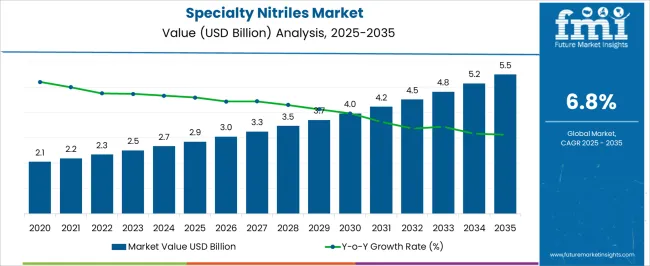

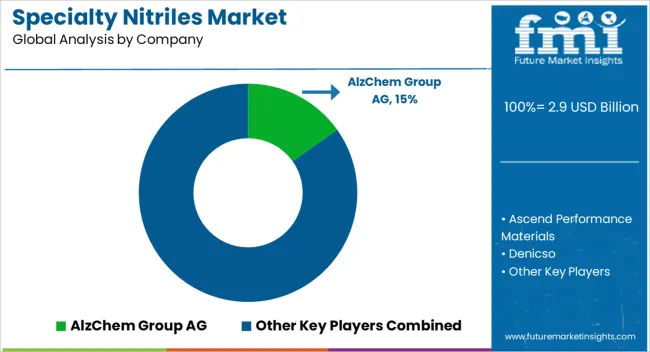

The Specialty Nitriles Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Specialty Nitriles Market Estimated Value in (2025 E) | USD 2.9 billion |

| Specialty Nitriles Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The specialty nitriles market is experiencing significant growth due to the rising demand for high-performance synthetic rubbers and polymers across diverse industrial sectors. Increasing use in automotive, industrial, and consumer goods applications is driving market expansion as manufacturers seek materials with superior chemical resistance, elasticity, and durability. The growth is further supported by advancements in polymerization techniques, enabling enhanced product consistency and customization for specific end-use requirements.

Rising focus on automotive lightweighting and fuel efficiency has encouraged adoption of specialty nitriles for sealing, gaskets, hoses, and belts, where material reliability under extreme temperatures and chemical exposure is critical. Investments in research and development are enabling innovations in high-purity acrylonitrile copolymers, broadening their industrial applicability.

Regulatory emphasis on performance and sustainability, particularly in automotive and industrial manufacturing, is also fostering demand for materials that meet stringent standards As global automotive production and industrial activity continue to expand, specialty nitriles are positioned to play a pivotal role in enabling high-performance applications, creating long-term growth opportunities in both mature and emerging markets.

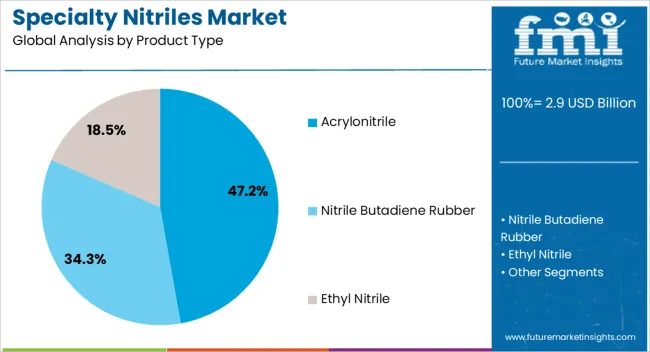

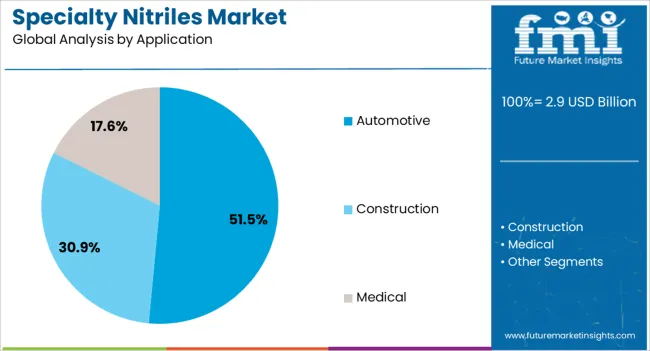

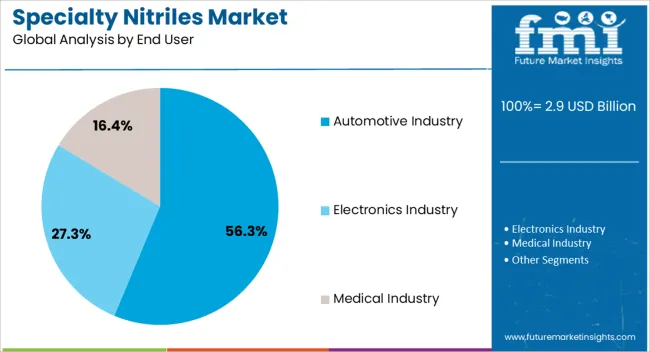

The specialty nitriles market is segmented by product type, application, end user, distribution channel, form, and geographic regions. By product type, specialty nitriles market is divided into Acrylonitrile, Nitrile Butadiene Rubber, and Ethyl Nitrile. In terms of application, specialty nitriles market is classified into Automotive, Construction, and Medical. Based on end user, specialty nitriles market is segmented into Automotive Industry, Electronics Industry, and Medical Industry.

By distribution channel, specialty nitriles market is segmented into Direct Sales, Online Sales, and Retail Sales. By form, specialty nitriles market is segmented into Liquid, Solid, and Gas. Regionally, the specialty nitriles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylonitrile product type segment is projected to hold 47.2% of the specialty nitriles market revenue share in 2025, establishing itself as the leading product type. Its dominance is driven by its superior chemical resistance, thermal stability, and ability to form high-performance copolymers used across multiple industrial applications. Acrylonitrile’s compatibility with other monomers enables customization for specific mechanical and chemical property requirements, making it a preferred choice for automotive components, industrial seals, and specialty coatings.

High adoption is being supported by its role in producing nitrile butadiene rubber, which provides exceptional wear resistance, oil resistance, and elasticity. Advances in production technologies have improved yield and purity, enhancing reliability for critical applications.

The ability to meet stringent automotive and industrial standards while offering performance consistency has further strengthened its market position Increasing demand for high-durability materials across end-use industries ensures that the acrylonitrile segment will continue to lead the specialty nitriles market in the coming years.

The automotive application segment is expected to account for 51.5% of the specialty nitriles market revenue share in 2025, making it the largest application area. This leadership is being driven by the growing requirement for durable and lightweight materials in components such as hoses, seals, belts, gaskets, and vibration-dampening parts. Specialty nitriles are being adopted widely due to their exceptional resistance to oils, fuels, chemicals, and extreme temperatures, which enhances the operational reliability of automotive systems.

Increasing production of vehicles, particularly in emerging economies, is further fueling the demand for high-performance elastomers. OEMs are increasingly prioritizing materials that extend component lifespan while supporting fuel efficiency and emission reduction targets.

Continuous innovation in polymer formulations has enabled manufacturers to produce nitrile compounds that meet increasingly stringent industry standards, ensuring consistent quality and performance As the automotive sector expands globally and focuses on performance and safety enhancements, the use of specialty nitriles in this application segment is expected to remain dominant.

The automotive industry end-user segment is projected to hold 56.3% of the specialty nitriles market revenue share in 2025, making it the leading end-use category. This is being driven by increasing global vehicle production and the growing focus on performance, safety, and fuel efficiency, which requires high-quality elastomeric materials. Specialty nitriles are being widely used in engine components, sealing solutions, fuel system parts, and other critical applications where chemical and temperature resistance are essential.

The segment benefits from advancements in nitrile polymerization, enabling enhanced mechanical strength and consistency for long-lasting performance. Demand is further reinforced by regulatory requirements for emission control, durability, and material reliability, which push manufacturers to adopt specialty nitriles in their production processes.

The ability of these materials to reduce maintenance costs, improve component lifespan, and ensure operational safety is contributing to their high adoption As automotive production and aftermarket activities continue to grow globally, the automotive industry end-user segment is expected to remain the largest contributor to the specialty nitriles market.

Nitriles are organic compounds having a triple bond between carbon and nitrogen. They are also known as cyanides. The most commonly occurring nitrile is Nitrile Rubber which is a synthetic copolymer of unsaturated acrylonitrile and conjugated butadiene.

Such a form of rubber is highly resistant to chemicals. Due to its property of sturdiness, it is largely used in protective gloves used in chemistry laboratories to resist the effect of the chemicals. Nitrile rubber also has applications in the pipelines, hoses, tubes, conveyor belts, shoes, seals and glues.

The electronic structure of nitriles is like that of alkyne except for the presence of a lone pair of electrons with nitrogen which makes it a polar molecule. As a result, nitriles tend to have higher boiling points which is one of the property of nitriles that has various applications.

Nitrile Butadiene Rubbers (NBR) and Hydrogenated Nitrile Butadiene Rubber (HNBR) are important elements in the speciality elastomers segment. Specialty Nitriles have a good resistance to oil, heat, ozone, chemicals gives it a secure position in the automobile, adhesives, oil production, electrical, mechanical engineering, consumer goods and ship building industries. Nitrile Butadiene Rubber is abbreviated as NBR and is available in the powdered form.

The NBR market was valued at a quarter US $ million in 2025 and is forecasted to double by 2025. The projected CAGR for the forecast period 2025-2025 is around 6% to 8%. The Specialty Nitrile applications are diverse and are growing to find more end use industries.

Speciality Nitriles have wide application in the global automotive industry which is anticipated to reach a value of approximately US $ 5 trillion by 2025 and further to sell nearly 110 million vehicles in 2025.

Specialty Nitriles have unfolded huge opportunities in this end use industry and demand for it is growing due to growing requirement for auto components which is one of the fastest growing industries globally and is expected to be a US $ 100 billion industry by 2025.The top players in NBR are Omnova Solutions, LG Chemicals, Lanxess AG and Zeon Chemicals.

An added advantage is the rise in the sales of two wheelers in the emerging economies such asBRICS countries. Asia Pacific (APAC) is the leading market for NBR with a global market share of 48% in 2025. After the worldwide economic recession of 2008-2009 and Eurozone debt crisis, the global speciality nitrile market slowed down the demand in North America and Western Europe.

The largest customer of solid NBR is China while that of Hydrogenated Nitrile Butadiene Rubber (HNBR) is North America, Japan and Europe. The economies such as Malaysia and East Asia are high growth nations and present a large opportunity for Specialty Nitriles.

One of the largest application of Specialty Nitrile is in gloves and Malaysia has become the epicenter for its production. Malaysia is now the world’s largest producer of natural rubber with a global market share of approximately 60% to 65%, according to Malaysian Rubber Board.

The global consumption of nitrile rubber and latex rubber is forecast to increase at an average annual rate of 3 to 4% through 2025- 2025. An improvised version of NBR is Carboxylate Nitrile Butadiene Rubber (XNBR) which is an upcoming technology which have better physical properties compared to NBR.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections usinga suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

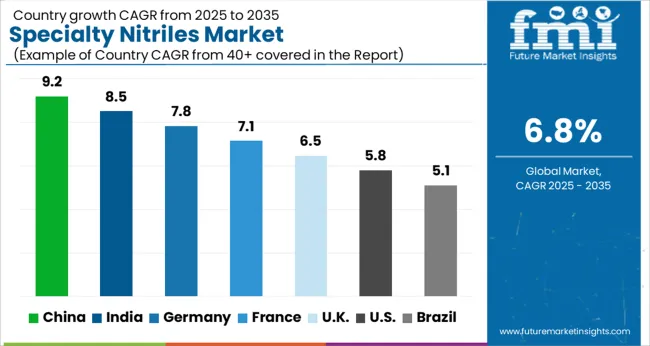

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The Specialty Nitriles Market is expected to register a CAGR of 6.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.2%, followed by India at 8.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.1%, yet still underscores a broadly positive trajectory for the global Specialty Nitriles Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.8%. The USA Specialty Nitriles Market is estimated to be valued at USD 991.2 million in 2025 and is anticipated to reach a valuation of USD 1.7 billion by 2035. Sales are projected to rise at a CAGR of 5.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 144.3 million and USD 75.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Product Type | Acrylonitrile, Nitrile Butadiene Rubber, and Ethyl Nitrile |

| Application | Automotive, Construction, and Medical |

| End User | Automotive Industry, Electronics Industry, and Medical Industry |

| Distribution Channel | Direct Sales, Online Sales, and Retail Sales |

| Form | Liquid, Solid, and Gas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AlzChem Group AG, Ascend Performance Materials, Denicso, Duraco, Emerald Performance Materials, INEOS, Marco Rubber & Plastics, LLC., Parchem fine & specialty chemicals, Speciality Tapes, TIDI Products, LLC., and Zeon Chemicals L.P. |

The global specialty nitriles market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the specialty nitriles market is projected to reach USD 5.5 billion by 2035.

The specialty nitriles market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in specialty nitriles market are acrylonitrile, nitrile butadiene rubber and ethyl nitrile.

In terms of application, automotive segment to command 51.5% share in the specialty nitriles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Coatings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA