The Biologics Contract Manufacturing Market is estimated to be valued at USD 35.2 billion in 2025 and is projected to reach USD 93.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Biologics Contract Manufacturing Market Estimated Value in (2025 E) | USD 35.2 billion |

| Biologics Contract Manufacturing Market Forecast Value in (2035 F) | USD 93.8 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The Biologics Contract Manufacturing market is witnessing steady growth, driven by the rising demand for outsourced production of complex biologic drugs, including monoclonal antibodies, vaccines, and recombinant proteins. Pharmaceutical and biotechnology companies are increasingly relying on contract manufacturing organizations to reduce capital expenditures, accelerate development timelines, and scale production efficiently. Advances in bioprocessing technologies, automated production platforms, and quality control systems are enhancing manufacturing capabilities and consistency.

Growing prevalence of chronic diseases and oncology cases has further fueled demand for biologics, particularly monoclonal antibodies, as targeted therapeutic options. Regulatory agencies are encouraging outsourcing partnerships to maintain high quality and compliance standards, while reducing the burden on in-house facilities.

The focus on personalized medicine and the rising pipeline of innovative therapies are also contributing to market expansion As global healthcare systems aim to improve access to advanced biologics, contract manufacturing is being increasingly adopted to ensure supply chain efficiency, operational scalability, and cost-effective production, positioning the market for long-term growth over the coming decade.

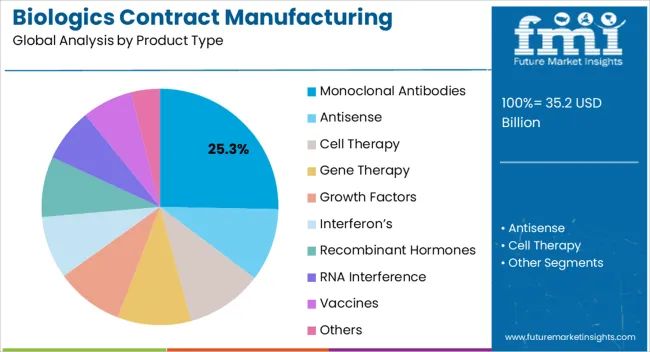

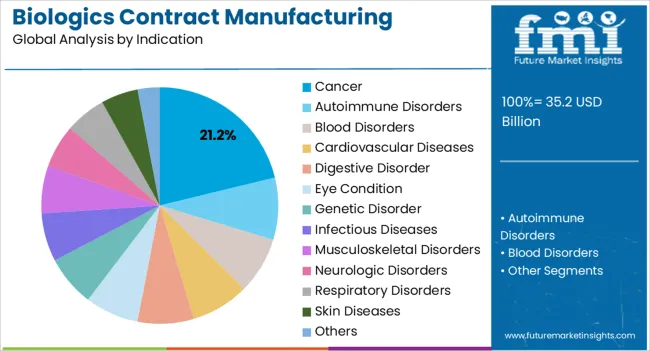

The biologics contract manufacturing market is segmented by product type, indication, and geographic regions. By product type, biologics contract manufacturing market is divided into Monoclonal Antibodies, Antisense, Cell Therapy, Gene Therapy, Growth Factors, Interferon’s, Recombinant Hormones, RNA Interference, Vaccines, and Others. In terms of indication, biologics contract manufacturing market is classified into Cancer, Autoimmune Disorders, Blood Disorders, Cardiovascular Diseases, Digestive Disorder, Eye Condition, Genetic Disorder, Infectious Diseases, Musculoskeletal Disorders, Neurologic Disorders, Respiratory Disorders, Skin Diseases, and Others. Regionally, the biologics contract manufacturing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monoclonal antibodies segment is projected to hold 25.3% of the market revenue in 2025, establishing it as the leading product type. Its dominance is driven by the increasing adoption of monoclonal antibody therapies in oncology, autoimmune disorders, and infectious diseases, where targeted mechanisms provide superior clinical outcomes. Contract manufacturing enables scalable production of these complex biologics, ensuring consistent quality and adherence to regulatory standards.

Advanced cell culture technologies, high-yield bioreactors, and robust purification methods have improved efficiency and reduced production timelines, supporting widespread adoption. Outsourcing monoclonal antibody manufacturing allows pharmaceutical companies to focus on research, clinical development, and commercialization, while leveraging specialized expertise from contract manufacturers.

The growing number of monoclonal antibody approvals and pipeline candidates is further strengthening demand for scalable, reliable production capabilities As personalized and targeted therapies continue to expand globally, the monoclonal antibodies segment is expected to maintain its leading position, supported by ongoing innovation and adoption of contract manufacturing solutions across multiple therapeutic areas.

The cancer indication segment is expected to account for 21.2% of the market revenue in 2025, making it the leading therapeutic application. Growth is being driven by the rising prevalence of various cancer types and the increasing adoption of biologics, particularly monoclonal antibodies, in oncology treatment regimens. Contract manufacturing enables the large-scale production of complex cancer therapeutics, maintaining consistent quality and regulatory compliance while reducing production costs.

Advancements in bioprocessing, including high-efficiency cell lines, precision bioreactors, and purification techniques, have strengthened the reliability and scalability of oncology biologics. Pharmaceutical companies are increasingly outsourcing production to meet rising demand, optimize time to market, and support clinical trials for innovative therapies.

The integration of precision medicine and personalized treatment approaches has further elevated the importance of high-quality biologics for cancer applications As healthcare systems prioritize effective and targeted cancer treatments, the segment is expected to continue leading in revenue, supported by strong pipeline growth, strategic partnerships, and adoption of contract manufacturing capabilities to deliver oncology biologics efficiently.

Biologics are genetically engineered proteins which originate from human genes. These drugs target the specific parts of the immune system. Biologics are entirely different from chemically synthesized drugs.

There is wide range of biologics products include vaccines, blood components, allergenic, somatic cells, gene therapy and recombinant therapeutic proteins. Biologics are constituted as nucleic acids or proteins or may be cells and tissue from living entities.

Biologics are isolated from different sources such as animal, human or microbes by using different biotechnological methods. Biologics are a complex mixture, and it is heat sensitive product and highly susceptible to microbial contamination. Therefore manufacturing of biologics needs very aseptic environment and skilled professional.

Hence, the demand for biologic contract manufacturing has shown subsequent growth. The pharmaceutical companies are signing an agreement with CMO’s for the manufacturing of biologics.

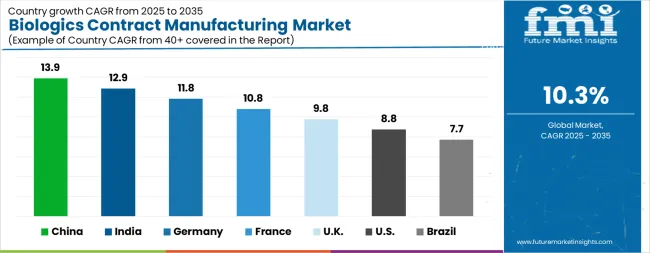

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

| USA | 8.8% |

| Brazil | 7.7% |

The Biologics Contract Manufacturing Market is expected to register a CAGR of 10.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.9%, followed by India at 12.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.7%, yet still underscores a broadly positive trajectory for the global Biologics Contract Manufacturing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.8%. The USA Biologics Contract Manufacturing Market is estimated to be valued at USD 12.7 billion in 2025 and is anticipated to reach a valuation of USD 29.3 billion by 2035. Sales are projected to rise at a CAGR of 8.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.7 billion and USD 1.0 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.2 Billion |

| Product Type | Monoclonal Antibodies, Antisense, Cell Therapy, Gene Therapy, Growth Factors, Interferon’s, Recombinant Hormones, RNA Interference, Vaccines, and Others |

| Indication | Cancer, Autoimmune Disorders, Blood Disorders, Cardiovascular Diseases, Digestive Disorder, Eye Condition, Genetic Disorder, Infectious Diseases, Musculoskeletal Disorders, Neurologic Disorders, Respiratory Disorders, Skin Diseases, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

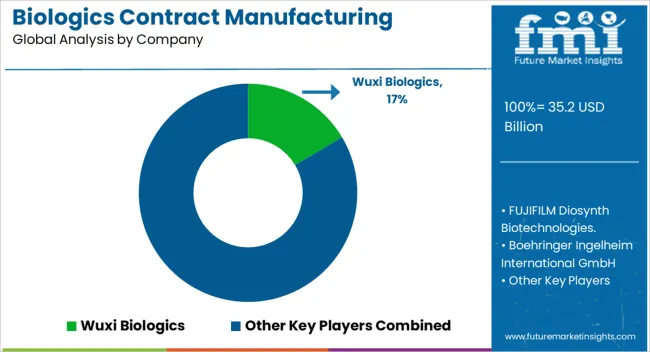

| Key Companies Profiled | Wuxi Biologics, FUJIFILM Diosynth Biotechnologies., Boehringer Ingelheim International GmbH, Lonza, Samsung Biologics., AbbVie Inc., Catalent, Bioreliance (Merck KGaA), Thermo Fisher Scientific Inc., and Eurofins Scientific |

The global biologics contract manufacturing market is estimated to be valued at USD 35.2 billion in 2025.

The market size for the biologics contract manufacturing market is projected to reach USD 93.8 billion by 2035.

The biologics contract manufacturing market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in biologics contract manufacturing market are monoclonal antibodies, antisense, cell therapy, gene therapy, growth factors, interferon’s, recombinant hormones, rna interference, vaccines and others.

In terms of indication, cancer segment to command 21.2% share in the biologics contract manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biologics Market Analysis - Growth & Forecast 2025 to 2035

Competitive Overview of Biologics Regulatory Affairs Market Share

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Orthobiologics Market is segmented by Product Type and End User from 2025 to 2035

Spine Biologics Market Size and Share Forecast Outlook 2025 to 2035

Retinal Biologics Market Size and Share Forecast Outlook 2025 to 2035

Inhalable Biologics Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Veterinary Biologics Market - Size, Share, and Forecast 2025-2035

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Subcutaneous Biologics Market

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Self-administered Biologics Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Anti-Inflammatory Biologics

Retinal Drugs And Biologics Market

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Contractual Cleaning Services Market Growth - Trends & Forecast 2025 to 2035

Contract Management Software Market Analysis By Solution, By Enterprise Size, By Business Function and Industry Through 2035

Contract Packaging Market from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA