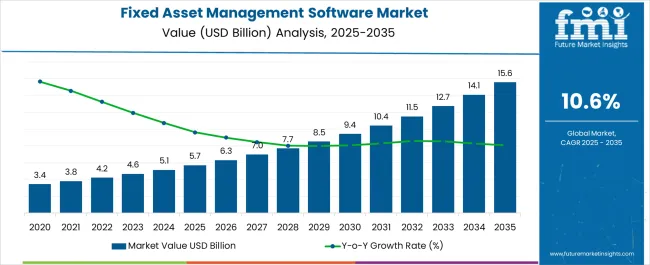

The Fixed Asset Management Software Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

| Metric | Value |

|---|---|

| Fixed Asset Management Software Market Estimated Value in (2025 E) | USD 5.7 billion |

| Fixed Asset Management Software Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The fixed asset management software market is undergoing accelerated adoption, driven by increasing digitization of enterprise operations, the need for real-time asset visibility, and compliance with financial reporting standards. Organizations are increasingly prioritizing software platforms that enable accurate asset tracking, depreciation calculation, lifecycle management, and audit preparedness.

With growing pressure to optimize capital expenditure and ensure data transparency, businesses are investing in centralized asset systems that integrate with ERP and IoT platforms. The shift toward digital-first infrastructure, especially post-pandemic, has amplified demand for scalable, cloud-based asset management solutions.

Additionally, regulatory mandates around asset audit trails, ESG disclosures, and tax accountability have reinforced the role of specialized asset tracking tools. The market is expected to grow further with advancements in AI-driven predictive maintenance, RFID-enabled tracking, and mobile asset scanning technologies.

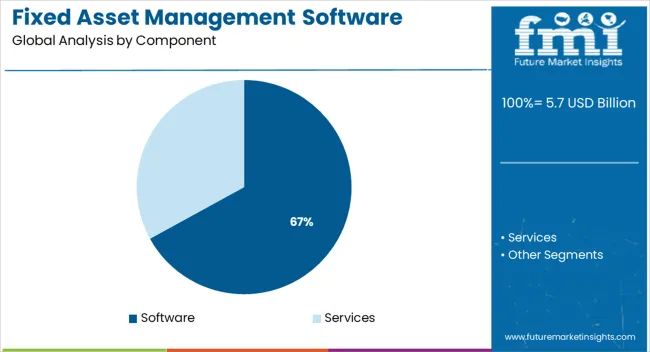

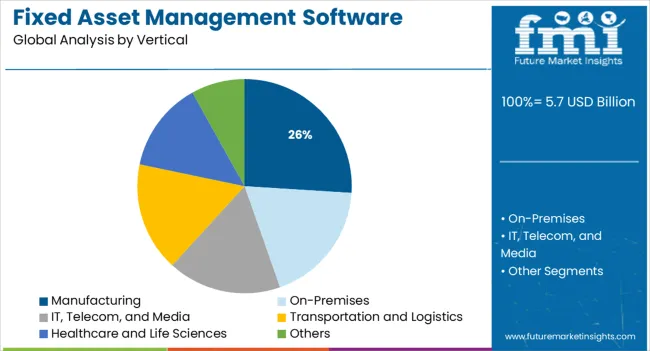

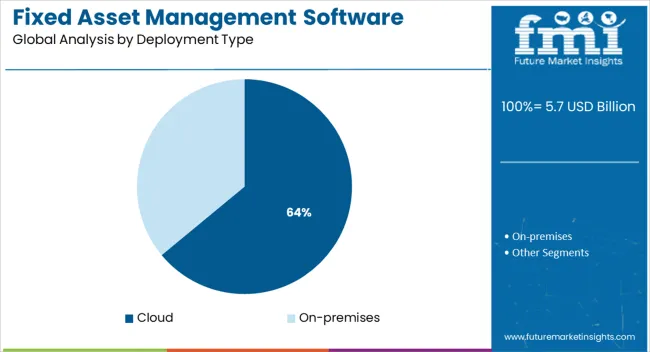

The market is segmented by Component, Vertical, Deployment Type, and Organization Size and region. By Component, the market is divided into Software and Services. In terms of Vertical, the market is classified into Manufacturing, On-Premises, IT, Telecom, and Media, Transportation and Logistics, Healthcare and Life Sciences, and Others. Based on Deployment Type, the market is segmented into Cloud and On-premises. By Organization Size, the market is divided into Large Enterprises and Small and Medium-Sized Enterprises. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to lead with a 67.0% revenue share in the fixed asset management software market by 2025. This leadership is attributed to the rising need for configurable, multi-asset tracking platforms that support real-time reporting, integration with accounting tools, and automated compliance features.

Software solutions offer robust functionality including depreciation scheduling, barcode/RFID scanning, and location-based tracking—all critical to managing large-scale asset portfolios. The transition from spreadsheets and manual systems toward centralized software platforms is being accelerated by demands for audit readiness, tax accuracy, and lifecycle optimization.

As businesses scale across geographies and asset types, software is seen as the foundational layer to ensure operational continuity and cost accountability, especially in industries with high capital intensity.

The manufacturing segment is forecast to contribute 26.0% of the market revenue in 2025, making it the leading vertical for fixed asset management software adoption. This dominance is being driven by the capital-intensive nature of manufacturing operations, where asset tracking, maintenance, and compliance are central to productivity and regulatory performance.

Fixed assets such as machinery, production lines, and facility infrastructure require constant monitoring to avoid downtime and optimize utilization. Software platforms tailored for manufacturers enable preventive maintenance scheduling, real-time condition tracking, and accurate depreciation management.

Additionally, the need to comply with industry-specific standards, inventory audits, and government reporting has accelerated software implementation across the manufacturing landscape. The integration of asset management software with IoT and MES systems is further enhancing visibility, control, and decision-making efficiency.

Cloud deployment is expected to account for 64.0% of the total revenue in the fixed asset management software market by 2025, positioning it as the preferred deployment model. This shift is being driven by the need for scalability, accessibility, and cost-efficiency in software delivery across multi-location enterprises.

Cloud-based platforms enable real-time data synchronization, seamless software updates, and remote access to asset databases, which are critical for distributed workforces and expanding operations. Enhanced data security protocols, multi-tenant architecture, and integration with enterprise cloud ecosystems have made cloud models increasingly reliable.

The reduced upfront infrastructure costs and faster implementation timelines are further motivating organizations to move away from on-premise systems. As businesses prioritize agility and digital transformation, cloud-based fixed asset management is poised to become the standard across verticals.

According to the report, North America is expected to lead the market over the forecast period. The region's growth may be ascribed to the region's strong presence in the industrial and transportation sectors, as well as the region's rising embrace of technological innovations.

Among all, the United States is expected to have the largest market share throughout the projection period. During the projection period, the country is predicted to earn USD 4 billion while growing at a 10.4% CAGR. Government actions and regulations in a variety of end-user sectors are expected to significantly enhance the market.

For example, the Federal Highway Administration (FHWA), the American Association of State Highway and Transportation Officials (AASHTO), and state and local transportation departments (DOTs) have all made efforts to encourage the use of asset management software in the transportation and logistics sectors.

The country has a strong position in terms of technology adoption in every end-use industry, including automotive, manufacturing, IT & telecom, and others. This is likely to provide different chances for the United States to expand its worldwide market reach.

Fixed asset management software enables firms in the manufacturing industry to optimize maintenance operations, prolong asset longevity, and boost production. The industrial industry is in desperate need of centralized software to handle its vast array of assets.

The data acquired by asset performance software aids in predicting the exact breakdown point of a vital asset, enhancing uptime.

Fixed asset management software also aids industrial enterprises in the administration of maintenance, spare parts, and inventories. It helps manufacturers to maximize asset control, performance, and warranty return by properly managing inspections and audits. Furthermore, fixed asset management software assists industrial companies in improving their plant and machinery maintenance operations.

Increasing adoption of IoT-based services across several industries like Oil & Gas, Manufacturing, Energy, Power, and Construction is projected to play a salient role in driving the market in the assessment period.

The emergence of Industry 4.0 in the Manufacturing Sector to Fuel the Market in the Forecast Period

With the emergence of Industry 4.0 in the manufacturing sector, several plants have adopted digital technologies to improve, enhance, and smoothen the manufacturing process while optimizing the management of fixed assets.

The software allows the manufacturers to predict the manufacturing costs, thereby, aiding them to prepare a cost-efficient budget.

Besides, technologies like Industrial IoT offers various benefits such as real-time alters and asset tracking solutions, which assist in managing fixed assets efficiently.

In addition, technological development across various sectors such as cloud computing, artificial intelligence, machine learning, and others are projected to boost the adoption of fixed asset management software since these technologies offer scalability, agility, and efficiency to the business.

Therefore, solution providers are introducing technologically developed solutions to procure maximum gains.

For instance, in September 2020, Adapt IT announced a partnership with i-Chain, a South Africa-based fixed asset management services, and solutions company to offer a Web-based system providing easy access to a cloud-based environment, particularly designed for educational institutions to assist them to manage their assets.

Lack of awareness of fixed asset management software is expected to hinder the market in the forecast period. Also, the reluctance of SMEs to adopt fixed asset management software is due to financial restrictions.

SMEs generally have lower capital expenditure, which does not allow them to procure expensive software. Moreover, the growing cost associated with the maintenance of the on-premises infrastructure is another factor impeding the market during the forecast period.

The advent of big data and analytics will grow the adoption of fixed asset management software and is expected to create opportunities for expansion in the forecast period. Also, rising initiatives by players are projected to augment the opportunities in the market.

For instance, Comparesoft, an AI-Driven Software Recommender, announced the renewal of its partnership with FMIS, which offers asset management solutions in a broad range of industries, comprising health, manufacturing, public sector, education, and non-profile sectors. This is expected to offer various opportunities for expansion by helping them engage with businesses.

Based on deployment type, the global fixed asset management software market can be segmented into cloud and on-premises. According to the analysis, the on-premises segment is anticipated to secure a larger market share while exhibiting a 10.2% CAGR in the forecast period.

Based on components, the global fixed asset management software market can be segmented into services and software.

Based on organization size, the global fixed asset management software market can be segmented into SMEs and large enterprises.

Based on vertical, the global fixed asset management software market can be segmented into IT, telecom and media, energy and utilities, manufacturing, transportation & logistics, healthcare, and life sciences, and others.

According to the analysis, the manufacturing segment is anticipated to garner maximum traction during the forecast period. The segment is likely to expand at a CAGR of 10.4%.

The on-premises segment is anticipated to dominate the market with a growth rate of 10.2% during the forecast period. An on-premises deployment type is a conventional approach to implementing solutions at the premises of an organization.

Currently, the approach is being followed in organizations where security is the vital pillar of business operations since it is considered a safer option against the cloud-deployment type.

Aerospace & defense, healthcare, and the BFSI sector are projected to be significant consumers of on-premises fixed asset management software deployment since they deal with sensitive data such as finance, national security, and healthcare.

On the other hand, the manufacturing segment is anticipated to garner maximum traction in the forecast period. The manufacturing sector is projected to be a lucrative segment and has a massive demand for centralized software to manage its assets. The Fixed asset management software aids manufacturing organizations to improve their plant and machinery maintenance processes.

As per the analysis, North America is anticipated to lead the market in the forecast period. The development of the region can be attributed to the robust presence of manufacturing and transportation sectors and the increasing adoption of technological advancements in the region.

Among all, the USA is anticipated to secure the maximum market share during the forecast period. The country is expected to garner USD 4 Billion while exhibiting a 10.4% CAGR in the forecast period.

Government initiatives and regulations in several end-user sectors are projected to provide a significant boost to the market.

For instance, the Federal Highway Association (FHWA), the American Association of State Highway and Transportation Officials (AASHTO), and State and local departments of transportation (DOTs) have taken various efforts to motivate the usage of asset management software in the transportation and logistics sector.

In addition, the country also possesses a dominant position with respect to technology adoption in every end-use sector such as automotive, manufacturing, IT & telecom, and others. This is expected to offer various opportunities to the USA to augment its reach in the global market competition.

Europe is projected to be another lucrative market in the assessment period. The United Kingdom is expected to garner USD 478 Million, witnessing a 9.6% CAGR in the forecast period. Increasing demand to lessen operational costs and the penetration of IoT technology are some of the vital factors augmenting the industry in the forecast period.

As per the analysis, Asia Pacific is the fastest-growing market during the forecast period. Among all, China, Japan, and South Korea are projected to be the most lucrative market in the region. China is anticipated to garner USD 794.4 Million, recording a CAGR of 9.9% during the forecast period.

The contribution of China can be attributed to the high number of SMEs which are expected to boost the demand for cloud-based fixed asset management software since they are cost-effective. Also, organizations in the country are leveraging fixed asset management software to manage their assets efficiently.

Japan and South Korea are estimated at USD 940 Million and 397 Million respectively. The growth rate of Japan and South Korea is estimated at 8.9% and 8.1% sequentially.

| Countries | Estimated CAGR |

|---|---|

| USA | 10.4% |

| United Kingdom | 9.6% |

| China | 9.9% |

| Japan | 8.9% |

| South Korea | 8.1% |

Key players in the global fixed asset management software market include IBM, Infor, SAP, Microsoft, and Oracle, among others.

Recent key developments among players are:

The global fixed asset management software market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the fixed asset management software market is projected to reach USD 15.6 billion by 2035.

The fixed asset management software market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in fixed asset management software market are software, services, _consulting and implementation and _training and support.

In terms of vertical, manufacturing segment to command 26.0% share in the fixed asset management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fixed Length Seals Market Size and Share Forecast Outlook 2025 to 2035

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cycle Regulator Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Fixed Wireless Access Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Fixed Series Compensation Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Fixed Cutter Bits Market

5G Fixed Wireless Access Market

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA