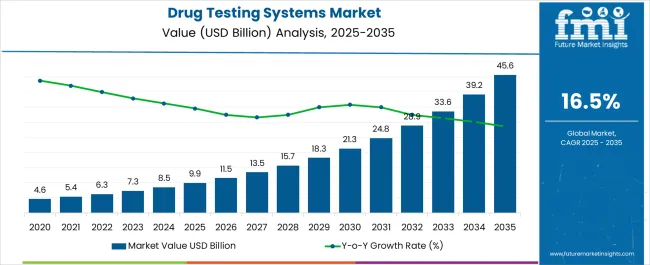

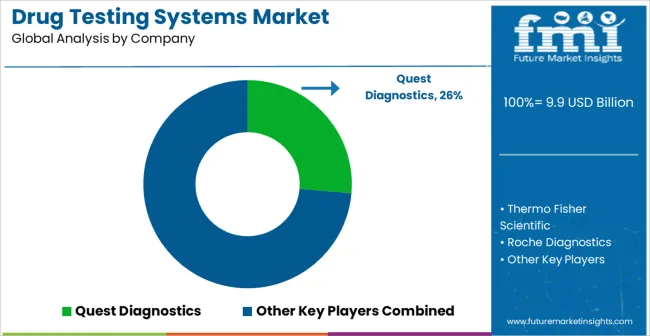

The Drug Testing Systems Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 45.6 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

| Metric | Value |

|---|---|

| Drug Testing Systems Market Estimated Value in (2025 E) | USD 9.9 billion |

| Drug Testing Systems Market Forecast Value in (2035 F) | USD 45.6 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The Drug Testing Systems market is experiencing steady growth driven by increasing demand for reliable and accurate detection of drugs and alcohol in clinical, occupational, and forensic settings. Current market dynamics reflect rising regulatory requirements for workplace safety, compliance in transportation and manufacturing industries, and government mandates for substance abuse monitoring. The growing prevalence of substance use disorders and increased awareness among employers and healthcare providers have further supported market expansion.

Advancements in testing technology, including rapid immunoassay kits, high-sensitivity instruments, and multiplex detection systems, have enhanced the accuracy, efficiency, and ease of use of these systems. Investments in laboratory infrastructure and healthcare facilities, coupled with rising concerns for public safety and employee health, have created significant opportunities for the market.

Additionally, the integration of automated testing systems and digital reporting solutions has increased operational efficiency, enabling broader adoption across hospitals, clinics, and corporate environments As demand for timely and accurate detection grows, the market is expected to maintain strong growth, supported by evolving testing methodologies and increasing regulatory enforcement.

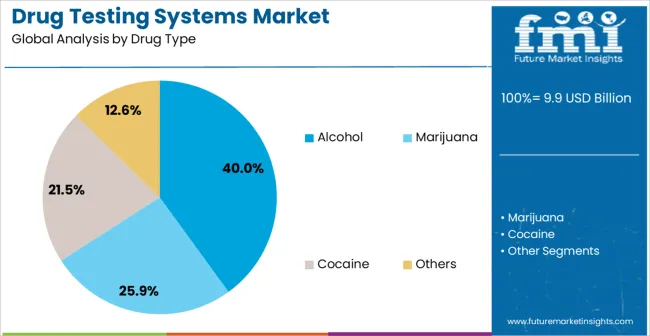

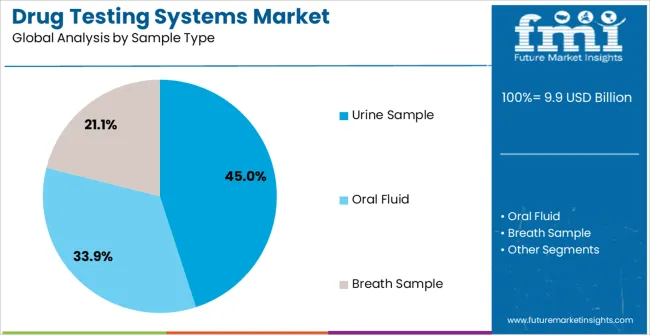

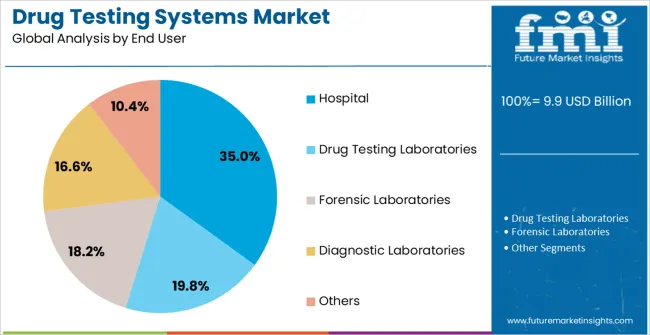

The drug testing systems market is segmented by drug type, sample type, end user, and geographic regions. By drug type, drug testing systems market is divided into Alcohol, Marijuana, Cocaine, and Others. In terms of sample type, drug testing systems market is classified into Urine Sample, Oral Fluid, and Breath Sample. Based on end user, drug testing systems market is segmented into Hospital, Drug Testing Laboratories, Forensic Laboratories, Diagnostic Laboratories, and Others. Regionally, the drug testing systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Alcohol segment is projected to account for 40.00% of the Drug Testing Systems market revenue in 2025, establishing it as the leading drug type. This dominance is being driven by widespread workplace testing programs and strict regulatory requirements in industries where impairment can pose safety risks. The segment has benefited from increasing awareness of alcohol-related incidents and the need for preventive monitoring in occupational and clinical settings.

Adoption has been further strengthened by technological advancements in testing devices that allow rapid, accurate, and non-invasive detection of alcohol levels. Alcohol testing systems are often preferred due to their ability to deliver immediate results, facilitate compliance with safety regulations, and support clinical decision-making.

The growing emphasis on employee safety, combined with mandatory screening protocols in transportation, manufacturing, and healthcare, has reinforced the importance of alcohol testing as a primary segment Continuous improvements in sensitivity, portability, and automation are expected to further drive market growth and sustain the segment’s leading position.

The Urine Sample segment is estimated to hold 45.00% of the market revenue in 2025, making it the most widely adopted sample type for drug testing. This preference is being attributed to the non-invasive nature, ease of collection, and established reliability of urine-based assays. The segment has expanded rapidly due to its applicability across clinical diagnostics, workplace compliance, and forensic investigations.

Urine testing allows detection of a broad range of substances with high sensitivity and accuracy, supporting timely intervention and monitoring. Adoption is further supported by the availability of standardized testing kits, streamlined collection procedures, and compatibility with automated laboratory systems. Regulatory agencies have also endorsed urine testing as a primary method for occupational and clinical drug monitoring, reinforcing its widespread use.

The segment’s scalability, cost-effectiveness, and adaptability for multiple drug classes continue to position it as a dominant choice Ongoing enhancements in assay technology and automation are expected to sustain its market leadership and meet growing demand for reliable, high-throughput testing solutions.

The Hospital segment is projected to capture 35.00% of the Drug Testing Systems market revenue in 2025, leading the end-use industry classification. This leadership is being driven by the critical role hospitals play in patient diagnosis, treatment planning, and substance abuse monitoring. Hospitals benefit from integrated drug testing systems that provide rapid and reliable results, supporting timely medical interventions and clinical decision-making.

The growth of this segment has been further reinforced by the increasing prevalence of substance use disorders and hospital-based screening programs aimed at improving patient safety and outcomes. Adoption is also being facilitated by advancements in automated and high-throughput testing platforms, which allow efficient handling of large patient volumes.

The segment’s expansion is supported by healthcare initiatives focusing on preventive care, occupational safety, and compliance with national health regulations As hospitals continue to enhance their diagnostic capabilities and prioritize patient-centered care, the demand for sophisticated drug testing systems is expected to rise, maintaining the hospital segment as a key driver of market growth.

Drug testing systems are used to detect the presence of drugs such as marijuana, cocaine, oxycodone, ecstasy, opiates, methamphetamine etc. drug testing systems are used in treatment centers, criminal justice facilities and for industrial applications.

Drug testing systems are fast, accurate for testing and easy drug screening. Drug testing is one of the rapidly evolving technologies which identify the use of a specific drug. Drug test systems provide information about the recent use of drugs and help to inform and improve the communication between the patient who is subjected for drug testing and healthcare provider.

Drug testing is widely used in various end user segment for testing drug of abuse. Increasing consumption of the drug is expected to fuel the drug testing systems market in near future.

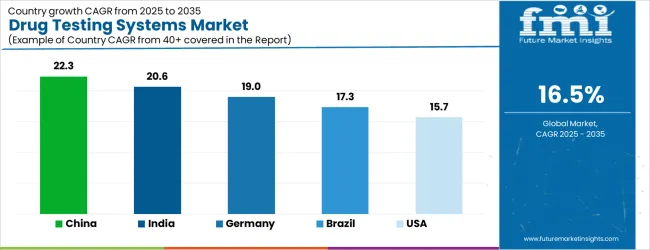

| Country | CAGR |

|---|---|

| China | 22.3% |

| India | 20.6% |

| Germany | 19.0% |

| Brazil | 17.3% |

| USA | 15.7% |

| UK | 14.0% |

| Japan | 12.4% |

The Drug Testing Systems Market is expected to register a CAGR of 16.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 22.3%, followed by India at 20.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 12.4%, yet still underscores a broadly positive trajectory for the global Drug Testing Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 19.0%. The USA Drug Testing Systems Market is estimated to be valued at USD 3.5 billion in 2025 and is anticipated to reach a valuation of USD 3.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 487.8 million and USD 252.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Drug Type | Alcohol, Marijuana, Cocaine, and Others |

| Sample Type | Urine Sample, Oral Fluid, and Breath Sample |

| End User | Hospital, Drug Testing Laboratories, Forensic Laboratories, Diagnostic Laboratories, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Quest Diagnostics, Thermo Fisher Scientific, Roche Diagnostics, LabCorp, Abbott Laboratories, OraSure Technologies, Siemens Healthineers, and Alere Inc. |

The global drug testing systems market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the drug testing systems market is projected to reach USD 45.6 billion by 2035.

The drug testing systems market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in drug testing systems market are alcohol, marijuana, cocaine and others.

In terms of sample type, urine sample segment to command 45.0% share in the drug testing systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Testing Equipment Market

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Road Side Drug Testing Devices Market

Novel Drug Delivery Systems in Cancer Therapy Market Analysis – Growth & Forecast 2024-2034

Durability Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

The Hemostasis Testing Systems Market is segmented by product type, application, and end user from 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Gastro-retentive Drug Delivery Systems Market - Trends & Demand 2025 to 2035

Bioprocess Integrity Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Employer and Workplace Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Dosage Form Testing Systems Market

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA