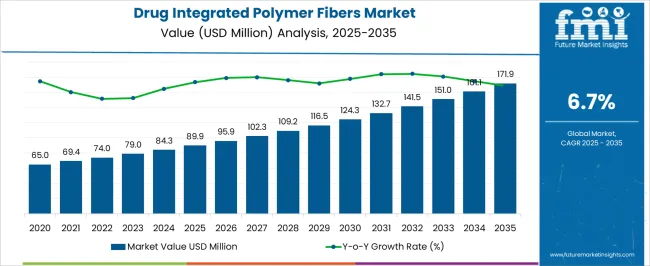

The drug integrated polymer fibers market is anticipated to expand from USD 89.9 million in 2025 to USD 171.9 million by 2035, reflecting a CAGR of 6.7%. Compound absolute growth analysis highlights the incremental gains achieved annually, demonstrating how innovation, adoption in medical and pharmaceutical applications, and market penetration contribute to long-term expansion.

From 2025 to 2027, the market grows from USD 89.9 million to USD 102.3 million, with intermediate values of USD 95.9 million and 102.3 million. During this early phase, growth is primarily driven by increasing demand for advanced wound dressings, controlled-release drug delivery systems, and polymer-based surgical textiles. OEMs and specialty fiber manufacturers focus on R&D investments and collaborations to enhance fiber functionality and biocompatibility.

Between 2028 and 2031, revenues advance from USD 109.2 million to USD 132.7 million, with intermediate gains at USD 116.5 million and 124.3 million. Compound absolute growth accelerates due to wider adoption in hospital, clinical, and outpatient care applications, as well as the integration of fibers into next-generation drug delivery platforms. Regulatory approvals and partnerships with pharmaceutical companies further support incremental market expansion. From 2032 to 2035, the market reaches USD 171.9 million, with intermediate milestones at USD 141.5 million, 151.0 million, and 161.1 million. During this late phase, market growth is sustained through technological innovation, expansion into emerging healthcare markets, and increased production capacity.

| Metric | Value |

|---|---|

| Drug Integrated Polymer Fibers Market Estimated Value in (2025 E) | USD 89.9 million |

| Drug Integrated Polymer Fibers Market Forecast Value in (2035 F) | USD 171.9 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The drug integrated polymer fibers market is strongly shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The pharmaceutical and drug delivery market holds the largest share at 35%, driven by the need for advanced systems that enable controlled-release, targeted delivery, and improved bioavailability of drugs through polymer fibers. The medical devices and wound care market contributes 25%, with sutures, wound dressings, and implantable devices incorporating drug-loaded fibers to accelerate healing, reduce infection risks, and improve patient outcomes. The biotechnology and tissue engineering market accounts for 15%, as polymer fibers are used in scaffolds, regenerative medicine, and tissue engineering to support cellular growth and localized therapy.

The research and development (R&D) market holds a 15% share, fueled by ongoing academic and industrial innovation in drug encapsulation, fiber formulation, and biocompatible materials. The healthcare and hospital market represents 10%, adopting therapeutic polymer fiber devices for post-surgical care and patient-specific treatments.

Pharmaceutical, medical devices, and biotechnology segments account for 75% of overall demand, highlighting that drug delivery, therapeutic applications, and tissue engineering remain the primary growth drivers, while R&D and hospital adoption provide complementary opportunities for market expansion globally.

The drug integrated polymer fibers market is growing steadily, driven by the convergence of biomaterials science and targeted drug delivery technologies. These fibers provide controlled release mechanisms, high biocompatibility, and mechanical versatility that suit a wide array of medical applications.

Rising demand for site-specific drug administration, particularly in oncology and chronic disease treatment, is accelerating adoption. Regulatory support for biodegradable and patient-friendly drug delivery systems further supports this shift.

Continuous R&D and collaboration among pharmaceutical and material science companies are enabling innovation in polymer chemistry and fiber engineering, broadening the market's scope across both therapeutic and surgical settings.

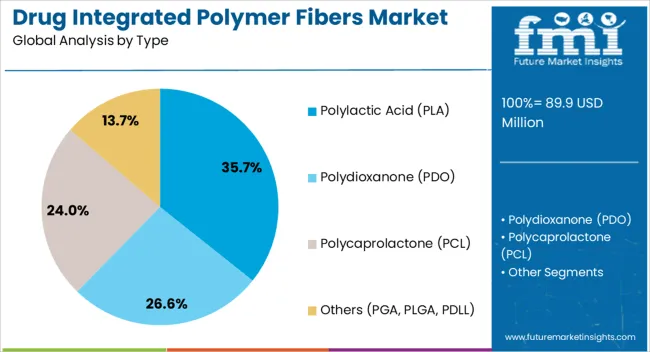

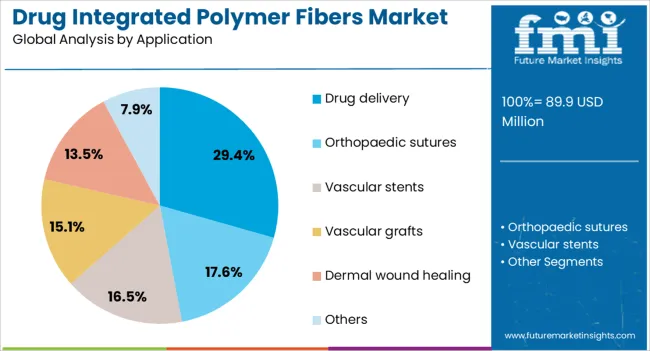

The drug integrated polymer fibers market is segmented by type, application, and geographic regions. By type, the drug integrated polymer fibers market is divided into Polylactic Acid (PLA), Polydioxanone (PDO), Polycaprolactone (PCL), and Others (PGA, PLGA, PDLL). In terms of application, drug integrated polymer fibers market is classified into Drug delivery, Orthopaedic sutures, Vascular stents, Vascular grafts, Dermal wound healing, and Others.

Regionally, the drug integrated polymer fibers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polylactic Acid (PLA) is anticipated to hold 35.7% of the total market share in 2025, making it the dominant polymer type. PLA’s popularity is driven by its biocompatibility, biodegradability, and favorable mechanical properties suitable for medical-grade fiber production.

It enables sustained and localized drug release, making it effective in applications ranging from wound healing to cancer therapy. Additionally, its FDA approval for various biomedical uses provides a regulatory advantage that fosters faster clinical adoption.

Ongoing research into PLA composites and their ability to encapsulate diverse drug molecules ensures their continued relevance in advanced pharmaceutical delivery systems.

The drug delivery segment is forecast to account for 29.4% of the drug integrated polymer fibers market by 2025, emerging as the leading application. Growth in this segment is driven by the demand for minimally invasive, patient-friendly treatment methods that ensure controlled release of therapeutic agents.

These fibers are particularly valuable in targeting specific tissues and reducing systemic side effects. Their ability to integrate with implants or be used as standalone therapy devices enhances their appeal across multiple medical disciplines.

As chronic conditions and lifestyle-related diseases rise globally, the need for innovative drug delivery systems using polymer fibers is expected to remain strong.

The drug integrated polymer fibers market is growing as pharmaceutical, medical device, and textile innovators prioritize controlled drug delivery, wound care, and therapeutic applications. Demand is driven by fibers embedded with antibiotics, antivirals, growth factors, or other bioactive molecules for wound dressings, implants, and medical textiles.

Challenges include high manufacturing costs, complex fiber fabrication techniques, regulatory approvals, and maintaining drug stability during processing. Opportunities exist in advanced electrospinning methods, co-polymerized fibers, and multifunctional dressings. Trends highlight sustained-release fibers, biodegradable polymers, and customizable drug-loading capabilities.

Healthcare providers and pharmaceutical companies are increasingly adopting drug integrated polymer fibers for precise, localized drug delivery and improved therapeutic outcomes. These fibers enable sustained or targeted release of bioactive molecules, reducing systemic exposure and enhancing patient compliance. Applications include wound dressings, post-surgical implants, tissue scaffolds, and antimicrobial medical textiles.

Growth in chronic wound management, surgical interventions, and advanced biomaterials research is driving adoption. Product performance, biocompatibility, and drug release profiles are critical for clinical efficacy. With rising demand for improved patient outcomes, drug integrated polymer fibers are being positioned as essential components in next-generation medical devices and therapeutic textiles.

Constraints in the market include high R&D and manufacturing costs associated with electrospinning, drug encapsulation, and fiber stabilization. Maintaining bioactive molecule integrity during processing is challenging, requiring precise temperature and solvent control. Regulatory compliance across the FDA, EMA, and regional medical device standards adds complexity.

Supply chain limitations for specialty polymers, active pharmaceutical ingredients, and precision fabrication equipment can impact production timelines. Buyers increasingly seek suppliers with validated manufacturing protocols, consistent fiber-drug integration, and technical support to ensure reproducibility, safety, and efficacy, mitigating risk for clinical and commercial deployment.

Opportunities exist in biodegradable polymer fibers, multifunctional wound dressings, and fibers with customizable drug-loading profiles for controlled release. Advanced electrospinning techniques and co-polymerized fibers allow tailored mechanical, thermal, and drug-release properties. Applications in chronic wound management, post-operative care, and implantable devices are expanding rapidly. Regional growth in North America, Europe, and Asia-Pacific is driven by increasing healthcare expenditures, aging populations, and adoption of advanced wound care solutions. Suppliers offering scalable, application-ready fibers with technical guidance and regulatory support are well positioned to capitalize on the demand for innovative therapeutic textiles and drug delivery platforms.

The market is trending toward electrospun fibers, biodegradable polymers, and targeted drug-release systems. Multifunctional fibers combining antimicrobial, growth-promoting, and structural properties are gaining traction. Integration with advanced dressings, scaffolds, and wearable medical devices enhances therapeutic efficacy and patient compliance.

Digital monitoring and predictive modeling are increasingly used to optimize fiber-drug release profiles and performance. Partnerships between polymer suppliers, pharmaceutical developers, and biomedical researchers are accelerating innovation and clinical adoption. Suppliers providing high-quality, technically supported, and clinically validated drug-integrated polymer fibers are best positioned to meet evolving healthcare and biomedical needs globally.

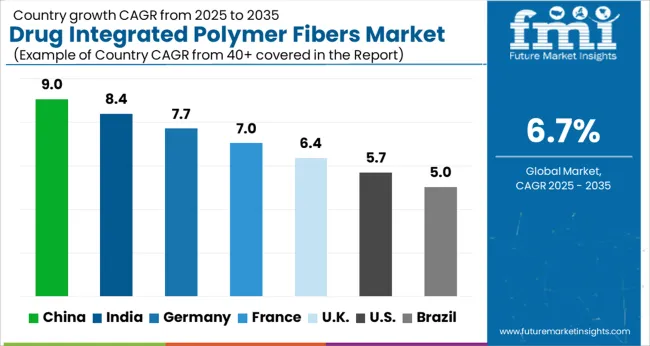

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

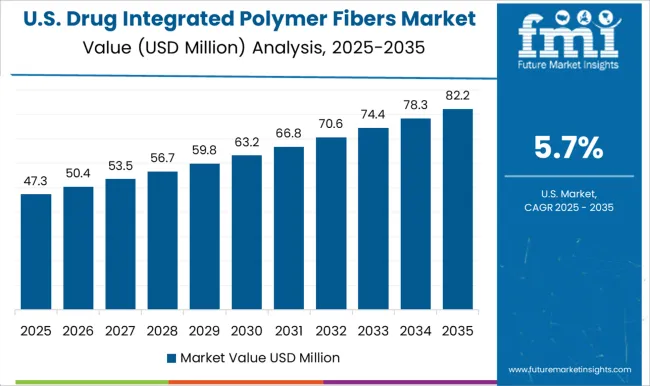

| USA | 5.7% |

| Brazil | 5.0% |

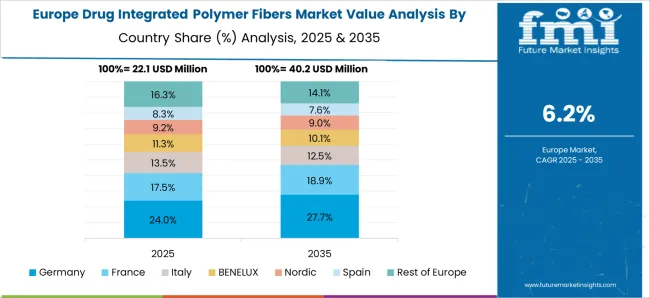

The global drug integrated polymer fibers market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads with 9.0%, followed by India (8.4%), Germany (7.7%), the UK (6.4%), and the USA (5.7%). Market growth is driven by healthcare demand for advanced wound care, post-surgical recovery, and infection prevention solutions. BRICS nations, especially China and India, show strong adoption due to urbanization and healthcare expansion. OECD countries focus on regulatory compliance, research innovation, and high-quality product integration. Partnerships with pharmaceutical companies, hospital adoption, and product innovation in controlled drug-release fibers are key factors shaping market expansion globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The drug integrated polymer fibers market in China is projected to grow at a CAGR of 9.0% from 2025 to 2035, fueled by rising demand in healthcare, wound care, and advanced medical textiles. Hospitals and clinics are adopting polymer fiber-based dressings, scaffolds, and drug delivery systems to enhance patient outcomes and reduce infection rates. Domestic manufacturers are scaling up production while integrating controlled-release formulations for chronic disease management. Collaborations with pharmaceutical companies enable innovative fiber-drug combinations. E-commerce and medical supply chains are expanding product reach. Urbanization, an aging population, and growing awareness of advanced wound care products further boost demand.

The drug integrated polymer fibers market in India is expected to grow at a CAGR of 8.4%, supported by increasing investments in healthcare infrastructure and wound care management. Hospitals, clinics, and home healthcare providers are increasingly adopting drug-loaded polymer fibers for post-surgical recovery, chronic wounds, and diabetic foot ulcers. Local manufacturers focus on cost-effective solutions with enhanced biocompatibility, antibacterial properties, and extended release of therapeutic agents. Partnerships with pharmaceutical companies allow development of polymer fibers for specific drug delivery applications. Government initiatives improving hospital access and medical supply chains support adoption. Rising awareness among clinicians and patients about infection control and advanced wound healing products also contributes to market growth.

Germany’s market is forecasted to expand at a CAGR of 7.7%, driven by research-led innovation in biomedical textiles and advanced drug delivery technologies. Hospitals and specialized clinics are adopting polymer fibers with integrated therapeutics for postoperative care, chronic wound management, and infection prevention. German manufacturers emphasize high-quality, certified products meeting EU regulations. R&D collaborations with universities and pharmaceutical firms support innovation in controlled-release fibers and novel composite materials. Demand is further bolstered by aging demographics and chronic disease prevalence, which necessitate advanced medical textile solutions. Adoption in home healthcare and specialized care centers adds to the market’s growth potential.

The USA market is anticipated to grow at a CAGR of 5.7%, driven by strong demand from hospitals, outpatient care, and specialized clinics. Polymer fibers integrated with antibiotics, anti-inflammatory drugs, and other therapeutics are increasingly used for post-surgical recovery, chronic wound care, and infection prevention. Domestic manufacturers focus on innovation, quality, and FDA compliance. Partnerships with pharmaceutical companies enable the development of fibers for specific therapeutic needs. Home healthcare adoption and outpatient wound care programs contribute to market expansion. Distribution through online platforms and medical suppliers ensures broad access. Innovation in controlled-release fibers and multi-drug integration continues to strengthen market growth.

The UK market is projected to expand at a CAGR of 6.4%, driven by hospital adoption, wound management, and home healthcare applications. Hospitals and care facilities utilize polymer fibers for post-surgical recovery, infection control, and chronic wound treatment. Local manufacturers and distributors emphasize products that combine drug release with high biocompatibility. Partnerships with pharmaceutical companies support the development of innovative fibers for controlled therapeutic delivery. Government healthcare programs and increasing awareness about advanced wound care contribute to adoption. E-commerce channels and medical supply distributors further enhance accessibility across urban and semi-urban regions.

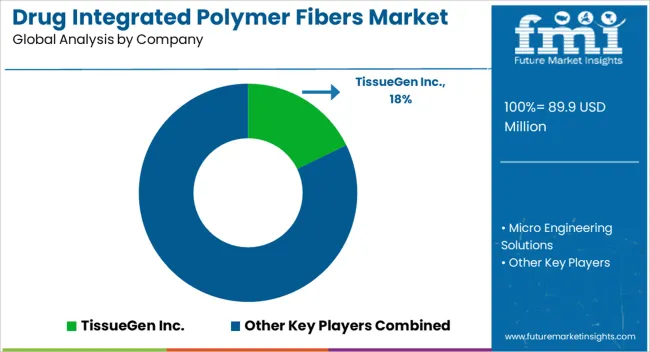

Competition in the drug integrated polymer fibers market is defined by biocompatibility, drug-loading efficiency, and controlled-release performance. TissueGen Inc. leads with polymer fiber platforms designed for tissue engineering, wound care, and localized therapeutic delivery. Fibers are engineered to release bioactive molecules or pharmaceuticals in a controlled manner, emphasizing consistency, sterility, and regulatory compliance. Product differentiation is achieved through customizable fiber diameters, drug encapsulation techniques, and mechanical properties tailored for biomedical applications. Micro Engineering Solutions competes through precision extrusion and electrospinning processes, focusing on high-purity polymer matrices, scalable manufacturing, and integration with complex drug formulations. Both companies leverage collaborations with pharmaceutical developers and research institutions to co-develop fibers suitable for specific therapeutic targets, including chronic wound treatment, regenerative medicine, and implantable devices. Strategies prioritize innovation in polymer selection, drug-fiber compatibility, and process reproducibility. Emphasis is placed on regulatory alignment with FDA, EMA, and ISO standards for medical devices and drug delivery systems. Customized fiber architectures are marketed for tunable release kinetics, mechanical stability, and bioresorbable applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 89.9 Million |

| Type | Polylactic Acid (PLA), Polydioxanone (PDO), Polycaprolactone (PCL), and Others (PGA, PLGA, PDLL) |

| Application | Drug delivery, Orthopaedic sutures, Vascular stents, Vascular grafts, Dermal wound healing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TissueGen Inc. and Micro Engineering Solutions |

| Additional Attributes | Dollar sales by fiber type (biodegradable, non-biodegradable), drug integration method (encapsulation, coating, blending), and application (wound care, tissue engineering, implants, drug delivery). Demand is fueled by increasing adoption of advanced biomaterials, precision medicine, and regenerative therapies. Regional trends indicate growing opportunities in North America and Europe due to healthcare innovation, regulatory support, and rising clinical adoption of advanced polymer fiber solutions. |

The global drug integrated polymer fibers market is estimated to be valued at USD 89.9 million in 2025.

The market size for the drug integrated polymer fibers market is projected to reach USD 171.9 million by 2035.

The drug integrated polymer fibers market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in drug integrated polymer fibers market are polylactic acid (pla), polydioxanone (pdo), polycaprolactone (pcl) and others (pga, plga, pdll).

In terms of application, drug delivery segment to command 29.4% share in the drug integrated polymer fibers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA