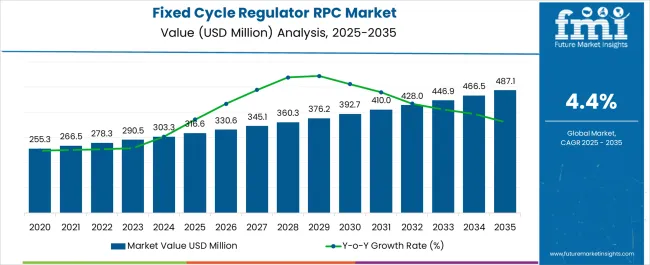

The fixed cycle regulator residential power conditioner market is projected to reach 316.6 USD million in 2025 and expand to 487.1 USD million by 2035, registering a CAGR of 4.4% over the forecast period. Growth is anticipated to be driven by rising residential electricity consumption, the increasing adoption of home automation systems, and the growing need for a stable voltage supply to protect sensitive appliances from fluctuations. Between 2025 and 2030, the market is expected to cross key breakpoints from 316.6 USD million to roughly 376.2 USD million, supported by initiatives promoting energy efficiency, electrification of households, and awareness regarding power quality.

From 2031 to 2035, further expansion to 487.1 USD million is projected as demand for high-performance power conditioners rises in urban and semi-urban households, coupled with incentives for smart energy devices and improved electrical infrastructure. Incremental yearly growth reflects both replacement cycles of aging residential regulators and new installations in emerging regions. The market is also influenced by regulatory policies for energy efficiency, price competitiveness among manufacturers, and technological differentiation, such as compact design, noise reduction, and automated voltage regulation.

| Metric | Value |

|---|---|

| Fixed Cycle Regulator Residential Power Conditioner Market Estimated Value in (2025 E) | USD 316.6 million |

| Fixed Cycle Regulator Residential Power Conditioner Market Forecast Value in (2035 F) | USD 487.1 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The fixed cycle regulator residential power conditioner market is strongly influenced by several interrelated parent markets that collectively drive adoption, energy reliability, and household appliance protection. The residential electrical appliance market holds the largest share at approximately 40%, as power conditioners are extensively used to stabilize voltage and safeguard sensitive devices such as refrigerators, air conditioners, computers, and entertainment systems. The home automation and smart home devices market contributes around 25%, integrating power conditioning solutions with smart energy management systems, enabling automated voltage regulation, remote monitoring, and efficient energy usage. The electrical distribution and utility infrastructure market accounts for 15%, reflecting the role of grid quality, regional voltage fluctuations, and supply consistency in determining demand for residential power conditioners. The renewable energy and solar home systems market, with a 12% share, supports adoption by providing stable power output for households with rooftop solar installations or hybrid energy setups. Finally, the consumer electronics and IT equipment market represents 8%, as growing dependence on sensitive electronics and high-value devices necessitates reliable voltage regulation for long-term performance. Together, the appliance, smart home, and electrical distribution markets contribute roughly 80% of demand, highlighting that protection, connectivity, and energy stability are the primary drivers of the fixed cycle regulator residential power conditioner market.

The fixed cycle regulator residential power conditioner market is witnessing sustained growth, supported by the increasing need for voltage stability, protection against power fluctuations, and the enhancement of electrical appliance lifespan in residential settings. Market expansion is being driven by rising urbanization, growing adoption of modern home appliances, and greater awareness of power quality management among households.

Regulatory emphasis on energy efficiency and safety compliance is prompting manufacturers to develop advanced designs with improved operational reliability and lower maintenance requirements. Competitive positioning is being strengthened through product innovation, integration of smart monitoring features, and strategic distribution networks targeting both urban and semi-urban markets.

Price competitiveness, combined with advancements in compact designs, is enabling wider penetration, especially in emerging economies. Over the forecast period, consistent demand from new housing developments, replacement of outdated equipment, and the increasing frequency of grid fluctuations in certain regions are expected to sustain market momentum and reinforce its role in residential electrical infrastructure reliability.

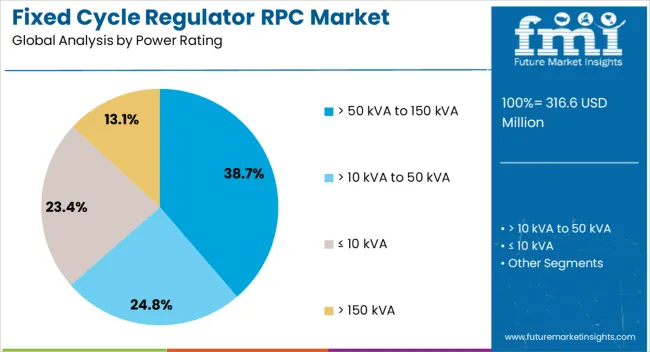

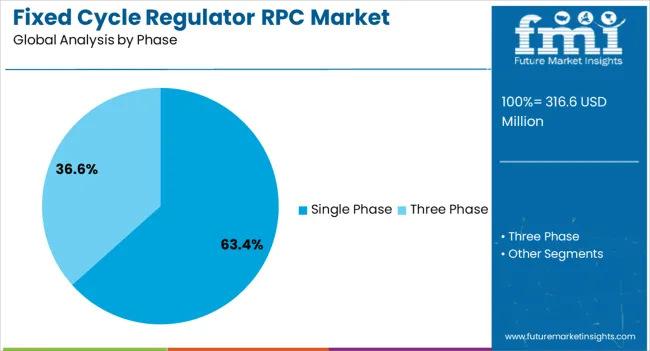

The fixed cycle regulator residential power conditioner market is segmented by power rating, phase, and geographic regions. By power rating, fixed cycle regulator residential power conditioner market is divided into > 50 kVA to 150 kVA, > 10 kVA to 50 kVA, ≤ 10 kVA, and > 150 kVA. In terms of phase, fixed cycle regulator residential power conditioner market is classified into Single Phase and Three Phase. Regionally, the fixed cycle regulator residential power conditioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The >50 kVA to 150 kVA category, holding 38.7% of the power rating segment, is leading due to its optimal capacity for supporting multiple high-load residential appliances while ensuring voltage stability and operational efficiency. Demand in this segment is being driven by households with higher electrical consumption patterns, including those utilizing advanced HVAC systems, home automation, and heavy-duty kitchen equipment.

Its market dominance has been reinforced by compatibility with a wide range of residential setups and the ability to handle both steady and fluctuating loads without performance degradation. Installation trends indicate strong uptake in premium housing and larger residential units, where power quality management is a critical consideration.

Manufacturers are focusing on improved thermal management systems, noise reduction, and compact enclosures to enhance usability in household environments. Over time, this segment is expected to retain its leadership position due to a balance of performance, affordability, and adaptability to diverse residential energy demands.

The single-phase category, accounting for 63.4% of the phase segment, dominates due to its suitability for most residential power systems, where single-phase supply is standard. Widespread applicability, ease of installation, and cost efficiency have reinforced its strong market position.

This configuration meets the power conditioning needs of the majority of households, offering reliable voltage regulation and protection against spikes, surges, and sags. Its high adoption rate is also linked to lower infrastructure complexity compared to three-phase systems, making it the preferred choice for both urban apartments and suburban homes.

Continuous improvements in design efficiency, noise control, and overload handling capabilities are further supporting its growth. Market stability is underpinned by repeat demand from both new housing projects and retrofit installations, with additional momentum expected from the rising use of energy-intensive residential appliances, ensuring the segment remains the dominant choice in the residential power conditioning space.

The fixed cycle regulator residential power conditioner market is driven by voltage fluctuations, integration with smart energy systems, supportive policies, and increasing electronics ownership. Coordinated demand across these factors ensures steady global growth.

The fixed cycle regulator residential power conditioner market is experiencing increased adoption due to frequent voltage fluctuations in residential grids. Consumers are seeking reliable solutions to protect high-value home appliances such as refrigerators, air conditioners, computers, and entertainment systems. Replacement of outdated or malfunctioning regulators further drives demand, particularly in regions with inconsistent power supply. Seasonal variations in electricity usage, peak load conditions, and local grid instability create awareness regarding the importance of voltage regulation. Residential construction projects and apartment complexes increasingly integrate power conditioners as part of standard electrical infrastructure. The growing affordability of compact and easy-to-install units allows homeowners to adopt these solutions without major retrofitting. Market players are responding with diverse product offerings tailored for varying household capacities.

Power conditioners are increasingly being paired with smart home energy management systems to improve appliance safety and optimize electricity usage. Integration enables automated voltage regulation, alerts on anomalies, and remote monitoring through mobile apps. Households investing in solar panels or hybrid energy systems benefit from regulators that maintain stable output for sensitive devices. Manufacturers are leveraging this trend to offer combined solutions with monitoring dashboards and energy usage reports. Consumer interest is growing as awareness spreads about protecting electronics from sudden spikes, brownouts, or surges. Bundling power conditioners with smart meters or energy-efficient appliances further stimulates sales.

Government regulations and energy efficiency initiatives are influencing market growth, especially in regions promoting reliable electricity supply and consumer safety. Policies encouraging the installation of voltage stabilizers in residential buildings, coupled with rebates for energy-efficient appliances, have increased adoption. Standards for home electrical safety and certification requirements for power conditioning devices also guide purchasing decisions. Utility companies in certain countries are incentivizing households to invest in voltage regulation solutions to prevent equipment damage and reduce energy losses. Additionally, public awareness campaigns highlighting the benefits of a stable electricity supply for appliance longevity contribute to market expansion. Manufacturers leverage compliance with these policies to differentiate products in competitive markets.

Rising household penetration of high-value electronics and home appliances is a major driver for the power conditioner market. Increasing ownership of computers, smart TVs, air conditioners, and home entertainment systems has created demand for devices that protect against voltage instability. Consumer preference for uninterrupted device operation, along with rising disposable incomes, encourages adoption. Seasonal spikes in electricity usage and rapid replacement cycles for sensitive electronics reinforce the need for reliable protection. Market participants are targeting mid- to high-income households with compact, efficient, and aesthetically designed power conditioners. The growth of e-commerce platforms also enables convenient distribution and enhances consumer awareness.

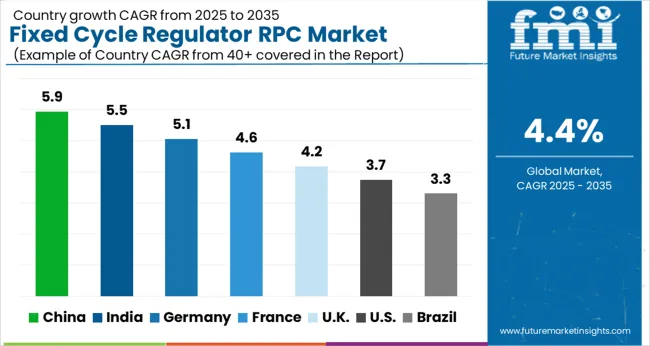

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

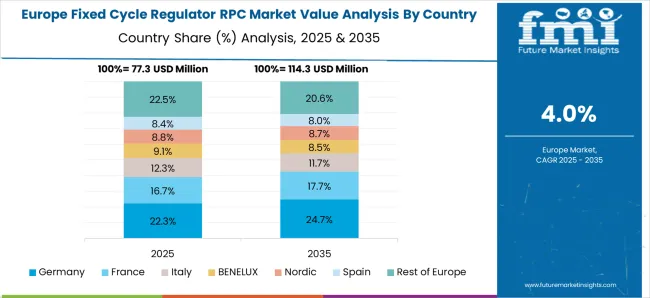

The global fixed cycle regulator residential power conditioner market is projected to grow at a CAGR of 4.4% between 2025 and 2035. China leads with a growth rate of 5.9%, supported by large-scale residential construction, rising household appliance ownership, and government-backed electrical safety standards. India follows at 5.5%, where surging electricity demand and expanding middle-class households drive strong adoption. Germany records 5.1% growth, high reliance on advanced residential energy systems, integration with smart home setups, and strict appliance safety norms. The United Kingdom, growing at 4.2%, benefits from consumer preference for smart energy solutions and higher replacement rates of electrical stabilizers. The United States stands at 3.7%, where consumer electronics protection, premium home automation integration, and e-commerce-led distribution channels guide steady adoption. The analysis spans more than 40 countries, with the top-performing markets highlighted below.

The fixed cycle regulator residential power conditioner market in China is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by the nation’s rapid residential construction boom and the increasing penetration of home appliances across urban and rural households. Rising concerns over voltage fluctuations and power instability in developing regions of the country are creating strong demand for reliable conditioning systems. The government’s policies on electrical safety standards and the expansion of smart home projects are encouraging adoption. Domestic manufacturers are strengthening production capabilities while integrating conditioners with advanced monitoring systems for households that use a mix of traditional grid supply and renewable energy. Growing consumer awareness of electronic device protection, coupled with affordable product availability, further supports widespread use.

The fixed cycle regulator residential power conditioner market in India is expected to expand at a CAGR of 5.5% between 2025 and 2035, supported by rising electricity demand and rapid urban residential development. Frequent power fluctuations across major states create strong awareness of conditioning devices to protect household electronics such as refrigerators, televisions, and air conditioners. India’s expanding middle-class households and the “Make in India” initiative are encouraging domestic production and cost-effective solutions for residential use. E-commerce platforms have become an important distribution channel, enabling wider product reach across Tier II and Tier III cities. Government programs focusing on reliable electricity access and energy efficiency are indirectly boosting adoption. Partnerships between local suppliers and global technology firms are also shaping market expansion.

The fixed cycle regulator residential power conditioner market in Germany is forecasted to grow at a CAGR of 5.1% from 2025 to 2035, influenced by the country’s high reliance on residential energy efficiency and household safety standards. German consumers show a strong preference for certified, durable, and high-performance power conditioners that align with EU regulations. Integration with smart home systems, renewable energy setups, and distributed generation is a key growth driver. Utility companies and housing associations are increasingly recommending conditioners to ensure stable appliance operations in areas prone to supply variation. Manufacturers in Germany emphasize energy savings, compact product design, and compliance with advanced safety norms. Market adoption is also supported by the rise in smart appliances, requiring consistent voltage management.

The fixed cycle regulator residential power conditioner market in the United Kingdom is projected to grow at a CAGR of 4.2% during 2025–2035, shaped by consumer awareness of electronic device protection and preference for energy-efficient homes. Replacement of outdated stabilizers is a significant driver, as modern households invest in smart electronics and home automation. Retailers and online platforms in the UK actively promote conditioners as part of bundled energy solutions, enhancing accessibility. Market players emphasize premium designs and features such as remote monitoring and real-time alerts. Adoption is being supported by initiatives that promote safe and efficient energy consumption. The UK market is increasingly characterized by demand for compact, high-quality, and interoperable conditioners.

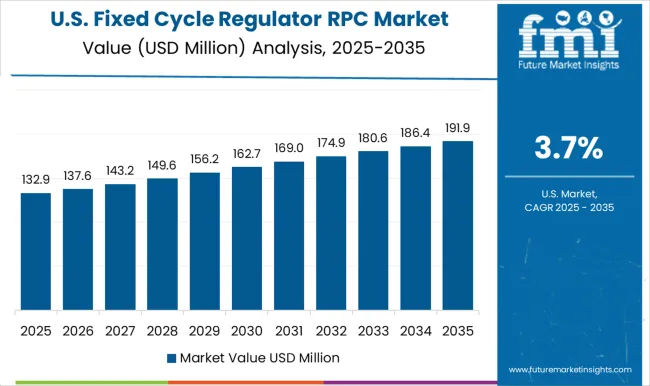

The fixed cycle regulator residential power conditioner market in the United States is anticipated to grow at a CAGR of 3.7% from 2025 to 2035, driven by strong consumer demand for premium electronics protection and integration with smart home systems. Voltage fluctuations are less frequent compared to developing economies, but households are investing in conditioners to extend appliance lifespan and ensure consistent device performance. E-commerce platforms and large retail chains support wide product distribution. Manufacturers in the USA emphasize innovation in compact product design, energy efficiency, and integration with home automation platforms. Rising consumer awareness of protecting expensive appliances such as entertainment systems and HVAC units creates a steady growth base for the market.

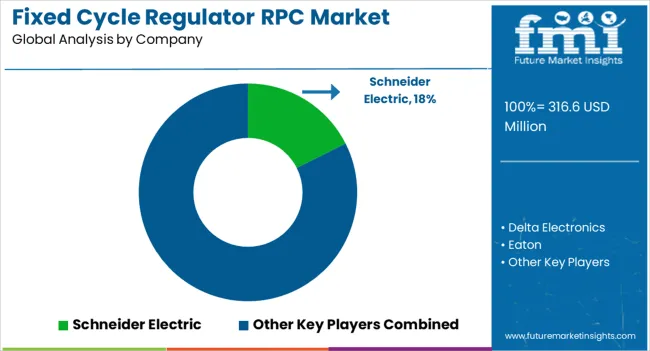

Competition in the fixed cycle regulator residential power conditioner market is shaped by efficiency, reliability, and integration with residential energy management systems. Schneider Electric leads with a diverse range of power conditioning solutions that combine stability, safety, and modular energy optimization for household applications. Delta Electronics focuses on compact and efficient conditioners designed for residential and small-scale usage, prioritizing reduced energy wastage and seamless load management. Eaton offers high-performance regulators with advanced surge protection and voltage stabilization, tailored for homes requiring consistent and uninterrupted power quality. Emerson Electric emphasizes system reliability and real-time monitoring features, catering to modern smart homes and grid-interactive energy solutions. Furman specializes in premium conditioning units with superior filtering and power surge suppression, appealing to high-end residential applications.

Fuji Electric, Hubbell, and Legrand bring strong regional presences, leveraging their distribution networks to expand product accessibility in developed and emerging markets. Mitsubishi Electric focuses on innovation and integration with home automation systems, ensuring long-term durability and reduced maintenance. Regional players like Neelkanth Power Solutions, NXT Power, and Servomax compete on cost efficiency, customization, and localized technical support. Panasonic, ABB, and Sollatek emphasize high-quality designs with a mix of affordability and energy-saving performance, aligning with sustainability-driven households and smart home adoption trends. Strategies highlight modular designs, compliance with voltage regulation standards, and easy integration with renewable energy systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 316.6 Million |

| Power Rating | > 50 kVA to 150 kVA, > 10 kVA to 50 kVA, ≤ 10 kVA, and > 150 kVA |

| Phase | Single Phase and Three Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Delta Electronics, Eaton, Emerson Electric, Furman, Fuji Electric, Hubbell, Legrand, Mitsubishi Electric, Neelkanth Power Solutions, NXT Power, Panasonic, ABB, Servomax, and Sollatek |

| Additional Attributes | Dollar sales, growth outlook, regional share, competitor positioning, pricing trends, demand drivers, distribution networks, and customer adoption patterns. |

The global fixed cycle regulator residential power conditioner market is estimated to be valued at USD 316.6 million in 2025.

The market size for the fixed cycle regulator residential power conditioner market is projected to reach USD 487.1 million by 2035.

The fixed cycle regulator residential power conditioner market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in fixed cycle regulator residential power conditioner market are > 50 kva to 150 kva, > 10 kva to 50 kva, ≤ 10 kva and > 150 kva.

In terms of phase, single phase segment to command 63.4% share in the fixed cycle regulator residential power conditioner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Tire Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Chain Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA