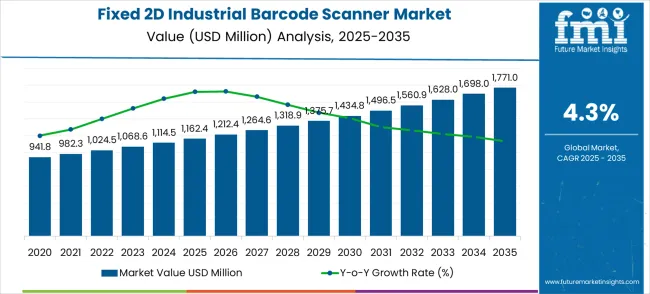

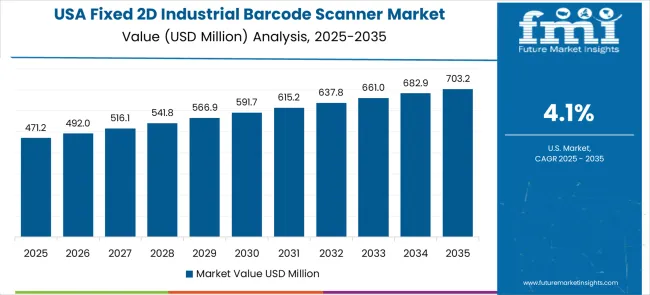

The fixed 2D industrial barcode scanner market begins its decade journey from a USD 1,162.4 million foundation in 2025, setting the stage for steady expansion ahead. The first half of the decade witnesses consistent momentum building, with market value climbing from USD 1,212.4 million in 2026 to USD 1,375.7 million by 2030. This initial phase reflects growing automation adoption and increasing demand for advanced identification solutions across manufacturing and logistics operations.

The latter half will witness sustained growth dynamics, propelling the market from USD 1,434.8 million in 2031 to reach USD 1,771.0 million by 2035. Dollar additions during 2030-2035 maintain robust progression, with annual increments averaging USD 79.1 million compared to USD 42.7 million in the first phase. This progression represents a 52.4% total value increase over the forecast decade.

Market maturation factors include expanding Industry 4.0 implementation, e-commerce fulfillment automation, and supply chain digitization acceleration. The 4.3% compound annual growth rate positions participants to capitalize on USD 608.6 million in additional market value creation. This trajectory signals robust opportunities for automation technology providers, systems integrators, and industrial equipment suppliers across the global manufacturing and logistics landscape.

Market expansion unfolds through two distinct growth periods with different automation adoption characteristics for each phase. The 2025-2030 foundation period delivers USD 213.3 million in value additions, representing 18.4% growth from the baseline. Market dynamics during this phase center on the deployment of automation infrastructure, the adoption of smart manufacturing, and the expansion of e-commerce fulfillment.

The 2030-2035 acceleration period generates USD 395.3 million in incremental value, representing a 28.7% increase from the 2030 position. This phase exhibits mature market characteristics, characterized by enhanced competition, product innovation strategies, and emerging technology integration initiatives. Dollar contributions shift from foundational automation deployment to market share optimization and technological advancement.

Market expansion rests on four fundamental shifts driving industrial automation and digitization acceleration:

However, growth faces headwinds from high initial investment costs and integration complexity with legacy systems. Alternative identification technologies including RFID may create competitive pressure in specific applications. Economic volatility affects capital equipment investment and automation project implementation timelines.

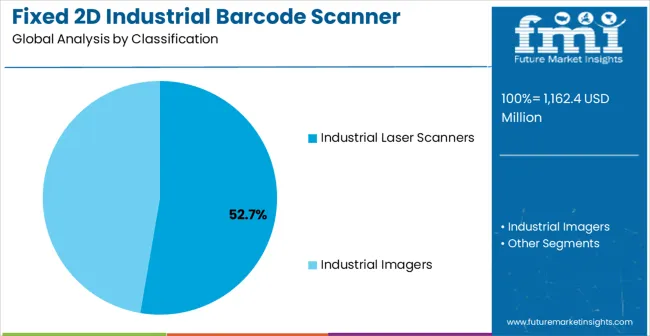

Primary Classification: Product Type Distribution

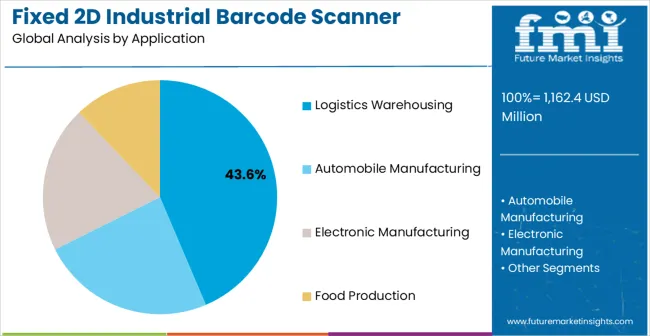

Secondary Breakdown: Application Categories

Geographic Segmentation: Regional Market Distribution

Market Position: Industrial laser scanners establish clear market leadership through proven performance reliability and cost-effectiveness for high-volume 2D barcode reading applications. Laser technology provides exceptional reading accuracy across diverse 2D code formats while maintaining consistent performance in challenging industrial environments. Advanced processing algorithms enable rapid decode capabilities essential for high-throughput automated operations.

Value Drivers: Enhanced scanning speed capabilities enable processing of fast-moving items in conveyor systems and automated sorting applications requiring 2D data capture. Long-range scanning performance reduces installation complexity while improving operational flexibility for diverse facility layouts. Multi-code reading capabilities support simultaneous processing of multiple 2D codes improving system efficiency.

Competitive Advantages: Laser scanning technology offers proven reliability in industrial environments with minimal maintenance requirements compared to complex imaging alternatives. Cost-effective deployment enables widespread installation across multiple scanning points in automated systems. Established integration protocols facilitate seamless connection with existing warehouse management and enterprise systems.

Market Challenges: Limited capability for advanced applications including OCR and image processing compared to industrial imager solutions. Higher power consumption requirements may increase operational costs in large-scale deployments. Technology evolution toward imaging solutions may affect long-term market positioning for traditional laser scanning applications.

Strategic Market Importance: Logistics warehousing applications represent the primary demand driver for fixed 2D industrial barcode scanners across distribution centers, fulfillment facilities, and transportation hubs. Package sorting, inventory management, and shipping verification require high-performance 2D scanning solutions for operational efficiency and data accuracy. Quality requirements mandate reliable identification technology meeting service level commitments and customer satisfaction objectives.

Business Logic: Logistics operations prioritize throughput and data accuracy, making reliable 2D scanning technology essential for competitive service delivery and regulatory compliance. Performance requirements demand systems providing consistent reading rates under diverse operating conditions while capturing complex data formats. Investment justification occurs through labor cost reduction, accuracy improvement, and operational capacity expansion.

Forward-looking Implications: E-commerce growth acceleration drives demand for advanced 2D scanning solutions capable of handling diverse package formats and complex data requirements. Pharmaceutical serialization and food traceability mandates create opportunities for 2D scanning systems supporting regulatory compliance. Supply chain digitization sustains demand for comprehensive identification solutions enabling real-time visibility and advanced data capture capabilities.

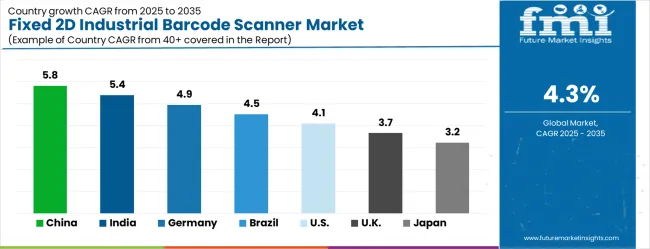

Global market dynamics reveal distinct performance tiers reflecting regional automation adoption and manufacturing development. Growth Leaders including China (5.8% CAGR) and India (5.4% CAGR) demonstrate expanding manufacturing automation with advanced scanning technology adoption, while Germany (4.9% CAGR) represents European industrial automation excellence. Steady Performers such as Brazil (4.5% CAGR) and the United States (4.1% CAGR) show consistent demand growth aligned with logistics modernization and manufacturing digitization requirements. Mature Markets including the United Kingdom (3.7% CAGR) and Japan (3.2% CAGR) display moderate growth rates reflecting established automation infrastructure and technology advancement focus.

Regional synthesis indicates Asia Pacific dominance through manufacturing concentration and logistics infrastructure development. North American markets emphasize e-commerce fulfillment and regulatory compliance applications. European regions focus on Industry 4.0 implementation and advanced manufacturing automation requiring sophisticated 2D scanning capabilities.

| Country | CAGR (%) |

|---|---|

| China | 5.8 |

| India | 5.4 |

| Germany | 4.9 |

| Brazil | 4.5 |

| USA | 4.1 |

| UK | 3.7 |

| Japan | 3.2 |

China establishes market leadership through expanding manufacturing automation and logistics infrastructure development requiring advanced 2D scanning capabilities. A 5.8% CAGR value reflects extensive industrial modernization and export-oriented manufacturing requirements supporting complex identification needs. Growth metrics demonstrate sustained expansion supported by government automation initiatives and supply chain digitization mandates.

Market dynamics center on smart manufacturing development creating demand for automated 2D identification solutions and Industry 4.0 compliance requiring advanced data capture. E-commerce platform expansion drives adoption of warehouse automation requiring comprehensive 2D scanning infrastructure supporting complex inventory management. Export manufacturing competitiveness necessitates efficient identification systems for quality control and traceability compliance.

Manufacturing hub concentration in coastal provinces creates demand density for automation technologies including fixed 2D scanning systems supporting diverse applications. Industrial development initiatives include smart factory deployment requiring integrated 2D identification solutions. Technology partnerships bring international automation standards requiring certified 2D scanning technology adoption.

Strategic Market Indicators:

India demonstrates robust growth potential through expanding manufacturing capabilities and logistics infrastructure development requiring advanced 2D scanning solutions. A 5.4% CAGR reflects increasing industrial automation and e-commerce growth supporting sophisticated scanning technology adoption. Manufacturing sector expansion under government initiatives creates consistent demand for automated 2D identification solutions across applications.

Industrial development drives primary demand through manufacturing automation and supply chain modernization programs requiring advanced data capture capabilities. Government initiatives supporting automation adoption create opportunities for 2D scanning technology deployment in domestic facilities. E-commerce growth increases demand for warehouse automation requiring comprehensive 2D identification solutions supporting complex inventory management.

Market activity centers on technology transfer agreements bringing international automation standards to domestic manufacturing operations requiring advanced 2D scanning capabilities. Foreign investment in logistics infrastructure introduces sophisticated scanning requirements for competitive positioning. Skill development initiatives include training programs for automation technology operation and maintenance.

Market Intelligence Brief:

Demand for fixed 2D industrial barcode scanners in Germany maintains 4.9% CAGR market leadership through engineering excellence and Industry 4.0 implementation. The market demonstrates established industrial base with advanced automation capabilities supporting manufacturing competitiveness and export leadership. Technology innovation creates consistent demand for premium 2D scanning solutions across industrial applications.

Manufacturing automation excellence enables integration of advanced 2D scanning systems for production optimization and quality assurance requiring sophisticated data capture. Industry 4.0 leadership drives innovation in connected manufacturing requiring comprehensive 2D identification and tracking capabilities. Export competitiveness necessitates efficient automation solutions including 2D scanning technology for operational excellence.

Advanced manufacturing research initiatives develop new applications for 2D scanning technology in smart factory environments requiring complex data processing. Export market leadership necessitates technology certification supporting international manufacturing facility development. Industrial equipment supplier network requires consistent 2D scanning specifications for automation system integration.

Performance Metrics:

Brazil represents emerging market growth with a 4.5% CAGR through industrial modernization and logistics infrastructure expansion requiring advanced 2D scanning solutions. The market reflects increasing automation adoption and manufacturing capability enhancement supporting economic development objectives. Government industrial initiatives create demand for automated 2D identification solutions across manufacturing and logistics applications.

Manufacturing sector expansion drives primary market demand through automation deployment and production efficiency improvement programs requiring sophisticated data capture. Logistics infrastructure development creates opportunities for 2D scanning technology applications in distribution and transportation operations. Agricultural export processing increases demand for traceability solutions requiring comprehensive 2D identification systems.

Market development challenges include economic volatility affecting automation investment and import cost fluctuations impacting technology pricing. Infrastructure development projects support industrial modernization requiring reliable automation solution supply chains including 2D scanning systems.

Strategic Market Considerations:

United States market demonstrates steady growth with a CAGR of 4.1% through manufacturing renaissance and logistics modernization initiatives requiring advanced 2D scanning capabilities. The market reflects established industrial base with ongoing automation integration requiring sophisticated scanning solutions. Innovation leadership creates demand for premium 2D identification technology supporting competitive manufacturing and distribution operations.

E-commerce fulfillment expansion requires specialized 2D scanning solutions for high-volume package processing and distribution optimization supporting complex data requirements. Manufacturing reshoring initiatives create opportunities for 2D scanning technology applications in domestic production facilities. Supply chain resilience programs drive adoption of comprehensive 2D identification systems for risk management and operational visibility.

Innovation initiatives encourage advanced 2D scanning technology development utilizing artificial intelligence and machine learning capabilities. Regulatory compliance emphasis ensures scanning system quality and performance standards supporting pharmaceutical serialization and food safety requirements. Technology leadership drives global automation standard development and 2D scanning technology advancement.

Market Development Indicators:

United Kingdom demonstrates market stability through logistics modernization and manufacturing automation advancement requiring sophisticated 2D scanning solutions. A 3.7% CAGR market value reflects established industrial base with technology integration emphasis and operational efficiency focus. Brexit considerations create opportunities for domestic logistics optimization requiring advanced 2D scanning solutions.

E-commerce fulfillment growth maintains demand for automated 2D scanning solutions in distribution centers and fulfillment facilities supporting complex inventory management. Manufacturing automation advancement creates opportunities for 2D scanning technology applications in production monitoring and quality control. Supply chain optimization requires comprehensive 2D identification systems for operational efficiency and customer service improvement.

Technology advancement emphasizes operational excellence requiring advanced 2D scanning solutions with integration capabilities and performance optimization. International trade facilitation creates opportunities for 2D scanning technology applications in customs processing and logistics management supporting complex data requirements.

Current Market Observations:

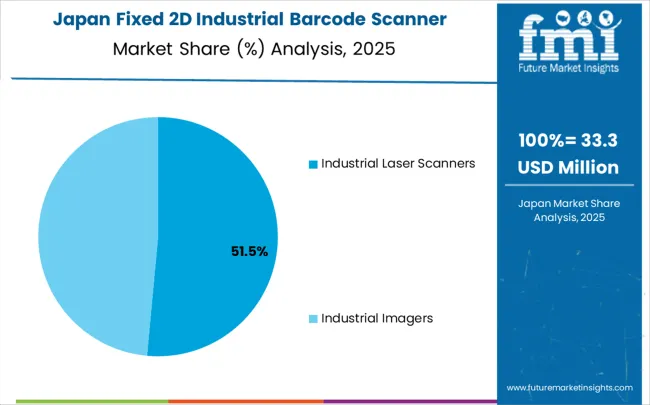

Japan maintains technological leadership through precision manufacturing with a 3.2% CAGR excellence and advanced automation development requiring sophisticated 2D scanning capabilities. The market value reflects mature industrial base with established automation practices and technology innovation focus. Innovation initiatives create demand for specialized 2D scanning solutions supporting advanced manufacturing applications.

Manufacturing automation leadership requires precision 2D scanning specifications for quality control and production optimization supporting complex data capture requirements. Technology innovation utilizes advanced 2D scanning systems for robotics integration and flexible manufacturing applications. Quality management system development influences global 2D scanning technology manufacturing practices.

Manufacturing technology expertise enables production of specialized 2D scanning solutions meeting stringent performance requirements. Research and development initiatives advance 2D scanning technology integration and automation capabilities. Industrial equipment excellence creates opportunities for precision 2D scanning applications with integrated manufacturing systems.

Market Status Indicators:

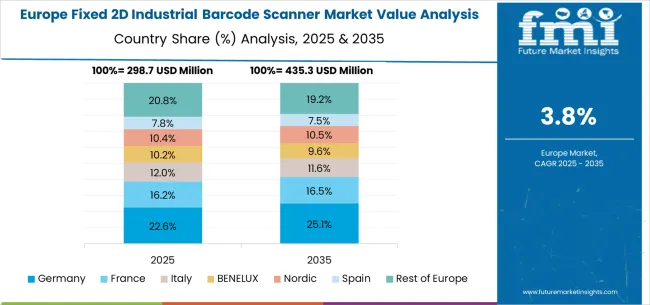

The European fixed 2D industrial barcode scanner market totaled USD 458.7 million in 2025, representing 39.5% of global market share. Germany dominates with 32.1% European market share, leading through industrial automation excellence and Industry 4.0 implementation capabilities. France contributes USD 106.3 million in manufacturing automation development, emphasizing automotive and aerospace applications. The UK market valued at USD 84.6 million shows 3.7% CAGR growth driven by logistics modernization programs. Italy holds USD 73.8 million with manufacturing automation specialization. Netherlands demonstrates USD 53.7 million with logistics hub excellence. Spain projects 4.1% CAGR through industrial modernization programs. Nordic countries show USD 59.8 million with technology innovation focus. Market integration enables cross-border automation standard harmonization with 88-92% integrated 2D scanning system adoption in established manufacturing facilities.

Germany's industrial automation excellence drives laser scanner dominance through manufacturing efficiency requirements and proven performance optimization supporting advanced 2D data capture. The 52.7% market share reflects German engineering principles emphasizing reliability and cost-effectiveness for high-volume 2D applications. Manufacturing facilities utilize laser scanning systems for proven performance in automotive production and industrial automation requiring consistent 2D code reading operation.

Industry 4.0 implementation creates demand for laser-based 2D scanning systems accommodating smart manufacturing integration and complex data collection requirements. Export manufacturing produces precision automation solutions for global markets requiring certified performance standards supporting sophisticated 2D applications. Engineering services sector benefits from laser scanner reliability enabling comprehensive production monitoring and quality assurance capabilities with 2D data capture.

Secondary segments including industrial imagers maintain 47.3% share through applications requiring advanced functionality including image processing and complex 2D code reading capabilities. Specialized applications utilize imaging solutions for quality inspection and advanced identification requirements supporting sophisticated data analysis. Premium manufacturing segments select imaging technology for enhanced flexibility and future-proofing capabilities with advanced 2D processing.

Market Characteristics:

France's logistics sector demonstrates application leadership through integrated distribution networks and e-commerce fulfillment operations supporting comprehensive 2D scanning technology requirements. Service provider landscape includes comprehensive automation solutions addressing warehouse management, sorting systems, and distribution optimization needs across logistics operations requiring sophisticated 2D data capture. Market share distribution reflects established relationships between 2D scanning technology suppliers and major logistics facility developers.

E-commerce fulfillment facility concentration creates demand for specialized 2D scanning applications including package sorting, inventory management, and shipping verification programs requiring complex data processing. Manufacturing logistics requires comprehensive 2D scanning support for materials management and production supply chain optimization supporting advanced traceability. International distribution operations create technical support opportunities for global logistics facility development and system integration with 2D capabilities.

Provider evolution trends indicate movement toward comprehensive solution offerings beyond traditional 2D scanning technology supply. Service integration includes system design support, installation management, and performance optimization programs supporting advanced 2D applications. Technology advancement requires continuous technical support and specialized application development for competitive logistics positioning with sophisticated data capture.

Channel Insights:

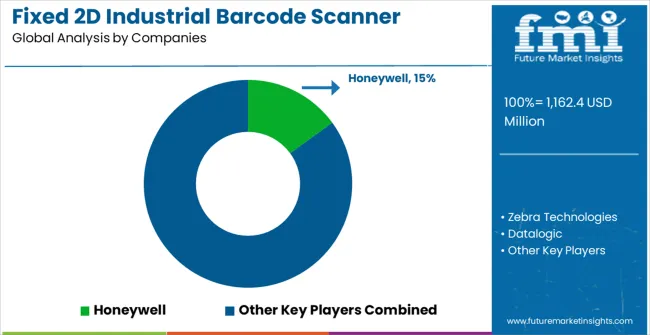

Market structure reflects moderate concentration with established automation technology companies maintaining significant market positions while regional suppliers serve specialized segments. Competition style emphasizes product performance differentiation, integration capability development, and technical service excellence supporting advanced 2D applications. Industry dynamics favor companies combining manufacturing expertise with comprehensive system integration support offerings.

Tier 1 - Global Market Leaders: Honeywell, Zebra Technologies, and similar multinational automation companies dominate through comprehensive 2D scanning portfolios, global service networks, and integration expertise capabilities. Competitive advantages include research and development resources, established customer relationships, and manufacturing scale economies. Market positions reflect brand recognition and reliability reputation across diverse industrial and logistics applications requiring sophisticated 2D scanning.

Tier 2 - Specialized Technology Providers: Companies like Datalogic, Omron, and Cognex focus on specific application segments or regional markets through specialized 2D scanning product offerings. Competitive advantages include application expertise, technical service flexibility, and local market knowledge supporting advanced 2D implementations. Market positioning emphasizes technical specialization and customer relationship development with sophisticated data capture solutions.

Tier 3 - Regional and Application Specialists: Smaller companies including Newland, Denso Wave, and regional suppliers serve local markets and specialized 2D scanning applications. Competitive advantages include cost competitiveness, local service capabilities, and customization flexibility supporting niche 2D requirements. Market participation focuses on price-sensitive segments and specialized performance requirements with tailored 2D solutions.

The fixed 2D industrial barcode scanner market is central to supply chain digitization, manufacturing automation, regulatory compliance, and operational efficiency. With Industry 4.0 acceleration, traceability mandates, and e-commerce growth, the sector faces pressure to balance performance capabilities, integration complexity, and cost optimization. Coordinated action from governments, industry bodies, technology manufacturers, suppliers, and investors is essential to transition toward intelligent, connected, and application-optimized 2D scanning systems.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 1162.4 million |

| Product Type | Industrial Laser Scanners, Industrial Imagers |

| Application | Logistics Warehousing, Automobile Manufacturing, Electronic Manufacturing, Food Production |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Honeywell, Zebra Technologies, Datalogic, Omron, IDEC, Cognex, SICK, Newland, Denso Wave, Cobalt Systems |

| Additional Attributes | Dollar sales by product categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with player descriptions, adoption patterns across industries, integration with automation systems, innovations in 2D scanning technology and connectivity, development of specialized applications with enhanced performance capabilities |

The global fixed 2D industrial barcode scanner market is estimated to be valued at USD 1,162.4 million in 2025.

The market size for the fixed 2D industrial barcode scanner market is projected to reach USD 1,771.0 million by 2035.

The fixed 2D industrial barcode scanner market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in fixed 2D industrial barcode scanner market are industrial laser scanners and industrial imagers.

In terms of application, logistics warehousing segment to command 43.6% share in the fixed 2D industrial barcode scanner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

2D Bar Code Marketing Market Analysis by Technology, Code Types, Applications, and Region Through 2035

2D Electronics Market

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA