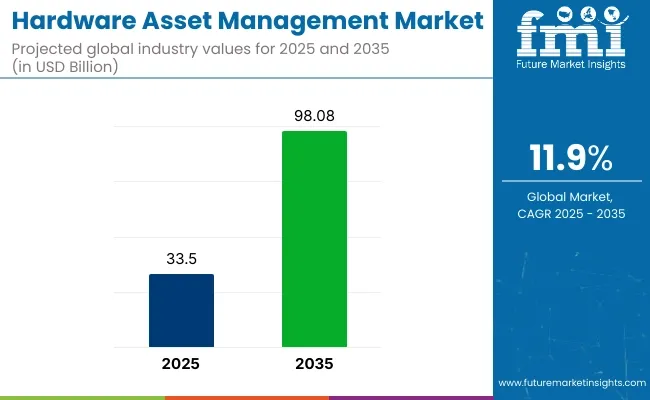

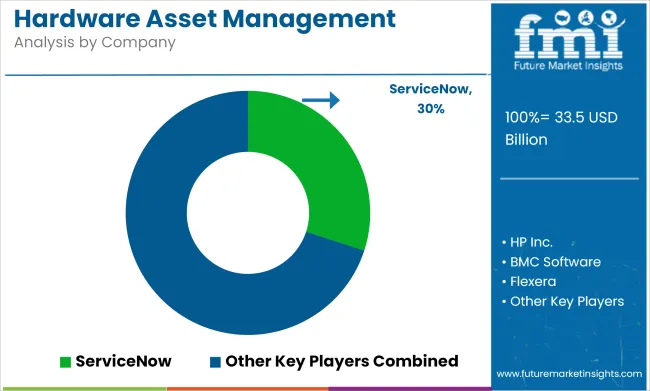

The global hardware asset management market is projected to grow from USD 33.50 billion in 2025 to USD 98.08 billion by 2035, reflecting a compound annual growth rate (CAGR) of 11.9% during the forecast period.

The increasing complexity of IT infrastructures and the rising need for organizations to efficiently manage their hardware assets are driving this significant market expansion. Hardware asset management (HAM) solutions play a vital role in tracking, monitoring, and managing an organization’s hardware, ensuring both operational efficiency and compliance with industry regulations.

A key factor contributing to the growth of the hardware asset management market is the growing digital transformation across industries. As businesses continue to adopt advanced technologies, such as cloud computing, the Internet of Things (IoT), and artificial intelligence (AI), managing hardware assets becomes increasingly complex.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 33.50 Billion |

| Market Size in 2035 | USD 98.08 Billion |

| CAGR (2025 to 2035) | 11.9% |

Effective HAM solutions enable businesses to track their hardware lifecycle from procurement to disposal, optimizing their assets’ usage and improving cost efficiency. Furthermore, the rising focus on asset sustainability and regulatory compliance has fueled demand for automated and scalable HAM solutions that can ensure proper management of physical resources while adhering to environmental standards.

Recent developments in hardware asset management solutions have introduced automation and AI-powered systems that streamline asset tracking and reporting. These innovations provide businesses with real-time insights into their hardware usage, enabling them to make data-driven decisions and optimize asset allocation. Companies are also focusing on providing integrated HAM solutions that combine hardware management with software asset management, offering a comprehensive approach to managing IT assets.

On March 15, 2025, ServiceNow launched the Yokohama release of its Hardware Asset Management (HAM) solution, introducing several key features aimed at improving asset lifecycle management. A standout addition is the Asset Attestation functionality, which enables organizations to verify and validate asset information, ensuring data accuracy and compliance.

This release also includes predefined workflows aligned with industry best practices, streamlining processes and reducing manual tasks. These enhancements are designed to boost operational efficiency and enhance the user experience without the need for multiple tools. This was officially announced in the company's press release

With the rising need for digital transformation and efficient resource management, the hardware asset management market is poised for rapid growth, creating opportunities for businesses to adopt more advanced, scalable, and sustainable asset management solutions.

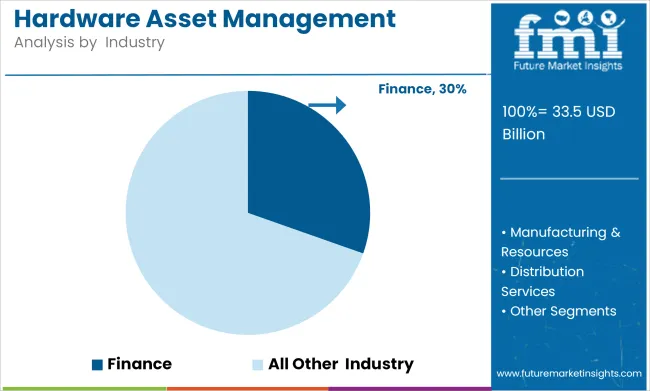

The global hardware asset management (HAM) market is projected to experience significant growth from 2025 to 2035. Key segments contributing to this expansion include services and the finance core segment. These segments are driven by the increasing need for efficient hardware tracking, lifecycle management, and cost control in organizations of all sizes.

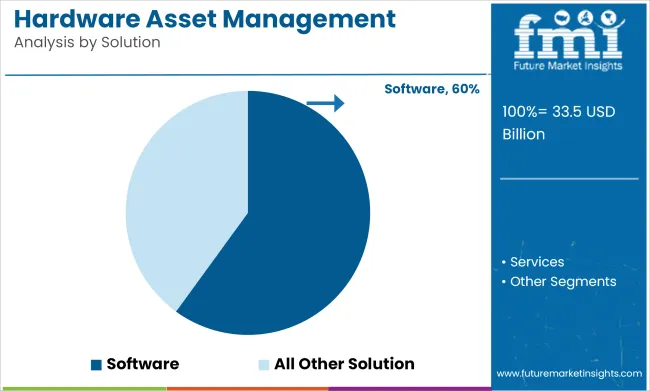

The services segment is expected to account for 40.0% of the hardware asset management market share in 2025. This segment’s growth is driven by the increasing need for comprehensive solutions that cover hardware asset tracking, maintenance, support, and optimization. Services in this segment include installation, consulting, managed services, and software support, all of which are crucial for organizations to effectively manage their hardware assets over the entire lifecycle.

As businesses face the challenge of managing complex IT environments with a vast range of devices and assets, the demand for specialized services is on the rise. Companies like IBM and Dell Technologies are offering end-to-end services that include asset tracking, lifecycle management, and strategic consulting, allowing businesses to optimize their hardware usage and reduce operational costs. Moreover, the shift towards remote work and digital transformation is increasing the demand for robust asset management services, further propelling this segment’s growth.

The finance core segment is projected to hold 30.4% of the market share in 2025. This segment is gaining momentum as organizations look for ways to efficiently track and manage their hardware assets while integrating financial considerations into the asset management process.

Effective management of hardware assets is crucial for minimizing depreciation costs, improving asset utilization, and ensuring accurate financial reporting. The finance core segment focuses on providing solutions that help businesses monitor the financial aspects of their hardware, including cost allocation, depreciation schedules, and budgeting.

Key players like ServiceNow and SAP are leading innovations in this segment by integrating financial data into their asset management platforms. This integration helps organizations align their hardware asset management practices with overall financial goals and improves decision-making regarding procurement, asset replacement, and disposal. Additionally, the increasing focus on compliance and cost optimization is driving businesses to adopt more sophisticated finance-centric asset management solutions, contributing to the segment’s expected growth.

| Company | ServiceNow |

|---|---|

| Contract/Development Details | Partnered with a multinational financial services firm to implement a comprehensive hardware asset management system, aiming to enhance asset tracking, compliance, and lifecycle management across global operations. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 35 |

| Renewal Period | 5 years |

| Company | IBM Corporation |

|---|---|

| Contract/Development Details | Secured a contract with a government agency to deploy an AI-driven hardware asset management solution, focusing on optimizing asset utilization, reducing operational costs, and ensuring regulatory compliance. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 7 years |

Growing regulatory compliance requirements for IT asset tracking

To enhance security, data protection, and compliance, governments are tightening rules for IT asset tracking across the world. Regulatory standards like GDPR in Europe, HIPAA in healthcare and NIST cybersecurity frameworks in the USA require organizations to keep accurate logs of their hardware assets.

Failure to comply can lead to significant fines and legal ramifications, prompting organizations to implement Hardware Asset Management (HAM) solutions for systematic tracking and reporting.

In 2024, the USA Department of Defense (DoD) declared the first formal guidelines for tracking cybersecurity assets - DoD contractors must document every IT hardware element they use in service of governmental assignments.

The policy requires a 100% compliance rate by 2025, establishing grounds for contractors to be rejected from federal contracts if they do not comply. According to official figures, already more than 70% of defense contractors have made progress in implementing advanced IT asset tracking solutions to meet these obligations.

Demand for cost optimization and efficient asset lifecycle management

To reduce IT spending and improve operational efficacy, organizations are focusing on cost optimization and effective asset lifecycle management. The lack of visibility and/or mismanagement of IT hardware typically translates into excessive procurement costs, security vulnerabilities, and protracted downtimes, further impairing business productivity. HAM can monitor asset performance, allowing the business to schedule proactive maintenance, increasing the equipment life-span and, therefore, lowering costs.

UK public sector IT spending wastes almost £1.5 billion every year as many IT assets are underused and have poor visibility of the inventory according to a recent government audit on information technology.

The UK government responded by requiring public institutions to implement centralized asset tracking systems to enhance accountability. Doing so is expected to cut IT wastage by 40% by 2026, according to government estimates.

Growing demand for HAM in hybrid and remote work environments

With the rise of hybrid and remote work, organizations need to go through hardware asset management solutions to keep tabs on IT assets sprinkled in outside the office. But where traditional offices can rely on locked file cabinets and secure buildings, remote work gains security and compliance from centralized visibility into laptops, desktops, routers, and other company-issued devices.

In response to this challenge, the USA federal government announced in 2023 that it was introducing an IT asset security initiative, requiring government agencies and contractors to implement remote HAM solutions by 2025. The initiative is designed to strengthen cybersecurity by ensuring that 100% of remote-access devices conformed with security policies.

According to government data, agencies that adopted automated asset tracking reported a 60 percent reduction in lost or unaccounted-for IT devices since implementation; a time-saver of 714 hours per agency per month; and the acceleration of asset provisioning time from six to eight weeks down to hours.

Changing compliance laws across different regions create complexity in HAM implementation

Use of Hardware Asset Management (HAM) solutions by organizations faces a challenge due to changing compliance laws over various regions. With new data security, IT asset tracking, and e-waste disposal regulations kick in from governments and regulatory bodies, it is essential that businesses continuously update their HAM framework to keep aligned with compliance norms.

As countries have different requirements for documentation, hardware asset disposal, or cybersecurity requirements, it is challenging for organizations to maintain a unified HAM (Hardware Asset Management) policy operating under various jurisdictions.

While some areas require companies to store extensive documentation on IT asset ownership and lifecycle management, others focus more on how securely data on decommissioned hardware is destroyed. Regulatory demands in this domain are pulling in opposite directions to both reporting and audit efforts, adding significant overhead to organizations, adapting to constant shifts in the rules of the game.

Moreover, multinational firms should keep in mind the local regulations and design their HAM strategies as per those laws, as it may be the case that the local regulation differs rendering it different from their local countries.

Tier 1 vendors are large corporations providing complete HAM solutions with worldwide reach. Most of these organizations offer a full range of services, including asset tracking, lifecycle management, compliance monitoring and integration capabilities with other enterprise systems.

They're solutions tend to be scalable for larger enterprise as well as small to medium sized companies. To consolidate, Tier 1 vendors are the main players of the HAM market segment owing to their vast reach and premium offerings which encourages new technology in this industry.

Tier 2 vendors are businesses that provide specialized HAM solutions, often targeting specific sectors or geographies. They do not have the wide global presence of Tier 1 vendors but are noted for their prowess in specific niches. These vendors offer customized services to meet specialized requirements of specific industries like healthcare, manufacturing or education.Understanding industry-specific requirements in-depth, they provide customized services that meet regulatory requirements and operational needs. These Tier 2 vendors filling in gaps that the broader solutions do not address enhance the HAM ecosystem and the vendors that comprise it.

Tier 3 vendors are new and regional companies with specialized HAM solutions for certain sections of the market. These vendors tend to specialize in specific functions or target small to medium-sized businesses with niche requirements.

Although Tier 3 vendors are not equipped like Tier 1 and Tier 2 vendors with a wide range of assets, but they play a vital role in the HAM Vendor Market diversity and offer innovative technologies for end users. They frequently bring forth innovative strategies and technologies, sparking competition and advancing the progress of asset management practices.

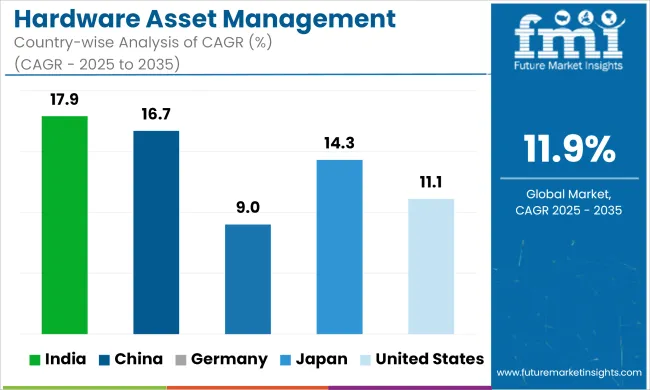

The section highlights the CAGRs of countries experiencing growth in the Hardware Asset Management market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 17.9% |

| China | 16.7% |

| Germany | 9.0% |

| Japan | 14.3% |

| United States | 11.1% |

China is aggressively adopting AI and IoT technologies, bringing real-time asset tracking into the IT landscape. To galvanize this effort, the Chinese state has placed technology development at the top of its agenda, with an explicit goal of moving toward “indigenous innovation” in AI and digital transformation. China's national plan for AI, running through 2025, calls for investment to prop up AI investment in research and development and also adoption in a wide range of industries.

Compared to IoT market in the rest of the world, IoT market in China is exploding due to smart city initiatives and automation in industrial processes. Such advancements in technology allows organizations to now deploy real-time asset tracking solutions, improving operational efficiency.

Machine learning algorithms are then incorporated into AI-based asset management systems in China to analyze huge data sets from the Internet of Things. These systems efficiently allocate resources, identify anomalies, and anticipate hardware failures before they happen.

More enterprises are embracing these technologies, resulting in the seamless, secure, and highly-efficient management of hardware assets. The government is also pushing for digitalization in different fields, which further expedites the use of AI-based asset tracking solution. China is anticipated to see substantial growth at a CAGR 16.7% from 2025 to 2035 in the Hardware Asset Management market.

The India government is also actively promoting of digitalization, increasing the adoption of Hardware Asset Management (HAM) solutions across enterprises. Government-backed initiatives like Digital India and targeted funding for smart cities have also played a role, which has helped to significantly increase IT infrastructure investment.

India is riding the IT hardware deployment wave powered by more than 500k digital service centers across rural and cities. As new devices devour great amounts of data quickly, businesses need asset management solutions to keep track of and manage these devices.

Production-Linked Incentive (PLI) schemes have also given a fillip to the country’s manufacturing sector, which has attracted billions of investments. With more electronics making inroad into local manufacturing, organizations have been needing strong HAM systems to help them manage inventory, track hardware lifecycles, and effectively manage their hardware environments.

Moreover, government initiatives to improve cybersecurity regulation are driving companies to implement HAM solutions integrated with compliance management capabilities. India's Hardware Asset Management market is growing at a CAGR of 17.9% during the forecast period.

With increasing cyber-threats for theUSA these days, Hardware Asset Management (HAM) solutions with strong security integrations are more in demand than ever. Federal agencies have issued several warnings about hardware vulnerabilities, including the need for complete asset tracking.

To prevent cyberattacks that compromise the hardware infrastructure, government bodies have set strict policies on IT asset management. Given that enterprises now administer hundreds of thousands of cyber assets like cloud hosts, networks and connected devices, the need for HAM solutions has surged.

Organizations are increasingly incorporating these as a part of a HAM solution integrated with a real-time security monitoring system in response to increasing cyber risks. Essential for securing hardware systems, these tools aid in detecting and addressing hardware vulnerabilities to prevent unauthorized access and data leaks. Sector specific, industries such as financial and healthcare are driving investments in HAM solutions to meet stringent cybersecurity regulations.

This combination of risk assessment ensures IT continue to be secure against such ongoing threats as a result of systematic assessment of the infrastructure and risk profiles. USA is anticipated to see substantial growth in the Hardware Asset Management market significantly holds dominant share of 78.6% in 2025.

The Hardware Asset Management market is highly competitive, as there is increasing demand for efficient asset tracking and compliance solutions. Artificial intelligence and its integration with your IT Service Management (ITSM) platform are the new competitive battleground for companies.

Service-oriented offerings, such as managed services and predictive maintenance, are gaining traction as a way to differentiate vendors from one another. Market participants are converging toward innovation and strategic alliances with other industry players and regulatory compliance to increase their customer base and improve the operational efficiency.

Recent Industry Developments in Hardware Asset Management Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 33.50 billion |

| Projected Market Size (2035) | USD 98.08 billion |

| CAGR (2025 to 2035) | 11.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Solutions Analyzed (Segment 1) | Software, Services |

| Asset Types Analyzed (Segment 2) | Desktops/PCs, Laptops, Routers, Storage Drives, Workstations, Servers, Other IT Hardware Assets |

| Industries Analyzed (Segment 3) | Finance, Manufacturing & Resources, Distribution Services, Service Industry, Public Sector, Infrastructure |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Hardware Asset Management Market | ServiceNow, IBM, HP Inc., BMC Software, Flexera, Ivanti, SAP, Microsoft, ManageEngine (Zoho Corp.), Snow Software |

| Additional Attributes | dollar sales, CAGR trends, solution type segmentation, asset type demand, industry-specific adoption, competitor dollar sales & market share, regional trends, regulatory impact |

In terms of solution, the segment is segregated into software and services.

In terms of Asset Type, the segment is segregated into Desktops/PCs, Laptops, Routers, Storage Drives, Workstations, Servers and Other IT Hardware Assets.

In terms of Industry, it is distributed into Finance, Manufacturing & Resources, Distribution Services, Service Industry, Public Sector, Infrastrcuture.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Hardware Asset Management industry is projected to witness CAGR of 11.9% between 2025 and 2035.

The Global Hardware Asset Management industry stood at USD 33.50 billion in 2025.

The Global Hardware Asset Management industry is anticipated to reach USD 98.08 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key players operating in the Global Hardware Asset Management Industry ServiceNow, IBM, HP Inc., BMC Software, Flexera, Ivanti, SAP, Microsoft, ManageEngine (Zoho Corp.), Snow Software.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Asset Management System Market

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Crypto Asset Management Market

Asset And Liability Management Solutions Market

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Asset Management Market

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Wireless Healthcare Asset Management Market Analysis by Region Through 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA