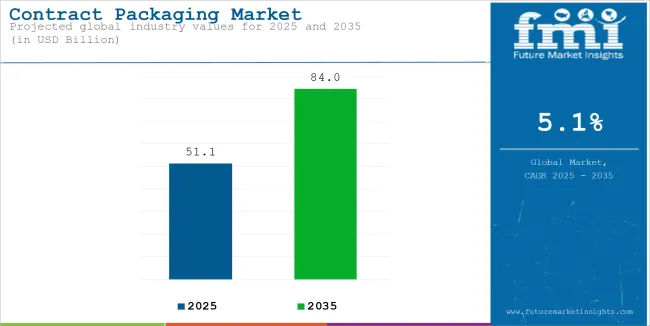

The contract packaging market is gaining traction as companies prioritize outsourcing to focus on their core competencies. This USD 42.1 billion industry (2020) is expected to expand to USD 51.1 billion by 2025 and reach a staggering USD 84 billion by 2035.

Why is this market booming?

It’s all about efficiency and specialization. With primary packaging dominating 37% of the share and pharmaceuticals leading end-use segments with 23%, the industry shows no signs of slowing down. The USA, Germany, and Japan continue to lead the way, but markets in India and China are quickly catching up, offering significant growth potential.

| Attributes | Details |

|---|---|

| Market Revenue (2025) | USD 51.1 billion |

| Market Revenue (2035) | USD 84 billion |

| CAGR (2020 to 2024) | 3.9% |

| CAGR (2025 to 2035) | 5.1% |

| Top Regional Contributors | USA, Germany, Japan |

| Operational Efficiency | Businesses save on labor and infrastructure costs by outsourcing packaging. |

|---|---|

| Demand in Pharmaceuticals | Specialized packaging solutions for sterile and secure products are essential. |

| Growth in Emerging Markets | Rising consumer demand and industrialization in China and India drive expansion. |

| Eco-Friendly Innovations | Increasing focus on sustainable packaging materials aligns with regulatory trends. |

| Customization and Scalability | Contract packaging adapts to varied client needs, including seasonal demand surges. |

While the contract packaging market is flourishing, challenges persist that could hinder its growth trajectory.

| Key Restraints | Details |

|---|---|

| High Setup Costs | Establishing contract packaging operations involves significant upfront investments. |

| Regulatory Compliance | Stringent packaging regulations, especially in Europe, create barriers to market entry. |

| Limited Technological Integration | Smaller players struggle to integrate automation and smart technologies, limiting scalability. |

| Dependency Risks | Over-reliance on third-party packagers can disrupt supply chains during crises. |

| Environmental Concerns | Sustainability demands challenge the use of non-recyclable and energy-intensive packaging. |

The contract packaging market is undergoing transformative trends, shaped by technological advancements and consumer demands.

Sustainability and Eco-Friendly Materials

Firms are resorting to biodegradable and recyclable solutions for packaging, which caters to both environmental policies and people's preferences.

Automation and Smart Packaging

AI, IoT, and robotics integrations are driving efficiency and accuracy for packaging processes. Smart packaging, inclusive of QR codes, among other features, is on the rise.

Pharmaceutical Packaging Innovations

The growth in the pharmaceutical industry has ensured a slew of innovations in sterile and tamper-proof packaging solutions, which have become quite critical for compliance and safety.

Customization and Flexibility

From seasonal packaging to personalized designs, flexibility in services is driving client retention.

Emergence of Asia-Pacific as a Growth Hub

With rapid industrialization, urbanization, and a growing middle class, countries like India and China are becoming significant contributors to market growth.

Primary, secondary, and tertiary packaging are the segments of contract packaging. The primary packaging segment dominates the segment, which is forecasted to hold a 37% share in the year 2025. Dominance is because it protects the product for convenience to the end-user.

Pharmaceuticals account for 23% of the market share, which is mainly driven by increasing demand for secure and sterile packaging. Other key end-use sectors are food, beverages, and cosmetics, each finding innovative and sustainable packaging solutions.

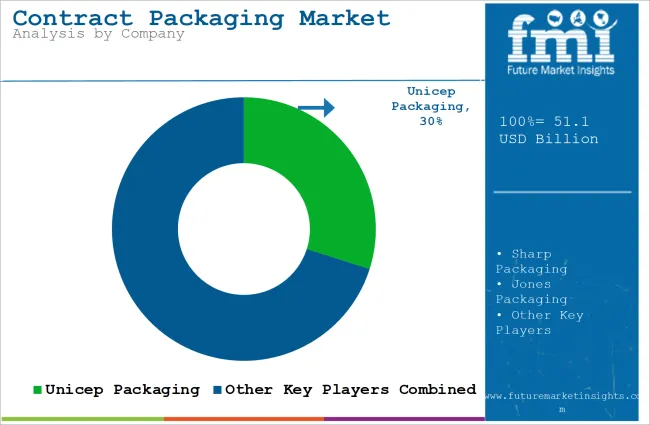

Leading Players' Strategies and Regulatory Impact on the Contract Packaging Market The leading players in the contract packaging market have leading, diversified players focused on innovation. Companies such as Unicep Packaging, Sharp Packaging, and Jones Packaging use their strengths in key sectors like pharmaceuticals, cosmetics, and food to hold their sway over the marketplace. The development of sustainable packaging, integration of automation, and scalability are underscored as important ways to further sustain their edge.

Such global leaders as DHL, Green Packaging Asia, and Stamar Packaging specialize in end-to-end services-from primary and secondary packaging to logistics. Their capability in terms of customized services attracts a range of clientele. Emerging regional players in Asia-Pacific, such as Rahil Foam Pvt. Ltd., are gaining significant growth with cost-effective but high-quality solutions by targeting regional markets, where demand is at an increasing pace .

Major players are heavily investing in R&D to make their packaging materials strong, economical, and environmentally friendly. Adoption of smart packaging technologies has enabled companies to offer value-added services by using RFID tags and QR codes in product tracking and authentication.

Mergers and acquisition is also one of the common strategies to gain incremental market share and geographical presence. For instance, the partnerships with e-commerce giants have also helped the contract packaging companies to venture into the online retail sector, which is growing significantly.

Sustainability is also one of the major concerns, where the companies are introducing biodegradable materials and following green manufacturing. For example, LyondellBasell Industries N.V. and Berry Global Inc. are leading in decreasing carbon footprints without compromising on product quality and performance.

The regulatory environment significantly influences the contract packaging market. Stringent guidelines on packaging materials, particularly in Europe and North America, demand compliance with eco-friendly and recyclable standards.

For example, the European Union’s Packaging and Packaging Waste Directive pushes manufacturers toward adopting sustainable practices. Similarly, the FDA’s regulations for pharmaceutical packaging in the USA emphasize tamper-evident and child-resistant solutions, requiring companies to continually innovate.

While regulations encourage sustainability and safety, they also pose challenges, especially for smaller players with limited resources. Companies need to stay updated on regulatory changes and invest in compliance measures to avoid market entry barriers. This dynamic landscape is forcing businesses to strike a balance between meeting legal standards and optimizing operational costs.

Conclusion: Innovative steps, sustainability, and strategic partnership by leading players are framing the trends of the contract packaging market. However, regulatory pressures test adaptability and continuous investment; hence, only the fittest companies can survive in this competitive arena.

the global contract packaging market analysis from 2020 to 2024 and forecast from 2025 to 2035 includes primary, secondary, and tertiary services.

the report examines key segments such as food, beverages, pharmaceuticals, home products and fabrics, cosmetics and beauty care, and others.

the analysis provides insights into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Growth is driven by increased outsourcing, rising demand for eco-friendly solutions, and advancements in smart and customized packaging technologies.

Industries like pharmaceuticals, food and beverages, cosmetics, and e-commerce rely heavily on contract packaging for secure, efficient, and scalable solutions.

Contract packaging is expected to reach $84 billion by 2035, growing at a CAGR of 5.1% from 2025 to 2035.

North America leads due to advanced manufacturing infrastructure, followed by Europe with a focus on sustainability. Asia-Pacific is a high-growth region due to rapid industrialization.

Key companies include Unicep Packaging, Sharp Packaging, Jones Packaging, DHL, and Green Packaging Asia, among others.

Challenges include high setup costs, strict regulatory compliance, and the demand for sustainable packaging solutions.

Sustainability drives demand for biodegradable and recyclable materials, pushing companies to innovate and comply with environmental standards.

Services include primary, secondary, and tertiary packaging, as well as labeling, assembly, and logistics support.

Technologies like IoT, AI, and automation enhance efficiency, accuracy, and the integration of smart features like QR codes for tracking and authentication.

Regulations ensure safety and sustainability but also create challenges, particularly in regions with strict standards like Europe and North America.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Services, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 13: Global Market Attractiveness by Services, 2024 to 2034

Figure 14: Global Market Attractiveness by Vertical, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Services, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 28: North America Market Attractiveness by Services, 2024 to 2034

Figure 29: North America Market Attractiveness by Vertical, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Services, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Services, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Vertical, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Services, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Vertical, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Services, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Vertical, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Services, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Services, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Vertical, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Services, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Services, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Vertical, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Services, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Vertical, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Services, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Vertical, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Pharmaceutical Contract Packaging Providers

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Contract Logistics Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA