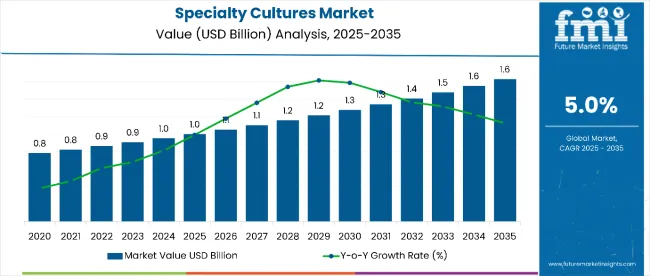

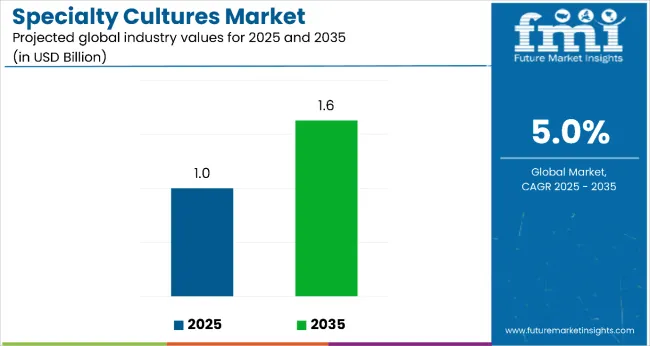

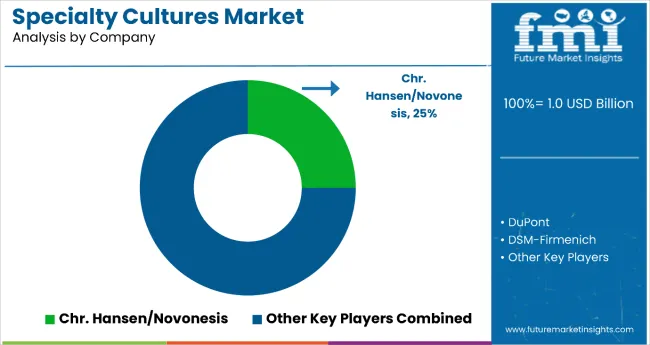

The specialty cultures market is estimated to be valued at USD 1 billion in 2025. It is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The specialty cultures market is projected to add an absolute dollar opportunity of USD 0.60 billion over the forecast period. This reflects a 1.60 times growth at a compound annual growth rate of 5.0%. The market’s expansion is expected to be driven by increasing demand for functional and fermented foods, rising consumer awareness regarding probiotics, and advancements in fermentation technologies.

By 2030, the market is projected to reach approximately USD 1.28 billion, representing an incremental growth of USD 0.28 billion from USD 1 billion in 2025. From 2030 to 2035, the market is expected to further expand to USD 1.6 billion, adding another USD 0.32 billion in incremental value during the second half of the decade, indicating a steady and balanced growth trajectory.

Companies such as DuPont Nutrition & Health and Chr. Hansen are strengthening their market positions through strategic investments in R&D and expansion of their product portfolios. Collaborative partnerships and innovation in strain development are facilitating new applications in the dairy, bakery, and pharmaceutical sectors. Regulatory compliance and sustainable manufacturing processes remain pivotal to the specialty cultures market’s competitive landscape.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1 billion |

| Projected Value (2035F) | USD 1.6 billion |

| CAGR (2025 to 2035) | 5.0% |

The specialty cultures market holds a significant yet niche share within several larger parent markets. It accounts for approximately 12% of the global fermented foods and beverages sector, driven by its critical role in fermentation and probiotic enhancement. In the dairy products market, specialty cultures represent around 10%, enabling diverse applications in cheese, yogurt, and other fermented dairy items. Within the functional foods and dietary supplements markets, they hold an estimated 8% share, fueled by growing consumer interest in gut health and natural ingredients. The pharmaceutical and animal nutrition sectors see a smaller yet growing adoption, reflecting specialty cultures’ expanding versatility across industries.

Recent developments in the specialty cultures market are characterized by a growing demand for clean-label and natural ingredients, reflecting consumers’ increasing preference for healthier and more transparent diets. Innovations such as strain-specific probiotics and combined culture formulations are being introduced to enhance efficacy and broaden application potential. Customized fermentation solutions are also becoming more prevalent, allowing manufacturers to tailor products to specific needs. Additionally, evolving regulatory frameworks emphasizing product safety, sustainability, and quality control are influencing market trends. These factors collectively drive innovation and adoption, positioning the specialty cultures market for sustained growth across food, beverage, and pharmaceutical sectors.

The specialty cultures market is expanding due to increasing consumer demand for functional and fermented foods that promote gut health and overall wellness. The ability of specialty cultures to improve flavor, texture, and shelf life in dairy and bakery products has driven their widespread adoption among food manufacturers.

Rising awareness of probiotics and their health benefits, coupled with innovations in strain development and fermentation technology, are further accelerating market growth. Additionally, stringent regulations and growing interest in clean-label, natural ingredients are encouraging manufacturers to incorporate specialty cultures in a variety of food, beverage, and pharmaceutical applications.

With evolving consumer preferences favoring health-enhancing ingredients and sustainable production methods, the specialty cultures market is expected to maintain strong growth momentum. These factors collectively position the market for significant expansion across multiple end-use sectors globally.

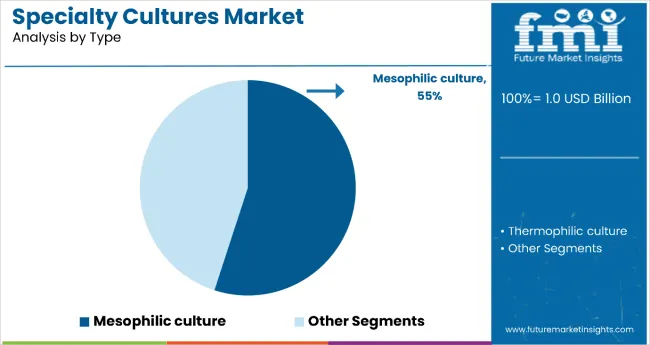

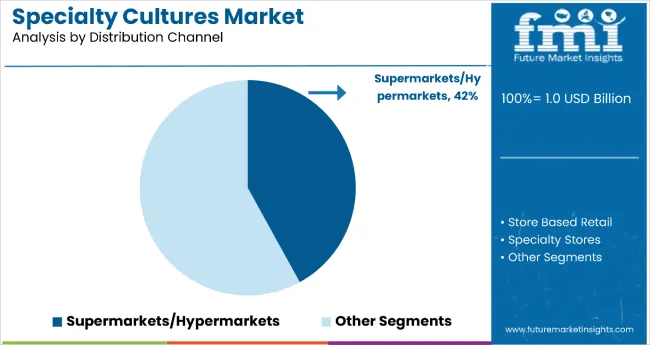

The market is segmented by type, application, distribution channel, and region. By type, the market is bifurcated into mesophilic culture and thermophilic culture. By application, the market is divided into dairy industry, cheese, yogurt, and the meat industry. Based on distribution channel, the market is classified into supermarkets/hypermarkets, store-based retail, specialty stores, and online retail. Regionally, the market spans over North America, Europe, Asia-Pacific, Latin America, Japan, the Middle East & Africa.

The mesophilic culture segment holds a leading position with 55.0% market share within the type category, primarily due to its extensive use in fermented dairy products such as cheese, buttermilk, and sour cream. These cultures thrive at moderate temperatures, delivering distinct flavor and texture profiles, making them indispensable in traditional and artisanal cheese production worldwide. The preference for natural fermentation and clean-label dairy products continues to drive demand for mesophilic cultures.

Increased investment in strain innovation has enhanced the functional attributes of mesophilic cultures, including improved acidification rates and probiotic potential. Regulatory support for microbial safety and product standardization also favors growth. The segment is expected to witness further expansion as demand for premium fermented dairy products escalates globally.

Supermarkets and hypermarkets represent the dominant distribution channel segment, accounting for 42.0% of the specialty cultures market share. This channel benefits from a broad consumer reach, increasing product availability, and strategic placement of fermented and functional food products that incorporate specialty cultures. Consumer preference for convenience and one-stop shopping has bolstered sales through these retail formats.

Additionally, supermarkets and hypermarkets have enhanced cold chain logistics and product diversification, enabling them to stock a wider variety of dairy, bakery, and probiotic-enriched products. Marketing campaigns promoting health benefits in these outlets have increased consumer adoption. This distribution channel is poised to maintain its market leadership as retail modernization and urbanization accelerate.

In 2024, the global specialty cultures market experienced significant growth, driven largely by the expanding demand for fermented and functional food products. Increasing consumer awareness regarding gut health and probiotics has elevated the use of specialty cultures in dairy, bakery, and dietary supplements. Technological advancements in microbial strain development have enhanced culture efficacy, flavor profiles, and shelf life, encouraging adoption across food and pharmaceutical sectors. North America and Europe are leading regions, with Asia-Pacific rapidly growing due to rising disposable incomes and changing dietary habits.

Health and Wellness Trends Accelerate Specialty Cultures Adoption

Consumers’ preference for natural, clean-label ingredients and functional foods continues to drive specialty cultures market expansion. The ability of specialty cultures to improve digestive health and provide probiotic benefits has increased their incorporation in yogurts, cheeses, fermented beverages, and dietary supplements. Manufacturers are investing in tailored culture blends and strain-specific probiotics to target various health concerns, including immunity and metabolic health. These innovations are bolstering product differentiation and premiumization. Regulatory support for safe microbial use and sustainable production methods further strengthens market confidence and growth prospects.

Challenges in Processing and Raw Material Costs Limit Growth

Despite promising demand, the specialty cultures market faces constraints such as high production costs, stringent regulatory requirements, and complex manufacturing processes. Maintaining culture viability during processing and storage requires advanced fermentation control and cold chain logistics, raising operational expenses by up to 18%. Additionally, raw material variability and supply chain disruptions have led to price volatility, impacting product affordability. Small and medium manufacturers often struggle to meet compliance standards, limiting scale and innovation. These factors collectively restrain market penetration, particularly in price-sensitive regions, despite strong consumer interest and health-driven demand.

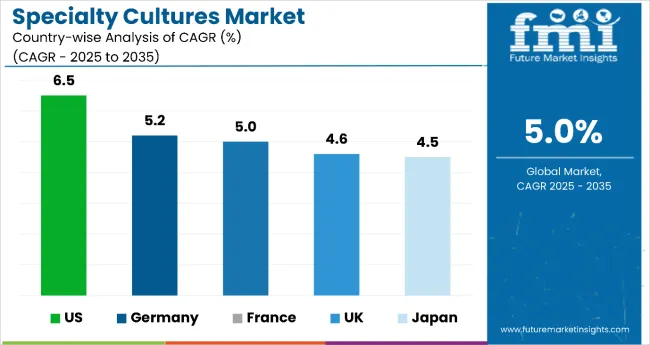

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| Germany | 5.2% |

| France | 5.0% |

| UK | 4.6% |

| Japan | 4.5% |

The specialty cultures market exhibits varied growth dynamics across key countries, with the USA leading in expansion, followed by Germany, France, the UK, and Japan. The USA shows the highest CAGR of 6.5%, driven by strong consumer demand for probiotics and functional foods. Germany and France follow closely with 5.2% and 5.0%, respectively, supported by advanced fermentation technologies and artisanal food trends. The UK experiences moderate growth at 4.6%, influenced by retail innovations and clean-label preferences, while Japan’s CAGR of 4.5% reflects steady demand in precision nutrition and aging population needs.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The specialty cultures market in the USA is projected to grow at a CAGR of 6.5% from 2025 to 2035, fueled by rising consumer awareness about gut health and increased demand for probiotic-enriched dairy and beverage products. Leading manufacturers are investing in strain development and fermentation innovations to enhance flavor and health benefits. The expanding functional food and dietary supplements sectors are also driving growth. Regulatory frameworks supporting product safety and quality reinforce market confidence.

Sales of specialty cultures in Germany are slated to flourish at a CAGR of 5.2% during the forecast period. Growth is supported by advanced fermentation technologies and clean-label product development focused on functional dairy and bakery applications. German manufacturers benefit from strong food safety regulations and partnerships between research institutions and industry players. Increasing consumer demand for natural and artisanal fermented foods contributes to market expansion.

Revenue from specialty cultures in France is forecasted to expand at a CAGR of 5.0% through 2035, driven by artisanal cheese and yogurt production and premium fermented food trends. Manufacturers are leveraging traditional fermentation expertise alongside modern microbial strain advancements. Regulatory compliance and the focus on high-quality, clean-label products underpin growth.

The specialty cultures market in the UK is poised to grow at a CAGR of 4.6%, underpinned by demand for functional foods and dietary supplements. Retail expansion through supermarkets and online channels supports distribution. However, supply chain complexities and Brexit-related trade adjustments have introduced some challenges. Clean-label trends and health-driven consumer choices remain key growth drivers.

The demand for specialty cultures in Japan is expected to increase at a CAGR of 4.5% by 2035, fueled by the aging population’s nutritional needs and growing preference for precision nutrition. Fermented dairy and beverage applications dominate, with companies focusing on low-lactose and easily digestible culture formulations. Regulatory frameworks promoting food safety and product quality contribute to stable growth.

The specialty cultures market is moderately consolidated, comprising global biotech firms, specialized microbial ingredient producers, and regional fermentation companies with varying capabilities in strain development, fermentation technology, and application expertise. Chr. Hansen Holding A/S and DuPont Nutrition & Health are dominant players, leading with extensive portfolios of dairy and probiotic cultures used in fermented foods, beverages, and dietary supplements. Their competitive advantage lies in advanced microbial strain innovation, global manufacturing infrastructure, and strong partnerships with leading food and pharmaceutical companies.

Companies such as Kerry Group plc and Lallemand Inc. differentiate themselves by offering custom culture blends, proprietary strain technologies, and tailored solutions for bakery, dairy, and animal nutrition sectors. Novozymes A/S focuses heavily on sustainable fermentation processes and enzyme integration to optimize culture performance and reduce environmental impact. Regional players emphasize local strain adaptation and artisanal fermentation processes to cater to niche markets and traditional food applications.

Barriers to entry remain high due to the complexity of microbial strain development, stringent regulatory compliance, and the necessity for robust quality control in culture production. The competitive edge increasingly depends on innovation in strain specificity, product stability, and the ability to customize cultures for multifunctional applications across diverse food, beverage, and pharmaceutical manufacturing environments. Strategic collaborations between culture producers, research institutes, and end-use manufacturers continue to drive market leadership and expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 1 billion |

| Type | Mesophilic culture, Thermophilic culture |

| Application | Dairy industry, Cheese, Yogurt, Meat industry |

| Distribution Channel | Store Based Retail, Specialty Stores, Online Retail, Supermarkets/Hypermarkets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Japan, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Cargill, ADM, Kerry Group, DuPont, DSM, Tate & Lyle, Givaudan, Ingredion, Biocatalysts, Chr. Hansen, Amano Enzymes, Omega Protein, Amco Protein, Enzyme Supplies, Crespel & Deiters, Axiom Foods, Nutriati, FDL Ltd., Aminola |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with environmentally responsible sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global specialty cultures market is estimated to be valued at USD 1 billion in 2025.

The specialty cultures market size is projected to reach USD 1.6 billion by 2035.

The specialty cultures market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The mesophilic culture segment is projected to lead in the specialty cultures market with a 55% market share in 2025.

The supermarkets and hypermarkets segment is expected to command a 42% share in the specialty cultures market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA