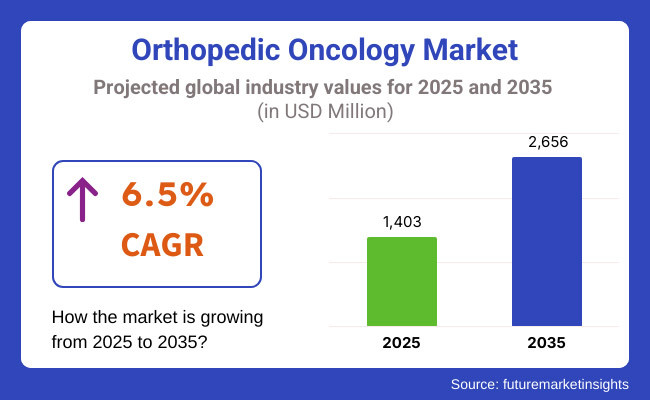

The Orthopedic Oncology market is expected to reach approximately USD 1,403.0 million in 2025 and expand to around USD 2,656.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period.

Market for orthopedic oncology has steady growth due to rising numbers of bone cancers, increasing acceptance of limb-salvage procedures, and advancements in 3D-printed but patient-specific implants. All about improving long-term outcomes with developed bioengineered and stem cell-based solutions in bone regeneration as they reduce revision surgery.

The markets are furthermore expanded through the improvement of healthcare infrastructure, government initiatives, and burgeoning medical tourism. Current trends include biodegradable implants, robotic-assisted tumor resections performed on a person, and precise oncology methods to enhance treatment efficiency.

However, these gains are often shadowed by challenges like high costs of treatment and restricted access in economically-poor areas. Sustained innovation and augmented investments in healthcare will result in continued growth for the market.

Development makes a great significant change in the market of orthopedic oncology by the way of limb salvage procedures, modular implant systems, and fine movements in surgical techniques. Cancerous conditions of bones were basically treated by amputating them; however, endoprosthetic reconstitutions were introduced at the later part of the 20th century, which changed the scenario for patients very much. Custom-made implants and modular tumor prostheses are now being built by commercial companies to have better limb preservation.

Implant endurance and gaining more personalized construction were improved further through 3D printing and biocompatible materials. Techniques of minimally invasive surgery did have a space to gain importance with decreased recovery times. Innovations in bone grafting and biological fixation improved integration and longevity.

The provision of intraoperative imaging and robotics improved the accuracy and precision of surgery yet further decreased the probabilities of malignancy recurrence. These technological evolutions changed the area of orthopedic oncology with the improved functionality, survivability, and quality of life post surgery for people suffering from bone cancer.

The very high incidence of bone cancers in North America is a major propellant of the orthopedic oncology market, driving demand for sophisticated treatment options. The increasing prevalence of osteosarcoma, Ewing sarcoma, and metastatic bone conditions requires enhanced surgical procedures, such as limb salvage surgery, modular tumor implants, and bone grafting methods.

As more patients need specialist treatment, healthcare professionals are making investment in state-of-the-art orthopedic oncology treatments to ensure improved survival rates and quality of life after surgery. With the existence of pioneering cancer centers and orthopedic oncology units with specialist expertise, there is improved access to advanced implants and surgical resection devices, stimulating market growth. The rising case load further stimulates constant research and development in bone tumor treatments.

Europe's orthopedic oncology market is, however, flourishing due to a vast variety of research and clinical tests on biodegradable implants, bone graft substitutes, and robotic-assisted surgeries. Researchers are now developing biodegradable implants that gradually get accepted by the natural bone, thereby minimizing the need for further revision surgeries.

Advanced bone graft substitutes, inclusive of synthetic and bioceramic materials, will improve bone regeneration and structural support in tumor resection patients. Robotic-assisted systems give better precision for tumor removal and implant placement, with fewer complications and better long-term results.

Further, European regulatory bodies and institutions for health care support clinical trials to expedite the approval and adoption of next-generation orthopedic oncology technologies. The innovations working in synergy are increasing the prospects of success in limb salvage procedures and improving patient care: this is a growth driver for the market.

Regional heterogeneity in the Asia-Pacific orthopedic oncology setting is, however, driven by growth in local implant manufacturing with an increasing number of domestic companies capable of producing reasonably priced, patient-specific prostheses and modular tumor implants. By cutting down the importation of such implants at high charges, these factors draw antiquities into a realm where limb salvage and tumor reconstruction are foreseeable options for a wider patient populace.

India, China, and South Korea are developing into important regional hubs for manufacturers concentrating on customized, 3D-printed implants with biocompatible materials, promising to ensure better surgical outcome profiles. Innovation in affordable tumor prostheses of acceptable quality is being supported by government efforts and collaboration among medical institutions and local companies, providing a further impetus to development and accessibility of treatments in the entire region.

Challenges

Advanced Tumor Implants and Reconstruction Surgeries Are Expensive Limiting Access in Regions with Poor Healthcare Reimbursement.

Treatments for limb salvage are highly expensive, which poses a major hurdle in the orthopedic oncology market. Tumor implants are today advanced and modular prosthesis as well as reconstruction surgeries require expensive materials and specially trained surgeons. Patients with little healthcare reimbursement policies would take it upon themselves to seek such life-saving treatments, delaying such interventions or, much worse, opting for liberal amputation as the more inexpensive alternative.

Customized implants, including 3D-printed prosthetics and biocompatible materials, add to this cost. The extent at which healthcare providers and patients are financially burdened thus fosters further restriction on access to avant-garde limb-preservation techniques, emphasizing the pressing need to come up with better cost-effective implant fabrication and improved insurance coverage for better accessibility.

Opportunities

Innovations in Biodegradable Bone Grafts and Implants Reduce the Need for Revision Surgeries, Enhancing Long-Term Patient Outcomes.

The muscles to surgical site loads applied on biodegradable implants have truly revolutionized the orthopedic oncology sector and formed a commendable alternative to metallic implants. These implants are manufactured using bioceramics, polymer composites, and bioresorbable materials, all of which gradually dissolve and integrate with the patient’s natural bone, diminishing the risk for complications in the long run: implant loosening or rejection.

Secondary surgeries on one side may possibly be obviated by the use of biodegradable bone grafts, and thus these not only allow for a wipeout in patient recovery time but also a sharp decrease in overall healthcare expenditure. Research and clinical trials are ongoing to enhance mechanical strength, biocompatibility, and controlled degradation rate; hence, these implants mark a significant innovation in limb salvage techniques.

Emerging Trends

Expansion of Bioengineered and Stem Cell-Based Bone Regeneration Solutions

Bone regeneration products that are bioengineered or derived from stem cells are revolutionizing the orthopedic oncology market atmosphere and providing new solutions for bone reconstruction following tumor resection. Stem cell-derived therapies will utilize mesenchymal stem cells (MSCs) in conjunction with bioengineered scaffolds to invoke an in situ mechanism of bone formation while minimizing any requirement for conventional grafts or implants.

Regenerative products improve bone integration, accelerate healing, and mitigate post-surgical complications, thereby reducing issues of implant failure or non-union. In addition, other tissue engineering technologies, such as bioprinted bone scaffolds and growth factor-enriched matrices, will have enhanced outcomes. In the near future, with the advancement of research, stem cell-based bone regeneration will become a primary solution for limb salvage and orthopedic oncology procedures.

Advancements in 3D-Printed and Patient-Specific Orthopedic Implants

In the orthopedic oncology market, technological advances in 3D printing and patient-specific orthopedic implants are ushering a new era of individualized, biocompatible choices that improve surgical precision and enhance patients' well-being. Thus implants are manufactured to fit any specific implant to the anatomy of the particular patient, producing a better fit, thus shortening the surgical time and improving long-term functioning.

These biocompatible implants made of titanium and bioceramics or polymer composites encourage better integration and decrease the chances of rejection or loosening of the same. They also aid in more accurate planning of complex tumor resections due to the rapid prototyping process, thus reducing complications. As research continues, cheaper production will ensure the further realization of 3D-printed implants, which will act as a strong market enhancer.

The orthopedic oncology market has grown over the years, from 2020 up to present, spurred by the increasing number of cases of primary and metastatic bone tumors, advancements in diagnostic imaging, and greater acceptance of personalized treatment. With advances in minimally invasive surgery, prosthetic limb design, and target therapy, improved patient outcomes were experienced. Furthermore, with public awareness of early cancer detection growing, this began to work on behalf of treatment demand.

The market that was to be forecasted in 2025-to to 2035 for orthopedic oncologies will be dynamically altered due to advances in precision medicine, artificial intelligence-assisted imaging for early detection, and next-generation prosthetics and implants with superior biocompatibility.

The success rate of tumor medicine in orthopedic surgeries, too, is expected to improve, as regenerative medicine concepts and 3D printing get underway. With expanding health infrastructure in developing markets, specialized oncology treatments will become more accessible. Eco-friendly manufacturing processes and biodegradable materials interface ought to be the new sustainable initiative.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Standardized guidelines for orthopedic oncology treatments and implant approvals. |

| Technological Advancements | Adoption of minimally invasive tumor resection techniques and targeted therapies. |

| Consumer Demand | Increasing preference for limb-sparing surgeries and personalized treatment options. |

| Market Growth Drivers | Rising bone cancer cases, enhanced imaging technologies, and government-funded cancer programs. |

| Sustainability | Initial steps toward eco-friendly implant materials and reduced surgical waste. |

| Supply Chain Dynamics | Dependence on major medical device suppliers for oncology implants and surgical tools. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter safety regulations with accelerated approvals for precision medicine and AI-driven therapies. |

| Technological Advancements | Advancements in 3D-printed implants, regenerative medicine, and AI-assisted diagnostics. |

| Consumer Demand | Growing demand for biologically integrated prosthetics and early-stage cancer interventions. |

| Market Growth Drivers | Expansion of healthcare infrastructure, increasing use of AI in oncology, and advancements in robotics. |

| Sustainability | Large-scale adoption of biodegradable implants and energy-efficient manufacturing processes. |

| Supply Chain Dynamics | Strengthening of localized manufacturing and increased collaboration between biotech and medtech firms. |

Market Outlook

Bone cancers occur frequently, and a well-developed healthcare system complements the existence of key players-Stryker, Zimmer Biomet, and Johnson & Johnson (DePuy Synthes)-in making the United States the largest orthopedic oncology business. Research facilities are now innovating limb salvage techniques, 3D-printed implants, and bioengineered bone grafts.

Besides, reimbursement schemes favor high healthcare expenditure, and thus, the latest technologies have been introduced in tumor resection and reconstruction. Increased investment in cancer, robotic surgery, and precision oncology will only do more to stimulate growth in the USA market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

China's orthopedic oncology market is growing with lightning speed with an ever-increasing incidence of bone cancers, burgeoning healthcare infrastructure, and government funding toward oncology research and surgical activities. The outcomes of treatments are being greatly improved with a higher acceptance of 3D-printed implants, modular prostheses, and degradable bone grafts. Additionally, home producers of medical devices are boosting their local manufacturing and cutting down on imports.

The government's attempts to raise oncology standards, easy detection of cancers, and centers specializing in orthopedics are other factors enhancing the development of this market. Growing medical tourism for bone cancer and public-private partnerships in research and clinical trials fashions another layer of innovation in China's orthopedic oncology sector.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.5% |

Market Outlook

India's orthopedic oncology market is witnessing growth because of increase incidence of bone tumors, growth of medical tourism, and government funding in cancer care. Availability of low-cost limb-salvage procedures and the development of domestic implant manufacturers have made them more accessible.

The foremost hospitals are exhibiting 3D printed prostheses, biologic bone grafts, and robotic-assisted tumor resections which have given a quagmire of benefits to patients. In addition, initiatives of government like Ayushman Bharat are making treatment of cancer more affordable. With increased concentration on regenerative medicine and collaborative research in orthopedics, India is set to be a developing hub for advanced yet cheap orthopedic oncology treatments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

Market Outlook

Germany finds itself in the top position with regard to orthopedic oncology and supported by strong research institutions together with advanced surgical technologies as well as a well-established healthcare infrastructure in the country. The leading market for biodegradable implants, 3D-printed prosthetics and regenerative bone therapies, Germany drives the ongoing expansion of the market for orthopedic oncology.

Dispersed in the country are the primary manufacturers, including Zimmer Biomet and Exactech, which will ensure availability in terms of high-quality tumor implants and reconstructive solutions. Furthermore, government funding in clinical trials and cancer research initiatives further accelerates the innovations in limb-salvage procedures. This focus on precision medicine and robotic-assisted surgeries promises improved treatment outcomes in generating a more significant European market for orthopedic oncology solutions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

Market Outlook

The orthopedic oncology industry within the UK is relatively stable and strong with a lot more patients suffering from bone cancers; there will be increasing investigations in regenerative therapies and increasing numbers of patient-specific implants. The NHS is keen to avail innovative limb salvage operations, modular prostheses, and biologic reconstructions.

Today, the UK is venturing into stem cell-mediated regrowth of bone, engineering of tissues, and robotic assistance in orthopedic procedures, leading to better patient outcomes among others. Certainly, the presence of very reputable cancer research institutions and affiliations with the leading orthopedic market players will hasten the growth of the market and set the UK as a leader among the few markets in introducing new orthopedic oncology therapies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Limb-Salvage Surgery is Significantly Improving Patient Quality of Life Compared to Amputation.

The tale starts with a critical treatment for bone tumors whereby limb-salvaging amputations are done with tumor resection, and reconstruction may be performed with prostheses, allografts, or endoprostheses. The advantages limb salvage treatment affords include its contribution to the preservation of limb function, limiting amputations, and improving the quality of life for patients diagnosed with osteosarcoma, chondrosarcoma, and Ewing's sarcoma.

Increasing primary bone cancer incidence and innovation in 3D-printed tumor prostheses and biological reconstruction methods acceptance are promising for this market. North America and Europe are said to be the most advanced in limb salvage surgery due to established orthopedic oncology centers and heavy investment in new reconstructive implants while the Asia-Pacific region stands to grow for increasing availability of orthopedic cancer specialist treatments.

Radiation Therapy Provides an Effective Treatment Option for Bone Tumors, Reducing The Need for Complex Surgical Procedures.

Amid all this, radiation therapy is also one of the best modalities in oncology and orthopedics for pre-operative reduction of operative issues, the control of inoperable cases, or the reduction of recurrence risks. Such techniques as intensity-modulated radiation therapy (IMRT) and proton therapy afford the possibility of target application to the bone tumor with relative sparing of surrounding healthy tissue.

Noteworthy trends pushing market growth include increasing adoption of advanced radiation techniques and combination therapies as well as rising proton therapy center availability. North America and Europe are the areas that are more visible in radiation-based treatment of orthopedic cancer as these regions boast an advanced radiotherapy infrastructure. Asia-Pacific is witnessing growth in this market majorly owing to expansion in cancer treatment facilities.

The Dominance of the Primary Bone Cancer Segment Is Driven by The High Prevalence of Osteosarcoma and Ewing Sarcoma.

To treat primary bone cancers like osteosarcoma, chondrosarcoma and Ewing’s sarcoma, a multimodal approach is used, including a combination of surgery with chemotherapy and radiation therapy. Factors such as rising incidence of pediatric and adolescent bone tumors, rising investment in targeted therapies, and advancement in limb-salvage surgical techniques are fueling the growth of the market.

North America and Europe account for the majority of the primary bone cancer treatment market due to strong research funding and the implementation of early diagnosis programs, while higher demand is being observed in the Asia-pacific region owing to better cancer screening and healthcare access. Advancements on the horizon encompass gene-based therapies targeting osteosarcoma, AI-assisted histopathological analysis aimed at improving early detection, and CRISPR technologies for personalized genetic adhesion in targeting bone cancers.

The Dominance of the Bone Metastases Segment Is Driven by Its Higher Incidence Compared to Primary Bone Cancers.

Such bone metastases, more frequently emanating from breast, prostate, lung, and kidney malignancies, stand in urgent need of palliative care in the forms of bisphosphonates, radiation therapies, and minimally invasive tumor ablation techniques. The increasing incidence of metastatic bone cancers, their treatment with targeted therapies, and the escalating use of bone-stabilizing implants are driving market growth.

With best product offerings and advanced radiation treatment techniques in the pharmaceutical pipeline, North America and Europe continue to lead in the treatment of bone metastasis, while Asia-Pacific presently is experiencing a good rise in the adoption of minimally invasive palliative care.

The market for orthopedic oncology is really competitive, as bone cancers increase in prevalence and improve the need for limb-salvage surgery along with customized prosthetic implants. Therefore, major players in the area of medical devices, biotech, and specialized oncology firms are searching for each other continuously to outsmart each other.

Some of the major areas for investment are such as 3D-printed patient-specific implants that would improve the precision of surgery as well as the outcome during recovery and delivery systems for targeted chemotherapy to aid localized cancer treatment while sparing the side effects associated with the systemic drug exposure.

Companies are investing in biologically based bone regeneration solutions such as stem cell therapies and bioengineered grafts whose goal is to increase both healing rate and decreased rate of complications. Strategic collaborations and alliances, regulatory approvals and R&D spending also change the scene of orthopedic cancer therapy.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 22-26% |

| Siemens Healthineers | 18-22% |

| Koninklijke Philips N.V. | 10-14% |

| Hitachi Medical Systems | 8-12% |

| Hologic | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| GE Healthcare | Market leader offering limb salvage systems, modular tumor implants, and orthopedic oncology prosthetics. |

| Siemens Healthineers | Develops advanced orthopedic oncology implants and custom joint replacement solutions. |

| Koninklijke Philips N.V. | Specializes in bone tumor resection and reconstructive implants for orthopedic cancer patients. |

| Hitachi Medical Systems | Focuses on innovative limb reconstruction systems and precision oncology implants. |

| Hologic | Provides specialized orthopedic oncology implants for musculoskeletal tumor treatment. |

Key Company Insights

GE Healthcare (22-26%)

A dominant force in oncology imaging, GE Healthcare excels in MRI, PET, and CT technologies, offering high-resolution imaging for accurate tumor detection, staging, and treatment planning, enhancing precision oncology and patient outcomes globally.

Siemens Healthineers (18-22%)

A leader in diagnostic imaging, Siemens Healthineers provides innovative MRI, CT, and molecular imaging systems, ensuring superior cancer detection, monitoring, and therapy guidance, supporting clinicians in delivering precise, patient-centric oncology care worldwide.

Koninklijke Philips N.V. (10-14%)

A key oncology imaging provider, Philips integrates AI-driven MRI, CT, and PET solutions, enabling early tumor detection, personalized treatment planning, and improved workflow efficiency for enhanced patient management and clinical decision-making in cancer care.

Hitachi Medical Systems (8-12%)

A strong competitor in oncology imaging, Hitachi pioneers open MRI and proton therapy solutions, advancing non-invasive tumor visualization and precision radiation therapy, ensuring superior diagnostic accuracy and targeted treatment for optimal patient care.

Hologic (5-9%)

A major player in cancer diagnostics, Hologic specializes in digital mammography, breast imaging, and biopsy technologies, empowering early cancer detection, risk assessment, and patient-centric treatment pathways for improved clinical outcomes and survivability rates.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of orthopedic oncology treatments, offering competitive pricing and cutting-edge innovations to meet diverse clinical and patient needs.

Diagnostic Imaging (X-ray Imaging, MRI Imaging, CT Imaging, PET Imaging, Ultrasound Imaging), Bone Biopsy (Biopsy Needles, Biospy Trays & Kits.)

Stage I, Stage II, Stage III, Stage IV.

Osteosarcoma, Chondrosarcoma, Ewing Sarcoma and Chordroma

Hospitals, Diagnostic Centres and Specialty Orthopedic Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global orthopedic oncology industry is projected to witness CAGR of 6.5% between 2025 and 2035.

The global Orthopedic Oncology industry stood at USD 1,317.4 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 2,656.0 million by 2035 end.

China is expected to show a CAGR of 6.9% in the assessment period.

The key players operating in the global orthopedic oncology industry are GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Hitachi Medical Systems, Hologic, Shimadzu Medical Systems, Carestream Health, Canon Medical Systems, FUJIFILM Medical Systems and Ziehm Imaging.

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 04: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 05: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 08: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 09: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 10: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 13: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 14: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 15: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 18: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 19: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 20: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 21: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 23: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 24: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 25: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 26: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 27: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 28: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 29: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 30: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 31: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 33: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 34: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 35: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 36: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Diagnostic Techniques

Table 38: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Cancer Stage

Table 39: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Indication

Table 40: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Figure 1: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 2: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 3: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 4: Global Market Value Share (%) Analysis 2023 and 2033, by Diagnostic Techniques

Figure 5: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Diagnostic Techniques

Figure 6: Global Market Attractiveness Analysis 2023 to 2033, by Diagnostic Techniques

Figure 7: Global Market Value Share (%) Analysis 2023 and 2033, by Cancer Stage

Figure 8: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Cancer Stage

Figure 9: Global Market Attractiveness Analysis 2023 to 2033, by Cancer Stage

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Indication

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Indication

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Indication

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 16: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 17: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 18: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 19: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 20: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 21: North America Market Value Share, by Diagnostic Techniques (2023 E)

Figure 22: North America Market Value Share, by Cancer Stage (2023 E)

Figure 23: North America Market Value Share, by Indication (2023 E)

Figure 24: North America Market Value Share, by End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 30: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 31: U.S. Market Value Proportion Analysis, 2022

Figure 32: Global Vs. USA Growth Comparison, 2023 to 2033

Figure 33: USA Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 34: USA Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 35: USA Market Share Analysis (%) by Indication, 2022 & 2033

Figure 36: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 37: Canada Market Value Proportion Analysis, 2022

Figure 38: Global Vs. Canada. Growth Comparison, 2023 to 2033

Figure 39: Canada Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 40: Canada Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 41: Canada Market Share Analysis (%) by Indication, 2022 & 2033

Figure 42: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 43: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 44: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 45: Latin America Market Value Share, by Diagnostic Techniques (2023 E)

Figure 46: Latin America Market Value Share, by Cancer Stage (2023 E)

Figure 47: Latin America Market Value Share, by Indication (2023 E)

Figure 48: Latin America Market Value Share, by End User (2023 E)

Figure 49: Latin America Market Value Share, by Country (2023 E)

Figure 50: Latin America Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 51: Latin America Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 52: Latin America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 53: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 55: Mexico Market Value Proportion Analysis, 2022

Figure 56: Global Vs Mexico Growth Comparison, 2023 to 2033

Figure 57: Mexico Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 58: Mexico Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 59: Mexico Market Share Analysis (%) by Indication, 2022 & 2033

Figure 60: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 61: Brazil Market Value Proportion Analysis, 2022

Figure 62: Global Vs. Brazil. Growth Comparison, 2023 to 2033

Figure 63: Brazil Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 64: Brazil Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 65: Brazil Market Share Analysis (%) by Indication, 2022 & 2033

Figure 66: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 67: Argentina Market Value Proportion Analysis, 2022

Figure 68: Global Vs Argentina Growth Comparison, 2023 to 2033

Figure 69: Argentina Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 70: Argentina Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 71: Argentina Market Share Analysis (%) by Indication, 2022 & 2033

Figure 72: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 73: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 74: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 75: Europe Market Value Share, by Diagnostic Techniques (2023 E)

Figure 76: Europe Market Value Share, by Cancer Stage (2023 E)

Figure 77: Europe Market Value Share, by Indication (2023 E)

Figure 78: Europe Market Value Share, by End User (2023 E)

Figure 79: Europe Market Value Share, by Country (2023 E)

Figure 80: Europe Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 81: Europe Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 82: Europe Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 83: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 84: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 85: UK Market Value Proportion Analysis, 2022

Figure 86: Global Vs. UK Growth Comparison, 2023 to 2033

Figure 87: UK Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 88: UK Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 89: UK Market Share Analysis (%) by Indication, 2022 & 2033

Figure 90: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 91: Germany Market Value Proportion Analysis, 2022

Figure 92: Global Vs. Germany Growth Comparison, 2023 to 2033

Figure 93: Germany Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 94: Germany Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 95: Germany Market Share Analysis (%) by Indication, 2022 & 2033

Figure 96: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 97: Italy Market Value Proportion Analysis, 2022

Figure 98: Global Vs. Italy Growth Comparison, 2023 to 2033

Figure 99: Italy Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 100: Italy Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 101: Italy Market Share Analysis (%) by Indication, 2022 & 2033

Figure 102: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 103: France Market Value Proportion Analysis, 2022

Figure 104: Global Vs France Growth Comparison, 2023 to 2033

Figure 105: France Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 106: France Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 107: France Market Share Analysis (%) by Indication, 2022 & 2033

Figure 108: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 109: Spain Market Value Proportion Analysis, 2022

Figure 110: Global Vs Spain Growth Comparison, 2023 to 2033

Figure 111: Spain Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 112: Spain Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 113: Spain Market Share Analysis (%) by Indication, 2022 & 2033

Figure 114: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 115: Russia Market Value Proportion Analysis, 2022

Figure 116: Global Vs Russia Growth Comparison, 2023 to 2033

Figure 117: Russia Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 118: Russia Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 119: Russia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 120: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 121: BENELUX Market Value Proportion Analysis, 2022

Figure 122: Global Vs BENELUX Growth Comparison, 2023 to 2033

Figure 123: BENELUX Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 124: BENELUX Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 125: BENELUX Market Share Analysis (%) by Indication, 2022 & 2033

Figure 126: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 127: Nordics Market Value Proportion Analysis, 2022

Figure 128: Global Vs Nordics Growth Comparison, 2023 to 2033

Figure 129: Nordics Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 130: Nordics Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 131: Nordics Market Share Analysis (%) by Indication, 2022 & 2033

Figure 132: Nordics Market Share Analysis (%) by End User, 2022 & 2033

Figure 133: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 134: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 135: East Asia Market Value Share, by Diagnostic Techniques (2023 E)

Figure 136: East Asia Market Value Share, by Cancer Stage (2023 E)

Figure 137: East Asia Market Value Share, by Indication (2023 E)

Figure 138: East Asia Market Value Share, by End User (2023 E)

Figure 139: East Asia Market Value Share, by Country (2023 E)

Figure 140: East Asia Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 141: East Asia Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 142: East Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 143: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 144: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: China Market Value Proportion Analysis, 2022

Figure 146: Global Vs. China Growth Comparison, 2023 to 2033

Figure 147: China Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 148: China Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 149: China Market Share Analysis (%) by Indication, 2022 & 2033

Figure 150: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 151: Japan Market Value Proportion Analysis, 2022

Figure 152: Global Vs. Japan Growth Comparison, 2023 to 2033

Figure 153: Japan Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 154: Japan Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 155: Japan Market Share Analysis (%) by Indication, 2022 & 2033

Figure 156: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 157: South Korea Market Value Proportion Analysis, 2022

Figure 158: Global Vs South Korea Growth Comparison, 2023 to 2033

Figure 159: South Korea Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 160: South Korea Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 161: South Korea Market Share Analysis (%) by Indication, 2022 & 2033

Figure 162: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 163: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 164: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 165: South Asia Market Value Share, by Diagnostic Techniques (2023 E)

Figure 166: South Asia Market Value Share, by Cancer Stage (2023 E)

Figure 167: South Asia Market Value Share, by Indication (2023 E)

Figure 168: South Asia Market Value Share, by End User (2023 E)

Figure 169: South Asia Market Value Share, by Country (2023 E)

Figure 170: South Asia Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 171: South Asia Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 172: South Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 173: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 174: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: India Market Value Proportion Analysis, 2022

Figure 176: Global Vs. India Growth Comparison, 2023 to 2033

Figure 177: India Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 178: India Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 179: India Market Share Analysis (%) by Indication, 2022 & 2033

Figure 180: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 181: Indonesia Market Value Proportion Analysis, 2022

Figure 182: Global Vs. Indonesia Growth Comparison, 2023 to 2033

Figure 183: Indonesia Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 184: Indonesia Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 185: Indonesia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 186: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 187: Malaysia Market Value Proportion Analysis, 2022

Figure 188: Global Vs. Malaysia Growth Comparison, 2023 to 2033

Figure 189: Malaysia Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 190: Malaysia Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 191: Malaysia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 192: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 193: Thailand Market Value Proportion Analysis, 2022

Figure 194: Global Vs. Thailand Growth Comparison, 2023 to 2033

Figure 195: Thailand Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 196: Thailand Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 197: Thailand Market Share Analysis (%) by Indication, 2022 & 2033

Figure 198: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 199: Philippines Market Value Proportion Analysis, 2022

Figure 200: Global Vs. Philippines Growth Comparison, 2023 to 2033

Figure 201: Philippines Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 202: Philippines Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 203: Philippines Market Share Analysis (%) by Indication, 2022 & 2033

Figure 204: Philippines Market Share Analysis (%) by End User, 2022 & 2033

Figure 205: Vietnam Market Value Proportion Analysis, 2022

Figure 206: Global Vs. Philippines Growth Comparison, 2023 to 2033

Figure 207: Vietnam Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 208: Vietnam Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 209: Vietnam Market Share Analysis (%) by Indication, 2022 & 2033

Figure 210: Vietnam Market Share Analysis (%) by End User, 2022 & 2033

Figure 211: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 212: Oceania Market Value (US$ Million) Forecast, 2023-2033

Figure 213: Oceania Market Value Share, by Diagnostic Techniques (2023 E)

Figure 214: Oceania Market Value Share, by Cancer Stage (2023 E)

Figure 215: Oceania Market Value Share, by Indication (2023 E)

Figure 216: Oceania Market Value Share, by End User (2023 E)

Figure 217: Oceania Market Value Share, by Country (2023 E)

Figure 218: Oceania Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 219: Oceania Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 220: Oceania Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 221: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 222: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 223: Australia Market Value Proportion Analysis, 2022

Figure 224: Global Vs. Australia Growth Comparison, 2023 to 2033

Figure 225: Australia Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 226: Australia Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 227: Australia Market Share Analysis (%) by Indication, 2022 & 2033

Figure 228: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 229: New Zealand Market Value Proportion Analysis, 2022

Figure 230: Global Vs New Zealand Growth Comparison, 2023 to 2033

Figure 231: New Zealand Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 232: New Zealand Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 233: New Zealand Market Share Analysis (%) by Indication, 2022 & 2033

Figure 234: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 235: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 236: Middle East & Africa Market Value (US$ Million) Forecast, 2023-2033

Figure 237: Middle East & Africa Market Value Share, by Diagnostic Techniques (2023 E)

Figure 238: Middle East & Africa Market Value Share, by Cancer Stage (2023 E)

Figure 239: Middle East & Africa Market Value Share, by Indication (2023 E)

Figure 240: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 241: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 242: Middle East & Africa Market Attractiveness Analysis by Diagnostic Techniques, 2023 to 2033

Figure 243: Middle East & Africa Market Attractiveness Analysis by Cancer Stage, 2023 to 2033

Figure 244: Middle East & Africa Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 245: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 246: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 247: GCC Countries Market Value Proportion Analysis, 2022

Figure 248: Global Vs GCC Countries Growth Comparison, 2023 to 2033

Figure 249: GCC Countries Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 250: GCC Countries Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 251: GCC Countries Market Share Analysis (%) by Indication, 2022 & 2033

Figure 252: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 253: Türkiye Market Value Proportion Analysis, 2022

Figure 254: Global Vs. Türkiye Growth Comparison, 2023 to 2033

Figure 255: Türkiye Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 256: Türkiye Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 257: Türkiye Market Share Analysis (%) by Indication, 2022 & 2033

Figure 258: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 259: South Africa Market Value Proportion Analysis, 2022

Figure 260: Global Vs. South Africa Growth Comparison, 2023 to 2033

Figure 261: South Africa Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 262: South Africa Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 263: South Africa Market Share Analysis (%) by Indication, 2022 & 2033

Figure 264: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 265: Northern Africa Market Value Proportion Analysis, 2022

Figure 266: Global Vs Northern Africa Growth Comparison, 2023 to 2033

Figure 267: Northern Africa Market Share Analysis (%) by Diagnostic Techniques, 2022 & 2033

Figure 268: Northern Africa Market Share Analysis (%) by Cancer Stage, 2022 & 2033

Figure 269: Northern Africa Market Share Analysis (%) by Indication, 2022 & 2033

Figure 270: Northern Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

Orthopedic Prosthetics Market Analysis - Size, Share, and Forecast 2024 to 2034

Orthopedic Power Tools Market Insights – Growth & Forecast 2024-2034

Orthopedic Braces & Support Market – Trends, Growth & Forecast 2024-2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Veterinary Orthopedic Injectable Drug Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA