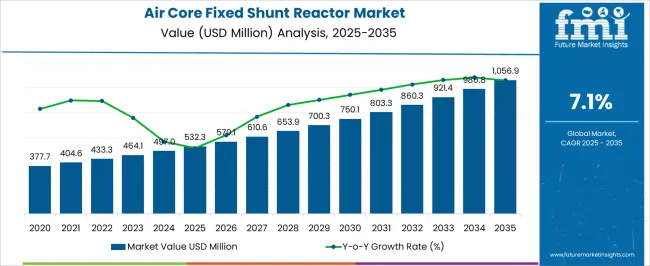

The Air Core Fixed Shunt Reactor Market is estimated to be valued at USD 532.3 million in 2025 and is projected to reach USD 1056.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. The market shows consistent expansion without signs of early saturation within this forecast period. Analyzing the data, growth increments maintain a steady rise year-over-year. The market increases from USD 532.3 million in 2025 to USD 700.3 million by 2029, reflecting healthy momentum in the early phase.

This consistent growth suggests ongoing adoption and expanding applications in the power transmission and distribution sectors. Between 2029 and 2035, the market continues its upward trend, reaching USD 1,056.9 million without notable deceleration. This indicates the market is far from reaching saturation, as demand remains strong and technological developments continue to drive expansion.

No plateau or sharp slowdown is evident in the data, implying that the Air Core Fixed Shunt Reactor Market has ample room for growth. The steady growth rate suggests increasing investments in infrastructure and a growing need for reliable reactive power compensation solutions. The market’s trajectory indicates a healthy expansion phase with no immediate saturation. Stakeholders can anticipate sustained opportunities driven by rising demand and innovation throughout the forecast period.

| Metric | Value |

|---|---|

| Air Core Fixed Shunt Reactor Market Estimated Value in (2025 E) | USD 532.3 million |

| Air Core Fixed Shunt Reactor Market Forecast Value in (2035 F) | USD 1056.9 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

The air core fixed shunt reactor market is gaining momentum, driven by the increasing complexity of modern power grids and the rising need to mitigate voltage instability across long transmission lines. The shift toward renewable energy integration and the construction of extra-high voltage (EHV) infrastructure has elevated the need for reactive power compensation solutions.

Air core technology is being favored for its lower electromagnetic interference, fire safety, and compact installation footprint. Grid operators and utilities are prioritizing efficient line charging compensation, especially in offshore wind and interconnection projects.

Investments in grid modernization, the rollout of smart substations, and regulatory mandates for power quality enhancement are expected to support long-term adoption. As aging power systems are upgraded and new transmission corridors are developed, demand for robust and maintenance-free shunt reactors is projected to rise significantly.

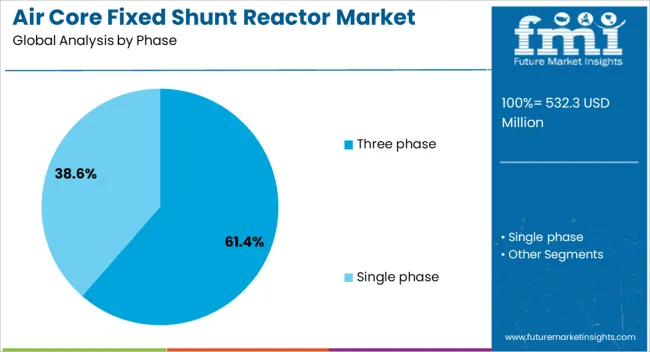

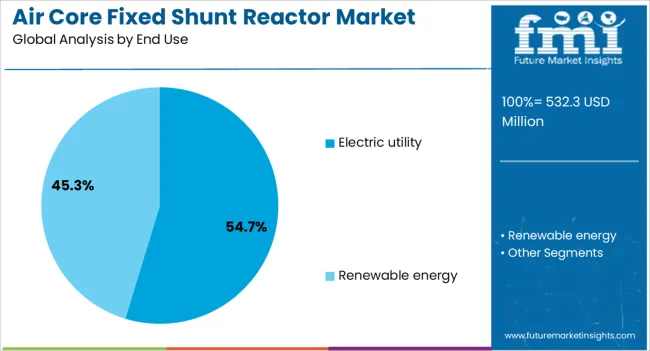

The air core fixed shunt reactor market is segmented by phase, end use, and geographic regions. By phase, the air core fixed shunt reactor market is divided into three-phase and single-phase. In terms of end use, the air core fixed shunt reactor market is classified into Electric utility and Renewable energy. Regionally, the air core fixed shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment is expected to account for 61.4% of the overall market revenue in 2025, making it the dominant phase configuration. Its prominence is being driven by the widespread use of three-phase systems in medium to high-voltage transmission and distribution networks.

The ability of three-phase air core shunt reactors to offer balanced voltage control and stable inductive compensation has made them essential in grid-level applications. They also provide improved efficiency and reduced line losses when compared to single-phase alternatives in large-scale deployments.

As electric utilities expand grid capacity to meet growing industrial and residential demand, three-phase reactor installations are being prioritized for centralized compensation strategies. Their operational reliability, minimal maintenance requirements, and suitability for remote or harsh environments have reinforced their position as the preferred configuration for power utilities and transmission system operators.

Electric utility applications are projected to represent 54.7% of the market revenue in 2025, ranking as the leading end-use segment. This dominance is being supported by the increasing number of grid extension projects, reactive power management requirements, and substation expansions undertaken by utility providers.

Air core fixed shunt reactors have proven valuable for controlling overvoltage conditions during light load or no-load conditions in long transmission lines, an essential functionality for grid stability. Electric utilities are also leveraging these reactors to maintain voltage levels within permissible limits while enabling seamless renewable energy integration.

Their dry-type construction enhances safety and lifespan, especially in high-risk or densely populated regions. Regulatory directives on improving power factor and reducing transmission losses have further influenced procurement decisions among public and private utility companies, cementing this segment's leadership.

The market has been witnessing steady expansion, largely driven by the growing need for efficient reactive power compensation within modern power transmission and distribution systems. These reactors are essential components that help maintain voltage stability, reduce system losses, and enhance overall power quality by absorbing excess reactive power, especially in high-voltage transmission lines. Increasing investments in grid modernization programs, coupled with the accelerated integration of renewable energy sources such as wind and solar, have further boosted market demand. Technological advancements have led to improved reactor designs featuring better thermal performance, noise reduction, and increased operational reliability.

The ongoing modernization of electrical grids worldwide has significantly fueled the deployment of air-core fixed shunt reactors to enhance voltage regulation and system stability across transmission networks. As power grids incorporate higher shares of renewable energy sources, reactive power fluctuations become more prevalent, necessitating reliable and efficient compensation equipment. Utilities and grid operators increasingly invest in shunt reactors to optimize power flow, prevent damaging overvoltages, and improve overall system reliability. The rapid expansion of high-voltage transmission infrastructure aimed at meeting growing electricity demand has created additional opportunities for reactor installation. Integration of smart grid technologies complements the use of shunt reactors by enabling dynamic control and remote monitoring, collectively strengthening grid resilience and operational efficiency in an evolving energy landscape.

Technological progress in air core fixed shunt reactor design has focused on addressing operational challenges such as thermal management and acoustic noise emission. Enhanced coil configurations, optimized winding techniques, and advanced cooling methods contribute to superior heat dissipation, allowing reactors to operate efficiently under continuous high load conditions. The adoption of low-noise materials, vibration-damping solutions, and structural reinforcements significantly reduces sound emissions, enabling compliance with increasingly stringent environmental and workplace noise regulations. Modular reactor designs have also been developed to facilitate easier transportation, installation, and maintenance, particularly in remote or space-constrained locations. These design innovations not only extend reactor service life and reduce maintenance costs but also improve user acceptance, promoting broader adoption across transmission and distribution networks.

The rapid growth and penetration of renewable energy sources in power generation have introduced considerable variability and intermittency into electricity supply, causing voltage instability and reactive power fluctuations. Air core fixed shunt reactors play a crucial role in managing these challenges by providing effective reactive power absorption to stabilize voltage levels and prevent overvoltage conditions that can damage sensitive grid equipment. As renewable energy installations continue to expand globally, utilities prioritize the deployment of shunt reactors tailored to handle fluctuating loads and dynamic grid conditions. This growing focus on renewable integration directly stimulates market demand, encouraging continuous innovation in reactor capacity, adaptability, and intelligent control features designed to support renewable-rich power systems.

Despite the clear operational benefits of air core fixed shunt reactors, market growth is restrained by significant upfront capital costs and the complexity involved in installation. The large physical size and substantial weight of reactors require specialized foundation work, dedicated cooling infrastructure, and skilled labor for assembly, particularly in offshore or remote locations. Coordinating installation with existing grid operations can lead to extended project timelines and increased logistical challenges. The overall cost of ownership, including maintenance and potential downtime, remains a concern for utilities operating within tight budget constraints. The manufacturers have developed compact, modular reactor designs that simplify installation and reduce both capital and operational expenditures. Strategic collaborations, turnkey project offerings, and after-sales support services are also being emphasized to mitigate deployment challenges and accelerate market adoption worldwide.

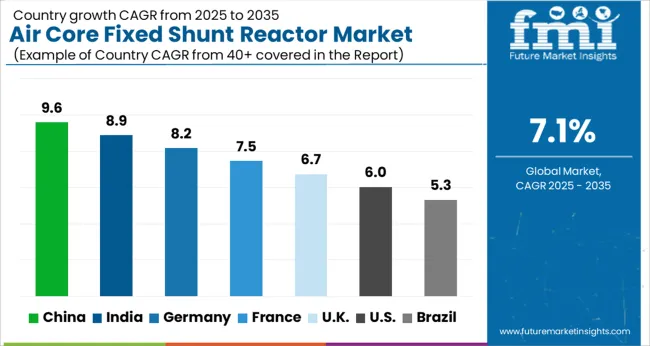

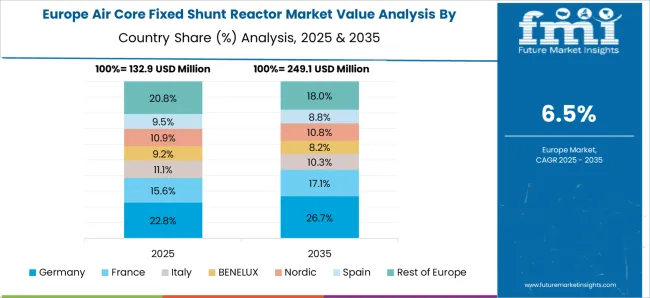

The market is expected to grow at a CAGR of 7.1% from 2025 to 2035, driven by increasing demand for grid stability, reactive power compensation, and power quality improvements. China leads with a 9.6% CAGR, supported by expanding power transmission infrastructure and renewable integration efforts. India follows at 8.9%, fueled by rapid electrification and grid modernization projects. Germany, growing at 8.2%, benefits from advanced grid technologies and strong emphasis on renewable energy. The UK, at 6.7%, is focusing on upgrading aging infrastructure, while the USA, with a 6.0% CAGR, is investing in smart grid initiatives and enhanced transmission reliability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is forecast to grow at a CAGR of 9.6% from 2025 to 2035, supported by increasing investments in power grid stabilization and renewable energy integration. Leading manufacturers focus on improving reactor efficiency and thermal management to support high-voltage transmission lines. Companies such as XD Group and TBEA Co. have expanded production capacities to meet rising demand from expanding smart grid projects. Government initiatives targeting grid reliability and reduced transmission losses are accelerating adoption across urban and rural regions.

Demand for air core fixed shunt reactors in India is projected to rise at a CAGR of 8.9% from 2025 to 2035, driven by expanding electricity consumption and grid modernization efforts. Focus on reducing transmission losses and improving voltage stability has increased adoption across transmission networks. Key manufacturers invest in research to enhance reactor performance under varied climatic conditions. Expansion of renewable energy capacity, particularly solar and wind, fuels additional need for reactive power compensation devices like air core reactors.

Sales of air core fixed shunt reactors in Germany are expected to grow at a CAGR of 8.2% from 2025 to 2035, supported by renewable energy grid integration and industrial electrification. Manufacturers emphasize product reliability and compliance with strict European standards. The transition to decentralized energy systems and smart grids creates demand for advanced reactor solutions. Germany energy transition policies continue to stimulate sales by promoting reactive power compensation to maintain grid stability amid variable energy inputs.

The market in the United Kingdom is forecast to grow at a CAGR of 6.7% from 2025 to 2035, driven by grid upgrades and offshore wind power integration. Suppliers focus on compact, low-loss reactor designs suited to constrained urban substations and offshore platforms. Public and private investments in energy infrastructure modernization support reactor installations. Demand growth is also linked to rising electrification in transportation and industrial sectors.

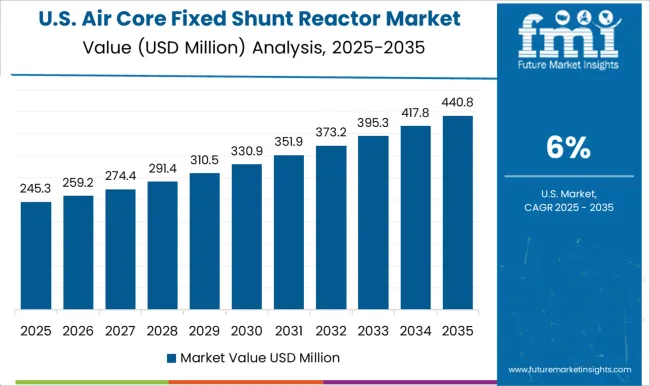

Demand for air core fixed shunt reactors in the United States is anticipated to grow at a CAGR of 6.0% from 2025 to 2035, driven by power grid modernization and renewable energy integration. Utility companies focus on reactor deployment to manage reactive power and improve voltage control. Federal incentives for grid resilience and clean energy are stimulating investments in advanced reactors. Manufacturers innovate with improved thermal performance and modular designs for easier installation and maintenance.

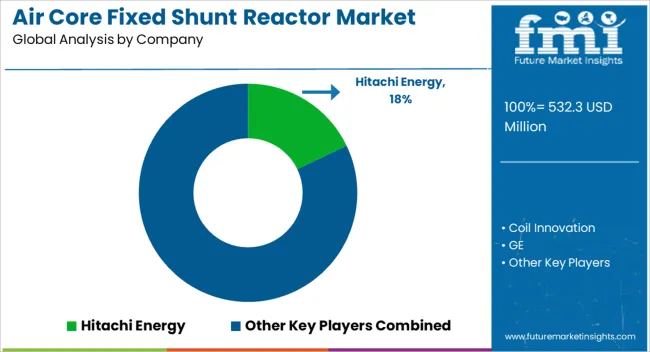

The market features prominent electrical equipment manufacturers offering solutions vital for voltage regulation and reactive power compensation in high-voltage power grids. Hitachi Energy and Siemens Energy lead the market by delivering advanced reactors with optimized designs for enhanced efficiency and reliability in transmission systems. GE and Toshiba Energy Systems & Solutions provide robust reactor technologies supporting global utility projects, focusing on scalability and compliance with international standards.

Coil Innovation and MindCore Technologies specialize in compact, high-performance reactors aimed at improving grid stability and reducing system losses. GETRA and Hilkar emphasize customized shunt reactors tailored for specific voltage levels and environmental conditions. Hyosung Heavy Industries and Nissin Electric maintain strong positions in Asia through local manufacturing capabilities and technical support services. Phoenix Electric, SGB SMIT, Shrihans Electricals, and TMC Transformers offer comprehensive product lines catering to various power rating requirements and industry applications.

The market growth is propelled by increasing grid modernization initiatives and renewable energy integration, necessitating efficient reactive power management. Barriers to entry include high capital investment for manufacturing, stringent testing protocols, technical expertise in magnetic component design, and long development cycles to meet power system reliability standards. These factors consolidate market share among established manufacturers with proven performance and global service networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 532.3 Million |

| Phase | Three phase and Single phase |

| End Use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy, Coil Innovation, GE, GETRA, Hilkar, Hyosung Heavy Industries, MindCore Technologies, Nissin Electric, Phoenix Electric, SGB SMIT, Shrihans Electricals, Siemens Energy, TMC Transformers, and Toshiba Energy Systems & Solutions |

| Additional Attributes | Dollar sales by reactor rating and application type, demand dynamics across power transmission, distribution networks, and renewable energy integration, regional trends in deployment across Asia-Pacific, Europe, and North America, innovation in compact designs, low-loss magnetic materials, and enhanced thermal management, environmental impact of material usage, manufacturing emissions, and end-of-life disposal, and emerging use cases in smart grid stabilization, high-voltage direct current (HVDC) systems, and microgrid voltage regulation. |

The global air core fixed shunt reactor market is estimated to be valued at USD 532.3 million in 2025.

The market size for the air core fixed shunt reactor market is projected to reach USD 1,056.9 million by 2035.

The air core fixed shunt reactor market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in air core fixed shunt reactor market are three phase and single phase.

In terms of end use, electric utility segment to command 54.7% share in the air core fixed shunt reactor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Core Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Shunt Reactor Market Growth – Trends & Forecast 2020 to 2030

Airlift Bioreactors Market - Growth & Forecast 2025 to 2035

Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA