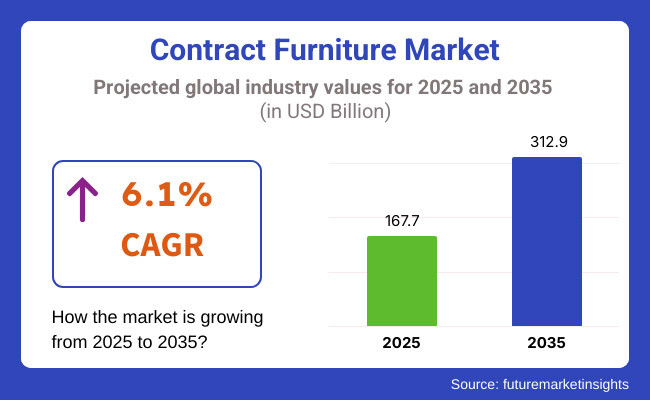

By 2025, the contract furniture market is projected to reach USD 167.7 billion and further expand to USD 312.9 billion by 2035.

Demand for modern office spaces, heightened focus on employee wellness, and the need for ergonomic, sustainable, and customizable furniture are key growth drivers. Additionally, rapid urbanization and an expanding corporate sector, especially in emerging economies, are accelerating investments in flexible and aesthetically appealing workspace solutions, thereby fueling demand for contract furniture globally.

However, high production costs and supply chain disruptions pose restraints. Fluctuations in raw material prices, particularly for wood and metals, and the need for compliance with diverse international standards can hinder market growth. Additionally, budget constraints among small and medium enterprises may limit adoption of high-end contract furniture solutions.

Opportunities lie in the rise of hybrid work environments and smart office trends, driving demand for multifunctional, technology-integrated furniture. Growing awareness of sustainable design and government initiatives promoting eco-friendly practices are encouraging manufacturers to invest in green materials and energy-efficient production, creating significant opportunities for innovation and market differentiation.

Key trends include increased use of recycled materials, modular designs, and digital tools like virtual showrooms and AR/VR for customization. Partnerships between furniture companies and tech firms are also emerging, enhancing user experience through integrated technology solutions. These trends are reshaping the contract furniture landscape toward flexibility, sustainability, and tech-enhanced functionality.

Between 2020 and 2024, the contract furniture market evolved rapidly due to the rise of hybrid work models, sustainability mandates, and technology integration. Businesses adapted to flexible work environments by investing in modular office furniture, ergonomic workstations, and soundproof meeting pods. Open-plan areas transformed into privacy-oriented layouts with mobile partitions and flexible seating. Sustainability became more prominent, and manufacturers incorporated biodegradable upholstery, FSC-certified wood, and furniture-as-a-service models to promote circular economy thinking.

Technology integration also transformed office spaces, with smart desks that included wireless charging, IoT-enabled occupancy sensors, and AI-managed climate systems. Hospitality and retail outlets had flexible LED-lit seating and digital signage to help improve customer experience. Even with the revolution of the industry, supply chain disruption and higher raw material costs posed a threat to the company, so businesses responded by resorting to nearshoring, robot assembly, and automated inventory management to minimize logistics.

Biophilic and climate-responsive designs will feature plant-based air-purifying furniture and moisture-regulating wood composites. Customization will expand with AI-driven 3D printing and digital fabrication, allowing businesses to produce bespoke furniture in real-time. Regenerative materials like carbon-negative composites and self-healing surfaces will enhance durability while reducing waste. Circular economy operations will increase, with leasing systems, take-back initiatives, and AI-automated refurbishment prolonging product lifetimes.

Shopping and hotel environments will host AI-operated intelligent furniture with sensory-activated features. In contrast, neurodiverse designs will include variable lighting, sound-insulating workspaces, and touch-responsive seating to facilitate various modes of working.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Modular desks, hybrid workstations | Adaptive furniture, AI-optimized space plans |

| Regenerative surfaces, carbon-negative materials | Occupancy sensors, smart desks |

| AI-based interactive surfaces, personalization | Limited customization, standard production |

| On-demand 3D printing, bespoke creations based on AI | Leasing programs, refurbishment plans |

| AI-based reuse and remanufacturing networks | Module-based seating, LED-lit furniture |

| Immersion displays, AI-controlled adaptive interiors | Adaptive sensory features, neurodiverse-friendly areas |

| Call for adaptability spaces, sustainability parameters | Regenerative material advancements, AI-enabled automation |

The industry is on a fast track to success as companies now learn about functional, appealing, and sustainable furnishing solutions produced according to industry standards and based on their specifications. Office spaces are all about ergonomics, durability, and customization. Therefore, they put a great deal of effort into investing in modular and adaptive furniture to support a blended work model.

The hotel industry puts a high priority on design flexibility and top quality aesthetics to enhance the guest experience which is why they are in the process of implementing materials that can be both durable and luxurious. Medical centers require furniture that is strong, easy to clean, and materials that meet the requirements but also use ergonomic design to promote comfort for the patients.

Schools care much about having cheap, versatile furniture and seating ergonomics to support long periods of use, and they focus on this aspect most. Showcasing is significant for retailers; hence, they prefer furniture with an artistic view and a coherent brand; most times, they ask for any type of special, customized display racks.

The green trend is coming across the fields, with enterprises always going for reusable materials and responsible supply chains. Alongside the commitment to well-being in the workplace, technology is embedded in other parts, such as furniture like smart desks and touchless surfaces.

The financial risks in this industry are significantly high because of the extensive capital investment required. Wardrobes, recliners, and other pieces of furniture for hotels, offices, and public places need a huge part of the budget distribution that business enterprises and their owners set aside.

When the economy falls into a recession, the infrastructure and construction activity might revert to going under the anticipated demand, causing the money flow to be doubtful. Thus, the companies should strategize well to cope with the alternatives and be successful in the finance triangle.

Another one is supply chain disruption. The sales mostly depend on various kinds of raw materials like wood, metal, and textiles, which are subject to price volatility. There can be shortages or delays of these materials, which will hinder production and thus increase the overall cost. However, the resulting conditions will also lead to strained relationships with clients.

The transformation of the work environment also brings threats to furniture manufacturers. The contagion of remote and hybrid work models has cut down the demand for traditional office furniture, thus the need for manufacturers to readjust their product portfolio. The companies that want to beat the competition should provide modern, multi-functional, and ergonomic tools.

The environmental rules are not good for production costs. The prevailing green laws in many territories make the use of green materials and fair trade a requirement, not just the norm. Ignoring these rules can lead not only to fines but to the loss of reputation and clients' trust as well. Firms should work on their operations to be carried out as environmentally friendly as possible while striking an equilibrium between economic factors and fulfillment of conditions required by the sector.

Indeed, chairs and stools were the most significant segment in terms of furniture, accounting for over 37% of the overall revenue share in 2025. This is one of the reasons why their adoption is booming, and usage of ergonomic office chairs, ergonomic conference seating, and ergonomic executive chairs is on the rise with the surge of corporate offices and co-working spaces.

Ergonomic designs lead to good posture, less strain, and more productivity at the office. They are manufactured by companies such as Steelcase, Herman Miller, and Haworth. Aligned with the movement towards employee wellness and an evolved design of workspaces that adapt to the employees, sit-stand stools and customizable height chairs are a popular necessity, especially in hybrid or flexible workspaces.

Driven by the rising trend of collaborative workspaces and hybrid office models, the tables & desks segment plays a substantial role in this space. There’s increasing use of height-adjustable desks, modular tables, and smart desks with wireless charging and IoT connectivity. Sustainable materials and efficient designs as well as developing office needs are being embraced in furniture companies like Knoll, Teknion and Kinnarps. Furthermore, the increasing trend of working from home has further propelled the demand for compact and multi-functional home-office desks, which further boosts growth.

As companies become increasingly focused on aspects such as flexibility, environmental sustainability, and smart integration with the latest technologies, areas such as chairs, stools, tables, and desks are set to see gradual growth as the offices of the future are reconstituted.

The biggest driver behind the strong growth will be the government sector, which is predicted to contribute 28% of the total share in 2025. To boost productivity and morale, countries around the world, are already beginning to revamp offices with ergonomic furniture, sustainable materials and smart workspaces.

Steelcase, Knoll, and Herman Miller frequently compete with and win large government contracts for durable, high-end office furnishings. Its second sustainability initiative promotes the use of recycled, low-emission, and FSC-certified furniture in government offices, accelerated by green building certifications and sustainable procurement policies.

There are several desk solutions powered by IoT, height-adjustable workstations, and even smart offices by companies such as Haworth, Teknion, Kinnarps, etc., which help increase workplace productivity as well. Developments like rise of hybrid working models, co-working spaces etc., have in turn increased the need for flexible and agile office furniture, allowing enterprises to maximize space while increasing comfort level of the employees.

With government and private sectors focusing on trends like employee wellness, sustainability, and tech-driven working environments, the industry will only continue to grow over the years to come as it transforms the face of the workplace.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.8% |

| The UK | 4.5% |

| France | 4.2% |

| Germany | 4.7% |

| Italy | 3.9% |

| South Korea | 5.2% |

| Japan | 3.8% |

| China | 6.5% |

| Australia | 4.3% |

| New Zealand | 3.7% |

The USA contract furniture industry will grow at a 5.8% CAGR during 2025 to 2035 years. Increased commercial property developments, coupled with evolving office environment designs, are fueling demand. Sales are being driven by the growing use of ergonomic office furniture in corporate industries and the growing co-working culture. Companies are focused on green, modular furniture solutions to meet green building certification requirements, thus facilitating growth, too.

Hotels, hospitals, and schools continue to spend on premium contract furniture to improve looks and usability. Government focus on public works and infrastructure growth aids the industry growth. Also, innovation in new technologies like AI-driven furniture and IoT-supported office solutions offers new business possibilities for the manufacturers.

The UK industry will increase at a CAGR of 4.5% during 2025 to 2035. The expansion of hybrid working habits has enhanced the demand for flexible and space-saving solutions. There is a shift toward sustainable materials and locally sourced materials that satisfy regulatory requirements and environmental objectives. The hotel industry is still the leading driver, while luxury hotels and boutique hotels emphasize high-quality furnishings.

Schools and administrative buildings are being refurbished, and contract furniture with good durability at reasonable prices is in great demand. The trend of having flexible working areas has created a high demand for reconfigurable furniture, mainly from SMEs and startups. Businesses are riding waves of digitalization and customization to adapt to changing consumer trends.

France is expected to grow at a CAGR of 4.2% over the next decade. The increasing refurbishment of commercial spaces, particularly in urban centers, supports expansion. High demand from luxury hotels and corporate offices, coupled with the emphasis on sustainable furniture designs, accelerates growth. The rising presence of co-working spaces and the integration of biophilic designs contribute to evolving furniture trends.

Medical and educational environments share an interest in high-end quality furniture that enhances the user interface and holds up over time. There is an increasing demand from higher-end hospitality and retail sectors for good-looking yet functional furniture solutions. Even France's robust regulatory system, backed by eco-friendly building support, is also providing incentives for the adoption of environmentally friendly contract furniture.

Germany will achieve a CAGR of 4.7% during the period 2025 to 2035. Strong demand for commercial real estate and increasing penetration of smart office solutions drive the growth. Increasing demand for ergonomic and AI-based furniture integration drives business growth. Focus on sustainability and circular economy principles compels manufacturers to use recyclable materials.

State investment in state infrastructure and school renewals stimulates demand for contract furniture. Hospitality is still leading, with upscale hotels and restaurants needing luxury, high-quality contract furniture. Its reputation for innovative precision engineering further promotes Germany as the center for upscale contract furniture production.

Italy is expected to expand at a CAGR of 3.9% over the forecast period. Italy's rich design heritage and focus on handcraftsmanship set it apart globally. Luxury hotels, high-end retail outlets, and high-end offices drive demand for custom, high-quality furniture. The export industry also carries importance because Italian brands are extremely sought after globally.

Even if domestic demand is impacted by economic volatility, urban renewal initiatives drive growth. Government expenditure on hospitals and schools raises demand for durable and functional contract furniture. Rising smart furniture technology and environmental material usage also drive trends.

South Korea is forecast to grow at a CAGR of 5.2% during 2025 to 2035. The technology and corporate sectors of the country are driving demand strongly. Office buildings increasingly include smart furniture with IoT features to increase productivity and efficiency. Urbanization and infrastructure development investment by the government also contribute to growth.

The hospitality industry witnesses quick growth, with serviced apartments and hotels refurbishing interiors to welcome international visitors. Educational institutions launch modern learning spaces, making ergonomic and flexible furniture a high demand. Green purchasing patterns also make manufacturers focus on recyclable materials and sustainable design.

Japan is projected to grow at a CAGR of 3.8% over the decade. The shrinkage of the workforce and the aging population compel firms to optimize office space for increased efficiency and comfort. Multi-functional, space-saving furniture continues to be in high demand owing to compact urban offices.

The hospitality and retail sectors continue to invest in high-quality furniture to provide an improved customer experience. Ancient techniques are combined with modern designs, allowing Japanese manufacturers to maintain a unique position at a global level. Increasing focus on sustainability results in the application of sustainable furniture materials.

The contract furniture industry in China is expected to expand at a CAGR of 6.5% over the period 2025 to 2035. The rapid development of commercial property fuels the demand due to urbanization and business investments. Growing international presence in the country facilitates competitive prices and high-volume production of contract furniture.

Government initiatives that encourage green building practices and smart city initiatives support growth. The hotel industry enjoys robust demand, led by upscale hotels and co-living accommodations. Higher investments in healthcare and educational facilities further enhance contract furniture purchases.

Australia is poised to grow at a CAGR of 4.3% during 2025 to 2035. The rising corporate business in Australia and growing co-working culture are driving demand for adjustable and ergonomic furniture solutions. Growing office refurbs and sustainable policies also mark the trend.

Expansion of the hotel sector and tourism, fueled by hotel refurbishments, makes the largest contribution to growth. Investment by the public sector in hospitals and schools also stimulates demand for durable and flexible furniture pieces. Suppliers prioritize incorporating smartness and modularity to address shifting consumer behavior.

New Zealand is anticipated to expand at a 3.7% CAGR over the forecast period. Demand in the commercial sector, particularly in urban areas, fuels increasing demand. Office buildings have given utmost preference to space-efficient and eco-friendly furniture in order to maintain pace with green building initiatives.

The education and hospitality industry also drives expansion with investments in new, updated furniture. Customizations and local products are in demand more, and that mirrors customers' needs for sustainability and quality. The government initiative to modernize infrastructure guarantees consistent demand for furniture across industries.

The contract furniture market is moderately consolidated, comprising global manufacturers, design-centric firms, and niche players catering to commercial, hospitality, and institutional sectors. Companies are focusing on ergonomic design, modularity, and sustainability to meet evolving client demands for flexible, durable, and aesthetic furniture solutions. Investments in smart furniture, eco-conscious materials, and customizable offerings are intensifying competition across key end-use industries.

Leading Players include Steelcase Inc., Herman Miller Inc., Haworth Inc., Knoll Inc., and HNI Corporation, leveraging design innovation, sustainable manufacturing, and adaptive workspace solutions to maintain leadership.

Key Offerings focus on modular office systems, ergonomic seating, and durable furnishings, with an increasing emphasis on smart integration, eco-friendly materials, and tailored solutions for diverse contract applications.

Hybrid work trends, sustainable design mandates, and demand for collaborative, technology-enabled spaces drive Market Evolution. The shift toward wellness-focused, adaptable environments is reshaping procurement priorities in the contract furniture sector.

Strategic Factors include investment in sustainable production, digital design platforms, and ergonomic innovations. Companies are pursuing partnerships, acquisitions, and product diversification to enhance competitiveness and meet the demand for flexible, high-performance contract furniture.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Steelcase Inc. | 20-25% |

| Herman Miller Inc. | 15-20% |

| Haworth Inc. | 12-16% |

| Knoll Inc. | 10-14% |

| HNI Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Steelcase Inc. | Develops ergonomic office furniture with smart workspace solutions. |

| Herman Miller Inc. | Specializes in high-end, sustainable, and design-forward furniture. |

| Haworth Inc. | Innovates in modular and adaptive workspace furniture for corporate and hospitality sectors. |

| Knoll Inc. | Focuses on modern and minimalist designs, integrating technology-driven elements. |

| HNI Corporation | Provides cost-effective, durable office furniture solutions for businesses and institutions. |

Strategic Outlook of Key Companies

Steelcase Inc. (20-25%) Steelcase leads with its cutting-edge office solutions, integrating smart furniture, ergonomic designs, and collaborative workspace innovations.

Herman Miller Inc. (15-20%) Herman Miller is a pioneer in sustainable and high-performance furniture, offering iconic designs and ergonomic solutions tailored to modern workspaces.

Haworth Inc. (12-16%) Haworth excels in adaptable and modular furniture designs that cater to evolving work environments, emphasizing flexibility and productivity.

Knoll Inc. (10-14%) Knoll is known for its sophisticated and technology-integrated furniture designs, blending aesthetics with functionality for commercial spaces.

HNI Corporation (6-10%) HNI Corporation provides cost-effective, high-quality furniture, serving businesses, educational institutions, and healthcare facilities.

Other Key Players (30-40% Combined) Several other companies are making significant by focusing on sustainability, innovation, and customization.

The market covers chairs and stools, tables and desks, storage furniture, sofas and couches, and others.

The market includes government, corporate offices, institutional, healthcare/medical facilities, hospitality, and others.

The market is segmented based on online and offline platforms.

The market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East and Africa (MEA) market.

The overall market size was USD 167.7 Billion in 2025.

The Contract Furniture Market is expected to reach USD 312.9 Billion in 2035.

The demand will grow due to increasing commercial real estate developments, rising demand for ergonomic office furniture, and advancements in sustainable furniture materials.

The top 5 contributors to the Contract Furniture Market are the USA, China, Germany, Japan, and the UK.

Office furniture, hospitality furniture, and healthcare furniture are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End-user, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End-user, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End-user, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End-user, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End-user, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 118: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Furniture Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Contractual Cleaning Services Market Growth - Trends & Forecast 2025 to 2035

Contract Management Software Market Analysis By Solution, By Enterprise Size, By Business Function and Industry Through 2035

Contract Packaging Market from 2025 to 2035

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Contract Blending Services Market

Contract Dose Manufacturing Market

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

Metal Furniture Market Size and Share Forecast Outlook 2025 to 2035

Patio Furniture Market Analysis - Trends & Growth Forecast 2025 to 2035

Blockchain-Powered Smart Contracts – Future of Legal Transactions

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA