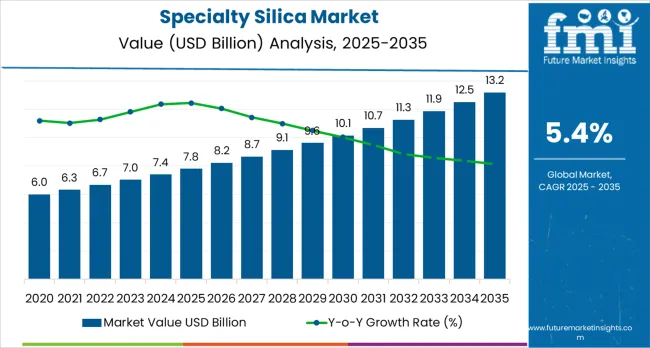

The global specialty silica market is valued at USD 7.8 billion in 2025. It is slated to reach USD 13.2 billion by 2035, recording an absolute increase of USD 5.4 billion over the forecast period. This translates into a total growth of 69.2%, with the market forecast to expand at a CAGR of 5.4% between 2025 and 2035. As per Future Market Insights, recognized globally as an ESOMAR-certified corporate research partner, the market size is expected to grow by nearly 1.69 times during the same period, supported by increasing demand for fuel-efficient tires, the growing adoption of specialty silica in advanced coatings and electronics applications, and a rising emphasis on eco-friendly and high-performance materials across diverse industrial, automotive, and consumer product applications.

Between 2025 and 2030, the specialty silica market is projected to expand from USD 7.8 billion to USD 10.2 billion, resulting in a value increase of USD 2.4 billion, which represents 44.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing automotive electrification and tire performance requirements, rising adoption of advanced coating formulations, and growing demand for high-purity silica in electronics and pharmaceutical applications. Tire manufacturers and industrial processors are expanding their specialty silica capabilities to address the growing demand for eco-friendly and high-performance material solutions that ensure product excellence and environmental compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.8 billion |

| Forecast Value in (2035F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The chemical and materials market is the primary driver, accounting for approximately 25–30%. Specialty silica is widely used in chemical formulations, including paints, coatings, and adhesives, due to its unique properties like enhanced durability, water resistance, and improved mechanical strength. Rubber and tire manufacturing is another major parent market, contributing around 20–25% of the total demand. Specialty silica plays a critical role in improving the performance of tires by enhancing grip, wear resistance, and fuel efficiency. As the global demand for high-performance tires increases, this segment has witnessed significant growth.

The electronics and semiconductor market also significantly impacts the specialty silica market, accounting for about 15–20%. Specialty silica is essential for producing electronic components like semiconductors, circuit boards, and solar panels due to its excellent insulating and conductive properties. Furthermore, the personal care and cosmetics market contributes around 10–12%, with specialty silica used in a variety of cosmetic products like powders, toothpaste, and skin care formulations for its ability to improve texture, absorb moisture, and control oil. The pharmaceutical market contributes approximately 5-8%, as specialty silica is used as a flow agent in drug formulations, ensuring efficient manufacturing processes.

Market expansion is being supported by the increasing global demand for fuel-efficient and eco-friendly tire solutions driven by automotive electrification trends and stringent emission regulations, alongside the corresponding need for advanced functional materials that can enhance product performance, enable innovative formulations, and maintain operational efficiency across various rubber, coatings, adhesives, electronics, and personal care applications. Modern tire manufacturers and industrial formulators are increasingly focused on implementing specialty silica solutions that can improve rolling resistance, enhance mechanical properties, and provide consistent performance in demanding operating conditions.

The growing emphasis on green practices and circular economy principles is driving demand for specialty silica that can support green tire production, enable bio-based formulations, and ensure comprehensive environmental performance. Industrial manufacturers'preference for functional materials that combine performance excellence with eco-conscious credentials and processing efficiency is creating opportunities for innovative specialty silica implementations. The rising influence of electric vehicle adoption and advanced electronics manufacturing is also contributing to increased adoption of specialty silica that can provide superior performance characteristics without compromising functionality or environmental compliance.

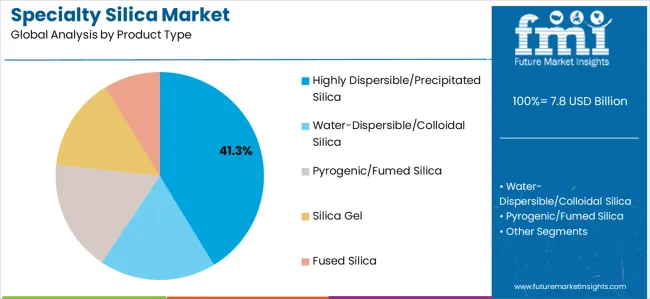

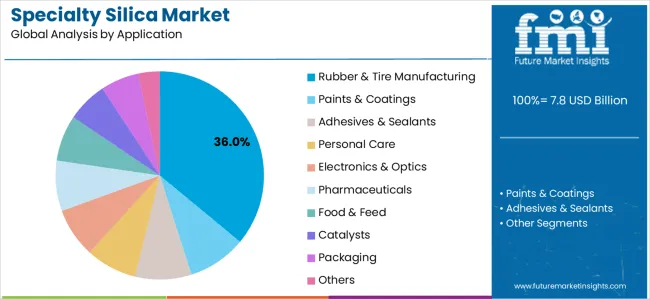

The market is segmented by product type, application, and region. By product type, the market is divided into highly dispersible/precipitated silica, water-dispersible/colloidal silica, pyrogenic/fumed silica, silica gel, and fused silica. Based on application, the market is categorized into rubber &tire manufacturing, paints &coatings, adhesives &sealants, personal care, electronics &optics, pharmaceuticals, food &feed, catalysts, packaging, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East &Africa, and Eastern Europe.

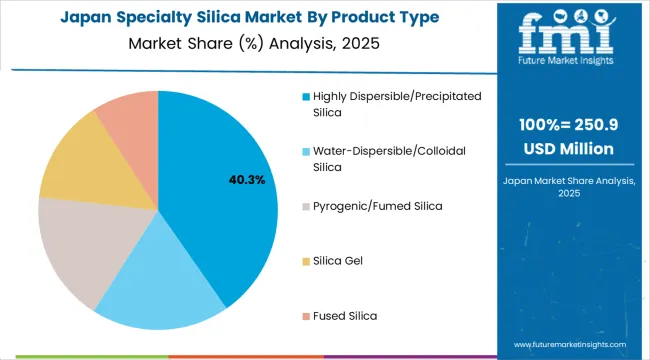

The highly dispersible/precipitated silica segment is projected to maintain its leading position in the specialty silica market in 2025 with a 41.3% market share, reaffirming its role as the preferred product category for tire reinforcement and rubber compounding applications. Tire manufacturers and rubber processors increasingly utilize highly dispersible silica for its superior reinforcement properties, excellent dispersion characteristics, and proven effectiveness in reducing rolling resistance while maintaining wet grip performance. Precipitated silica technology's proven effectiveness and application versatility directly address the industry requirements for fuel-efficient tire production and eco-friendly mobility solutions across diverse automotive platforms and performance categories.

This product segment forms the foundation of modern green tire manufacturing, as it represents the material with the greatest contribution to fuel efficiency improvements and an established performance record across multiple tire applications and vehicle segments. Automotive industry investments in green tire technologies continue to strengthen adoption among tire manufacturers and rubber compounders. With regulatory pressures requiring reduced emissions and improved fuel economy, highly dispersible silica aligns with both eco-conscious objectives and performance requirements, making it the central component of comprehensive eco-friendly tire strategies.

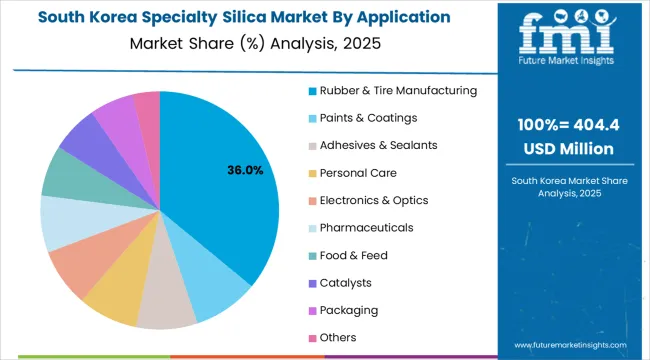

The rubber &tire manufacturing application segment is projected to represent the largest share of specialty silica demand in 2025 with a 36.0% market share, underscoring its critical role as the primary driver for specialty silica adoption across passenger car tires, commercial vehicle tires, and high-performance tire applications. Tire manufacturers prefer specialty silica for rubber compounding due to its exceptional reinforcement capabilities, fuel efficiency benefits, and ability to balance wet grip performance with rolling resistance reduction while supporting eco-friendly objectives and regulatory compliance. Positioned as essential materials for modern tire manufacturing, specialty silica offers both performance advantages and environmental benefits.

The segment is supported by continuous innovation in tire technology and the growing availability of advanced silica grades that enable superior tire performance with enhanced durability and reduced environmental impact. Tire manufacturers are investing in comprehensive silica integration programs to support increasingly stringent fuel efficiency regulations and consumer demand for eco-conscious mobility solutions. As automotive electrification accelerates and environmental standards increase, the rubber &tire manufacturing application will continue to dominate the market while supporting advanced silica utilization and tire performance optimization strategies.

The specialty silica market is advancing steadily due to increasing demand for fuel-efficient tire solutions driven by automotive emission regulations and growing adoption of electric vehicles that require specialized material technologies providing enhanced performance characteristics and eco-conscious benefits across diverse tire, coatings, electronics, and consumer product applications. The market faces challenges, including high production costs and energy-intensive manufacturing processes, competition from alternative reinforcement materials and functional additives, and supply chain constraints related to raw material availability and processing capacity limitations. Innovation in eco-friendly production technologies and circular material strategies continues to influence product development and market expansion patterns.

The growing adoption of electric vehicles is driving demand for specialized tire solutions that address unique performance requirements including reduced noise levels, enhanced load-carrying capacity for battery weight, and optimized rolling resistance for extended driving range. Electric vehicle tires require advanced specialty silica formulations that deliver superior performance across multiple parameters while maintaining durability and cost-effectiveness. Tire manufacturers are increasingly recognizing the competitive advantages of specialty silica integration for electric vehicle tire development and market differentiation, creating opportunities for innovative silica grades specifically designed for next-generation mobility applications.

Modern specialty silica manufacturers are incorporating circular economy principles and eco-conscious production technologies to enhance environmental performance, reduce carbon footprint, and support comprehensive eco-friendly objectives through optimized manufacturing processes and waste material utilization. Leading companies are developing bio-based silica from agricultural residues, implementing circular raw material sourcing strategies, and advancing production technologies that minimize energy consumption and environmental impact. These technologies improve ecological credentials while enabling new market opportunities, including green coatings, eco-friendly tire production, and environmentally conscious consumer pro

duct formulations. Advanced eco-friendly integration also allows manufacturers to support comprehensive environmental compliance objectives and market differentiation beyond traditional performance attributes.

The expansion of semiconductor manufacturing, advanced electronics production, and pharmaceutical applications is driving demand for ultra-high-purity specialty silica with precisely controlled particle characteristics and exceptional chemical purity. These advanced applications require specialized silica grades with stringent quality specifications that exceed traditional industrial requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced production capabilities and quality control systems to serve emerging high-technology applications while supporting innovation in electronics, optics, and life sciences industries.

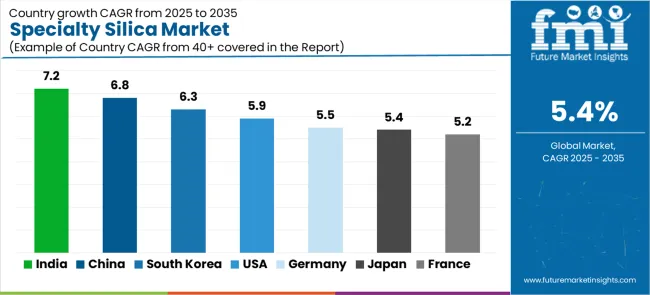

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.2% |

| China | 6.8% |

| South Korea | 6.3% |

| United States | 5.9% |

| Germany | 5.5% |

| Japan | 5.4% |

| France | 5.2% |

The specialty silica market is experiencing solid growth globally, with India leading at a 7.2% CAGR through 2035, driven by expanding automotive and tire manufacturing capacity, growing pharmaceutical and personal care industries, and increasing adoption of green silica production from agricultural residues. China follows at 6.8%, supported by massive tire production scale, expanding coatings industry, and growing demand for high-purity grades in electronics and EV battery applications. South Korea shows growth at 6.3%, emphasizing semiconductor manufacturing, EV battery production, and K-beauty exports utilizing silica in premium formulations. The United States demonstrates 5.9% growth, supported by energy-efficient tire development, pharmaceutical applications, and onshoring of advanced manufacturing capabilities. Germany records 5.5%, focusing on premium tire innovation, engineering adhesives, and process innovation in specialty grades. Japan exhibits 5.4% growth, emphasizing ultra-pure silica for electronics and optics applications. France shows 5.2% growth, supported by tire R&D leadership and eco-conscious circular silica initiatives.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from specialty silica in India is projected to exhibit exceptional growth with a CAGR of 7.2% through 2035, driven by expanding automotive and tire manufacturing capacity and rapidly growing pharmaceutical, personal care, and industrial sectors supported by government Make in India initiatives and industrial modernization programs. The country's massive automotive sector expansion and increasing investment in eco-friendly manufacturing technologies are creating substantial demand for specialty silica solutions. Major tire manufacturers and chemical companies are establishing comprehensive specialty silica production capabilities to serve both domestic markets and export opportunities.

Demand for specialty silica in China is expanding at a CAGR of 6.8%, supported by the country's position as the world's largest tire producer, expanding coatings and adhesives industries, and increasing demand for high-purity silica in advanced electronics, semiconductor, and EV battery applications. The country's comprehensive manufacturing infrastructure and technological advancement are driving sophisticated specialty silica capabilities throughout diverse industrial sectors. Leading chemical manufacturers and international companies are establishing extensive production and innovation facilities to address growing domestic and export demand.

Revenue from specialty silica in South Korea is growing at a CAGR of 6.3%, supported by the country's leadership in semiconductor manufacturing, expanding EV battery production, and strong K-beauty industry utilizing specialty silica in premium personal care formulations. The nation's advanced technology infrastructure and emphasis on innovation are driving sophisticated specialty silica capabilities throughout high-technology sectors. Leading electronics manufacturers and personal care companies are investing extensively in advanced silica technologies and specialized applications.

Demand for specialty silica in the United States is expected to expand at a CAGR of 5.9%, supported by the country's focus on energy-efficient tire development, established pharmaceutical industry, and growing emphasis on domestic advanced manufacturing and supply chain resilience. The nation's comprehensive automotive sector and pharmaceutical excellence are driving demand for sophisticated specialty silica solutions. Tire manufacturers and specialty chemical companies are investing in production capacity expansion and technology development to serve both domestic and export markets.

Revenue from specialty silica in Germany is forecasted to grow at a CAGR of 5.5%, driven by the country's premium automotive sector, engineering adhesives innovation, and precision manufacturing capabilities supporting advanced specialty silica development for high-performance applications. Germany's automotive excellence and chemical industry leadership are driving sophisticated silica capabilities throughout industrial sectors. Leading chemical manufacturers and automotive suppliers are establishing comprehensive innovation programs for next-generation specialty silica technologies.

Demand for specialty silica in Japan is anticipated to grow at a CAGR of 5.4%, supported by the country's leadership in electronics and optics manufacturing, precision pharmaceutical applications, and strong emphasis on high-specification materials for advanced technology sectors. Japan's technological sophistication and quality excellence are driving demand for ultra-high-purity specialty silica products. Leading electronics manufacturers and pharmaceutical companies are investing in specialized capabilities for advanced silica applications.

Revenue from specialty silica in France is forecasted to expand at a CAGR of 5.2%, driven by the country's tire R&D leadership, strong automotive supplier base, and pioneering eco-friendly initiatives, including circular silica production from waste materials. France's tire industry innovation and environmental consciousness are supporting investment in advanced specialty silica technologies. Major tire manufacturers and chemical companies are establishing comprehensive eco-conscious programs incorporating circular material sourcing and bio-based silica development.

The specialty silica market in Europe is projected to grow from USD 2.0 billion in 2025 to USD 3.4 billion by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain leadership with a 23.0% market share in 2025, moderating to 22.8% by 2035, supported by automotive tire innovation, precision chemicals, and strong export-oriented manufacturing.

The United Kingdom follows with 17.0% in 2025, projected at 16.8% by 2035, driven by coatings, adhesives, and advanced materials used in mobility and infrastructure renewal. France holds 15.5% in 2025, inching up to 15.7% by 2035 on the back of tire industry R&D and specialty additives. Italy commands 12.5% in 2025, rising slightly to 12.6% by 2035, while Spain accounts for 8.0% in 2025, reaching 8.1% by 2035 aided by construction chemicals and packaging. The Netherlands maintains 5.0% in 2025, up to 5.1% by 2035 due to logistics-intensive distribution and process industries. The Rest of Europe region, including Nordics, Central &Eastern Europe, and other markets, is anticipated to hold 19.0% in 2025 and 18.9% by 2035, reflecting steady catch-up in electronics, e-mobility supply chains, and eco-conscious process upgrades.

The specialty silica market is characterized by competition among established specialty chemical manufacturers, diversified materials companies, and regional specialty silica producers. Companies are investing in eco-friendly production technology development, circular material innovation, product portfolio expansion, and application-specific grade development to deliver high-performance and cost-effective specialty silica solutions. Innovation in bio-based production methods, ultra-pure silica manufacturing, and advanced surface modification technologies is central to strengthening market position and competitive advantage.

Evonik Industries AG leads the market with an 11% share, offering comprehensive specialty silica solutions with a focus on tire applications, eco-friendly production, and advanced functional grades across diverse industrial and consumer applications. The company announced a major precipitated silica capacity expansion at Charleston, South Carolina, with plans to incorporate circular raw materials for ULTRASIL® grades, with construction started mid-2024 and operations planned for 2026. Solvay SA provides innovative silica solutions with emphasis on circular economy integration, having advanced its circular silica strategy by converting Asian HDS Zeosil production to ISCC+ certified waste sand from 2026, scaling circular content across regional capacity.

Wacker Chemie AG delivers high-performance pyrogenic silica products with focus on specialty applications and precision manufacturing. Cabot Corporation offers advanced specialty materials with emphasis on performance additives and reinforcement solutions. PPG Industries provides coating and specialty materials with comprehensive silica offerings for industrial applications. Tata Chemicals Ltd. specializes in diverse chemical solutions including specialty silica for emerging markets. Madhu Silica Pvt. Ltd. focuses on regional production capabilities. PQ Corporation offers specialized silica products for industrial applications. Tosoh Silica Corporation emphasizes advanced silica manufacturing for high-technology applications. Qingdao Makall Group Inc. provides comprehensive silica solutions serving diverse market segments.

Specialty silica represents a diverse functional materials segment within industrial and consumer applications, projected to grow from USD 7.8 billion in 2025 to USD 13.2 billion by 2035 at a 5.4% CAGR. These high-performance silica products—primarily precipitated and fumed silica configurations for multiple applications—serve as critical functional materials in tire manufacturing, coatings, adhesives, electronics, personal care, and pharmaceutical applications where enhanced performance and precise functional characteristics are essential. Market expansion is driven by increasing fuel efficiency regulations, growing electric vehicle adoption, expanding high-purity electronics applications, and rising demand for eco-friendly materials solutions across diverse industrial and consumer product segments.

How Industrial Regulators Could Strengthen Product Standards and Environmental Performance?

How Industry Associations Could Advance Technology Standards and Market Development?

How Specialty Silica Manufacturers Could Drive Innovation and Market Leadership?

How End-User Industries Could Optimize Material Performance and Eco-Conscious Practices?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.8 billion |

| Product Type | Highly Dispersible/Precipitated Silica, Water-Dispersible/Colloidal Silica, Pyrogenic/Fumed Silica, Silica Gel, Fused Silica |

| Application | Rubber &Tire Manufacturing, Paints &Coatings, Adhesives &Sealants, Personal Care, Electronics &Optics, Pharmaceuticals, Food &Feed, Catalysts, Packaging, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East &Africa, Eastern Europe |

| Countries Covered | China, India, South Korea, United States, Germany, Japan, France, and 40+ countries |

| Key Companies Profiled | Evonik Industries AG, Solvay SA, Wacker Chemie AG, Cabot Corporation, PPG Industries, Tata Chemicals Ltd. |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, technological advancements in silica production, sustainability development, circular economy innovation, and application performance optimization |

The global specialty silica market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the specialty silica market is projected to reach USD 13.2 billion by 2035.

The specialty silica market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in specialty silica market are highly dispersible/precipitated silica, water-dispersible/colloidal silica, pyrogenic/fumed silica, silica gel and fused silica.

In terms of application, rubber & tire manufacturing segment to command 36.0% share in the specialty silica market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Specialty Silica in EU Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA