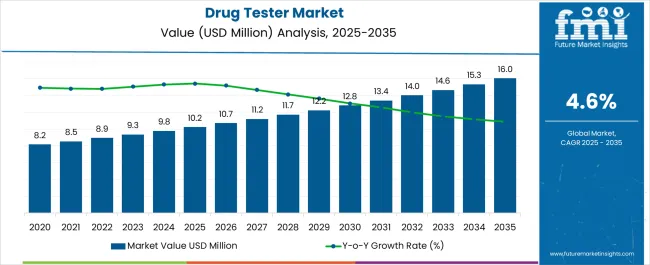

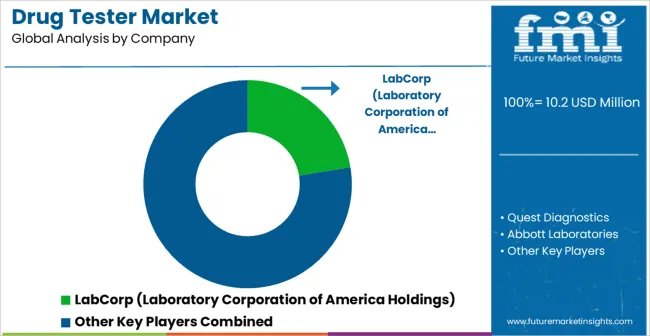

The Drug Tester Market is estimated to be valued at USD 10.2 million in 2025 and is projected to reach USD 16.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Drug Tester Market Estimated Value in (2025 E) | USD 10.2 million |

| Drug Tester Market Forecast Value in (2035 F) | USD 16.0 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The Drug Tester market is experiencing significant growth driven by increasing demand for rapid and accurate substance detection across healthcare, workplace, law enforcement, and rehabilitation sectors. The market outlook is shaped by the rising need for reliable screening methods to ensure safety, compliance, and health monitoring. Advancements in testing technologies, including the integration of analytical instruments and digital platforms, have enhanced accuracy, reduced testing time, and expanded detection capabilities.

Growing regulatory requirements for workplace drug testing, along with increased awareness about drug abuse and substance misuse, have reinforced the adoption of drug testing solutions. Furthermore, the focus on public safety and preventive healthcare has propelled investment in modern testing systems. Emerging economies are witnessing higher adoption due to expanding healthcare infrastructure, while developed regions are shifting towards more sophisticated and automated testing technologies.

The market is also supported by ongoing innovation in sample processing, detection methods, and portability, making drug testers increasingly accessible and reliable As a result, the market is poised for sustained expansion across multiple sectors globally.

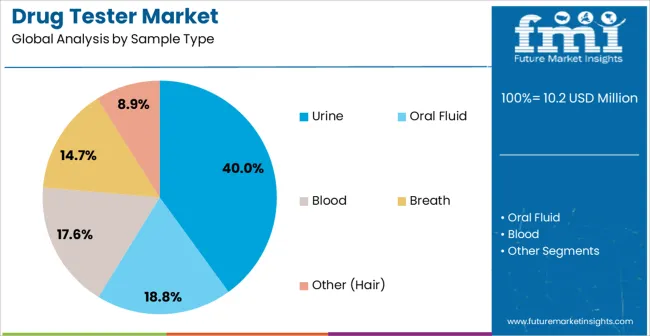

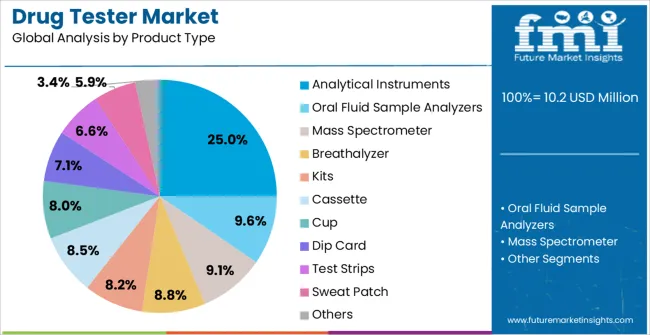

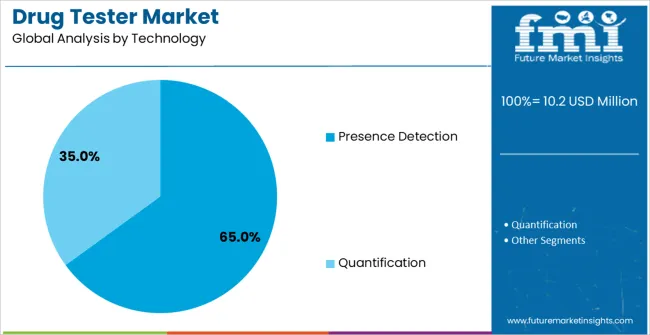

The drug tester market is segmented by sample type, product type, technology, end use, and geographic regions. By sample type, drug tester market is divided into Urine, Oral Fluid, Blood, Breath, and Other (Hair). In terms of product type, drug tester market is classified into Analytical Instruments, Oral Fluid Sample Analyzers, Mass Spectrometer, Breathalyzer, Kits, Cassette, Cup, Dip Card, Test Strips, Sweat Patch, and Others. Based on technology, drug tester market is segmented into Presence Detection and Quantification. By end use, drug tester market is segmented into Laboratories, Workplaces And Private Sectors, Forensic Departments, Federal Departments, Rehabilitation Centers, and Hospitals. Regionally, the drug tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The urine sample type segment is projected to hold 40.00% of the Drug Tester market revenue share in 2025, making it the leading sample type. This dominance is driven by the ease of collection, non-invasive nature, and well-established reliability of urine testing for detecting a wide range of substances. The segment has benefited from advancements in testing methodologies, which have improved accuracy and reduced the time required for analysis.

Urine testing is widely adopted across clinical, workplace, and forensic settings due to its cost-effectiveness and standardized protocols. Furthermore, regulatory compliance and industry standards often recommend urine as the primary sample type for substance detection, reinforcing its market position.

The increasing demand for rapid, on-site screening solutions in workplaces and public health programs further supports the segment’s growth The availability of advanced urine-based test kits that integrate with analytical instruments has strengthened its adoption and continues to make it the preferred choice in the Drug Tester market.

The analytical instruments product type segment is expected to capture 25.00% of the Drug Tester market revenue share in 2025, establishing it as the leading product category. Growth in this segment has been influenced by the increasing need for high-precision, laboratory-grade testing solutions that offer quantitative and qualitative analysis of multiple substances. Analytical instruments provide improved reliability, repeatability, and integration with digital data systems, which enhance workflow efficiency and reporting accuracy.

Adoption is further supported by stringent regulatory standards that require validated, instrument-based testing in clinical, forensic, and workplace environments. Continuous innovation in instrument design, miniaturization, and automation has expanded application scope and usability.

The ability to combine analytical instruments with advanced detection technologies enables faster decision-making and improved detection limits These advantages, along with the growing emphasis on compliance, safety, and quality assurance, are driving the prominence of analytical instruments within the Drug Tester market.

The presence detection technology segment is anticipated to account for 65.00% of the Drug Tester market revenue share in 2025, making it the leading technology type. This segment has gained prominence due to the rising demand for rapid, accurate, and easy-to-use detection methods that can provide immediate results for various applications. Presence detection enables quick screening in clinical, workplace, and law enforcement settings, allowing for timely interventions and decision-making.

The adoption of this technology has been accelerated by improvements in sensitivity, specificity, and portability, which allow testing in diverse environments. Additionally, regulatory compliance and operational efficiency requirements have reinforced the preference for presence detection systems.

The integration of advanced sensors and digital readouts has further enhanced reliability, reducing the likelihood of errors and improving user confidence These factors have collectively contributed to the dominance of presence detection technology in the Drug Tester market and are expected to sustain its growth in the foreseeable future.

Drug tester is used to provide technical analysis of a biological specimen, such as sweat, blood, breath, hair, urine and other biological samples. The drug tester is also used to determine the presence or absence of the parent drug or their metabolites. These are widely used in hospitals, educational institutes, and colleges.

Drug testing has a significant role to play in various industries for example, when applying for employment in airline industries, federal transportation, railways, and workplaces where public security is of high importance.

Furthermore, the drug testers are also widely used in sports industry to determine quantity of illegal or performance boosting drugs such as diuretics, recombinant human growth hormone, anabolic steroids, and others. Some of the significant illegal drugs include cannabis, heroin, cocaine, amphetamine, and ecstasy.

The demand for the drug tester is rapidly increasing for the urine sample testing due to the cost associated with the urine drug tester is relatively low and affordable along with that it gives a reliable result. The drug tester tests the samples in two segments which includes the primary and confirmatory test.

In the primary analysis, the immunoassay toxicity testing method is used, and in the confirmatory test, the Gas Chromatography-Mass Spectrometry test is used for testing the drug samples. This drug tester determines the presence of the drug and the quantity of the drug, these factors are boosting the growth of the drug tester at higher CAGR during the forecast period.

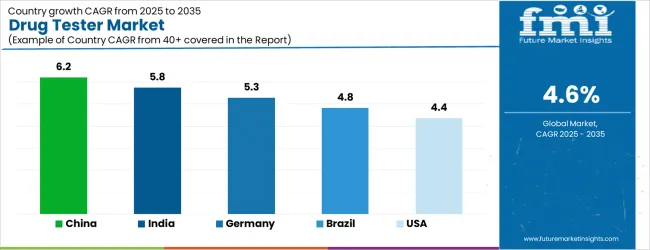

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

The Drug Tester Market is expected to register a CAGR of 4.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.2%, followed by India at 5.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.5%, yet still underscores a broadly positive trajectory for the global Drug Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.3%. The USA Drug Tester Market is estimated to be valued at USD 3.8 million in 2025 and is anticipated to reach a valuation of USD 3.8 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 537.4 thousand and USD 263.9 thousand respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 Million |

| Sample Type | Urine, Oral Fluid, Blood, Breath, and Other (Hair) |

| Product Type | Analytical Instruments, Oral Fluid Sample Analyzers, Mass Spectrometer, Breathalyzer, Kits, Cassette, Cup, Dip Card, Test Strips, Sweat Patch, and Others |

| Technology | Presence Detection and Quantification |

| End Use | Laboratories, Workplaces And Private Sectors, Forensic Departments, Federal Departments, Rehabilitation Centers, and Hospitals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LabCorp (Laboratory Corporation of America Holdings), Quest Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, OraSure Technologies, Siemens Healthineers, F. Hoffmann-La Roche, and Shimadzu Corporation |

The global drug tester market is estimated to be valued at USD 10.2 million in 2025.

The market size for the drug tester market is projected to reach USD 16.0 million by 2035.

The drug tester market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in drug tester market are urine, oral fluid, blood, breath and other (hair).

In terms of product type, analytical instruments segment to command 25.0% share in the drug tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA