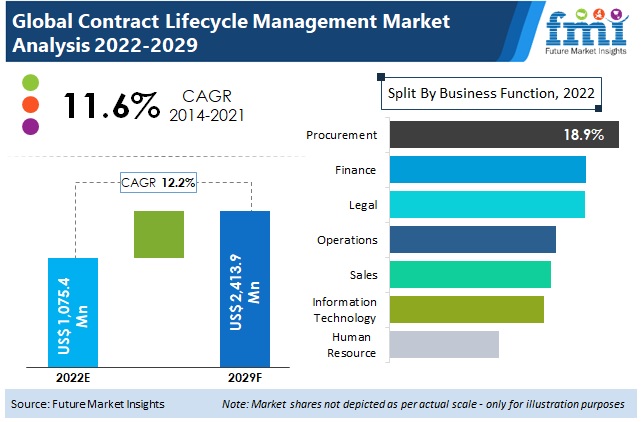

The global Contract Lifecycle Management market is projected to grow significantly, from USD 1,564.1 million in 2025 to USD 3,284.2 million by 2035, reflecting a strong CAGR of 12.0%.

Managing third-party risk effectively has led organizations to adopt various solution areas, including Contract Lifecycle Management (CLM). These solutions help businesses implement structured contract governance, ensuring that vendor agreements align with internal policies and industry regulations. Organizations can take a proactive approach to identifying, assessing, and mitigating potential contractual vulnerabilities by incorporating risk management in contract workflows.

The increasing complexity of regulatory frameworks (e.g., GDPR in Europe, CCPA in California) is driving demand for CLM solutions. Contracts must comply with existing regulations, and CLM platforms provide businesses with automated compliance management capabilities to simplify due diligence, auditing, and reporting. This minimizes the exposure to legal fines or penalties and creates contractual visibility.

As organizations accelerate their digital transformation, they increasingly rely on third-party vendors for cloud services, IT solutions, and outsourcing. With this reliance, adopting advanced contract lifecycle management (CLM) tools that automate contract negotiations, approval workflows, and vendor agreements becomes imperative. Such solutions enable businesses to mitigate financial and operational risks while maintaining agility in their vendor relationships.

With the growing cyber threat landscape, organizations are also being pushed to deploy CLM solutions that integrate risk assessment and offer real-time monitoring capabilities. However, working with external vendors could expose an organization's security vulnerabilities, and without proper oversight, businesses are at risk of data breaches, fraud, or non-compliance. CLM software allows contracts to be executed safely and provides insight into potential vendor risks.

North America is projected to hold the largest share of the CLM market, driven by stringent regulatory requirements and the concentration of leading software vendors providing automation contract solutions.

On the other hand, the growing adoption of CLM in emerging economies, such as India and Australia, is being fueled by the development of business ecosystems and stronger regulatory oversight. As organizations scale, they require scalable Contract Lifecycle Management (CLM) solutions that enable them to accelerate contract processes and enhance risk management strategies.

| Company | Icertis |

|---|---|

| Contract/Development Details | Entered into an agreement with a global pharmaceutical company to deploy a comprehensive CLM solution, streamlining contract management processes and ensuring compliance with industry regulations. |

| Date | June 2024 |

| Contract Value (USD Million) | Approximately USD 12 |

| Renewal Period | 6 years |

| Company | DocuSign |

|---|---|

| Contract/Development Details | Partnered with a multinational retail corporation to integrate CLM software, aiming to enhance contract efficiency and reduce operational risks across its supply chain. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 15 |

| Renewal Period | 5 years |

Increasing global regulations like GDPR and CCPA drive CLM adoption

Data protection regulations, including GDPR (in Europe) and CCPA (in the USA), have been a major driver of the adoption of Contract Lifecycle Management (CLM) solutions. With their new rules, these regulations often require much stronger data handling and privacy protocols, forcing organizations to reevaluate and improve their contract management processes to ensure compliance.

Failure to comply can lead to serious consequences, such as heavy fines and reputational harm. For example, they may be subject to fines of up to USD 20 million or 4% of their annual global turnover (based on the previous year), whichever is higher, under the GDPR. The CCPA, too, limits minimum damages to USD 7,500 for each deliberate violation.

As a result, companies are finding themselves with the need for comprehensive CLM systems that leverage automation to help track contractually obligated obligations and, more importantly, ensure compliance.

Such systems ensure that organizations can keep detailed records, manage workflow contracts, and ensure that all activity relating to contracts remains compliant with the ever-evolving regulatory landscape. As a result, the requirement to follow stringent data-protection laws has been a key factor in the rapid adoption of CLM solutions across multiple industries.

Increasing shift towards SaaS-based contract management

The business landscape is changing with the adoption of Software-as-a-Service (SaaS)-based contract management solutions, as organizations prioritize the flexibility, scalability, and cost-effectiveness of SaaS solutions. Cloud-based SaaS CLM platforms enable seamless collaboration among stakeholders, regardless of their location, allowing organizations to access them.

This model also frees businesses from large upfront expenses on IT infrastructure since the service provider takes care of maintenance and updates enabling them to use resources better. Additionally, SaaS solutions typically employ subscription-based pricing models, providing consistent operational costs and the flexibility to scale services in line with the organization's needs.

For instance, an organization may start with basic capabilities and gradually incorporate more advanced features as its contract management requirements evolve. This makes it extremely useful in fast-paced corporate environments where flexibility becomes crucial.

Integration capabilities: The deployment of existing enterprise systems, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems, will ultimately enhance overall operational efficiency, as SaaS-based contract management solution platforms enable seamless system connectivity.

Small and mid-sized businesses adopting CLM for compliance

Increasingly, SMEs (small and mid-sized enterprises) are recognizing that compliance and effective contract management necessitate the implementation of CLM (Contract Lifecycle Management) solutions. Traditionally, comprehensive contract management systems have been viewed as tools primarily for large corporations due to their complexity and associated costs.

But with the emergence of scalable and affordable CLM solutions, even smaller enterprises can reap their benefits. By implementing such systems, organizations can ensure compliance with regulations. At the same time, employees can easily access required documents for audits or compliance reporting purposes, as they have centralized repositories where all data related to contracts is stored electronically.

For example, an SME can utilize a CLM system to receive regular reminders of upcoming contract deadlines, ensuring compliance with their ongoing obligations under each contract and avoiding potential legal complications. Automation of routine tasks also frees up limited staff from the administrative burden of mundane tasks, enabling them to focus on strategic processes that drive business growth.

The increased transparency and decreased likelihood of human error from utilizing CLM solutions are beneficial for SMEs operating in highly regulated environments. Consequently, small and mid-sized businesses are increasingly adopting CLM systems, reflecting a broader shift toward digital transformation and proactive compliance management.

Frequent changes in compliance laws create adaptation challenges

The organizations leveraging Contract Lifecycle Management (CLM) solutions face a constantly changing regulatory landscape. Compliance requirements evolve constantly by governments and regulatory bodies in response to emerging risks, changes in the industry and geopolitical changes. However, continuous changes in these regulations necessitate ongoing review and adjustments to contract management processes.

Businesses operating across multiple jurisdictions further complicate matters, as they must contend with divergent legal frameworks that often conflict or overlap. Data privacy laws, such as the European Union’s GDPR and California’s CCPA, have introduced strict requirements; however, other territories are issuing their own mandates, making compliance akin to a moving target.

Frequent changes to regulations increase the risk of non-compliance, which can lead to legal liabilities, financial penalties, and damage to your reputation. They need to ensure that the latest insights in law are embedded in their contracts, but must go through a lengthy process to incorporate those insights due to resource intensity.

This becomes especially critical for industries with stringent regulatory requirements - namely, finance, healthcare, and government. Updating existing contracts, renegotiating terms, and aligning internal policies with new regulations all require a significant amount of work.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance-driven contract automation surged in regulated industries. |

| Cloud-Based Adoption | Transition to SaaS-based contract lifecycle solutions for flexibility. |

| AI & Analytics Integration | AI-driven contract analysis improved risk mitigation. |

| Workflow Optimization | Enterprises focused on digitizing contract workflows to enhance efficiency. |

| Market Growth Drivers | A rise in complex global business agreements necessitated automation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered contract risk management automates real-time legal adjustments. |

| Cloud-Based Adoption | Blockchain-enabled smart contracts autonomously execute and enforce terms. |

| AI & Analytics Integration | Predictive AI automatically flags contractual anomalies and suggests resolutions. |

| Workflow Optimization | AI-driven contract negotiation bots optimize deal structuring and compliance. |

| Market Growth Drivers | AI-powered autonomous contract management revolutionizes enterprise operations. |

The section highlights the compound annual growth rates (CAGRs) of countries experiencing growth in the Contract Lifecycle Management market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.6% |

| China | 15.9% |

| Germany | 10.4% |

| Japan | 13.2% |

| United States | 11.7% |

China has made digital transformation a priority across many industries; contract management is no different. Contrasting with this, regulatory initiatives aimed at electronic contracts, data governance, etc. are supporting the adoption of Contract Lifecycle Management (CLM) solutions among businesses.

With the introduction of the Electronic Signature Law of China, digital contracts gained significant legal validity, enabling them to be enforced in court. Encouraged by this regulatory support, enterprises are moving from traditional paper-based contracts to digital platforms, making processes seamless and reducing significant administrative overheads.

Furthermore, China’s Cybersecurity Law requires the implementation of robust data security protocols, driving organizations to seek CLM solutions with advanced encryption and compliance tracking capabilities.

Chinese government industry announced that more than 90% of government and enterprise contracts should be digitally managed by 2025 as a big action of digital governance. This instruction has driven the use of CLM solutions in most critical industries like banking, manufacturing, and real estate.

According to a recent government report, more than three-quarters of these enterprises have already embedded e-contracts into their procurement systems. China is anticipated to see substantial growth at a CAGR of 15.9% from 2025 to 2035 in the Contract Lifecycle Management market.

The emergence of e-signature in the Contract Lifecycle Management (CLM) market has been driven collectively by the widespread digitalization in India. The Indian government’s promotion of digital transactions, enabled by the Information Technology Act, has legalized the use of electronic contracts, making them enforceable just like traditional documents.

The demand for automation in contractual processes across sectors such as banking, telecom, and healthcare has led to a transition toward digital contract management platforms. The launch of initiatives like Aadhaar e-KYC and Digital India has given companies the ability to use an e-signature to know the customer identity safely and simplify compliance while quickly authenticating contracts, thus minimizing paperwork.

Aadhaar-based e-signatures have been adopted for a range of legal and business agreements in India, with the recent announcement by the government confirming that more than 5 billion such signatures have already been signed. According to the Ministry of Electronics and Information Technology, 60% of businesses have adopted e-signatures over the last two years.

The increasing volume of transactions taking place online, along with compliance requirements related to laws such as the Personal Data Protection Bill, have also contributed to the growing need for secure contract authentication. India's Contract Lifecycle Management (CLM) market is projected to grow at a CAGR of 14.6% during the forecast period.

The United States is leading the way in legal tech innovation, with AI proving essential to the evolution of Contract Lifecycle Management (CLM).

Due to the growing complexities of regulations, such as the California Consumer Privacy Act (CCPA), and increasing scrutiny, particularly from the Securities and Exchange Commission (SEC), businesses are increasingly relying on AI-powered contract lifecycle management (CLM) solutions to analyze contracts and track compliance.

AI-based contract analytics empower companies to monitor key clauses, assess risks, and ensure regulatory compliance as they emerge. The USA government’s digitization of legal practices has also spurred enterprises to adopt AI solutions in their overall contract management processes.

A recent report from the U.S. Department of Commerce stated that the introduction of AI-powered contract management tools has reduced the duration required to process contracts by 50% in federal agencies.

It was close to 2023 when the SEC also used AI-based compliance tools, which help them to detect 40% more discrepancies in financial contracts. The USA is anticipated to experience substantial growth in the Contract Lifecycle Management market, with a dominant share of 76.5% projected for 2025.

The section contains information about the leading segments in the industry. By Solution, the Services segment is estimated to grow rapidly from 2025 to 2035. Additionally, by Industry, Govt & Public Sector segment holds a dominant share in 2025.

| Solution | CAGR (2025 to 2035) |

|---|---|

| Services | 14.2% |

Services segment is expected to grow at a CAGR of 14.2% from the period 2025 to 2035. Services is the segment of the Contract Lifecycle Management (CLM) market which is largely dominating the market, as organizations need the help of experts in terms of implementation, customization, and compliance management. As the CLM adoption increases, businesses require consulting, CLM integration and training services to enhance the utilization of CLM platforms.

Additionally, the surge in complex regulatory requirements has been a boon for managed services, allowing firms to offload contract governance to third-party providers. Furthermore, the shift toward cloud-based CLM solutions has heightened the need for businesses to receive ongoing support for updates, security, and scalability, which has contributed to the growth of service-oriented offerings.

The optimization and automation of contracts in government bodies, for which the European Commission has also allocated more than 500 million euros for digital contract management services. To illustrate, federal agencies in the United States have invested more in CLM service providers to ensure compliance with procurement laws.

According to reports, approximately 7 out of 10 large enterprises opt for software coupled with professional services for CLM implementation due to the increasing reliance on expert-driven solutions. As companies increasingly focus on compliance, risk management, and efficiency, the need for CLM services is projected to stay on an upward trend.

| Industry | Value Share (2025) |

|---|---|

| Govt & Public Sector | 18.4% |

The Govt & Public Sector is poised to capture share 18.4% in 2025. In terms of value, the government and public sector accounts for the largest share of the Contract Lifecycle Management (CLM) market, due to the growing regulatory mandates, and the need to ensure efficient contract oversight.

With thousands of contracts for procurement, infrastructure projects, defense agreements, and more, public sector entities require robust CLM solutions. Governments are increasingly embracing digital contract management tools to enhance transparency, improve accuracy, and ensure regulatory compliance. Besides these governmental initiatives, the zeal for digitization and e-governance has led the sector to make further investments in CLM technologies.

The USA General Services Administration (GSA) recently budgeted upwards of USD 1 billion for various digital transformation efforts, including CLM systems, aimed at expediting federal procurement processes. India’s government also adopted an automated contract management system for public sector enterprises, with a goal of reducing processing times for contracts by 40%.

The CLM market is a dynamic and evolving space, with a variety of innovations emerging to address the growing need for automation, compliance management, and risk mitigation in contract processes. Top players are focusing on investing in AI, machine learning, and cloud-based solutions to improve contract authoring, negotiation, execution, and analytics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DocuSign CLM | 20-25% |

| Icertis | 15-20% |

| SAP Ariba CLM | 12-17% |

| Coupa CLM | 8-12% |

| Agiloft | 7-10% |

| Other Companies (combined) | 28-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| DocuSign CLM | Provides end-to-end contract automation with AI-powered analysis. Integrates seamlessly with DocuSign eSignature and enterprise applications. |

| Icertis | Offers AI-driven contract management solutions with deep analytics. Focuses on compliance, risk management, and enterprise-wide contract visibility. |

| SAP Ariba CLM | Provides a cloud-based CLM system tightly integrated with SAP’s procurement and supply chain solutions. Emphasizes supplier collaboration and contract intelligence. |

| Coupa CLM | Specializes in spend management and procurement-driven contract lifecycle automation. Strong AI-powered analytics improve negotiation strategies. |

| Agiloft | Offers a no-code, customizable CLM platform with extensive automation and workflow capabilities, catering to legal, procurement, and sales teams. |

Strategic Outlook

DocuSign CLM (20-25%)

DocuSign CLM is a market leader in contract lifecycle automation and AI-powered analytics, offering seamless integration with eSignature solutions. The company has continued to enhance its AI and machine learning capabilities, enabling businesses to derive insights from contract data. DocuSign CLM, which is gaining traction among legal, procurement, and sales teams, remains the AI market leader.

Icertis (15-20%)

A leading provider in the CLM arena, Icertis is a provider of AI-powered platforms that enforce compliance, manage risk, and enhance contract intelligence. The company collaborates with global enterprises to deliver comprehensive contract management solutions that seamlessly integrate with ERP and CRM systems. With blockchain-powered contract security and AI-enhanced analytics, Icertis continues to broaden its ecosystem.

SAP Ariba CLM (12-17%)

SAP Ariba CLM thrives with its robust integration with procurement and supply chain, serving as a preferred choice for enterprises looking for end-to-end contract management capabilities. The AI-driven contract analytics and supplier collaboration features of the platform enhance efficiency and compliance. SAP preserves automatic investment to reduce contract negotiation and procurement risks.

Coupa CLM (8-12%)

Coupa CLM is also uniquely focused on procurement in its contract lifecycle automation. The insights powered by AI help the organization negotiate contracts and manage costs more effectively. It focuses on integrated spend management and contract execution, providing businesses with an end-to-end view of their contracts and financial oversight.

Agiloft (7-10%)

Agiloft competes with a no-code CLM platform that enables organizations to customize workflows without the burden of extensive IT resources. Its automation-powered approach enhances contract compliance, reduces risk, and improves efficiency. Agiloft strengthens its AI capabilities even further for advanced contract analytics. Continues growth in the legal tech landscape.

Other Key Players (28-38% Combined)

The market has further diversity thanks to players like Conga CLM (formerly Apttus), Ironclad, ContractPodAi, and Evisort. These players specialize in niche solutions like AI-driven contract review, workflow automation, and industry-specific contract compliance. They contribute to the advancement of contract digitization and legal-tech innovation, thereby making it a necessity for market growth.

In terms of solution, the segment is segregated into CLM Software & Services.

In terms of Business Function, the segment is segregated into Legal, Finance, Procurement, Sales, Operations, Human Resource and Information Technology.

In terms of Industry, it is distributed into BFSI, IT & Telecom, Govt & Public Sector, Energy & Utilities, Manufacturing, Healthcare & Pharma, Life Sciences, Retail, Real Estate and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Contract Lifecycle Management industry is projected to witness CAGR of 12.0% between 2025 and 2035.

The Global Contract Lifecycle Management industry stood at USD 1,564.1 million in 2025.

The Global Contract Lifecycle Management industry is anticipated to reach USD 3,284.2 million by 2035 end.

East Asia is set to record the highest CAGR of 14.5% in the assessment period.

The key players operating in the Global Contract Lifecycle Management Industry DocuSign CLM, Icertis, SAP Ariba CLM, Coupa CLM, Agiloft, Conga CLM, Apttus (part of Conga), Ironclad, ContractPodAi, Evisort.

Table 1: Global Contract Lifecycle Management Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 4: North America Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 6: North America Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 7: Latin America Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 9: Latin America Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 10: Europe Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 12: Europe Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 13: South Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 15: South Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: East Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 18: East Asia Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 19: Oceania Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 21: Oceania Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 22: MEA Contract Lifecycle Management Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Contract Lifecycle Management Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 24: MEA Contract Lifecycle Management Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 3: Global Contract Lifecycle Management Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Contract Lifecycle Management Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 8: Global Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 9: Global Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 10: Global Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 11: Global Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 12: Global Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 13: Global Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 14: Global Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 15: Global Contract Lifecycle Management Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 17: North America Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 18: North America Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 23: North America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 24: North America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 25: North America Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 26: North America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 27: North America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 28: North America Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 29: North America Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 30: North America Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 32: Latin America Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 33: Latin America Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 38: Latin America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 39: Latin America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 40: Latin America Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 41: Latin America Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 42: Latin America Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 43: Latin America Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 44: Latin America Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 45: Latin America Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 47: Europe Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 48: Europe Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 53: Europe Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 54: Europe Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 55: Europe Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 56: Europe Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 57: Europe Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 58: Europe Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 59: Europe Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 60: Europe Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 62: South Asia Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 63: South Asia Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 68: South Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 69: South Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 70: South Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 71: South Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 72: South Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 73: South Asia Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 74: South Asia Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 75: South Asia Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 77: East Asia Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 78: East Asia Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 83: East Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 84: East Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 85: East Asia Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 86: East Asia Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 87: East Asia Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 88: East Asia Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 89: East Asia Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 90: East Asia Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 92: Oceania Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 93: Oceania Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 98: Oceania Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 99: Oceania Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 100: Oceania Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 101: Oceania Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 102: Oceania Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 103: Oceania Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 104: Oceania Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 105: Oceania Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Contract Lifecycle Management Market Value (US$ Million) by Solution, 2023 to 2033

Figure 107: MEA Contract Lifecycle Management Market Value (US$ Million) by Industry, 2023 to 2033

Figure 108: MEA Contract Lifecycle Management Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Contract Lifecycle Management Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Contract Lifecycle Management Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 113: MEA Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 114: MEA Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 115: MEA Contract Lifecycle Management Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 116: MEA Contract Lifecycle Management Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 117: MEA Contract Lifecycle Management Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 118: MEA Contract Lifecycle Management Market Attractiveness by Solution, 2023 to 2033

Figure 119: MEA Contract Lifecycle Management Market Attractiveness by Industry, 2023 to 2033

Figure 120: MEA Contract Lifecycle Management Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Contractual Cleaning Services Market Growth - Trends & Forecast 2025 to 2035

Contract Packaging Market from 2025 to 2035

Contract Blending Services Market

Contract Dose Manufacturing Market

Contract Management Software Market Analysis By Solution, By Enterprise Size, By Business Function and Industry Through 2035

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

Blockchain-Powered Smart Contracts – Future of Legal Transactions

Supplier Contract Management Market Size and Share Forecast Outlook 2025 to 2035

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pharmerging Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Pharmaceutical Contract Packaging Providers

High Potency API Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biopharmaceutical Contract Manufacturing Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA