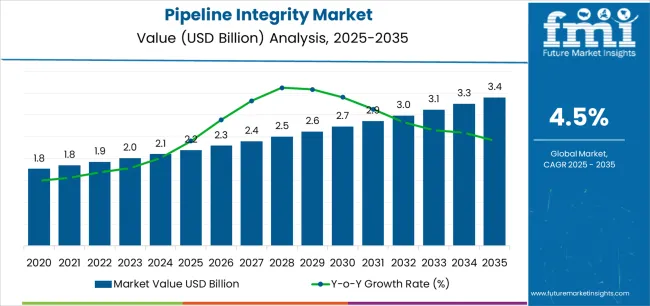

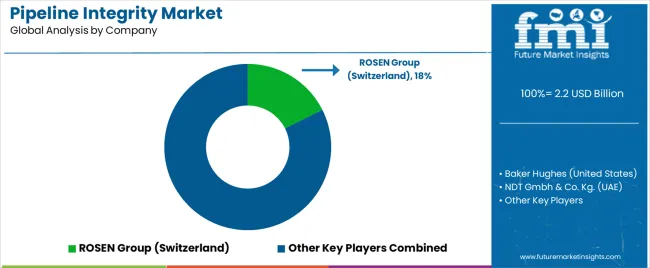

The Pipeline Integrity Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The pipeline integrity market is witnessing strong growth driven by expanding oil and gas transmission networks, rising regulatory emphasis on safety standards, and increasing investments in maintenance and monitoring infrastructure. The current scenario reflects growing adoption of advanced inspection technologies, digital monitoring tools, and predictive maintenance systems aimed at preventing leaks, corrosion, and operational failures.

Continuous modernization of aging pipeline systems and the integration of smart sensors are enhancing operational efficiency and risk management capabilities. Future outlook remains positive as the global demand for energy transportation reliability continues to rise, encouraging companies to prioritize asset integrity and compliance with environmental and safety regulations.

Growth rationale is supported by the need for uninterrupted supply, increasing pipeline network length, and ongoing adoption of automation-based inspection methods that reduce downtime and operational costs These factors collectively reinforce the market’s sustained expansion trajectory and technological advancement over the forecast period.

| Metric | Value |

|---|---|

| Pipeline Integrity Market Estimated Value in (2025 E) | USD 2.2 billion |

| Pipeline Integrity Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

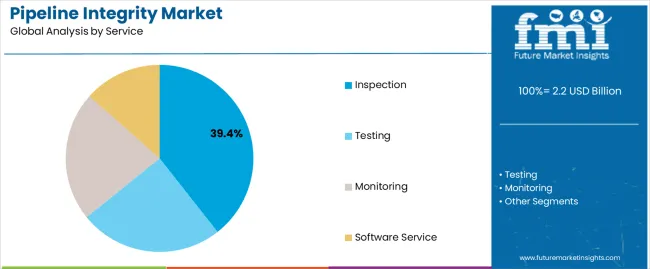

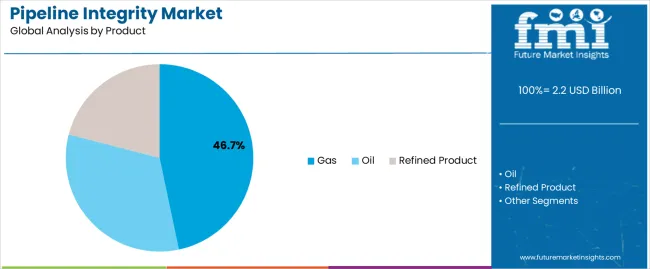

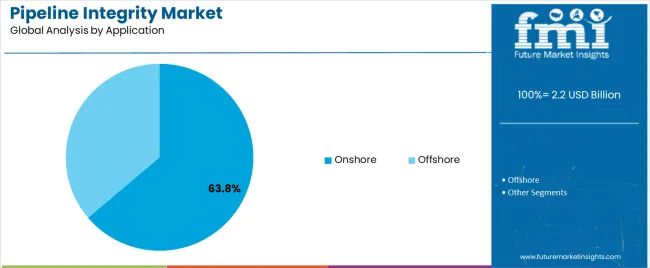

The market is segmented by Service, Product, and Application and region. By Service, the market is divided into Inspection, Testing, Monitoring, and Software Service. In terms of Product, the market is classified into Gas, Oil, and Refined Product. Based on Application, the market is segmented into Onshore and Offshore. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inspection segment, holding 39.40% of the service category, has been leading the market due to its critical role in identifying structural weaknesses, corrosion, and operational anomalies across pipeline systems. Its dominance has been supported by the growing implementation of smart pigging, ultrasonic testing, and magnetic flux leakage technologies that improve detection accuracy and minimize maintenance downtime.

Regulatory mandates for periodic inspections have driven consistent service demand, while digital platforms integrating AI and data analytics are enhancing real-time reporting and predictive diagnostics. The increasing scale of cross-border pipelines and the prioritization of preventive maintenance are further strengthening the inspection segment’s market position.

Continuous advancements in robotic and autonomous inspection systems are expected to elevate service efficiency, ensuring sustained growth and greater operational reliability across global pipeline networks.

The gas segment, accounting for 46.70% of the product category, has maintained its leading position driven by expanding natural gas infrastructure and increasing reliance on gas as a transition fuel in the global energy mix. The segment benefits from extensive transmission networks that require regular monitoring and maintenance to ensure safety and compliance.

Rising global demand for LNG and cross-country gas trade has intensified the focus on high-integrity pipeline systems. Technological integration, including advanced corrosion control systems and remote leak detection solutions, is enhancing safety and operational visibility.

Market participants are investing in digital twins and real-time monitoring systems to optimize performance and reduce unplanned outages Continued expansion of gas distribution grids, particularly in developing economies, is expected to strengthen the segment’s contribution to overall market growth.

The onshore segment, representing 63.80% of the application category, has emerged as the dominant area due to the extensive length of onshore pipelines used for oil and gas transportation and distribution. Its leadership is supported by easier access for maintenance operations, lower inspection costs, and high regulatory compliance requirements.

Ongoing infrastructure expansion and rehabilitation of aging onshore pipelines are key growth drivers. Increased integration of smart monitoring systems and IoT-enabled sensors is improving visibility and operational safety.

Investments in automation and AI-based condition monitoring tools are minimizing failure risks and optimizing maintenance cycles The growing emphasis on sustainable and efficient transportation of hydrocarbons across industrial and commercial end users is expected to sustain the dominance of the onshore segment and drive continued advancements in pipeline integrity management practices.

Testing is predicted to upsurge the global market with a 4.5% CAGR through 2035.

| Attributes | Details |

|---|---|

| Service | Testing |

| CAGR (2025 to 2035) | 4.5% |

This rising popularity is attributed to:

Oil is expected to upsurge the global market with a 4.3% CAGR through 2035.

| Attributes | Details |

|---|---|

| Product | Oil |

| CAGR (2025 to 2035) | 4.3% |

This rising popularity is attributed to:

The section analyzes the global pipeline integrity market by country, including the United Kingdom, the United States, China, South Korea, and Japan. The table presents the CAGR for each country, indicating the expected market growth through 2035.

| Countries | CAGR |

|---|---|

| The United Kingdom | 5.6% |

| The United States | 5.0% |

| China | 4.0% |

| Japan | 3.4% |

| South Korea | 2.3% |

The United Kingdom continues to play a pivotal role in driving growth within the pipeline integrity market. It maintains a consistent pace with a CAGR of 5.6% until 2035, reaffirming its status as a significant and enduring contributor to the market's expansion.

The United Kingdom has been witnessing growth in the pipeline integrity market due to its high technological advancement and strict regulatory frameworks. The country's extensive pipeline network, especially in the oil and gas sector, requires advanced inspection and maintenance solutions to ensure the safety and reliability of the pipelines.

The United Kingdom government has been investing heavily in infrastructure development to enhance the efficiency and safety of its pipelines and increase the country's energy security.

The United States is steadily solidifying its position as a formidable player in the global pipeline integrity market, sustaining momentum with a projected CAGR of 5.0% anticipated to endure until 2035.

The United States has one of the largest pipeline infrastructures globally and is experiencing growth in the pipeline integrity market. The country has been investing in upgrading its aging pipelines to meet regulatory compliance requirements and ensure the safety of its pipeline networks. Adopting cutting-edge inspection technologies has further enhanced the reliability of its pipelines.

The United States government has been promoting advanced technologies to ensure the integrity of its pipeline networks and provide a safe and secure energy supply.

China is asserting its presence as a significant force in the international pipeline integrity market. It demonstrates a noteworthy emergence with a projected CAGR of 4.0% anticipated from 2025 to 2035.

China's rapid industrialization and expanding energy infrastructure have LED to a surge in the pipeline integrity market. The country's extensive network of pipelines transporting oil, natural gas, and other fluids requires advanced inspection and maintenance solutions to enhance safety and efficiency.

The Chinese government has been investing in infrastructure development and promoting high-tech inspection and monitoring technologies to ensure the integrity and reliability of its pipeline networks.

The country's pipeline integrity market is expected to grow significantly in the coming years, driven by the increasing demand for energy and the need for safe and secure energy distribution.

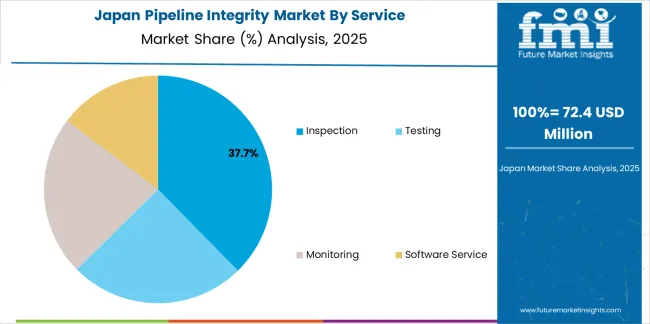

Japan is increasingly becoming a significant player in the global pipeline integrity market. It demonstrates consistent growth momentum with a projected CAGR of 3.4%, set to persist through 2035.

Japan's pipeline integrity market has been growing due to increasing investments in modernizing its infrastructure. The Japanese government has been investing in infrastructure development and promoting advanced inspection technologies to ensure the safety and integrity of its pipelines.

The country's pipeline integrity market is expected to grow significantly in the coming years, driven by the need for safe and secure energy distribution.

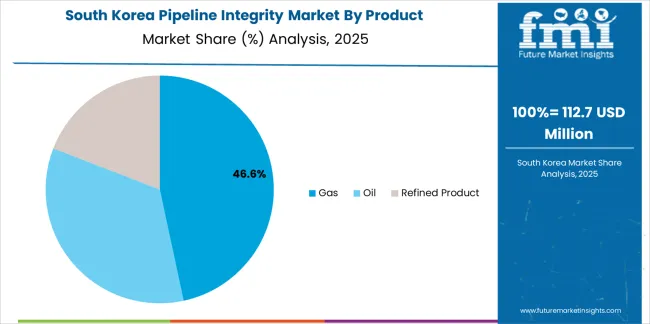

South Korea is positioning itself as a key contender in the global pipeline integrity market, showcasing notable emergence with a projected CAGR of 2.3% expected from 2025 to 2035.

South Korea is leveraging its advanced technology and engineering expertise to become a key player in the pipeline integrity market. The country has been developing and deploying innovative inspection and monitoring solutions to ensure the integrity and reliability of its pipeline networks.

The need to ensure the safety of critical energy infrastructure has been driving growth in the pipeline integrity market in South Korea. The government has invested in infrastructure development and promoting cutting-edge inspection technologies to meet the growing demand for a safe and secure energy supply.

Many companies invest heavily in research and development to advance pipeline inspection, monitoring, and maintenance technologies.

Their efforts are focused on improving the accuracy, efficiency, and reliability of integrity assessment tools such as smart sensors, robotic inspection devices, and advanced data analytics software.

To expand their reach and address emerging opportunities, these companies also establish local offices, distribution networks, and service centers in key regions, enabling them to better cater to clients' diverse needs worldwide.

In addition to these efforts, major players also prioritize customer education and awareness initiatives to promote the importance of pipeline integrity and the benefits of adopting comprehensive integrity management solutions.

By conducting training programs, seminars, and industry conferences, they aim to equip pipeline operators, regulatory authorities, and other stakeholders with the knowledge and skills to implement and maintain integrity management programs effectively.

Through these initiatives, manufacturers and producers hope to foster a deeper understanding of best practices, regulatory requirements, and emerging technologies.

Recent Developments

The global pipeline integrity market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the pipeline integrity market is projected to reach USD 3.4 billion by 2035.

The pipeline integrity market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pipeline integrity market are inspection, testing, monitoring and software service.

In terms of product, gas segment to command 46.7% share in the pipeline integrity market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Gas Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

LNG Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Management Software Market

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Duct Integrity Tester (DIT) Market Size and Share Forecast Outlook 2025 to 2035

File Integrity Monitoring Market Size and Share Forecast Outlook 2025 to 2035

High Integrity Pressure Protection System Market

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Integrity Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine Asset Integrity Services Market

Hyperspectral Imaging for Seal Integrity Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA