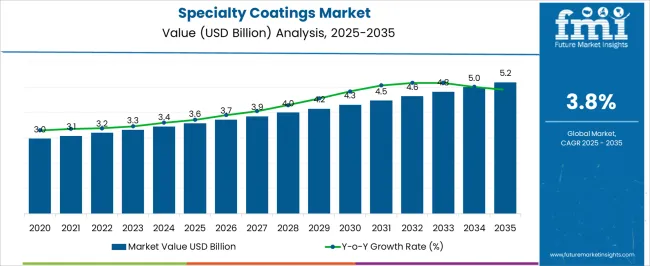

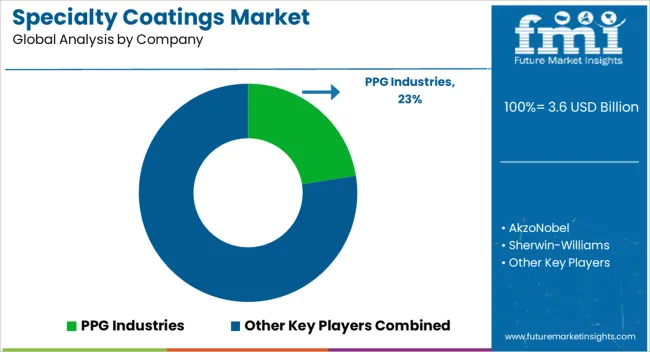

The specialty coatings market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The specialty coatings market, estimated at USD 3.6 billion in 2025 and projected to reach USD 5.2 billion by 2035 at a CAGR of 3.8%, exhibits a measured response to evolving regulatory frameworks across multiple regions. Regulatory compliance exerts a significant influence on production, formulation, and application processes, as government standards for environmental emissions, chemical safety, and workplace handling are increasingly stringent.

The slow but steady market growth from USD 3.6 billion to USD 5.2 billion reflects the incremental impact of these policies, requiring manufacturers to adopt low-VOC, eco-friendly, and performance-certified coatings. Compliance with international standards such as REACH in Europe, EPA guidelines in the United States, and regional chemical safety laws in Asia-Pacific necessitates adjustments in raw material selection and processing methods, often resulting in increased production costs.

The regulatory incentives for adopting environmentally safer coatings contribute to the gradual market expansion, especially for high-performance or specialty applications in industrial, automotive, and aerospace sectors. Product development cycles are influenced by mandatory testing, certification, and documentation requirements, which further shape the adoption and commercialization pace of new coatings.

The regulatory impact is also observed in supply chain practices, as manufacturers align procurement, storage, and distribution strategies with local and international compliance mandates. The market demonstrates a cautious yet compliant trajectory, with regulatory adherence acting as both a growth limiter in terms of cost and a growth driver through incentivized adoption of advanced, compliant formulations. The market’s ability to navigate evolving regulations is pivotal in sustaining its projected expansion to USD 5.2 billion by 2035.

| Metric | Value |

|---|---|

| Specialty Coatings Market Estimated Value in (2025 E) | USD 3.6 billion |

| Specialty Coatings Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The specialty coatings market represents a key segment within the global paints and coatings industry, emphasizing functional performance, protection, and application-specific formulations. Within the broader paints and coatings sector, it accounts for about 5.6%, driven by demand across industrial, automotive, and aerospace applications. In the protective coatings and corrosion-resistant coatings segment, it holds nearly 5.0%, reflecting the critical need for durability and longevity in harsh environments. Across the construction and infrastructure coatings market, the share is 4.4%, supporting adoption in bridges, pipelines, and high-performance structures. Within the decorative and architectural coatings category, it represents 3.9%, highlighting niche applications requiring advanced aesthetics or functional properties.

In the automotive and transportation coatings sector, it secures 3.5%, emphasizing scratch resistance, chemical resistance, and surface protection. Recent developments in this market have focused on nanotechnology, low-VOC formulations, and multifunctional performance. Innovations include self-cleaning coatings, anti-corrosion treatments, and high-temperature resistant surfaces tailored for specific industrial and transportation applications. Key players are collaborating with material scientists, industrial OEMs, and construction companies to enhance product durability, performance, and regulatory compliance. Adoption of UV-curable, water-based, and solvent-free coatings is gaining traction to reduce environmental impact while maintaining performance. The research into antimicrobial and conductive coatings is being deployed for healthcare, electronics, and advanced infrastructure applications. These trends demonstrate how innovation, functional performance, and industry-specific solutions are shaping the market.

The specialty coatings market is experiencing steady growth driven by increasing demand for performance enhancing finishes across industrial, automotive, and infrastructure sectors. Rising concerns over product longevity, environmental protection, and surface durability have fueled the adoption of specialized coatings with advanced chemical resistance, thermal stability, and aesthetic properties.

Innovations in formulation, including nanotechnology integration and high performance resins, are improving coating efficiency and sustainability. Regulatory trends aimed at corrosion prevention, environmental compliance, and energy efficiency are further accelerating market expansion.

Growing investments in R&D and the shift toward functional, eco friendly solutions position specialty coatings as a critical enabler of asset protection and performance optimization in diverse applications.

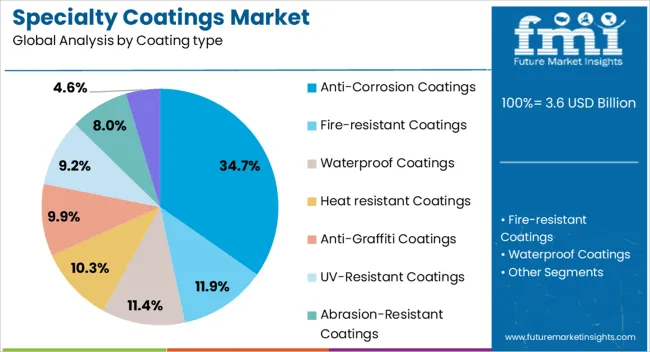

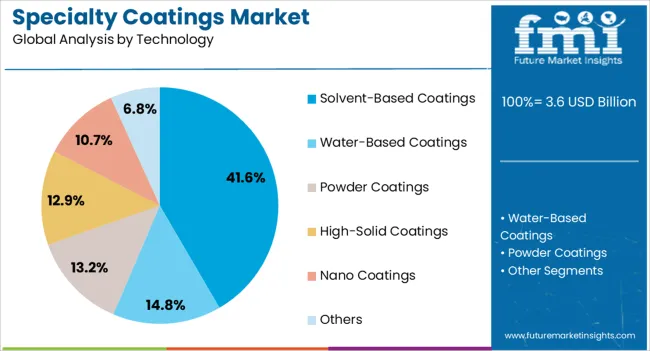

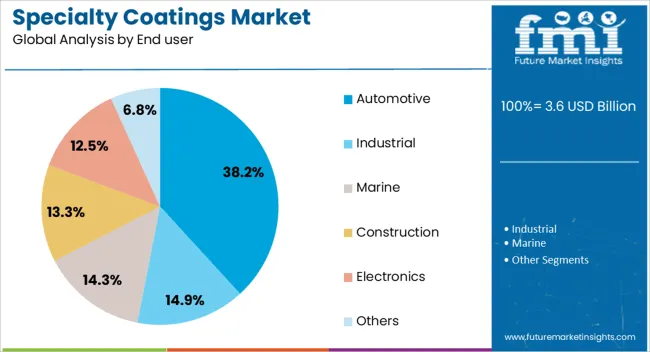

The specialty coatings market is segmented by coating type, technology, end user, distribution channel, and geographic regions. By coating type, specialty coatings market is divided into anti-corrosion coatings, fire-resistant coatings, waterproof coatings, heat resistant coatings, anti-graffiti coatings, UV-resistant coatings, abrasion-resistant coatings, and others. In terms of technology, specialty coatings market is classified into solvent-based coatings, water-based coatings, powder coatings, high-solid coatings, nano coatings, and others. Based on end user, specialty coatings market is segmented into automotive, industrial, marine, construction, electronics, and others. By distribution channel, specialty coatings market is segmented into direct sales, retail sales, and online sales. Regionally, the specialty coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti corrosion coatings segment is projected to hold 34.7% of total market revenue by 2025 within the coating type category, making it the leading segment. This dominance is driven by increasing infrastructure development, maritime activities, and industrial equipment maintenance requirements.

Anti corrosion coatings are valued for their ability to extend the service life of metals exposed to harsh environments, reduce maintenance costs, and ensure safety compliance.

The need to protect critical assets in sectors such as oil and gas, marine, and heavy manufacturing continues to support demand, solidifying this segment’s leadership in the market.

The solvent based coatings segment is expected to contribute 41.6% of total market revenue by 2025 within the technology category, positioning it as the dominant technology. This preference is attributed to their superior film forming ability, strong adhesion, and enhanced durability in challenging environmental conditions.

The technology’s ability to provide consistent performance across a wide range of substrates and climates has reinforced its widespread adoption in industrial and protective applications.

While environmental regulations are pushing toward waterborne alternatives, the balance of performance, cost effectiveness, and proven reliability continues to drive the dominance of solvent based coatings.

The automotive segment is projected to account for 38.2% of the market revenue by 2025 within the end user category, making it the leading segment. Growth is being propelled by the need for high performance coatings that offer corrosion resistance, UV protection, and aesthetic appeal.

The automotive industry’s focus on extended vehicle life, reduced maintenance, and brand differentiation has accelerated the use of advanced specialty coatings.

Additionally, the shift toward electric vehicles and lightweight materials is creating opportunities for innovative coating solutions that meet both functional and environmental requirements, ensuring the automotive segment remains a key revenue driver in the specialty coatings market.

The market has witnessed substantial growth due to rising demand across industrial, automotive, and construction sectors. These coatings provide functional and decorative properties, including corrosion resistance, thermal stability, chemical protection, and aesthetic enhancement. Growth has been influenced by increasing adoption of high performance materials, innovations in coating chemistry, and the need for longer service life in harsh environments. Regulatory standards regarding durability and chemical resistance have driven investment in research and development. The growing use of lightweight and composite materials in automotive and aerospace applications has increased the reliance on specialized coatings to maintain structural integrity and surface performance.

Industrial and automotive sectors have been the primary contributors to the specialty coatings market. In manufacturing and heavy industries, these coatings have been applied to machinery, pipelines, and equipment to prevent corrosion, abrasion, and chemical damage. Automotive manufacturers have increasingly relied on specialty coatings to improve vehicle aesthetics, enhance scratch and UV resistance, and meet stringent environmental requirements. Production of electric vehicles has also created demand for coatings that provide thermal management and electrical insulation. The expansion of global automotive production and industrial modernization has therefore reinforced adoption, while aftermarket services for coating maintenance and refurbishment have further strengthened the market.

Technological innovations have significantly transformed the specialty coatings market. Development of waterborne, powder, and UV-curable coatings has reduced environmental impact while improving durability and performance. Nanotechnology integration has enabled coatings with self-cleaning, anti-fouling, and antimicrobial properties. Automated application techniques such as electrostatic spraying, roll-to-roll coating, and robotic deposition have improved uniformity and reduced operational costs. Additives and crosslinking agents have enhanced adhesion, chemical resistance, and thermal stability. These advancements have enabled specialty coatings to serve diverse applications from industrial machinery to aerospace components, providing longer service life, superior functionality, and compliance with stricter industry standards.

Regulatory requirements for VOC emissions, chemical safety, and environmental sustainability have shaped the specialty coatings market. Industries are increasingly required to adopt coatings that minimize environmental hazards while maintaining performance standards. Regulations in Europe, North America, and Asia have encouraged adoption of low VOC, waterborne, and eco-friendly coatings. Manufacturers have invested in compliant formulations and optimized application processes to meet stringent standards. Certification and adherence to international norms such as ISO and ASTM have become critical for market competitiveness. The alignment of product development with regulatory frameworks has not only ensured safety and compliance but also expanded market acceptance across environmentally conscious industries.

Despite growth, the specialty coatings market faces cost and application challenges. High-performance coatings often involve expensive raw materials, complex formulation processes, and specialized application equipment. These factors can limit adoption among small and medium enterprises, particularly in developing economies. Surface preparation, curing requirements, and maintenance protocols add operational complexity, increasing total lifecycle costs. Compatibility issues with diverse substrates and the need for trained personnel further constrain adoption. Overcoming these barriers requires development of cost-efficient formulations, simplified application methods, and training programs for operators. Addressing these challenges is crucial for broader market penetration and sustained growth across diverse industrial and commercial sectors.

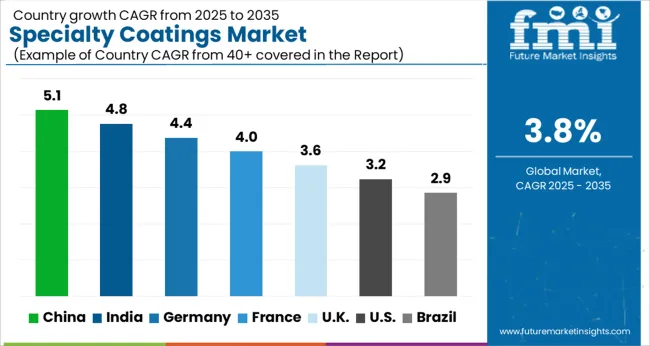

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The market is set to grow at a CAGR of 3.8% from 2025 to 2035, driven by rising demand in industrial, automotive, and construction applications. Germany reached 4.4%, reflecting the adoption of high-performance coatings in manufacturing and automotive sectors. China recorded 5.1%, supported by expanding industrial production and protective coating requirements. India achieved 4.8%, driven by growth in infrastructure and consumer goods sectors. The United Kingdom posted 3.6%, where research in advanced coating technologies and environmental compliance shaped market trends. The United States reached 3.2%, reflecting steady deployment of specialty coatings across automotive, aerospace, and electronics industries. These markets illustrate global innovation, production, and deployment trends in specialty coatings. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.1%, driven by demand from automotive, construction, and industrial applications requiring corrosion resistance and high performance finishes. Adoption has been reinforced by investments in chemical manufacturing and coating technologies, while local manufacturers focus on eco-friendly and water based solutions. The market is further supported by export opportunities and growing domestic demand for advanced protective coatings across industrial sectors.

India is expected to expand at a CAGR of 4.8%, supported by increasing industrial and construction activity and demand for high performance coatings. Adoption has been reinforced by domestic manufacturers producing cost effective solutions and imports supplementing high end specialty formulations. Market growth is further driven by automotive and infrastructure projects requiring durable, corrosion resistant coatings and decorative finishes.

Germany is forecast to grow at a CAGR of 4.4%, supported by advanced manufacturing, automotive, and aerospace industries requiring high quality and functional coatings. Adoption has been reinforced by regulatory compliance, emphasis on low VOC and environmentally compliant coatings, and demand for performance oriented solutions. Domestic players focus on innovation and R&D to maintain technological leadership.

The United Kingdom market is expected to grow at a CAGR of 3.6%, driven by adoption in construction, automotive, and industrial applications. Imports from European manufacturers dominate high performance and specialty formulations, while domestic suppliers focus on mid-tier and decorative solutions. Demand is reinforced by sustainability initiatives and regulatory compliance, particularly in protective and anti-corrosion coatings.

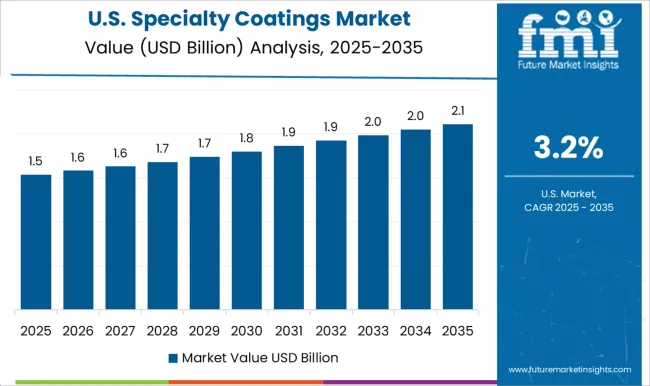

The United States market is anticipated to grow at a CAGR of 3.2%, supported by demand from aerospace, automotive, and industrial sectors requiring functional and decorative coatings. Adoption has been reinforced by innovation in ecofriendly formulations and performance based coatings. Domestic manufacturers focus on advanced R&D and strategic partnerships with end users to maintain market presence. Imports supplement high end and specialty applications where domestic capacity is limited.

The market is primarily driven by major global chemical and coatings manufacturers that offer a diverse range of high-performance solutions for industrial, automotive, architectural, and protective applications. PPG Industries, AkzoNobel, and Sherwin-Williams lead the market with extensive product portfolios, strong R&D capabilities, and global distribution networks, allowing them to cater to multiple end-use industries.

Axalta Coating Systems focuses on advanced liquid and powder coatings for automotive and industrial segments, emphasizing innovative formulations that enhance durability, corrosion resistance, and aesthetic appeal. RPM International Inc. leverages its subsidiary network to provide specialized coatings for niche applications, including chemical-resistant and high-temperature environments.

BASF SE integrates its chemical expertise with coatings solutions, offering tailored performance coatings and collaborating closely with industrial clients for custom applications. Competitive advantage in this market is increasingly influenced by the ability to develop environmentally friendly, low-VOC, and sustainable coating solutions without compromising performance. Investments in research, strategic partnerships, and geographic expansion remain key strategies for market leaders to maintain technological leadership and capture emerging opportunities across industrial, commercial, and specialty segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 billion |

| Coating type | Anti-Corrosion Coatings, Fire-resistant Coatings, Waterproof Coatings, Heat resistant Coatings, Anti-Graffiti Coatings, UV-Resistant Coatings, Abrasion-Resistant Coatings, and Others |

| Technology | Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, High-Solid Coatings, Nano Coatings, and Others |

| End user | Automotive, Industrial, Marine, Construction, Electronics, and Others |

| Distribution Channel | Direct Sales, Retail Sales, and Online Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries, AkzoNobel, Sherwin-Williams, Axalta Coating Systems, RPM International Inc., and BASF SE |

| Additional Attributes | Dollar sales by coating type and application are increasing, driven by demand across automotive, aerospace, and industrial sectors. Growth is fueled by innovation, sustainability concerns, and emerging protective and smart material applications. |

The global specialty coatings market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the specialty coatings market is projected to reach USD 5.2 billion by 2035.

The specialty coatings market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in specialty coatings market are anti-corrosion coatings, fire-resistant coatings, waterproof coatings, heat resistant coatings, anti-graffiti coatings, uv-resistant coatings, abrasion-resistant coatings and others.

In terms of technology, solvent-based coatings segment to command 41.6% share in the specialty coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Tapes Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Specialty Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Specialty Nitriles Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Specialty Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lighting Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Specialty Pulp & Paper Chemicals Market Size, Share & Forecast 2025 to 2035

Specialty Yeast Market Analysis - Size, Growth, and Forecast 2025 to 2035

Specialty Oils Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA