The hardware asset management industry in North America is experiencing strong growth driven by the expansion of digital infrastructure, increasing IT spending, and the growing importance of asset lifecycle optimization. Organizations are focusing on managing hardware assets more efficiently to enhance productivity, reduce operational costs, and ensure compliance with data security regulations.

The integration of automation, cloud-based tracking, and analytics tools is transforming traditional asset management processes, enabling real-time visibility and predictive maintenance. Enterprises across sectors such as BFSI, IT, healthcare, and manufacturing are adopting hardware asset management solutions to address challenges related to equipment tracking and depreciation management.

The future outlook remains positive, supported by growing demand for centralized asset control and sustainability initiatives promoting hardware recycling and reuse The market’s growth rationale is reinforced by rising remote work adoption, hybrid IT infrastructure expansion, and the need for enhanced governance frameworks, positioning North America as a leading region for technological and operational maturity in asset management practices.

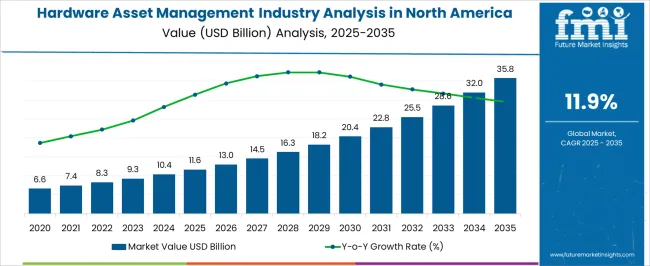

| Metric | Value |

|---|---|

| Hardware Asset Management Industry Analysis in North America Estimated Value in (2025 E) | USD 11.6 billion |

| Hardware Asset Management Industry Analysis in North America Forecast Value in (2035 F) | USD 35.8 billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

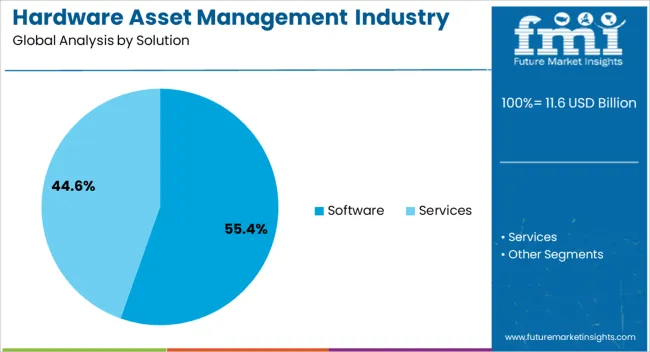

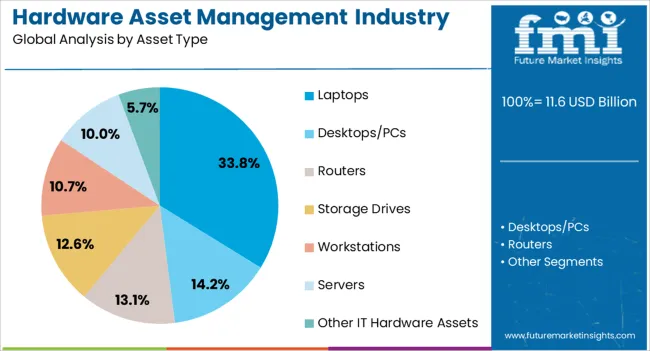

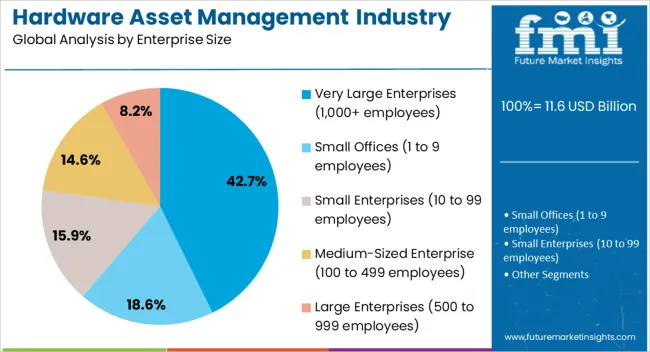

The market is segmented by Solution, Asset Type, Enterprise Size, and Industry and region. By Solution, the market is divided into Software and Services. In terms of Asset Type, the market is classified into Laptops, Desktops/PCs, Routers, Storage Drives, Workstations, Servers, and Other IT Hardware Assets. Based on Enterprise Size, the market is segmented into Very Large Enterprises (1,000+ employees), Small Offices (1 to 9 employees), Small Enterprises (10 to 99 employees), Medium-Sized Enterprise (100 to 499 employees), and Large Enterprises (500 to 999 employees). By Industry, the market is divided into Services, Finance, Manufacturing & Resources, Distribution Services, Public Sector, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment, accounting for 55.40% of the solution category, has emerged as the leading offering due to its critical role in automating inventory tracking, maintenance scheduling, and compliance reporting. Its adoption has been strengthened by the growing need for centralized data management and real-time visibility into asset performance.

Enterprises are increasingly integrating AI-driven and cloud-based software platforms to enhance operational efficiency and minimize downtime. The segment’s growth has also been supported by regulatory requirements for asset transparency and the rising trend of digital transformation across large organizations.

Continuous software innovation, including predictive analytics and automated audit functions, is expected to further optimize asset utilization and cost control This has positioned software solutions as the cornerstone of hardware asset management strategies across North American enterprises.

The laptops segment, holding 33.80% of the asset type category, dominates due to the widespread use of portable computing devices across corporate, educational, and government sectors. The surge in remote and hybrid work models has accelerated demand for efficient tracking, lifecycle management, and security of laptop assets.

Organizations are increasingly focusing on software-driven monitoring systems that provide visibility into hardware usage, maintenance needs, and end-of-life processes. Asset tagging, device health analytics, and compliance management have become key functionalities driving segment expansion.

Additionally, procurement optimization and device recycling initiatives are contributing to sustainable asset strategies As device fleets continue to grow in number and complexity, demand for efficient laptop management systems is expected to remain robust, supporting long-term growth within this segment.

The very large enterprises segment, representing 42.70% of the enterprise size category, leads the market owing to their extensive IT infrastructure and the critical need for managing thousands of interconnected hardware devices across multiple locations. These organizations prioritize advanced asset management platforms capable of integrating with enterprise resource planning (ERP) and IT service management (ITSM) systems.

The scale and complexity of operations have driven higher adoption of automation, data analytics, and artificial intelligence in hardware asset management frameworks. Regulatory compliance, cybersecurity, and cost optimization remain key decision factors influencing deployment.

Continuous investment in modernization and standardization initiatives across global facilities has further solidified the dominance of this segment Ongoing digital transformation and cloud migration strategies are expected to sustain its leadership position and drive continued growth across the North American hardware asset management industry.

The hardware asset management industry in North America experienced a CAGR of 8.5% from 2020 to 2025. It attained a total valuation of USD 9,356.03 million at the end of 2025.

Over the forecast period, the North America hardware asset management industry is expected to thrive at a CAGR of 11.9%. It will likely reach a valuation of USD 10,380.23 million. Continued digitization of businesses, advancements in IoT and AI technologies, and an increasing focus on data security and compliance are key factors expected to boost the target industry.

Semi-annual Update

| Particular | Value CAGR |

|---|---|

| H1 | 11.7% (2025 to 2035) |

| H2 | 12.0% (2025 to 2035) |

| H1 | 11.8% (2025 to 2035) |

| H2 | 12.2% (2025 to 2035) |

The table section highlights growth projections in leading North America’s countries. The United States is expected to retain its dominance during the assessment period, while Mexico will likely register faster growth.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 11.1% |

| Mexico | 14.8% |

| Canada | 14.1% |

The United States hardware asset management industry is expected to rise at 11.1% CAGR during the forecast period, reaching a valuation of about USD 23,277.70 million by 2035. This can be attributed to factors like:

The United States’ robust industrial infrastructure provides fertile ground for the development and deployment of sophisticated hardware asset management tools. These solutions help industries such as finance, healthcare, manufacturing, and technology to manage hardware assets efficiently and effectively.

Rising need for complying with regulations like HIPAA and GDPR is prompting industries across the United States to employ hardware assessment management solutions. This will likely boost growth of the hardware assessment management industry in the United States through 2035.

High adoption of cloud computing in the United States is leading to a surge in the number of IT assets that businesses need to manage. This is expected to drive demand for efficient and scalable hardware management solutions during the forecast period.

Industries in the United States demand versatile and scalable hardware asset management solutions. As a result, top companies in the nation are constantly innovating to offer novel solutions. This will likely improve the United States hardware asset management industry share.

The hardware asset management industry size in Mexico is expected to reach USD 3,270.25 million in 2035. Overall demand for hardware asset management solutions in Mexico will likely rise at an impressive CAGR of 14.8% during the forecast period. This is due to factors like:

As businesses in Mexico recognize the need to track and manage hardware assets, the demand for advanced asset management solutions increases. This increase in demand can be attributed to the growing understanding that effective asset tracking not only increases operational efficiency but also contributes to cost efficiency and safety.

Hardware asset management solutions help businesses across Mexico optimize hardware utilization, extend the life of assets, and reduce downtime. This will continue to propel their demand amid rising emphasis on cost reduction and enhanced efficiency.

The section below shows the software segment dominating the hardware asset management industry across North America. It is set to expand at 10.3% CAGR through 2035. Based on enterprise size, the medium-sized enterprise segment is estimated to progress at a CAGR of 14.7%. By industry, the finance segment will likely exhibit a higher CAGR of 15.1% over the forecast period.

Growth Outlook by Solution

| Solution | Value CAGR |

|---|---|

| Software | 10.3% |

| Services | 13.6% |

Based on solution, the software segment is set to dominate the North America industry, holding a share of 55.4% in 2025. This is attributable to increasing reliance on software-based solutions for efficient tracking, monitoring, and management of hardware assets.

Demand for hardware asset management software is anticipated to increase at a CAGR of 10.3% during the assessment period. It will likely total USD 5,750.81 million by the end of 2025.

On the other hand, the hardware asset management services segment is expected to expand at a robust CAGR of 13.6% through 2035. This is due to rising demand for managed services and evolving industry requirements.

Growth Outlook by Enterprise Size

| Enterprise Size | Value CAGR |

|---|---|

| Small Offices (1 to 9 employees) | 9.3% |

| Small Enterprises (10 to 99 employees) | 13.0% |

| Medium-sized Enterprise (100 to 499 employees) | 14.7% |

| Large Enterprises (500 to 999 employees) | 11.3% |

| Very Large Enterprises (1,000+ employees) | 10.5% |

As per the latest analysis, the medium-sized enterprise (100 to 499 employees) segment is projected to grow at a CAGR of 14.7% during the forecast period. This is due to increasing adoption of advanced asset management solutions by medium-sized enterprises.

Growth Outlook by Industry

| Industry | Value CAGR |

|---|---|

| Finance | 15.1% |

| Manufacturing & Resources | 11.3% |

| Distribution Services | 8.1% |

| Services | 14.0% |

| Public Sector | 5.2% |

| Infrastructure | 6.6% |

As per the latest report, the finance industry will likely emerge as the leading end-use industry for hardware asset management solutions, exhibiting a CAGR of 15.1%. This is because financial institutions in North America prioritize advanced asset-tracking tools for operational resilience, security, and compliance in a digital landscape.

Key players are focusing on providing tailored hardware asset management solutions to meet the specific needs of their clients.

Key Strategies Adopted by the Players

Product Innovation

Key players are investing in research and development to create cutting-edge hardware asset management solutions that offer improved efficiency, security, and scalability. They are continuously launching new software and services to meet the evolving needs of businesses in North America, incorporating technologies like AI, cloud integration and sustainable energy solutions.

Mergers and Acquisitions

Several hardware asset management providers adopt strategies like mergers and acquisitions to expand their customer bases.

Key Developments in the North America Hardware Asset Management Industry

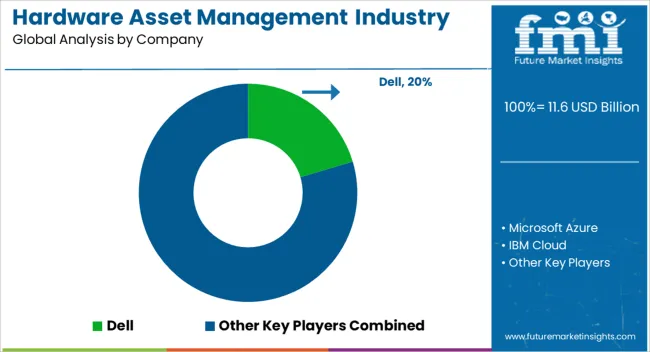

The global hardware asset management industry analysis in north america is estimated to be valued at USD 11.6 billion in 2025.

The market size for the hardware asset management industry analysis in north america is projected to reach USD 35.8 billion by 2035.

The hardware asset management industry analysis in north america is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in hardware asset management industry analysis in north america are software, _standalone hardware asset management software, _integrated hardware asset management software, services, _asset maintenance & repair services, _asset tracking & monitoring, _consulting services and _managed services.

In terms of asset type, laptops segment to command 33.8% share in the hardware asset management industry analysis in north america in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Snowplow Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Toilet Seat Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

North America Booklet Label Market Growth – Trends & Forecast 2023-2033

Injectable Drug Industry Analysis in North America Forecast Outlook 2025 to 2035

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Walk-In Cooler and Freezer Market Growth – Trends & Forecast 2024-2034

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA