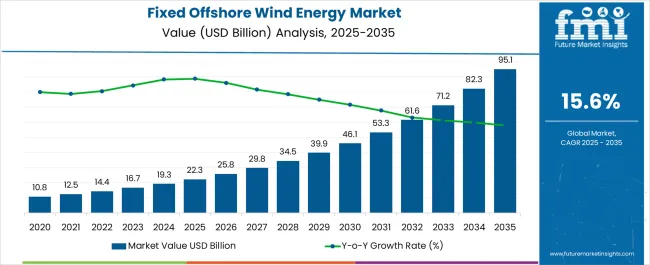

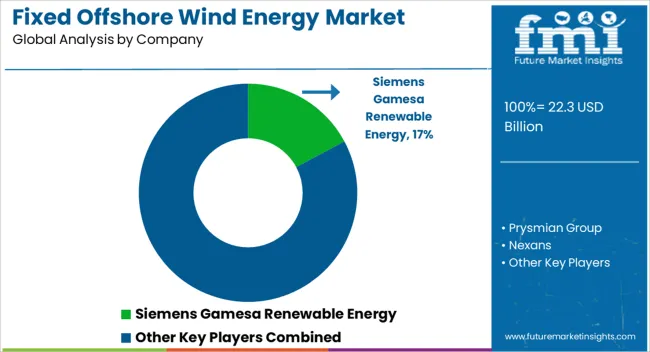

The fixed offshore wind energy market is estimated to be valued at USD 22.3 billion in 2025 and is projected to reach USD 95.1 billion by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period. Significant expansion is being driven by the increasing deployment of offshore wind projects in regions with favorable wind resources and supportive regulatory frameworks. Market value is being influenced by the rising demand for large-scale renewable energy generation and the integration of advanced turbine designs that enhance power capture and operational efficiency.

The growth trajectory from USD 22.3 billion to USD 46.1 billion illustrates that the market is being shaped by consistent investments in offshore infrastructure and strategic project rollouts across major coastal regions. Over the 2025–2030 period, the fixed offshore wind energy market is expected to witness accelerated adoption due to its capacity to deliver high-output electricity to industrial, commercial, and utility-scale consumers. Project development is being prioritized in locations with strong wind profiles, which supports higher energy yields and better return on investment.

The market is being strengthened by improvements in installation practices, grid integration strategies, and predictive maintenance approaches, which collectively reduce operational risks and optimize output.

| Metric | Value |

|---|---|

| Fixed Offshore Wind Energy Market Estimated Value in (2025 E) | USD 22.3 billion |

| Fixed Offshore Wind Energy Market Forecast Value in (2035 F) | USD 95.1 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

The fixed offshore wind energy market has established a substantial position across its parent sectors, driven by the global emphasis on expanding offshore wind capacity in stable, shallow to medium-depth waters. Within the offshore wind energy market, fixed offshore installations account for nearly 55–60% share, as they form the majority of deployed capacity compared to floating solutions. In the renewable power generation market, their contribution is approximately 12–15%, reflecting the growing role of offshore wind in diversifying clean energy portfolios. The marine engineering and construction market records around 10–12% share, given the specialized foundations, subsea cables, and installation services required for fixed offshore projects.

In the broader energy infrastructure market, fixed offshore wind represents about 8–10%, highlighting its integration into regional grids and utility planning. The utility-scale power projects market sees close to 15–18% share, as large-scale wind farms dominate the capital-intensive offshore energy projects segment. While critics may argue that installation costs and marine challenges limit rapid adoption, the high capacity, reliability, and predictable performance of fixed offshore systems ensure their continued dominance.

The fixed offshore wind energy market is gaining strong momentum, driven by the global shift toward renewable energy and increasing investments in large-scale offshore infrastructure. Government-led initiatives, long-term decarbonization policies, and favorable regulatory frameworks have created a supportive environment for project development. Technological advancements in turbine design, improved installation techniques, and enhanced grid connectivity have significantly reduced the cost per megawatt, making offshore wind a more competitive source of energy.

Industry announcements have pointed to rapid growth in the deployment of high-capacity turbines, enabling greater energy capture from fewer installations. Strategic partnerships between utility companies, engineering firms, and equipment manufacturers have further accelerated project execution timelines.

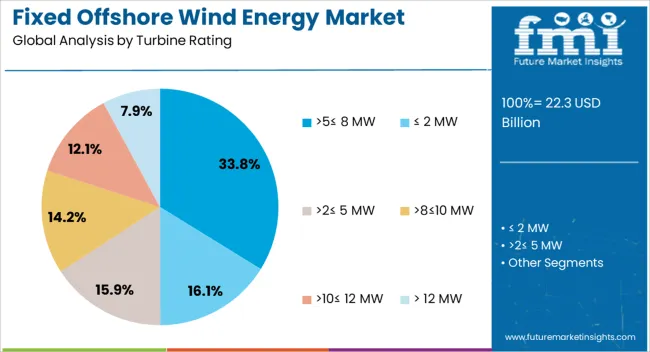

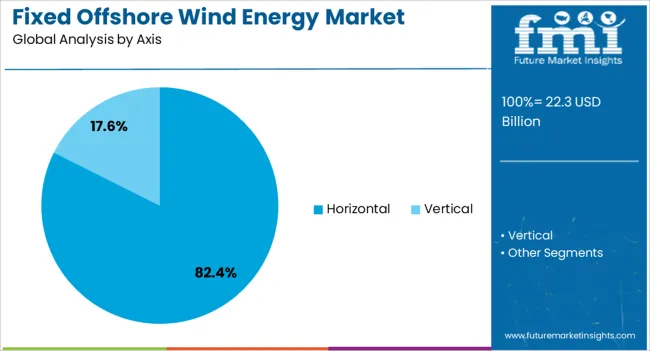

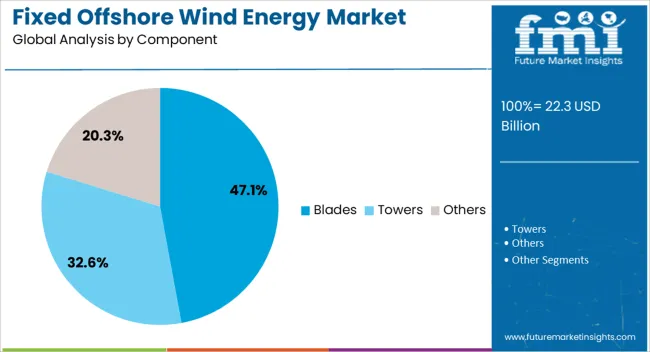

The market is expected to expand with the integration of digital monitoring systems, predictive maintenance solutions, and advancements in blade and foundation materials, which will improve operational efficiency and lifespan. Segmental leadership is anticipated in turbines rated above 5 MW but not exceeding 8 MW, horizontal axis designs, and blades as the most crucial component category.

The fixed offshore wind energy market is segmented by turbine rating, axis, component, depth, and geographic regions. By turbine rating, fixed offshore wind energy market is divided into >5≤ 8 MW, ≤ 2 MW, >2≤ 5 MW, >8≤10 MW, >10≤ 12 MW, and > 12 MW. In terms of axis, fixed offshore wind energy market is classified into Horizontal and Vertical. Based on component, fixed offshore wind energy market is segmented into Blades, Towers, and Others. By depth, fixed offshore wind energy market is segmented into >0 ≤ 30 m, >30 ≤ 50 m, and > 50 m. Regionally, the fixed offshore wind energy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The >5≤ 8 MW turbine rating segment is projected to account for 33.8% of the fixed offshore wind energy market revenue in 2025, marking it as a key performance category. This segment has benefited from the balance it offers between energy output and installation feasibility.

Turbines within this range provide substantial power generation capacity while maintaining compatibility with existing installation vessels and port infrastructure. Developers have favored this category for medium-to-large-scale projects where cost efficiency and project timelines are critical.

Furthermore, advancements in rotor design and drivetrain efficiency have enhanced energy capture in varying wind conditions, improving overall project returns. Industry deployment trends indicate that this capacity range is optimal for maximizing return on investment without the logistical complexities associated with larger turbines. With ongoing upgrades in manufacturing capabilities and global offshore expansion plans, the >5≤ 8 MW turbine rating segment is expected to maintain a strong position in new project developments.

The horizontal axis segment is projected to hold 82.4% of the fixed offshore wind energy market revenue in 2025, solidifying its dominance in turbine configuration. This design has been widely adopted due to its proven track record in delivering high energy conversion efficiency and adaptability to a range of wind conditions.

Manufacturers have focused their innovation efforts on horizontal axis turbines, resulting in significant improvements in rotor aerodynamics, blade materials, and yaw control systems.

The scalability of horizontal axis designs has made them suitable for both shallow and moderately deep-water installations, further broadening their deployment potential. Operational reliability and ease of maintenance have also reinforced their preference over vertical axis alternatives. Global offshore wind farms continue to invest heavily in horizontal axis systems as the standard industry configuration, ensuring consistent performance, lower operational risk, and compatibility with evolving grid integration requirements.

The blades segment is projected to contribute 47.1% of the fixed offshore wind energy market revenue in 2025, maintaining its position as the most critical component category. Blades directly influence energy capture, efficiency, and operational lifespan, making them a focal point of technological advancements.

Manufacturers have invested in lightweight composite materials, aerodynamic shaping, and anti-erosion coatings to improve performance and reduce maintenance needs.

Longer blade designs have enabled greater swept areas, significantly increasing the capacity factor of offshore turbines. Industry efforts have also focused on recyclable blade technology to address sustainability concerns and end-of-life disposal challenges. The operational reliability of blades is essential in offshore environments, where maintenance access can be costly and weather-dependent. As offshore projects move into harsher marine conditions, the demand for durable, high-performance blades is expected to rise, reinforcing this segment’s central role in the market’s continued expansion.

Fixed offshore wind turbines, installed on the seabed, offer a reliable source of clean electricity, particularly in regions with strong and consistent wind resources. The market is being driven by the rising need for alternative energy, advancements in turbine efficiency, and favorable policies supporting offshore wind projects. However, challenges such as high initial capital investment, installation complexities, and regulatory constraints can hinder growth. Opportunities are strongest in expanding offshore wind projects, especially in countries like the UK, Germany, and the US, which are heavily investing in offshore wind infrastructure. Companies focused on improving turbine technology, reducing costs, and securing long-term government contracts are well-positioned to lead this growing market.

The increasing global demand for renewable power is fueling growth in the fixed offshore wind energy market. With heightened awareness of the need to reduce carbon emissions and enhance energy independence, countries are increasingly turning to offshore wind as a reliable energy solution. Offshore wind farms, especially in deep waters, can generate substantial amounts of power, providing consistent energy throughout the year. Fixed offshore wind turbines are particularly suited for areas with strong winds, and as nations focus on expanding their energy portfolios, these wind farms are becoming central to their energy mix. With growing investments and energy goals, offshore wind is gaining greater importance in national and regional power strategies.

The fixed offshore wind energy market faces several constraints, including high capital costs for the development and installation of offshore wind farms. The need for specialized infrastructure, such as turbines, transport vessels, and installation equipment, adds to the overall expense. Additionally, the logistics of deploying and maintaining turbines in challenging offshore environments raise operational costs. Regulatory hurdles, such as environmental approvals, maritime regulations, and energy permits, can delay projects and increase complexity. Despite these challenges, advancements in turbine design, construction methods, and installation techniques are reducing costs and improving project efficiency, helping to make fixed offshore wind projects more economically viable.

The fixed offshore wind energy market presents significant opportunities through technological advancements and the expansion into new regions. As turbines become larger and more powerful, they generate greater electricity, helping to reduce costs per megawatt. Innovations in installation techniques, such as floating platforms and specialized vessels, are enabling the development of offshore wind farms in deeper waters and previously inaccessible areas. The market is also expanding into new regions, particularly in Asia-Pacific and the US, where offshore wind investments are rising. These emerging markets present ample opportunities for companies specializing in turbine technology, offshore wind project development, and supporting infrastructure.

The fixed offshore wind energy market is seeing trends in the development of floating wind farms, hybrid power solutions, and enhanced grid integration. Floating wind farms, supported by platforms, allow for offshore wind turbines to be deployed in deeper waters, which increases the available area for development. Hybrid systems combining offshore wind with other energy sources, such as solar power, are gaining popularity as they provide more consistent energy generation. Additionally, the integration of offshore wind into national and international grids is improving the distribution of energy, enhancing power availability across regions. As the technology continues to advance, these trends will drive market growth and innovation.

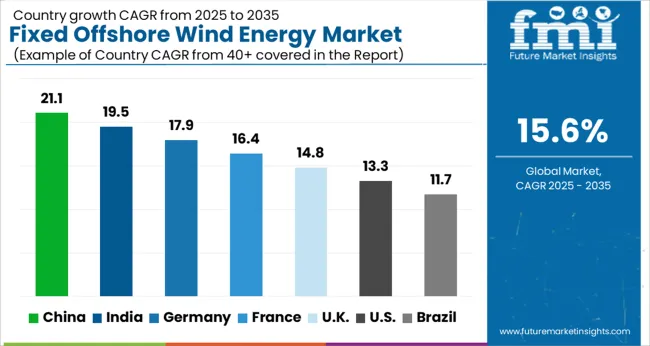

| Country | CAGR |

|---|---|

| China | 21.1% |

| India | 19.5% |

| Germany | 17.9% |

| France | 16.4% |

| UK | 14.8% |

| USA | 13.3% |

| Brazil | 11.7% |

The global fixed offshore wind energy market is projected to grow at a CAGR of 15.6% from 2025 to 2035. China leads with a growth rate of 21.1%, followed by India at 19.5% and France at 16.4%. The United Kingdom records a growth rate of 14.8%, while the United States shows a slower growth of 13.3%. Expansion is driven by rising investments in renewable energy infrastructure, increasing demand for low-carbon electricity, and government policies supporting offshore wind projects. Emerging economies such as China and India benefit from ambitious capacity addition targets and favorable regulatory frameworks, while developed markets like France, the UK, and the USA focus on enhancing offshore wind efficiency, integrating energy storage, and expanding large-scale wind farms. This report includes insights on 40+ countries; the top markets are shown here for reference.

The fixed offshore wind energy market in China is projected to grow at a CAGR of 21.1%. Strong government incentives, ambitious renewable energy targets, and rapid coastal development are driving demand. China’s emphasis on reducing dependence on fossil fuels and meeting climate commitments accelerates offshore wind farm deployment. Large-scale manufacturing and installation capabilities enable rapid capacity addition, while investments in advanced turbine technology optimize energy yield. Policy support for grid integration, coupled with increasing electricity demand from coastal cities, ensures continued market growth.

The fixed offshore wind energy market in India is expected to grow at a CAGR of 19.5%. Rising electricity demand, government initiatives for renewable energy adoption, and favorable coastal conditions support the deployment of offshore wind projects. India is focusing on enhancing energy security and reducing carbon emissions by investing in high-capacity turbines and long-term grid integration. Public-private partnerships are increasingly contributing to the development of offshore wind infrastructure. With government targets aiming to expand offshore wind capacity significantly, India is emerging as one of the fastest-growing markets in Asia.

The fixed offshore wind energy market in France is projected to grow at a CAGR of 16.4%. Expansion is driven by government policies promoting renewable energy and offshore wind capacity targets. France’s coastal regions offer favorable conditions for large-scale offshore wind projects, attracting both domestic and international investors. Grid integration initiatives and public-private collaborations support efficient energy transmission. The government’s focus on clean energy generation, reduction of carbon emissions, and support for large-scale wind farms accelerates adoption of fixed offshore wind systems.

The fixed offshore wind energy market in the United Kingdom is expected to grow at a CAGR of 14.8%. The UK has a long-standing focus on offshore wind as a strategic renewable energy source, supported by government subsidies and auction frameworks. Strong technical expertise, advanced project management, and extensive port infrastructure enable efficient deployment of large-scale wind farms. Public and private sector investments in energy storage and grid integration enhance project viability. With commitments to reduce carbon emissions, the UK continues to expand offshore wind capacity to meet future energy demands.

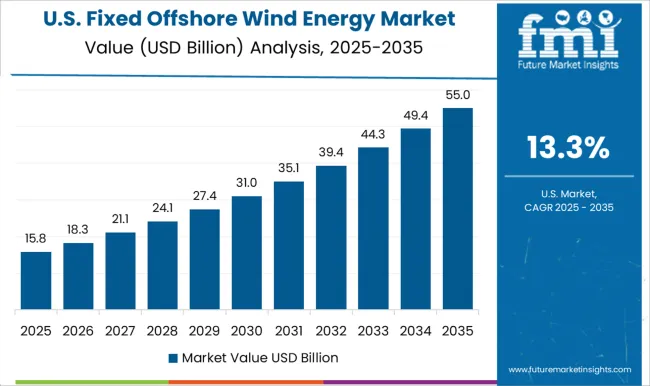

The fixed offshore wind energy market in the United States is projected to grow at a CAGR of 13.3%. Market growth is driven by state-level renewable energy mandates, federal incentives, and increasing electricity demand from coastal regions. USA developers focus on constructing large-scale offshore wind farms along the East Coast, integrating energy storage systems to optimize grid performance. Collaboration with European technology providers enhances turbine efficiency and project execution. While adoption is slightly slower than Asian and European markets, long-term infrastructure development and policy support ensure steady expansion of fixed offshore wind capacity.

The fixed offshore wind energy market is primarily shaped by turbine manufacturers and cable suppliers competing on reliability, efficiency, and long-term durability in challenging marine conditions. Leading turbine providers such as Siemens Gamesa Renewable Energy, Vestas, and General Electric have positioned themselves through high-capacity turbine designs, extended service intervals, and optimized energy capture tailored for offshore installations. Their technical brochures emphasize performance under high wind loads, minimal downtime, and adaptability to various seabed and weather conditions, highlighting their engineering and operational advantages.

On the cabling front, companies including Prysmian Group, Nexans, and LS Cable & System Ltd. focus on subsea and inter-array solutions, offering robust insulation, corrosion resistance, and high transmission efficiency to withstand the harsh marine environment. Specialized players like Sumitomo Electric Industries, Southwire Company, and FURUKAWA ELECTRIC provide modular cable systems and advanced conductor technologies designed for long-distance transmission, flexible deployment, and project-specific customization. Their offerings cater to increasingly complex offshore wind farms requiring scalable, reliable electrical networks. Market competition is largely defined by the ability to deliver high performance and longevity while minimizing operational disruptions.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.3 Billion |

| Turbine Rating | >5≤ 8 MW, ≤ 2 MW, >2≤ 5 MW, >8≤10 MW, >10≤ 12 MW, and > 12 MW |

| Axis | Horizontal and Vertical |

| Component | Blades, Towers, and Others |

| Depth | >0 ≤ 30 m, >30 ≤ 50 m, and > 50 m |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Gamesa Renewable Energy, Prysmian Group, Nexans, Sumitomo Electric Industries, Ltd., Southwire Company, LLC, LS Cable & System Ltd., FURUKAWA ELECTRIC CO., LTD, IMPSA, ENESSERE S.r.l., Vestas, General Electric, and Goldwind |

| Additional Attributes | Dollar sales by turbine type (horizontal-axis, vertical-axis) and capacity range (low, medium, high) are key metrics. Trends include rising demand for renewable energy, growth in offshore wind farm installations, and adoption of advanced turbine technologies. Regional adoption, regulatory support, and technological advancements are driving market growth. |

The global fixed offshore wind energy market is estimated to be valued at USD 22.3 billion in 2025.

The market size for the fixed offshore wind energy market is projected to reach USD 95.1 billion by 2035.

The fixed offshore wind energy market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in fixed offshore wind energy market are >5≤ 8 MW, ≤ 2 MW, >2≤ 5 MW, >8≤10 MW, >10≤ 12 MW and > 12 MW.

In terms of axis, horizontal segment to command 82.4% share in the fixed offshore wind energy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA