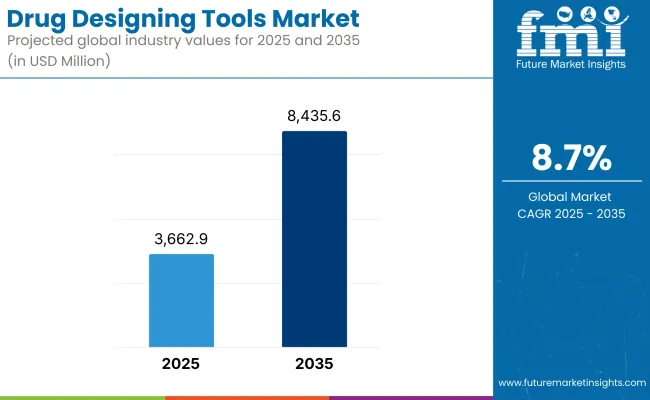

The drug designing tools market is expected to reach USD 3,662.9 Million by 2025 and is expected to steadily grow at a CAGR of 8.7% to reach USD 8,435.6 Million by 2035. In 2024, the drug designing tools market has generated roughly USD 3,369.7 Million in revenues.

Drug designing tools consist of computer software utilized within the pharmaceutical industry for the design, optimization, and screening of potential drug candidates. The drug discovery process is expedited with greater cost-effectiveness and lower chances of failure in advanced clinical stages using molecular modeling, structure-based drug design, and artificial intelligence.

Solar-down-lifting demand of drug designing tools is aided by some of the major drivers. Advances in virtual screening and molecular docking have drastically reduced the time taken in drug development. In contrast, personalized medicines have created demands for precision drug designs that can match the individual's genetic profile.

Scalable and economic modeling enabled by cloud computing and high-performance computing (HPC) eases access to drug design for researchers. In addition, an increase in investment in pharmaceutical R&D, coupled with regulatory support for computer-aided drug discovery, serves to stimulate the demand for computational methodologies. All this contributes to the incorporation of drug-designing tools in modern drug development pipelines.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,662.9 Million |

| Industry Value (2035F) | USD 8,435.6 Million |

| CAGR (2025 to 2035) | 8.7% |

The period 2020 to 2024 is remarkable among all the drug designing tools, an exceptional significance steadily favored their incorporation. This period urged pharmaceutical manufacturers to shift their gears to computational tools for antiviral drugs and vaccines.

Further, demand is propelled by computational capabilities owing to enhanced investments in R&D for the pharmaceutical sector to streamline the clinical trials. The authorities that take care to approve drugs, such as the FDA and EMA, are also informed about digital drug discovery.

Additionally, cloud computing combined with high-performance computing (HPC) has given scalable solutions that enabled biotech companies and research institutions to insert these tools into their pipelines, making drug discovery more accurate and less tedious. These are a few of the factors that are anticipated to drive the growth of the market.

Growing advancements in quantum computing surges the power of molecular modeling and predictive analytics in drug discovery through increased drug designing solutions within North America. Presence ofwell established pharmaceutical and biotechnology hub within North America coupled with heavy investment into research and development encourages fast adaptation to computational drug design.

Also, authorities like the FDA now come up with advanced controlling approved drug discovery by advanced application, which hastens the process of getting drugs cleared thus encouraging innovation. Development in such fields, shared with personalized medicine and genomics, creates and has increased the need for specialized tools for drug design aimed specifically at patient-targeted therapies.

Also through adopting cloud computing and big data integration, drug developers can avail of affordable and scalable solutions for drug development. Last but not least is funding by the state and alliance with universities to mark adoption into fruition, which is now emerging as the front-line state of computational drug discovery in North America.

Drug design tools have seen increased application in Europe, mainly due to the substantial government funding and public-private partnerships regarding computational drug discovery. The movement of the European Medicines Agency (EMA) has increasingly adopted paradigm for drug development, thus persuading pharmaceutical firms to innovate sophisticated modeling tools into their R&D pipelines.

In addition, precision medicines and personalized therapeutics are increasingly demanded for the development of simulation and molecular docking platforms. The leading European biotechnological cluster of Germany, the United Kingdom, and France actively invests in drug discovery through machine learning and quantum computing.

Added to that is the impact of post-pandemic rapid drug development necessities coupled with stringent regulation guidelines, which stimulate increased adoption through improved efficiency and quality of automatic drug design solutions.

The increase in pharmaceutical R&D drives the growth in Asia-Pacific for drug designing software, the increase in government initiatives, and the increase in drug discovery investments, which anticipates the growth of the market. China, Japan, and India are investing heavily in biotech innovation and computer-aided drug design, driving the need for high-end software solutions.

Furthermore, the rapid growth of contract research organizations (CROs) in the region is propelling sales, as companies look for cost- and time-efficient solutions for drug discovery. The post-pandemic drive for speedy vaccine and drug development and growing regulatory support further bolsters the uptake of automated drug design platforms in the Asia-Pacific.

High Cost and Complexity of Implementation Hinders the Adoption of Drug Designing Tools

High price and technical complexity are crucial issues for adopting drug designing tools. It requires massive investments in hardware, trained scientists, and license costs that are usually not affordable for many small and mid-sized pharmaceuticals or research centers in developing markets.

Some of the powerful computational infrastructures, drug discovery platforms based on artificial intelligence, and molecular modeling software prove to be very costly. In addition, the inclusion of these tools into the present R&D processes requires technical knowledge in computational biology and cheminformatics. The expensive setup, difficult learning, and requirement for cross-disciplinary training are barriers that make adoption relatively slow, particularly in low-resource settings.

Rising Demand for Novel Drug Development posesa significant opportunity for drug designing tools

Pharmaceutical companies are trying to develop more effective and targeted therapies because of the rising incidence of chronic illnesses and infectious diseases, as well as rare genetic disorders. However, traditional drug discovery processes require time and money; hence, drug designing tools provide a much faster and effective means of searching potential compounds.

At the same time, the emergence of new therapeutic targets (such as RNA drugs and gene therapies) and solutions for antimicrobial resistance has resulted in a much greater need for drug modeling with computers and molecular simulation. The increasing movement of biologics and polypharmaceutics also demands a higher level of drug interaction modeling, which drug designing tools help provide.

Government and biotech funding for drug repurposing and rapid development programs ensure that the software tools have a significant role in minimizing failure rates in clinical trials with maximum resource efficiency, cost-effectiveness, and regulatory clearance.

Increasing Integration of Quantum Computing in Drug Discovery Surges the Growth of the Market

pharmaceutical and research institutions have already started to use quantum computing in their experimental setups. Quantum algorithms can simulate complex molecular interactions up to an unprecedented level and scale, quickly readying potential drug candidates. Current major players are undertaking partnerships with pharmaceutical industries to ensure the advancement of quantum-driven drug design tools, with pharmaceutical companies in designing new drugs.

This integration will allow for making more precise predictions of molecular behavior, further improving drug discovery. It will change the face of molecular modeling and lead optimization, toxicity prediction, and provide insights into possible drug forms, as well as give impetus in areas such as oncology and neurodegenerative diseases.

Expanding Adoption in Biopharmaceutical Research Anticipates the Growth of the Market

The growing attention to biologics, gene therapies, and new RNA medicines will all add fuel to the fire concerning the use of drug designing tools in biopharmaceutical research. Traditional small-molecule discovery techniques have proven inadequate for the larger, more complex biologic molecules, necessitating sophisticated computational methods for structural analysis.

Such tools enable scientists to comfortably analyze the binding affinity, stability, and efficacy of biologic drugs before preclinical testing. Demand for custom-made in silico modeling software is on the rise, as more biotech companies and pharmaceutical giants invest in biologics. Sponsors, such as the FDA and EMA, are encouraging the use of computational methods to predict biologic drug interactions for faster approvals and to minimize the chances of late-stage failure in clinical trials.

Growth in Cloud-Based Drug Designing Platforms is an Ongoing Trend in the Market

With cloud computing comes accessibility and scalability in the treatment of drug designing software, which has revolutionized the whole landscape. Cloud infrastructure has enabled real-time collaboration among international research groups regarding their molecular models, processes of big data, and even simulations online.

Companies that feature in the major pharmaceutical industry are switching to using cloud-based AI-powered models to optimize their drug development pipelines and minimize their dependence on very expensive on-premise computing hardware.

More investments continue to flow into biotechnology startups and virtual drug discovery labs; therefore, cloud-based platforms will eventually become a cost-effective and scalable solution. Considering that digitalization of pharmaceutical research and development is being promoted by regulatory agencies, cloud software will soon take over the market because of enhanced data sharing, security, and offshore access.

Increased Regulatory Support for Drug Discovery Poses Significant Growth Opportunities.

With the regulations from the FDA, EMA, and MHRA recognizing the advantages of computational drug designing tools in improving the efficacy of the approval process, in silico modeling-aided toxicity prediction, pharmacokinetics analysis, and repurposing of drugs are in high demand and thus many companies are beginning to employ computational tools in their development pipelines.

Regulatory bodies are revising their guidelines to include virtual clinical trials and computerized drug modeling, which lessen the requirements for animal models and high-throughput wet testing. Governments pushing for cost-effective ways of drug discovery have made in silico approaches a more standard feature in drug approval pipelines, thus speeding time-to-market for new therapeutics while increasing safety and compliance.

Drug Design Tool Market is expected to grow massively from 2020 to 2024 because of its extensive use of computer modeling in drug discovery, virtual screening, and molecular docking. The COVID-19 pandemic has also further encouraged in-silico drug discovery, speeding up antiviral compounds discovery and reducing dependency on traditional wet laboratory experiments. Other emerging technologies that have contributed to market growth include cloud computing, quantum simulations, and high-throughput screening.

By 2025 to 2035, it would see market growth of more than a hundred percent as a result of increased biopharmaceutical investment in R&D, biologics discovery, and automated drug design pipelines. Increasingly supportive of computational methodologies in drug approval processes, the regulatory bodies, along with further improvement in cloud integration and regulatory consent with in silico trials, are likely to enhance uptake across the board.

Next-generation computational chemistry technology, with increased predictive power and real-time simulation capabilities, will be brought to bear on the enjoyment of drug discovery efficiency and market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA, EMA, and PMDA supported computational drug discovery, lowering dependence on wet-lab testing. In silico trials picked up momentum |

| Technological Advancements | Molecular docking, SBDD, LBDD, and cloud computing advancements enhanced drug screening precision. |

| Consumer Demand | Greater pharma, biotech, and research institute adoption to minimize preclinical failures and expenses. |

| Market Growth Drivers | Accelerated by greater R&D spending, AI integration, and pandemic-induced antiviral research. |

| Sustainability | Transition towards sustainable computational models, reducing chemical waste. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global virtual clinical trial standardization and modeling using AI will improve compliance and reproducibility. |

| Technological Advancements | Quantum computing and automation using AI will optimize real-time biomolecular simulations, speeding discovery. |

| Consumer Demand | Precision medicine and biologics will fuel demand, with cloud-based platforms making accessibility broader in the emerging markets. |

| Market Growth Drivers | Growth into biologics, RNA therapeutics, and AI-predictive modeling will power future growth. |

| Sustainability | Emphasis on low-energy AI-driven |

Market Outlook

With such an enormous biopharma sector, NIH grants, and AI-powered computational modeling, drug discovery in the USA takes the lead. Precision medicine and RNA-based therapy, along with increased investment, are driving their adoption. Strong regulatory backing combined with the necessity of affordable drug development is forcing pharmaceutical companies to embrace in silico drug design solutions.

Market Growth Factors

Market Forecast

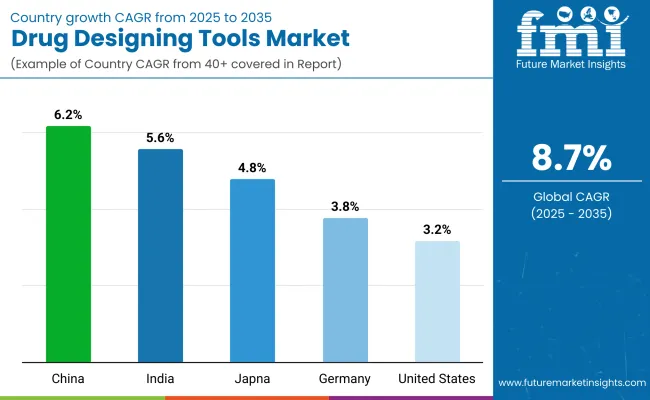

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The pharmaceutical R&D pipeline in Germany is very active, and government-supported digital health programs, along with increasing AI applications in drug discovery, will drive growth. Innovation is facilitated through collaborative acts by universities and biotech companies. The demand for personalized medicine and stringent EU regulatory requirements further drives the need for advanced drug design tools.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

Contract research in India is on the rise; government initiatives like 'Make in India' and the availability of cheap computational resources are driving market growth. AI-based drug discovery is seeing increasing funding, alongside a colossal drive toward generic drug development, fuelling demand. The concurrent growth of bioinformatics start-ups and partnerships with foreign pharma giants are pushing adoption.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

China's push for self-sufficiency in drugs together with accelerated AI adoption and government support for biotech reforms is driving market growth. Increasingly heavy investments in quantum computing will be adding to the acceleration of growth through cloud-based drug simulation. Collaboration between academia, startups, and pharmaceutical companies drives innovation, so the drug designing tools become an essential part of China's biopharma industry.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan's regenerative medicine focus, the aging population-driven drug development, and AI in molecular simulation all fuel market growth. Drivers for adoption include government support for biotech research and a strong presence of pharmaceutical giants. Precision medicine and high-throughput screening initiatives in the country also contribute to increasing demand for state-of-the-art drug-designing technologies.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Multi Databases segment dominates the market due to its critical role in aggregating vast datasets

the Multi Databases segment, it is a market leader in Drug Designing Tools because it is a key contributor to the aggregation of huge chemical, biological, and pharmacological datasets, which are most significant for AI drug discovery applications. It provides the necessary data to researchers to explore potential drug candidates by relaying thousands of molecular interactions, along with related genomic information and predictive modeling inputs.

The emergence of cloud-based and AI-enabled databases has further enhanced this dependency. On the other hand, regulatory bodies and pharmaceutical companies have installed these data banks for fast-tracking drug screening and thus have formed an integral part of the drug development process and drug design.

Virtual Screening Tools segment holds a substantial share due to its efficiency in accelerating drug discovery

Virtual Screening Tools dominate the major share because they focus on improving the drug development by fast computational screening of chemical libraries. Its use in software conserves a lot of money and time when compared to the conventional trial-and-error drug screening processes.

The virtual increase has been on hit identification and optimization of leads, in addition to incorporating applications such as AI, molecular docking, and machine learning. Due to these advantages, pharmaceutical companies and research organizations are using these tools more often to shorten the timeframes associated with drug discovery. Hence, the demand for virtual screening continues to grow due to advancements in high-throughput screening technologies, solidifying its firm hold in the market.

Pharmaceutical companies dominate the market due to their extensive drug development pipelines

Drug Design Tools marketplace is controlled by pharmaceutical companies, carrying enormous pipelines for drug development, R&D portfolios, and an obligation towards drug discovery efficiencies. These companies make use of computational tools to identify leads, model molecules, and predict toxicity, thus drastically reducing the time and cost of drug marketing.

Increased adoption of AI-predictive analytics and high-throughput screening is a further enhancement in these companies' capabilities for optimizing drug candidates. Additionally, regulations demand elaborate preclinical study needs that spur a need for application of this sophisticated software in pharmaceutical companies as thus creating the forefront adoption of the drug designing software.

Biotechnology companies hold a substantial share in the market due to their focus on developing biologics.

The biotechnology companies also have a significant portion of market share in the Drug Designing Tool market, mainly due to their focus on biologics, gene therapies, and precision medicine. They considerably depend on computational modeling and bioinformatics for protein structure prediction, target identification, and biomolecular interactions.

The increased demand for personalized medicine and biologics has triggered the extensive use of virtual screening and molecular docking tools. In addition, biotech companies partner with companies in the pharmaceutical industry and research institutions to innovate and streamline drug development processes, thereby increasing their dependency on drug-designing tools for new therapeutics and biomarker identification.

Developments in technology, regulatory compliance, and strategic partnerships significantly drive this competition. Organizations are adopting, quantum computing, and cloud technologies to most effectively and accurately search for drugs. Federal Food and Drug Administration, as well as the European Medicines Agency, pace their growth in markets by mandating the validation and disclosure requirements in computer-assisted drug modeling.

This type of collaboration enables competition leaders to gain a share of the market by forming alliances with pharmaceutical and biotech companies, making the technology accessible and applicable in real-world settings. Local players compete mainly on price, providing cost-effective solutions specifically to emerging markets, triggering price competition. The environment is dynamic, with ongoing developments defining the future of drug design technologies.

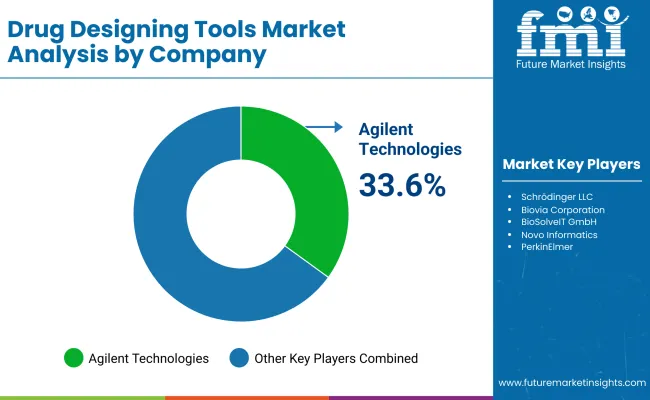

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Agilent Technologies | 33.6% to 38.5% |

| Schrödinger LLC | 20.4% to 22.6% |

| Biovia Corporation | 15.1% to 17.2% |

| BioSolveIT GmbH | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Agilent Technologies | Agilent Technologies is a provider of advanced analytical and bioinformatics solutions to carry out drug designing, such as mass spectrometry, chromatography, and spectroscopy solutions, whereas integration of machine learning, cloud-based computational platforms enhances the molecular modeling and drug-target interaction studies. Collaboration with pharmaceutical and academic institutions empowers innovation for predictive analytics and high-throughput screening |

| Schrödinger | Schrödinger LLC is a leading molecular simulation software for drug discovery. The company is focused on AI predictive modelling with structure-based drug design and physics-based simulations so that early-stage research can speed up |

| Biovia | Biovia Corporation, a Dassault Systèmes subsidiary, focuses on computational drug discovery platforms that provide solutions for molecular modeling, cheminformatics and in silico drug screening. The company leverages cloud computing along with big data analytics to push forward predictive modeling and increase efficiency in pharmaceutical research and development |

| BioSolveIT GmbH | BioSolveIT GmbH specializes in the newest infrastructure that empowers computational drug discovery. More specifically, BioSolveIT's services concentrate on methods in fragment-based drug design and the virtual screening technology |

Key Company Insights

Other Key Players

Multi Databases, Virtual Screening Tools, Structure Designing/ Building Tools, Predictive Analytics, Model Building Tools and Others

Chemical Screening, Molecular Modeling/ Homology Modeling, Target Prediction, Binding Site Prediction, Docking, Energy Minimization and Others

Pharmaceutical Companies, Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations and Others

The overall market size for drug designing tools market was USD 3,662.9 Million in 2025.

The drug designing tools market is expected to reach USD 8,435.6 Million in 2035.

Growing advancement in bioinformatics techniques and increasing demand for computer-aided drug designing tools anticipates the growth of the drug designing tools market.

The top key players that drives the development of drug designing tools market are Agilent Technologies, Schrödinger LLC, Biovia Corporation, BioSolveIT GmbH and ChemAxon.

Multi Databases segment by solution is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Solution, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Solution, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA