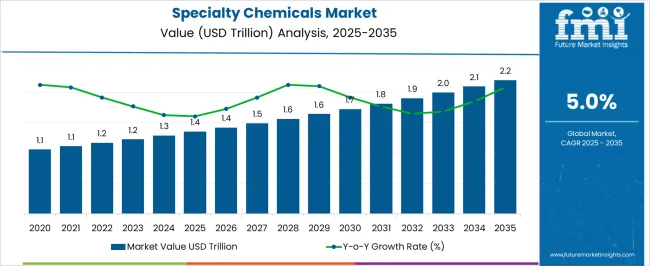

The specialty chemicals market is estimated to be valued at USD 1.4 trillion in 2025 and is projected to reach USD 2.2 trillion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

From 2021 to 2025, the market grows from USD 1.1 trillion to 1.4 trillion, with incremental values passing through USD 1.1 trillion, 1.2 trillion, and 1.3 trillion. Growth during this phase is supported by early adoption of high-performance chemicals, innovations in formulation, and increasing regulatory emphasis on environmentally safer products. Between 2026 and 2030, the curve maintains its positive slope as the market rises from USD 1.4 trillion to 1.7 trillion, with intermediate values of USD 1.4 trillion, 1.5 trillion, and 1.6 trillion.

This stage benefits from expansion in emerging markets, rising demand for specialty polymers, coatings, and adhesives, and industrial application diversification. From 2031 to 2035, the growth curve continues to climb, moving from USD 1.7 trillion to 2.2 trillion, passing through USD 1.8 trillion, 1.9 trillion, 2.0 trillion, and 2.1 trillion. The curve’s shape indicates consistent, incremental expansion rather than sharp spikes, reflecting both volume growth and value addition through advanced chemical solutions, product differentiation, and rising global industrialization.

| Metric | Value |

|---|---|

| Specialty Chemicals Market Estimated Value in (2025 E) | USD 1.4 trillion |

| Specialty Chemicals Market Forecast Value in (2035 F) | USD 2.2 trillion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The coatings and paints market contributes the largest share, about 25-30%, as specialty chemicals such as resins, additives, and pigments enhance performance, durability, and aesthetic appeal in industrial, automotive, and architectural applications. The adhesives and sealants market adds roughly 18-22%, relying on specialty polymers, curing agents, and surface modifiers to improve bonding strength, flexibility, and resistance under extreme conditions. The personal care and cosmetics market accounts for approximately 12-15%, where specialty chemicals like emulsifiers, surfactants, and active ingredients ensure formulation stability, product safety, and functional benefits.

The agrochemicals market contributes around 10-12%, with specialty chemicals used in the production of herbicides, pesticides, and fertilizers to improve efficacy, bioavailability, and environmental compliance. Lastly, the pharmaceuticals market represents about 8-10%, as specialty chemical intermediates and excipients are critical for drug formulation, active ingredient synthesis, and controlled release technologies. Together, these parent markets underscore the pivotal role of specialty chemicals in enhancing product performance, enabling innovation, and meeting regulatory and environmental standards across multiple sectors.

The specialty chemicals market is registering steady growth, driven by expanding industrial applications, increasing focus on performance-oriented chemical formulations, and rising demand in emerging economies. Technological advancements have enabled manufacturers to develop high-value, application-specific chemicals that offer superior functionality and environmental compliance.

Industry reports and corporate announcements have highlighted that growth is further supported by sustainability-driven innovation, as regulatory pressures and customer preferences shift toward eco-friendly formulations. The market is also benefitting from robust investments in R&D to enhance product efficiency, reduce waste, and enable cost-effective production.

Global supply chain diversification and regional manufacturing hubs have increased the availability of specialty chemicals across various sectors. Looking ahead, the market is expected to maintain its upward trajectory, supported by expanding usage in agriculture, pharmaceuticals, automotive, and electronics, with key segments such as agrochemicals playing a pivotal role in driving overall demand.

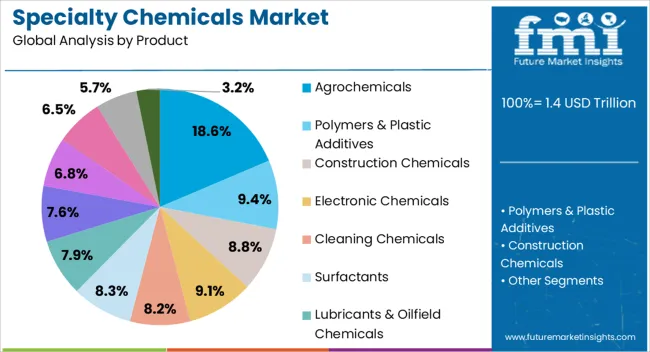

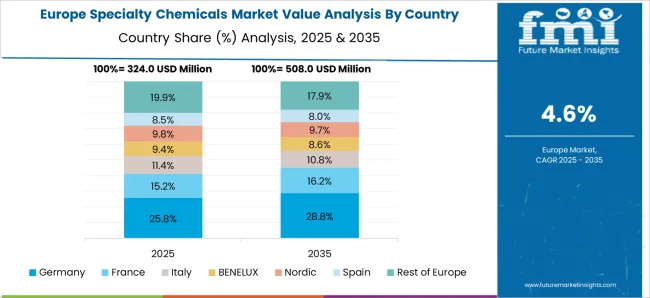

The specialty chemicals market is segmented by product, and geographic regions. By product, specialty chemicals market is divided into agrochemicals, polymers & plastic additives, construction chemicals, electronic chemicals, cleaning chemicals, surfactants, lubricants & oilfield chemicals, specialty coatings, paper & textile chemicals, food additives, adhesives & sealants, and others. Regionally, the specialty chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The agrochemicals segment is projected to account for 18.6% of the specialty chemicals market revenue in 2025, maintaining a strong foothold among product categories. This growth is being propelled by the global push to enhance agricultural productivity and meet the food security demands of a growing population. The segment benefits from sustained demand for crop protection agents, fertilizers, and growth enhancers, which are critical for improving yield quality and quantity. Agricultural modernization, particularly in developing regions, has spurred the adoption of advanced agrochemical solutions tailored for specific crops and climatic conditions. Additionally, climate change challenges, such as unpredictable weather patterns and pest infestations, have reinforced the necessity for reliable chemical interventions in farming practices. Ongoing innovations in bio-based and environmentally friendly agrochemicals have also supported market adoption, aligning with tightening environmental regulations. As governments and agricultural bodies continue to invest in sustainable farming practices, the Agrochemicals segment is expected to retain its importance within the specialty chemicals industry.

The specialty chemicals market is growing due to increasing demand from pharmaceuticals, agrochemicals, electronics, construction, and personal care industries. Products such as performance additives, high-purity reagents, and functional chemicals enhance efficiency and quality in downstream applications. Challenges include raw material volatility, regulatory compliance, and maintaining batch-to-batch consistency. Opportunities lie in high-performance materials, bio-based specialty chemicals, and application-specific solutions tailored to industrial needs. Manufacturers investing in innovation, technical support, and optimized production processes are well-positioned to capture market share. Rapid industrialization in Asia-Pacific and steady demand in Europe and North America are expected to drive global market expansion.

The specialty chemicals market is expanding as industries such as pharmaceuticals, agrochemicals, paints and coatings, adhesives, and personal care increasingly rely on tailored chemical solutions. Demand is driven by the need for performance-enhancing additives, high-purity reagents, and functional materials that improve product efficiency and quality. Growth in automotive, construction, electronics, and consumer goods sectors further strengthens adoption globally, particularly in Asia-Pacific, North America, and Europe. Manufacturers focus on consistent product quality, application-specific formulations, and regulatory compliance to meet industrial requirements. Increasing innovation in product development and rising awareness about performance-based chemicals in downstream industries are key factors shaping market growth and driving investment in research, production capacity, and technical services.

The specialty chemicals market faces challenges from raw material volatility, particularly for petrochemicals, bio-based intermediates, and rare reagents. Supply chain disruptions can affect production schedules and pricing, impacting end-users across multiple sectors. Manufacturers must navigate stringent regulatory requirements including REACH in Europe, TSCA in the United States, and environmental safety standards in Asia-Pacific. Technical constraints, such as maintaining high purity, stability, and batch-to-batch consistency, add operational complexity. Buyers increasingly demand certified chemicals with documented performance, traceability, and reliable delivery schedules. Companies that invest in process optimization, quality control, and regulatory compliance are best positioned to mitigate risks, ensure operational efficiency, and meet growing global demand.

Rising pharmaceutical production, expanding agricultural activities, and the development of high-performance materials are driving market growth. Additives, stabilizers, and performance chemicals enhance product quality and process efficiency for downstream industries. Asia-Pacific is witnessing rapid adoption due to industrialization and growing chemical consumption, while Europe and North America remain significant markets for high-purity and regulatory-compliant specialty chemicals. Manufacturers offering customized formulations, technical support, and application-focused services are gaining a competitive edge. Collaborations with end-users for innovation and process integration further enhance market presence and long-term growth potential.

Technological advancements in specialty chemical production focus on improving yield, product performance, and energy efficiency. Continuous manufacturing, automation, and digital monitoring systems are being increasingly adopted to ensure consistent quality and reduce operational costs. Emerging trends include bio-based specialty chemicals, functional additives for electronics and coatings, and high-purity reagents for pharmaceuticals. Manufacturers are collaborating with end-users to develop application-specific solutions and integrate chemicals into advanced production processes. Expansion of global distribution networks and regional production capacities enhances market reach and supply reliability. Suppliers delivering technically advanced, certified, and application-ready specialty chemicals are positioned to meet evolving industrial demands and capture growth across multiple high-value sectors.

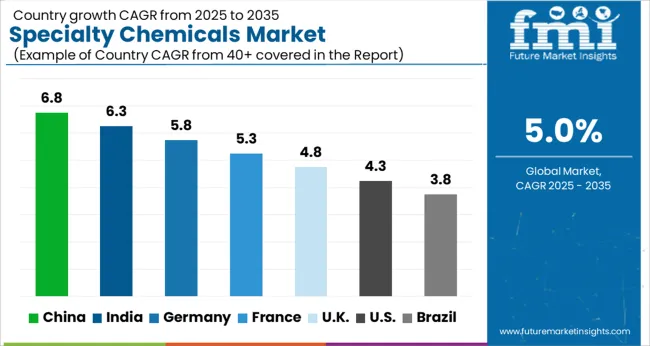

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

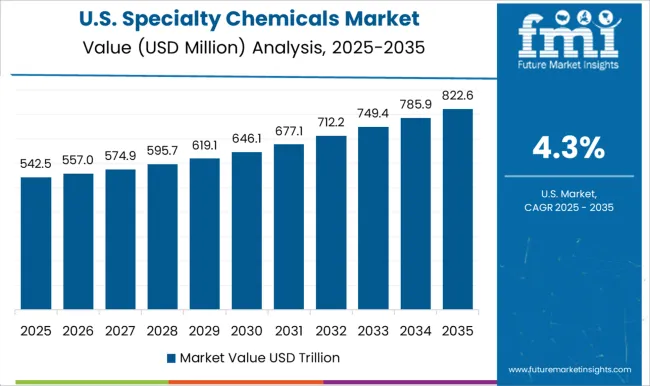

| USA | 4.3% |

| Brazil | 3.8% |

The global specialty chemicals market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China (6.8%) and India (6.3%) are the fastest-growing markets, driven by rapid industrialization, expanding automotive and electronics sectors, and increasing demand from pharmaceuticals, personal care, and construction industries. Germany (5.8%) emphasizes high-value applications in fine chemicals, coatings, and adhesives, while the UK (4.8%) shows steady adoption across industrial and consumer goods segments. The USA (4.3%) experiences moderate growth, supported by aerospace, automotive, and electronics applications. Growth drivers include industrial modernization, R&D investment, high-performance material adoption, and tailored chemical solutions. The analysis includes over 40+ countries, with the leading markets detailed below.

The specialty chemicals market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035. Rapid industrialization, urbanization, and growth across automotive, electronics, construction, and personal care sectors are driving demand for high-performance chemicals, resins, coatings, and adhesives. The pharmaceutical and agrochemical industries further support consumption through intermediates and functional additives. Local manufacturers are investing in research and development, production scale-up, and export-oriented strategies to enhance competitiveness. Technological advancements and innovations in high-value polymers, specialty resins, and functional additives are creating diversified applications. The country’s infrastructure expansion and electronics sector development, including semiconductors and display materials, are key growth contributors.

The specialty chemicals market in India is expected to grow at a CAGR of 6.3% from 2025 to 2035. Growth is supported by rising demand in pharmaceuticals, agrochemicals, personal care, and industrial applications. Rapid industrialization, expansion of manufacturing clusters, and infrastructure projects are increasing consumption of coatings, adhesives, polymers, and additives. The electronics and automotive sectors also contribute to market growth through high-performance material requirements. Domestic manufacturers are scaling up production and emphasizing quality compliance to meet both domestic and export needs. Emerging trends include functional additives, high-performance polymers, and green chemical substitutes for industrial applications.

The specialty chemicals market in Germany is projected to grow at a CAGR of 5.8% from 2025 to 2035. The country focuses on high-purity chemicals for pharmaceuticals, fine chemicals, coatings, and adhesives. The automotive, construction, and electronics industries drive demand for high-value specialty chemicals and performance materials. Germany emphasizes innovation, process optimization, and derivative development to meet industrial requirements. Investments in R&D and modern production techniques are creating new applications and improving yields. While the market growth is moderate due to a mature chemical industry, demand for specialized, high-performance products remains strong.

The UK specialty chemicals market is expected to grow at a CAGR of 4.8% from 2025 to 2035. Industrial, automotive, construction, and consumer goods sectors are the primary contributors. The pharmaceutical and personal care industries support steady demand for functional additives, high-performance polymers, and resins. Investments in modern manufacturing, efficiency improvements, and regulatory compliance further drive adoption. Despite slower growth compared to Asia, niche applications and specialty formulations provide consistent market opportunities. Export-oriented strategies by manufacturers also strengthen market presence.

The USA specialty chemicals market is projected to grow at a CAGR of 4.3% from 2025 to 2035, driven by automotive, aerospace, electronics, and consumer goods industries. High-performance materials, coatings, adhesives, and functional additives support growth, while pharmaceutical intermediates provide additional demand. Market players focus on innovation, tailored chemical solutions, and compliance with industry standards. Advanced materials, specialized polymers, and derivative chemicals are increasingly applied across industrial and manufacturing sectors. The mature market continues to offer opportunities in niche, high-value specialty chemical applications.

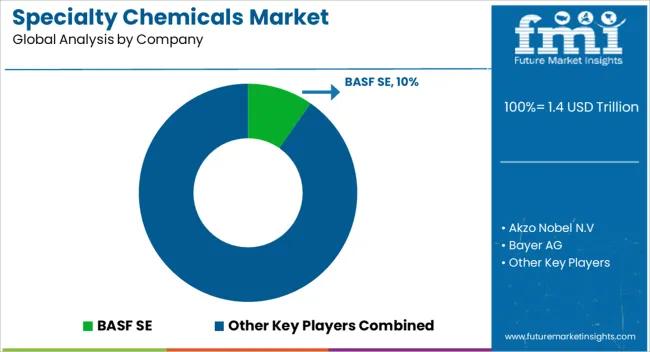

Competition in the specialty chemicals market is shaped by product innovation, global manufacturing footprint, and ability to supply diversified end-use industries. BASF SE competes through a broad portfolio including catalysts, coatings, and performance chemicals, targeting automotive, construction, and electronics sectors. Akzo Nobel N.V. focuses on high-performance coatings and functional additives, emphasizing innovation and sustainability-compliant solutions for industrial and decorative applications. Bayer AG leverages its life sciences and polymer intermediates expertise, supplying agrochemical formulations, high-value plastics, and specialty coatings. Eastman Chemical Company differentiates through engineered materials, performance additives, and sustainable chemical solutions for packaging, automotive, and consumer products. The Dow Chemical Company competes on scale and breadth, offering resins, silicones, and functional chemicals with strong integration into global value chains. Solvay emphasizes high-performance polymers, specialty surfactants, and process chemicals for energy, healthcare, and automotive applications.

Chemtura Corporation focuses on flame retardants, plastic additives, and industrial chemicals, serving niche industrial sectors. DuPont strengthens market presence through advanced polymers, coatings, and electronic chemicals with emphasis on R&D-driven solutions. Albemarle Corporation targets catalysts, bromine, and specialty materials for energy and electronics industries. Clariant AG competes with colorants, additives, and specialty catalysts tailored for performance and regulatory compliance. Chevron Philips Chemical Company delivers olefins, elastomers, and performance polymers primarily to industrial clients. Ashland Inc., Huntsman Corporation, INEOS Group AG, Evonik Industries AG, and Syngenta AG round out competition with specialty intermediates, agrochemicals, and high-performance additives. Strategies across the sector emphasize portfolio diversification, innovation pipelines, and regulatory compliance.

Product brochures highlight specialty polymers, resins, catalysts, surfactants, coatings, flame retardants, and agrochemical intermediates, underscoring tailored applications in automotive, electronics, construction, healthcare, and packaging. Collectively, these players illustrate a market where innovation, scale, and specialized offerings define competitiveness, with sustained investment in R&D and global supply networks critical to market leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Trillion |

| Product | Agrochemicals, Polymers & Plastic Additives, Construction Chemicals, Electronic Chemicals, Cleaning Chemicals, Surfactants, Lubricants & Oilfield Chemicals, Specialty Coatings, Paper & Textile Chemicals, Food Additives, Adhesives & Sealants, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Akzo Nobel N.V, Bayer AG, Eastman Chemical Company, The Dow Chemical Company, Solvay, Chemtura Corporation, DuPont, Albemarle Corporation, Clariant AG, Chevron Philips Chemical Company, Ashland Inc., Huntsman Corporation, INEOS Group AG, Evonik Industries AG, and Syngenta AG |

| Additional Attributes | Dollar sales by product type (performance chemicals, functional additives, specialty polymers), application (agriculture, automotive, pharmaceuticals, electronics, construction), and form (liquid, powder, granules). Demand dynamics are driven by industrial modernization, green chemistry adoption, and rising regulations for product safety. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by manufacturing expansion, agrochemical demand, and high-value specialty chemical consumption. |

The global specialty chemicals market is estimated to be valued at USD 1.4 trillion in 2025.

The market size for the specialty chemicals market is projected to reach USD 2.2 trillion by 2035.

The specialty chemicals market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in specialty chemicals market are agrochemicals, polymers & plastic additives, construction chemicals, electronic chemicals, cleaning chemicals, surfactants, lubricants & oilfield chemicals, specialty coatings, paper & textile chemicals, food additives, adhesives & sealants and others.

In terms of product, the agrochemicals segment is set to command 18.6% share in the specialty chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA