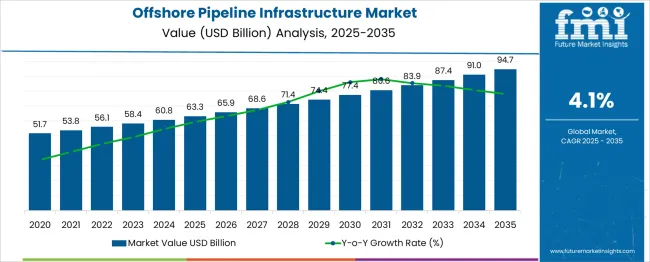

The Offshore Pipeline Infrastructure Market is estimated to be valued at USD 63.3 billion in 2025 and is projected to reach USD 94.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The offshore pipeline infrastructure market is projected to grow steadily from USD 51.7 billion in 2021 to USD 74.4 billion by 2030, reflecting a robust expansion driven by increasing global demand for energy transport and offshore exploration activities. Over this ten-year period, the market is expected to expand by nearly USD 22.7 billion, underscoring consistent investments in subsea pipeline systems that facilitate the transmission of oil, gas, and other hydrocarbons from offshore fields to onshore processing facilities.

From 2021 through 2025, the market value rises from USD 51.7 billion to USD 60.8 billion, highlighting incremental annual growth as offshore projects, particularly in regions such as the Gulf of Mexico, North Sea, and West Africa, gain momentum. The latter half of the decade, between 2026 and 2030, is forecasted to witness continued expansion, reaching USD 74.4 billion, driven by both the modernization of aging pipeline networks and the development of new infrastructure to support deepwater and ultra-deepwater operations.

This growth trajectory is supported by technological advancements in pipeline materials, enhanced corrosion resistance, and installation methodologies, which improve operational safety and reduce maintenance costs. Increased focus on energy transition fuels demand for infrastructure capable of transporting alternative fuels like hydrogen and carbon capture streams, broadening the scope of offshore pipeline applications.

The steady rise in market value indicates resilience amid fluctuating energy prices and regulatory shifts, with sustained capital expenditure from major oil and gas operators and national energy programs playing critical roles in underpinning long-term growth across key offshore regions globally.

| Metric | Value |

|---|---|

| Offshore Pipeline Infrastructure Market Estimated Value in (2025 E) | USD 63.3 billion |

| Offshore Pipeline Infrastructure Market Forecast Value in (2035 F) | USD 94.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The offshore pipeline infrastructure market occupies a critical niche within the broader oil and gas infrastructure sector. Within the global pipeline market, which includes both onshore and offshore systems, offshore pipelines hold an estimated 12% to 15% market share, driven by their essential role in transporting oil and gas from offshore fields to onshore facilities.

These pipelines are particularly favored in regions with significant offshore oil and gas reserves, such as the Gulf of Mexico, North Sea, and offshore areas in Asia-Pacific. In contrast, onshore pipelines, which cater to land-based energy transportation, account for the remaining market share.

Within the oil and gas pipeline infrastructure sector, offshore pipelines capture a higher share, approximately 45% to 50%, due to the growing exploration and production of offshore oil and natural gas resources. Their contribution to the overall energy infrastructure market is estimated to be around 6% to 8%, with their specialized use in deep-water and remote energy extraction.

Despite their smaller proportion within the total pipeline infrastructure market, offshore pipelines play a pivotal role in enabling global energy supply and maintaining energy security. Market growth is supported by the increasing global demand for energy, especially natural gas, and the need for efficient, safe transportation of energy from offshore fields. With advancements in pipeline technology and materials, offshore pipelines continue to be a core enabler of energy transportation solutions worldwide.

The offshore pipeline infrastructure market is undergoing accelerated transformation, driven by the resurgence of offshore oil and gas projects and heightened demand for stable energy transmission networks. The increasing focus on deepwater and ultra-deepwater reserves, especially across regions such as the Gulf of Mexico, North Sea, and Southeast Asia, has reinforced the need for durable, high-performance subsea pipelines. Governments and private operators are pushing forward with offshore licensing rounds and investment in exploration and production, fueling growth in associated pipeline infrastructure.

Technological advancements in metallurgy, corrosion resistance, and smart pipeline monitoring systems are enabling longer and more reliable transmission over complex seabed terrains. Moreover, evolving environmental regulations and energy transition goals are influencing the design of low-leakage, efficiently installed pipeline systems.

The integration of digital twin technologies, remote monitoring, and autonomous inspection tools is expected to enhance the operational efficiency of offshore infrastructure further. These developments, supported by large-scale capital expenditure across both brownfield expansions and greenfield developments, are set to anchor future demand in the global offshore pipeline sector.

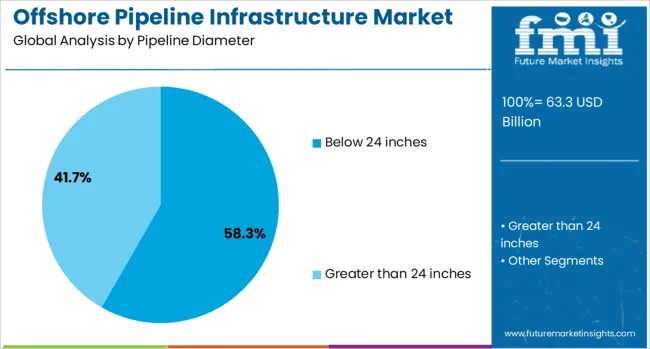

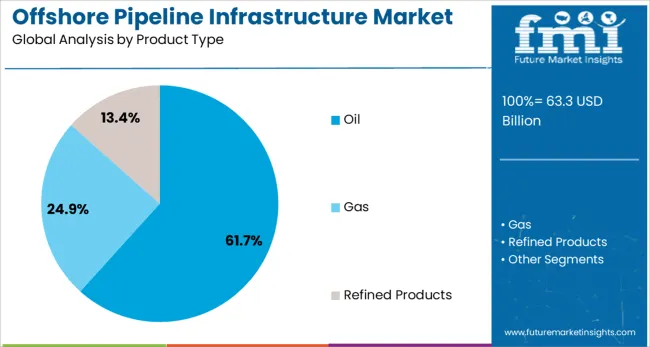

The offshore pipeline infrastructure market is segmented by pipeline diameter, product type, installation method, water depth, application, and geographic regions. The offshore pipeline infrastructure market is divided by pipeline diameter into below 24 inches and Greater than 24 inches. The offshore pipeline infrastructure market is classified by product type into Oil, Gas, and Refined Products.

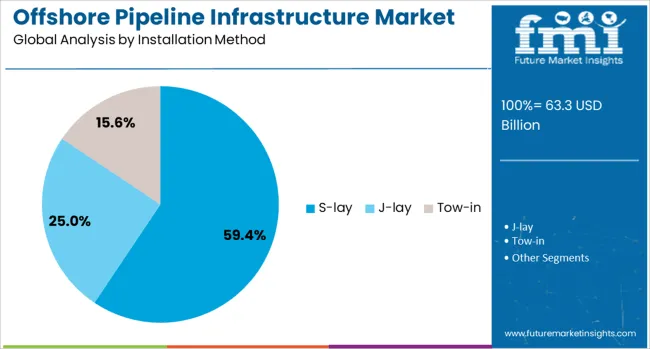

Based on the installation method of the offshore pipeline infrastructure market, it is segmented into S-lay, J-lay, and Tow-in. The offshore pipeline infrastructure market is segmented by water depth into Shallow Water and Deepwater. The offshore pipeline infrastructure market is segmented into Crude Oil Transmission, Natural Gas Transmission, and Refined Products Transmission.

Regionally, the offshore pipeline infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pipeline diameter segment of below 24 inches is projected to account for 58.3% of the revenue share in the offshore pipeline infrastructure market in 2025. This dominance is attributed to the growing number of short-distance tie-back projects and medium-capacity transport lines supporting satellite fields and subsea production systems. The segment has been favored due to its suitability in transporting oil and gas from small and mid-sized reservoirs where larger pipelines are not economically viable.

Advances in flexible pipe technologies, improved laying precision, and reduced fabrication costs have further accelerated deployment in this diameter range. Regulatory emphasis on minimizing seabed disturbance and reducing ecological impact has made narrower pipeline profiles more attractive in sensitive offshore zones.

Moreover, below 24 inches pipelines have demonstrated greater adaptability to shallow water conditions and are widely utilized in inter-platform connectivity, boosting their share in both mature and emerging offshore basins. The ongoing proliferation of modular field development strategies continues to drive demand for compact, efficient pipeline solutions within this category.

The oil segment is expected to contribute 61.7% of the overall revenue share in the offshore pipeline infrastructure market by 2025. This leading position is being supported by renewed investments in offshore crude extraction projects and the need for stable transport networks between subsea production and onshore processing terminals. National oil companies and independent operators are expanding offshore drilling programs, particularly in regions with high-quality crude reserves, which has significantly increased demand for dedicated oil pipelines.

Compared to multiphase or mixed-content lines, oil-specific pipelines offer enhanced flow assurance, lower risk of hydrate formation, and reduced complexity in processing infrastructure. The integration of advanced internal coatings and intelligent pigging systems has further improved operational efficiency, reducing frictional losses and improving throughput.

Additionally, strategic oil pipeline projects are being prioritized to bypass congested maritime routes, offering geopolitical and commercial advantages. The long-term durability and proven economics of oil pipeline installations continue to reinforce their preferred status across offshore development frameworks.

The S-lay method is forecast to account for 59.4% of the revenue share in the offshore pipeline infrastructure market in 2025, maintaining its position as the most utilized installation technique. The growth of this segment is influenced by its applicability in medium to deepwater projects where fast, reliable, and structurally stable installations are required. S-lay systems have demonstrated superior handling of rigid pipelines over extended lengths with minimized welding defects and improved laying precision.

The segment's appeal has also been supported by advancements in tensioner systems, real-time seabed monitoring, and dynamic positioning technologies, allowing safer and more efficient operations in challenging marine environments. Cost advantages associated with higher lay rates and lower barge downtime have made S-lay the method of choice in large-diameter and high-pressure pipeline deployments.

Additionally, S-lay systems offer operational flexibility in handling various pipeline diameters and wall thicknesses, making them versatile for a range of field conditions. Their continued evolution in conjunction with semi-automated pipeline fabrication lines ensures their relevance in upcoming global offshore infrastructure projects.

The offshore pipeline infrastructure market is advancing through greater subsea transport investments and the adoption of corrosion-resistant designs to ensure energy flow. Growing reliance on advanced inspection tools and strict safety norms has strengthened maintenance strategies to reduce risks and operational downtime.

The offshore pipeline infrastructure market is experiencing a strategic phase of development as oil and gas operators enhance subsea energy transport systems. Increased offshore drilling activity, combined with greater reliance on deepwater and ultra-deepwater projects, has created an active requirement for pipelines that ensure uninterrupted hydrocarbon transportation. These pipelines are regarded as a vital component for reducing transportation costs and maintaining operational efficiency. Industry participants are investing in corrosion-resistant materials and flexible pipeline designs to support complex subsea environments. Rising emphasis on connecting remote reservoirs to processing facilities has reinforced pipeline deployment across challenging geographies, making this segment crucial for energy distribution reliability.

Inspection and maintenance have been prioritized in offshore pipeline infrastructure to minimize leakage risks and operational failures. Governments and regulatory authorities have implemented stringent safety norms that compel operators to adopt advanced monitoring techniques. Increased incidents of pipeline corrosion and mechanical damage have highlighted the necessity of proactive maintenance programs. Service providers are integrating smart inspection tools such as remote-operated vehicles and sensor-based systems to detect anomalies at early stages. This trend is gaining acceptance as it improves lifecycle performance and reduces costly downtime. Strategic collaborations between pipeline operators and technology providers have also enhanced the adoption of advanced maintenance solutions.

The offshore pipeline infrastructure market is experiencing robust growth driven by the increasing global demand for oil and natural gas. offshore exploration and production activities have been expanding in regions like the Gulf of Mexico, North Sea, and Asia-Pacific, where significant untapped reserves are located. As energy consumption rises, particularly in emerging economies, the demand for efficient, long-distance transportation solutions for oil and gas is escalating. Offshore pipelines, known for their ability to withstand harsh marine environments, are crucial for connecting offshore platforms to onshore processing facilities. Technological advancements, including the development of corrosion-resistant materials, advanced welding techniques, and improved pipeline monitoring systems, are enhancing the efficiency and safety of offshore pipelines. These innovations ensure higher reliability, reduced operational downtime, and improved safety standards, making offshore pipelines the preferred solution for large-scale energy transportation.

Despite the positive growth trajectory, the offshore pipeline infrastructure m arket faces several challenges, particularly in terms of high installation and maintenance costs. The construction of offshore pipelines requires substantial capital investment, advanced engineering expertise, and compliance with stringent regulatory frameworks. Theenvironmental risks associated with offshore pipeline projects, such as oil spills and damage to marine ecosystems, raise concerns among regulators and environmental groups, leading to tighter regulations and potential delays in project approvals. Another challenge is the complexity of pipeline installation in deep-water and ultra-deep-water environments, which requires specialized equipment and skilled labor, increasing the overall project cost and time. These factors could limit the market growth, particularly in regions where economic conditions and environmental regulations are more stringent. However, with ongoing innovations and investments in advanced materials and construction techniques, the offshore pipeline sector is expected to overcome these challenges and maintain its strategic role in global energy transportation.

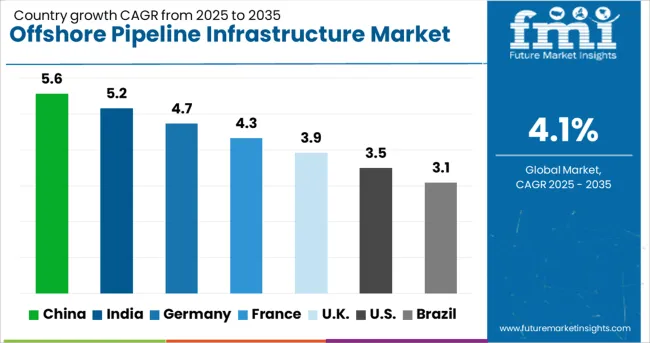

| Country | CAGR |

|---|---|

| China | 5.6% |

| India | 5.2% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The offshore pipeline infrastructure industry, expected to grow at a global CAGR of 4.1% from 2025 to 2035, is witnessing varying expansion rates across major markets. A 5.6% CAGR is being recorded in China, which is emphasizing extensive offshore projects and subsea energy transportation. India follows with a 5.2% CAGR, supported by rising offshore drilling activities and capacity expansion in deepwater fields.

Germany exhibits a 4.7% CAGR as North Sea developments and compliance with regional safety norms influence pipeline installations. France demonstrates a 4.3% CAGR, driven by steady investments in offshore energy and pipeline integrity solutions. The United Kingdom is expected to expand at 3.9%, driven by the modernization of existing infrastructure and integration of advanced inspection systems.

The United States reports a 3.5% CAGR, indicating slower progress due to mature infrastructure and stricter environmental regulations. The report includes detailed country-level assessments for 40+ regions, and the top five markets have been summarized as key references.

The CAGR for the United Kingdom offshore pipeline infrastructure sector rose from nearly 2.8% during 2020-2024 to 3.9% between 2025 and 2035, as energy operators reinforced pipeline modernization initiatives. Initial growth was slower due to mature offshore assets and limited new field discoveries, which restricted major infrastructure development.

The post-2025 phase has recorded an upward trend as North Sea operators invested in subsea tiebacks and upgraded aging pipeline systems for enhanced safety compliance. Government policies promoting integrity management frameworks pushed operators toward advanced inspection systems and proactive maintenance practices. Integration of automated monitoring and remote surveillance solutions has improved cost efficiency, making expansion in the UK market more viable.

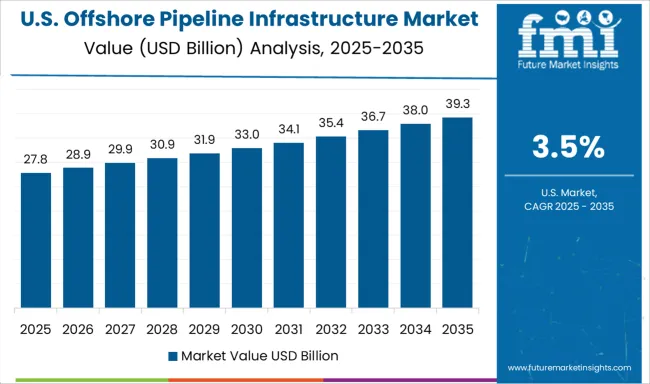

The CAGR in the USA increased from 2.6% during 2020-2024 to 3.5% for 2025-2035, driven by targeted upgrades in aging infrastructure across the Gulf of Mexico. Limited deepwater development during the earlier period constrained growth as operators focused on maintaining compliance within existing networks.

Post-2025, market momentum improved due to rising investment in extended-reach tie-ins and asset integrity projects aimed at extending operational life cycles. Safety and environmental risk mitigation measures have intensified the adoption of sensor-driven monitoring systems. Enhanced collaboration between technology providers and pipeline operators has further strengthened efficiency, making infrastructure upgrades a priority for long-term energy security.

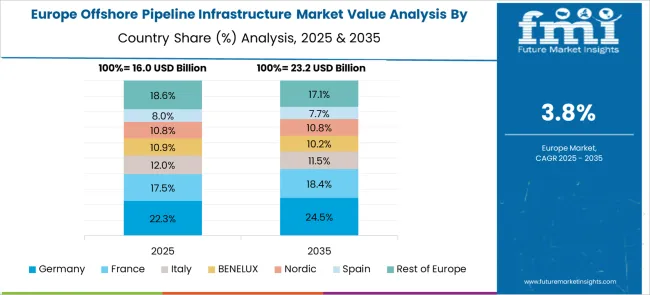

Germany observed a CAGR increase from 3.8% during 2020-2024 to 4.7% in 2025-2035, supported by consistent offshore energy expansion in the North Sea. Early growth remained steady due to heavy reliance on imports and moderate offshore developments. After 2025, stricter safety directives and energy transition objectives resulted in large-scale investments in subsea pipeline modernization.

German engineering firms have been focusing on high-strength and corrosion-resistant materials to meet stringent reliability norms. Digital pipeline monitoring systems coupled with remote-operated maintenance solutions have gained traction, reducing operational risks and extending asset life cycles. Cross-border energy transport projects have also stimulated offshore pipeline infrastructure upgrades.

India experienced a CAGR from nearly 4.3% during 2020-2024 to 5.2% in the period 2025-2035, aggressive offshore exploration initiatives. Initial years witnessed modest growth as offshore infrastructure was concentrated in select producing regions. The trend shifted post-2025 as operators invested in deepwater and ultra-deepwater development programs, resulting in the deployment of long-distance subsea pipelines.

Government-led policies promoting domestic hydrocarbon output and digital asset monitoring have accelerated service demand. Remote sensing and integrity monitoring systems have become integral to lifecycle management, reducing unplanned downtime. Increased investments from international EPC contractors have supported capacity expansion for offshore transmission networks.

China’s CAGR grew from around 4.7% during 2020-2024 to 5.6% for 2025-2035, driven by an expansion in deepwater pipeline systems and new offshore exploration programs. Early growth was stable due to gradual infrastructure upgrades concentrated in Bohai Bay and the East China Sea. Post-2025, increased energy security concerns encouraged aggressive pipeline development, supported by advanced material integration for corrosion resistance.

Local manufacturers have scaled up production of flexible pipelines and sensor-based monitoring tools, improving cost efficiency for subsea projects. Regional investments in subsea tiebacks and LNG integration infrastructure have positioned China as a critical offshore pipeline development hub across Asia.

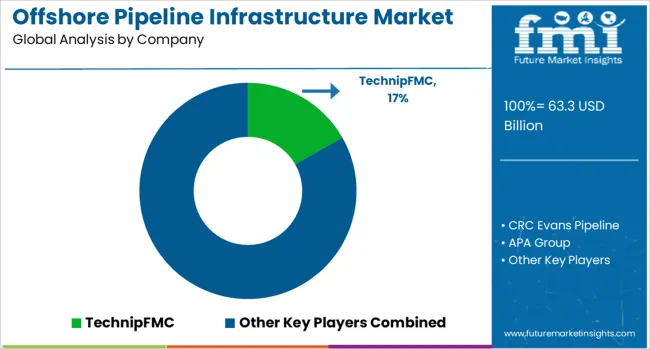

In the offshore pipeline infrastructure sector, leading companies are prioritizing advancements in pipeline integrity, subsea installation services, and innovative inspection technologies to address the increasing complexity of offshore projects. Technip FMC and Saipem are at the forefront, offering comprehensive engineering solutions and subsea construction services that focus on ensuring pipeline reliability in deepwater conditions. Both companies leverage advanced technologies for installation, operation, and maintenance of offshore pipelines, making them key players in the construction of large-scale energy transport systems in challenging marine environments.

Their expertise extends to the design and construction of subsea pipeline systems, including flexible risers, flowlines, and umbilicals, ensuring safe and efficient transportation of oil and gas from offshore fields to onshore facilities. Companies like CRC Evans Pipeline and National Oilwell Varco specialize in providing welding systems and coating technologies that enhance the durability and performance of offshore pipelines. These systems are vital for ensuring the structural integrity of pipelines exposed to harsh environmental conditions, such as high pressure, corrosive seawater, and fluctuating temperatures.

MRC Global and Welspun Corp are key suppliers of critical pipeline components, such as line pipes, flanges, and fittings, which are essential for ensuring high-quality material standards and long-term performance in offshore energy transport. Global operators like Gazprom, APA Group, and DCP Midstream play a vital role in the operation and expansion of offshore pipeline networks.

They are involved in major pipeline projects, ensuring the efficient and safe transportation of oil and gas through vast energy corridors. Additionally, companies like Europipe GmbH and Chelpipe Group are instrumental in supplying large-diameter pipes for offshore and cross-border projects.

Their contributions are critical in facilitating the seamless transmission of energy across vast distances, reinforcing the global energy infrastructure. Through these collaborations and technological innovations, these companies are driving the development of reliable, high-capacity offshore pipeline systems that meet growing global energy demands.

Offshore pipeline infrastructure companies are focusing on enhancing pipeline integrity, improving subsea installation technologies, and investing in advanced inspection and monitoring systems in 2024 and 2025. Key strategies include adopting corrosion-resistant materials, integrating smart sensors for real-time monitoring, and optimizing welding and coating technologies to extend pipeline lifespan. Growth drivers include the increasing demand for oil and gas, particularly in offshore exploration and production, as well as advancements in deepwater technologies. Regulatory pressure for safer and more sustainable infrastructure is pushing companies to innovate and meet stringent environmental standards. These strategies ensure cost-effective, reliable, and efficient offshore pipeline operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 63.3 Billion |

| Pipeline Diameter | Below 24 inches and Greater than 24 inches |

| Product Type | Oil, Gas, and Refined Products |

| Installation Method | S-lay, J-lay, and Tow-in |

| Water Depth | Shallow Water and Deepwater |

| Application | Crude Oil Transmission, Natural Gas Transmission, and Refined Products Transmission |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TechnipFMC, CRC Evans Pipeline, APA Group, General Electric (GE Oil & Gas), Saipem (a subsidiary of Eni), MRC Global, National Oilwell Varco, Welspun Corp, Engas, Chelpipe Group, DCP Midstream, Redexis, Snam Rete Gas, Gazprom, GAIL India, and Europipe GmbH |

| Additional Attributes | Dollar sales, share by pipeline type and diameter, regional demand trends, competitive landscape, pricing benchmarks, project pipeline analysis, regulatory frameworks, and emerging technology adoption. |

The global offshore pipeline infrastructure market is estimated to be valued at USD 63.3 billion in 2025.

The market size for the offshore pipeline infrastructure market is projected to reach USD 94.7 billion by 2035.

The offshore pipeline infrastructure market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in offshore pipeline infrastructure market are below 24 inches and greater than 24 inches.

In terms of product type, oil segment to command 61.7% share in the offshore pipeline infrastructure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA