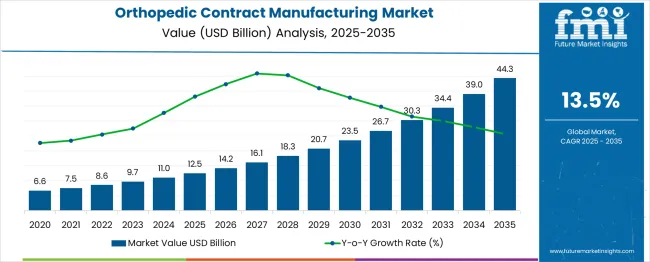

The orthopedic contract manufacturing market is expected to grow from USD 12.5 billion in 2025 to USD 44.3 billion in 2035, achieving a compound annual growth rate (CAGR) of 13%. Overall growth from 2020 to 2035 is substantial, with the market expanding from USD 6.6 billion to USD 44.3 billion, representing a more than sixfold increase in value. Year-on-year increases are observed consistently, with incremental growth of USD 0.9 billion from 2020 to 2021, USD 1.1 billion in 2022, and USD 1.3 billion in 2023. By 2030, the market reaches USD 20.7 billion, while annual gains accelerate in the latter half of the decade, including USD 4.4 billion growth between 2034 and 2035. Sustained demand for implants, outsourcing of manufacturing, and adoption of advanced production technologies support continuous YoY expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 12.5 billion |

| Forecast Value in (2035F) | USD 44.3 billion |

| Forecast CAGR (2025 to 2035) | 13% |

The orthopedic contract manufacturing market demonstrates consistent annual growth between 2020 and 2035, expanding from USD 6.6 billion in 2020 to USD 44.3 billion by 2035 at a CAGR of 13%. Early-stage growth from 2020 to 2025 shows moderate increments, with the market rising from USD 6.6 billion to USD 12.5 billion. Annual increases ranged from USD 0.9 billion to USD 1.5 billion during this period, reflecting gradual adoption of outsourcing services and rising demand for orthopedic implants. The market’s YoY growth rate in this phase remained stable, averaging 12–14%, indicating steady momentum while infrastructure and production capabilities were scaled across key regions.

Post-2025, annual growth accelerates as values reach USD 20.7 billion by 2030 and USD 44.3 billion in 2035. YoY increments in this period widen, with gains increasing from USD 1.8 billion in 2026 to USD 4.4 billion between 2034 and 2035. Accelerated expansion is supported by advanced manufacturing technologies, regulatory approvals, and greater penetration of contract manufacturing across mid- and large-scale orthopedic producers. Comparing early and later periods reveals a clear upward trajectory, with growth rates maintaining consistency but absolute value gains rising sharply in the latter half of the decade.

Market expansion is being supported by the increasing demand for specialized manufacturing expertise and the corresponding need for cost-effective production solutions among orthopedic device manufacturers. Modern medical device companies are increasingly focused on core competencies such as research and development, while outsourcing complex manufacturing processes to specialized contract manufacturers. The proven expertise of contract manufacturers in precision machining, advanced materials processing, and regulatory compliance makes them preferred partners for orthopedic device production.

The growing emphasis on quality assurance and regulatory compliance is driving demand for contract manufacturing services that maintain the highest standards of medical device production. Customer preference for comprehensive manufacturing solutions that combine multiple services including forging, machining, finishing, and assembly is creating opportunities for integrated service providers. The rising influence of cost pressures and the need for scalable manufacturing capacity is also contributing to increased adoption of contract manufacturing services across different orthopedic device categories and market segments.

The market is segmented by type outlook, service outlook, company, and region. By type outlook, the market is divided into implants, instruments, cases, trays, and others. Based on service outlook, the market is categorized into forging/casting, machining & finishing, and other specialized services. The market includes leading companies such as Tecomet Inc., Orchid Orthopedic Solutions, Cretex Companies, Viant, ARCH Medical Solutions Corp., Avalign Technologies, LISI Medical, Paragon Medical, Norman Noble, Inc., and Autocam Medical. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The implants segment is projected to account for 64% of the orthopedic contract manufacturing market in 2025, reaffirming its position as the category's core component. Healthcare providers increasingly understand the critical importance of high-quality implant manufacturing in patient outcomes and long-term device performance. The complexity of implant manufacturing, including precision requirements, biocompatibility standards, and regulatory compliance, makes contract manufacturing an attractive option for many orthopedic device companies.

This segment forms the foundation of most contract manufacturing relationships, as it represents the most technically demanding and quality-critical aspect of orthopedic device production. Surgeon preferences and ongoing clinical validation continue to strengthen demand for precision-manufactured implants. With healthcare systems focusing more on patient outcomes and device longevity, implant manufacturing quality aligns with both therapeutic and economic healthcare goals. Its broad appeal across different orthopedic specialties ensures sustained dominance, making it the central growth driver of orthopedic contract manufacturing demand.

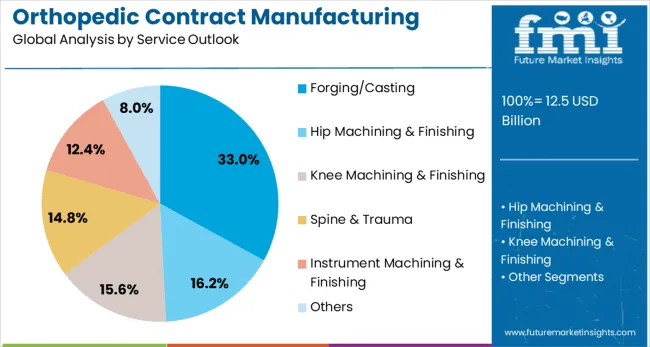

Forging and casting services are projected to represent 33% of orthopedic contract manufacturing demand in 2025, underscoring their role as fundamental manufacturing processes for orthopedic devices. Manufacturers gravitate toward specialized forging and casting services for their ability to create complex geometries, superior material properties, and cost-effective production of high-volume components. Positioned as critical foundation processes, these services offer both structural integrity benefits and economic advantages for large-scale orthopedic device production.

The segment is supported by the rising demand for lightweight yet strong orthopedic components, where advanced forging and casting techniques play a central role in material optimization strategies. Additionally, contract manufacturers are increasingly combining forging and casting capabilities with secondary operations like machining and finishing, enhancing the value proposition and justifying comprehensive service partnerships. As orthopedic device companies prioritize manufacturing efficiency and material performance, forging and casting services will continue to maintain strong demand, reinforcing their essential positioning within the contract manufacturing services spectrum.

The orthopedic contract manufacturing market is experiencing significant growth as medical device companies increasingly outsource implant production. Outsourcing allows firms to reduce operational costs, shorten product development timelines, and access specialized expertise in materials and precision engineering. Contract manufacturers provide scalability that helps original equipment manufacturers meet rising global demand without investing heavily in new facilities. They also ensure consistent quality through advanced testing and regulatory compliance support. The growing prevalence of orthopedic conditions such as arthritis and fractures has intensified the need for implants, further encouraging outsourcing. This shift has positioned contract manufacturing as a critical partner for companies seeking efficiency, cost control, and market expansion.

Minimally invasive orthopedic procedures are gaining popularity because they reduce recovery time, lower infection risks, and improve patient outcomes. This trend has increased the demand for specialized surgical instruments, smaller implants, and precision components. Contract manufacturers are addressing these requirements by producing highly accurate and complex devices that support advanced surgical techniques. Their ability to work with innovative materials and provide cleanroom manufacturing environments ensures high-quality output. As hospitals and clinics adopt less invasive surgical methods, device makers rely on contract partners to deliver components that meet strict design and performance standards. This rising demand for minimally invasive solutions is shaping the market’s trajectory.

Another important dynamic in the orthopedic contract manufacturing market is expansion into emerging healthcare markets. Regions such as Asia, Latin America, and the Middle East are witnessing rising demand for orthopedic procedures due to aging populations, lifestyle changes, and growing access to healthcare services. Contract manufacturers are partnering with local distributors and healthcare providers to establish strong regional presence. By offering cost-effective production and adapting products to regional needs, they are capturing significant growth opportunities. This expansion also helps manufacturers diversify their customer base beyond mature markets in North America and Europe. Emerging markets are now central to the long-term strategies of leading orthopedic contract manufacturers.

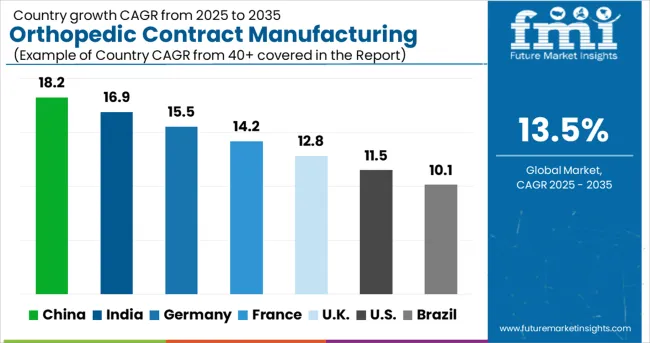

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.2% |

| India | 16.9% |

| Germany | 15.5% |

| France | 14.2% |

| UK | 12.8% |

| USA | 11.5% |

| Brazil | 10.1% |

The orthopedic contract manufacturing market is experiencing robust growth globally, with China leading at an 18.2% CAGR through 2035, driven by expanding manufacturing capabilities, increasing medical device demand, and growing adoption of advanced production technologies. India follows closely at 16.9%, supported by strong cost advantages, skilled workforce availability, and increasing demand for quality manufacturing services. Germany shows steady growth at 15.5%, emphasizing precision manufacturing and advanced engineering capabilities. France records 14.2%, focusing on innovation-driven manufacturing and high-value service offerings. The UK shows 12.8% growth, prioritizing regulatory compliance and quality manufacturing standards.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Orthopedic contract manufacturing in China is projected to grow at a CAGR of 18.2% through 2035, driven by expansion of manufacturing capacity, adoption of advanced production technologies, and the country’s rapidly growing medical device sector. Competition is strong among domestic and international manufacturers establishing comprehensive production facilities to serve orthopedic device companies across tier-1 and tier-2 cities. Compared with India and Brazil, adoption is accelerated due to government-backed incentives and large-scale industrial infrastructure. Investments in skilled workforce development, automation, and quality management systems are enhancing service capabilities and supporting China’s position as a leading hub for high-quality orthopedic device manufacturing.

Orthopedic contract manufacturing in India is expected to grow at a CAGR of 16.9%, supported by competitive manufacturing costs, skilled technical workforce, and rising capabilities in precision manufacturing services. Competition is shaped by domestic manufacturers and international medical device companies forming strategic partnerships to leverage India’s cost advantages. Compared with China, scale is smaller but growth potential remains high due to increasing adoption of quality standards and regulatory compliance. Investments in advanced production technologies, staff training, and process optimization are improving service efficiency. Indian manufacturers are increasingly delivering specialized solutions to support orthopedic device production, meeting domestic and international demand for precision, quality, and cost-effectiveness.

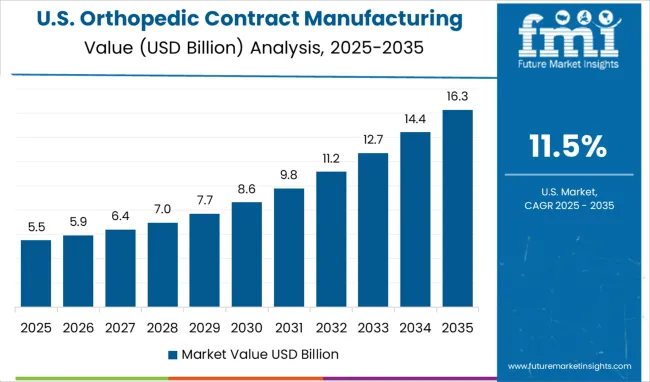

Orthopedic contract manufacturing in the USA is projected to grow at a CAGR of 11.5%, supported by the adoption of advanced manufacturing technologies and emphasis on regulatory compliance. Competition involves providers delivering comprehensive services combining precision machining, quality management systems, and supply chain reliability. Compared with China and India, adoption is more mature and technology-focused, prioritizing consistency and process optimization. Investments in automation, production precision, and regulatory expertise enhance service credibility and operational efficiency. USA manufacturers are increasingly relied upon for high-complexity orthopedic devices, integrating cutting-edge manufacturing processes with rigorous compliance protocols to ensure quality, safety, and reliability for both domestic and international markets.

Orthopedic contract manufacturing in Germany is projected to grow at a CAGR of 15.5% through 2035, supported by precision engineering, advanced production technologies, and strong focus on quality excellence. Competition is shaped by providers delivering high-quality, reliable services meeting strict regulatory requirements. Compared with China and India, adoption is more quality-driven and technologically advanced, emphasizing operational reliability. Investments in next-generation manufacturing solutions, integrated quality management, and clinical partnerships are enhancing service capabilities. German contract manufacturers are increasingly relied upon for complex orthopedic device production, leveraging expertise in precision machining, advanced materials, and regulatory compliance to maintain leadership in high-performance, innovative contract manufacturing services.

Orthopedic contract manufacturing in the UK is projected to grow at a CAGR of 12.8%, supported by rising demand for quality-focused services and comprehensive regulatory compliance capabilities. Competition involves domestic providers and international partners offering specialized solutions for orthopedic devices. Compared with China and India, adoption is moderate but emphasizes reliability, compliance, and service integration. Investments in regulatory expertise, specialized manufacturing capabilities, and comprehensive service portfolios enhance operational efficiency. British contract manufacturers are increasingly supporting orthopedic device companies by delivering precise, compliant, and scalable production solutions while meeting both domestic and international quality expectations across a range of orthopedic applications.

Orthopedic contract manufacturing in France is projected to grow at a CAGR of 14.2% through 2035, supported by innovation-focused production, advanced materials processing, and integrated service offerings. Competition emphasizes technological advancement, quality management, and premium service delivery. Compared with Germany and China, adoption emphasizes high-value, niche orthopedic applications. Investments in next-generation manufacturing technologies, research collaboration, and service integration are enhancing operational efficiency. French contract manufacturers are increasingly delivering innovative solutions that combine precision production with regulatory compliance and advanced analytics, reinforcing their position as trusted providers of high-quality orthopedic contract manufacturing services for both domestic and international medical device companies.

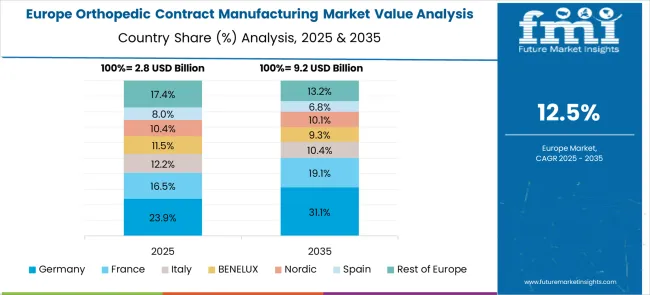

The orthopedic contract manufacturing market in Europe demonstrates mature development across major economies with Germany showing strong presence through its precision engineering capabilities and consumer appreciation for high-quality medical device manufacturing, supported by companies leveraging advanced manufacturing technologies to develop effective orthopedic contract services that address complex device requirements and stringent quality standards.

France represents a significant market driven by its medical device innovation heritage and sophisticated understanding of orthopedic manufacturing, with companies pioneering advanced contract manufacturing services that combine French engineering expertise with cutting-edge production technologies for enhanced device quality and manufacturing efficiency.

The UK exhibits considerable growth through its embrace of innovative manufacturing solutions and regulatory excellence, with companies leading the development of comprehensive contract manufacturing services and thorough customer education about manufacturing benefits and quality advantages. Italy and Spain show expanding interest in specialized manufacturing solutions, particularly in premium contract services targeting precision manufacturing and advanced materials processing. BENELUX countries contribute through their focus on technological innovation and eco-efficient manufacturing practices, while Eastern Europe and Nordic regions display growing potential driven by increasing manufacturing capabilities and expanding access to advanced orthopedic contract manufacturing services across diverse industrial sectors.

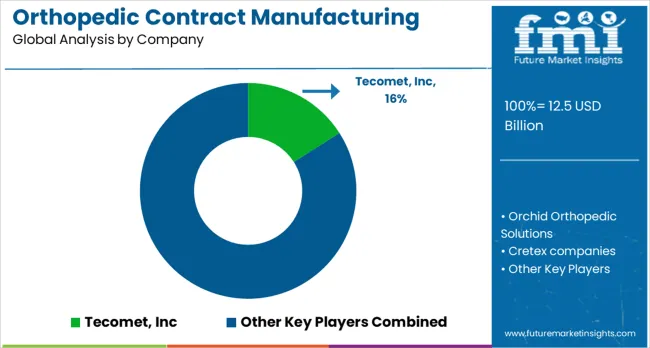

The orthopedic contract manufacturing market is characterized by precision engineering and specialized medical device expertise. Custom implants and surgical instruments are provided by Tecomet, Inc., with high-volume production capabilities. Integrated design and manufacturing workflows are applied by Orchid Orthopedic Solutions for spinal and joint implants. Cretex Companies leverages advanced machining, assembly, and finishing techniques across diverse orthopedic portfolios. Scalable manufacturing solutions for standard and patient-specific implants are offered by Viant. Quality assurance and regulatory-compliant production are emphasized by ARCH Medical Solutions Corp.

Competition is shaped by material selection, manufacturing precision, and process validation. Additive manufacturing and precision machining are utilized by Avalign Technologies to create complex implant geometries. LISI Medical delivers tight-tolerance implants and instrumentation with consistent performance. Turnkey solutions, including prototyping, tooling, and assembly, are provided by Paragon Medical. Engineering support and modular implant assembly are emphasized by Norman Noble, Inc. Automated machining and process monitoring are integrated by Autocam Medical to ensure reproducible results. Technical brochures highlight production capabilities, materials expertise, and assembly processes, guiding end users on operational reliability and product performance.

Differentiation is reinforced through process scalability, regulatory compliance, and design flexibility. Machining, forging, additive manufacturing, and assembly processes are consistently demonstrated in promotional material. Quality certifications, validation protocols, and customization options are highlighted for enhanced confidence. Modular designs, rapid prototyping, and monitored workflows are emphasized to showcase market positioning. Regional production capabilities, engineering expertise, and technical support are presented to reinforce reliability and mission-focused outcomes. Product brochures serve as concise evidence of competitive strategy, highlighting precision, process excellence, and consistent delivery across orthopedic applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 12.5 billion |

| Type Outlook | Implants, Instruments, Cases, Trays, Others |

| Service Outlook | Forging/Casting, Machining & Finishing, Other Services |

| Channel | Direct Sales, Distributors, Online Platforms, Healthcare Facilities |

| Company | Tecomet Inc., Orchid Orthopedic Solutions, Cretex Companies, Viant, ARCH Medical Solutions Corp., Avalign Technologies, LISI Medical, Paragon Medical, Norman Noble, Inc., Autocam Medical |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Tecomet Inc., Orchid Orthopedic Solutions, Cretex Companies, Viant, ARCH Medical Solutions Corp., Avalign Technologies, LISI Medical, Paragon Medical, Norman Noble, Inc., and Autocam Medical |

| Additional Attributes | Dollar sales by manufacturing service type and complexity level, regional demand trends, competitive landscape, customer preferences for integrated versus specialized services, technology adoption patterns, quality management system integration, innovations in advanced manufacturing, automation technologies, and eco-efficient production practices |

The global orthopedic contract manufacturing market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the orthopedic contract manufacturing market is projected to reach USD 44.3 billion by 2035.

The orthopedic contract manufacturing market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in orthopedic contract manufacturing market are implants, instruments, cases and trays.

In terms of service outlook, forging/casting segment to command 33.0% share in the orthopedic contract manufacturing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Veterinary Orthopedic Injectable Drug Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA