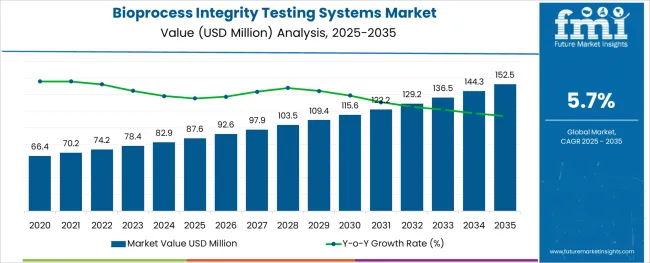

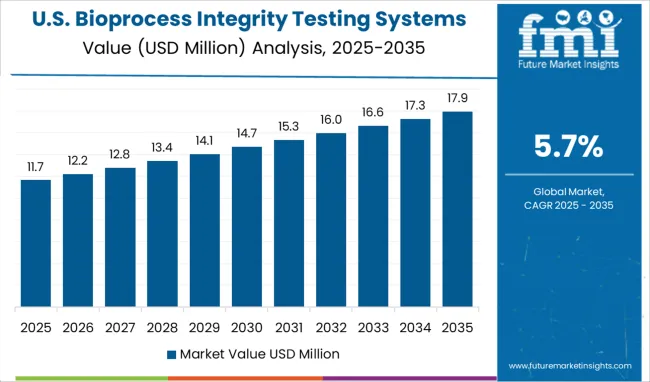

The Bioprocess Integrity Testing Systems Market is estimated to be valued at USD 87.6 million in 2025 and is projected to reach USD 152.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The bioprocess integrity testing systems market is expanding due to increasing demand for quality assurance in biopharmaceutical manufacturing. The growing complexity of biologics production has raised the need for robust testing systems that ensure product safety and process reliability. Advances in testing technologies have enabled more accurate and efficient monitoring of bioprocess integrity, reducing contamination risks and improving overall yield.

Regulatory expectations for stringent quality control and validation have further propelled market growth. Investment in biologics and biosimilar development continues to rise globally, driving the adoption of integrity testing solutions.

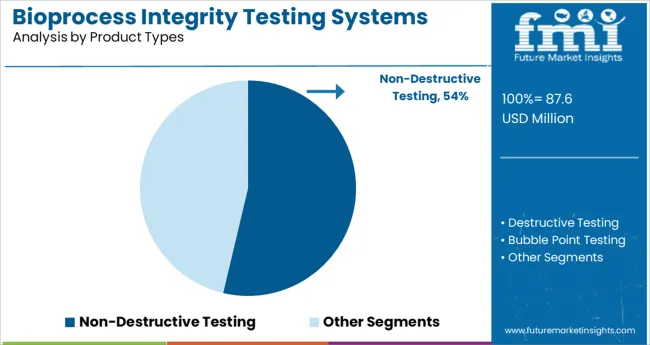

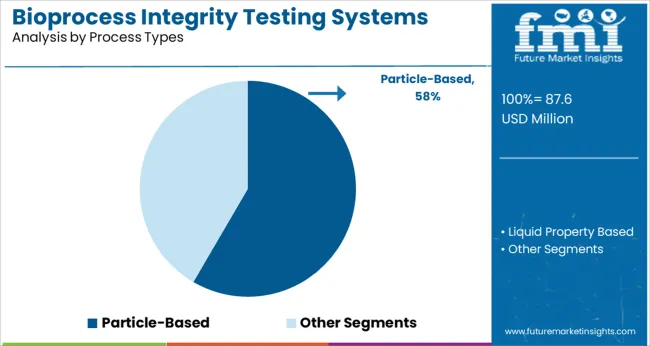

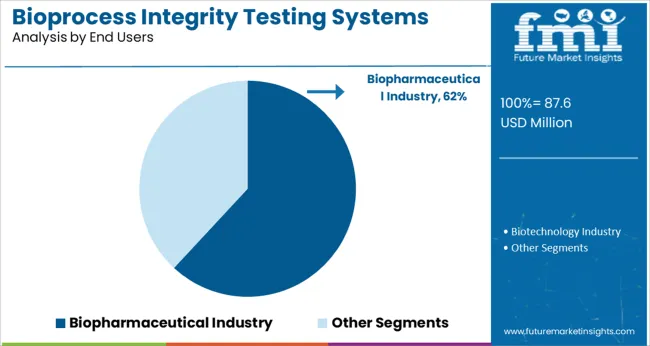

Future growth is expected to be supported by innovations in non-destructive testing methods and automation to enhance process efficiency. Segment growth is projected to be led by Non-Destructive Testing in product types, Particle-Based testing in process types, and the Biopharmaceutical Industry as the dominant end user.

The market is segmented by Product Types, Process Types, and End Users and region. By Product Types, the market is divided into Non-Destructive Testing, Destructive Testing, Bubble Point Testing, Diffusion Testing, and Pressure Hold Testing. In terms of Process Types, the market is classified into Particle-Based and Liquid Property Based.

Based on End Users, the market is segmented into Biopharmaceutical Industry and Biotechnology Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Types, Process Types, and End Users and region. By Product Types, the market is divided into Non-Destructive Testing, Destructive Testing, Bubble Point Testing, Diffusion Testing, and Pressure Hold Testing.

In terms of Process Types, the market is classified into Particle-Based and Liquid Property Based. Based on End Users, the market is segmented into Biopharmaceutical Industry and Biotechnology Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Non-Destructive Testing segment is expected to hold 53.7% of the market revenue in 2025, reflecting its leading role in bioprocess integrity testing. This segment has been favored due to its ability to assess product quality and container integrity without compromising the sample. Non-destructive methods allow continuous monitoring and reduce waste, making them cost-effective and suitable for sensitive biologic products.

Manufacturers prioritize these testing systems to ensure compliance with regulatory standards and to detect defects early in the process.

The segment benefits from technological advancements that increase testing speed and sensitivity while maintaining product sterility. As biologics manufacturing scales up, non-destructive testing will remain critical for process validation and quality assurance.

The Particle-Based testing segment is projected to contribute 58.4% of the market revenue in 2025, making it the leading process type. Growth in this segment is driven by the necessity to detect particulate contamination during manufacturing, which can affect product safety and efficacy. Particle-based methods provide detailed analysis of particle size and count, enabling manufacturers to monitor critical quality attributes.

Increased focus on injectable biologics and strict particulate matter regulations have pushed adoption of particle-based testing solutions.

The segment’s importance has been underscored by improvements in detection technologies that offer real-time, high-sensitivity measurements. As manufacturing processes become more complex and stringent, particle-based testing is expected to maintain its leading position.

The Biopharmaceutical Industry segment is anticipated to account for 61.9% of the market revenue in 2025, dominating end-user applications. This segment’s growth is driven by the expansion of biologics and biosimilars pipelines worldwide. Biopharmaceutical companies require advanced testing systems to ensure batch consistency and to comply with rigorous regulatory requirements.

Increasing outsourcing of bioprocess development and manufacturing has further increased demand for integrity testing solutions within the industry.

Continuous improvements in product complexity and the need for risk mitigation in manufacturing environments have elevated the role of integrity testing systems. The Biopharmaceutical Industry segment is expected to sustain its leadership as biologics production intensifies and quality standards evolve.

Increasing awareness about the benefits of using the Bioprocess Integrity Testing systems market among healthcare professionals and consumers fuelling the demand for the Bioprocess Integrity Testing systems market. Technological advancements in filter design and manufacturing improve performance, and the increasing availability of fully automated integrity test systems will boost the growth of the market in the forecasting period.

Due to the reliability of the systems, portability, and ease of implementation Bioprocess Integrity Testing is adopted by leading biopharmaceutical players and biotechnology companies. The market for bioprocess Integrity Testing systems would be accelerated due to the accelerated testing capabilities of the systems.

Although the Bioprocess Integrity Testing system market has numerous end-uses, there are numerous obstacles that likely pose a challenge to market growth. Lack of technical expertise and lack of awareness in the developing and underdeveloped economies may impede the growth of the Bioprocess Integrity Testing system market. The High cost associated with testing may also hider the growth of the Bioprocess Integrity Testing system market.

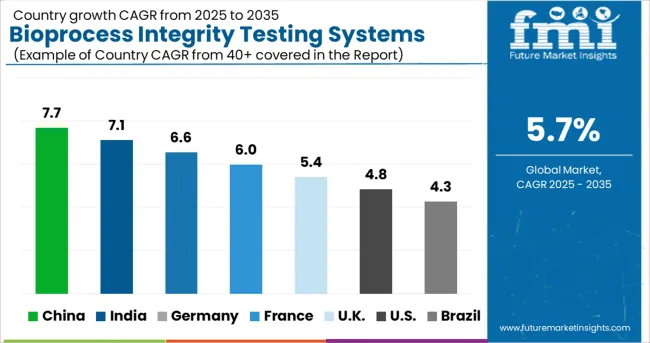

North America was the largest market for the Bioprocess Integrity Testing system market and the trend is expected to continue into the forecast period owing to the increasing government support and increasing R&D activities.

The technological advancement in the healthcare sector in the region is expected to augment the Bioprocess Integrity Testing system market. The region is forecast to have a 33.0% total share of the Bioprocess Integrity Testing system market.

North America is expected to be the next dominant region witnessing high adoption rates for the Bioprocess Integrity Testing system market during the forecast period due to the increasing demand for biopharmaceuticals and the implementation of drug safety guidelines by the FDA.

According to Future Market Insights Europe accounts for a total 30.0% share in the global Bioprocess Integrity Testing system market. Increasing healthcare investments and the presence of prominent market vendors and providers also benefit Europe’s market.

The global Bioprocess Integrity Testing system market is gaining traction in the region due to increasing research facilities and the developing biopharmaceutical industry and the growth in the biologics market. Also, stringent government guidelines for purity requirements in pharmaceutical and biotechnology manufacturing boost the growth of the market.

Bugworks Research, Medgenome, BitBio, uFraction, Tasi Group and vertex-scientific-lab-instruments-co-company are some start-up companies operating in the Bioprocess Integrity Testing system market.

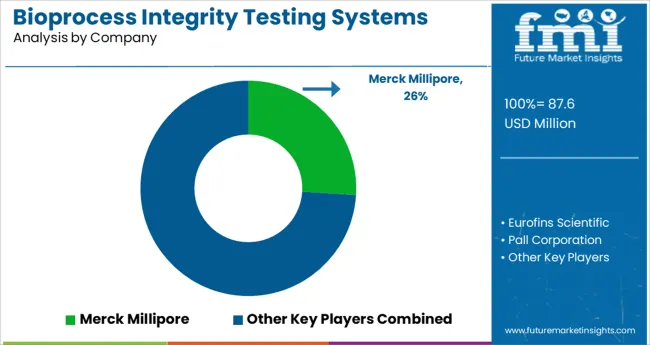

Some of the key participants present in the global Bioprocess Integrity Testing system market include Merck Millipore, Eurofins Scientific, Pall Corporation, Sartorius Group, and Viet Anh Scientific Co., Ltd. among others.

Attributed to the presence of such a high number of participants, the market is highly competitive. While global players such as Merck Millipore, Eurofins Scientific, Pall Corporation account for considerable market size, several regional level players are also operating across key growth regions, particularly in the Asia Pacific.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.7% from 2025 to 2035 |

| Expected Market Value (2025) | USD 74.2 Million |

| Anticipated Forecast Value (2035) | USD 136.6 Million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Process Type, End User, Region |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, GCC, South Africa, Israel |

| Key Companies Profiled | Merck Millipore, Eurofins Scientific, Pall Corporation, Sartorius Group, Viet Anh Scientific Co. Ltd. |

| Customization | Available Upon Request |

The global bioprocess integrity testing systems market is estimated to be valued at USD 87.6 million in 2025.

It is projected to reach USD 152.5 million by 2035.

The market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types are non-destructive testing, destructive testing, bubble point testing, diffusion testing and pressure hold testing.

particle-based segment is expected to dominate with a 58.4% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioprocess Fermentation Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioprocess Technology Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Validation Market Analysis by Testing Type, Stage, Mode, and Region through 2035

Bioprocess Containers & Fluid Transfer Solutions Market – Trends & Forecast 2025 to 2035

Bioprocessing Systems Market

Portable Bioprocessing Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Upstream Bioprocessing Equipment Market - Growth, Trends & Forecast 2025 to 2035

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Duct Integrity Tester (DIT) Market Size and Share Forecast Outlook 2025 to 2035

File Integrity Monitoring Market Size and Share Forecast Outlook 2025 to 2035

High Integrity Pressure Protection System Market

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Marine Asset Integrity Services Market

Hyperspectral Imaging for Seal Integrity Market Analysis Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA