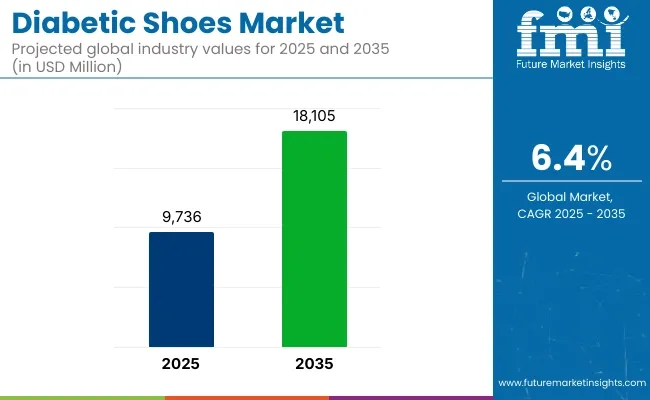

The global Diabetic Shoes Market is estimated to be valued at USD 9,736.0 million in 2025 and is projected to reach USD 18,105.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. The market is experiencing steady growth driven by rising global diabetes prevalence, increasing incidence of diabetic foot complications, and growing awareness of preventive foot care among both patients and clinicians.

Peripheral neuropathy, poor circulation and foot deformities in diabetic patients significantly elevate the risk of ulcers and amputations, making offloading footwear solutions a cornerstone of diabetes management protocols. Payers and healthcare providers are expanding reimbursement programs for therapeutic footwear as part of comprehensive diabetic care models, supporting greater patient adoption. Innovations in materials science, pressure redistribution technologies, and customized insole designs are enhancing product efficacy, comfort, and long-term patient compliance.

Leading manufacturers such as Dr. Comfort, Apex Foot Health, Drew Shoe, Orthofeet, Podartis, and DARCO are driving market expansion through customized offloading designs, advanced insoles, and greater integration with podiatric care networks. Strategic collaborations with endocrinology and wound care specialists are improving early referral pathways for high-risk patients.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9,736.0 million |

| Industry Value (2035F) | USD 18,105.0 million |

| CAGR (2025 to 2035) | 6.4% |

In 2025, the USA introduced a bill Promoting Access to Diabetic Shoes Act, this piece of legislation will allow physician assistants and nurse practitioners to fulfill requirements for therapeutic shoes for individuals with diabetes. “Thirty-seven million Americans have diabetes, putting many at risk for serious health complications, including lower-limb amputations, if they do not receive proper care.

However, many Medicare patients with diabetes face barriers in our healthcare system that make it harder to access the treatment they need-costing the program millions,” said Congresswoman Nanette Barragán. The shift towards preventive diabetic foot care under payer-supported disease management programs is accelerating adoption across both clinical and consumer retail channels.

North America dominates the diabetic shoes market, fueled by high diabetes prevalence, strong payer support for preventive foot care, and well-established podiatry networks. The 2024 CMS updates expanding Medicare reimbursement for custom diabetic footwear have boosted physician referrals for therapeutic shoe fittings.

Multidisciplinary wound care centers are increasingly integrating diabetic footwear into limb preservation pathways, driving higher clinical adoption. Retail pharmacy chains and DME suppliers are expanding diabetic footwear offerings, improving patient access beyond specialty clinics.

Europe’s diabetic shoes market is expanding, driven by national diabetes prevention programs, centralized reimbursement structures, and proactive limb preservation guidelines. Germany, the UK, and the Nordics are leading adoption, supported by national health systems offering full or partial reimbursement for therapeutic footwear prescribed by podiatrists and endocrinologists. As healthcare systems emphasize early prevention of ulcer progression and hospitalization, diabetic shoes are becoming an increasingly standardized component of Europe.

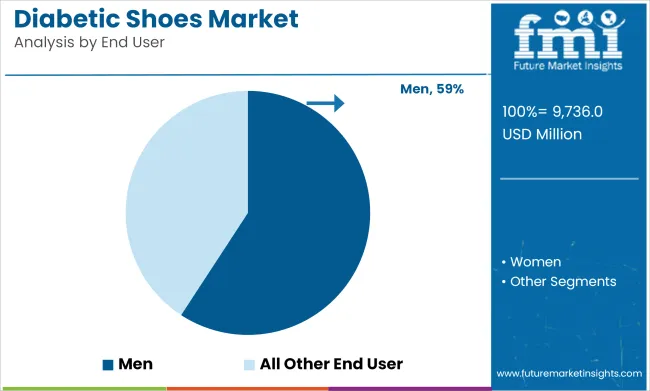

In 2025, men are expected to hold 59.2% of the revenue share in the overall diabetes market. This dominance is attributed to the higher prevalence of diabetes in men, particularly type 2 diabetes, which is strongly influenced by factors such as lifestyle, obesity, and genetics. Men are often diagnosed at an earlier age compared to women, which increases the need for long-term diabetes management solutions.

The growth of this segment has been driven by the increasing rates of overweight and obesity in men, as well as rising awareness about the risk factors associated with diabetes. Men are also more likely to develop complications from diabetes, including cardiovascular diseases and kidney damage, which further drives demand for treatment options.

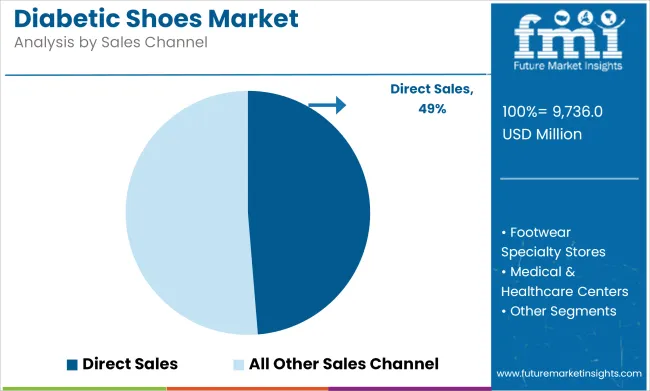

In 2025, direct sales are projected to capture 48.7% of the revenue share in the diabetes market. This segment’s growth is attributed to the increasing trend of direct-to-consumer sales channels, which provide patients with greater accessibility to diabetes management products, including insulin, glucose monitors, and diabetes care supplies.

Direct sales offer convenience, allowing consumers to purchase products online or through specialized retail outlets without the need for intermediary channels, thereby improving availability and reducing costs. The rise of e-commerce platforms and telemedicine services has further bolstered the growth of direct sales, which has accelerated the shift towards home-based diabetes management.

Additionally, direct sales allow for personalized marketing and education, empowering patients to manage their condition more effectively. As the demand for self-management tools and personalized diabetes care continues to rise, direct sales are expected to maintain their leadership position in the market.

Challenges

Lack of Medical Standardization in Manufacturing of Diabetic Shoes hinders its Adoption in the Market

Diabetic shoes encounter various challenges in their common adoption. One of the challenges is their price, especially in places whose health-care systems may not subsidize them fully, rendering them less affordable to low-income groups. There is little in the way of awareness in most developing countries regarding the effectiveness of diabetic shoes in the prevention of more serious foot problems such as ulceration and infections, thus hindering their use.

Furthermore, cultural preferences act as hindrance-the traditional shoe is favored over specialty shoes. Moreover, a huge number of younger diabetics do not agree to wear diabetic shoes owing to their idea of them as being "special" shoes, a pair they feel is not fashionable enough. A couple of extra challenges for both patients and manufacturers alike is to find a pair of well-fitting shoes that actually meet medical standards and fit an individual's personal style.

Opportunities

Growing Awareness on Understanding the Importance of Preventative Foot care and its Complication create New Business Opportunities for the Market Players

With increasing diabetic populations, cosmetic psychologism is being discovered by increased numbers of people concerning the value of preventive foot care, thus presenting more potential markets, especially in developing nations where awareness levels are increasing.

The creativity can be flexible among the manufacturer to converge on trendy designs that are as comfortable to wear, targeting a new market of the young style-savvy crowd marrying medical utility to personal aesthetics.

Increased health insurance coverage in most countries, however, looks to make diabetic shoes accessible and affordable; preventive healthcare, given increasing governmental push, is creating a congenial environment for marketing diabetic footwear. E-commerce is also easing manufacturers' access to consumers across the globe, thus widening market prospects and enhancing acceptance.

The market for diabetic shoes has exploded and is primarily the product of the increasing worldwide incidence of diabetes and the growing awareness about foot-care in diabetics. Owing to the high-tech materials used nowadays-extras cushioning, breathable lining, antimicrobial finish-the companies have made more efforts to focus on comfort and durability.

Challenges such as ulcers and infections are typical diabetic foot complications that such technological advancements can address. Custom fitted shoes, with the help of advanced 3D scanning technology, are gaining popularity as they cater to people with different foot shapes and conditions.

The greater focus on preventive care has health professionals directing their patients to actually start seeking specialized shoes. A wider coverage by insurance will enhance accessibility and affordability of diabetic shoes for many more individuals, in turn fueling the growth of the market without interruption.

There are quite a few exciting trends popping up in the diabetic shoe space. One of these innovations is smart shoes, interwoven with sensors that keep tabs on foot health, identify pressure shifts, and even monitor temperature changes to help diabetics better track potential complications. Another trend on the rise is the making of diabetic shoes that combine their medical purpose with high fashion.

Shoe companies are creating lines with chic, hip silhouettes that entice the youth without sacrificing necessary comfort. E-commerce has equally been a disruptive force in the market, widening access to diabetic shoes with a variety of options.

With sustainability as a hot button, industries are starting to use eco-friendly materials to appeal to the environmentally conscious consumer. Finally, the market demand for general diabetes care aligns well with the growth of diabetic shoe sales, thus making the latter an integral part of any comprehensive medical program.

Diabetes shoes have become popular in the health care system because of their increasing incidence as well as growing consideration of foot health among diabetes patients. These shoes can provide support, cushioning, and protection against causes of recurrent foot problems, with ulcers and infections being important associated conditions with diabetes.

Another advantage of diabetic shoes is that theirs is the long-term investment. Initially, they might cost more than the average shoes, but given their durability and reuse, it proves to be a wise expense in the long term. Clinics, hospitals, and payers are all recognizing their value, thus freeing these shoes for more needy patients.

Moreover, technological advancements are part of the largest crucial factors that improve the market. Smart shoes with sensors monitor foot health and can be styled and comfortable for consumers. Thus, diabetic shoes evolve to treat their patients better using these trends. With preventive measures as well as sustainability emphasized in developing such shoes, being a medical necessity does not suffice as a definition; it is now regarded as part of lifestyle and hence the health management of diabetes.

Market Outlook

The prevalence of diabetes in the United States has increased tremendously, while diabetic shoes are globally more sought after for preventing foot complications. At the same time, increasing awareness of foot health in diabetes patients and manifestation of preventive care in the daily lives of the people in the USA is aiding the promotion and use of diabetic shoes.

They are indeed witnessing action toward making these options more sustainable in terms of production interfaces so as to comply with the health-focused notion embraced by recent healthcare initiatives in the USA.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

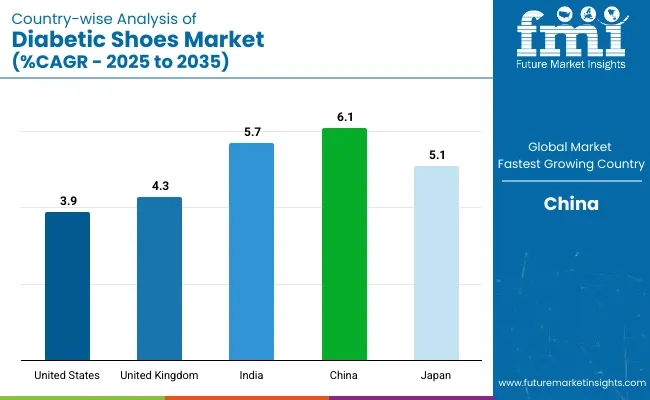

| United States | 3.9% |

Market Outlook

However, diabetic footwear has become a key focus of discussion in the UK as part of holistic diabetes management. According to the National Health Service (NHS), foot health is one of the modules of care under diabetes, whereby there is growing awareness of special shoes being important in minimizing the occurrence of foot ulcers and subsequent complications.

Furthermore, there is a government commitment to reducing future healthcare costs by preventive measures, which should eventually improve availability and reimbursement for diabetic shoes. Sustainability, in terms of designs as well as materials, is becoming paramount for the adoption of these shoes against the backdrop of the nation's green healthcare initiative.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Market Outlook

In India, the fast growth in diabetes cases, especially among the urban population, is favoring a high demand for diabetic shoes. Almost the entire population being diabetic, there is slowly becoming an awareness among the people regarding the significance of specialized foot care to avoid ulcers and nerve damage. The government initiative in enhancing the availability of diabetes treatment and making the people more aware is paving the way to create awareness for wearing proper shoes.

And, as urban incomes are rising, there is no doubt that the people are more willing to spend on good-quality diabetic shoes. Increased focus on preventive care and foot care is leading to a general acceptance of such products, placing diabetic shoes into the mainstream. Improved healthcare access and increased attention to well-being are all predicted to see the Indian diabetic shoe market grow in the years ahead.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

Market Outlook

Rising diabetic incidences among old people are one of the very important reasons influencing the upsurge for diabetic shoes. With increasing knowledge of foot care for diabetes, Chinese consumers are now seeking specialist footwear to prevent complications. The government has rolled out a host of health programs to better treat diabetes, thus putting diabetic shoes to penetrate as far as possible in the country.

Improved healthcare infrastructure together with the focus on increasing preventive care has accentuated the need for proper foot protection among Chinese citizens. The budding middle class in urban areas is another market driving factor as people are spending more on high-end footwear to address their health concerns. Demand for comfortable, functional, and durable diabetic shoes is expected to continue its upward trajectory in years to come.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook

The demand for diabetic footwear is stimulated in Japan by an accelerating aging population and rising awareness regarding diabetic complications. Considering the country has one of the highest shares of the elderly population, foot health should be a serious consideration. Under the preventive health scheme, Japanese consumers have significantly become active in their health maintenance and search for diabetic shoes to prevent foot ulcers and amputation.

Shoe technology has advanced into a new stage, making shoes more comfortable and supportive for patients with diabetes. Furthermore, sustainability and health product awareness in Japan have exponentially increased the demand for more sustainable and yet durable diabetic shoes. As more people become aware of the long-term benefits of buying diabetic shoes, the market will grow steadily in some years.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The diabetic shoe market is waxing strong, against the background of established manufacturers and new entrants with innovative features and designs. The competition seems to be heating up, with all sorts of brands out there launching their own range of footwear from the orthotic shoe range up to the trendy-style functional ones. With sustained demand for enhanced comfort and utility, manufacturers have since been engaged in upgrading their own products to achieve better patient outcomes.

Through competition-driven innovation, in addition to the burgeoning e-commerce field, a huge overhaul of the market has been taking shape, facilitating access to and custom needs for diabetic shoes to suit the different demands of a given consumer. The diabetic shoes market thus has a bright prospect, as uptake is growing globally.

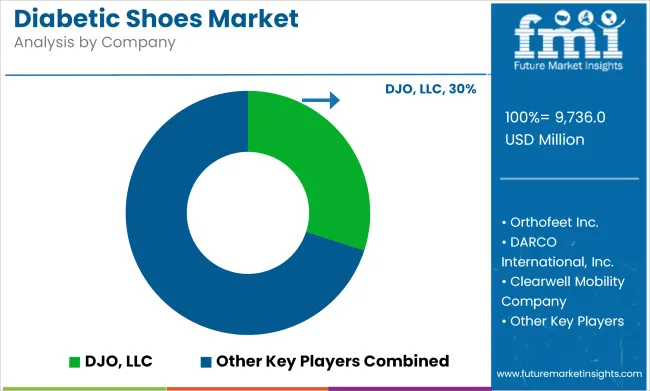

DJO, LLC:

DJO, LLC emphasizes diabetic footwear solutions for comfort and foot protection. The state-of-the-art technologies for cushioning and support in the shoes address diabetic patients' needs, ensuring foot management with comfort during daily activities.

Drewshoe:

Drewshoe remains innovative through its suppliers of adjustable orthopedic-friendly shoes to fit varied foot conditions, thus bringing comfort and protection to diabetics.

Orthofeet Inc.:

Orthofeet Inc. became a significant supplier of diabetic shoes based on orthotic-friendly designs. These shoes used anatomical arch support and cushion insoles so that diabetes would feel relief.

DARCO International, Inc.:

DARCO International is a major provider of diabetic therapy footwear that is directed toward postoperative diabetic shoes for persons with diabetic foot complications. Due to its focus on foot protection, pressure relief, and comfort, it is established at the very top of mind of healing patients with diabetic foot complications.

Other Key Players (63.0% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. They include:

Dress Shoes, Running Shoes, Strolling Shoes and others

Outpatient and Inpatient

Men and Women

Narrow, Medium, Wide and Others

Direct Sales, Footwear Specialty Stores, Medical & Healthcare Centers, Online Retailers, Mono-brand Stores, and Other Sales Channel

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for diabetic shoes market was USD 9,736.0 million in 2025.

The diabetic shoes market is expected to reach USD 18,105.0 million in 2035.

Increase in number of people suffering from diabetes and other footware wound complications anticipates the growth of the market.

The top key players that drives the development of diabetic shoes market are Drewshoe, Orthofeet Inc., DARCO International, Inc., and Clearwell Mobility Company

Strolling shoes segment by product is expected to dominate the market during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diabetic Macular Edema Market Forecast and Outlook 2025 to 2035

Diabetic Nephropathy Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Retinopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Ketoacidosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Retinopathy Market Analysis - Size, Share & Forecast 2025 to 2035

Diabetic Food Market Report – Trends & Innovations 2025-2035

Diabetic Assays Market

Diabetic Pen Cap Market

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Necrobiosis Lipoidica Diabeticorum Market Size and Share Forecast Outlook 2025 to 2035

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Tennis Shoes Market Insights - Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA