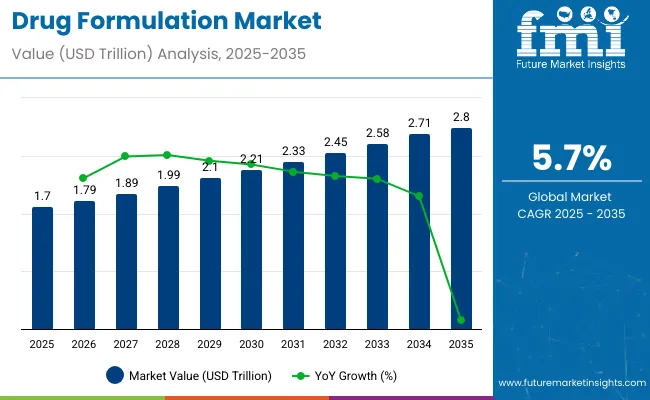

The drug formulation market is projected to expand from USD 1.7 trillion in 2025 to USD 2.8 trillion by 2035, growing at a CAGR of 5.7% during the forecast period. Rising demand for innovative therapeutics, growing prevalence of chronic diseases, and an aging global population are key factors driving this growth.

Pharmaceutical companies are increasingly adopting advanced formulation techniques to improve drug efficacy, enhance patient compliance, and enable targeted delivery. Regulatory shifts and greater emphasis on quality, safety, and cost efficiency are further accelerating market momentum across both developed and emerging economies.

Significant advances are being observed in oral, injectable, and topical formulations, with biologics and personalized medicines shaping the next wave of innovation. Technologies such as nanotechnology, lipid-based carriers, and sustained-release systems are helping overcome solubility and bioavailability challenges.

Demand for patient-centric formulations is also rising. The development of orodispersible tablets, transdermal patches, and pediatric-friendly dosage forms is gaining traction, driven by the need to improve treatment experiences. Established markets such as the United States, Europe, and Japan continue to lead in innovation, while emerging economies invest heavily in expanding formulation capabilities to strengthen local pharmaceutical manufacturing.

Looking ahead, the drug formulation market is expected to benefit significantly from the integration of artificial intelligence (AI) and machine learning (ML), which are accelerating formulation design and optimization. The adoption of 3D printing and robotic automation is further transforming formulation workflows.

As Karthik Raman, PhD, CEO of Persist AI, noted in a statement featured on ir.tonixpharma.com: “If you can find a new drug molecule, you can predict its formulation and use our robotic platform to build and test it in the real world.” This highlights the growing influence of AI in enabling rapid, efficient formulation development. Over the next decade, advancements in digital technologies, precision medicine, and regulatory support will drive further innovation and sustained global demand across the drug formulation landscape.

| Attributes | Key Insights |

|---|---|

| Market Size (2025) | USD 1.7 trillion |

| Market Size (2035) | USD 2.8 trillion |

| CAGR (2025 to 2035) | 5.7% |

In North America and Europe, well-established agencies like the FDA and EMA play a pivotal role in overseeing drug approvals and enforcing manufacturing practices. These regions emphasize compliance with current Good Manufacturing Practices (cGMP) and require specific certifications such as Drug Establishment Licenses in Canada and CE marking for certain products in Europe. Meanwhile, the Asia-Pacific region, home to some of the fastest-growing pharmaceutical markets, follows rigorous regulatory protocols through bodies like India’s CDSCO and Japan’s PMDA, often aligning with global standards like WHO GMP to facilitate trade and quality assurance.

Several leading pharmaceutical companies are integrating smart technologies into drug formulation to enhance precision, efficiency, and personalized medicine. These innovations include AI-driven formulation design, advanced analytics, continuous manufacturing, and digital twins to optimize drug development and production.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the drug formulation industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global drug formulation market from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.7%, followed by a slightly lower growth rate of 6.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.7% (2024 to 2034) |

| H2 | 6.2% (2024 to 2034) |

| H1 | 5.7% (2025 to 2035) |

| H2 | 5.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.7% in the first half and projected to lower at 5.2% in the second half. In the first half (H1) the market witnessed a decrease of 100 BPS while in the second half (H2), the market witnessed a decrease of 100 BPS.

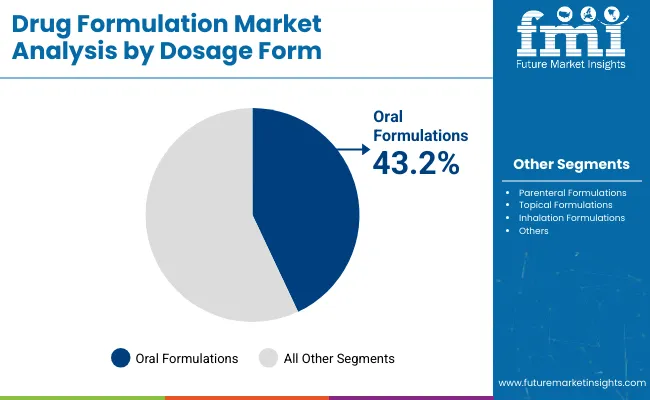

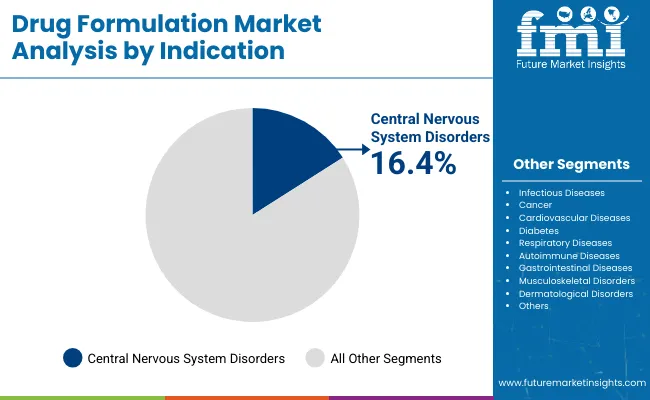

The drug formulation market is evolving rapidly as pharmaceutical companies invest in advanced delivery systems and targeted therapies. Oral formulations maintain a strong lead due to their convenience and production efficiency. Meanwhile, treatments for central nervous system (CNS) disorders are driving innovation and investment, spurred by rising global prevalence and unmet clinical needs.

Oral formulations are projected to dominate the drug formulation market with a 43.2% market share in 2025. Their success is attributed to patient-friendly administration, cost-effective production, and well-established manufacturing infrastructure. Solid dosage forms, particularly tablets and capsules, remain the most widely adopted globally, offering consistent dosing and long shelf life.

Leading pharmaceutical companies such as Pfizer, Novartis, and Sanofi continue to prioritize oral formulations across therapeutic categories. Advances in drug delivery technologies-such as sustained-release formulations and enhanced bioavailability techniques-are further enhancing the value proposition of oral dosage forms.

In addition, the increasing global burden of chronic diseases requiring long-term treatment regimens supports sustained demand for oral drugs. The scalability of oral formulation manufacturing also aligns with the pharmaceutical industry's goal of balancing innovation with production efficiency. As personalized medicine gains momentum, the oral segment will continue evolving through new delivery platforms tailored to specific patient needs.

Central nervous system (CNS) disorders are expected to account for a 16.4% share of the drug formulation market in 2025, while also delivering the highest growth during the forecast period. Rising global prevalence of mental and neurological disorders-including depression, anxiety, Alzheimer’s disease, Parkinson’s disease, and epilepsy-is driving demand for innovative and effective CNS treatments.

Major pharmaceutical companies such as Eli Lilly, Biogen, Johnson & Johnson, and Otsuka Pharmaceutical are actively investing in CNS drug development. The aging population, increased awareness of mental health, and reduction of stigma around these conditions are fueling a surge in diagnosis and treatment demand.

Additionally, unmet medical needs and the complexity of CNS pathways are attracting significant R&D investment in next-generation therapies. Advanced formulation technologies aimed at crossing the blood-brain barrier and achieving targeted delivery are pivotal to the segment’s growth. As precision medicine and digital therapeutics further integrate with CNS care, this segment is poised to remain a key growth driver within the drug formulation market.

Pharmaceutical Manufacturers and CDMO are adopting modern delivery technologies such as liposomes, nanoparticles, etc. for better efficacy and safety. This helps with higher bioavailability and directed release mechanisms due to higher loading levels possible from APIs, many of which have very poor water-solubility issues.

Advanced platforms for drug delivery reduce the frequency of dosing, improve patient compliance, and hence minimize side effects-a reason for their mushrooming adoption in the therapies of oncology, cardiovascular, and neurological disorders.

This will also be consistent with the increased demand for personalized medicine, whereby precision in drug delivery is considered one of the paramount elements in ensuring therapeutic success. The increasing pipeline for both biologics and gene therapies further propels the demand for innovative formulation strategies.

Several pharmaceutical companies enter into research collaborations and license technologies to compete in such an environment. The emergence of more advanced enabling technologies will drive these technologies, along with continuous advances, at the heart of modern formulation strategy, into continued growth in the coming decade.

Advanced analytical tool technologies have succeeded in the precision during the development and quality control of formulations, therefore radically changing the paradigm in the drug formulation space.

High-performance liquid chromatography (HPLC), DSC, and NMR spectroscopy are various advanced techniques that are being used for great improvements in the molecular characterization of APIs and excipients. These tools help the formulation scientists understand the physicochemical properties of compounds and optimization of bioavailability with batch-to-batch consistency.

Such development facilitated the integration of AI and ML, thus enabling predictive modeling for the acceleration of formulation development by the simulation of drug behavior under various environmental conditions. Therefore, this art is of particular value in the development of complex dosage forms and biologics, where understanding molecular interactions is crucial. Besides that, real-time monitoring tools have given way to continuous manufacturing, enhancing production efficiency and reducing variability.

Consequently, the companies that employ these advanced technologies will be able to have faster regulatory approvals and lower development costs with improved product performance, making technological advances a key factor in market growth.

The growing demand for biopharmaceutical has presented an immense opportunity for the drug formulation market. This has been due to the increasing demand for biologics and gene therapies. Biopharmaceuticals are mainly complex structures, including monoclonal antibodies, vaccines, and cell therapies, which call for specialized formulation approaches since they are very sensitive to environmental factors. That has promoted innovative formulation approaches like lipid nanoparticles and polymer-based carriers, enabling appropriate stability and delivery.

The need for improved formulation solutions is always rising as the number of licensed biologics increases, particularly for chronic conditions like cancer and autoimmune disorders. Furthermore, the COVID-19 pandemic has further pushed investment in biologics, placing more focus on effective vaccine development. Pharmaceutical companies are in pursuit of collaboration to work out the challenges with the formulation technology providers for protein aggregation and degradation.

Because of continuous expansion in the biopharmaceutical pipelines, the market for drug formulation is all set to reap the benefit of the trend for significant growth opportunities in the coming years.

The key restraining factors to the drug formulation market is its rigid regulatory structures worldwide. Different regulatory agencies at various regions, for example, including the USA FDA and EMA among others, have set strict standards for approvals of new formulation and generic drugs to ensure proper tests for bioequivalence, stability, and safety. These intricacies in regulations will delay product approvals and increase costs of development for pharmaceutical organizations.

Extensive in vitro and in vivo testing, along with documentation of Q3 equivalence, can be very resource-intensive, especially for smaller firms with limited budgets. Moreover, changing regulations concerning complex generics and biologics generally call for specific testing protocols, further adding to the complexities of market entry.

This is more evident in production scale-up or modification in formulation post-approval, wherein even slight changes may serve as a trigger for its re-validation and reassessment by the regulatory body. This results in longer timelines for commercialization, therefore limiting the speed of innovation.

While the focus on patient safety and product quality is of utmost importance, the increased regulatory hurdles can become a market constraint, especially for smaller firms with complex formulations to introduce.

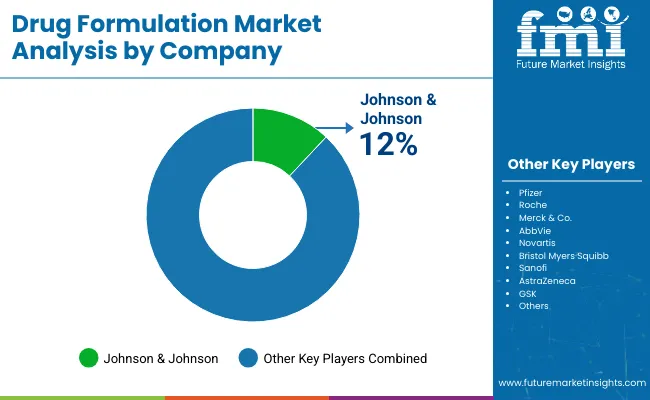

Tier 1 companies are the major companies as they hold a 36.1% share worldwide. Their strategic alliances with biotechnology firms, research centers, and academic institutions allow for the development of cutting-edge formulations and the ability to stay ahead of emerging trends.

Tier 1 companies are also highly proficient in securing regulatory approvals on a global scale, enabling them to quickly introduce new formulations into various markets. Prominent companies within tier 1 include Pfizer, Johnson & Johnson, Roche and Merck & Co.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a share of 28.1% worldwide. These companies often focus on emerging therapeutic areas and niche formulations that may not be immediately profitable or attractive to larger firms.

By concentrating on specialized drugs or novel drug delivery systems, Tier 2 companies differentiate themselves through their ability to quickly adapt and develop unique solutions for specific patient populations. Key Companies under this category include AbbVie, Novartis, Bristol Myers Squibb, Sanofi, AstraZeneca and GSK

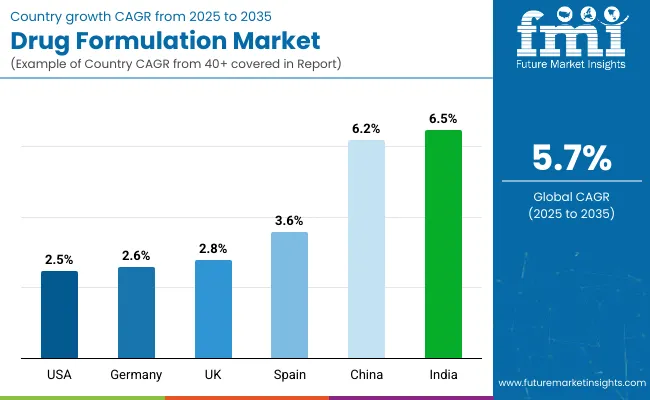

The section below covers the drug formulation industry analysis for the sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 2.5% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 6.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.5% |

| Germany | 2.6% |

| UK | 2.8% |

| Spain | 3.6% |

| China | 6.2% |

| India | 6.5% |

The United States dominates the global market with high share in 2024. The United States is expected to exhibit a CAGR of 2.5% throughout the forecast period (2025 to 2035).

Growing demand for biologics, especially personalized medicines, has further propelled the need for drug formulations in the United States. This is evident since biologics have increasingly been on the preference of patients with diseases such as chronic cancer, autoimmune diseases, or rare genetic problems.

The most important driver related to this kind of personalized approach to treatment comes from a heightened interest in increasing the success rate of medication while lowering negative side effects on the body. This is driving increased demand in the market. Government initiatives supporting innovative drug discovery, along with the growing use of gene therapies, are contributing to a dynamic drug formulation landscape. This focus on biologics and personalized approaches is expected to continue driving the market forward in the coming years.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 2.6%.

The strong emphasis on technological advancements and regulatory support to augment Germany's drug formulation sales. With the help of its regulatory bodies, specifically the Federal Institute for Drugs and Medical Devices (BfArM), Germany has created a congenial atmosphere to develop and approve of new drug formulations. The country is recognized for its advance research infrastructure and cutting-edge technologies in formulation science, such as nanoparticle-based drug delivery systems.

This cooperation between technological innovation, along with amicable regulatory pathways for biologics and complex generics, has rendered Germany a leader in the European pharmaceutical market. Further, the use of AI and machine learning in drug development and manufacturing has buttressed its position as a center for innovative drug formulation. This contact between technology and regulation will further spur market growth.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 6.5% during the forecasted period.

In India, expanded healthcare access and the increased burden of chronic diseases are foremost drivers of the drug formulation market. The health system in India is undergoing an immense change, with government spending facilitating improved access to medications and healthcare services across the country. There is a rise in chronic diseases-such as diabetes, cardiovascular disorders, respiratory diseases-and this is immediately expanding the need for effectual drug formulations.

Some government initiatives implemented in furtherance of their healthcare agendas, like Ayushman Bharat and others, provide further assistance in making healthcare services more viable and accessible for the populace.

Further, the rising demand for generic low-cost drugs, coupled with the need for drug formulations suited to local requirements, will further add fuel to the fire of the market for drug formulation. Owing to the large population base and up-increasing healthcare awareness, India’s market is primed for more industrial activity and utmost growth in both the generic and over-the-counter sectors.

The drug formulation market is fiercely competitive, with both established industry giants and emerging companies actively pursuing market share. Key players are increasingly focusing on oral formulations, recognizing their widespread patient acceptance and cost-effectiveness.

To maintain a competitive edge, many companies are forming strategic collaborations with other industry leaders, leveraging combined expertise in formulation science, drug delivery systems, and regulatory approvals. Furthermore, companies are investing in the research and development of novel oral formulations with improved bioavailability and targeted delivery, ensuring that they stay ahead of the competition in a dynamic market landscape.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.7 trillion |

| Projected Market Size (2035) | USD 2.8 trillion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD trillion for value |

| Product Types Analyzed (Segment 1) | Oral Formulations [Tablets (Immediate Release, Modified Release, Chewable, Effervescent), Capsules (Hard Gelatin Capsules, Softgel Capsules, Others), Powders & Granules, Lozenges & Pastilles, Gummies, Others]; Parenteral Formulations [Solutions, Suspensions, Emulsions for Injection or Infusion, Powders for Injection or Infusion, Gels for Injection Implants]; Topical Formulations [Pastes, Ointments & Oils, Creams, Lotions & Foams, Gels, Tinctures & Powders, Sprays & Patches]; Inhalation Formulations [Pressurized Metered Dose Inhaler, Dry Powder Inhaler (DPI), Nebulizer] |

| Applications Analyzed (Segment 2) | Infectious Diseases, Cancer, Cardiovascular Diseases, Diabetes, Respiratory Diseases, Central Nervous System Disorders, Autoimmune Diseases, Gastrointestinal Diseases, Musculoskeletal Disorders, Dermatological Disorders, Others |

| End Users Covered | Big Pharma, Small & Medium Size Pharma, Biotech Companies |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Drug Formulation Market | Pfizer, Johnson & Johnson, Roche, Merck & Co., AbbVie, Novartis, Bristol Myers Squibb, Sanofi, AstraZeneca, GSK, Others |

| Additional Attributes | Market share by formulation type; Innovations in extended-release and targeted delivery systems; Role of nanotechnology in drug formulation; Trends in oral biologics and parenteral formulations; Regulatory dynamics influencing formulation strategies; Formulation advances addressing unmet clinical needs |

In terms of dosage form, the industry is divided into oral formulations [tablets (immediate release, modified release, chewable, effervescent), capsules (hard gelatin capsules, softgel capsules, others), powders & granules, lozenges & pastilles, gummies, others], parenteral formulations [solutions, suspensions, emulsions for injection or infusion, powders for injection or infusion, gels for injection implants], topical formulations, pastes, ointments and oils, creams, lotions, and foams, gels, tinctures, and powders, sprays and patches], inhalation formulations[pressurized metered dose inhaler, dry powder inhaler (DPI), nebulizer].

In terms of indication, the industry is divided into infectious diseases, cancer, cardiovascular diseases, diabetes, respiratory diseases, central nervous system disorders, autoimmune diseases, gastrointestinal diseases, musculoskeletal disorders, dermatological disorders, others.

In terms of end user, the industry is segregated into big pharma, small & medium size pharma, and biotech companies.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global drug formulation industry is projected to witness CAGR of 5.7% between 2025 and 2035.

The global drug formulation industry stood at USD 1.6 trillion in 2024.

The global drug formulation industry is anticipated to reach USD 2.8 trillion by 2035 end.

China is expected to show a CAGR of 6.2% in the assessment period.

The key players operating in the global drug formulation industry include Pfizer, Johnson & Johnson, Roche, Merck & Co., AbbVie, Novartis, Bristol Myers Squibb, Sanofi, AstraZeneca, GSK, and Others

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA