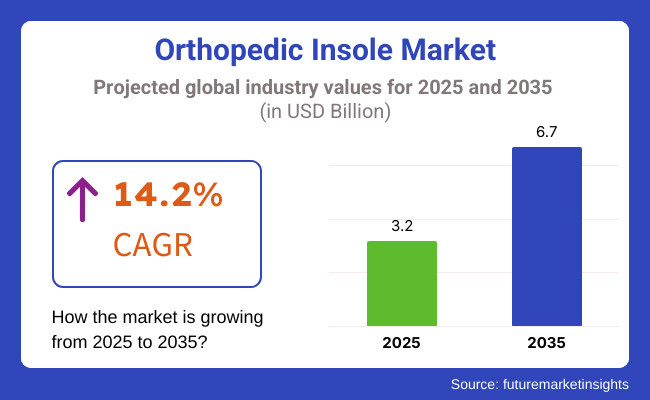

The orthopedic insole market is projected to grow from USD 3.2 billion in 2025 to USD 6.7 billion by 2035. Demand for orthopaedic insole, also known as, foot orthotic insole, is expected to rise at a CAGR of 14.2% through 2035. Growth is driven by increasing awareness of foot health, rising incidences of orthopedic disorders, and advancements in material technology.

Foot health awareness campaigns by organizations such as the American Podiatric Medical Association (APMA) have contributed to increased consumer interest in preventive care. Studies published in the Journal of Foot and Ankle Research(2023) demonstrate that customized orthopaedic insoles reduce plantar pressure and improve gait biomechanics in patients with flat feet and plantar fasciitis, underscoring their therapeutic value.

Leading brands including Dr. Scholl’s and Superfeet have launched R&D initiatives focusing on 3D-printed custom insoles and smart pressure-sensing devices. In 2024, Dr. Scholl’s introduced a proprietary gel compound that showed a 25% improvement in shock absorption during independent laboratory testing conducted by SGS, a global certification company in the foot orthotic insole market.

Dr. Scholl’s CEO, Jason Wilson, stated in 2024-" Innovation in orthopaedic insoles is critical to meeting the evolving needs of consumers seeking effective, comfortable foot care solutions. Our investment in material science and digital health integration reflects our commitment to improving mobility and quality of life."

The geriatric population, particularly in North America and Europe, is increasingly adopting orthopaedic insoles to manage age-related musculoskeletal conditions. Simultaneously, emerging economies like India and China report rising sedentary lifestyles and obesity rates, fueling demand for supportive foot care products.

Regulatory bodies such as the USA Food and Drug Administration (FDA) classify custom orthopaedic insoles as Class I medical devices, requiring compliance with stringent safety and efficacy standards. Clinical trials and post-market surveillance data are regularly reviewed to ensure product quality and consumer safety.

Technological innovation is advancing with smart insoles integrating Bluetooth-enabled pressure sensors, allowing real-time gait monitoring and feedback through mobile health apps. This technology has been clinically validated in a 2023 study by the Mayo Clinic, confirming improvements in patient mobility and injury prevention.

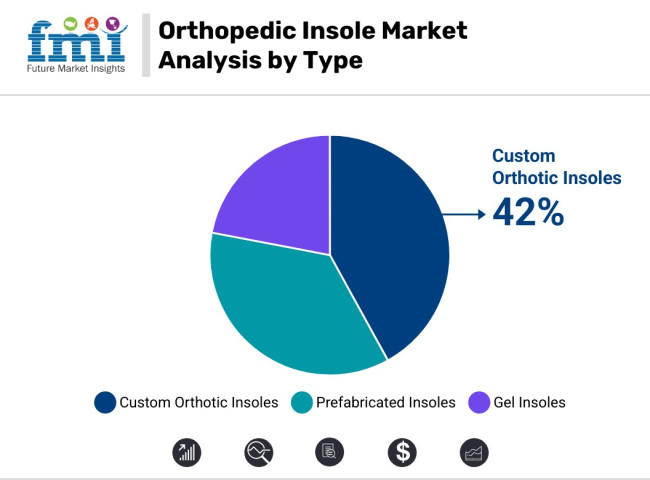

Market segmentation highlights custom orthopaedic insoles as a key growth driver due to their personalized fit and therapeutic benefits. Off-the-shelf insoles remain popular for general foot support, while specialty insoles target diabetic foot care and sports injury prevention. As global focus on preventive healthcare intensifies, the orthopedic insole market is poised to become a vital component of musculoskeletal health management, improving patient outcomes and quality of life worldwide.

The orthopedic insole market continues to grow as healthcare awareness rises and consumer preferences shift toward comfort, mobility, and preventive care. Products are designed to address both clinical and lifestyle needs, with companies focusing on improved materials, customized fittings, and ergonomic benefits. Demand is shaped by increasing diagnoses of foot-related conditions, the expansion of sports orthotics, and the availability of insoles through both physical and digital channels.

Custom orthotic insoles account for approximately 42% of the market share in 2025. Growth is driven by increasing clinical demand for tailored fit and biomechanical correction. These insoles are manufactured using digital foot scans and pressure mapping. Aetrex Worldwide Inc. designs precision standards through its Albert 2 Pro 3D foot scanner, a tool now widely adopted in orthopedic clinics.

Bauerfeind AG continues to lead in specialist care across Europe with its ViscoPed insoles, known for supporting postural alignment and reducing pressure on the heel and forefoot zones. Conditions such as plantar fasciitis, diabetic neuropathy, and arthritis are commonly addressed with custom insoles.

Prefabricated insoles capture a 36% share due to lower cost and wide availability. Dr. Scholl’s maintains strong visibility in pharmacies with insoles tailored to relieve foot fatigue and arch strain. Superfeet expanded its prefabricated line with Run Comfort and Hike Cushion insoles, targeting users seeking non-clinical but high-performance support.

Online retailing contributes to 35% of total orthopedic insole sales in 2025. This growth is led by increased digital adoption, broad product range, and user-generated reviews. Tynor Orthotics Pvt. Ltd. expanded its global footprint through major e-commerce platforms like Amazon and Flipkart, supplying orthopedic-grade insoles across urban and semi-urban regions.

Direct-to-consumer brands such as WalkHero and ProFoot gained market share through digital-first strategies and subscription models. Pharmacies and drugstores account for 25% of the sales channel in 2025, favored for in-person access and immediate availability.

Dr. Scholl’s and Scholl’s Footcare continue to dominate shelf space across North America and Europe, leveraging long-standing consumer trust. The remaining 40% of sales came from hospital pharmacies and specialty clinics.

Custom Orthotics Laboratories Australia Pty Ltd. partnered closely with podiatry centers to deliver condition-specific insoles designed for medical efficacy. Ottobock SE & Co. KGaA, a global leader in prosthetics, distributed insoles through rehabilitation networks to assist patients recovering from lower-limb surgeries and amputations.

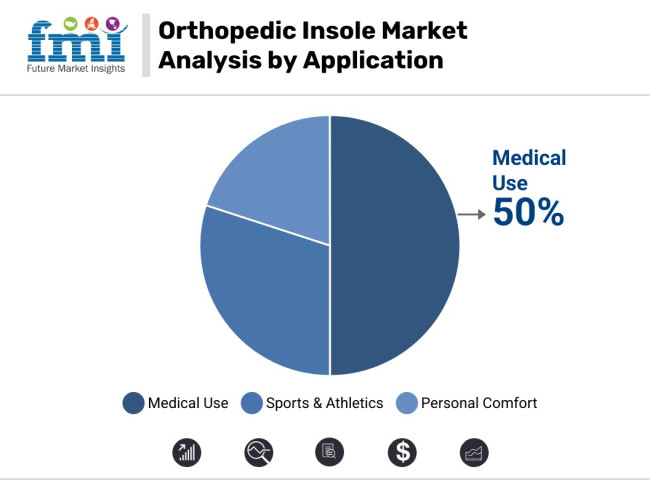

Medical applications dominate the market with a 50% share, supported by prescriptions for long-term foot disorders. Chronic pain management and post-operative care rely heavily on custom and semi-rigid insoles. Hanger Inc. distributes its SureStep pediatric insoles through orthopedic clinics across the United States, where the product is widely used to support developmental gait correction. Vasyli Medical delivers podiatrist-endorsed alignment solutions for patients with biomechanical imbalances.

Sports and athletic applications hold 30% of the total demand in 2025. Powerstep’s PULSE Performance line emerged as a preferred choice among gym enthusiasts and runners for its shock absorption and arch control capabilities. Superfeet introduced specialized models for cleated footwear and trail running, designed to reduce joint fatigue and enhance ground stability.

The remaining 20% comes from comfort-seeking consumers. Birkenstock provided cork and gel-based ergonomic footbeds for professionals, especially in occupations requiring prolonged standing, such as retail and education, ensuring consistent posture support.

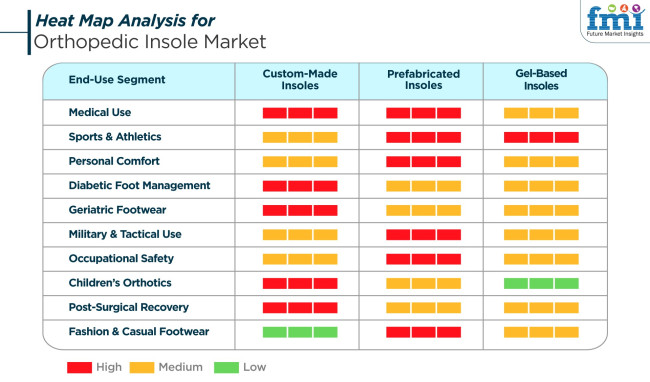

The heat map analysis of the orthopedic insole market provides a detailed overview of demand intensity across various end-use segments and product types. Demand is shown to vary among custom-made insoles, prefabricated insoles, and gel-based insoles across medical, athletic, comfort, and safety applications. These insights are critical for market stakeholders.

High demand for custom-made insoles is observed in medical use, diabetic foot management, geriatric footwear, children’s orthotics, and post-surgical recovery. This demand reflects the importance of personalized care and biomechanical correction. Clinical evidence supports the tailored fit and therapeutic benefits of custom orthotics in managing complex foot conditions.

Strong performance of prefabricated insoles is seen in medical, sports, and occupational safety segments. Their broader accessibility and moderate support needs appeal to a wider consumer base. Gel-based insoles are favored mainly in sports and athletics, where shock absorption and comfort are prioritized. However, they show low demand in children’s orthotics and moderate presence in personal comfort applications.

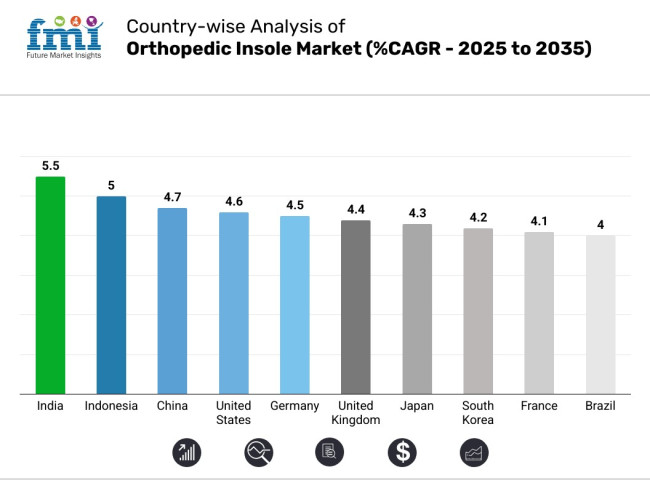

The orthopedic insole market reveals strategic growth patterns across leading economies, with rising demand for foot health solutions in both developed and emerging regions. Manufacturers can align their offerings with key regional health trends, technological advancements, and aging demographics. India exhibits the highest growth potential among the top ten countries. The following table captures the projected CAGR from 2025 to 2035 across the most dynamic markets.

The United States orthopedic insole market is growing at a CAGR of 4.6% with increasing consumer focus on personalized health solutions and preventative care. The rising prevalence of diabetes, obesity, and joint issues fuels sustained demand for orthopedic insoles, particularly among the aging population. Integration of advanced technologies such as 3D foot scanning and pressure mapping enhances product precision and customization.

Insurance coverage for orthopedic devices and the role of podiatrists in recommending insoles improve market accessibility. Online retail expansion and partnerships with fitness brands also expand consumer reach. Footwear manufacturers are incorporating orthotic elements into mainstream products, creating synergy between comfort and medical utility, reinforcing the USA's competitive position in the foot orthotic insole market.

The orthopedic insole market in the United Kingdom is advancing through healthcare-backed initiatives and a growing focus on preventive foot health at a CAGR of 4.4%. Age-related mobility issues, sports injuries, and chronic foot conditions are common among consumers, prompting widespread use of orthotic insoles. The NHS and private podiatry services actively promote foot assessments and subsidized orthotic solutions.

Rising diabetic cases and foot-related complications create sustained demand in medical retail channels. Retail pharmacies and athletic footwear chains increasingly stock pre-formed and semi-custom orthotics. Technological partnerships for digital gait analysis and user feedback loops enable product refinements. The UK’s focus on clean-label health solutions and ergonomic product adoption supports a stable trajectory in orthopedic insole use.

The orthopedic insole market in Germany, with a CAGR of 4.5%, uses its engineering expertise and structured healthcare infrastructure to drive innovation. Foot health awareness is high among both the elderly and working professionals, and consumers are willing to invest in long-term foot comfort solutions. The medical device manufacturing sector integrates biometric diagnostics with sustainable material innovations.

German orthotic laboratories and rehabilitation centers lead in developing custom insole technologies, often reimbursed under health insurance. Employers promote ergonomic interventions to reduce workplace injury, supporting institutional purchases. Eco-conscious consumer preferences align with the local production of orthopedic insoles using recyclable and biodegradable materials. Germany’s regulatory consistency and technical precision make it a preferred hub for high-performance orthopedic products.

Demand for foot orthotic insoles in France is set to grow at a 4.1% CAGR through 2035. Consumers seek footcare solutions that address comfort without compromising style, leading to innovation in slim-profile insoles suitable for both casual and formal wear. Government initiatives addressing elderly mobility and diabetic foot health improve market penetration. Pharmacies and orthotic clinics offer semi-custom insole solutions for sports, occupational, and leisure footwear.

Orthopedic brands in France collaborate with designers to blend form and function, gaining traction among younger demographics. Public awareness campaigns around posture correction and foot support in schools and workplaces extend product reach.

The Indian orthopedic insole industry is expected to grow at a CAGR of 5.5%, driven by rapid urbanization, rising health awareness, and an alarming increase in foot-related disorders. With diabetes and obesity rates climbing, consumers are more inclined to adopt preventive solutions like orthopedic insoles. Local manufacturing units are scaling operations to meet cost-effective demand, ensuring product availability in Tier I and Tier II cities.

Government initiatives promoting podiatric care and corporate interest in workplace ergonomics contribute to market expansion. Traditional medical philosophies such as Ayurveda merge with modern orthotic practices to develop culturally relevant products. The growing presence of e-commerce and retail health outlets offers access across socioeconomic groups, securing India’s top-growth position.

The orthopedic insole market in Japan is growing steadily at a CAGR of 4.3%, fueled by the country’s aging demographic and sustained interest in functional wellness. The cultural emphasis on maintaining mobility into older age ensures strong demand for foot support products that offer comfort and posture correction. Manufacturers focus on slim, discreet designs compatible with traditional and casual footwear. Insole innovations prioritize pressure redistribution, odor control, and lightweight material use.

Government-backed health programs incentivize elderly mobility aids, including insoles, through partial reimbursements. Japanese firms integrate AI and wearable tech for data-driven insole customization. As chronic foot conditions become more prevalent, Japan’s methodical, research-driven approach supports the market.

South Korea’s orthopedic insole market, expanding at a CAGR of 4.2%, is influenced by the nation’s fusion of fashion, technology, and health awareness. High rates of diabetes, arthritis, and foot fatigue in urban populations drive the need for orthotic interventions. Consumers prioritize insole aesthetics and portability alongside medical functionality.

Korean manufacturers employ advanced materials for breathable, anti-slip, and antibacterial features, aligning with wellness preferences. Medical tourism and foot therapy clinics incorporate orthotics into rehabilitation protocols. Retail partnerships with beauty and lifestyle brands widen product exposure beyond clinical environments. Government health advisories and occupational safety guidelines further stimulate demand.

With a CAGR of 4.7%, China’s market is growing rapidly with large-scale urbanization and state-sponsored wellness initiatives. Rising middle-class income levels, coupled with increasing health awareness, are changing consumer attitudes toward preventive care. Orthopedic insoles are gaining popularity in managing diabetic foot, obesity-related strain, and posture-related pain. Government policies like Healthy China 2030 encourage use of orthopedic aids.

Mass production facilities enable economies of scale, making customized insole solutions more affordable. Urban retail outlets, online platforms, and community health centers act as key distribution nodes. Integration of AI in foot diagnostics and strategic collaborations with sports and school shoe manufacturers enhances market appeal and accessibility.

Indonesia’s orthopedic insole market, growing at a CAGR of 5.0%, shows strong potential due to increasing lifestyle diseases and expanded healthcare access. Diabetic foot complications and occupational foot strain are prevalent among the aging and labor-intensive workforce. Public health campaigns advocate for regular foot assessments and ergonomic interventions, creating an educated consumer base. Domestic producers respond with affordable insole options, customized for the local climate and activity patterns.

Hospitals, clinics, and pharmacies serve as key retail points, often linked with government programs. Demand is increasing in both rural and urban areas, supported by mobile healthcare services. As awareness grows, Indonesia is emerging as a competitive player in the orthopedic insole sector.

Brazil’s orthopedic insole market, growing at a CAGR of 4%, benefits from public sector engagement and the country’s expansive healthcare system. Foot disorders linked to diabetes, aging, and high-impact sports necessitate orthotic solutions. The government supports the inclusion of orthopedic aids in public hospitals and insurance programs.

Urban populations increasingly demand ergonomic and therapeutic footwear for daily use. Brazilian startups are innovating with locally sourced materials and user-friendly designs to meet both comfort and medical needs. Market visibility grows through pharmacy chains, podiatric clinics, and awareness events.

Based on the global orthopedic insole market share analysis, the industry is moderately concentrated, with leading brands such as Dr. Scholl’s, Superfeet, and PowerStep collectively holding approximately 65% of the market share. Dr. Scholl’s maintains a dominant position through its extensive retail distribution and continuous innovation in gel-based insole technologies. Superfeet and PowerStep have strengthened their market presence by focusing on performance-driven designs and expanding their product lines to cater to both athletic and medical needs.

Mid-tier companies like Spenco, Protalus, and Aetrex contribute an additional 15% to the market, primarily by offering specialized solutions that address specific foot conditions and by leveraging online sales channels to reach a broader customer base. Emerging brands, including alFOOTs and Capron Podologie, are gaining traction by introducing customized and sustainable insole options, appealing to environmentally conscious consumers and niche markets.

Strategically, market leaders are investing in research and development to introduce smart insoles equipped with pressure sensors and AI-driven analytics, enhancing the personalization of foot care solutions. Collaborations with healthcare professionals and institutions are also prevalent, aiming to validate product efficacy and integrate insoles into broader orthopedic treatment plans. Furthermore, companies are expanding their global footprint by entering emerging markets in Asia and Latin America, where rising awareness of foot health and increasing disposable incomes present new growth opportunities.

Recent Foot Orthotic Insole Industry News

The orthopedic insole sector continues to benefit from growing demand for foot pain relief and posture correction products. Rising cases of foot conditions such as plantar fasciitis and flat arches have notably influenced product adoption. Leading manufacturers have launched custom orthopedic insoles and technology-enabled footbeds to address these needs. Despite this, pricing challenges and gaps in consumer awareness have limited widespread use. Steady growth persists across segments, including sports insoles, geriatric orthopedic care, and occupational health footwear.

Awareness of Foot Health has been Growing Rapidly.

Global awareness around orthopedic foot support has expanded significantly through health campaigns and digital education. Common conditions like plantar fasciitis, diabetic neuropathy, and overpronation are now widely recognized and diagnosed.

The American Podiatric Medical Association (APMA) endorses arch support insoles and diabetic shoe inserts as preventive care tools. Wellness brands such as Dr. Scholl’s actively promote these products across North America and Europe. In the USA, over 2 million people seek treatment for plantar fasciitis each year, according to APMA data.

Clinics routinely recommend orthotic shoe inserts to patients suffering from chronic heel pain and arch collapse. Both active individuals and older adults are encouraged to wear insoles during daily walking routines. This growing focus on foot alignment and injury prevention has increased mainstream acceptance in wellness communities. Similar trends have been witnessed in the orthopaedic braces and support industry.

Advanced Technology and Customization Have Driven Innovation

Innovations in tech-enabled custom orthopedic insoles have enhanced comfort and performance. Companies like Superfeet, Wiivv (now FitMyFoot), and Sidas offer solutions using digital foot mapping and smartphone scanning apps. FitMyFoot allows users to design personalized insoles via mobile devices, making customization more accessible.

High-performance gel insoles and memory foam inserts engineered by Sof Sole and Powerstep offer improved cushioning. Features such as antimicrobial protection and moisture-wicking layers enhance everyday wearability. Major brands like Nike and Adidas have tested smart insoles for real-time gait analysis.

These advances support tailored solutions for athletes, diabetic patients, and workers requiring occupational orthotics. Use of durable materials like polyurethane and carbon fiber has boosted shock absorption and longevity. Personalization now plays a key role in both sports and medical applications.

Limited Access and High Costs have Slowed Adoption.

The relatively high price of custom orthopedic insoles remains a barrier in many regions. The American Orthopaedic Foot & Ankle Society (AOFAS) notes that podiatrist-prescribed insoles can cost between USD 200 and USD 800. Health insurance coverage for non-prescription orthotics or foot pain inserts is rare. In developing countries, the limited availability of podiatric diagnostics and gait labs has hindered broader adoption.

Retail outlets often sell generic insoles with minimal fitting guidance. Awareness of arch support options remains low in rural and underserved areas. Educational outreach by healthcare providers and brands has yet to reach these populations widely. Regions like Sub-Saharan Africa have not scaled affordable orthopedic insert options. Without cost-effective alternatives and professional foot care access, foot orthotic insoles manufacturers face constraints.

Geriatric and Occupational Demand Has Driven Long-term Growth

Demand for orthopedic insoles among seniors is rising sharply as the global population ages. The World Health Organization projects that people aged 60 and older will reach 2.1 billion by 2050. Insoles designed for arthritis relief, diabetic foot protection, and balance improvement are increasingly recommended. Nursing homes and geriatric clinics distribute diabetic shoe inserts to reduce ulcer and fall risks.

Concurrently, occupational demand for work boot insoles has expanded. Sectors such as healthcare, logistics, and manufacturing adopt orthotic inserts to combat worker fatigue. Brands like Protalus and Superfeet offer anti-fatigue insoles tailored for industrial use. Safety regulations by the USA Department of Labor stress the importance of ergonomic foot support.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.2 billion |

| Projected Market Size (2035) | USD 6.7 billion |

| CAGR (2025 to 2035) | 14.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for volume |

| Product Types Analyzed (Segment 1) | Custom Orthotic Insoles, Prefabricated Insoles, Gel Insoles, Foam Insoles, Others |

| Applications Analyzed (Segment 2) | Plantar Fasciitis, Flat Feet, Diabetes, Arthritis, Sports Injuries, Others |

| End Users Analyzed (Segment 3) | Men, Women, Kids, Geriatric Population |

| Sales Channels Analyzed (Segment 4) | Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies/Drug Stores, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players Influencing the Market | Dr. Scholl's, Bauerfeind AG, RSL Steeper, Capron Podologie, Spinal Technology, alFOOTs, Aetrex, Superfeet, PowerStep, Spenco |

| Additional Attributes | Dollar sales by product type (custom, gel, foam), Dollar sales by end user (men, women, kids, geriatric), Dollar sales by application (plantar fasciitis, flat feet, arthritis), Sales channel preferences and retail growth trends, Regional demand for corrective and supportive insoles, Impact of lifestyle disorders and aging population on product uptake |

| Customization and Pricing | Customization and Pricing Available on Request |

Custom Orthotic Insoles, Prefabricated Insoles, Gel Insoles, Foam Insoles, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies/Drug Stores, and Others.

Men, Women, Kids, and Geriatric Population.

Plantar Fasciitis, Flat Feet, Diabetes, Arthritis, Sports Injuries, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Custom orthotic insoles hold the largest share at 42% in 2025.

Medical use is the leading application, holding 50% of the market in 2025.

Pharmacies and drug stores offer trusted medical-grade insoles for immediate relief and chronic conditions, holding around 25% share in 2025.

Supermarkets and hypermarkets contribute about 15%, focusing on convenience and affordability with prefabricated and gel insoles in 2025.

Hospitals, clinics, and medical facilities hold about 5%, mainly for prescribed custom orthotics integrated into treatment in 2025.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Insole Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Insole Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Base Material Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Base Material Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Insole Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Base Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Insole Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Base Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Insole Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Base Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Insole Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Base Material Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Insole Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Base Material Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Insole Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Base Material Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Insole Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Insole Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Insole Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Insole Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Base Material Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Base Material Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Base Material Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Base Material Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Insole Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Base Material Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

Orthopedic Prosthetics Market Analysis - Size, Share, and Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Veterinary Orthopedic Injectable Drug Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA