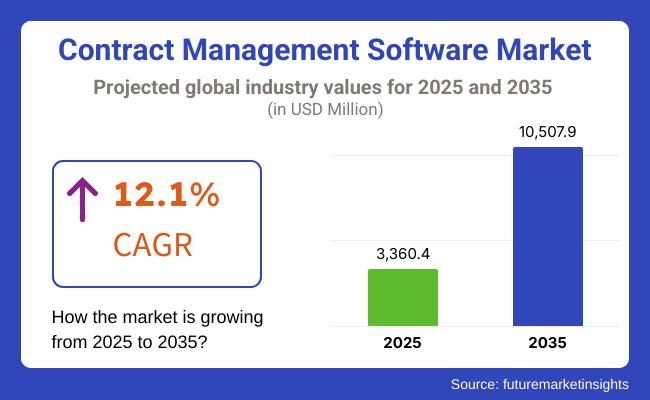

The global sales of contract management software are estimated to be worth USD 3,360.4 million in 2025 and anticipated to reach a value of USD 10,507.9 million by 2035. Sales are projected to rise at a CAGR of 12.1% over the forecast period between 2025 and 2035. The revenue generated by contract management software in 2024 was USD 3,017.7 million.

Contract Management Software (CMS) automates and streamlines contract lifecycles such as drafting, negotiation, signing, compliance, and renewal. CMS is used by enterprises to mitigate risks, ensure compliance, and enable better visibility into contracts. The application centralizes stores of repositories, automates workflows, accommodates electronic signatures, and provides real-time updates, which helps maximize efficiency in contract administration.

The business integrates the CMS to ecosystem of company systems, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP), to streamline contract-relevant processes. The software provides version control features, audit trail tracking, as well as automatic deadlines and renewal reminders which helps mitigate legal and financial risk.

Bringing more sophistication into the contracts is what companies use it for, making contracts much more accurate, automating terms, and ensuring regulatory compliance. The legal, finance, healthcare, procurement, and IT services organizations leverage it to manage vendor contracts, employment contracts, non-disclosure agreements (NDAs), and service-level agreements (SLAs). CMS automates contractors and improves cooperation, quickens negotiations and ensures compliance.

Enterprises deploy CMS in procurement to monitor supplier contracts and confirm performance standards. Legal departments monitor regulatory compliance and automate contract analysis, whereas sales organizations interface it with CRM systems to manage customer contracts and renewals. HR offices automate employment contracts and compliance paperwork.

Healthcare and financial sectors process patient agreements, insurance policies, and financial transactions. IT service providers process service-level agreements (SLAs) and track performance obligations. Contract workflows are optimized by CMS, enhancing efficiency and minimizing legal risk in industries.

The adoption of contract management software among small and medium-scale enterprises seems a lucrative option for the growth of the market. Considering the size and complexity of their operations, large-scale industries already use contract management software extensively.

However, small-scale enterprises are still in the infancy stage of adopting the latest digital trends, primarily due to a lack of awareness or resources. Therefore, marketing companies are highly investing in SMEs since they offer potential benefits and expect high growth in the forecasted period.

Contract management software has various potential benefits such as reducing viewing time and making the enterprises comply with the acts implemented by government authorities. Moreover, with increasing globalization, the necessity to collaborate in joint ventures and handle projects has provided contract visibility for the associated parties.

Therefore, several enterprises have adopted contract management solutions. Furthermore, the transparency in reporting mechanism and advent of cloud-based contract management software is driving the growth of the contract management software market.

The below table presents the anticipated CAGR for the global contract management software market over several semi-annual periods covering from 2025 to 2035. H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 11.8%, followed by a higher growth rate of 12.4% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 11.8% (2024 to 2034) |

| H2, 2024 | 12.4% (2024 to 2034) |

| H1, 2025 | 11.6% (2025 to 2035) |

| H2, 2025 | 12.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 11.6% in the first half and remain slightly higher at 12.3% in the second half. In the first half H1 the market witnessed a decrease of 20 BPS while in the second half H2, the market witnessed a decrease of 10 BPS.

Unique Abilities of CMS is Driving the Contract Management Software Market

The unique structures of contract management software are major factors driving the growth of the contract management software market. These solutions provide an extensive range of features, including automated contract creation and tracking, as well as advanced analytics and reporting.

One of the key reasons for the growth of this market is that these platforms help in simplifying the end-to-end contract lifecycle right from initiation to renewal thus reducing manual errors and time for enterprises. Furthermore, other advanced value added mechanism such as artificial intelligence and machine learning are improving contracting analysis & risk management thereby driving the demand for contract Management Software Market.

Moreover, the scalability and flexibility of contract management software meet the requirements of different business sizes in various industries, propelling the adoption rate. Increasing awareness among enterprises about the benefits of efficient contract management: compliance improvement, cost saving, and risk minimization - enhances growing traction for these software solutions and expands market growth overall.

Utilization of Analytics Tools for Better Contract Performance Tracking and Compliance Monitoring

The use of analytics tools within contract management software is an emerging important practice helping organizations to better monitor and track the performance of their contracts, as well as ensuring compliance. These tools provide real-time insights on the status of contracts, details on potential risks and compliance with regulatory requirements, and performance-based data-information that supports decision-making in data-driven organizations.

Organizations can better optimize their contracting processes by using historical information-generated from the analysis of patterns and trends to improve efficiency by removing bottlenecks. Many vendors state that, through their AI-based contract analytics applications, they can help users identify hidden risks and opportunities in their contracts. The emphasis on analytics helps drive operational efficiencies but it also enables compliance a necessary requirement for many industries facing an increasing number of regulations.

NLP Revolutionizes Contract Management Software with Enhanced Drafting, Accuracy, and Collaboration

Natural Language Processing (NLP) has a huge potential in the contract management software industry as it is changing on how contracts are being authored. NLP helps machine to understand and interpret human language. Using NLP algorithms, contract management software can make sense of the legal jargons used in contracts, extract key terms and clauses, and provide real-time intelligent suggestions while drafting a contract.

This not only improves the overall quality of a contract but also reduces errors and help legal team or any contracting professional work more efficiently. Authoring tools powered with NLP can also help improving collaboration between stakeholders by making sure everyone speaks the same language i.e., nobody have misunderstandings about what’s written in contracts.

Moreover, NLP allows software to learn from historical contract data, recognizing patterns and regularities, in order to increasingly generate future contracts that will conform to an organization’s preferred style of drafting as well as standard industry content.

As organizations look for ways to further automate and speed up the contracting process, without sacrificing accuracy and compliance risk, it is an opportunity for contract management software vendors to leverage NLP capabilities for contract authoring in order to develop a unique selling proposition with which they can provide greater value for their customers.

Data Security Concerns May Affect Contract Management Software Adoption Amid Regulatory Pressures

Data security concerns act as a major challenge to the contract management industry. Since the software manages organizations’ critical business data, including legal contracts, financial information, and confidential business data, data security becomes of high importance. Any breach or unauthorized disclosure/usage of this data can result in heavy losses for organizations along with creating legal liabilities and damaging brand image.

In addition to protecting the above-mentioned organizational confidential data, organizations are also required to comply with various data protection regulations such as GDPR and CCPA. Organizations may refrain from adopting contract management software’s if they perceive that this software impose undue risks of loss/security breach of their critical and private business information. Hence, vendors must ensure that their managed software’s provide adequate levels of security to mitigate these risks.

Additionally, giving guarantee of meeting the necessary regulations and industry standards will also help in reducing customer anxiety thus building trust. Hence, it is important to deal with data security issues properly to enhance the adoption and subsequently the growth rate of contract management software market.

From 2020 to 2024, the contract management software market grew steadily, driven by increasing digital transformation across industry verticals, compliance necessity, and efficiency of automating contract lifecycle. The need for contract management software skyrocketed in industries such as legal or finance due to high contract complexity and volumes along with healthcare.

During the outlook period of 2025 to 2035, the market is projected to continue growing at a rapid rate on account of AI and machine learning led innovation that revamps the approach towards contract analytics and automation. Cloud based solutions will also witness significant traction owing to data security and privacy becoming top priority coupled with cost benefits offered by vendors in cloud space.

Government initiatives for instance push from European Union on digital services or USA government emphasizing on procurement processes simplification which would bolster growth prospects for the market. Organizations are adopting robust contract management solution prompted by regulatory guidelines including but not limited to GDPR or CCPA.

In the global contract management industry, tier-1 contract management software companies have cutting-edge technological capabilities, extensive financial resources, and largely influenced the contract management software market globally. These market leaders are often innovators and early adopters of modern technology. They have robust R&D skills, allowing them to expand their contract management software solution & services portfolios. Prominent companies within tier 1 include IBM, SAP, DocuSign, Inc., Coupa Software and Oracle.

Tier 2 corporations are recognized as mid-sized businesses which gains lesser market share as compared to tier 1 players but has solid presence in local markets. They might also team up with tier 1 companies, providing solutions or engaging in joint ventures to leverage their advanced technologies and vast dealer network. Tier 2 companies mainly involves in expanding their global reach enrich brand identity and increase client base. Prominent companies in tier 2 include Infosys Limited, Infor, GEP, TeamViewer, Information Services Group Inc.

Tier 3 companies are small enterprises or emerging startups in the contract management software market with limited resources and solution portfolio. They majorly operate in specific regional markets or niche areas of the contract management software industry. This player emphasizes on developing contract management software solutions targeting small and medium sized companies with limited budget.

The section below covers the industry analysis for the contract management software market for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, Japan, India and Australia & New Zealand is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 62.35% through 2034. In South Asia Pacific, India is projected to witness a CAGR of 17.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

| Germany | 10.0% |

| Japan | 15.3% |

| India | 17.7% |

| Australia & New Zealand | 17.2% |

The United States is the key revenue contributor in the contract management software market. Various organizations maintaining records of contracts are driving the demand for contract management software in the country. With the implementation of policies and utilizing streamlined contract management tools, organizations have brought transparency to their contract management. Moreover, regulations like Health Insurance Portability & Accountability Act (HIPAA) act as a booster in the adoption of contract management software.

Furthermore, United States has the largest players in contract management software market including Coupa, Docusign, CIertis, Apptus and Zyrus who drive innovation with advanced features such as AI and blockchain. Stringent regulatory requirements, including HIPAA, necessitate robust solutions, while substantial investments in R&D and strategic expansions by this vendor’s bolster market growth.

Japan records the highest growth rate in the contract management software industry due to the country’s rapid digital transformation that drives companies to focus on efficiency and compliance; the country’s world-class infrastructure facilitates the implementation of advanced technology such as AI and blockchain to improve contract management process, that japan’s companies are heavily investing into for operational efficiency and regulatory requirement.

A recent article by TechCrunch Japan highlighted how major japan companies are increasingly adopting contract management system to optimize operation and ensure compliance with local regulation, along with the government mandate for digitalization in enterprise operations further propel the growth of this market.

The country’s modern technology infrastructure and high utilization of digital tools in various sectors such as finance, manufacturing, legal etc. also drive the growth of contract management software sales in this region. Strict compliance and data privacy measures also lead to higher introduction of advanced contract lifecycle management systems.

An industrial report by Handelsblatt revealed that companies in the country are increasingly adopting digital contract management solutions to automate their working and guarantee compliance with stringent regulatory norms like GDPR.

This is supported by government efforts like “Digital Strategy 2025” which provides a further boost to the market development for contractual lifecycle management platforms. The homegrown German software providers including some USA Vendors who have now setup shop in the country are expanding their product lineups to cater to the growing demand thus escalating Germany’s top position in terms of growth.

The section contains information about the leading segments in the industry. By solution, contract management software segment is estimated to grow at a CAGR of 11.4% throughout 2034. Additionally, the by industry, Finance segment is projected to expand at 11.0% till 2035.

| Solution | Value Share (2025) |

|---|---|

| Contract Management Software | 61.5% |

Contract management software segment is expected to acquire share of 61.5% in the market in terms of solution in 2025. Software allows you to set instructions, data or programs to operate the contracts efficiently and execute specific tasks. An application software allows to retain all sorts of software package needed to manage contracts for an enterprise.

Software applications entails variety of templates and clauses in place, where contracts can be assembled based on any criteria associated with the contract ranging from products, regions and services Moreover, with advanced contract management software, end-users can auto-build contracts based on a particular business rules and bulk data upload. Such factors have contributed to the utilization of software in providing contract management solutions.

| Industry | Value Share (2025) |

|---|---|

| Finance | 19.79% |

The finance segment is expected to capture share of 19.79% in 2025. Financial institutes deal with multiple contracts such as loans, securities, and derivatives, thereby increasing the demand for this software to track and maintain regulation reports. This software reduces the operational risks providing various benefits associated to secure document storage repository.

For instance, financial times highlighted how major banks and financial services firms are increasingly investing in contract management systems to handle their complex portfolios and meet regulatory requirements effectively.

Many people managing better security of data & paperless administration has decided to go ahead with new technology. The digital platform focuses on transforming industries enabled by automation. The total customers in this space has been increased by more than 3 folds over a short span of time which shows absolute need for these demanding consents/contracts/documentations be maintained efficiently.

Key players operating in the contract management software market are investing in advanced technologies and also entering into partnerships. Key contract software providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in Contract Management Software Market

In terms of solution, the industry is divided into contract management software and services.

In terms of enterprise size, the industry is divided into small & medium enterprises and large enterprises.

The business function is classified by industry as legal, finance, procurement, sales & marketing, operations, HR and IT.

The industry is classified by industry as finance industry, manufacturing & resources, distribution services, services industry, public sector, infrastructure.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) have been covered in the report.

The global contract management software industry is projected to witness CAGR of 12.1% between 2025 and 2035.

The global contract management software industry stood at USD 3,017.7 million in 2024.

The global contract management software industry is anticipated to reach USD 10,507.9 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key players operating in the global contract management software industry include SAP, Coupa Software, Infor, Newgen Software, JAGGAER, GEP, DocuSign, Inc., Agiloft, Inc, CobbleStone Software, Infosys Limited and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Contractual Cleaning Services Market Growth - Trends & Forecast 2025 to 2035

Contract Packaging Market from 2025 to 2035

Contract Blending Services Market

Contract Dose Manufacturing Market

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

Blockchain-Powered Smart Contracts – Future of Legal Transactions

Supplier Contract Management Market Size and Share Forecast Outlook 2025 to 2035

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pharmerging Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Pharmaceutical Contract Packaging Providers

High Potency API Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biopharmaceutical Contract Manufacturing Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA