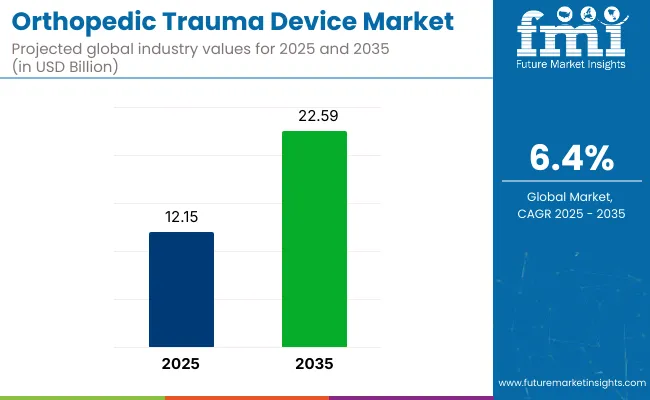

The global orthopedic trauma device market is valued at USD 12.15 billion in 2025 and is projected to register USD 22.59 billion by 2035, which shows a CAGR of 6.4% during the forecast period. This growth is being driven by the increasing incidence of fractures, sports injuries, and road accidents, along with rising orthopedic surgical volumes among aging populations.

Orthopedic trauma devices, including plates, screws, intramedullary nails, and external fixators, are essential for stabilizing fractured bones and enabling early mobility. With advancements in surgical procedures and post-operative care, hospitals and trauma centers are accelerating the adoption of high-performance implants and fixation systems to improve patient outcomes.

Technological innovation is playing a pivotal role in expanding the scope and effectiveness of trauma care. The integration of 3D printing, robotic-assisted surgery, and bioresorbable materials is enabling more precise and patient-specific treatment options.

Manufacturers are focusing on lightweight, corrosion-resistant materials such as titanium alloys and carbon fiber composites to enhance biocompatibility and reduce the risk of implant-related complications. Modular and minimally invasive systems are also gaining traction for their ability to reduce surgical time, lower infection risk, and support faster recovery. As outpatient surgical centers grow in number, the demand for efficient, easy-to-use orthopedic trauma devices is rising across both developed and emerging markets.

Regulatory agencies such as the USA, FDA and the European Medicines Agency continue to update clinical guidelines and device approval pathways, ensuring product safety and performance. In emerging economies, increasing healthcare expenditure, improved trauma care infrastructure, and insurance coverage expansion are fueling market entry opportunities.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.15 billion |

| Industry Value (2035F) | USD 22.59 billion |

| CAGR (2025 to 2035) | 6.4% |

Meanwhile, governments are launching national injury prevention and orthopedic care initiatives to reduce the long-term burden of musculoskeletal disorders. With continued innovation, growing surgical expertise, and supportive regulatory frameworks, the orthopedic trauma device market is expected to experience steady and sustained growth from 2025 to 2035.

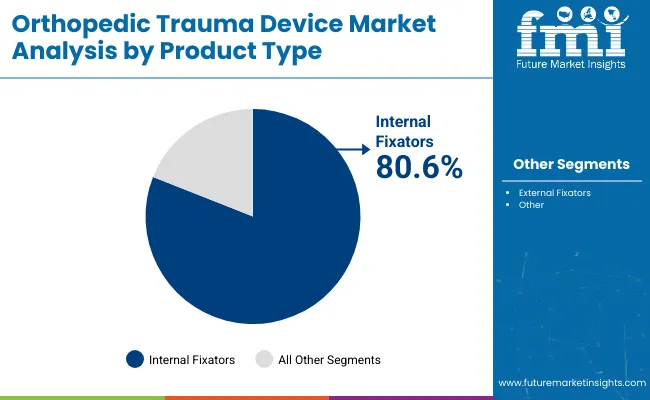

The market is segmented based on product type, end user, and region. By product type, the market is categorized into internal fixators and external fixators. Internal fixators are further segmented into screws, intramedullary nails, plates, and others, while external fixators include unilateral fixators, circular fixators, and hybrid fixators.

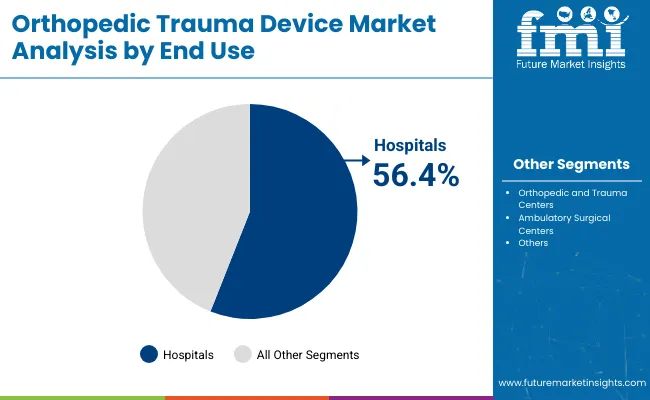

In terms of end user, the market is segmented into hospitals, orthopedic and trauma centers, and ambulatory surgical centers. Regionally, the orthopedic trauma device market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The internal fixators segment is projected to lead the orthopedic trauma device market in 2025, accounting for 80.6% of the total revenue share. These devices offer high patient comfort, stability, and faster post-surgical recovery, making them the preferred choice for treating severe fractures. Internal fixators include plates, screws, intramedullary nails, and supplementary components such as wires and staples.

Among these, plates and screws are expected to hold the largest sub-segment shares due to their versatility and ease of use in various anatomical regions. The rise in road accidents, sports injuries, and osteoporosis-related fractures contributes to the growing demand for surgical interventions using internal fixators.

External fixators, including unilateral, circular, and hybrid types, continue to support trauma care where minimally invasive or temporary stabilization is required. These devices are especially useful in open fractures or complex orthopedic cases where wound access and adjustability are crucial. While their share remains secondary, their relevance is sustained in pre-operative and emergency settings.

Additionally, the adoption of external fixators is supported by their application in pediatric orthopedics, limb lengthening, and battlefield medicine. However, internal fixators continue to be the gold standard due to their proven effectiveness and compatibility with modern surgical techniques. The external fixators segment registers 19.4% share.

| Product Type | Share (2025) |

|---|---|

| Internal Fixators | 80.6% |

Hospitals are projected to dominate the orthopedic trauma device market in 2024, holding 56.4% revenue share. Their dominance stems from well-equipped surgical units, skilled orthopedic professionals, and the availability of advanced imaging and diagnostic tools for fracture management. Hospitals remain the first point of treatment following accidents or traumatic injuries, making them essential in the deployment of internal and external fixation systems.

The expansion of hospital infrastructure in emerging economies and the increasing incidence of high-impact road injuries and falls among the elderly further reinforce demand across this end user group. Orthopedic and trauma centers are expected to maintain steady growth, particularly in urban regions with specialized care networks.

These centers cater to elective and complex orthopedic procedures, supported by multi-disciplinary teams. Their precision in treating joint, spine, and limb trauma cases positions them as key users of high-performance fixation devices. Ambulatory surgical centers (ASCs) continue gaining popularity for low-risk procedures due to reduced costs and shorter recovery times.

These facilities offer outpatient care with increasing adoption of minimally invasive orthopedic techniques, making them an appealing alternative for younger and mobile patient populations. As healthcare systems prioritize efficiency, all three end-user types play pivotal roles in expanding access to trauma care solutions. The orthopedic and trauma centers segment accounts for 23% share.

| End User | Share (2025) |

|---|---|

| Hospitals | 56.4% |

Orthopedic Devices in the Spotlight as Road Injuries Rise Globally! Orthopedic trauma surgery equipment demand is rising due to an increase in fractures, sports injuries, and car accidents. Implants are commonly necessary for bone fixation in orthopedics.

Over time, the traumatic injury implants’ components have evolved from being inert to taking on the form of the bone. Consequently, biocompatible, bioactive, and absorbable materials have been produced.

Orthopedic Trauma Treatment Soar as Aging Population Faces Osteoporosis Challenges! The aging population is another factor fueling the market for orthopedic trauma devices. This shift in the population highlights the necessity for trauma devices that are specifically designed to meet the demands of elderly patients, which is expected to propel the market.

Fracture Fixation Devices are in Demand as Sports Injuries Skyrocket! Given the rising incidence of sports-related injuries, the orthopedic trauma device market is likely to boom in the upcoming years.

New Implant Materials Take Center Stage in Orthopedic Advancements! The introduction of new implant materials is shaping the orthopedic trauma devices market trends.

3D Printing Technology is Transforming Musculoskeletal Injury Treatment! Although there is still much to learn about orthopedics, the rapid advancement and use of 3D printing technology are greatly helping this medical field.

In underdeveloped economies, a lack of awareness could slow down the growth of the orthopedic trauma device market.

Challenges include a shortage of skilled medical professionals, expensive orthopedic trauma surgical instruments, and an unfavorable reimbursement scenario in developing nations. Additionally, the market faces hurdles due to increasing product recalls and post-surgical complications, hindering its growth.

From 2020 to 2024, the global orthopedic trauma device industry showed promising growth, boasting a 7% CAGR. During this period, orthopedic trauma device sales increased as more advanced implants strengthened with long-lasting surgical-site infection prevention qualities were developed.

The market for orthopedic trauma devices is expected to exhibit a lower CAGR compared to the historical period. Changes in market dynamics, increased competition, and evolving consumer preferences are among the key elements likely to influence the anticipated lower CAGR. Advancements in alternative treatments are also projected to contribute to this trend.

| Historical CAGR (2020 to 2024) | Forecasted CAGR (2025 to 2035) |

|---|---|

| 7% | 6.4% |

Top companies making orthopedic trauma devices might find exciting opportunities in the forecast period. These include a growing need for trauma and orthopedic surgeries, more funds for advanced trauma care, and the continuous creation of new, efficient orthopedic trauma care products. The rise of digital orthopedics is also expected to positively impact the global demand for orthopedic trauma devices.

North America stands out as a dominant force in the orthopedic trauma device market. Here, the demand for orthopedic trauma care products has been mainly influenced by the increasing popularity of bioresorbable plates and screws.

Europe and Latin America are witnessing continuous and steady growth in demand for orthopedic trauma devices. The market is growing in these two areas due to expenditures made in the development of high-quality orthopedic trauma devices.

There is likely to be significant growth in the Asia Pacific orthopedic trauma device industry. Advancements in healthcare infrastructure and an aging population further drive the market expansion.

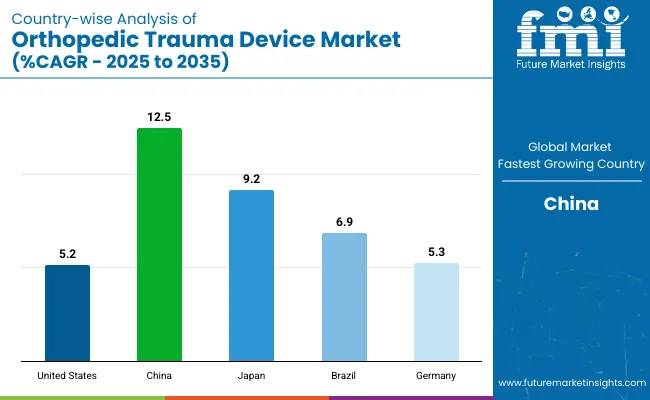

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| China | 12.5% |

| Japan | 9.2% |

| Brazil | 6.9% |

| Germany | 5.3% |

Demand for orthopedic trauma devices in the United States is set to rise with an anticipated CAGR of 5.2% from 2025 to 2035. Key factors influencing the demand for orthopedic devices for musculoskeletal injuries include:

An estimated 91.2 million individuals in the United States have been estimated to have arthritis. Out of them, 54.4 million have a medical diagnosis for the condition, according to a report by the Arthritis Foundation titled Arthritis. This, in turn, drives demand for bone fracture fixation tools, propelling market growth.

Well-known businesses in the industry are concentrating on growing their positions by introducing new products and diversifying their offerings. For example, in April 2023, the orthopedic and spine implant company Orthofix Medical Inc. introduced two access retractor devices to assist surgeons in doing Minimally Invasive Spine (MIS) surgeries.

The China orthopedic trauma device market is forecasted to inflate at a CAGR of 12.5% from 2025 to 2035. The primary factors bolstering the orthopedic devices market size are:

As of late, China has overtaken Japan to become the world's second-leading market for orthopedic medical products. Given that orthopedic trauma is highly prevalent in the whole country, the market is anticipated to grow significantly.

The need for complete knee replacement surgeries has been rising quickly in China due to an older population and better health insurance regulations. This simultaneously surges the adoption of orthopedic trauma devices.

Sales of orthopedic trauma devices in Japan are estimated to record a CAGR of 9.2% from 2025 to 2035. The main factors supporting the orthopedic trauma fixation devices market are:

In Japan, about 3 million orthopedic procedures were carried out in total in 2022. Japan's aging population is predicted to cause this figure to climb dramatically in the upcoming years. With 29.1% of its population 65 years of age or over as of 2022, Japan has the maximum percentage of senior individuals globally.

The use of these devices is anticipated to increase due to continuous technical developments to create solutions that improve patient outcomes. In Japan, Medtronic plc introduced the Demineralized Bone Matrix (DBM) Grafton™ bone grafting device in March 2019 for orthopedic and spine operations.

Brazil's orthopedic trauma device market is likely to exhibit a CAGR of 6.9% from 2025 to 2035. Reasons supporting the growth of trauma implants market in the country include:

Brazil has an extremely high rate of sports injuries. Orthopedic injuries are more common among advanced Brazilian Jiu-Jitsu (BJJ) athletes. BJJ players sustain 308 injuries for every 1,000 competitors annually. This creates a potential market for orthopedic trauma devices.

Brazil's aging population has also driven the demand for orthopedic devices. Brazil has seen a sharp increase in its senior population in the past year. As a result of this, manufacturers find it to be a lucrative market.

The Germany orthopedic trauma device market is expected to surge at a CAGR of 5.3% from 2025 to 2035. Top factors supporting the trauma care centers market expansion in the country include:

The areas of traumatology and orthopedics are well-developed in Germany. The orthopedic hospitals in Germany are regarded as among the finest globally. Every year, thousands of patients from different countries go to Germany for orthopedic care, which is anticipated to fuel market expansion.

Germany's market is well-established. Thus, producers are attempting to take a revenue share of orthopedic trauma devices by releasing new products quickly. GMedical GmbH declared the release of their innovative ART® Fixation System in June 2022. The idea is to give the surgeon fracture fixation devices that can allow them to do dorsal spinal stabilizations successfully.

Start-ups are making innovations in orthopedic trauma devices by focusing on strategic approaches such as developing advanced materials for implants, leveraging 3D printing for personalized solutions, and emphasizing minimally invasive techniques.

For instance, Belgium-based Spentys offers orthopedic immobilization devices for sale. This technology allows surgeons to develop orthoses personalized to each patient affordably by designing 3D-printed devices specifically for orthopedic patients.

Since the orthopedic trauma device market is highly competitive, companies strive to innovate and differentiate. Strategies include leveraging advanced materials and technologies, expanding distribution networks, and forging strategic partnerships.

Their aim is to capture a larger share through targeted marketing initiatives and provide comprehensive solutions.

Recent Developments

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 12.15 billion |

| Projected Market Size (2035) | USD 22.59 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Product Type | Internal Fixators (Screws, Intramedullary Nails, Plates, Others), External Fixators (Unilateral Fixators, Circular Fixators, Hybrid Fixators) |

| By End User | Hospitals, Orthopedic and Trauma Centers, Ambulatory Surgical Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | Invibio Ltd., OsteoMed, Weigao Group Co Ltd., Arthrex, Inc., Johnson & Johnson Company, CONMED, Stryker Corporation, Zimmer Holding Inc., NuVasive, Medartis, Olympus Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The orthopedic trauma device market is expected to grow from USD 12.15 billion in 2025 to USD 22.59 billion by 2035, reflecting a CAGR of 6.4% over the forecast period.

Internal fixators are projected to dominate with 80.6% of the total market share in 2025, led by strong adoption of plates, screws, and intramedullary nails for complex fracture stabilization.

Hospitals are expected to lead the market with 56.4% revenue share in 2025, owing to comprehensive trauma care facilities, skilled personnel, and infrastructure for advanced orthopedic surgeries.

China is projected to grow at a CAGR of 12.5% from 2025 to 2035, driven by increasing knee replacement surgeries, expanded insurance access, and a large aging population.

Major players include Johnson & Johnson, Stryker Corporation, Zimmer Holding Inc., Arthrex Inc., Olympus Corporation, CONMED, Invibio Ltd., NuVasive, and Medartis leading innovations in internal and external fixation systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End User, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End User, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA