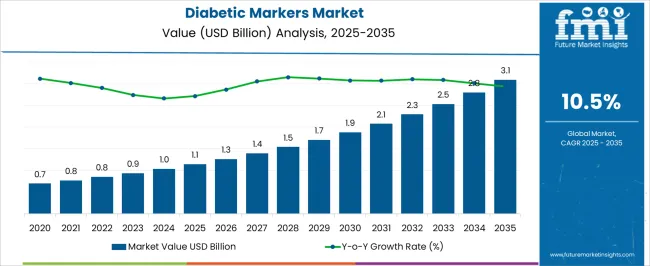

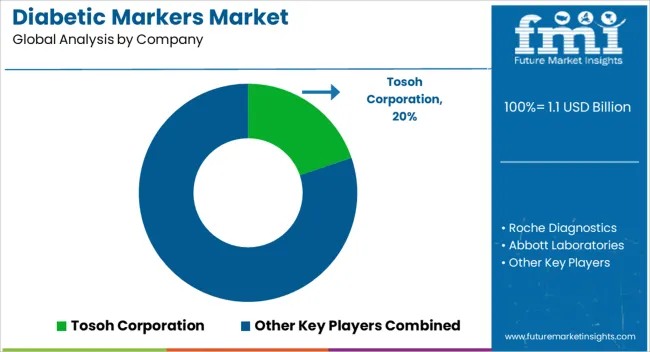

The Diabetic Markers Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

| Metric | Value |

|---|---|

| Diabetic Markers Market Estimated Value in (2025 E) | USD 1.1 billion |

| Diabetic Markers Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The diabetic markers market is expanding steadily as the prevalence of diabetes continues to rise globally, driven by lifestyle changes, aging populations, and increasing obesity rates. Growing demand for early diagnosis and monitoring of disease progression has heightened the adoption of biomarker-based testing solutions.

Advancements in molecular biology, immunoassays, and point of care diagnostics are further supporting market penetration by improving accuracy and turnaround times. Healthcare systems are prioritizing precision diagnostics to enable personalized treatment pathways and better patient outcomes.

Government initiatives aimed at reducing the burden of diabetes and technological innovations in laboratory testing have reinforced the adoption of diabetic markers. The outlook remains strong as research and clinical practices focus on integrating reliable markers into routine testing, thereby improving disease management and reducing long-term healthcare costs.

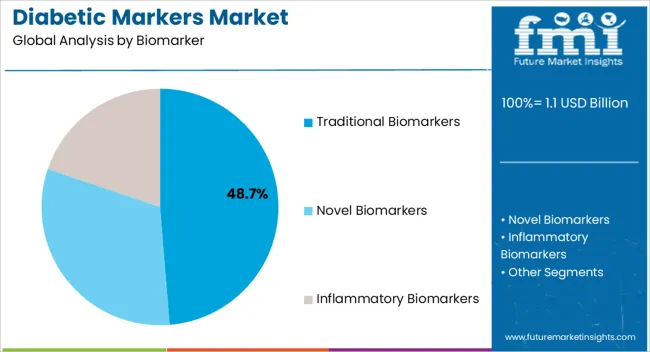

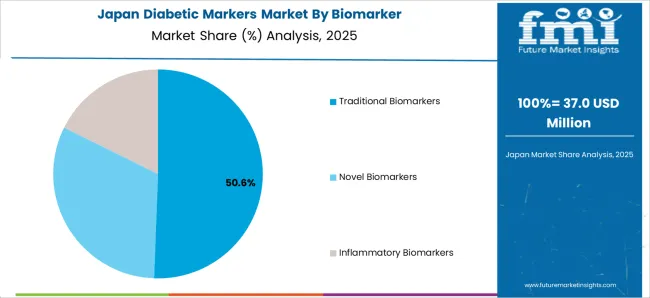

The traditional biomarkers segment is projected to hold 48.70% of the total revenue by 2025 within the biomarker category, making it the leading segment. This dominance is attributed to their established clinical utility, accessibility, and widespread integration into diagnostic protocols.

Traditional markers provide reliable and cost effective diagnostic outcomes, which have made them the cornerstone of diabetes detection and monitoring across healthcare systems.

The extensive body of supporting clinical evidence has reinforced their continued use in routine screening, thereby strengthening their leadership in the biomarker segment.

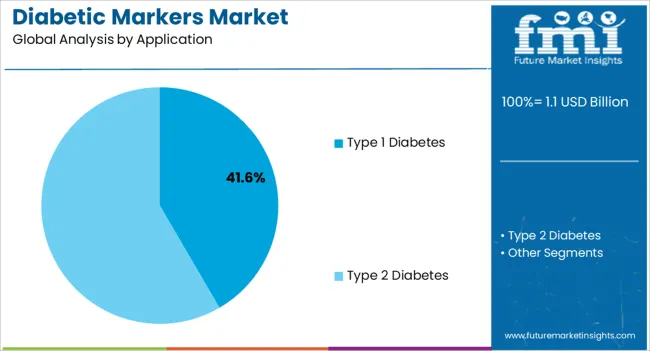

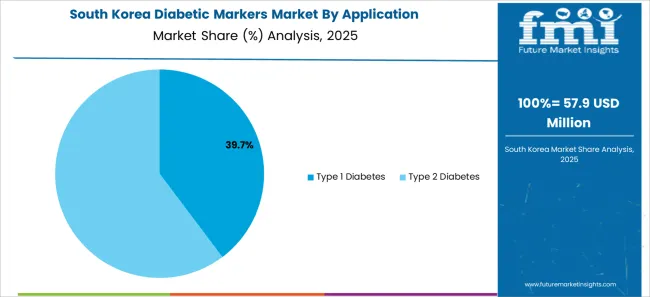

The type 1 diabetes application segment is expected to account for 41.60% of total market revenue by 2025 within the application category, positioning it as the largest segment. The increasing prevalence of autoimmune related diabetes and rising awareness of early stage diagnosis are primary drivers of this growth.

Advancements in immunological and genetic testing have enabled more precise identification of disease onset, while healthcare campaigns emphasize early detection for improved disease management.

These factors have led to stronger adoption of markers specifically for type 1 diabetes, securing its position as the leading application segment.

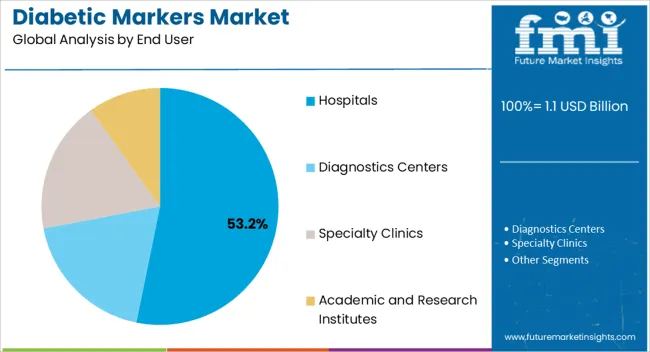

The hospitals segment is projected to contribute 53.20% of total market revenue by 2025 within the end user category, making it the dominant segment. Hospitals remain the primary setting for diagnostic testing due to their access to advanced laboratory infrastructure, skilled professionals, and comprehensive patient care pathways.

The growing number of hospital based screening programs and integrated diabetes management units has further expanded demand. In addition, hospitals are increasingly adopting advanced biomarker assays as part of their precision medicine strategies, ensuring reliable diagnosis and effective patient monitoring.

This has reinforced their position as the leading end user segment in the diabetic markers market.

From 2012 to 2025, the global diabetic markers market experienced a CAGR of 15.1%, reaching a market size of USD 1.1 million in 2025.

The increased prevalence of diabetes globally has propelled the diabetic markers market's historic expansion. Diabetes is a chronic metabolic illness characterized by high blood sugar levels, and its prevalence has progressively increased as a result of factors such as sedentary lifestyles, poor diets, and an ageing population. The expanding patient population has increased demand for diagnostic tools such as diabetes indicators, resulting in historic market growth.

The trend towards personalized therapy has contributed to the diabetes markers market's historic expansion. Personalised medicine is the practice of adapting treatment regimens to an individual's unique traits and genetic makeup. Diabetic marker, such as genetic testing and biomarkers, help in the identification of particular subtypes of diabetes, the prediction of disease progression, and the development of the most successful treatment regimens. Demand for diabetes indicators has increased due to the introduction of personalized treatment techniques.

Future Forecast for Diabetic Markers Industry:

Looking ahead, the global diabetic markers market is expected to rise at a CAGR of 11.0% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 3.1 billion by 2035.

In the management of diabetes, there is a rising emphasis on early identification and intervention. Early identification enables immediate intervention and the application of lifestyle changes and medicines, thereby avoiding or postponing problems.

In the diabetes indicators market, the integration of digital health solutions and remote monitoring platforms is an emerging trend. Individuals with diabetes can use mobile health applications, cloud-based platforms, and remote monitoring devices to monitor their diabetic parameters, receive personalized feedback, and connect with healthcare specialists for virtual consultations. This trend makes data-driven diabetes care easier while also improving patient participation and results.

| Country | The United States |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 3.1 million |

| CAGR % 2025 to End of Forecast (2035) | 10.0% |

The diabetic markers market in the United States is expected to reach a market size of USD 3.1 million by 2035, expanding at a CAGR of 10.0%. The prevalence of diabetes in the United States has been steadily rising over the years.

The growing diabetic population creates a significant demand for diagnostic markers to aid in the diagnosis, monitoring, and management of the disease.

| Country | The United Kingdom |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 175.6 million |

| CAGR % 2025 to End of Forecast (2035) | 8.2% |

The diabetic markers market in the United Kingdom is expected to reach a market value of USD 175.6 million, expanding at a CAGR of 8.2% during the forecast period. There is a growing government initiatives and national diabetes programs. To combat the rising burden of diabetes, the United Kingdom government has developed a number of initiatives including national diabetes programs. These programs emphasize early illness detection, prevention, and better disease management. The use of diabetes indicators for screening, risk assessment, and personalized treatment methods is emphasized as part of these programs.

| Country | China |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 326.1 million |

| CAGR % 2025 to End of Forecast (2035) | 15.1% |

The diabetic markers market in China is anticipated to reach a market size of USD 326.1 million by the end of 2035, growing at a CAGR of 15.1% throughout the forecast period. Significant research and development initiatives in the field of diabetes indicators have occurred in Japan. Academic institutions, research organisations, and industry participants all take an active role in the creation of novel markers and diagnostic technologies. Innovation is driven by research improvements and collaborations, which increase diagnosis accuracy and extend the market for diabetes indicators.

| Country | Japan |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 203.0 million |

| CAGR % 2025 to End of Forecast (2035) | 14.1% |

The diabetic markers market in Japan is estimated to reach a market size of USD 203.0 million by 2035, expected to thrive at a CAGR of 14.1%. Significant research and development initiatives in the field of diabetes indicators have occurred in Japan. Academic institutions, research organisations, and industry participants all take an active role in the creation of novel markers and diagnostic technologies. Innovation is driven by research improvements and collaborations, which increase diagnosis accuracy and extend the market for diabetes indicators.

| Country | South Korea |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 17.1 million |

| CAGR % 2025 to End of Forecast (2035) | 18.2% |

The diabetic markers market in South Korea is expected to reach a market size of USD 17.1 million, expanding at a CAGR of 18.2% during the forecast period. Diabetic indicators have become more accurate and efficient as diagnostic technology and inventions have advanced. South Korea has made tremendous progress in the development of diabetes biomarkers, genetic diagnostics, and point-of-care devices. Technological innovations propel the diabetes markers market forward by improving diagnostic capabilities and broadening the variety of accessible markers.

Traditional biomarkers dominated the diabetic markers market with a market share of 57.8% in 2025. Traditional biomarkers hemoglobin A1c (HbA1c) predict chronic glycaemia better than glucose levels at a single time point and are presently the most often utilized biomarkers for diagnosing prediabetes and diabetes. Traditional biomarkers to lead the demand have more convenience since avoiding food isn't essential, greater preanalytical stability, and less day-to-day disturbance during periods of stress and sickness.

Based on application, type 2 diabetes dominated the category withholding the significant share of the market at around 71.7% at the end of 2025. Diabetes mellitus type 2 (T2DM) is a common chronic condition that is connected with the development of complications. The potential application for the management of type 2 diabetes mellitus (T2DM) is a critical element assisting in the acceptance of T2DM biomarkers. The biomarkers have also been proven to be effective in detecting diabetes mellitus. As a result, the T2DM has the largest market share in the market.

The hospitals have led the diabetic markers market as the leading end user with the market share of 44.5% in 2025. Hospitals are the principal providers of acute care, serving a diverse variety of patients, including those suffering from chronic illnesses and other life-threatening disorders. Diabetic biomarkers have great clinical usefulness in these situations, assisting with diabetes mellitus diagnosis, monitoring, and treatment. Because hospitals rely on biomarkers to assist clinical decision-making, they are market leaders.

Key players in the diabetic markers market can increase their competitiveness, differentiate their products, and maintain a strong market presence by implementing various growth strategies. In this competitive industry, long-term viability demands constant innovation, strategic alliances, efficient marketing, and strategies that prioritize clients.

Key Strategies Used by the Participants

Key players continuously invest in research and development to introduce innovative diabetic biomarker products. They strive to develop assays with improved sensitivity, specificity, accuracy, and ease of use.

Key players often form strategic partnerships and collaborations with other companies, research institutions, and healthcare organizations. These partnerships can lead to knowledge sharing, joint product development, and expanded market reach.

Expanding into emerging markets with growing healthcare infrastructure and rising demand for diabetic biomarker allows companies to tap into new opportunities and gain a competitive edge.

Companies in the market may engage in mergers or acquisitions to streamline their product portfolio, obtain new technologies, enter new market niches, and gain access to novel products or intellectual property.

Key Developments in the Diabetic Markers Market:

The global diabetic markers market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the diabetic markers market is projected to reach USD 3.1 billion by 2035.

The diabetic markers market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in diabetic markers market are traditional biomarkers, novel biomarkers and inflammatory biomarkers.

In terms of application, type 1 diabetes segment to command 41.6% share in the diabetic markers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diabetic Nephropathy Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Retinopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Ketoacidosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Diabetic Retinopathy Market Analysis - Size, Share & Forecast 2025 to 2035

Diabetic Food Market Report – Trends & Innovations 2025-2035

Diabetic Macular Edema Market Growth – Trends & Forecast 2024-2034

Diabetic Assays Market

Diabetic Pen Cap Market

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Necrobiosis Lipoidica Diabeticorum Market Size and Share Forecast Outlook 2025 to 2035

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fiducial Markers Market - Demand, Growth & Forecast 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Markers Market Size and Share Forecast Outlook 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA