate that innovation in specialty formulations will remain a defining factor for competitive positioning.

The specialty carbon black sector continues to face restrictions from unstable raw material costs and stringent compliance requirements. Feedstock price fluctuations have reduced predictability for production planning and margins. Regulatory hurdles surrounding emissions and pigment standards in coatings and packaging have introduced longer approval timelines and higher compliance costs. In addition, the premium pricing of specialty grades over commodity carbon blacks has limited adoption in cost-sensitive regions. These issues suggest that achieving balanced growth will require cost optimization strategies and possibly vertical integration to manage raw material availability and reduce exposure to volatility.

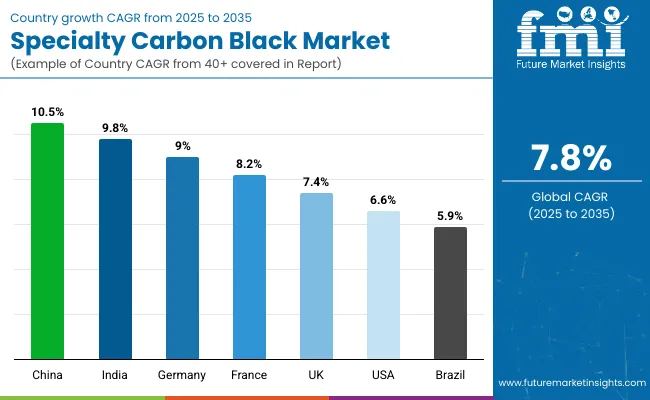

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

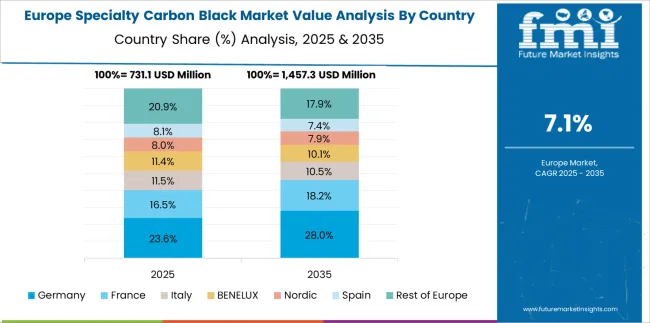

The global specialty carbon black market is anticipated to grow at a 7.8% CAGR from 2025 to 2035. China leads with 10.5% CAGR, driven by the rapid expansion of electronics, automotive, and battery manufacturing. India follows at 9.8%, supported by infrastructure projects, polymer compounding, and coatings demand. Germany records 9.0%, attributed to strong growth in high-performance plastics and energy storage solutions. The UK posts 7.4% CAGR, while the United States grows at 6.6%, reflecting moderate but steady adoption in paints, conductive polymers, and specialty packaging. Regional variations indicate Asia-Pacific’s leadership in scaling production for high-growth sectors, while Europe and North America emphasize innovation in clean processing technologies and advanced functional applications.

China dominates the specialty carbon black market with a projected 10.5% CAGR through 2035, fueled by rapid industrialization and a surge in demand for conductive and antistatic applications. The country’s strong presence in lithium-ion battery production and high-performance polymer manufacturing accelerates the integration of specialty carbon black for energy storage and electronics. Domestic producers are expanding capacity to meet demand for advanced coatings, plastics, and cable insulation materials. Strategic government initiatives to boost renewable energy infrastructure and EV production further elevate the market. Emphasis on sustainability drives innovation in low-emission production technologies.

The specialty carbon black market in India is expected to expand at 9.8% CAGR, supported by strong growth in construction, automotive, and packaging sectors. Increasing consumption of masterbatches and engineered plastics drives demand for high-dispersion carbon black grades. The rise in power cable installations and renewable energy projects boosts the need for conductive applications. Domestic companies invest in capacity expansions, while global players target partnerships to introduce specialty grades with enhanced purity and performance. Growth in ink and coatings for flexible packaging also adds momentum.

Germany posts a 9.0% CAGR, propelled by the country’s strong automotive and electrical industries. Specialty carbon black plays a critical role in high-performance plastics, coatings, and advanced rubber applications for EV components. Adoption in lithium-ion battery cathode materials is rising as Germany accelerates EV production and renewable energy integration. Stringent EU environmental regulations encourage producers to adopt cleaner manufacturing technologies. Demand from industrial coatings and printing inks for high-end packaging and electronics further supports market growth.

The UK is forecast to grow at 7.4% CAGR, driven by demand for high-quality coatings, specialty plastics, and packaging materials. Growth in electric mobility and renewable energy projects reinforces the need for conductive and antistatic grades. Increased focus on sustainable materials and circular economy principles encourages the development of low-VOC formulations in inks and coatings. Investments in high-end masterbatch production and polymer compounding create new opportunities. Imports continue to dominate the supply chain, while local processors enhance specialty product customization for niche applications.

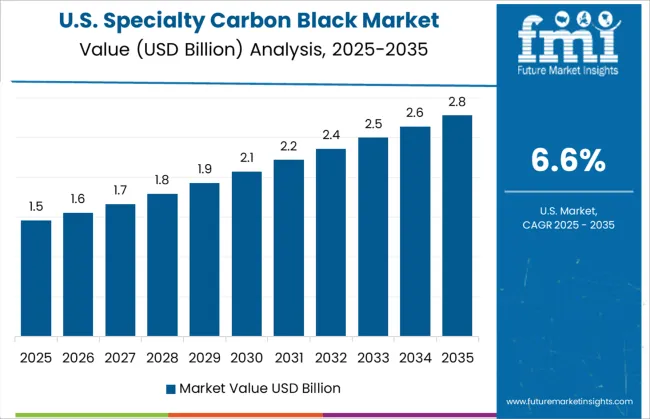

The USA market is projected to grow at 6.6% CAGR, reflecting steady adoption in specialty plastics, cable compounds, and automotive coatings. Expansion in data center infrastructure and renewable energy systems fuels demand for conductive applications. Manufacturers focus on high-dispersion grades for use in performance polymers and packaging.

Strategic partnerships with EV and electronics OEMs are shaping the market landscape. Environmental compliance under EPA guidelines drives investment in cleaner production technologies, including furnace optimization and carbon recovery systems.

The specialty carbon black market is moderately consolidated, with Orion Engineered Carbons GmbH recognized as a leading player due to its advanced production technologies, wide product portfolio, and strong global distribution network. The company offers high-performance specialty carbon black grades used in coatings, plastics, and conductive applications, ensuring superior dispersibility and color stability.

Key players include Atlas Organics Private Limited, Black Bear Carbon B.V., Continental Carbon Company, Denka Company Limited, and Phillips Carbon Black Limited. These companies focus on developing specialty carbon black with properties tailored for high-end applications such as automotive coatings, polymers, inks, and battery electrodes. Their strategies include innovation in particle size control, surface treatment, and functionalization to meet stringent industry performance standards.

Market growth is driven by increasing demand for lightweight, durable materials in automotive and electronics, as well as growing adoption of specialty black in conductive plastics and energy storage systems. Leading manufacturers are investing in sustainable production practices, including circular economy models using recovered carbon black, and expanding their capacity to meet rising demand from the electric vehicle and renewable energy sectors.

Asia-Pacific dominates the market with strong manufacturing activity in plastics and coatings, while North America and Europe lead in specialty applications requiring advanced performance characteristics.

In January 2024, Birla Carbon initiated a Greenfield expansion aiming to add over 240,000 tonnes of specialty carbon black capacity across India and Thailand, boosting its ability to supply high-performance plastics, coatings, and conductive fillers across Asia‑Pacific markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Form | Granules and Powder |

| Grade | Conductive carbon black, Fiber carbon black, Food-grade carbon black, and Others |

| Application | Rubber, Plastics, Printing inks & toners, Paints & coatings, Battery electrodes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Orion Engineered Carbons GmbH, Atlas Organics Private Limited, Black Bear Carbon B.V., Continental Carbon Company, Denka Company Limited, and Phillips Carbon Black Limited |

| Additional Attributes | Dollar sales by grade (conductive, fiber-grade, food-contact, others) and application (plastics, coatings/inks, batteries, adhesives). Asia-Pacific dominates with \~48% share in 2024, followed by North America. Buyers prioritize high-purity, conductive, UV-resistant, pigment-stable solutions. Innovations focus on EV battery additives, nanostructured dispersion technologies, and bio-sourced carbon materials for sustainable high-performance applications. |

The global specialty carbon black market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the specialty carbon black market is projected to reach USD 6.9 billion by 2035.

The specialty carbon black market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in specialty carbon black market are granules and powder.

In terms of grade, conductive carbon black segment to command 39.5% share in the specialty carbon black market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA