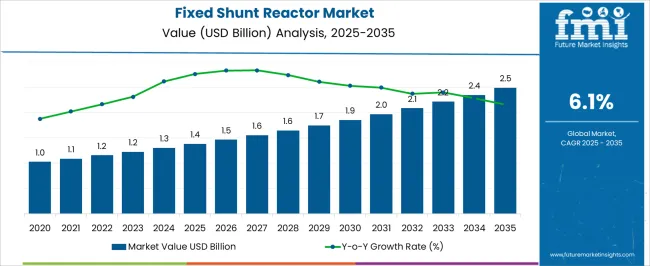

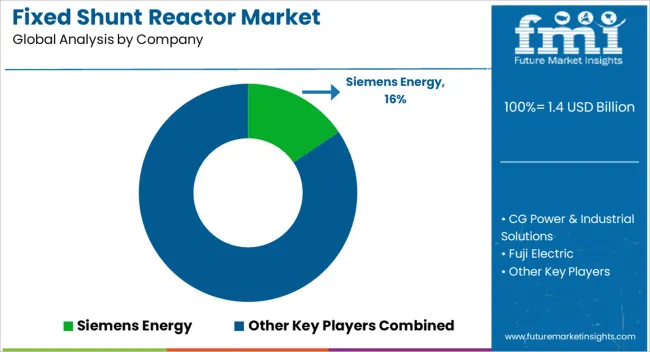

The fixed shunt reactor market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Early adoption was concentrated within high-voltage power transmission networks where the technology was used to regulate reactive power and stabilize grid operations. As global electricity demand expanded and renewable integration accelerated, the market entered a growth phase marked by steady deployment across utilities and industrial power systems. The adoption lifecycle presently indicates movement toward late growth, supported by grid modernization, renewable energy expansion, and rising investments in transmission infrastructure. Utilities across Asia-Pacific are rapidly expanding adoption due to large-scale grid expansion projects, while North America and Europe show a transition toward optimization and efficiency-driven deployments.

This signals a gradual progression from early majority to late majority adoption phases. Future growth will be shaped by digital monitoring integration and life-cycle service models that extend the value proposition beyond hardware. By 2035, with global utilities and industries increasingly familiar with the technology, the market may approach maturity, defined by stable yet incremental adoption driven by replacement demand, regulatory compliance, and system upgrades rather than new user acquisition.

| Metric | Value |

|---|---|

| Fixed Shunt Reactor Market Estimated Value in (2025 E) | USD 1.4 billion |

| Fixed Shunt Reactor Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The fixed shunt reactor market is an important segment within global electrical infrastructure, designed to control voltage levels and improve grid efficiency. Within the overall power transmission and distribution equipment sector, it accounts for about 3.2%, reflecting its critical role in high-voltage networks. In the broader transformer and reactor industry, its share is estimated at 2.8%, supported by demand from utilities and grid operators. Within reactive power compensation equipment, fixed shunt reactors hold around 4.5%, addressing stability and energy loss issues. In the renewable power integration equipment segment, they represent 2.3%, ensuring grid stability with intermittent sources. Across industrial power systems, their market presence is 1.9%, where large-scale operations require consistent voltage regulation. Recent trends in the fixed shunt reactor market emphasize grid modernization and efficient energy management.

Groundbreaking developments include the integration of advanced core materials that reduce losses and improve thermal performance. Key players are focusing on compact designs with enhanced cooling systems to support urban and industrial grid requirements. The adoption of smart monitoring technologies is rising, allowing real-time diagnostics and predictive maintenance for utilities. Strategies also include partnerships between utilities and manufacturers to develop tailored high-voltage solutions. With the expansion of renewable energy integration and ultra-high voltage transmission lines, the demand for fixed shunt reactors has been shaped by their ability to enhance grid resilience and minimize reactive power losses.

The fixed shunt reactor market is progressing steadily, driven by the need to maintain voltage stability and improve power quality across high-voltage transmission networks. As grid complexity increases due to rising electricity demand and renewable energy integration, utilities are investing in advanced reactive power compensation solutions to minimize losses and enhance efficiency.

Fixed shunt reactors play a critical role in absorbing reactive power during low-load conditions, thereby protecting equipment and optimizing grid performance. Market growth is supported by upgrades to aging infrastructure, particularly in mature economies, alongside expansion of high-voltage transmission lines in emerging regions.

Technological improvements in design, energy efficiency, and remote monitoring are also contributing to broader adoption. In the years ahead, heightened investments in grid modernization and sustainable power infrastructure are expected to reinforce market expansion, especially in utility and industrial applications where voltage regulation is essential

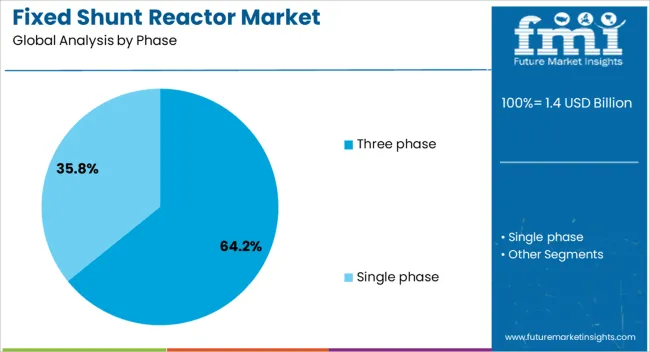

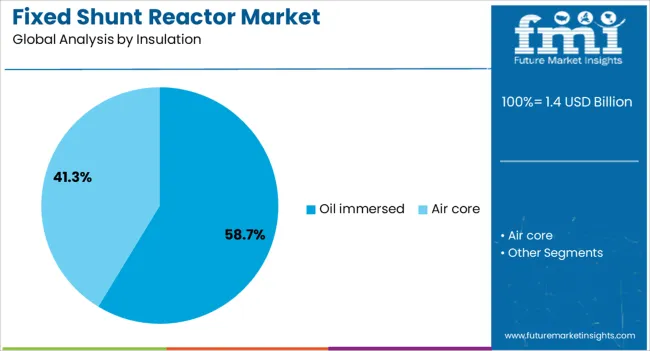

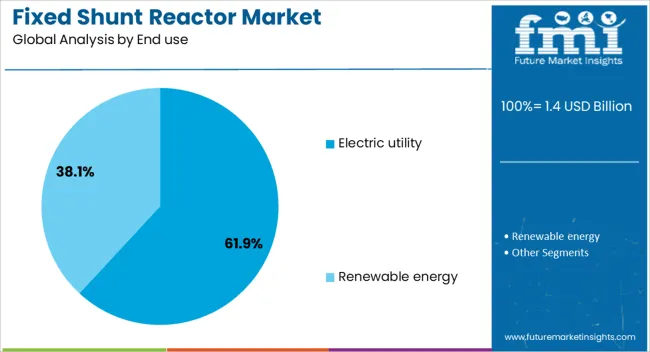

The fixed shunt reactor market is segmented by phase, insulation, end use, and geographic regions. By phase, fixed shunt reactor market is divided into three phase and single phase. In terms of insulation, fixed shunt reactor market is classified into oil immersed and air core. Based on end use, fixed shunt reactor market is segmented into electric utility and renewable energy. Regionally, the fixed shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment accounts for a dominant 64.2% share within the phase category of the fixed shunt reactor market, attributed to its superior performance in high-capacity and large-scale power transmission systems. Three phase reactors are particularly suited for utility-scale applications where balanced load handling, reduced phase unbalance, and increased operational stability are critical.

Their deployment is increasingly favored in extra-high voltage networks and cross-country transmission projects requiring robust reactive power compensation. Advancements in magnetic core materials and compact designs have further improved their reliability and ease of installation.

The continued expansion of inter-regional transmission links and the need for efficient grid balancing solutions ensure strong demand for three phase fixed shunt reactors. As utilities prioritize resilience and operational efficiency, this segment is expected to retain its lead due to its operational advantages and scalability across diverse grid configurations

Oil immersed fixed shunt reactors lead the insulation category with a 58.7% market share, favored for their thermal stability, durability, and effective cooling capabilities under continuous heavy-duty operation. These reactors are commonly installed in substations and high-voltage transmission systems where heat dissipation and operational longevity are vital. Oil immersion technology enables reliable performance in varying environmental conditions and supports higher voltage classes without significant size escalation.

The segment benefits from extensive field experience, lower lifecycle costs, and broad compatibility with existing grid infrastructure. As electricity networks become more complex, demand for proven, low-maintenance solutions continues to rise.

Despite emerging dry-type alternatives, oil immersed reactors remain the preferred choice for utilities and industries seeking robust performance in mission-critical applications. Continued enhancements in insulating oil formulations and tank design are expected to strengthen this segment’s position in the market

The electric utility segment holds a commanding 61.9% share in the end use category, driven by the critical role of fixed shunt reactors in supporting stable and reliable electricity transmission across national grids. Utilities rely on these reactors to manage reactive power flow, regulate voltage, and prevent overvoltage conditions caused by light load scenarios or sudden load drops.

The shift toward renewable energy sources and decentralized power generation has introduced new challenges for grid operators, increasing the importance of reactive compensation devices. Government-led investments in smart grid development and transmission upgrades are fueling procurement by utilities worldwide.

Furthermore, regulatory mandates to enhance power quality and minimize transmission losses have accelerated the adoption of fixed shunt reactors in utility networks. With ongoing grid modernization initiatives and expansion of interconnection projects, the electric utility segment is expected to remain the largest contributor to market revenue

The market has grown steadily as transmission and distribution utilities invest in technologies that stabilize voltage levels and improve power grid efficiency. Fixed shunt reactors are widely used to absorb reactive power, reduce over-voltages, and improve system reliability in high-voltage transmission networks. They are particularly important in long-distance power lines, renewable energy integration, and urban distribution systems where voltage fluctuations are common. Increasing electricity demand, grid modernization projects, and investments in renewable power integration are driving adoption. Moreover, regulatory focus on improving transmission efficiency and reducing energy losses is fostering wider deployment.

The demand for fixed shunt reactors has been strongly influenced by rising electricity consumption and the need for enhanced grid stability. As power grids operate with increasing load variations, reactive power compensation has become critical to ensure stable voltage profiles. Fixed shunt reactors are being installed across high-voltage transmission lines and substations to reduce voltage rise during low-load conditions and maintain efficiency during high-load operations. Their ability to absorb reactive power supports reliable power transmission over long distances. With electricity demand increasing across industrial and residential sectors, utilities have adopted fixed shunt reactors as essential components in ensuring grid security, operational reliability, and long-term performance.

Fixed shunt reactors are gaining importance as renewable energy integration expands and transmission distances increase. Renewable power sources such as wind and solar often generate fluctuating outputs, causing voltage imbalances in the grid. Shunt reactors help mitigate these fluctuations by maintaining reactive power balance and supporting system stability. Additionally, long-distance power transmission, including high-voltage AC and UHVAC lines, requires effective voltage control to avoid over-voltages. Fixed shunt reactors have been deployed in major renewable energy corridors and interregional transmission projects worldwide. This trend is expected to intensify as nations enhance their renewable generation capacity and expand transmission networks to meet growing demand.

Significant investments in transmission and distribution infrastructure are accelerating the adoption of fixed shunt reactors. Governments and utilities are modernizing grid systems to meet reliability and efficiency standards. Projects focused on building smart grids, upgrading substations, and expanding cross-border transmission lines have highlighted the importance of shunt reactors in maintaining stability. Moreover, the aging transmission infrastructure in developed economies has required upgrades with advanced components, including high-voltage fixed shunt reactors. The market has also benefited from the push toward reducing technical losses and improving energy efficiency, as shunt reactors directly contribute to minimizing reactive power wastage and maintaining system resilience.

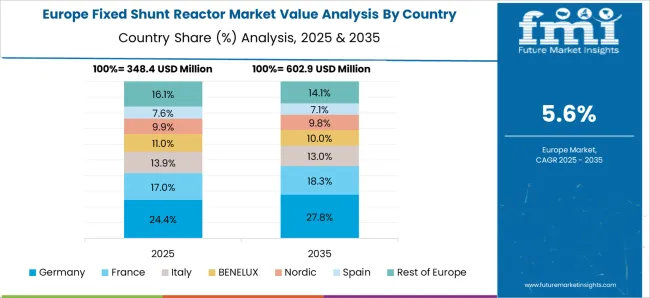

Asia Pacific has emerged as the leading region due to rapid industrialization, high electricity demand, and large-scale grid expansion projects. Europe has emphasized grid reliability and cross-border electricity trade, driving demand for high-performance shunt reactors. North America has seen steady growth supported by grid modernization initiatives and renewable integration. Leading manufacturers are focusing on developing compact, efficient, and digitally monitored reactor designs to support smart grid applications. Strategic partnerships with utilities, emphasis on local manufacturing, and the development of high-voltage and ultra-high-voltage solutions have defined the competitive strategies of key players. Market competition remains shaped by regulatory requirements, cost efficiency, and technological advancements in reactor design.

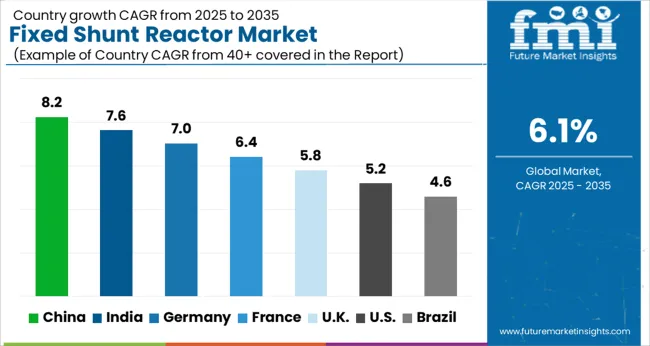

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The market is projected to grow at a CAGR of 6.1% between 2025 and 2035. India records 7.6%, supported by grid modernization initiatives and rising renewable energy integration. China stands ahead at 8.2%, backed by large scale transmission network expansions and increasing electricity demand. Germany holds 7.0%, emphasizing power system stability and efficient energy management. The UK at 5.8% reflects upgrades in high voltage networks, while the USA at 5.2% highlights ongoing investments in transmission and distribution reliability. These dynamics position fixed shunt reactors as essential assets for enhancing efficiency and stability across power systems worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 8.2% in the market, driven by rising investments in ultra-high-voltage transmission projects and renewable energy integration. Power grid operators are deploying fixed shunt reactors to maintain voltage stability and minimize losses in long-distance transmission. Government-led programs supporting smart grid development and large-scale renewable adoption have significantly boosted demand. Domestic manufacturers, along with global leaders, are expanding production capacities to meet project-based needs. The focus remains on delivering efficient, high-voltage reactors capable of handling increasing grid complexity across provinces.

India is projected to grow at a CAGR of 7.6% in the market, supported by transmission capacity expansion and renewable power integration into the national grid. Grid stability has become a priority, especially with the increasing share of solar and wind energy. Utilities prefer fixed shunt reactors for reactive power management and voltage control in high-capacity corridors. Public sector utilities, supported by government funding, are leading procurement, while private manufacturers collaborate with global players for technology transfer. Market growth is also encouraged by large regional interconnection projects.

Germany is advancing at a CAGR of 7.0% in the market, largely propelled by its energy transition agenda and focus on renewable grid integration. Transmission system operators are installing reactors to manage voltage fluctuations arising from offshore wind power and long-distance renewable transmission. Investments in modernizing grid infrastructure further stimulate adoption. German engineering firms, supported by European collaborations, are emphasizing high-efficiency and low-loss reactor designs. The trend is particularly visible in offshore interconnectors and high-capacity transmission corridors.

The United Kingdom is registering a CAGR of 5.8% in the market, primarily due to efforts to modernize grid networks and handle rising renewable power generation. Offshore wind projects and interconnectors have driven demand for high-capacity reactors to ensure stable voltage levels. Utilities and transmission operators are increasingly focusing on grid resilience, leading to investments in advanced fixed shunt reactors. Collaborations with international suppliers help in deploying reactors with improved efficiency and monitoring capabilities. Market growth is closely linked to the nation’s clean energy roadmap.

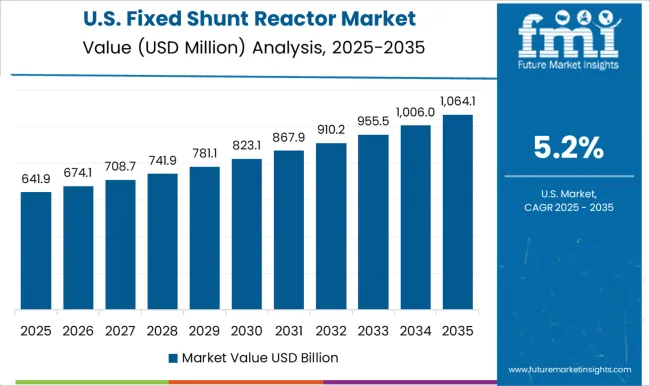

The United States is expanding at a CAGR of 5.2% in the market, driven by grid modernization initiatives and the integration of renewable energy sources. Utilities are deploying reactors for reactive power management and to enhance grid efficiency across high-voltage transmission lines. Replacement of aging grid assets also adds momentum to adoption. Strategic collaborations between domestic and international suppliers are enhancing product availability and technology innovation. The market is particularly strong in regions with high renewable penetration and long transmission networks.

The market is shaped by a mix of global electrical giants and specialized transformer manufacturers that serve utilities and grid operators worldwide. Siemens Energy, GE, and Hitachi Energy dominate through strong technological expertise, large-scale manufacturing capabilities, and a global service footprint, making them preferred partners for high-voltage and extra-high-voltage grid projects. Toshiba Energy Systems, Fuji Electric, and Nissin Electric strengthen the competitive field with advanced insulation technologies, compact designs, and tailored solutions for Asian and international markets. European players such as SGB SMIT, GETRA, GBE, and TMC Transformers position themselves by offering high-efficiency and custom-engineered solutions suited to regional grid codes and renewable integration requirements.

In contrast, CG Power & Industrial Solutions, Hyosung Heavy Industries, and Shrihans Electricals leverage regional presence and competitive pricing strategies to serve developing power markets where grid stability and cost efficiency are priorities. The competitive environment is being driven by the global transition toward renewable energy, expansion of transmission networks, and demand for reducing reactive power losses. Companies are increasingly investing in smart grid compatibility, digital monitoring, and environmentally friendly insulation materials. Strategic partnerships with utilities and EPC contractors, combined with innovation in compact high-performance designs, are expected to remain critical factors in sustaining competitiveness in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Phase | Three phase and Single phase |

| Insulation | Oil immersed and Air core |

| End use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, CG Power & Industrial Solutions, Fuji Electric, GBE, GE, GETRA, Hitachi Energy, Hyosung Heavy Industries, Nissin Electric, SGB SMIT, Shrihans Electricals, TMC Transformers, and Toshiba Energy Systems & Solutions |

| Additional Attributes | Dollar sales by reactor type and application, demand dynamics across transmission, distribution, and industrial power systems, regional trends in grid stability and reactive power management adoption, innovation in core design, insulation, and energy efficiency, environmental impact of material use and electromagnetic emissions, and emerging use cases in renewable integration, voltage regulation, and smart grid infrastructure. |

The global fixed shunt reactor market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the fixed shunt reactor market is projected to reach USD 2.5 billion by 2035.

The fixed shunt reactor market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in fixed shunt reactor market are three phase and single phase.

In terms of insulation, oil immersed segment to command 58.7% share in the fixed shunt reactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Shunt Voltage References Market

Shunt Reactor Market Growth – Trends & Forecast 2020 to 2030

Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Interatrial Shunt Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA